11g Release 1 (11.1.1.5.0)

Part Number E20383-01

Contents

Previous

Next

|

Oracle® Fusion

Applications

Procurement Implementation Guide 11g Release 1 (11.1.1.5.0) Part Number E20383-01 |

Contents |

Previous |

Next |

This chapter contains the following:

Define Transaction Account Rules

Define Corporate Procurement Cards

Define Common Payables and Procurement Options

A catalog is a collection of categories that you use to classify items. You can organize the categories into a hierarchy the represents a taxonomy. You create new categories only in the context of a catalog. You can add existing categories to one or more catalogs, either from another catalog or as shared categories from a source catalog.

You can set the Catalog Content value to Items at all levels which allows items to be assigned to any level within the category hierarchy, not only to the leaf levels.

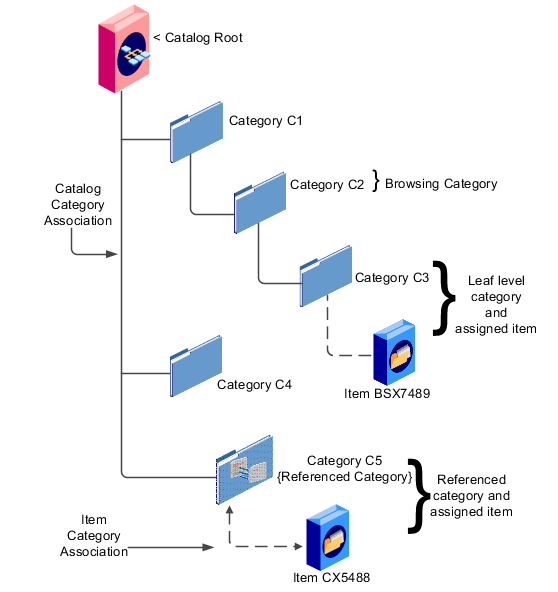

The following diagram shows the relationships of the catalog components.

A catalog is a collection of categories that are organized to define a classification of items. The top most level of a catalog is the catalog root. All categories for the first level in the category hierarchy are associated with the catalog root through the catalog category association component.

A category is a component of a catalog that represents a portion of the classification defined by the categories and category hierarchy in the catalog. You can associate a category to a catalog through the catalog category association. Both the shared category and the native category are associated thorough the catalog category association.

Catalog category association represents the relationship between a catalog and a category, or a parent category and a child category. Each catalog category association represents one relationship between the catalog and a category or one relationship between a parent category and a child category.

Item category assignment represents the assignment of the item to a category in a catalog. Each item category assignment represents the relationship between a category and an item.

An item represents objects such as a product, service or template. An item is assigned through the item category assignment component.

Information is associated to the catalog and/or category, or both, through the attachment framework. Multiple attachments are supported but you can associate only a single attachment or attachment type image with a catalog or category.

The format of a catalog is defined at the time the catalog is created and controls the behavior of the catalog at runtime.

When you format a catalog the layout controls three main areas and includes the following tasks, some fields are required, and others are optional.

Catalog configuration

Date enablement

Category sharing

You can configure the catalog, and this affects how the content behaves. The catalog configuration contains a set of attributes that define the catalog configuration. These attributes interact to define the runtime behavior of the catalog.

The configuration functions are:

Catalog code: A unique identifier that is used.

Catalog structure: The key flexfield structure used to define the catalog.

Controlled at: Controls how items are assigned to categories and has two values. The first value is master level, which enables the automatic assignment of items to all child organizations associated with the master organization, if the current context is a master organization. The second value is organization level, which assigns the item only to the organization in the current context.

Default category: Applies any time a new item is created. The newly created item is assigned to this category within the catalog automatically. The automatic assigned is controlled by the functional area.

Catalog content: Controls what content can be added to the catalog and where the content can be added. This attribute has three values:

The Item at leaf levels allows items to be added only to the bottom level categories in the hierarchy.

The Items at all levels allows items to be assigned to any category in the hierarchy regardless of level.

Categories only allows categories to be added only to the catalog.

Allow multiple item category assignment: When this option is selected, you can assign an item to one or more categories in the catalog. The default is deselected, which means that each item can be assigned to only one category in the catalog.

Enable hierarchies for categories: When this option is selected, you can create a hierarchy for the catalog. The default is deselected, which means that the catalog cannot have a hierarchy and categories are associated with the catalog root.

Enable automatic assignment of categories: When this option is selected, the catalog is built by automatically associating all categories, based on matching the catalog structure value to the category structure value.

The date enablement function controls when the catalog is in an active state or inactive state by using the start date and end date attributes.

The category sharing function enables sharing by reference to categories from a designated source catalog.

The sharing function has these attributes:

Source catalog: A catalog that does not have sharing enabled from which categories, category hierarchies, and assigned items can be added to the catalog.

Sharing content: Controls what content can be added from the source catalog. This attribute has three values:

Categories only: Only categories without assigned items can be shared.

Items only: Only categories with assigned items can be shared.

Items and categories: All categories can be shared.

You can change a default category so that you can use it for item creation, or modify the inactive date so that the category is no longer used as you update a catalog. You can correct mistakes or reclassify the category due to shifting relationships within the category hierarchy.

You can view and edit a catalog on the Edit Catalog page when you have editing rights. For users that do not have rights to edit, the page is in read only mode.

The following aspects are important regarding managing and editing catalog details:

Catalog header region

Catalog detail tab

Category hierarchy tab

This region contains the catalog name and description, the selection of the default category and the start and end date for the catalog.

The Detail tab contains:

The configuration attributes for the catalog that controls the runtime behavior for the catalog.

The sharing attributes for the catalog which controls the source catalog that will be used for sharing from and what content can be shared.

The additional information which contains the descriptive flexfields defined for the catalog.

This contains the category hierarchy region in which the category hierarchy can be created and maintained. In addition, items can be assigned, and the usage of the category in other catalog can be viewed, and the attributes for the category and catalog category association can be edited.

The automatic assignment catalog feature enables you to reduce the cost of creating and maintaining a catalog. It is a simple way to create a nonhierarchical catalog because you do not have to add categories manually to the catalog.

All categories that have the same category structure value as the catalog are automatically assigned and associated to the catalog when you create a catalog category association for each category. Note that if you create a category in another catalog with the same structure value as the automatic assignment catalog, the category is added to your catalog. The categories displayed for auto assignment catalogs are refreshed only at startup and after you save.

The automatic assignment feature is enabled during catalog creation when you select the Enable automatic assignment of category check box. When you open a new catalog, any categories that have the same category structure value as the catalog structure value for the catalog are automatically assigned to the catalog.

For example, Purchasing may maintain a master catalog containing all categories that represent commodities. Each commodity team can create categories for their commodity in their own catalog.

The master catalog for Purchasing is named Purchasing and is configured during creation to support the automatic assignment of categories.

