Understanding the Withholding Process

Understanding the Withholding Process

This chapter provides an overview of the withholding process and discusses how to:

Review and enter withholding information for vouchers.

Review withholding calculations.

Create withholding accounting entries.

Post withholding transactions.

Run the Withholding Mismatch report.

Adjust withholding manually.

Process withholding updates.

Generate withholding reports.

Review withholding information.

See Also

Resolving Complex Withholding Scenarios

Processing Special Withholding Requirements

(IND) Setting Up and Processing Tax Deducted at Source for India

Understanding the Withholding Process

Understanding the Withholding Process

This section discusses:

Withholding general processing overview.

PeopleSoft Payables and PeopleSoft Real Estate Management withholding behavior.

Withholding General Processing Overview

Our withholding architecture enables you to meet the varying withholding requirements of different countries. To use withholding in PeopleSoft Payables, you must set up your withholding environment, complete your business unit withholding setup, and set up your withholding vendors. The setup information you provide defaults onto the applicable voucher lines.

The system calculates the actual withholding amounts as part of the Payment Posting Application Engine process (AP_PSTPYMNT) or the Voucher Posting Application Engine process (AP_PSTVCHR) depending on your withholding entity setup or withholding override options at the voucher. To generate withholding reports, you need to post your payments (either using the Voucher Posting process or the Payment Posting process) and then post your withholding transactions. The system creates reporting information from the posted withholding transactions, enabling you to generate withholding reports, withholding certificates, and/or files as applicable.

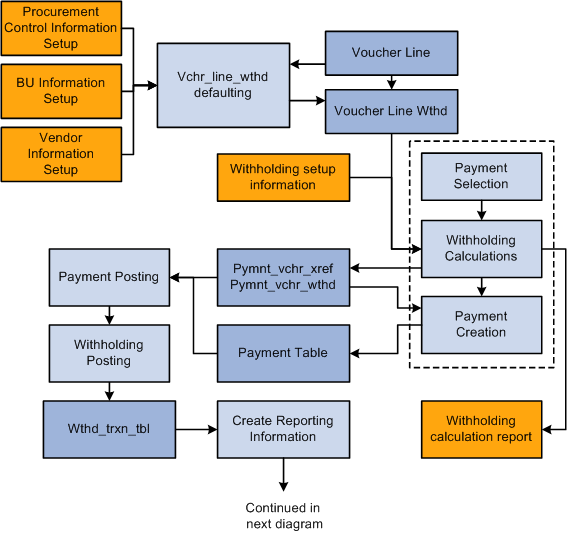

The following diagrams illustrate the general process flow for withholding in PeopleSoft (the withholding process for your location may differ slightly):

Withholding process flow (part 1)

Withholding process flow (part 2)

You complete the withholding process as follows:

Set up your withholding environment.

Set up the appropriate withholding rules, classes, types, jurisdictions, and entities. Under the withholding entity, define the withholding remit vendor or vendors, assign the combination of withholding types, jurisdictions, classes, and rules that apply, and define the type of control information required from the vendor to process the withholding. You apply combinations of withholding entities, types, jurisdictions, classes, and rules to your withholding vendors when you define them. You can assign more than one combination to a vendor. For example, a U.S. vendor may be subject to both 1099–G and 1099–MISC withholding.

You can also define withholding codes, which you can use to override the withholding information that defaults onto the voucher from the vendor; these, too, are combinations of withholding entities, types, jurisdictions, and classes.

As a final step, set up the withholding reports to meet your reporting requirements.

Enter withholding vendors.

Make any vendor a withholding vendor by selecting the Withholding check box on the Vendor Information - Identifying Information page, and by transferring to the Withholding Vendor Information page from the Vendor Information - Location page, on which you select the appropriate withholding entities and enter the associated withholding control information.

Enter withholding vouchers.

The type of withholding that you define for the vendor defaults to each voucher line. Therefore, any vouchers you enter for a vendor that you have defined as a withholding vendor are subject to withholding. If the voucher is for a withholding vendor, you can click the Withholding link on the Voucher - Invoice Information page to access the Withholding Information page, where you can view the withholding for each voucher line and make the lines not withholding applicable, or make adjustments as needed.

Pay the vouchers.

Depending on your withholding setup, the system may generate a separate withholding payment to the tax authority when the voucher is paid, or just calculate the withholding for reporting to the tax authority. During payment posting, a liability is created for the withholding portion. As you pay the withholding portion, the liability is reduced based on your general ledger setup.

Post the withholding.

Posting combines voucher and payment information into transaction tables.

View withholding balances online.

Complete the required set up for generating your withholding reports by entering your withholding control information and running a withholding control report.

Once you have completed these steps you can run your withholding reports based on the requirements of your tax authority.

PeopleSoft Payables and PeopleSoft Real Estate Management Withholding Behavior

If you implement withholding functionality between PeopleSoft Payables and PeopleSoft Real Estate Management, the system does or does not default the withholding code onto the voucher, depending on the particular scenario. This table illustrates the scenarios:

|

Withholding Established in PeopleSoft Payables |

Withholding Applicable in PeopleSoft Real Estate Management |

Withholding Code |

Voucher Results |

|

Yes |

Yes |

Same code defined for the PeopleSoft Payables vendor and PeopleSoft Real Estate Management. |

The system determines that the withholding codes are the same, and defaults the PeopleSoft Real Estate Management withholding code onto the voucher. |

|

Yes |

Yes |

Different codes defined for the PeopleSoft Payables vendor and PeopleSoft Real Estate Management. |

The system defaults the PeopleSoft Real Estate Management withholding code onto the voucher. |

|

No |

Yes |

The system creates the voucher without a withholding code. |

|

|

Yes |

No |

The system creates the voucher without a withholding code. |

Important! Note that you must establish withholding in both PeopleSoft Payables and PeopleSoft Real Estate Management for the system to default a withholding code. If not, the system creates the invoice without a withholding code.

