Understanding Tax Calculations

Understanding Tax Calculations

This chapter provides overviews of tax calculations and delivered elements, and discusses how to:

Enter and retrieve tax data.

Calculate taxable base.

Calculate tax.

Calculate employer tax reductions (Afdrachtsvermindering).

Set up tax reporting.

Generate wage declarations.

Create corrections to wage declarations.

View return messages.

Run tax reports.

Understanding Tax Calculations

Understanding Tax Calculations

The system calculates salary tax based on the tax year that starts January 1 and ends December 31. Salaries, wages, and certain periodic payments received under social security legislation are subject to salary tax. The employer withholds this tax, and it is essentially an advance levy on the person's final income tax assessment.

Income taxes in the Netherlands consist of taxes and national insurance premiums for AOW (Dutch Old age Pensions Law), ANW (Dutch (surviving) relatives Law) and AWBZ (Law for special health care). Not all Dutch employees are eligible for the Dutch income tax. For those people who are not eligible for the Dutch income tax the salary tax is also the final tax.

Global Payroll for the Netherlands performs the major steps of salary tax calculation in the following order:

Retrieves tax data.

Calculates regular and non-regular taxable base.

Calculates regular tax.

Calculates exception tax (Herleidingsregels).

Calculates non-regular tax.

Calculates advantage rule.

Calculates yearly maximum.

Calculates special earnings.

Calculates employer tax reductions.

Later sections discuss most of these calculation steps in detail.

Understanding Delivered Elements

Understanding Delivered ElementsThis section discusses:

Delivered tax deductions.

Delivered tax earnings.

Process lists and sections.

Viewing delivered elements.

Delivered Tax Deductions

Delivered Tax Deductions

Global Payroll for the Netherlands calculates the following delivered deductions for taxes:

|

Name/Description |

Unit |

Rate |

Base |

% |

Amount |

|

INGEH. LB TA Regular tax |

N/A |

N/A |

N/A |

N/A |

BEL VR NORM TAR |

|

INGEH. LB BI Non-regular tax |

N/A |

N/A |

N/A |

N/A |

BEL VR INH BT |

|

ARBEIDSKORT Labor tax reduction |

N/A |

N/A |

N/A |

N/A |

BEL VR ARBKORT |

|

LAGE LONEN Tax reduction for low wages |

N/A |

N/A |

N/A |

N/A |

BEL FM LAGE LONEN |

|

EXL WERKL Tax reduction for former unemployment |

N/A |

N/A |

N/A |

N/A |

BEL FM EXL WERKL |

|

KWALIFICATIE Tax reduction for starter qualification |

N/A |

N/A |

N/A |

N/A |

BEL FM WALIFICATIE |

|

ONDERWIJS Tax reduction for education |

N/A |

N/A |

N/A |

N/A |

BEL FM ONDERWIJS |

|

OUDERSCH Tax reduction for parental leave |

N/A |

N/A |

N/A |

N/A |

BEL FM OUDERSCH |

|

30 REG NT 30% ruling regular |

N/A |

N/A |

N/A |

N/A |

BEL VR 30P REG NT |

|

30 REG BT 30% ruling non-regular |

N/A |

N/A |

N/A |

N/A |

BEL VR 30P REG BT |

Delivered Tax Earnings

Delivered Tax Earnings

Global Payroll for the Netherlands calculates the following delivered earnings for taxes:

|

Name/Description |

Unit |

Rate |

Base |

% |

Amount |

|

30 REG 30% ruling net |

N/A |

N/A |

N/A |

N/A |

BEL VR 30P TOTAAL |

|

EH BRUTO Gross up tax |

N/A |

N/A |

N/A |

N/A |

BEL VR EH BRUTO |

|

EH ENKEL Simple tax |

N/A |

N/A |

N/A |

N/A |

BEL VR EH ENKELV |

|

EH 15P Fixed tax |

N/A |

N/A |

N/A |

N/A |

BEL VR EH 15P |

Process Lists and Sections

Process Lists and Sections

Global Payroll for the Netherlands delivers the following sections for taxes:

|

Section |

Description |

|

BEL SE INIT |

Tax initialization |

|

BEL SE BEREKENING |

Tax calculation |

|

BEL SE AFDR VERM |

Employer tax deductions |

Taxation sections are included in the SALARIS PR process list for the regular payroll process. The taxation sections are also triggered for the non-regular processes and for holiday allowance and 13th month.

Note. In addition to brackets, some variables that contain amounts required for calculation have the category set to “BEL”. The amount variables are classified by category. You can view and update these amounts by using the Variables by Category page. The navigation is Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Elements, Supporting Elements, Variables by Category.

Viewing Delivered Elements

Viewing Delivered ElementsThe PeopleSoft system delivers a query that you can run to view the names of all delivered elements that are designed for the Netherlands. Instructions for running the query are provided in PeopleSoft Enterprise Global Payroll 9.1 PeopleBook.