The Electronic commodity team creates a catalog named Electronics and proceeds to create categories that represent the classification of their commodity. The Electronic commodity team creates the categories televisions, computers, and home theaters.

The other commodity teams create and maintain separate catalogs.

Because you enabled automatic assignments for the Purchasing catalog, any categories created by the commodity teams are added to the catalog automatically. The Purchasing managers can view the collection of all commodities represented as categories in the Purchasing catalog.

The Edit Catalog dialog is a shared page that has two modes, view and update. The view mode displays the selected catalog in a read-only file. The update mode displays the selected catalog in an editable file. You must have edit catalog privileges to access the catalog in update mode. You can edit only an active or future-dated catalog.

The following fields are editable in the catalog:

Catalog Name

Description

Start Date

End Date

Default Category

Allow multiple item category assignment

Addition Information

Category Hierarchy

Category Details

Items assigned to category

You can edit this field to select another category as the default category for item creation. You cannot remove the default category if the catalog is assigned to a functional area that requires a default category to be specified.

This check box is editable only until you assign an item to a category in the catalog.

You can edit the values of the descriptive flexfields attributes.

After you make changes, clicking the Save button saves the changes to the database but will does not close the Edit Catalog page. Clicking the Save and Close button saves the changes to the database and closes the Edit Catalog page.

Catalogs are used to organize and classify collections of items by associating categories to the catalog. The categories are organized to form a taxonomy and items are assigned to the categories. When a category is associated with the catalog a catalog category association is created which specifies the relationship of the association. The catalog category association may also represent the relationship between two categories, for example a relationship between a parent category and a child category.

The following aspect is important regarding catalog category association:

Date enablement attribute value

The catalog category association is date enabled providing the control of when the catalog category association is active in the catalog and when the catalog category association is inactive. The catalog category association has two attributes to support date enablement; the start date and the end date. The start date is value is the first day that the catalog category association is available or active for use and the end date is the last day the catalog category association can be used, after this date the catalog category association is inactive. The date enablement attribute values are also used to control the visibility of content and the behavior of the category in the catalog. If a category association is inactive or end dated, having the value of the end date attribute past the current date, then the items cannot be assigned to the category.

A catalog category association will be set to inactive state when the category referenced by the catalog category association is set to an inactive state automatically, but the display will not be refreshed automatically.

The catalog, categories, and catalog category association use date enablement to determine if the object specified is active or inactive based on the start date and end date. The following are date enablement definitions:

Active An object is active when the current date is later than or equal to the value of the start date, but earlier than or equal to value of the end date.

Inactive An object is inactive when the current date is later than the value of the end date.

Future dated An object is future dated when the current date is earlier than the value of the start date.

You set the date enablement attributes are used to determine when a catalog, category, or catalog category association is used or visible.

On the Manage Catalog page, a table filter determines which catalogs appear. The default value for the choice list is Active, indicating that only active catalogs will be displayed. You can select the value All to view both active and inactive catalogs.

On the Edit Catalog page, on the category hierarchy tab, two table filters determine what categories and catalog category associations appear. The default values for the two choice lists are Active, indicating that only active categories and active catalog category associations will be displayed. You can select the value All to view both active and inactive categories and catalog categories associations.

Other applications also use the date enablement attributes to filter information retrieved through application programming interfaces or services for catalogs.

The following illustration provides the date enablement attributes for these objects. The catalog, category, or the catalog category association has an internal state that is active or inactive.

The following aspects are important regarding date enablement for catalogs and categories:

Start date

End date

Catalog and category objects

Catalog category association

Catalog and category rules

The start date is defined as the first date that the object can be active. The start date can be future dated by setting the value to a date later than the current date. The start date value defaults to the system date if no date is entered during catalog or category creation.

The end date is defined as the last date that the object can be active. The object is end dated one second after the date specified by the value of End Date, that is the next day at 12:00:01 a.m. You cannot set the end date in the past. Also, you can change the end date from a condition when the object is ended to a new end date greater than or equal to the system date, causing the object to go from inactive to active. The end date value is optional during catalog or category creation.

The start and end dates have been added for the catalog and catalog category association. The inactive date for categories has been renamed as the end date and the start date has been added.

The catalog category association is used to specify the parent and child relationships between catalogs and categories and for category to category relationships. The catalog category association date enablement is independent of the category data enablement, except for the case where the category is end dated; the association is ended automatically as well. The catalog category association dates represents the state of the category for the catalog in which the category is associated.

When a catalog is inactive the following rules apply:

All operations for the catalog are disabled; the catalog is not editable.

The catalog cannot be used in other processes.

The catalog can be viewed only if you set filters on the Manage Catalog page to a value of All, enabling you to view active and inactive catalogs.

When a category is inactive the following rules apply:

All operations for the category are disabled; the category is not editable.

The category cannot be added to other catalogs.

The category can be viewed only if you set the filters on the Edit Catalog page to a value of All, enabling you to view active and inactive catalogs.

The system sets the catalog category association for the inactive category to inactive.

When a catalog category association is inactive the following rules apply:

The category may be inactive or active; if the category is active it can be edited.

The catalog category associations and related category can be viewed only if you set the association filter on the Edit Catalog page to a value of All, enabling you to view active and inactive catalogs.

When a catalog is future dated the following rules apply:

All the operations of the catalog are enabled and the catalog is editable.

The catalog can be used in other processes, if allowed.

The catalog can be viewed only if the you set the filters on the Manage Catalog page to value of All.

You use catalogs to organize and classify collections of items by associating categories with the catalog. You organize the categories to form a taxonomy and assign items to the categories. When you associate a category with the catalog, a catalog category association is created which specifies the relationship of the association. The catalog category association may also represent the relationship between two categories, for example, a relationship between a parent category and a child category.

The following diagram shows the relationships of the category hierarchy components:

The components of a category hierarchy are:

Catalog root: The topmost node in category hierarchy that represents the object called catalog.

Category: The catalog component that is used to represent the classification structure.

Catalog category association: The line in the diagram represents the relationship between a catalog and category or between a parent category and child category.

Item category assignment: The dotted line in the dialog represents the relationship between a category and an item.

Reference category: The category C5 in this diagram is shared as a reference category from a source catalog.

Leaf level category: The lowest or bottom-level category in a category hierarchy. You can assign items to all levels in a category hierarchy if you configure the catalog to support this.

Browsing category: The category C2 in this diagram is a browsing category. Browsing categories are categories that you add to the category hierarchy for the purpose of classification and do not have items assigned to them.

The category hierarchy does not have a limit on how many levels can be represented. The category hierarchy can have multiple hierarchies within a single category hierarchy.

Categories can be edited only from within an Edit Catalog page, the category hierarchy tab. The category can be edited by selecting row for the category in the category hierarchy table and editing the category information in the category detail panel. The category can only be edited if the category is active and the catalog is active or future dated.

The category information can be edited in both the details and items tabs.