See Also

Defining Transaction Routing Codes

Common Elements Used in This Chapter

Common Elements Used in This Chapter|

Entity |

Tax authority. |

|

Type |

Defines withholding at the highest level in PeopleSoft Payables. For example, in the U.S. 1099 is a withholding type. |

|

Jurisdictions introduce an additional level of classification between the withholding type and class. |

|

|

Class |

For each withholding type, you can define classes or activities, such as Rent, or Royalties. |

|

For the sake of brevity, we sometimes refer to the combination of withholding entity, type, jurisdiction, and class as a withholding class combination. |

Reviewing and Entering Withholding Information for Vouchers

Reviewing and Entering Withholding Information for Vouchers

This section provides prerequisites and explains how to view and override withholding information when you enter withholding vouchers.

Prerequisites

Prerequisites

Before entering and processing withholding vouchers you must.

Set up withholding entities, types, classes, jurisdictions, rules, and codes.

Set up withholding for applicable vendors at the vendor location level.

Any vendor entered into the system can be a withholding vendor. Flag a vendor as withholding-applicable on the Vendor Information - Identifying Information page by selecting the Withholding check box. From the Vendor Information - Location page you can transfer to the Withholding Vendor Information page, on which you select the withholding entity and enter the required control information.

Set up withholding at the general ledger business unit (Procurement Control component).

See Also

Setting Up the PeopleSoft Payables Withholding Environment

Maintaining Vendor Information

Page Used to Review and Override Withholding on Vouchers

Page Used to Review and Override Withholding on Vouchers|

Page Name |

Definition Name |

Navigation |

Usage |

|

VCHR_WTHD_EXP |

Accounts Payable, Vouchers, Add/Update, Regular Entry, Invoice Information Click the Withholding link on the Invoice Information page for a withholding-applicable voucher. During voucher entry, PeopleSoft Payables marks any vouchers for a withholding vendor as withholding-applicable. |

Review or override the withholding for individual voucher lines for a withholding-applicable voucher. |

Reviewing and Overriding Withholding Information on a Voucher

Reviewing and Overriding Withholding Information on a VoucherAccess the Withholding Information page (click the Withholding link on the Invoice Information page for a withholding-applicable voucher).

|

Postpone Withholding |

Select this check box to postpone withholding for prepaid vouchers. If you select this option, withholding is not calculated when the prepaid voucher is paid. It is calculated when the regular voucher is created. |

|

Apply Withholding at Voucher Post |

Select to apply withholding during the voucher posting process. If the withholding has not yet been calculated, users with the appropriate security can select this option to override the entity setting and have withholding for unposted vouchers calculated at voucher posting. The Apply Withholding field in the Withholding Details grid updates to display Vchr Post as the withholding calculation setting. Note. You provide users with the authority to override withhold calculation using the User Preferences component. This field does not appear unless users have the authority to override the calculation. |

|

Line |

Displays the voucher line number whose withholding information you are viewing. |

|

Withholding Code |

Select a withholding code for this voucher line if you are using withholding codes to define a set of withholding class combinations that you want to apply at the same time. Instead of withholding codes, you can utilize the options in the grid to create the withholding class combinations you need. |

|

Withholding Applicable |

Deselect this check box to disable withholding for the individual voucher line. |

|

Entity, Type, Jurisdiction, and Class |

Displays the withholding entity, type, jurisdiction, and class specified for the vendor at the vendor location level. You can override the defaults by selecting new values. |

|

Withholding Basis Amt Override (withholding basis amount override) |

Enter an amount if you need to withhold on the basis of an amount other than the amount you established as the basis for withholding on the Withholding Options page. If you don't enter an amount here, the system accepts the defaults you established on the Withholding Options page. |

|

Contract Reference |

(IND) Enter a contract reference number. This field is mandatory if you select the Contract Reference field for this type on the Withhold Type page. |

|

Rule Override |

Select a withholding rule to override the rule that defaults automatically from the withholding entity. Note. Users typically leave this field blank. |

|

Apply Withholding |

See the definition for Apply Withholding at Voucher Post. |

|

Applicable |

Use this check box to control withholding applicability for the specific withholding class combination for a voucher line. If multiple withholding class combinations are listed you can choose to deselect this check box for one or more of them so that withholding does not occur for that withholding class combination on this voucher line. |

Note. For the withholding to default properly, you must set up vendor and business unit information accordingly on the Procurement Control − Withholding Page. Also, if there are no values here withholding does not occur.

Note. If you try to save a voucher with a withholding vendor that wasn't set up completely, the system issues a warning.

See Also

Reviewing Withholding Calculations

Reviewing Withholding Calculations

This section provides overviews of the withholding calculation and hold payment options for withholding, and lists the page used to review withholding calculations.

Understanding Withholding Calculation

Understanding Withholding CalculationThe PeopleSoft Payables calculation module calculates withholdings at voucher posting or at payment processing, depending on the withholding calculation setting on the withholding entity and the voucher.

The following diagram illustrates how the calculation model works (note that calculation for India is slightly different):

Withholding calculation process flow

See Also

(IND) Setting Up and Processing Tax Deducted at Source for India

Understanding Hold Payment Options for Withholding

Understanding Hold Payment Options for Withholding

When withholding is calculated at voucher post, the Voucher Posting process calls the Withhold Calculation Application Engine process (AP_WTHDCALC) to determine whether withholding vouchers exist. The Withhold Calculation process uses the payment hold option you define at the withholding entity or the vendor level, if specified, and the payment hold status on the original payment schedule of the voucher to determine if the scheduled payments should be placed on hold.

