11g Release 1 (11.1.1.5.0)

Part Number E20374-01

Contents

Previous

Next

|

Oracle® Fusion

Accounting Hub Implementation Guide 11g Release 1 (11.1.1.5.0) Part Number E20374-01 |

Contents |

Previous |

Next |

This chapter contains the following:

Representing Your Enterprise Structure in Your Financial Reporting Structure: Overview

Financial Enterprise Structure: How It Fits Together

Modeling Your Financial Reporting Structure in Oracle Fusion: Example

Maintain Segment Value Attributes

Manage Chart of Accounts Mapping

Represent your enterprise structures in your chart of accounts to track and report on your financial objectives and meet your reporting requirements. The benefit of representing your enterprise in the chart of accounts is the Oracle Fusion General Ledger functionality which includes multidimensional reporting with its Essbase tool. Segments included in the chart of account become dimensions in Essbase. The recorded data is automatically loaded into the Essbase cube when you post your journal entries. The Essbase tool includes powerful functionality for analysis and reporting on your financial data.

Oracle Fusion Applications is an integrated suite of business applications that connects and automates the entire flow of the business process across both front and back office operations and addresses the needs of a global enterprise. The process of designing the enterprise structure, including the accounting configuration, is the starting point for an implementation. This process often includes determining financial, legal, and management reporting requirements and examining consolidation considerations.

The accounting configuration components are:

Ledgers: A ledger is the main record-keeping structure. A ledger records transactional balances by defining a chart of accounts with a consistent calendar and currency, and accounting rules, implemented in an accounting method. The ledger is associated with the subledger transactions for the business units that are assigned to it, and provides context and accounting for them.

Balancing Segments: Oracle Fusion Applications use the chart of account element, balancing segment, to represent and track both legal and management entities. Specifically, Oracle Fusion Applications provide a primary balancing segment to represent your legal entities, and additional balancing segments, you can implement for management reporting and analysis.

Balancing segments provide automatic balancing functionality by legal entity for journal entries, including intercompany and intracompany entries, suspense posting, and rounding imbalances.

Cost Centers: Cost Centers aggregate elements of natural expenses to identify functional costs. A cost center can be the smallest segment of an organization for which costs are collected and reported. Not all cost centers represent organizations. A manager is assigned responsibility for cost control and is assigned both a department and a cost center; in which case the cost center and department might be identified with each other. However, a finance department manager might have separate cost centers for finance cost and audit costs, and an Research and Development department manager might have separate cost centers for research and development.

Cost centers are represented by segment values in the chart of accounts that indicate the functional areas of your business, such as accounting, facilities, shipping, or human resources. You might keep track of functional areas at a detailed level, but produce summary reports that group cost centers into one or more departments. Cost center values are also used by Oracle Fusion Assets to assist the managers in tracking locations and accounting for assets assigned to their departments.

Accounts: The account segment is a code in the chart of accounts that uniquely identifies each type of transactions recorded in the ledger and subledgers. The account segment is mapped to a dimension in the Essbase cube to enable reporting and inquiry. This functionality uses Oracle Fusion Business Intelligence Edition to analyze and drill into expense and revenue transactions.

The following list provides information on how to represent legal entities, business units, and departments in chart of accounts.

Representing Legal Entities in the Chart of Accounts: Legal entity is the term used in Oracle Fusion Applications for registered companies and other organizations recognized in law as having a legal existence and as parties with given rights and responsibilities.

Legal entities are created in the applications and then assigned balancing segment values, sometimes called company codes in your ledgers during accounting configuration.

Representing Business Units in the Chart of Accounts: A business unit (BU) is part of an enterprise managed by a manager with profit and loss responsibility. The business unit is generally tracked in the chart of accounts. A business unit can be represented by a single ledger. For example, in countries where you need document sequencing for unique transaction sequencing within a legal entity, you can have a single ledger with a single business unit and legal entity.

A business unit can also be identified in the chart of accounts as a:

Management segment value

Balancing segment value

Roll up of cost center segments using hierarchies

For example, a business unit manager is responsible for working capital utilization or overall asset utilization. You identify the business unit as a balancing segment value, to enable calculation of ratios for various utilization measurements.

A business unit is assigned to a primary ledger, as well as a default legal entity when it is configured. A BU identifies the primary ledger that subledger transactions are posted to, facilitating the use of more than one BU per general ledger. Each business unit posts transactions to a single primary ledger. For example, a shared service center handles all the procurement functions for the entire company. The procurement transactions are posted to the business unit's ledger with intercompany entries to other ledgers as needed.

Representing Departments in the Chart of Accounts: A department is an organizational structure with one or more operational objectives or responsibilities that exist independently of its manager and that has one or more employees assigned to it. The manager of a department is typically responsible for business deliverables, personnel resource management, competency management, and occasionally, for cost control and asset tracking.

In Oracle Fusion Applications, departments can be set up in Oracle Fusion Human Capital Management (HCM). If desired, they can also be represented by a unique segment in the chart of accounts or a group of cost center values.

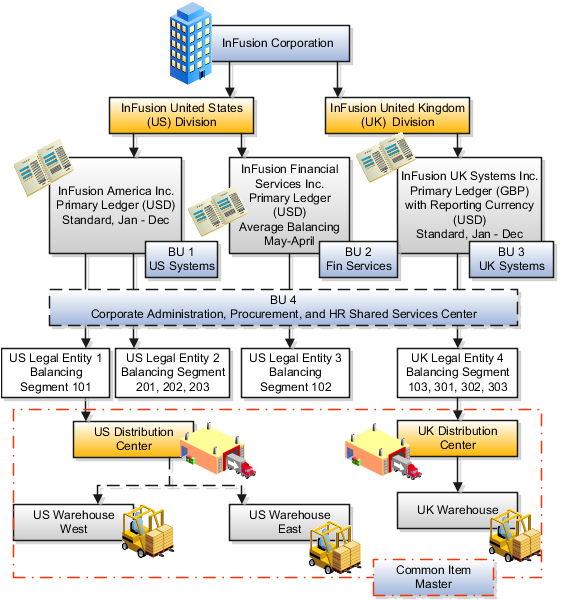

This example uses a fictitious global company to demonstrate the analysis that can occur during the financial reporting structure planning process.

Your company, InFusion Corporation, is a multinational conglomerate that operates in the United States (US) and the United Kingdom (UK). InFusion has purchased an Oracle Fusion enterprise resource planning (ERP) solution including Oracle Fusion General Ledger and all of the Oracle Fusion subledgers. You are chairing a committee to discuss creation of a model for your global financial reporting structure including your chart of accounts for both your US and UK operations.

InFusion Corporation has 400 plus employees and revenue of $120 million. Your product line includes all the components to build and maintain air quality monitoring (AQM) systems for homes and businesses. You have two distribution centers and three warehouses that share a common item master in the US and UK. Your financial services organization provides funding to your customers for the start up costs of these systems.

The following are elements you need to consider in creating your model for your financial reporting structure.

Your company is required to report using US Generally Accepted Accounting Principles (GAAP) standards and UK Statements of Standard Accounting Practice and Financial Reporting Standards. How many ledgers do you need to achieve proper statutory reporting?