See Also

Understanding How to View Delivered Elements

Entering and Retrieving Tax Data

Entering and Retrieving Tax DataThis section discusses how to:

Enter employee tax data.

Retrieve tax data.

Page Used to Enter Employee Tax Data

Page Used to Enter Employee Tax Data|

Page Name |

Definition Name |

Navigation |

Usage |

|

GPNL_EE_TAX |

Global Payroll & Absence Mgmt, Payee Data, Taxes, Maintain Tax Data NLD, Maintain Tax Data NLD |

Maintain employee data related to tax calculation and reporting. |

Entering Employee Tax Data

Entering Employee Tax Data

Access the Maintain Tax Data NLD page (Global Payroll & Absence Mgmt, Payee Data, Taxes, Maintain Tax Data NLD, Maintain Tax Data NLD).

|

Tax Table |

Select the appropriate tax table to use for calculating the employee's taxes. Values are:

|

|

Exception Tax |

The selected value determines which additional tax rule is applicable in calculating exception tax (Herleidingsregels). |

|

Travel Data |

Select the value that describes the employee's travel conditions that impact taxes:

|

|

No Tax on Car |

Select one of these values if the employee has a company car or van but is exempt from the normal tax rules that apply to private use of company cars:

|

|

Kind of Hours |

Select the basis for determining the part-time factor for calculating tax reduction.

|

|

Income Code |

Select the value that describes the type of employee. This information is reported to tax authorities but is not used for tax calculations. |

|

Savings Plan |

Select a savings plan if the employee contributes to a plan. There are two type of savings plan: Life Cycle Arrangement or Save As You Earn. See Savings Plans. |

|

Tax Credits |

Select if the employee is claiming a tax credit that reduces the amount of tax paid (Heffingskorting). |

|

Anonymous Rate |

Select to indicate that an employee has not handed over the documentation regarded as official proof of identity. To discourage illegal immigration, the highest tax rate is applied to anonymous employees. |

|

Advantage Rule |

When you select this check box, the system calculates and withholds the lowest tax when the employee has earnings and deductions for regular payments and non-regular payments at the same time. A message on the payslip appears when the advantage rule was used for the calculation. |

|

30% Ruling |

Select if the 30 percent ruling applies to the employee, whereby 30 percent of their income is tax-free. The 30 percent ruling applies to Dutch employees on international assignments and non-Dutch employees working in the Netherlands on an international assignment. |

Special Adjustment

|

Percentage |

Enter the percentage special tax rate. |

|

Authorization Date |

Enter the date on which authorization was given for the special tax percentage. |

Special Tax Codes

Enter rows and select as many values as necessary for reporting special tax codes to the authorities. These codes are not used for calculations.

Employer Tax Reductions

|

Element Name |

Select from the supported tax reduction rules. You can select more than one. |

Retrieving Tax Data

Retrieving Tax Data

For tax calculations, the system uses arrays to retrieve data from the Company table, PeopleSoft Human Resources tables, and the Employee Tax Data table. Data retrieved includes:

Employer tax ID number from the Company table.

Young handicap data from the Disability table.

Full time student data from the employee's Personal data.

Frequency annualization factor from the Frequency table.

Employee standard workdays from the employee's Job data.

Employee tax data entered on the Maintain Tax Data NLD page including:

Tax table.

Tax credits.

Exception tax.

Advantage rule.

Kind of hours.

30% ruling.

Anonymous rate.

Special adjustment and authorization date.

Employer tax reductions.

Calculating Taxable Base

Calculating Taxable Base

This section provides an overview of regular and non-regular base accumulators and discusses how to:

Apply the 30% ruling.

Calculate base for a full-time student.

Understanding Regular and Non-Regular Base Accumulators

Understanding Regular and Non-Regular Base Accumulators For calculation purposes, segment accumulators sum the earnings and deductions for regular and non-regular base:

BEL AC BSREG STHB—Regular base for tax calculation.

Regular taxable base consists of earnings and deductions for salary, sickness, disability allowance, private medical allowance, taxable commuting allowance, save-as-you-earn, pension premium, pre-pension premium, Disability Benefits Act Gap, and General Surviving Relatives Act Gap, health insurance employer part, and Withholding WW.

Global Payroll for the Netherlands delivers a non-maintained segment accumulator (BEL AC BSCRG STHB) for this base, which you can adapt to your needs.

BEL AC BSNRG STHB—Non-regular base for tax calculation.

Non-regular taxable base consists of earnings and deductions for holiday allowance, 13th month, bonus, weekend allowance, shift work allowance, overtime, meal allowance, golden handshake, and taxable mileage allowance health insurance employer part, and Withholding WW.

Global Payroll for the Netherlands delivers a non-maintained segment accumulator (BEL AC BSCNR STHB) for this base, which you can adapt to your needs.