When withholding is calculated at payment post, and the payment is on hold, the payment is not selected or processed by the Withhold Calculation process.

This table provides various scenarios and expected results for the payment hold options:

|

Withhold Entity or Vendor Payment Hold Option |

Payment Hold Status on Original Payment Schedule |

Payment Hold Status and Hold Reason of Original Payment Schedule After Voucher Posting |

Payment Hold Status and Hold Reason of Withhold Payment Schedule After Voucher Posting |

|

No Hold |

No |

No |

No |

|

No Hold |

Yes Reason code: QTY |

Yes Reason code: QTY |

Yes Reason code: QTY |

|

Wthd Only Reason Code: WTHD |

No |

No |

Yes Reason Code: WTHD |

|

Wthd Only Reason code: WTHD |

Yes Reason code: QTY |

Yes Reason code: QTY |

Yes Reason Code: WTHD |

|

Hold Both Reason code: WTHD |

No |

Yes Reason Code: WTHD |

Yes Reason Code: WTHD |

|

Hold Both Reason code: WTHD |

Yes Reason code: QTY |

Yes Reason code: QTY |

Yes Reason Code: WTHD |

See Also

Page Used to Review Withholding Calculations

Page Used to Review Withholding Calculations

|

Page Name |

Definition Name |

Navigation |

Usage |

|

RUN_APY7050 |

Accounts Payable, Reports, Payments, Withhold Calculation |

Specify the pay cycle for which you want to review the withholding calculations and click run to run the Withholding Calculations Crystal report (APY7050). This report produces a listing of the calculations made during the specified pay cycle. |

Creating Withholding Accounting Entries

Creating Withholding Accounting Entries

This section provides an overview of withholding accounting entries.

Understanding Withholding Accounting Entries

Understanding Withholding Accounting EntriesDepending on your withholding setup, PeopleSoft Payables either generates a separate withholding payment when the voucher is paid, or tracks the withholding for reporting purposes. During payment posting or voucher posting (depending on whether you selected to have withholding calculated at voucher posting or at payment time), a liability is created for the withholding portion as the vendor portion is paid. As you pay the withholding portion, the liability is reduced based on the general ledger setup.

The posting process retrieves the ChartField information for the accounting liability entry from the procurement control definition based on the TableSet control value for the PeopleSoft Payables business unit used during voucher entry. You define the ChartFields for the withholding liability on the Withholding ChartFields page within the Procurement Control component (BUS_UNIT_INTFC2). For example:

Define procurement controls for general ledger business units.

Business unit = FED01.

Business unit = FEDRL.

Define, at a minimum, the account ChartFields for the withholding class combination for the general ledger business units.

FED01 account ChartField = 230000.

FEDRL account ChartField = 235000.

Create a voucher in the FED01 PeopleSoft Payables business unit for a vendor who is set up for withholding.

The TableSet control for this business unit's ChartFields is FEDRL.

Run the posting process.

The system looks at the TableSet control for the PeopleSoft Payables business unit and retrieves the account defined for FEDRL in the procurement control definition. The system selects account 235000 as the liability account.

Note. This example is intended to illustrate how the system determines the withholding liability ChartFields and does not represent the entire set up and process flow for withholding.

This section provides posting examples.

Withholding Calculated at Payment: Posting Example

The following example shows the accounting for a 100 USD voucher subject to 1099 withholding. The withholding portion is 33 USD and the non-withholding portion 67 USD.

The following are the accounting entries created:

Post the voucher.

|

Account |

Debit |

Credit |

|

Expense Account |

100.00 |

|

|

AP Liability |

|

100.00 |

Pay and post the non-withholding portion.

|

Account |

Debit |

Credit |

|

AP Liability |

100.00 |

|

|

Cash |

|

67.00 |

|

Withholding Liability |

|

33.00 |

Pay and post the withholding.

|

Account |

Debit |

Credit |

|

Withholding Liability |

33.00 |

|

|

Cash |

|

33.00 |

Withholding Calculated at Voucher Posting: Voucher and Payment Posting Example

The following example shows the accounting for a 100 USD voucher subject to 1099 withholding, but in this case the withholding is calculated at voucher posting. The withholding portion is 33 USD and the non-withholding portion 67 USD.

The following are the accounting entries created:

Post the voucher.

|

Account |

Debit |

Credit |

|

Expense Account |

100.00 |

|

|

AP Liability |

|

67.00 |

|

Withholding Liability |

|

33.00 |

Pay and post the non-withholding portion.

|

Account |

Debit |

Credit |

|

AP Liability |

67.00 |

|

|

Cash |

|

67.00 |

Pay and post the withholding.

|

Account |

Debit |

Credit |

|

Withholding Liability |

33.00 |

|

|

Cash |

|

33.00 |

Posting Withholding Transactions

Posting Withholding Transactions

You must post the withholding transactions using the Withholding Posting Application Engine process (AP_WTHD) before you can create withholding reports. Posting withholding combines the voucher and payment information in withholding transaction tables. The system uses these tables to generate the withholding reports.

You must post payments before running withholding posting.

This section lists the page used to post withholding transactions.