Your financial services line of business has a different year end. Do you need a different calendar? Your financial services entity must report with average balance sheets. This feature of Oracle Fusion General Ledger provides you with the ability to track average and end-of-day balances, report average balance sheets, and create custom reports using both standard and average balances.

Your corporate management requires reports showing total organizational performance with drill down capability to the supporting details. Do you need multiple balancing segment hierarchies to achieve proper rollup of balances for reporting requirements?

Legal entity balancing options: Do you need to produce financial statements by one or more than one legal entity? Can you record multiple legal entities in one ledger or do you require multiple ledgers? Are you upgrading to Oracle Fusion Applications or a new install? If an upgrade, is your current financial reporting structure meeting your reporting needs?

The following figure and table summarize the model that your committee has designed and uses numerical values to provide a sample representation of your financial reporting structure. The model includes the following recommendations:

Creation of three separate ledgers representing your separate legal entities:

InFusion America Inc.

InFusion Financial Services Inc.

InFusion UK Services Inc.

Data security is controlled by balancing segment values using Oracle Fusion General Ledger data access sets

Recommendations for the chart of accounts design include:

Segments required for cost centers with hierarchical rollups to departments providing reporting at both the detail (cost center) and summary (department) level.

Accounts configured to provide drill down capability to the subledger transactions, enabling analysis of data.

|

Decision |

InFusion America, Inc. |

InFusion Financial Services, Inc. |

InFusion UK Systems, Inc. |

|---|---|---|---|

|

Type of Ledgers |

Primary |

Primary |

Primary with the use of Reporting Currency functionality |

|

Legal Entity Codes |

US Legal Entity 1: US Corporate US Legal Entity 2: US Systems |

US Legal Entity 3: US Financial Services |

UK Legal Entity 4: UK Systems |

|

Balancing Segments |

101: US Corporate 201: US Systems Components 202: US Systems Installations 203: US Systems Maintenance |

102: US Financial Services |

103: UK Systems 301: Components 302: UK Systems Installations 303: UK Systems Maintenance |

|

Currencies for Reporting |

US Dollar (USD) |

US Dollar (USD) |

Great Britain Pounds (GBP) US Dollar (USD) |

|

Calendar Ending date |

December 31st |

April 30th |

December 31st |

|

Business Units (BU)* |

BU 1: US Systems BU 4: Corporate (Shared Service Center) |

BU 2: Financial Services |

BU 3: UK Systems |

|

Balances Storage Method |

Standard Balances |

Average and Standard Balances |

Standard Balances |

|

Locations represented by cost centers in the chart of accounts. |

Headquarters US Distribution Center (BU 1) US Warehouse West US Warehouse East |

Headquarters |

UK Distribution Center (BU 3) UK Warehouse |

Note

In the chart of accounts, cost centers, with hierarchical rollups, represent business units. InFusion Corporation is also a legal entity but is not discussed in this example.

The chart of accounts is the underlying structure for organizing financial information and reporting. An entity records transactions with a set of codes representing balances by type, expenses by function, and other divisional or organizational codes that are important to its business.

A well-designed chart of accounts provides the following benefits:

Effectively manages an organization's financial business

Supports the audit and control of financial transactions

Provides flexibility for management reporting and analysis

Anticipates growth and maintenance needs as organizational changes occur

Facilitates an efficient data processing flow

Allows for delegation of responsibility for cost control, profit attainment, and asset utilization

Measures performance against corporate objectives by your managers

The chart of accounts facilitates aggregating data from different operations, from within an operation, and from different business flows, thus enabling the organization to report using consistent definitions to their stakeholders in compliance with legislative and corporate reporting standards and aiding in management decisions.

Best practices include starting the design from external and management reporting requirements and making decisions about data storage in the general ledger, including thick versus thin general ledger concepts.

Thick versus thin general ledger is standard terminology used to describe the amount of data populated and analysis performed in your general ledger. Thick and thin are the poles; most implementations are somewhere in between. Here are some variations to consider:

A general ledger used in conjunction with an enterprise profitability management (EPM) product, which has data standardized from each operation, is designed as a thin general ledger. Use this variation if your solution is project based, and Oracle Fusion Projects is implemented. More detailed reporting can be obtained from the Projects system. In the thin general ledger, business units, divisions, and individual departments are not represented in the chart of accounts.

A general ledger, with segments representing all aspects and capturing every detail of your business, with frequent posting, many values in each segment, and many segments, is called a thick general ledger. A thick general ledger is designed to serve as a repository of management data for a certain level of management. For example, a subsidiary's general ledger is designed to provide the upper management enough data to supervise operations, such as daily sales, without invoice details or inventory without part number details.

A primary ledger and a secondary ledger, where one is a thick general ledger and the other a thin general ledger, provides dual representation for reporting requirements that require more than one ledger.

With a thin general ledger, you use the general ledger for internal control, statutory reporting, and tracking of asset ownership. You minimize the data stored in your general ledger. A thin general ledger has many of the following characteristics:

Minimal chart of accounts

Short list of cost centers

Short list of natural accounts

Short list of cost accounts

Summary level asset and liability accounts

Low number of optional segments

Infrequent posting schedule

A thin general ledger has natural accounts at a statutory reporting level, for example, payroll expense, rent, property taxes, and utilities. It has cost centers at the functional expense level, such as Research and Development (R&D) or Selling, General, and Administrative (SG&A) expense lines, rather than at department or analytic levels. It omits business unit, division, and product detail.

One example of an industry that frequently uses a thin general ledger is retail. In a retail organization, the general ledger tracks overall sales numbers by region. A retail point of sales product tracks sales and inventory by store, product, supplier, markup, and other retail sales measures.

With a thick general ledger, you use the general ledger as a detailed, analytic tool, performing analytic functions directly in the general ledger. Data is broken down by many reporting labels, and populated frequently from the subledgers.

You maximize the data stored in the general ledger. A thick general ledger has many of the following characteristics:

Maximum use of the chart of accounts

Long list of natural accounts

Long list of cost centers

Long list of costing accounts

Detailed asset and liability accounts

Frequent posting schedule

In a thick general ledger, you obtain detail for cost of goods sold and inventory balances and track property plant and equipment at a granular level. Cost centers represent functional expenses, but also roll up to departmental or other expense analysis levels. Using product and location codes in optional segments can provide reporting by line of business. Posting daily, at the individual transaction level, can maximize the data stored in the general ledger.

One example of an industry that frequently uses a thick general ledger is electronic manufacturers. Detail on the revenue line is tagged by sales channel. Product is structured differently to provide detail on the cost of goods sold line, including your bill of materials costs. The general ledger is used to compare and contrast both revenue and cost of goods sold for margin analysis.

Consider implementing a thick ledger if there are business requirements to do any of the following:

Track entered currency balances at the level of an operational dimension or segment of your chart of accounts, such as by department or cost center

Generate financial allocations at the level of an operational dimension or segment

Report using multiple layered and versioned hierarchies of the operational dimension or segment from your general ledger

Consider implementing a thin ledger in addition to a thick ledger, if there are additional requirements for:

Minimal disclosure to the authorities in addition to the requirements listed above. For example, in some European countries, fiscal authorities examine ledgers at the detailed account level.

Fiscal only adjustments, allocations, and revaluations, which don't impact the thick general ledger.