The following fields are editable in the category:

Category name

Description

Attachments

Category start date

Category end date

Items assigned to category

After changes are made the Save button will save the changes to the database but will not close the Edit Catalog page. The Save and Close button will save the changes to the database and close the Edit Catalog page.

The catalog category association can be edited only within the Edit Catalog page, in the category hierarchy tab. The catalog category association start date and end date attributes can be edited in the details region.

You select the category in the category hierarchy table for the catalog category association that is being edited, the category details are displayed in the right hand panel. The association start date and association end date are the only editable fields.

After completing the edits, click on the Save button to save your changes to the database, the Edit Catalog page will not close. The Save and Close button will save the changes to the database and close the Edit Catalog page.

You can update category details when you select the row with the category in the category hierarchy table, the category details are displayed in the right hand panel in the user interface in an edit mode for all native categories. The category detail region contains information about the category that is associated to the catalog. It also contains the association start and end dates.

You can view and edit a catalog on the category details tab when you have editing rights. For users that do not have rights to edit, the page is in read only mode.

The following aspects are important regarding managing and editing category details:

Category details tab

Items tab

Where used tab

The details tab contains information about the category that has been associated to the catalog. This information appears in all catalogs, since a category can be associated to one or more catalogs. The details tab contains the category configuration, category date enablement, association date enablement, and the additional attributes for the category.

The details tab contains attributes that define a category. Unstructured information is added through attachments. Images are added to a category and are displayed in the category details tab.

The item assignments are specific to the catalog where the category is associated.

The Where used tab contains a list of catalogs that the category is associated with.

You can create categories only in the context of a catalog, on the Edit Catalog page, Category hierarchy tab. When you select the Create icon in the category hierarchy table, it launches the Create Category dialog.

Consider the following important aspects when creating categories for catalogs:

Create category region

Configuration region

Date enablement region

Additional information region

Enter a name and a meaningful description of the category in the create category region. Optionally, you can add an image and an attachment to this category.

The key flexfield is determined during creation based on the catalog structure of the catalog. Enter the key flexfield segment values for the category. The number of key flexfield segment values depends on how you define the key flexfield at setup time. The category structure is the key flexfield structure instance that you create as part of the setup. When you define the key flexfield structure instance, you define the segments for the structure instance. For example, the family group and class group are segments. The segments appear in the Create Category dialog based on the key flexfield structure instance that you select.

The default value of the category content selection value is Items and Categories, but you can change the value. The values in the category content choice list vary based on the catalog content value.

The category content attribute value controls the content that you can add to this category.

Items Only: Select to add only items to the category

Categories Only: Select to add only categories to the category

Items and Categories: Select to add both items and categories to the category

Date enablement determines if an object is active or inactive based on the start date and end date. When categories are created, the default start date value is the current date. You can move the category start date beyond the current date to a future date within the category. The end date value is optional.

The additional information region contains all descriptive flexfield attributes that you set up for categories. You can edit the values of the descriptive flexfield attributes at the time of category creation.

After you complete the required fields for the catalog, clicking OK creates the category in the database, adds the category to the point of selection in the category hierarchy, and closes the dialog.

You use the move category function in the category tree table region of the Edit Catalog page. This is a table row action. The dialog is launched when you select an active or future dated category within the catalog and select this action. The move category function is disabled when the Enable hierarchies for categories check box is not checked or left unchecked.

Consider the following important aspects when moving categories within catalogs:

Indentifying the new parent

The dialog provides the current category parent and allows you to pick a new category parent. Only the legal category parents are displayed in the choice list.

The category list within the New Parent choice list is filtered by based on a set of rules:

The new parent category must be an active or future dated category; the end date value of the category must be later than the current system date.

The value of the category content for the new parent category must allow the selected category to be added; the legal values are items and categories and categories only.

A selected category associated with the catalog at a level below the categories at the root categories can be moved to the root of the catalog.

The new parent category catalog category association must be active; the end date value of the catalog category association must be later than the current system date.

Category hierarchy can be created and maintained through a spreadsheet interface reducing the amount of time to create and maintain catalogs. Existing catalog content can be exported and the content used in other catalogs for catalog category hierarchies.

The following aspects are important regarding category hierarchy import used in catalogs:

Spreadsheet interface

Export category hierarchy

You can manage the catalog category hierarchy to use the spreadsheet interface that is available in the Edit Catalog page by using the Export Hierarchy button to download existing catalog content, modify this content in a spreadsheet, and upload the content back into the Product Information Management application.

You use export category hierarchy for example, when you need to provide the category hierarchy to a partner. Your partner has the capability to import the catalog file using an Excel spreadsheet.

You can export the category hierarchy from our catalog and it can be used by partners. If your partner has the Oracle Product Information Management solution, they can directly import the category hierarchy into their catalog.

Catalogs and categories support attachments and use a common component for managing attachment content. You can add attachments on both the Create Catalog and Edit Catalog pages.

The attachment component displays a green plus sign icon indicating that no attachments are available for the object. The Attachment dialog appears when you click the green plus sign icon. You define the attachment by selecting the attachment type, file name or Uniform Resource Locator (URL), title, description, and by indicating whether the attachment can be shared with other objects. Once you define the attachments and click the OK button, that attachment title appears in the attachment component region of the page along with a red X icon that you can click to delete the attachment.

The attachment file types are:

File

Repository File/Folder

Text

URL

You must provide a title for the file and create a description for the attachment. You select a file to upload from your desktop.

You click the Browse button to attach a repository file/folder from the document repository to a catalog. The attachment repository contains existing attachments and is organized as a set of folders. The Browse button launches the Attachment Repository dialog to enable you to select an attachment. You must provide a title for the repository file/folder and create a description for the attachment.

Enter the text string in the field that you want to appear as an attachment. You must provide a title for the text and create a description for the text attachment.

Enter the URL address to a web page that you want to attach to the catalog. You must provide a title for the URL attachment and create a description for it.

The Share check box alerts users that you added an attachment and the date that you performed the task.

You can assign items to categories on the Edit Catalog page, category hierarchy tab, on the category detail item tab. You can assign items only to active categories and categories where the Category Content field value is Items and Categories or Items Only. In addition, you can configure catalogs to control item assignment to categories within the catalog by selecting the Allow multiple item category assignment check box, which allows items to be added to all levels of the category hierarchy.

You select items from a choice list and add them to the category. The choice list is filtered based on a set of rules:

Item data level security: Displays only the items that the user has permission to view and assign.

Organization context: Based on the organization context that is controlled by a choice list in the item table header, only the items assigned to organizations are displayed.

You also control item assignment by selecting the value of the Controlled at check box. If you select the Master Level value and the organization context is a master organization, the items are automatically assigned to all child organizations that are associated with the master organization.

Other applications can use catalog data if you export the catalog content. For example, you may want to export catalog content to use as a monthly report of all items assigned to a specific catalog. You can use the default publish template provided in hyper text markup language (HTML). You can specify the content and layout of the catalog information. When the catalog is published, you select the format and initiate the creation of the content in the file.