Page Used to Post Withholding Transactions

Page Used to Post Withholding Transactions|

Page Name |

Definition Name |

Navigation |

Usage |

|

WTHD_TRXN_POST |

Vendors, 1099/Global Withholding, Maintain, Post Withholdings, Withhold Transaction Post |

Define the parameters for running the Withholding Posting Application Engine process (AP_WTHD). You can post all transactions available for withholding post through a specified date, or specify by business unit. The through date is the withholding declaration date. |

Running the Withholding Mismatch Report

Running the Withholding Mismatch Report

Before you can create the Withholding Mismatch report (APY9010), you must run the Withholding Mismatch Application Engine process (WTHD_MISMTCH). The Withholding Mismatch report enables to you identify voucher lines on which the withholding applicable flag does not match the withholding flag on the vendor. You can update transactions using the Withholding Update Application Engine process (AP_WTHD_UPDT), and then rerun the Withholding Missmatch process and Withholding Mismatch report to recheck the voucher line withholding.

Note. If you manually adjust mismatches reported on this report by using the Withhold Adjustment page, the mismatches will continue to appear on this report even after you make the adjustments, although the adjusted transactions have been written to the withholding transaction table.

This section discusses how to enter the Withholding Mismatch parameters.

Page Used to Run the Withholding Mismatch Report

Page Used to Run the Withholding Mismatch Report|

Page Name |

Definition Name |

Navigation |

Usage |

|

WTHD_MISMTCH_RQST |

Vendors, 1099/Global Withholding, General Reports, Wthd Voucher/Vendor Mismatch, Withhold Mismatch Request |

Define run parameters for the Withholding Missmatch Application Engine process (WTHD_MISMTCH) and the Withholding Mismatch Crystal report (APY9010). Use the report to identify all voucher lines on which the withholding applicable flag does not match the withholding flag on the vendor. The report does not compare the withholding class combination on the vendor to the withholding class combination on the voucher lines. It only checks the withholding flag. |

Entering the Withholding Mismatch Parameters

Entering the Withholding Mismatch Parameters

Access the Withhold Mismatch Request page (Vendors, 1099/Global Withholding, General Reports, Wthd Voucher/Vendor Mismatch, Withhold Mismatch Request).

|

Business Unit |

Select a business unit to run the report for only that particular business unit. |

|

Vendor SetID |

Select a vendor setID to run the report for only that setID. |

|

Vendor ID |

Select a vendor ID to run the report for only that vendor. |

|

Start Date and End Date |

Specify the date range for which you want to run the report. These are required fields. |

Click Run to access the Process Scheduler Request page. You can select to run the Withholding Missmatch process and the Withholding Mismatch report as part of a job, or you can select to run them individually.

Adjusting Withholding Manually

Adjusting Withholding Manually

Once you have posted the withholding data, you may need to make adjustments to the withholding transactions. You can either run the Withholding Update process to make adjustments automatically, or you can enter adjustments manually using the Withhold Adjustments page.

This section discusses how to manually adjust posted withholding transactions.

See Also

Processing Withholding Updates

Page Used to Adjust Withholding Manually

Page Used to Adjust Withholding Manually|

Page Name |

Definition Name |

Navigation |

Usage |

|

WTHD_ADJUSTMENT |

Vendors, 1099/Global Withholding, Maintain, Adjust Withholding, Withhold Adjustments |

Manually adjust posted withholding transactions by vendor or add withholding entries from a legacy or third-party system. |

Manually Adjusting Posted Withholding Transactions

Manually Adjusting Posted Withholding Transactions

Access the Withhold Adjustments page (Vendors, 1099/Global Withholding, Maintain, Adjust Withholding, Withhold Adjustments).

You can either modify existing posted withholding entries or add withholding entries from a legacy or third-party system.

To modify an existing withholding entry:

Enter your search criteria in the Search Criteria group box and click the Search button.

The Adjustments grid displays all posted withholding transactions that meet your criteria.

Modify data for each withholding transaction in the Adjustments grid that requires it.

You can also add and delete transaction rows as needed.

Save.

Saving the page updates the withholding transaction table, but does not update the underlying voucher tables. To have the system update the underlying voucher tables, use the Withholding Update process.

To add legacy or third-party data:

Add a withholding transaction row in the Adjustments grid.

Enter the following information, at minimum: business unit, entity, type, jurisdiction, class, rule, basis amount, liability amount, paid amount, payment date, declaration date, and adjustment reason.

Save.

Each transaction row you enter is added to the withholding transaction table, and is added to or subtracted from the totals already in the withholding transaction table.

Adjustments

This grid shows business unit and withholding class combination data on the Main Information tab, withholding transaction details on the Transaction Info tab, and bank account and payment information on the Payment Information tab. The Adjustment Reason tab displays the creation date and the user ID of the user who created the transaction adjustment row, along with a field for entering adjustment reasons.

|

Basis Amt (basis amount) |

Displays the amount on which the withholding is calculated. This is the basis amount that is reported to the withholding entity for this payment. It includes the liability amount and is typically the gross amount of the voucher. |

|

Liability Amt (liability amount) |

Displays the amount of back up withholding that is retained to remit to the withholding entity. This amount may also be remitted to the original vendor depending on your business processes. |

|

Paid Amount |

Displays the amount of the withholding liability amount that has been paid to the withholding entity or original vendor. This value appears after you pay the liability to the entity or original vendor and post the payment. An amount of 0.00 means that no withholding has been paid. |

|

Payment Date |

Displays the date on which the payment was made. Some entities, including the IRS in the United States, require that you report withholding based on payment date. In this case the payment date needs to be in the year that you are reporting in. For example, let's say that you need to do an adjustment for a vendor for 2005 but the current year is 2006. When you add a row, the payment date defaults to today's date, which you must override with a 2005 date. |

|

Declaration Date |

Displays the date on which the withholding is declared. Declaration date is used for withholding entities who use a date other than payment date—accounting date, for example—to report withholding transactions. |

|

Posted Date |

Displays the date the payment was posted. |

|

Adjustment Reason |

Enter an adjustment reason for the listed transaction. |

Processing Withholding Updates

Processing Withholding Updates

This section provides an overview of the Withholding Update process and discusses how to:

Update individual voucher lines.