The important consideration in determining if a thick ledger is the primary or secondary ledger is your reporting needs. Other considerations include how the values for an operational dimension or segment are derived and the amount of resources used in reconciling your different ledgers. If values for the operational dimension are always entered by the user like other segments of the accounting flexfield, then a thick primary ledger is the better choice.

However, if values for the operational dimension or segment are automatically derived from other attributes on the transactions in your subledger accounting rules, rather than entered in the user interface, then use a thick secondary ledger. This decision affects the amount of:

Storage and maintenance needed for both the general ledger and subledger accounting entries

System resources required to perform additional posting

In summary, you have:

Minimum demand on storage, maintenance, and system resources with the use of a thin ledger

Greater demand on storage, maintenance, and system resources with the use of a thick ledger

Greatest demand on storage, maintenance and system resources with the use of both thick and thin ledgers

Note

Generally speaking, there is a tradeoff between the volume of journals and balances created and maintained versus system resource demands. Actual performance depends on a wide range of factors including hardware and network considerations, transaction volume, and data retention policies.

The factors you need to consider in your decision to use a thick or thin general ledger for your organization, are your:

Downstream EPM system and its capabilities

Business intelligence system and its capabilities

Subledger systems and their capabilities and characteristics, including heterogeneity

General ledger reporting systems and their capabilities

Maintenance required for the thick or thin distributions and record keeping

Maintenance required to update value sets for the chart of accounts segments

Preferences of the product that serves as a source of truth

Level at which to report profitability including gross margin analysis

Industry and business complexity

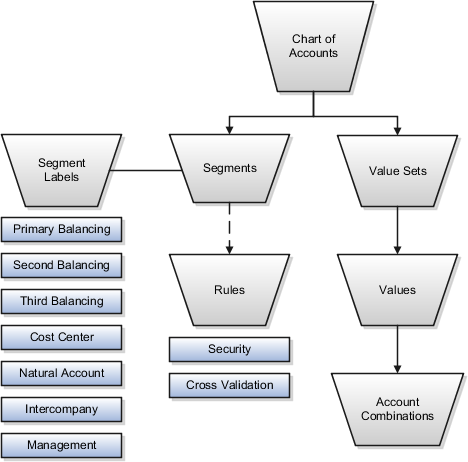

There are several important elements to the basic chart of accounts in Oracle Fusion Applications: a structure that defines the account values, segments, and their labels, and rules (security and validation). Account combinations link the values in the segments together and provide the accounting mechanism to capture financial transactions.

The chart of accounts defines the number and attributes of various segments, including the order of segments, the width of segments, prompts, and segment labels, such as balancing, natural account, and cost center.

The chart of accounts further defines the combination of value sets associated with each segment of the chart of accounts, as well as the type, default value, additional conditions designating the source of the values using database tables, and the required and displayed properties for the segments.

A chart of accounts segment is a component of the account combination. Each segment has a value set attached to it to provide formatting and validation of the set of values used with that segment. The combination of segments creates the account combination used for recording and reporting financial transactions. Examples of segments that may be found in a chart of accounts are company, cost center, department, division, region, account, product, program, and location.

The value sets define the attributes and values associated with a segment of the chart of accounts. You can think of a value set as a container for your values. You can set up your flexfield so that it automatically validates the segment values that you enter against a table of valid values. If you enter an invalid segment value, a list of valid values appears automatically so that you can select a valid value. You can assign a single value set to more than one segment, and you can share value sets across different flexfields.

Segment labels identify certain segments in your chart of accounts and assign special functionality to those segments. Segment labels were referred to as flexfield qualifiers in Oracle E-Business Suite. Here are the segment labels that are available to use with the chart of accounts.

Balancing: Ensures that all journals balance for each balancing segment value or combination of multiple balancing segment values to use in trial balance reporting. There are three balancing segment labels: primary, second, and third balancing. The primary balancing segment label is required.

Cost Center: Facilitates grouping of natural accounts by functional cost types, accommodating tracking of specific business expenses across natural accounts. As cost centers combine expenses and headcount data into costs, they are useful for detailed analysis and reporting. Cost centers are optional, but required if you are accounting for depreciation, additions, and other transactions in Oracle Fusion Assets, and for storing expense approval limits in Oracle Fusion Expense Management.

Natural Account: Determines the account type (asset, liability, expense, revenue, or equity) and other information specific to the segment value. The natural account segment label is required.

Management: Optionally, denotes the segment that has management responsibility, such as the department, cost center, or line of business. Also can be attached to the same segment as one of the balancing segments to make legal entity reporting more granular.

Intercompany: Optionally, assigns the segment to be used in intercompany balancing functionality.

Note

All segments have a segment qualifier that enables posting for each value. The predefined setting is Yes to post.

An account combination is a completed code of segment values that uniquely identifies an account in the chart of accounts, for example 01-2900-500-123, might represent InFusion America (company)-Monitor Sales (division)-Revenue (account)-Air Filters (product).

The chart of accounts uses two different types of rules to control functionality.

Security rules: Prohibit certain users from accessing specific segment values. For example, you can create a security rule that grants a user access only to his or her department.

Cross-validation rules: Control the account combinations that can be created during data entry. For example, you may decide that sales cost centers 600 to 699 should enter amounts only to product sales accounts 4000 to 4999.

In Oracle Fusion General Ledger, the chart of accounts model is framed around the concept of a chart of account structure, under which one or more chart of accounts structure instances can be created.

Your company, InFusion Corporation, is a multinational conglomerate that operates in the United States (US) and the United Kingdom (UK). InFusion has purchased an Oracle Fusion enterprise resource planning (ERP) solution including Oracle Fusion General Ledger and all of the Oracle Fusion subledgers. You are chairing a committee to discuss creation of a model for your global financial reporting structure including your charts of accounts for both your US and UK operations.

InFusion Corporation has 400 plus employees and revenue of $120 million. Your product line includes all the components to build and maintain air quality monitoring (AQM) systems for homes and businesses.

In Oracle Fusion General Ledger, the chart of accounts model is framed around the concept of a chart of account structure, under which one or more chart of accounts structure instances can be created.

The chart of accounts structure provides the general outline of the chart of accounts and determines the number of segments, the type, the length, and the label (qualifier) of each segment. This forms the foundation of the chart of accounts definition object.

For each chart of accounts structure, it is possible to associate one or more chart of accounts structure instances. Chart of accounts structure instances under the same structure share a common configuration with the same segments, in the same order, and the same characteristics. Using one chart of accounts structure with multiple instances simplifies your accounting and reporting.

At the chart of accounts structure instance level, each segment is associated with a value set that conforms to the characteristic of that segment. For example, you assign a value set with the same segment type and length to each segment. You are using hierarchies with your chart of account segments. Each structure instance segment is assigned a tree code to indicate the source of the hierarchy information for the associated value set. The same value set can be used multiple times within the same or across different chart of accounts instances within the same structure or in different structures. This functionality reduces your segment value creation and maintenance across your charts of accounts.

The collective assignment of value sets to each of the segments forms one chart of account instance. At the chart of accounts structure instance level, you can select to enable dynamic insertion. Dynamic insertion allows the creation of account code combinations automatically the first time your users enter that new account combination. The alternative is to create them manually. By deciding to enable dynamic insertion, you save data entry time and prevent delays caused by the manual creation of new code combinations. Well defined cross validation rules help prevent the creation of inappropriate account code combinations.