The following aspects are important regarding catalog data to be published:

Publish a catalog

Type of catalog content that can be published

You initiate a search for a catalog from the Manage Catalogs page, select the row corresponding to the catalog that you want to publish and select the Publish action. The application generates the report based on the default template in HTML format, and the locale prior to creation of the file. You can select a new template or format from the report window. The content displayed for items, categories, catalog categories, and catalog is based on the publish template.

The default catalog publish template allows the publication of the catalog header details, category hierarchy, category details, and category item assignments. The order of a published report begins with the catalog header and the catalog category details. If the category has a child relationship then the catalog category association details for the child category follows. If the child category has a hierarchy, then the complete hierarchy under the category is published with the catalog category association details and categories details.

Categories can be shared across multiple catalogs allowing catalog content to be reused and saving the work needed to maintain multiple copies of the categories. In the case of category sharing, the category structure in the source catalog can be different than the native catalog.

Categories can be shared using two methods; the first method is directly associating the category to the catalog. The category is added to the catalog and can be edited in the catalog or any catalog the category is associated to. The items assigned to the category are not shared, but are assigned to the category in context with the catalog the category is associated. For example if the category name or description is changed in one catalog, the change will be reflected in all catalogs where the category is associated, but if items are assigned to a category, the assignment will be for that single catalog.

The second method of sharing categories is adding a category by reference into the catalog. During the creation of the catalog, sharing can be enabled by specifying a single source catalog that will be used for sharing by reference and setting the value of the sharing content to control what content will be shared from the source catalog. The advantage of using sharing by reference is source catalog content can be shared to multiple catalogs and maintained in a single place, the source catalog. In addition, the referenced content can be more than one category, for example a complete category hierarchy and any assigned items to categories in shared content can also be reference within the catalog.

Categories can be organized to represent classification taxonomies. The hierarchy organizations for categories have parent and child relationships that form a tree structure. The category hierarchy is created and maintained within the Edit Catalog page, category hierarchy tab. The category hierarchy is shown in true relationship to the way it is defined.

The category hierarchy can be created using two methods: the first is manually creating the hierarchy by adding referenced categories, duplicating categories or creating category for the catalog.

The second method for creating the hierarchy is by importing the category hierarchy through the spreadsheet interface. The category hierarchy can be exported from other catalog or other sources, edited and imported into a new catalog, additionally it can be added manually to the spreadsheet.

The category hierarchy can be edited using Move Category. The catalog category association cannot be deleted, but can be end dated to make the catalog category association inactive. The category hierarchy table provides a choice list filter that controls what catalog category associations and categories area displayed based on the date enablement. The category hierarchy can also be edited by exporting the complete hierarchy, editing it and importing the category hierarchy back into the catalog.

You can select and duplicate a category as a quick way to create a similar category configuration. Selecting the Duplicate icon action launches a Create Category dialog that has attribute fields populated based on the selected category attribute values. The category name is prefixed with Copy_ followed by the name of the selected category. You fill in the required field information in the key flexfield segment values which are blank. Once the category attributes are updated and the key flexfield segments values are entered, the OK button adds the newly created category into the category hierarchy of the selected category you have configured.

Categories are catalog components that are associated to a catalog for purpose of classification of items. You can add existing categories to the point of selection which can be a category in the hierarchy or the root of the catalog. If no category is selected, the default is the root of the catalog.

You can add categories by selecting the Add Category field and selecting the value Add Category. You can then search for existing categories based on the value of the catalog structure for the catalog. You can narrow the search for existing categories by using the Advance Search region in the dialog. You can add each selected category by selecting the Apply button and the add category region remains open. The OK button adds a category if a category is selected and then closes the dialog.

Adding a shared category is similar to adding an existing category except the category is selected from the catalog that has been designated as a source catalog. The sharing content attribute value determines what content is shared from the source catalog. A category within a source catalog that has been added to a native catalog is also known as a referenced category. You use the drop list menu from the Add Categories menu, and the Shared Category option will be disabled if the catalog has not been configured for category sharing.

You can attach an image from your desktop or from a configured repository to a catalog or a category, or both. The image is displayed in the catalog detail and the category detail section of the catalog page. Only one image can be associated with a catalog or category. To attach an image, select the green plus icon to launch the Manage Attachment dialog. The image attachment type can have values of File or Repository File/Folder and is selected in this dialog. The title you provide for the image attachment will appear under the image that is displayed in the catalog. The description you provide is not displayed. Browse will allow you to select the file to be used as the image for the catalog or category. After the information is entered in to the dialog, you click the OK button to load the image and the image attachment title will be displayed under the image. The image will not initially be displayed until the catalog is saved. The image can be replaced with another image by selecting the red X to delete the existing image and entering a new image.

You use Catalog Category mapping to map categories of different catalogs to the reporting categories in other catalogs. This feature allows one or more categories within a catalog to be mapped to category in a second catalog. For example, suppose that you want to roll up the costs associated with allow items assigned to a set of categories in catalog. Catalog mapping allows you to select a category in a catalog, and map all the categories in the set to that category. When you use this feature you are required to write code to do the roll up as identified in the example.

You can map a catalog to be assigned to a functional area such as Purchasing. When a catalog is assigned to a functional area, the catalog will behave based on the rules you defined for that functional area. Only one catalog can be assigned to a functional area.

The Procurement Application Administrator is responsible for supplier numbering setup. Suppliers created through the Create Supplier task flow, through the supplier registration process, or supplier import are automatically numbered using a numeric sequence. The starting supplier number is defined in the Specify Supplier Numbering setup page (the seeded default number is 1). The supplier number then increments automatically as numbers are assigned during supplier creation.

Additionally, the next supplier number can be updated at any time, not just during initial setup, if for example there's ever a need to skip a range of supplier numbers. The application will validate that the number is not already used.

Business classifications support the tracking of supplier certifications that are important to companies for different reasons, such as for supplier diversity programs. Since classification requirements can vary by country or region the seeded classifications can be changed. The application allows you to capture certification details for each classification such as Certificate Number, Certifying Agency, and Expiration Date.

The following seeded classifications are provided for tracking suppliers.

Hub Zone

Minority Owned

Subclassification: (African American, American Indian, Asian, Hispanic)

Service-disabled Veteran Owned

Small Business

Veteran Owned

Woman Owned

The Business Classifications subtab displays an alert if there are certificates that are expired or about to expire. The alert is only raised if a certificate expired in the past 30 days or about to expire in the next 30 days.

Content under development

Oracle Fusion Tax provides a single-point solution for managing your transaction-based tax requirements. In the Define Transaction Taxes activity, set up your entire tax configuration.