Update all voucher lines for a vendor.

Run the Withholding Update process.

Understanding the Withholding Update Process

Understanding the Withholding Update ProcessOccasionally, you may discover that a vendor's withholding setup was incorrect during the year and that you must correct it before generating your final withholding reports. You can do this by:

Updating individual voucher lines.

You may find, for example, that originally a vendor was not set up for withholding, but that the vendor changed to withholding-applicable in mid-year. Perhaps you created several vouchers with the wrong withholding information and you need to update them. In a case such as this one, use the Withholding Invoice Line Update page to update the voucher lines that have the wrong withholding flag or class.

View each voucher line for a specified vendor, business unit and payment date on the Withholding Invoice Line Update page. You can update the withhold flag or the withhold class for a single voucher line. At save, the system stores the changes in a pre-processing table until you run the Withholding Update process. During that process, the system makes the changes to the voucher lines and transaction tables.

Updating all voucher lines for a vendor.

You can easily update individual lines using the Withholding Invoice Line Update page, but what if you need to update all vouchers lines for a vendor? Perhaps you discover that a vendor whom you did not set up for withholding, is, in fact, withholding-applicable. In this case, update all voucher lines for the vendor using the Withholding Vendor Update page.

Use this page only if you intend to update all voucher lines with the same withholding information. If you want to specify different withholding information for different voucher lines for one vendor location, use the Withholding Invoice Line Update page on which you can select voucher lines and update them individually.

Important! To change a vendor's voucher lines to withholdable, you must first ensure that the withholding information on the vendor is correct before running the Withholding Update process.

Special Cases and How the Withholding Update Process Handles Them

The following situations may require some manual processing in addition to or instead of using the Withholding Update process:

The Withholding Update process does not consider the basis amount options you specify on the Withholding Options page when you set up withholding entities (that is, whether sales tax, freight, miscellaneous charges, discounts, freight, or VAT amounts are included in the withholding basis amount).

For example, if you use the Withholding Update process to change from withholding class 01, which includes freight and sales tax in the basis amount, to withholding class 02, which includes only freight, the Withholding Update process will not recalculate the basis amount to include only freight; the basis amount will still include freight and sales tax.

The Withholding Update process always uses the invoicing vendor when creating new withholding transaction data, regardless of the Apply Withholding Balance To option (Remit to vendor or Invoicing Vendor) selected on the Withholding Options page.

You cannot use the Withholding Invoice Line Update page to update partially paid vouchers.

You must either make adjustments manually, using the Withhold Adjustments page, or fully pay the vouchers in question before running the Withholding Update process. You can, however, update partially paid vouchers using the Withholding Vendor Update page.

You cannot use the Withholding Invoice Line Update page to update fully paid vouchers whose payment schedules are extended into the next tax reporting year or period.

You must make adjustments in those cases manually, using the Withhold Adjustments page You can update vouchers whose payment schedules are extended into the next tax reporting year or period using the Withholding Vendor Update page, but only if you run the same vendor update for both the current tax reporting period and the next one.

Updated withholding data is for reporting purposes only and will not take into account any rule tier definition, contract reference, threshold, cumulative flag, surcharges, or similar local withholding setup.

Take the way the Withholding Update process handles a withholding class combination with a threshold of 100,000 INR, for example. If all existing vouchers for a vendor total 90,000 INR, and you update the withholding for them all by running the Withholding Update process, the new withholding transactions are available for reporting, but when you create new vouchers for the vendor, the withholding accumulated basis amount reverts to zero even though there are 90,000 INR worth of vouchers for this vendor.

The Withholding Update process is designed such that withholding is reported as one "bucket" per withholding class combination.

Warning! Pay close attention to the exclusions listed above before attempting to use the Withholding Update process.

See Also

Adjusting Withholding Manually

Common Elements Used in This Section

Common Elements Used in This Section|

Action |

Select an on-demand process group option and click Run to perform the following process online: Withhold Update: Select to run the Withholding Posting process and the Withholding Update process. The on-demand update process will process all pending transactions. |

See Also

Posting Withholding Transactions

Adjusting Withholding Manually

Pages Used to Process Withholding Updates

Pages Used to Process Withholding Updates|

Page Name |

Definition Name |

Navigation |

Usage |

|

WTHD_LINE_UPDT |

Vendors, 1099/Global Withholding, Maintain, Update Voucher Line Withholding, Withholding Invoice Line Update |

Enter and store the updated voucher line withholding information which will be used to update the withholding transaction table and underlying voucher tables when you run the Withholding Update process. |

|

|

WTHD_VNDR_UPDT |

Vendors, 1099/Global Withholding, Maintain, Update Vendor Withholdings, Withholding Vendor Update |

Enter and store updated withholding information for vendors. This information will be used to update the withholding transaction table and voucher tables with withholding information for all of the vendor's vouchers when you run the Withholding Update process. |

|

|

UPDT_WTHD_RQST |

Vendors, 1099/Global Withholding, Maintain, Update Withholdings, Withhold Update Request |

Request a run of the Withholding Update process to update the withholding transaction table and voucher tables with the updated withholding information you've entered on the Withholding Vendor Update and Withholding Invoice Line Update pages. |

Updating Individual Voucher Lines

Updating Individual Voucher Lines

Access the Withholding Invoice Line Update page (Vendors, 1099/Global Withholding, Maintain, Update Voucher Line Withholding, Withholding Invoice Line Update).