Perform deployment after a new chart of accounts structure and structure instances are defined or any of their modifiable attributes are updated. Deployment validates and regenerates the necessary objects to enable your charts of accounts and chart of accounts structure instances. By unifying and standardizing you organization's chart of accounts, you are positioned to take full advantage of future functionality in Oracle Fusion General Ledger.

In summary, you are recommending to your company to unify the organization's chart of accounts in a single chart of account structure based on chart of accounts commonalities across ledgers. You have also decided to use the chart of accounts structure instance construct to serve different accounting and reporting requirements by using value sets specific to each of your entities.

Oracle Fusion General Ledger supports tracking financial results at a finer level of granularity than a single balancing segment. In addition to the required primary balancing segment for the chart of accounts, which is typically associated with the company dimension of a business organization, two additional segments of the chart of accounts can be optionally qualified as the second and third balancing segments respectively. Possible chart of account segments that can be tagged as these additional balancing segments include cost center or department, additional aspects of a business commonly used in measuring financial results.

There are several points to consider in using multiple balancing segments:

Processes performed

Implementation timing

Change options

Migration adjustments

By enabling multiple balancing segments for your chart of accounts, it is possible to produce financial statements for each unique combination of segment values across not only one, but two or even three qualified balancing segments. This ability provides you greater insights into your operations as it affords you visibility along the critical fiscal dimensions you use to plan, monitor, and measure your financial performance.

The following processes are performed using the multiple balancing segment functionality:

Intercompany balancing: Adds lines to unbalanced journals using intercompany rules.

Opening first period of the new accounting year: Calculates retained earnings amounts at the level of granularity that totals revenue and expense account balances for multiple balancing segment value combinations. This applies to standard and average balances.

Importing journals: Adds lines using the suspense account on unbalanced journals.

Posting journals: Adds additional lines to unbalanced journals for the following enabled account types:

Suspense

Rounding imbalance

Net income

Retained earnings

Cumulative translation adjustments from replication of revaluation journals to reporting currencies and for multiple reporting currency account type specific conversion

Posting prior period journals: Calculates any income statement impact and posts to the appropriate retained earnings account.

Translating balances: Supports multiple balancing segments for the following accounts:

Retained earnings: Calculated translated retained earnings are post to the retained earnings accounts by balancing segment. Retained earnings represents the summing of the translated revenue and expense accounts across multiple balancing segment values.

Cumulative translation adjustment: Amounts posted by balancing segment to these accounts represents currency fluctuation differences between ranges of accounts which use different rate types. For example, period end rates are used for asset and liability accounts and historical rates for equity accounts.

Revaluing Balances: Supports multiple balancing segments when calculating gain or loss accounts.

Creating Opening Balances: Initializes reporting currency balances by converting from the total primary currency. Any difference in the reporting currency amounts is offset by populating retained earnings accounts.

Closing year end: Supports multiple balancing segments when calculating the income statement offset and closing account in the closing journals.

Multiple balancing segments ensure that account balances come from journal entries where the debits equal the credits, and thus, the financial reports are properly generated for each unique instance of account value combinations across the balancing segments.

A simple example follows to illustrate balancing along two balancing segments for a simple chart of accounts with three segments, qualified as follows:

Company: Primary balancing segment

Cost Center: Second balancing segment

Account: Natural account segment

The following multiple company and cost center journal shows transferring of advertising and phone expense from Company 1, Cost Center A to Company 2, Cost Center B. During the posting process, the last four lines are created to balance the entry across the primary and second balancing segments, company and cost center.

|

Account |

Debit |

Credit |

|---|---|---|

|

Company 1-Cost Center A-Advertising Expense Account |

600 |

|

|

Company 2-Cost Center B-Advertising Expense Account |

|

600 |

|

Company 1-Cost Center A-Phone Expense Account |

800 |

|

|

Company 2-Cost Center B-Phone Expense Account |

|

800 |

|

Company 1-Cost Center A-Balancing Account |

|

600 |

|

Company 2-Cost Center B-Balancing Account |

600 |

|

|

Company 1-Cost Center A-Balancing Account |

|

800 |

|

Company 2-Cost Center B-Balancing Account |

800 |

|

When considering implementing the optional second and third balancing segments, keep in mind that these chart of accounts segment labels are set from the beginning of time and are actively used by your ledgers. This is important to ensure that balances are immediately maintained in accordance with the necessary balancing actions to produce consistent financial reporting for the desired business dimensions. Multiple balancing segment ledgers that are not maintained from the beginning of time require extensive manual balance adjustments to catch up and realign the balances in accordance with the multiple balancing segments.

Note

A segment already qualified as a natural account or intercompany segment is not set as any of the three balancing segments. Neither of these two segments is qualified with another label beyond that of the natural account or intercompany segment label. Validations are not performed when segment labels are assigned, so verify that all are assigned correctly before using your chart of accounts.

Once a segment has been enabled and designated as a balancing segment, you must not change the segment. Do not disable the segment or remove the segment labels. These settings must be consistently maintained throughout the life of the chart of accounts to control the accuracy and integrity of the financial data.

For charts of accounts migrated from Oracle E-Business Suite to Oracle Fusion General Ledger that use a segment with the secondary balance tracking segment qualifier, steps must be taken to ensure the proper transition to the second and third balancing segments. The required adjustments are extensive and care needs to be taken

For ledgers associated with a migrated chart of accounts, its balances must be adjusted manually to be consistent with the second and third balancing segments as though these segment labels have been in place since the beginning of entries for these ledgers. This requires recomputing and updating of the following processes to reflect the correct balancing for each unique combination of segment values across the additional second and third balancing segments.

Intercompany balancing

Suspense posting

Rounding imbalance adjustments on posting

Entered currency balancing

Revaluation gains or losses

Retained earnings calculations at the opening of each new fiscal year

Cumulative translation adjustments during translation

Note

All previously translated balances must also be purged, and new translations run to properly account for translated retained earnings and cumulative translation adjustments with the correct level of balancing.

A cost center represents the smallest segment of an organization for which costs are collected and reported. A department is an organization with one or more operational objectives or responsibilities that exist independently of its manager and has one or more workers assigned to it.

The following two components need to be considered in designing your enterprise structure:

Cost centers

Departments

A cost center also represents the destination or function of an expense as opposed to the nature of the expense which is represented by the natural account. For example, a sales cost center indicates that the expense goes to the sales department.

A cost center is generally attached to a single legal entity. To identify the cost centers within a chart of accounts structure use one of these two methods:

Assign a cost center value in the value set for each cost center. For example, assign cost center values of PL04 and G3J1 to your manufacturing teams in the US and India. These unique cost center values allow easy aggregation of cost centers in hierarchies (trees) even if the cost centers are in different ledgers. However, this approach will require defining more cost center values.

Assign a balancing segment value with a standardized cost center value to create a combination of segment values to represent the cost center. For example, assign the balancing segment values of 001 and 013 with cost center PL04 to represent your manufacturing teams in the US and India. This creates 001-PL04 and 013-PL04 as the cost center reporting values.

The cost center value of PL04 has a consistent meaning. This method requires fewer cost center values to be defined. However, it prevents construction of cost center hierarchies using trees where only cost center values are used to report results for a single legal entity. You must specify a balancing segment value in combination with the cost center values to report on a single legal entity.