Oracle Fusion Tax:

Uniformly delivers tax services to all Oracle Fusion application business flows through one application interface

Provides a single integration point for third-party tax products and services

Is configurable and scalable for adding and maintaining country-specific tax content

With Oracle Fusion Tax, you can model your taxes according to the needs of the following local and international tax requirements:

Both simple and complex country-specific tax legislation

Cross-border transactions, including exports and Intra-European Community transactions

Intercompany transactions

Local compliance requirements for recording and reporting

Continual changes to tax legislation, such as new taxes, local law changes, special tax rates, and special exceptions for products and customers

You can manage the entire configuration and maintenance of tax content from the one Oracle Fusion Tax application. Using one application ensures a uniform tax setup across applications, with a centrally managed system of automated tax services and control over manual intervention and update.

The Define Transaction Taxes activity is logically defined with prerequisite tasks, core tax configuration tasks, optional setup tasks, and validate configuration tasks. The activity categories include:

Define Tax Geographies: Configure tax geographies to define geographical regions that share the same tax requirement. These prerequisite tasks are required for core tax configuration but they might not have been defined in the previous steps of the Financials offering.

Define Tax Regimes: Configure tax regimes for the taxes in each country and geographic region where a separate tax applies. These tasks are most commonly used by all the implementations. You should be able to calculate taxes on the transactions based on this configuration.

Define First Party Tax Profiles: Configure tax profile details that control the transaction tax activities for your first party legal entities, legal reporting units, and business units.

Define Third Party Tax Profiles: Configure tax profile details that control the transaction tax activities for your third party customer, customer sites, supplier, and supplier sites.

Define Occasional Implementation Setups: Configure initial tax setup that impacts tax calculation and reporting. These tasks either are predefined and you do not have to configure them unless the predefined data needs to be extended or these are tasks required only for certain implementations.

Verify Tax Configuration: Verify the transaction tax configuration by simulating transaction data and reviewing tax calculation results.

With Oracle Fusion Tax, you can model your tax requirements according to the needs of local and international tax requirements. These requirements include:

Both simple and complex country-specific tax legislation

Cross-border transactions

Local compliance requirements for recording and reporting

Continual changes to tax legislation, such as new taxes, local law changes, special tax rates, and special exceptions for products and customers

In order to determine how to set up your tax configuration, you must first analyze your tax requirements.

The following table represents key decisions that you must make when you analyze your tax requirements and use Oracle Fusion Tax and other Oracle Fusion applications to implement a solution

|

Question |

Consideration |

Impact to Tax Configuration |

|---|---|---|

|

Who am I? |

You must first answer questions about yourself and your relationship to the legal and regulatory agencies that enable you to operate in one or more counties. |

|

|

Where do I have operations and businesses? |

Identify the countries in which you operate. You will need to identify the country where you are legally registered and the countries where you have subsidiary companies that are legally registered or have a legal presence. |

Use Oracle Fusion Legal Entity Configurator to capture information about your legal entities and legal registration. |

|

What taxes am I subject to? |

Analyze your tax environment for each of the countries in which you operate. |

Set up your tax regimes, taxes, and tax jurisdictions according to the tax requirements for each country. |

|

What are the operations and businesses that I have? |

Consider the types of operations and businesses in which you are engaged and the countries where you have legal entities or reporting units. The type of industries that you work under (for example, mining, telecommunications, and pharmaceuticals), the kind of operations in which you engage (for example, trading, manufacturing, and services), and the scale of your operations (for example, your turnover, company size, and growth) may all impact your taxability. |

Use the classifications feature to categorize or classify your first parties under various classification schemes. In analyzing your operations, you can associate the three main classifications of a transaction to:

|

|

What do I do? |

Identify and classify the transactions that you enter into. For example, do you primarily sell physical goods? If you do, do you manufacture them, or do you buy and sell them without additional manufacturing? Do you sell these goods in another state or province? Do you export these goods? Do you provide or use services? |

Use Oracle Fusion Tax to create fiscal classifications to classify and categorize your transactions in a common manner across your organization. Use these fiscal classifications in tax rules to obtain the appropriate tax result. |

|

What products do I buy or sell? |

Determine the products that you buy and sell as they impact the taxes to which you are subject. For example, you must register for, and therefore collect and remit, service taxes only if you provide taxable services. If you manufacture goods for export, you may not be subject to taxes on the purchases that go into the manufacture of such goods. |

Where Oracle Fusion Inventory is installed use the Inventory Catalog feature with Oracle Fusion Tax product fiscal classifications and intended use functionality to classify the taxable nature and intended use of the items. You can then define tax rules using these classifications to obtain the appropriate tax result. Define product category and noninventory-based intended use fiscal classifications to address classification needs for transactions that do not use inventory items. |

|

Who are my customers and suppliers? |

Determine the types of customers and suppliers with whom you do business, as they can impact the taxes to which you are subject or the tax status or tax rate that applies. For example, let's say that you are a company in the UK that supplies physical goods to another country that is also a member of the European Union. The transaction rate for UK VAT is dependant on whether the customer is registered for VAT in the country to which the supply is made. |

Use the party classifications feature to categorize or classify your customers and suppliers. You can use these classifications in your tax rules to derive the appropriate tax result. You create a party fiscal classification by assigning an Oracle Fusion Trading Community Model class category to a party fiscal classification type code that you define. The Trading Community Model class codes defined under the class category become fiscal classification codes belonging to the party fiscal classification type. You can create a hierarchy of party fiscal classification types to reflect the levels of codes and subcodes within the Trading Community Model classification. |

The purpose of scope is to define the parameters of your implementation project by setting the context of a task list during initial configuration. The foundation tax setup is an incremental setup where each step of the foundation configuration builds on the previous step. The task list is organized sequentially to ensure that you perform setup tasks in the order required. You can define scope values at incremental steps in the implementation project to pass to subsequent tasks to ensure continuity and ease of setup. Additionally, when exporting setup data based on setup migration services, the scope values serve as parameters to control the data selected for export to the respective configuration package. It is important to note that while scope is a valuable tool when implementing, tax scope values are not a required element of the implementation and you do not need to define them.

When implementing tax the foundation setup task of Define Tax Regimes prompts you to Select and Add or Create New the scope value for the implementation project. You can select an existing tax regime value or define a new tax regime value to set the scope. You can also Select and Add multiple scope values to the implementation. When you select the tax regime value to define the scope of an implementation project the feature selection is available to further define the constructs of the implementation.

As you continue the incremental setup, the next task is to define a tax. You are prompted to Select and Add or Create New the tax value. The tax regime scope value already associated to the implementation project filters existing taxes and assigns the tax regime value to any newly defined taxes. This controls the parameters of the implementation to be within the context of the tax regime. When there are multiple scope values passed, it is referred to as a composite scope.

The same logic applies to the next step in the foundation setup when you define a tax status. The tax status, either new or existing, is in the context of the tax regime and tax scope values. Tax regime, tax, tax status, and tax rate are all scope values defined within the implementation project.