If there are no taxable days, then regular base is considered non-regular. If the employee is terminated during the period, the regular base is adjusted for a daily basis.

Additional accumulators sum regular and non-regular earnings for the period and (for full-time students calculations) the quarter.

See Also

Understanding Earnings for the Netherlands

Applying the 30% Ruling

Applying the 30% Ruling

The 30% ruling is valid for certain Dutch employees who work outside the Netherlands and foreigners who meet specific requirements. For qualifying employees, the ruling means that a factor of 30/70 of gross salary can be paid as a net expense earning.

If 30% Ruling is selected on the Maintain Tax Data NLD page, a formula calculates the following:

30% ruling regular amount.

30% non regular amount.

30% ruling net earning (nontaxable) that is equal to a factor 30/70 of the sum of the regular and non–regular gross salary.

Example of 30% Ruling Calculation

Assume the following taxable bases before applying the 30% ruling:

Regular: 7,000.

Non-regular: 700.

The system calculates the following:

30% ruling regular amount of 3,000.

30% non-regular amount of 3,000.

30% ruling net earning of 3,300.

Calculating Base for a Full-Time Student

Calculating Base for a Full-Time Student

To avoid too much salary tax, the system calculates the earnings of a full-time student on a quarterly basis for tax purposes.

To determine full-time student status, Global Payroll for the Netherlands retrieves the value in the Full-Time Student field on the Biographical Details page in Human Resources. The navigation for the Biographical Details page is Workforce Administration, Personal Information, Biographical, Modify a Person. If the employee is a full-time student, the system calculates the tax bases by adding the regular or non-regular base for the quarter to the respective regular or non-regular base. The formula uses a quarterly frequency.

Calculating Tax

Calculating Tax

This section discusses how to:

Calculate regular tax.

Calculate non-regular tax.

Calculate taxes for full-time students.

Calculate the exception tax (Herleidingsregels).

Calculate the advantage rule (Voordeelregel).

Calculate tax maximums.

Calculate earnings for special tax treaties (Eindheffing).

Calculating Regular Tax

Calculating Regular Tax

The system calculates the taxable regular base to an annual amount to determine the regular tax deduction. There are five basic steps of regular tax calculation:

Calculate annual taxable base.

Correct (round down) the annual taxable base, if appropriate.

Calculate annual tax.

Calculate tax credits (Loonheffingskorting).

Calculate period tax.

If Tax Credits is selected on the Maintain Tax Data NLD page, the system calculates the appropriate tax credits:

Tax labor reduction (Arbeidskorting).

This is used for present employment, determined by the selection of White Tax Table on the Maintain Tax Data NLD page. A formula calculates the reduction using limits determined through a bracket based on the employee's age category.

Other tax credits applicable for present and past employment.

The tax credit is determined by a bracket based on the employee's age category and annual salary for regular tax. These credits are:

General tax credit (Algemene heffingskorting).

Old age tax credit for present employment (Ouderenkorting).

Old age tax credit for past employment (Aanvullende Ouderenkorting).

Tax Reduction for the Disabled (Wajong)

An employee qualifies for an additional tax reduction after regular tax calculation if Tax Credits is selected on the Maintain Tax Data NLD page and Young Handicapped is selected on the Disability page in Human Resources.

Calculating Non-Regular Tax

Calculating Non-Regular Tax

For non-regular earnings and deductions, the system calculates the tax using a fixed tax percentage. The percentage is based on:

The previous year's annual taxable base salary (Loonstaat column 14).

The employee's age category.

The tax table.

If the employee was not with the company for the entire previous year, the system calculates the annual salary used to determine the percentage.

You can enter an employee's income for the previous year by overriding the variable BEL VR JAARLOON VJ. You must enter an end date of December 31 for any year.

Calculating Taxes for Full-Time Students

Calculating Taxes for Full-Time Students

The system accumulates monthly earnings within a quarter and bases only tax calculation on a quarterly pay-period. It calculates the total tax of the quarter each time and deducts the paid tax of the previous period (within a quarter). The total tax can never be less than 0.

Calculating the Exception Tax (Herleidingsregels)

Calculating the Exception Tax (Herleidingsregels)

For certain groups of people, the regular white and green tax tables are used but an additional calculation must be applied.

Application of Exception Tax Rates

The system uses brackets to select and apply exception tax rates as follows:

Regular tax.

Applies an additional, exception tax rate after calculating regular tax.

Period tax labor reduction.

Applies an additional, exception tax rate after calculating tax labor reduction (Arbeidskorting).

Non-regular tax.

The exception tax rate overrides the tax percentage that is based on the previous year's fiscal income.

Selection of Exception Tax Rates

To determine whether and how to calculate exception tax, the system calculates the age category from the employee's birth date and uses the following fields from the Maintain Tax Data NLD page: Exception Tax, Tax Credit, and Tax Table.