A department is an organization with one or more operational objectives or responsibilities that exist independently of its manager. For example, although the manager may change, the objectives do not change. Departments have one or more workers assigned to them.

A manager of a department is typically responsible for:

Controlling costs within their budget

Tracking assets used by their department

Managing employees, their assignments, and compensation

Note

The manager of a sales department may also be responsible for meeting the revenue targets.

The financial performance of departments is generally tracked through one or more cost centers. In Oracle Fusion Applications, departments are defined and classified as Department organizations. Oracle Fusion Human Capital Management (HCM) assigns workers to departments, and tracks the headcount at the departmental level.

The granularity of cost centers and their relationship to departments varies across implementations. Cost center and department configuration may be unrelated, identical, or consist of many cost centers tracking the costs of one department.

To plan for future growth in the business organization that requires additional segments in the chart of accounts, extra segments can be added to the chart of account structure during your original implementation. Since all segments of the chart are required and have to be enabled, these unused segments can be assigned value sets that have a single value in the chart of accounts structure instance. This value is set as a default for that segment so that the extra segments are automatically populated when an account code combination is used.

A value set is a set of valid values that you assign to a flexfield segment.

An end user enters a value into a flexfield segment while using the application. The flexfield validates the segment against the set of valid values that you configured as a value set and assigned to the segment.

For example, you can define a required format, such as a five digit number, or a list of valid values, such as green, red, and blue.

Flexfield segments are usually validated, and typically each segment in a given flexfield uses a different value set. You can assign a single value set to more than one segment, and you can share value sets among different flexfields.

Caution

Be sure changes to a shared value set are compatible with all flexfields segments using the value set.

Defining value sets involves making decisions about the following.

Validation

Security

Precision and scale

Usage and deployment

The following types of validation are available for value sets.

Format only, where end users enter data rather than selecting values from a list

Independent, a list of values consisting of valid values you specify

Dependent, a list of values where a valid value derives from the independent value of another segment

Subset, where the list of values is a subset of the values in an existing independent value set

Table, where the values derive from a column in an application table and the list of values is limited by a WHERE clause

A segment that uses a format only value set does not present a list of valid values to users.

You can build a tree structure from the values in an independent value set whose data type is character.

Note

Adding table validated value sets to the list of available value sets available for configuration is considered a custom task.

For more information, see the Oracle Fusion Applications Extensibility Guide.

Value set security only works in conjunction with usage within flexfield segments. If a value set is used standalone, meaning outside a flexfield, value set security is not applied, but Oracle Fusion data security is enforced.

You can specify that data security be applied to the values in flexfield segments that use a value set. Based on the roles provisioned to users, data security policies determine which values of the flexfield segment end users can view or modify.

Value set security applies at the value set level. If a value set is secured, every usage of it in any flexfield is secured. It is not possible to disable security for individual usages of the same value set.

Value set security applies to independent, dependent or table-validated value sets.

Value set security applies mainly when data is being created or updated, and to key flexfield combinations tables for query purposes. Value set security does not determine which descriptive flexfield data is shown upon querying.

Security conditions defined on value sets will always use table aliases. When filters are used, table aliases are always used by default. When predicates are defined for data security conditions, make sure that the predicates will also use table aliases.

For key flexfields, the attributes in the view object that correspond to the code combination ID (CCID), structure instance number (SIN) and data set number (DSN) cannot be transient. They must exist in the database table. For key flexfields, the SIN segment is the discriminator attribute, and the CCID segment is the common attribute.

For a value set with the data type Number, you can specify the precision (maximum number of digits user can enter) or scale (maximum number of digits following the decimal point).

The usage of a value set is the flexfields where that value set is used. The deployment status of flexfields in which the value set is used indicates the deployment status of the value set instance.

The figure shows a value set used by a segment in a key flexfield and the context segment of a descriptive flexfield.

For most value sets, when you enter values into a flexfield segment, you can enter only values that already exist in the value set assigned to that segment.

Global and context-sensitive segment require a value set. You can assign a value set to a descriptive flexfield context segment. If you specify only context values, not value sets for contexts, the set of valid values is equal to the set of context values.

A value set is the collection of account values that are associated with a segment of a chart of accounts structure instance. When creating values sets, consider the following critical choices:

Module Designation

Validation Type

Format Assignments

Security Rules

Values Definition

The module designation is used to tag value sets in Oracle Fusion Applications and sets the value sets apart during upgrades and other processes. Chart of accounts value sets upgraded from Oracle E-Business Suite Release 12 generically bear the module value of Oracle Fusion Middleware. When creating new value sets for a chart of accounts, the module can be specified as Oracle Fusion General Ledger to distinctly identify its intended use in an accounting flexfield, basically a chart of accounts.

Assign one of the following validation types to chart of accounts value sets:

Independent: The values are independently selected when filling out the segment in the account combination.

Table Validated: The values are stored in an external table to facilitate maintenance and sharing of the reference data.

Value sets for chart of accounts must use the Value Data Type of Character. The Value Subtype is set to Text. These two setting support values that are both numbers and characters, which are typical in natural account segment values. Set the maximum length of the value set to correspond to the length of the chart of accounts segment to which it is assigned. Best practices recommend restricting values to Upper Case Only or Numeric values that are zero filled by default.

If flexfield data security rules are to be applied to the chart of accounts segment associated with the value set, the Enable Security check box must be checked for the assigned value set. In addition, assign a data security resource name to enable creation of a data security object automatically for the value set. The data security object is used in the definition of flexfield data security rules.

Once these basic characteristic are defined for the value set, values can be added to the set in the Manage Values page.

Set the values to conform to the value set length and type.

Enter the value, its description, and its attributes including the Enable check box, Start Date, and End Date.

Assign the following attributes: Parent or Summary check box, Posting is allowed, and Budgeting is allowed.

Note

If the value set is used with a natural account segment, the value also requires you set the Natural Account Type, with one of the following values: Asset, Liability, Equity, Revenue or Expense. Other attributes used are Third Party Control Account, Reconciliation indicator, and Financial Category used with Oracle Transaction Business Intelligence reporting.

Segment labels identify certain segments in your chart of accounts structure and assign special functionality to those segments. Segment labels were referred to as flexfield qualifiers in Oracle E-Business Suite (EBS). Best practice is to assign each segment label one time within the chart of accounts structure. Here are the segment labels that are available to use with the chart of accounts structure.

Caution: Validations are not performed when segment labels are assigned, so verify that all are assigned correctly before using your chart of accounts.

Ensures that all journals balance for each balancing segment value or combination of multiple balancing segment values. You can secure access to your primary balancing segment values only with data access sets. The general ledger application automatically calculates and creates balancing lines as required in journal entries. For example, recognizing an entity's receivable and the other entity's payable. There are three balancing segment labels: primary, second, and third balancing. The primary balancing segment label is required.

Represents the smallest segment of an organization for which costs are collected and reported. Facilitates grouping of natural accounts by functional cost types, accommodating tracking of specific business expenses across natural accounts. As cost centers combine expenses and headcount data into costs, they are useful for detailed analysis and reporting. Cost centers are optional, but required if accounting for depreciation, additions, and other transactions in Oracle Fusion Assets, and for storing expense approval limits in Oracle Fusion iExpense.