The following table identifies where you define the scope value in the implementation project and what tasks the scope value is passed to:

|

Scope |

Where Scope Is Defined |

Tasks Impacted by Scope |

|---|---|---|

|

Tax Regime |

Define Tax Regimes |

|

|

Tax |

Define Taxes |

|

|

Tax Status |

Define Tax Statuses |

|

|

Tax Rate |

Define Tax Rates |

Manage Tax Rates |

Use Oracle Fusion Tax to set up and maintain your transaction tax requirements in all geographic locations where you do business. Foundation tax configuration refers to a set of tax setup components that you will use to satisfy your tax requirements. At transaction time, Oracle Fusion Tax uses your tax configuration to determine the taxes that apply to each transaction and to calculate the tax amounts.

Foundation tax configuration components consist of:

Tax regimes

Taxes

Tax jurisdictions

Tax statuses

Tax rates

Complete the setup tasks to create a basic tax configuration for each of your tax regimes. A foundation tax configuration contains the data applicable to the taxes belonging to a tax regime. The following table describes the appropriate levels of specifying setup options for foundation tax components and provides a Canada Goods and Services Tax (GST) and Harmonized Sales Tax (HST) example for each component.

|

Component |

Appropriate Level to: |

Typically, Not Appropriate Level to: |

Canada GST and HST Example |

|---|---|---|---|

|

Tax Regime |

|

|

CA GST & HST |

|

Tax |

|

|

|

|

Tax Jurisdictions |

|

Specify tax rule defaults. |

|

|

Tax Status |

|

|

|

|

Tax Rates |

|

|

|

Create a simple tax model using tax rule defaults that you define in setting up your foundation tax configuration. You can also create tax rules for your complex tax requirements that consider each tax requirement related to a transaction before making the final tax calculation. When running the tax determination process, Oracle Fusion Tax evaluates, in order of priority, the tax rules that you have defined against the foundation tax configuration setup and the details on the transactions. If the first rule is successfully evaluated, the result associated with the rule is used. If that tax rule is not successful, the next rule is evaluated until either a successful evaluation or a default value is found.

Advanced tax configuration consists of tax rules to define exceptions to the default results.

The complexity of tax rule setup falls into three general categories: no tax rules required, simple tax rule regimes, and complex tax regimes. This table presents the scenarios and actions associated with each of these categories.

|

Category |

Scenario |

Action |

|---|---|---|

|

No tax rules required |

The tax authority levies tax on all sales and purchase transactions at the same rate. Neither tax applicability nor the tax rates and recovery rates vary by the parties to the transaction, the products or services in the transaction, or the business processes involved in the transaction. |

For the tax, define tax rule defaults for the tax status, tax rate, and tax recovery rate. The tax determination process uses the tax rule defaults to determine the tax. |

|

Simple tax rule regimes |

The tax authority levies tax on your transactions at the same rate, with a simple set of identifiable exceptions. The exceptions either apply to one part of the transaction only, such as to certain parties, or to a combination of parties, products, and transaction processes that you can summarize in a simple way. |

Create a simple set of rules, for example, to identify place of supply and tax registration, and use the tax rule default values for the other processes. The tax determination process uses the tax rules and the tax rule defaults to determine the tax. |

|

Complex tax regimes |

Tax regimes in certain countries require a complex logic to determine the applicable taxes and rates on a transaction. Both tax applicability and tax rates can vary, for example, by place of origin and place of destination, party registration, tax status, service, or a combination of factors. In some cases, the taxable amount of one tax may depend upon the amount of another tax on the same transaction. And in rare cases, the tax amount itself may depend on the tax amount of another tax. |

Set up tax rule to define the logic necessary to identify each step of the tax determination process. The tax determination process uses the tax rules to determine the tax. |

Set a tax rule default value to the most commonly used value for tax determination. In the case of tax registration the default or most commonly used value for registration party is ship-from party. However, you can set up a rule to provide additional logic to use the registration of the bill-to party if the registration status is Not Registered for the ship-from party for purchase transactions. Create a determining factor set with the registration status and transaction business category determining factors along with condition sets to provide values for the respective determining factors.

For this example, the following setup exists for the Determine Tax Registration tax rule:

Tax rule default: The default for tax registration is ship-from party.

Tax rule: If the supplier is not registered, then you should consider the tax registration of the bill-to party.

When the following conditions are true, then the tax registration is the same as that defined for the bill-to party:

|

Tax Determining Factor Class |

Tax Class Qualifier |

Tax Determining Factor |

Operator |

Value |

|---|---|---|---|---|

|

Registration |

Ship-from party |

Registration status |

Equal to |

Not registered |

|

Transaction Generic Classification |

Level 1 |

Transaction business category |

Equal to |

Purchase transaction |

The tax determination process determines the tax registration by first considering the Determine Tax Registration tax rule and then the default party registration. As a result of this rule, the tax determination process determines that for a purchase transaction, if the supplier is not registered, the tax registration of the bill-to party is considered.

All tax regimes need information about place or geography.

Information is required to determine:

Where the tax is applicable

The tax rules that can identify when a transaction is an export, or delivered to another country, or deliveries inside or outside an economic region such as, the European Community (EC).

Specific regions such as, city, country, and states for US Sales and Use Tax or provinces in Canada.

To support these requirements, Oracle Fusion Tax allows you to define and use geography regions and tax zones. Geography regions and tax zones provide a conceptual model to use place information on transactions and information related to the transaction.

The following types of places are supported for tax purposes in Oracle Fusion Tax:

Country information: Use country as a specific geography element in tax rules to define tax regimes, taxes, and tax jurisdictions.

Geography elements: Use geography elements or levels defined in the Oracle Fusion Trading Community Model geography functionality in tax rules to define tax regimes, taxes, and tax jurisdictions.

Tax zones: Use geography elements or levels defined in Trading Community Model geography in tax rules to define tax regimes, taxes, and tax jurisdictions.

Use place information for determining factors within tax rules in the tax determination process. Also, use place information while defining tax regimes, tax geography, and tax jurisdictions.

Country is a required field in all of the tax-related address locations. The country fields are supported by a predefined ISO 3166 country name and two-character country code. For more information on country names and codes, see http://www.iso.org/iso/english_country_names_and_code_elements.

You do not set up a country as a specific geography level in Trading Community Model geography because country is an inherent part of all tax-related address locations.

Tip

Use the highest level of geography, typically country, wherever possible.

Define geography elements as part of Trading Community Model geography. They control the use of geography and addresses throughout Oracle Fusion. Oracle Fusion Tax commonly uses the following features: geography or tax zones, geography levels, address controls, and geoname referencing.

Use geography levels to define the levels of geography that are used within a country. For example, addresses in the US comprise of state, county, city, street, and postal code. Addresses in the UK comprise of county, city or town, street, and postal code. There may be other geography elements as well, such as building. From a tax perspective it is only those elements of the address that are referenced for tax purposes. For example, state, county, and city are important for US Sales and Use Tax while county in UK is not relevant from a tax perspective and therefore, you do not need to set it up.