Exception Tax Rules

The value entered in the Exception Tax field on the Maintain Tax Data NLD page determines which exception tax rule applies. Exception Tax rules are:

|

No Exception Rules |

Employees for whom no exception rules apply. |

|

NI Premiums/No Tax |

Employees who pay national insurance premiums and no tax. |

|

NO Tax/Premium AOW-ANW |

Employees under age 65 who pay no tax and pay national insurance premium for AOW and ANW. |

|

NO Tax/Premium ANW |

Employees over the age of 65 who pay no tax and pay national insurance premium for ANW. |

|

NO Tax/Premium AWBZ |

Employees who pay no tax and pay national insurance premium for AWBZ. |

|

Tax/No NI Premiums |

Employees who pay taxes and no national insurance premiums. |

|

Tax/Premium AWBZ |

Employees who pay tax and national insurance premium for AWBZ. |

|

Tax/Premiums for AOW-ANW |

Employees who pay tax and national insurance premiums for AOW and ANW. |

Calculating the Advantage Rule (Voordeelregel)

Calculating the Advantage Rule (Voordeelregel)

Global Payroll for the Netherlands calculates the advantage rule if Advantage Rule is selected on the Maintain Tax Data NLD page. This calculation assures that the employee who has both regular and non-regular earnings in the same period pays the lowest tax. A message on the payslip indicates when the advantage rule has been used for final tax calculation.

Calculating Tax Maximums

Calculating Tax Maximums

The system verifies that the year-to date accumulated taxes do not exceed the appropriate annual maximum based on age, tax table, exception tax, and credits. In making the determination, it first compares the year-to-date total without non-regular tax. If the maximum is not exceeded, it compares the total with the non-regular tax. If the year-to date accumulated tax would exceed the maximum, the appropriate deduction is reduced.

Calculating Earnings for Special Tax Treaties (Eindheffing)

Calculating Earnings for Special Tax Treaties (Eindheffing)

In the Netherlands, employers pay tax on certain benefits that employees receive. This tax is known as a levy tax (Eindheffing). Global Payroll for the Netherlands provides elements and rules to support three types of calculations of earnings for Eindheffing:

Gross up tax tariff.

Simple tax tariff.

Fixed tariff.

Some benefits are taxed at a fixed rate that is not dependent on the employee's wage. From January 1, 2006 the fixed tariffs rates are as follows:

Festivity allowance: 15%

Savings plans: 25%

Early retirement: 26%

Accumulators sum the taxable base earnings for each of these methods. We also provide non-maintained accumulators that you can adapt to your own use.

Employer Taxes for Savings Plans

Employers must pay tax on employee deductions for the save as you earn plan (Spaarloonregeling).

Note. Before January 1, 2003, employers also paid tax on employer contributions to the premium (Premierspaaregeling) savings plan. However, this type of savings plan was abolished as of January 1, 2003.

Calculating Employer Tax Reductions (Afdrachtsvermindering)

Calculating Employer Tax Reductions (Afdrachtsvermindering)

Global Payroll for the Netherlands provides rules and elements to support the calculation of the following employer tax reductions:

Tax reduction for former unemployment.

Tax reduction for education.

Tax reduction for parental leave.

Tax reduction for starter qualification.

A formula calculates a part-time factor, which cannot exceed 1, for use in calculating employer contribution deductions. The system also enforces the end date of the deduction. Select the reductions and enter end dates on the Maintain Tax Data NLD page.

Setting Up Tax Reporting

Setting Up Tax ReportingTo set up tax reporting, use the Tax Reports Setup NLD component (GPNL_TXR). This section discusses how to set up tax reports.

Page Used to Set Up for Tax Reporting

Page Used to Set Up for Tax Reporting|

Page Name |

Definition Name |

Navigation |

Usage |

|

GPNL_TXR |

Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Reports, Tax Reports Setup NLD, Tax Reports Setup NLD |

Set up tax reporting. Enter the tax number suffix and the accumulators to be printed on the Year-End Employee report (Jaaropgaaf). |

Setting Up Tax Reports

Setting Up Tax Reports

Access the Tax Reports Setup NLD page (Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Reports, Tax Reports Setup NLD, Tax Reports Setup NLD).

|

Tax Number Suffix |

The default value is L01. Enter a different value if appropriate. |

|

Last Wage Decl Message # (last wage declaration message number) |

Enter the message number used for the last wage declaration. You complete this field once during implementation only. When you generate wage declarations, this field is automatically updated. |

Year to Date Accumulators

|

Element Name |

Select from the yearly accumulators for this company. Selected accumulators print on the Year-End Employee report (Jaaropgaaf). |

Generating Wage Declarations

Generating Wage DeclarationsThis section provides overviews of wage declarations and wage declaration generation and discusses how to:

Run the Wage Declaration process.

Enter levy tax and tax reduction amounts.

Run the Wage Declaration report.