Determines the account type (asset, liability, expense, revenue, or equity), whether posting is allowed, and other information specific to the segment value. The natural account segment is mapped to the Financial Category dimension in the balances cube to enable ad hoc reporting and transactional dashboards. This functionality uses Oracle Fusion Business Intelligence Enterprise Edition to analyze and drill into expense and revenue transactions. The natural account segment label is required.

Optionally, assigns the segment to be used in intercompany balancing functionality. You cannot use the primary balancing or natural account segments as the intercompany segment. It is recommended that you use this segment and assign the same values to both the primary balancing and intercompany value sets to enable clear visibility of the due to and due from relationships inherent in intercompany accounting across the entire organization. Consider using the same values set for the primary balancing and intercompany segments to save maintenance and ensure completeness.

Optionally, denotes the segment that has management responsibility, such as the department, cost center, or line of business. Can be any segment, except the primary balancing or natural account segments. By designating a segment of your chart of accounts to the management segment, you can secure access to the management segment values with data access sets. By providing segment values to represent the lowest level of your organization, you can roll up results by line of business or other management criteria.

Note: Available in a future release. Do not assign this segment to your chart of accounts in Oracle Fusion Version 1.

For a chart of accounts, each segment can be qualified by a label to distinctly indicate its purpose. This designation is also used by the Oracle Fusion General Ledger programs to determine the proper way to display and process transactions and balances that are recorded.

You are creating your chart of accounts with six segments. Oracle Fusion General Ledger permits selection of up to thirty segments for your chart of accounts. You must have a minimum of three required segments, as determined below by the number of required segment labels (qualifiers). Required segment labels are:

Primary Balancing Segment: Main balancing segment typically used to represent the company dimension of the organization. The segment set with this label cannot be set with another label.

Cost Center Segment: Subunits of the company, such as cost or profit centers, or departments. You are required to create this segment if you are implementing Oracle Fusion Assets.

Natural Account Segment: Classification of transactions and balances according to distinct account types: asset, liability, equity, revenue, and expense accounts. The segment set with this label cannot be set with another label.

The following optional segment labels are available and you are implementing all except for the Management Segment:

Second Balancing Segment: Used to balance transactions, as needed, by an additional dimension beyond the primary balancing segment.

Third Balancing Segment: Used to balance transactions, as needed, by an additional dimension beyond the primary and second balancing segments.

Management Segment: Used in a future release. For Oracle Fusion Version 1, do not enable this qualifier.

Intercompany Segment: Used to track intercompany due to and due from balances by identifying the specific trading company. The intercompany qualified segment cannot be set with any of the three balancing segment qualifiers. The values in this segment's value set need to be the same as the primary balancing segment.

Segment labels can only be assigned once within your chart of accounts. The following table shows how you are assigning the segment labels in your chart of accounts.

|

Segment |

Segment Label |

|---|---|

|

Company |

Primary Balancing Segment |

|

Cost Center |

Cost Center and Second Balancing Segment |

|

Location |

Third Balancing Segment |

|

Account |

Natural Account Segment |

|

Product Line |

|

|

Intercompany |

Intercompany Segment |

Note

Validations are not performed when segment labels are assigned, so verify that all are assigned correctly before using your chart of accounts.

For Oracle Transactional Business Intelligence reporting, all labeled or qualified segments of the chart of accounts are automatically maintained in the data that reporting is based on. For non-qualified segments, the granularity of information stored in these segments is summarized and thus, Oracle Transactional Business Intelligence would not be able to provide detailed reporting along by these segments. If it is important to maintain the ability to perform detailed reporting on such segments, create custom labels to qualify these segments.

For example, one of the segments of the chart of accounts is based on product line, and none of the predefined segment labels above are applicable. It is important for the organization to derive product line based Oracle Transactional Business Intelligence reports. Create a custom label called Product Line to use to qualify the Product Line segment of the chart of accounts.

The Segment Value Inheritance process simplifies the maintenance of the chart of accounts. When the characteristics of values in the value sets are updated, such as changes in enabled status, effective date, posting allowed status, or natural account type, all previously created account code combinations that referenced such values are not automatically updated by these changes. The Segment Value Inheritance process allows you to run a controlled process to update such existing account code combinations. This process maintains and corrects the current attribute settings for those account code combinations that contain the account values that were changed.

For account code combinations where the present settings need to be retained and not impacted by account attribute changes, activate the flag to preserve the account code combination's attribute. Activating the flag prevents those account code combination's attributes from being update when the Segment Value Inheritance process is run.

For example, there are three inactive account code combinations that share a common inactive cost center value of 110.

|

Company-Cost Center-Account |

Enabled |

|---|---|

|

01-110-5210 |

No |

|

04-110-4310 (Preserve Attributes flag enabled) |

No |

|

03-110-6810 |

No |

Cost center 110 went from being disabled to enabled. When the Segment Value Inheritance process is run, the following shows the result on these three account code combinations.

|

Company-Cost Center-Account |

Enabled |

|---|---|

|

01-110-5210 |

Yes |

|

04-110-4310 (Preserve Attributes flag enabled) |

No |

|

03-110-6810 |

Yes |

Note

Once you disable a segment value and you log out of the system and back in, all code combinations containing that segment no longer work, even if the account combination still shows enabled in the account combination page. Use the Segment Value Inheritance process to set the enable flag correctly on the affected account code combinations.

The chart of accounts structure and chart of accounts structure instance are fundamental constructs in the Oracle Fusion General Ledger accounting setup and cannot be altered once they are in use. The number of segments, the segments' order, each segment's label, length, type, and value set assignment are not updateable. These components set the foundation upon which accounting data is recorded for ledgers that use them. Careful and thoughtful planning must precede all decisions pertaining to defining the chart of accounts.

To use a flexfield at runtime, the flexfield must have been deployed at least once. Deployment generates or refreshes the Application Development Framework (ADF) business component objects that render the flexfield in a user interface. Flexfields are deployed for the first time during the application provisioning process.

You can deploy a flexfield to a sandbox for testing or to the mainline for use.

Every flexfield has a: deployment status.

A flexfield can have the following deployment statuses.

|

Deployment Status |

Meaning |

|---|---|

|

Edited |

The flexfield metadata definition has not been deployed yet. Updates of the metadata definition are not applied in the runtime yet. |

|

Patched |

The flexfield metadata definition has been modified through a patch, but the flexfield has not yet been deployed so the patched definition is not reflected in the runtime. |

|

Deployed to Sandbox |

The current metadata for the flexfield is deployed in ADF artifacts and available as a flexfield-enabled sandbox. The status of the sandbox is managed by the Manage Sandboxes task available to the Administrator menu of Setup and Maintenance work area. |

|

Deployed |

The current metadata for the flexfield is deployed in ADF artifacts and available to end users. There have not been any changes to the flexfield since it was last deployed in the mainline. |

|

Error |

The deployment attempt in the mainline failed. |

Note

Whenever a value set definition changes, the deployment status of a flexfield that uses that value set changes to edited. If the change results from a patch, the deployment status of the flexfield changes to patched.

The Oracle Fusion Applications installation loads flexfield metadata into the database. This initial load sets the flexfield status to Edited to indicate that the flexfield has not been deployed yet. The application provisioning process during installation deploys the predefined flexfields of the provisioned applications, which sets their status to Deployed if no errors are encountered.