Use the Criteria and Tax Reporting Year group boxes to enter the selection criteria for the vouchers you want to update. Click Search when you have entered all of your search criteria in these group boxes.

Use the Defaults group box to enter the withholding class combination you want to apply to your updated voucher lines.

Use the Details grid to view the voucher lines retrieved by your search and select voucher lines for updating.

Criteria

Enter a business unit and date range for the vouchers you want to update. These fields are required.

|

Clear Updated Withholding |

Select to delete all the previously updated voucher lines from the staging table upon save. This does not delete the voucher lines from the transaction table. It is for cleaning up previous update requests. |

Defaults

Specify any withholding entity, type, jurisdiction, and class you want to apply to all of your updated voucher lines. You can also override these for individual lines on the Details grid after you've applied them to all of the lines.

|

Set All Lines to Wthd (set all lines to withhold) |

Click to apply the withholding combination you enter here to all of the voucher lines in the Details grid. |

|

Set All Lines to No Wthd (set all lines to no withholding) |

Click to set all voucher lines in the Details grid to withholding not applicable. |

Tax Reporting Year

Enter the start and end dates of the tax year for which you are reporting withholding.

Details

The Details grid lists the voucher lines returned by your search. The Current Withhold Details tab displays the original withholding information for the selected voucher lines. You can update these by entering new values on each row. If you want to update all the voucher lines to the same new withholding combination, enter the withholding combination in the Defaults group box and click the Set All Lines to Wthd button.

The New Withhold Details tab shows the updated withholding details after you have saved the page.

The following are fields that appear on the Current Withhold Details tab:

|

Current Withhold |

Displays selected to indicate that the voucher line is currently withholdable. |

|

New Withhold |

Select Y for withholding applicable or N for no withholding on the voucher line. Note. You must complete the remaining line information (Entity, Type, Jurisdiction, and Class fields), regardless of whether selecting Y or N. This ensures the system correctly processes the withholding data. |

|

Payment Date |

Displays the voucher payment date. Vouchers must be paid before you can update voucher lines. |

The following field appears on the New Withhold Details tab:

|

Status |

Displays the update status: P (pending) means that an update occurs the next time you run the Withholding Update process. U (updated) means that the Withholding Update process has run and the transaction tables are updated. If this field is blank, the line is not selected for update. |

Updating all Voucher Lines for a Vendor

Updating all Voucher Lines for a Vendor

Access the Withholding Vendor Update page (Vendors, 1099/Global Withholding, Maintain, Update Vendor Withholdings, Withholding Vendor Update).

Enter a vendor setID and tax reporting year before you enter information in the Details grid.

Warning! If you change the vendor setID, the system deletes all the information in the grid. This is necessary to ensure that only vendors for the specified setID exist in the grid.

Details

You must select a vendor ID, vendor location, and business unit. The following fields also appear on the Vendor tab:

|

Current Withhold |

Displays the current withholding applicability of the vendor location: Y if the vendor location is currently withholding applicable. N if the vendor location is not withholding applicable. |

The following fields appear on the New Withhold Details tab:

|

New Withhold (new withholding) |

Select the new withholding applicability status for the vendor location: Y if the new vendor location is withholding applicable. N if the new vendor location for withholding is not applicable. If you select Y, the withholding combination fields appear. |

If the new withholding applicability is Y, then you must enter a withholding entity in the Entity field. Fields for new withholding type, new jurisdiction (New Jur CD), and new class also appear. Enter as needed.

|

Criteria |

Displays the update status: P (pending) means that an update occurs the next time you run the Withholding Update process. U (updated) means the Withholding Update process has run and the transaction tables are updated. |

Running the Withholding Update Process

Running the Withholding Update Process

Access the Withhold Update Request page (Vendors, 1099/Global Withholding, Maintain, Update Withholdings, Withhold Update Request).

For the run control, enter the request ID and a description.

|

Process Option |

Select among Process All Updates, Process Only Vendor Updates, or Process Only Voucher Lines. |

Warning! The Withholding Update process is not advised if there are

multiple withholding classes per voucher line or there are multiple entity-withholding

type combinations for a given voucher or for a vendor's vouchers (the latter

when updating by vendor).

Also, the Withholding Update process does not adjust entries in the

WTHD_PERIOD_LOG or WTHD_CALC_RPT tables.

See Also

Understanding the Withholding Update Process

Generating Withholding Reports

Generating Withholding Reports

To set up your withholding reports, use the following components:

1099 Piggyback States (WTHD_STATE_TABLE).

Report Control Information (WTHD_CONTROL).

PeopleSoft Payables provides withholding reporting capabilities. Throughout the year, PeopleSoft Payables tracks all withholding vendor information. When it is time to send your withholding reports, PeopleSoft Payables extracts all the withholding balances from vouchers in the period, business units, and vendors you specify, and prepares a report or electronic file for transmission to the tax authority, based on your setup.

This section discusses how to:

Enter transmitter and payor data.

Select vendors and business units.

(USA) Enter states for the combined federal and state filing program.

Run the Withholding Reporting Application Engine process (AP_WTHDRPT).

Review withholding report information.

Run withholding reports.

Some reports specific to particular tax authorities are discussed in the chapter, "Processing Special Withholding Requirements."