Review wage declarations.

Understanding Wage Declarations

Understanding Wage Declarations

Wage declarations are submitted to the Tax Authority on a monthly or four-weekly basis, depending on your payroll frequency. It includes tax and social security information for the previous month or four-week period. For example, if your payroll is monthly, you submit a declaration for January during February.

The declaration is based on employer tax number. If your organization is set up with each company having a different tax number, then a declaration is submitted for each company. If you have multiple companies sharing the same tax number, one declaration is submitted for all the companies with the same tax number.

The declaration includes individual employee information and totals for all employees. It is submitted electronically in XML format as defined by the Tax Authority.

The Tax Authority issues return messages on receipt of declarations. Return messages are used to acknowledge receipt of the declaration and notify employers of errors in the declaration.

Understanding Wage Declaration Generation

Understanding Wage Declaration GenerationPeopleSoft delivers the following to enable you to generate and review wage declarations:

Wage Tax Declaration Interface Application Engine process (GPNL_WD_AE).

This process creates the actual wage declaration. It creates the XML file that you submit to the Tax Authority.

Wage Tax Declaration SQR report (GPNLWD01).

This report provides a summary of the totals reported in wage declarations that you have previously created.

Wage Declaration Review NLD page.

This inquiry page provides information about employees processed in a wage declaration.

Running the Wage Tax Declaration Interface Process

When you run the Wage Tax Declaration Interface process, these fields on the Wage Declaration Interface NLD page determine which payroll results are included in the wage declaration:

Begin Date and End Date

These fields define the payroll period for the wage tax declaration.

Company

Indicator

This field has four possible values:

Complete

Creates a wage declaration that includes all retro processing results.

C w/o Rtro (complete without retro)

Creates a wage declaration that includes retro processing results that existed when you finalized the payroll and excludes retro results processed within successive payroll periods. Use this option if you want the wage tax declaration to reconcile with the finalized payroll for the period.

Adjustment

Use this value to create a correction report for a wage declaration that you have previously submitted. When you select this option, the wage declaration includes the employee data that has changed and the updated totals.

Correction

Use this value to generate a separate correction report for the applicable period. The records included in a correction report are associated with retroactive payroll results based on the Corrective retro method.

Note. To determine if retroactive calculations across year end are allowed, the system looks at the system settings as well as the type of retroactive method that you want applied (either Corrective or Forwarding). For retroactive results based on the forwarding method, there are no correction records; instead, the amounts are included within the period to which the changes have been forwarded. In this case the changes are taxable. By default PeopleSoft delivers the application with the Retro Method Varies check box selected on the Retro Process Definition page. If you leave the settings this way, the system uses the Forwarding method for retroactive events across year-end, For retroactive events within the current year, the system applies the Corrective method. If you want to apply Corrective regardless of the year of the correction, you must select the Corrective option as the retro method on the Retro Process Definition page.

Annual Due to unreliable data in the stored records at the Social Security, the Tax Authority requires many employers to send a Year Remuneration Statement to determine the final amounts for allowances and payback for the ZVW premium. In response PeopleSoft has created a new Application Engine to generate the Year Remuneration Statement. Use this value to generate an annual statement. It is important to enter values in the Begin Date and End Date fields to reflect the whole year. On the Process Scheduler Request page, select the Annual Wage Tax Declaration (GPNL_WD_ANNL) check box before you click OK. The XML output has a similar structure as the regular wage declaration, but there are less data elements required. The address information has been omitted. The collective data is only informative and is not used for validation.

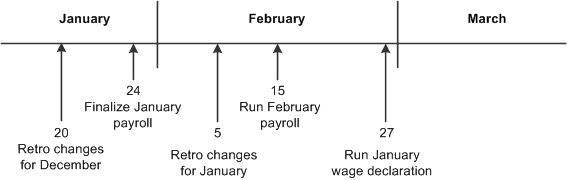

To illustrate how the Indicator field (Complete and C w/o Rtro) works, consider the following scenario, where retro changes, payroll finalizations, and January wage declarations are run on the dates indicated below:

Example of a Wage Tax Declaration Timeline to complete retro changes, payroll runs, and wage declarations in the January to February time period

In this example the wage declaration for January is run after the payroll for February has been run (but not finalized). This means that the retro changes made on February 5 have been processed. This table explains how the Indicator field affects the contents of the wage declaration created for January:

|

Indicator |

Wage Declaration |

|

Complete |

Includes the retro changes made on January 20 and February 5 (after the January payroll was finalized). This means that the values for the January payroll that was finalized on January 24 do not match the January wage declaration. |

|

C w/o Rtro (complete without retro) |

Excludes any retro changes made after January 24 when payroll was finalized. This means that the retro changes made on January 20 are included, but the retro changes made on February 5 are not included in the wage declaration. |

Prerequisites

Prerequisites

Before you can generate wage declarations, payroll for the period must be finalized. If you run the process and payroll is not finalized, the process populates the reporting tables, but does not generate XML.