When accessing a provisioned application, deployed flexfields are ready to use. In some cases, flexfield availability at runtime requires setup, such as defining key flexfields.

Use the Validate Metadata command to view possible metadata errors before attempting to deploy the flexfield. Metadata validation is the initial phase of the Deploy and Deploy to Sandbox commands. By successfully validating metadata before running the deployment commands, you can avoid failures in the metadata validation phase of a deployment attempt. Errors in the metadata validation phase of deployment cause the deployment attempt to abort. Metadata validation results do not affect the deployment status of a flexfield.

Flexfield deployment status indicates how the flexfield metadata definition in the Oracle Applications database relates to the Application Development Framework (ADF) business components generated into a Metadata Services (MDS) repository.

If you have made a change to a flexfield and expect a changed deployment status, be sure you have saved your changes. No settings affect flexfield deployment status.

If the flexfield definition has been edited through the Define Flexfields activity task flows, the status is Edited. The latest flexfield metadata definition in the Oracle Fusion application diverges from the latest deployed flexfield definition. Any change, including if a value set used in a flexfield changes, changes the deployment status to Edited. If a flexfield has never been deployed, its status is Edited.

Note

When an application is provisioned, the provisioning framework attempts to deploy all flexfields in that application.

If you deploy the flexfield to a sandbox successfully, the status is Deployed to Sandbox. The latest flexfield metadata definition in the Oracle Fusion Application matches the metadata definition that generated ADF business components in a sandbox MDS repository. Whether the sandbox is active or not does not affect the deployment status. If the flexfield was deployed by a sandbox and has not been edited or re-deployed to the mainline since then, the status remains Deployed to Sandbox independent of whether the sandbox is active, or who is viewing the status.

If you deploy the flexfield successfully, meaning to the mainline, the status is Deployed. The latest flexfield metadata definition in the Oracle Fusion application matches the metadata definition that generated ADF business components in a mainline MDS repository. Change notifications are sent when a flexfield is deployed successfully to the mainline.

If either type of deployment fails so the current flexfield definition is not deployed, the status is Error. The deployment error message gives details about the error. The latest flexfield metadata definition in the Oracle Fusion application likely diverges from the latest successfully deployed flexfield definition.

If the flexfield definition has been modified by a patch, the status is Patched. The latest flexfield metadata definition in the Oracle Fusion application diverges from the latest deployed flexfield definition.

When a deployment attempt fails and you can access the Deployment Error Message for details.

The flexfield definition in a sandbox corresponds to the flexfield metadata definition in the Oracle Fusion Applications database at the time the flexfield was deployed to the sandbox. When the flexfield is ready for end users, the flexfield must be deployed to the mainline.

A flexfield-enabled sandbox uses the following components.

Flexfield metadata in the Oracle Fusion Applications database

Flexfield business components in a sandbox Metadata Services (MDS) repository

User interface customizations for the flexfield in the mainline MDS repository

The figure shows the two types of deployment available in the Manage Flexfield tasks of the Define Flexfields activity. Deploying a flexfield to a sandbox creates a sandbox MDS repository for the sole purpose of testing flexfield behavior. The sandbox is only accessible to the administrator who activates and accesses it, not to users generally. Deploying a flexfield to the mainline applies the flexfield definition to the mainline MDS repository where it is available to end users. After deploying the flexfield to the mainline, customize the page where the flexfield segments appear. Customization of the page in the sandbox MDS repository cannot be published to the mainline MDS repository.

Deploying the flexfield to a sandbox generates the Application Development Framework (ADF) business components of a flexfield in a sandbox MDS repository for testing in isolation.

Warning

Do not make changes to flexfield segment display features in a flexfield-enabled sandbox as these changes will be lost when deploying the flexfield to the mainline.

The Oracle Fusion Applications database stores the single source of truth about a flexfield. From this the ADF business component objects that implement the flexfield in the runtime user interface are generated in the mainline MDS repository when the flexfield is deployed.

Deploying a flexfield to a sandbox creates a flexfield-enabled sandbox . Each flexfield-enabled sandbox contains only one flexfield.

You can test the runtime behavior of a flexfield in the flexfield-enabled sandbox. If changes are needed, return to the Define Flexfield tasks to change the flexfield definition.

When you deploy a flexfield to sandbox, the process reads the metadata about the segments from the database, generates flexfield Application Development Framework (ADF) business component artifacts based on that definition, and stores in the sandbox only the generated artifacts derived from the definition.

The sandbox data allows you to test the flexfield in isolation without first deploying it in the mainline where it could be accessed by users.

Warning

Do not make changes to flexfield segment display features in a flexfield-enabled sandbox as these changes will be lost when deploying the flexfield to the mainline.

When you deploy a flexfield as a sandbox, that flexfield-enabled sandbox automatically gets activated in your user session. When you sign back in to see the changes, the sandbox is active in your session.

You can only deploy a flexfield to a sandbox using the Define Flexfields task flow pages.

You also can use the Manage Sandboxes feature in the Administration menu of the Setup and Maintenance work area to activate, access, or delete a flexfield-enabled sandbox.

Note

Whether you use the Define Flexfields or Manage Sandboxes task flows to access a flexfield-enabled sandbox, you must sign out and sign back in before you can see the changes you deployed in the runtime.

You cannot publish the flexfield from the sandbox to the mainline. You must use the Define Flexfields task flow pages to deploy the flexfield for access by users of the mainline because the flexfield configuration in the mainline is the single source of truth.

You can use the Manage Key Flexfields, Manage Descriptive Flexfields, and Manage Extensible Flexfields tasks to deploy flexfields. You can also use WebLogic Server Tool (WLST) commands for priming the Metadata Services (MDS) repository with predefined flexfield artifacts and for deploying flexfields.

The table describes the available commands.

|

WebLogic Server Tool Command |

Description |

|---|---|

|

Deploys all flexfields for the specified enterprise application. Only flexfields whose status is other than deployed are affected by this command unless the option is enabled to force all flexfields to be deployed regardless of deployment status. Initial application provisioning runs this command to prime the MDS repository with flexfield artifacts. |

|

Deploy a single flexfield regardless of deployment status |

|

Deploys flexfield changes that have been delivered using a flexfield Seed Data Framework (SDF)patch. Deploys flexfields that have a Patched deployment status. |

Executing these commands outputs a report at the command line. The report provides the following information for every flexfield that is processed.

Application identity (APPID)

Flexfield code

Deployment result, such as success or error

In case of errors, the report lists the usages for which the errors were encountered. If a runtime exception occurs, the output displays the traceback information.

Consider the following aspects of command line deployment.

Preparing to use the WLST flexfield commands

Using the deployFlexForApp command

Using the deployFlex command

Using the deployPatchedFlex command

Exiting the WLST and checking the results

You can only execute the WLST flexfield commands on a WebLogic Administration Server for a domain that has a running instance of the Oracle Fusion Middleware Extensions for Applications (Applications Core) Setup application.

For more information on deploying the Applications Core Setup application, see the Oracle Fusion Applications Developer's Guide.

Ensure that the AppMasterDB data source is registered as a JDBC data source with the WebLogic Administration Server and points to the same database as the ApplicationDB data source.

Start the WebLogic Server Tool (WLST) tool, if it is not currently running.