See Also

Processing Special Withholding Requirements

Pages Used to Generate Withholding Reports

Pages Used to Generate Withholding Reports

|

Page Name |

Definition Name |

Navigation |

Usage |

|

WTHD_CONTROL |

Set Up Financials/Supply Chain, Product Related, Procurement Options, Withholding, Report Control Information, Payor Data |

Identify payor information. |

|

|

WTHD_CNTL_ADDR_SEC |

|

Enter transmitter's address data, formatted as required by your tax authority. |

|

|

WTHD_CNTL_PHN_SEC |

|

Enter transmitter phone information. |

|

|

PAYER_ADDRESS_SEC |

|

Enter the payer's address data, formatted as required by your tax authority. |

|

|

PAYER_PHONE_SEC |

|

Enter the payer's phone information. |

|

|

WTHD_CNTL_VNDR_BU |

Set Up Financials/Supply Chain, Product Related, Procurement Options, Withholding, Report Control Information, Vendors and Business Units |

Specify which withholding vendors you want to include as well as the PeopleSoft Payables business units from which you want the system to select paid vouchers for each payer. |

|

|

WTHD_STATE_TABLE |

Set Up Financials/Supply Chain, Product Related, Procurement Options, Withholding, 1099 Piggyback States, 1099 Piggyback States |

(USA) Define states that participate in the U.S. Combine Federal/State Filing Program. Specify a minimum reporting amount. |

|

|

WTHD_CNTL_STATE |

Set Up Financials/Supply Chain, Product Related, Procurement Options, Withholding, Report Control Information, Piggyback States/Numbers |

(USA) Enter the information the IRS requires to have the IRS forward copies of your 1099 report tapes to the state governments (defined on the 1099 Piggyback States page) who have an interest in your vendors' 1099 earnings. |

|

|

RUN_APY3012 |

Vendors, 1099/Global Withholding, General Reports, Withhold Control Report, Withholding Control Report |

Define run parameters for the Withholding Control Report (APY3012). This report is an optional process that enables you to track withholding activity for internal audits. It is advisable to run the report on a regular basis to check the withholding summaries. |

|

|

WTHD_RPT_POST |

Vendors, 1099/Global Withholding, Global Withholding Reports, Create Reporting Information, Withhold Report Post |

Run the Withholding Reporting Application Engine process (AP_WTHDRPT) to populate the withholding report table with data from the withholding transaction table based on your report setup. |

|

|

WTHD_RPT_PNL |

Set Up Financials/Supply Chain, Product Related, Procurement Options, Withholding, Withholding Report Information, Withholding Report Info |

Review the information you generated during the Withholding Reporting Application Engine process (AP_WTHDRPT). |

|

|

WTHD_RPT_RUN |

Vendors, 1099/Global Withholding, Global Withholding Reports, Withholding Report, Withhold Report |

Define run parameters to run your withholding reports. |

Entering Transmitter and Payor Data

Entering Transmitter and Payor Data

Access the Report Control Information - Payor Data page (Set Up Financials/Supply Chain, Product Related, Procurement Options, Withholding, Report Control Information, Payor Data).

Note. Withholding control information is keyed by setID and control ID. This enables you to define several control information IDs to run different withholding reports. You may wish to run separate reports based on business units, vendors, or payors. Typically, you have one control ID set up for each government reporting entity.

Transmitter Information

|

|

Click to access the Transmitter Address page, where you can enter the transmitter's address data, formatted as required by your tax authority. |

|

|

Click to access the Transmitter Phone page, where you can enter the transmitter's telephone, fax information, and contact information. |

|

Vendor Software Indicator |

Selected by default indicating that the electronic file was generated via outside vendor software. Deselect this check box if you have customized this process. |

|

Transmitter Name 1 and Transmitter Name 2 |

Use to enter the transmitter's name. |

|

Tax ID |

Enter your tax ID for this transmitter. |

|

Transmitter Cntl Code (transmitter control code) |

If applicable, enter your transmitter control code. |

|

Media Number |

If applicable, enter your media number. |

|

Contact Name 1 and Contact Email Address |

Enter the name of a contact person for this transmitter and email address, as applicable |

Payer Information

|

|

Click to access the Payer Address page on which you can enter the payer address data, formatted as required by your tax authority. |

|

|

Click to access the Payer Phone page on which you can enter the payer's telephone and fax information. |

|

Combined Federal State Filing Participant |

(USA) Select this flag if the payer is participating in the Combined Federal State Filing program. |

|

Payer Name 1 and Payer Name 2 |

Enter the payer's name. |

|

Control ID |

Enter a control ID. This could be a business unit. |

|

Payer Tax ID |

Enter your tax ID for this payer. |

|

Employer's Ref # (employer's reference number) |

Enter the employer's reference number for use in payment reporting to Sub-contractors and the monthly reporting for the HMRC. |

|

HMRC Office #(HM Revenue and Customs office number |

Enter the HM Revenue & Customs Office number for use in payment reporting to Sub-contractors and the monthly reporting for the HMRC. |

|

Accts Office Ref # (accounts office reference number) |

Enter the HM Revenue & Customs Office reference number for use in payment reporting to Sub-contractors and the monthly reporting for the HMRC. |

Selecting Vendors and Business Units

Selecting Vendors and Business Units

Access the Report Control Information - Vendors and Business Units page (Set Up Financials/Supply Chain, Product Related, Procurement Options, Withholding, Report Control Information, Vendors and Business Units).

|

All Vendors |

Select if you want to process all withholding vendors that are associated with the business units you specify. If you only want to process specific withholding vendors, deselect this check box. A Vendors group box displays in which you can enter the individual vendor IDs. Note. (USA) Select this option for 1099 reporting. If you do not, your correction files will be incorrect. |

|

Include Direct Sales Vendors |

Select to have the reporting process list all direct sales vendors who have no vouchers for the reporting year. Only select this for one payer, not for all. Otherwise, the system reports vendors several times. |

|

Vendors |

Use this group box to select the withholding vendors (that are associated with the business units you specify) on which you want to report if you do not select the All Vendors option. |

|

Business Units |

Specify one or more business units to process. The business units must be associated with the selected setID. If you fail to specify any business units, the system will not find any withholding transactions to report. If you specify multiple business units, the system consolidates the balances of vendors that have vouchers spread out over the selected business units. |

(USA) Entering States for the Combined Federal and State Filing Program

(USA) Entering States for the Combined Federal and State Filing Program

Access the Report Control Information - Piggyback States/Numbers page (Set Up Financials/Supply Chain, Product Related, Procurement Options, Withholding, Report Control Information, Piggyback States/Numbers).