Pages Used to Generate and Review Wage Declarations

Pages Used to Generate and Review Wage Declarations|

Page Name |

Definition Name |

Navigation |

Usage |

|

GPNL_RC_WD |

Global Payroll & Absence Mgmt, Absence and Payroll Processing, Reports, Wage Declaration Interface NLD, Wage Declaration Interface NLD |

Run the Wage Tax Declaration Interface process to generate the XML files for submission to the Tax Authority. |

|

|

GPNL_RC_WD_SEC |

Click the Collective Data Adjustment link on the Wage Declaration Interface NLD page. |

Enter adjustments for levy tax and tax reductions for the employer. |

|

|

GPNL_RC_WDREPORT |

Global Payroll & Absence Mgmt, Absence and Payroll Processing, Reports, Wage Declaration Report NLD, Wage Declaration Report NLD |

Run the Wage Tax Declaration SQR report (GPNLWD01). |

|

|

GPNL_WD_RVW |

Global Payroll & Absence Mgmt, Absence and Payroll Processing, Reports, Wage Declaration Review NLD, Wage Declaration Review NLD |

Review wage declaration information. |

Running the Wage Declaration Process

Running the Wage Declaration Process

Access the Wage Declaration Interface NLD page (Global Payroll & Absence Mgmt, Absence and Payroll Processing, Reports, Wage Declaration Interface NLD, Wage Declaration Interface NLD).

|

Begin Date, End Date |

Enter the dates for the period on which to report. Wage declarations are created on a monthly, four-week, or annual basis. Note. You must ensure that the regular payroll and any off-cycle payroll for the period are finalized. If the payroll has not been finalized, the XML file is not generated, but the process populates the corresponding XML tables. This enables you to review the data using PeopleSoft Query before finalizing the payroll. |

|

All Companies Same Tax Number |

Select this check box if you have multiple companies that share the same tax number. When you run the wage declaration, the process creates one declaration for all companies that have the same tax number as the company specified in the Company field. If each company has a different tax number, leave this check box deselected. |

|

Reuse Last Message Number |

Select this check box if you want to regenerate the previous message. This enables you to perform test runs prior to finalizing a declaration. Note. This option deletes the stored results from the previous message. Do not use this check box if the declaration has been processed by the Tax Authority. |

|

Message ID Text |

Enter free format text that is combined with the tax number and the message number to create a unique message ID. |

|

Indicator |

Select one of these values: Complete: to create a wage declaration that includes all retro processing results. C w/o Rtro (complete without retro): to create a wage declaration that includes retro processing results that existed when the payroll was finalized. Any retro processing results created after the payroll was finalized are excluded from the wage tax declaration. Adjustment: if you are creating a correction report for a wage declaration that you have previously submitted. Correction:This option should only be used to generate corrections for periods from the previous year. If you select this option, remember to use the appropriate begin and end date to indicate the applicable period. Annual:Use this option to generate an annual statement. It is important to enter values in the Begin Date and End Date fields to reflect the whole year. On the Process Scheduler Request page, select the Annual Wage Tax Declaration (GPNL_WD_ANNL) check box before you click OK. Note. In the 1st month of a new year, when the reporting period of the last period of the previous year has not ended, use the regular options for generating a wage declaration. Do not use the Correction option in this situation. |

|

File Path |

Enter the location of the XML file that is created by the Wage Tax Declaration Interface process. Enter an absolute path name, such as c:/temp/, or a relative path such as: \\machinename\temp\. |

|

File Name |

Enter the name of the XML file that is created by the Wage Tax Declaration Interface process. |

|

Contact Name |

Select the contact person for the wage declaration. |

|

Collective Data Adjustment |

Click this link to access the Collective Data Adjustment page that you use to enter adjustment amounts for levy tax and tax reductions. |

Entering Levy Tax and Tax Reduction Amounts

Entering Levy Tax and Tax Reduction Amounts

Access the Collective Data Adjustment page (Click the Collective Data Adjustment link on the Wage Declaration Interface NLD page).

Use this page to specify adjustments to levy taxes and tax reductions for the company that you specified on the Wage Declaration Interface NLD page. The system adds the values you enter here to the calculated amounts based on the employee data.

The default period end date is the end date that you specified on the Wage Declaration Interface NLD page. Modify this date if the adjustments are for previous periods that have already been reported.

Note. If you enter corrections for a period, these are only processed if there are also corrections for employees for the same period.