Tip

When address elements are needed for tax purposes, such as country and city for US Sales and Use Tax, set these address levels as mandatory within Trading Community Model geography. This ensures that these elements are always present on all applicable addresses.

Setting address levels as mandatory ensures that amended or newly applicable addresses are validated and that the level is either derived or entered. When you are setting up migrated addresses ensure that they are also compliant with the mandatory levels being present. This should be validated and any address levels added as part of the migration process.

The geoname referencing process within Trading Community Model geography links specific addresses to the levels defined in the geography setup. This process is typically automatic. However, when you encounter issues, you may need to trigger this process to ensure that all addresses are correctly linked to their applicable levels.

Use the tax zone functionality when you need to identify a group of geography elements while calculating tax. Tax zones are defined as part of Trading Community Model geography.

For example, in the EC it is important to know whether goods and services are being delivered within the EC. Use the tax zone functionality to create a tax zone, which defines the membership to the EC as well as, the dates on which a country became the member.

Tip

Create a generic tax zone so that you create a tax zone type that can be used in multiple situations. For example, for a tax zone type needed to identify EC, create a generic tax zone type for all economic communities, which can later be used in other situations where economic communities or trade agreements affect tax determination.

You can also use the tax zone functionality to group postal codes to provide useful groupings that can identify some higher-level tax regions such as, cities or counties.

Geography determination factors allow you to use country information in the tax rules. A combination of determination factor class, class qualifier, and determining factor represent these determination factors. Specify the taxation country at transaction time which is used, along with the tax rules, during the tax determination process.

Use geography as the determining factor class, location type on the transaction as the class qualifier, and country as the determining factor. You can also use country as a tax rule qualifier.

The tax determining factors for locations are given generic names such as ship-to and bill-from, depending on the transaction types. The transaction types are Order-to-cash, for example, Oracle Fusion Order Management and Oracle Fusion Receivables, and Procure-to-pay, for example Oracle Fusion Purchasing and Oracle Fusion Payables.

Oracle Fusion Tax translates these generic locations into specific locations based on the transaction as shown in the following table:

|

Generic Party |

Order-to-Cash Party |

Procure-to-Pay Party |

|---|---|---|

|

Bill-from party |

Location assigned to the business unit for the transactions |

Supplier |

|

Bill-to party |

Customer |

Location assigned to the business unit for the transactions |

|

Ship-to party |

Customer (ship-to) party site |

Ship-to location on the line |

|

Ship-from party |

Warehouse on the line. If there is no warehouse on the line, such as with services, the default location assigned in the Receivables system parameters is used. |

Supplier (ship-from) party site |

|

Point of acceptance party |

Customer point of acceptance party |

Not applicable |

|

Point of origin party |

Customer point of origin party |

Not applicable |

Specify the taxation country on the transaction to identify the country in which the transaction is deemed to have taken place for taxation purposes. The default value is the country of the legal entity. Use the country name to search for country defaults, which control the fiscal classification defaults, party tax profile defaults, and tax regime and tax defaults. Use the country name to select the following fiscal classifications associated with that specific country:

User-defined fiscal classifications

Product categories

Intended use fiscal classifications

Transaction business categories

For many regimes, it is important to know if the supply of goods is exported. The easiest way of doing this is to ensure that the ship-from location is from the country in question and the ship-to location is a different country.

The following scenario illustrates setting up tax rule components to identify if the goods are exported from the United States.

Use geography as the determining factor class, country as the class qualifier for ship-from and ship-to locations, and country as the determining factor as shown in the following table:

|

Determining Factor Class |

Class Qualifier |

Determining Factor Name |

|---|---|---|

|

Geography |

Ship-from |

Country |

|

Geography |

Ship-to |

Country |

Create a condition set that refers to this geography determining factor as follows:

|

Determining Factor Class |

Class Qualifier |

Determining Factor Name |

Operator |

Value |

|---|---|---|---|---|

|

Geography |

Ship-from |

Country |

Equal to |

United States |

|

Geography |

Ship-to |

Country |

Not equal to |

United States |

Use this combination of determining factors in any situation where you need to identify exports from the United States.

Geography determination factors allow you to use geography elements in tax rules. A combination of determination factor class, class qualifier, and determining factor represent these determination factors.

Use geography as the determining factor class, location type on the transaction as the class qualifier, and geography level such as county, province, or city, as the tax determining factor.

The tax determining factors for locations are given generic names such as ship-to and bill-from, depending on the transaction types. The transaction types are Order-to-cash, for example, Oracle Fusion Order Management and Oracle Fusion Receivables, and Procure-to-pay, for example Oracle Fusion Purchasing and Oracle Fusion Payables.

These generic locations are mapped to the specific location, based on the transaction as shown in the following table:

|

Generic Party |

Order-to-Cash Party |

Procure-to-Pay Party |

|---|---|---|

|

Bill-from party |

First party legal entity |

Supplier |

|

Bill-to party |

Customer |

First party legal entity |

|

Ship-to party |

Customer (ship-to) party site |

First party legal entity |

|

Ship-from party |

First party legal reporting unit |

Supplier (ship-from) party site |

|

Point of acceptance party |

Customer point of acceptance party |

Not applicable |

|

Point of origin party |

Customer point of origin party |

Not applicable |

You can also use the geography level as a tax rule qualifier.

Use the geography element in tax rules to identify a specific geography region when taxes in a specific country need to identify specific geography elements below the country level. For example, in US Sales and Use Tax for county taxes, there may be specific rules for a specific state.

The following scenario describes how you can set up tax rule components to identify when goods are being delivered to a specific state, such as Ohio.

Use geography as the determining factor class, ship-to as the class qualifier, and state as the determining factor as shown in the following table:

|

Determining Factor Class |

Class Qualifier |

Determining Factor Name |

|---|---|---|

|

Geography |

Ship-to |

State |

Create a condition set that refers to a specific state value as follows:

|

Determining Factor Class |

Class Qualifier |

Determining Factor Name |

Operator |

Value |

|---|---|---|---|---|

|

Geography |

Ship-to |

State |

Equal to |

Ohio |

You can use this combination of determining factors in any situation where you need to identify specific deliveries to a specific state.

Geography determination factors allow you to use geography elements in the tax rules. A combination of determination factor class, class qualifier, and determining factor represent these determination factors.

Use geography as the determining factor class, location type on the transaction as the class qualifier, and tax zone type such as county, as the determining factor.

The tax determining factors for locations are given generic names such as ship-to and bill-from, depending on the transaction types. The transaction types are Order-to-cash, for example, Oracle Fusion Order Management and Oracle Fusion Receivables, and Procure-to-pay, for example Oracle Fusion Purchasing and Oracle Fusion Payables.