UNIX:

sh $JDEV_HOME/oracle_common/common/bin/wlst.sh

Windows:

wlst.cmd

Connect to the server, replacing the user name and password arguments with your WebLogic Server user name and password.

connect('wls_username', 'wls_password', 'wls_uri')

The values must be wrapped in single-quotes. The wls_uri value is typically T3://localhost:7101.

For more information on the WLST scripting tool, see the Oracle Fusion Middleware Oracle WebLogic Scripting Tool.

deployFlexForApp CommandThe deployFlexForApp command translates the product application's predefined flexfield

metadata into artifacts in the MDS repository.

Important

This command is run automatically when you provision

applications. However, after custom applications development, you

must run the deployFlexForApp command

after you configure your application to read the flexfield artifacts

from the MDS repository and before you log into the application for

the first time, even if there is no predefined flexfield metadata.

This command does not deploy flexfields that have

a status of Deployed unless the force parameter is set to 'true' (the default setting is 'false').

For more information on priming the MDS partition with configured flexfield artifacts, see the Oracle Fusion Applications Developer's Guide.

From the WLST tool, execute the following commands

to deploy the artifacts to the MDS partition, replacing product_application_shortname with the application's

short name wrapped in single-quotes.

deployFlexForApp('product_application_shortname'[, 'enterprise_id'] [,'force'])

In a multi-tenant environment, replace enterprise_id with the Enterprise ID to which

the flexfield is mapped. Otherwise, replace with 'None' or do not provide a second argument.

To deploy all flexfields regardless of their deployment

status, set force to 'true' (the default

setting is 'false'). If you want to

deploy all flexfields in a single-tenant environment, you either can

set enterprise_id to 'None', or you can use the following signature:

deployFlexForApp(applicationShortName='product_application_shortname',force='true')

Tip

The application's short name is the same as the application's module name.

For more information about working with application taxonomy, see the Oracle Fusion Applications Developer's Guide.

deployFlex CommandFrom the WLST tool, execute the following

command to deploy a flexfield, replacing flex_code with the code that identifies the flexfield, and replacing flex_type with the flexfield's type, which is

either DFF, KFF, or EFF.

deployFlex('flex_code', 'flex_type')

The values must be wrapped in single-quotes.

deployPatchedFlex CommandUse the deployPatchedFlex command for situations where the patching framework does not invoke

the command, such as when an application has been patched offline.

If the installation is multi-tenant enabled, the command deploys all patched flexfields for all enterprises. This command is not intended to be invoked manually.

Check with your provisioning or patching team, or the task flows for managing flexfields, to verify that the flexfield has a Patched deployment status.

From the WLST tool, execute the following command to deploy the artifacts to the MDS partition.

deployPatchedFlex()

To exit the tool, execute the following command.

disconnect()

Optionally, sign into the application, access user interface pages that contain flexfields, and confirm the presence of flexfields for which configuration exists, such as value sets, segments, context, or structures.

In Oracle Fusion General Ledger, use cross validation rules to determine the account combinations that your users can create dynamically as they enter transactions or journal entries. Once enabled, a cross validation rule determines whether a selected value for a particular segment of the account combination can be combined with specific values in the other segments to form a new account combination.

If account combinations already exist and violate the newly enabled cross validation rules, these account combinations continue to be valid. Before disabling any existing account combinations that violate your rules and you are no longer using, move the balances in those accounts to the correct accounts. Then disable the account combinations manually to prevent further posting.

Note

Best practice is to define and enable cross validation rules before:

Balances are loaded

Transactions or journal entries are imported or entered

Account combinations are created

The chart of accounts mapping feature supports the ability to correlate a source chart of accounts to a target chart of accounts to allow for the processing of balances or amounts. This is accomplished by either using segment rules, account rules, or a combination of both. A chart of accounts mapping is used by the posting program in propagating transactions from the primary ledger to its secondary ledger, providing the means to map the primary ledger chart of accounts to that of the secondary ledger. The mapping feature is used by both balance transfer programs for balance level secondary ledgers as well as cross ledger transfers, whereby balances from one ledger are copied to another ledger.

Segment rules serve to map each segment of the target chart of accounts to an account value or segment in the source account. Three different mapping actions are available:

Assign a constant value for a segment in the target chart of accounts

Copy the value from the source segment to the corresponding target segment

Note

To use this action, the paired target and source segments must share identical values in their value sets.

Use roll up rules to aggregate source accounts to a corresponding target segment or account

Create a single value mapping when a specific detail source segment value is given a detail target segment value.

Use hierarchical roll up rules when a specific parent source value and all of its child segment values, are mapped to a given detail target segment value. This provides the ability to process groups of source segment values in one single roll up rule.

Define parent source values in roll up rules when date effective versions of the hierarchy are used with the accounting date of the transactions produced by the programs that reference the chart of accounts mapping. This gives the additional benefit of self maintaining mappings since the hierarchies referenced change with time, and the applicable child values are processed automatically.

In addition to segment rules, define account rules for the chart of accounts mapping. Account rules map a complete target account code combination against one or more source account code combinations. The source account code combinations can be defined segment by segment using:

Single detail account values

Detail account value ranges

Parent values for each segment

Note

When using parent values, its child values for the date effective version of the hierarchy, are processed when the mapping is called.

Segment rules and account rules can be exclusively used in a chart of accounts mapping, or you can use a combination of both. If there is an overlap between the two types of rules, whereby a source account is mapped one way by the segment rules, and another by the account rules, the account rule supersedes. As such, segment rules can be used to more broadly define how to map the relationship between two charts of accounts on a segment by segment basis, and account rules can be used to more precisely delineate specific source account code combinations into their intended target accounts.

Use the tree management feature in Oracle Fusion applications to organize data into hierarchies. A hierarchy contains organized data and enables the creation of groups and rollups of information that exist within an organization. Trees are hierarchical structures that enable several data management functions such as better access control, application of business rules at various levels of hierarchies, improved query performance, and so on.

For example, XYZ Corporation has two departments: Marketing and Finance. The Finance department has two functional divisions: Receivables and Payables. Defining a tree for the XYZ Corporation establishes a hierarchy between the organization and its departments, and between the departments and their respective functional divisions. Such a hierarchical modeling of organizational data could be used for executing several data management functions within that organization.

You can create one or more versions of trees, and they can be labeled for better accessibility and information retrieval. You can create trees for multiple data sources, which allow the trees to be shared across Oracle Fusion applications.

A tree structure is a representation of the data hierarchy, and guides the creation of a tree. A tree is an instance of the hierarchy as defined in the tree structure. Tree structures enable you to enforce business rules to which the data must adhere.

The root node is the topmost node of a tree. Child nodes report to the root node. Child nodes at the same level, which report to a common parent node, are called siblings. Leaves are details branching off from a node but not extending further down the tree hierarchy.

A tree is created having only one version. However, users can create more than one tree version depending on the need, and they can make changes to those versions. Depending on varying requirements, users can create one or more tree versions and publish all of them or some of them by making the versions active at the same time. Similar to any other version control system, versions of trees are maintained to keep track of all the changes that a tree undergoes in its life cycle.

Tree labels are short names associated with trees and tree structures and point directly to the data source. Tree labels are automatically assigned to the tree nodes. You can store labels in any table and register the label data source with the tree structure.