Running the Wage Declaration Report

Running the Wage Declaration Report

Access the Wage Declaration Report NLD page (Global Payroll & Absence Mgmt, Absence and Payroll Processing, Reports, Wage Declaration Report NLD, Wage Declaration Report NLD).

|

Message ID |

Select the message ID of the wage declaration for which you want to create a report. |

Reviewing Wage Declarations

Reviewing Wage Declarations

Access the Wage Declaration Review NLD page (Global Payroll & Absence Mgmt, Absence and Payroll Processing, Reports, Wage Declaration Review NLD, Wage Declaration Review NLD).

|

Message ID |

Select a message ID if you want to display only those payees included in the message ID. |

|

Process Date |

Select a process date if you want to display employees who were processed on a given date. |

|

Status |

Select a status if you want to display only payroll calendars with a given status. |

|

Select with Matching Criteria |

Click to display a list of employees who match the selection criteria you specified. The system populates the Payees group box with employees that match your criteria. |

Payees

|

Wage Declaration Status |

Select a status: Done, Cancel, or Re-do. The system sets the status to Done for any processed payroll calendar. This prevents duplicate reporting of corrective payroll results. Update the status to Re-do, to identify a payroll calendar that should be resent in an adjustment or correction report. Update the status to Cancel, to identify a payroll calendar that should be omitted from future reports. Note. You must consider carefully the implications of changing the status of a payroll calendar on your wage declarations. |

Creating Corrections to Wage Declarations

Creating Corrections to Wage Declarations

After submitting a wage declaration, any subsequent changes to the submitted data must be reported to the Tax Authority.

In Global Payroll retroactive processing manages the recalculation of earlier payroll calendars. The way that you implement retroactive processing affects correction reporting in wage declarations:

Corrective retro replaces the previously calculated run.

For wage declarations this means that the data submitted must be updated to reflect the new calculations. To do this you need to generate adjustments or correction reports.

Forwarding retro carries forward the differences between the original and recalculated pay runs to the current calendar period.

For wage declarations, this means that the data submitted for the original pay run is not changed. Instead, the differences are incorporated into the wage declaration for the current pay period.

Corrective retro is the default retro method for the Netherlands and the most commonly used method.

See Retroactivity.

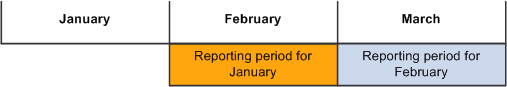

With corrective retro, the method you use to submit the changed data depends on whether you are within the reporting period. Consider the following example, when the reporting period is moved one month forward for the January to March time period:

Example of Wage Declaration Reporting Periods (when they are moved one month ahead)

For the January declaration, the reporting period is February. From March 1, changes to the data for January are considered outside the reporting period.

To submit changes to a wage declaration:

If you are within the reporting period, you have two options:

Create an updated declaration with the latest payroll results.

To create an updated declaration, rerun the Wage Tax Declaration Interface process. Enter the same data on the run control page except for the file name. You should specify a different file name for the updated declaration. The process automatically uses the most recent payroll results to generate the declaration. The process does not process payroll calendars that you assigned the Cancel status on the Wage Declaration Review NLD page.

Create an adjustment report that includes the employee data that has changed and the updated totals.

To create an adjustment, select Adjustment in the Indicator field on the run control page for the Wage Tax Declaration Interface process. When you select Adjustment, the process identifies the payroll calendar results that have not been processed before, and those that you have manually updated with a Re-do status on the Wage Declaration Review NLD page.

If you are outside the reporting period, the changes are included in the correction report section of the declaration for the next month.

For example, if there are changes to January data that are made after March 1, the corrected data is automatically included in the wage declaration for February.

See Also

Defining Retroactive Processing

Viewing Return Messages

Viewing Return Messages

This section provides an overview of return messages and discusses how to:

Import return messages.

View return messages.

Understanding Return Messages

Understanding Return MessagesThe Tax Authority issues return messages in response to submitted wage declarations. There are three types of return message:

Response messages.

There are three types of response messages: acknowledgements, error, and warning response messages. Acknowledgements are issued within 5 minutes of a submission while error and warning messages are issued within 3 days of a submission. An error response indicates that the declaration could not be processed and a warning indicates that there is a potential problem with the declaration, but it will be considered for processing.

Notification Incorrect Employee data (Melding Onjuiste Werknemersgegevens ([MOW]).

MOW messages notify senders of errors within the employee data that were found during processing of the tax declaration. These are sent within the reporting period, which enables you to send an adjustment. For example, if you submit a declaration for January, the Tax Authority may issue a MOW message before the end of February.

Correction Notifications (correctieverplichting [CV]).

Corrections notifications are similar to MOW messages, except that they are sent after the end of the reporting period. This means that you must send a correction report to submit the corrected data. For example, if you submit a declaration for January, the Tax Authority may issue a CV message from the start of March onwards.

The Tax Authority issues return messages in XML format. To view these online:

Ensure that the return message files are in a directory that the Process Scheduler can access.

Run the WTD Import Return Messages Application Engine process (GPNL_WD_RTRN).

This process populates tables in PeopleSoft based on the XML file you specify.

Use the Wage Decl Reponse Import NLD page to view the messages.