These generic locations are mapped to the specific location based on the transaction as shown in the following table:

|

Generic Party |

Order-to-Cash Party |

Procure-to-Pay Party |

|---|---|---|

|

Bill-from party |

First party legal entity |

Supplier |

|

Bill-to party |

Customer |

First party legal entity |

|

Ship-to party |

Customer (ship-to) party site |

First party legal entity |

|

Ship-from party |

First party legal reporting unit |

Supplier (ship-from) party site |

|

Point of acceptance party |

Customer point of acceptance party |

Not applicable |

|

Point of origin party |

Customer point of origin party |

Not applicable |

You can also use tax zones as tax rule qualifiers.

For the European Community (EC) or the Economic Union (EU) it is important to know whether goods and services are being delivered within the EC. Use the tax zone functionality to create a tax zone that defines the membership of the EC as well as the dates on which a country became a member.

The following scenario describes the use of a partial condition set that you can use within tax rules to define when a delivery is being made to an EC from the United Kingdom.

Use geography as the determining factor class, ship-to as the class qualifier, and all economic communities and country as the determining factors of the tax zone type as shown in the following table:

|

Determining Factor Class |

Class Qualifier |

Determining Factor Name |

|---|---|---|

|

Geography |

Ship-to |

All Economic Communities |

|

Geography |

Ship-to |

Country |

|

Geography |

Ship-from |

Country |

Create the condition set as follows:

|

Determining Factor Class |

Class Qualifier |

Determining Factor Name |

Operator |

Value |

|---|---|---|---|---|

|

Geography |

Ship-to |

All Economic Communities |

Equal to |

European Community |

|

Geography |

Ship-to |

Country |

Not equal to |

United Kingdom |

|

Geography |

Ship-from |

Country |

Equal to |

United Kingdom |

You can use this combination of determining factors in any situation where you need to identify the deliveries that are made from the UK to other EU countries.

Streamline your implementation by selecting the features that are applicable to the tax regime in scope. Features are used in rendering the task lists and tasks in the context of the features applicable to the tax regime in scope.

The following table displays each feature and the impact of not selecting that feature.

Warning

Once you select a feature for a tax regime, you cannot disable it. You can enable the feature later if you do not enable it initially for a tax regime.

|

Feature |

Description |

Impact of Not Selecting Feature |

|---|---|---|

|

Multiple Tax Jurisdictions |

Create tax jurisdictions for a particular tax in more than one geographic region. |

The Allow multiple jurisdictions option is not available to taxes within this tax regime. |

|

Offset Taxes |

Create offset taxes for tax calculation and recording of third party payables tax liabilities for reverse charges, self-assessments, and in the United States, Consumer's Use tax. |

The Set as offset tax option is not available to taxes within this tax regime. |

|

Tax Exemptions |

Create tax exemptions to apply to a specific customer or to a combination of customer and specific product. |

The Allow tax exemptions option is not available to taxes within this tax regime. |

|

Tax Rate Exceptions |

Create tax exceptions to apply a special tax rate to products. |

The Allow tax exceptions option is not available to taxes within this tax regime. |

|

Tax Recovery |

Create tax recovery rates for full or partial recovery of taxes paid on purchases. |

The Allow tax recovery option is not available to taxes within this tax regime. |

|

Tax Registration Statuses |

Manage tax registration statuses to be used as determining factors in tax rules. |

The Tax Registration Status field is not available for party tax profiles. You cannot use the tax registration status of Agent, Registered, or Not Registered in tax rules. |

|

Party Fiscal Classifications |

Manage tax classifications used by a tax authority to categorize a party and which are applicable in the tax determination process. |

The Classifications tab is not available for party tax profiles. You cannot use party fiscal classifications in tax rules. |

|

Legal Fiscal Classifications |

Manage classifications associated with a legal entity that represents its legal status within a country and which also guide the tax determination process. |

The Legal Classification pages and Associated Legal Classifications region are not available for party tax profiles. You cannot use legal classifications in tax rules. |

|

Product Category Classifications |

Manage tax classifications for a noninventory-based product category that is used for tax determination or tax reporting purposes. |

The Manage Product Category Fiscal Classification Codes page is not available. You cannot use product category classification codes in tax rules. |

|

Product Fiscal Classifications |

Manage tax classifications used by a tax authority to categorize a product for a tax and which are applicable in the tax determination process. |

The Product Fiscal Classification pages are not available. You cannot use product fiscal classifications in tax rules. |

|

Transaction Business Categories |

Manage tax classifications to identify and categorize an external transaction into an Oracle Fusion Tax transaction and which are applicable in the tax determination process. |

The Manage Transaction Business Category Codes page is not available. You cannot use transaction business category codes in tax rules. |

|

Transaction Fiscal Classifications |

Manage tax classifications used by a tax authority to categorize a transaction for a tax and which are applicable in the tax determination and tax reporting processes. |

The Transaction Fiscal Classification pages are not available. You cannot use transaction fiscal classifications in tax rules. |

|

Document Fiscal Classifications |

Manage tax classifications used by a tax authority to categorize a document associated with a transaction for a tax and which are applicable in the tax determination and tax reporting processes. |

The Manage Document Fiscal Classification Codes page is not available. You cannot use document fiscal classification codes in tax rules. |

|

Intended Use Fiscal Classifications |

Manage tax classifications based on the purpose for which a product is used and which are applicable in the tax determination process. |

The Intended Use Fiscal Classification pages are not available. You cannot use intended use fiscal classifications in tax rules. |

|

User-Defined Fiscal Classifications |

Manage tax classifications for any tax requirement that you cannot define using the existing fiscal classification types. |

The User-Defined Fiscal Classification pages are not available. You cannot use user-defined fiscal classifications in tax rules. |

Regime to rate setup contains the details of a tax regime, including all taxes, tax jurisdictions, tax statuses, and tax rates. You can update existing records or create new records at any point in the tax regime hierarchy.

Regime to rate setup tasks include:

Tax regimes

Taxes

Tax jurisdictions

Tax statuses

Tax rates

Set up tax regimes in each country and geographical region where you do business and where a separate tax applies. A tax regime associates a common set of default information, regulations, fiscal classifications, and optionally, registrations, to one or more taxes. For example, in the United States create a Sales and Use Tax tax regime to group taxes levied at the state, county, and district levels.

The tax regime provides these functions:

Groups similar taxes together

Designates the geography within which taxes apply

Applies as defaults the settings and values that you define for each tax in the tax regime

Defines for which taxes the configuration options apply and a specific subscription option applies

Provides a single registration for all taxes associated with the tax regime

Defines the use of fiscal classifications as follows:

Transaction fiscal classifications

Product fiscal classifications

Party fiscal classifications

The common tax regime setup is one tax regime per country per tax type, with the tax requirements administered by a government tax authority for the entire country. There are also cases where tax regimes are defined for standard geographical types or subdivisions within a country, such as a state, province, country, or city. In these cases, you base the tax regime on the Oracle Fusion Trading Community Model standard geography.