Pages Used to Import and View Return Messages

Pages Used to Import and View Return Messages

Importing Return Messages

Importing Return Messages

Access the Wage Decl Reponse Import NLD page (Global Payroll & Absence Mgmt, Absence and Payroll Processing, Reports, Wage Decl Response Import NLD, Wage Decl Reponse Import NLD).

|

File Path |

Enter the location of the XML file that contains the return messages. |

|

File Name |

Enter the name of the XML file that contains the return messages you want to import. |

This table lists the file naming convention for return messages:

|

Message Type |

Filename |

Description |

|

Error messages |

[unique ID]-E-[filename].xml |

Error messages. |

|

Warning message |

[unique ID]-W-[filename].xml |

Inconsistent data |

|

MOW |

[unique ID]-MOW-[filename].xml |

MOW messages that indicate errors in employee data, such as an invalid employment code. |

|

CV |

[unique ID]-CV-[filename].xml |

CV messages. |

Viewing Return Messages

Viewing Return Messages

Access the Wage Decl Response Review NLD page (Global Payroll & Absence Mgmt, Absence and Payroll Processing, Reports, Wage Decl Response Review NLD, Wage Decl Response Review NLD).

|

Error Message ID |

Select the response message that you want to view. Error message IDs are unique identifiers that are assigned by the Tax Authority. |

|

Message ID |

The message ID of the declaration that you submitted to the Tax Authority. |

|

Tax Message ID |

The identifier assigned by the Tax Authority to the declaration specified in the Message ID field. |

|

Response Type |

Specifies the type of return message: Acknowledgement, Warning, or Error. |

Error Details

|

Error Class |

Defines the class of error. This is one of: Calc Error: Error in content of the declaration. File: Error transferring the file. Mail: Error in the message signature and/or certification. XML: The XML structure of the declaration is invalid. |

|

Error Code |

Displays an error code that further defines the error. |

|

Error Description |

Description of the error. |

|

Error Location |

For some error types, this field provides information about the location of the error within the file. |

Running Tax Reports

Running Tax Reports

This section provides an overview of writable arrays for tax reporting, lists common elements, and pages used to run tax reports.

Understanding Writable Arrays for Tax Reporting

Understanding Writable Arrays for Tax Reporting

Global Payroll for the Netherlands uses writable arrays to gather the information that is reported on the tax and year-end reports. This table summarizes the writable arrays:

|

Writable Array |

Function |

Subrecord Written To |

|

GPNL_PSUM_WA |

Retrieves all personal information required by the personal information report (Loonstaat), and by other reports based on the same figures. |

GPNL_PSUM_SBR |

|

GPNL_PERS_WA |

Retrieves all payroll information required by the personal information report (Loonstaat), and by other reports based on the same figures. |

GPNL_PERS_SBR |

|

GPNL_SPCL_WA |

Retrieves all payroll information related to special tax codes. |

GPNL_SPCL_SBR |

|

GPNL_EMPL_WA |

Retrieves payroll information required by the wage declaration |

GPNL_EMPL_SBR |

|

GPNL_RED_WA |

Retrieves all payroll information required by the Tax Reductions report (Aafdracht Verminderingen). |

GPNL_RED_SBR |

Common Elements Used in This Section

Common Elements Used in This Section|

Begin Date |

The starting date of the reporting period. |

|

End Date |

The ending date of the reporting period. The report includes only pay periods that have an end date that is within the begin and end date period specified in the run parameters. |

|

Year |

The tax year for which you're printing the report. |

|

Filter By |

Indicate how employees are to be selected for the report. Company: If you select this value, an additional field appears in which you select the company whose employees are to be included in the report. Some reports enable you to select more than one company. EmplID: Select this value to run the report for a single employee. Enter the employee's ID in the EmplID field. Group: If you select this value, the Group ID, As Of Date, Refinement Date, and Rebuild Group fields appear. |

|

Group ID |

Select a group that has been defined using the Group Build pages. |

|

As Of Date |

The report lists the members who belong to the selected group as of this date, or as of the date you specify in the Refinement Date field. |

|

Refinement Date |

If the group definition includes effective-dated records, enter the date for which you want the records run. For instance, you might want to run a group with an effective date of January 1, 1990, but run the effective-dated rows in the group as of February 15, 1998. In that case, select a Group As of Date of January 1, 1990 and a Refinement Date of February 15, 1998. If you leave this field blank, the system runs the group as of the current date. |

|

Rebuild Group |

Select to rebuild the group based on the group definition and the As Of Date and Refinement Date. |

|

Print Order |

Select the sort order of the report. This field appears on two tax report run control pages. Year-End Employee Report page: The values are Company, Department, Name, and Postal Code. Tax Reductions Report page: The values are Employee and Tax Reduction. |

Pages Used to Run Tax Reports

Pages Used to Run Tax Reports