Note. This page applies only to 1099 reporting in the U.S.

|

Piggyback States |

Displays the states participating in the combined federal and state 1099 filing process. Only states that you have defined on the 1099 Piggyback States page appear here. |

|

Process? |

Select the Process check box for each relevant state name to tell the IRS which states need copies. |

|

Payer State |

Enter the standard two-character alpha state abbreviation for the payer state. |

|

Numbers |

Enter the state number. This is the ID number that is assigned by individual states. This number is used on the forms (Copy B) that you send to your vendors, but is not included on the tape you send to the IRS. |

Running the Withholding Reporting Application Engine Process (AP_WTHDRPT)

Running the Withholding Reporting Application Engine Process (AP_WTHDRPT)

Access the Withhold Report Post page (Vendors, 1099/Global Withholding, Global Withholding Reports, Create Reporting Information, Withhold Report Post).

Important! For 1099 reports, you use a separate report posting process, described in another chapter.

See Processing Special Withholding Requirements.

|

Report ID |

Select the withholding report ID for which you want to create the report information. |

|

Report Date |

Select the date of the report. |

|

Control ID |

Select the report control ID. |

|

Calendar ID |

Select the appropriate calendar ID. |

|

Fiscal Year |

Enter the fiscal year for the report. |

|

Period |

Enter the period for the report. The fiscal year and period determine the date range used to select vendor payments for withholding reporting. |

|

Withhold Certificate |

Select if you require the system to create a withholding certificate. |

|

Quarterly Return Certificate |

Select if you require the system to create a TDS quarterly return certificate. |

Note. Before you can run the Withholding Reporting process, you must define the withholding control information on the pages in the Report Control Information component.

Reviewing Withholding Report Information

Reviewing Withholding Report Information

Access the Withholding Report Info page (Set Up Financials/Supply Chain, Product Related, Procurement Options, Withholding, Withholding Report Information, Withholding Report Info).

|

Tax ID and Description |

Displays the tax ID of the vendor from whom the withholding in this report was withheld, and the description of the Tax ID. |

|

Basis Amt (basis amount) |

Displays the basis amount on which the withholdings were calculated. |

|

Liability Amt (liability amount) |

Displays the amount of the withholding. |

|

Paid Amount |

Displays how much of the withholding has been paid to the tax authority. |

|

Report Date |

Displays the date on which you created your reporting information. |

Running Withholding Reports

Running Withholding Reports

Access the Withhold Report page (Vendors, 1099/Global Withholding, Global Withholding Reports, Withholding Report, Withhold Report).

Note. Do not use this page for 1099 reporting. Use the Withhold

1099 Report page instead.

You must run the Withholding Reporting process before you can generate

withholding reports.

|

Withholding Report ID |

Select the ID of the withholding report you want to run. The Report Processes group box displays the name of the process for this report and a description. |

The following table lists some of the sample global withholding reports we provide with PeopleSoft Payables using the Withhold Report page.

|

Report ID |

Report Type |

Country |

Report Name |

|

Crystal |

Japan |

Japan Withholding Report |

|

|

Crystal |

Spain |

Spain IRPF Model 190 |

|

|

File |

Spain |

Spain IRPF Model 190 File |

|

|

Crystal |

United Kingdom |

CIS (construction industry scheme) File |

|

|

Crystal |

France |

DAS-2 'Declaration d'honoraires'/Fees return |

|

|

Crystal |

Australia |

PPS Remittance Advice to ATO |

|

|

Crystal |

Australia |

PPS Annual Reconciliation Statement to ATO |

|

|

Crystal |

Australia |

PPS Payment Summary to ATO |

|

|

Crystal |

Canada |

T4A - Statement of Pension, Retirement, Annuity, and other Income |

|

|

Crystal |

Italy |

Withholding Report 770 |

See Also

Processing Special Withholding Requirements

Reviewing Withholding Information

Reviewing Withholding Information

You can review withholding information using several inquiry pages.

This section discusses how to review payments to withholding vendors.

Pages Used to Review Withholding Information

Pages Used to Review Withholding Information|

Page Name |

Definition Name |

Navigation |

Usage |

|

WTHD_BAL_VNDR |

Vendors, 1099/Global Withholding, Review, Vendor Balance by Class, Vendor Balance |

View the totals for all of a vendor's withholding transactions over a specified period of time. |

|

|

WTHD_VCHR_VNDR |

Vendors, 1099/Global Withholding, Review, Vouchers by Vendor, Vouchers by Vendor |

View a vendor's withholding transactions. |

|

|

WTHD_PYMNT_SRCH |

Vendors, 1099/Global Withholding, Review, Withhold Payment, Withhold Payment Inquiry |

Inquire on the payment amount, schedule number, and payment date for vendors subject to withholding. This page shows all withholding payments made to the withholding entities by vendor. |

Reviewing Payments to Withholding Vendors

Reviewing Payments to Withholding Vendors

Access the Withhold Payment Inquiry page (Vendors, 1099/Global Withholding, Review, Withhold Payment, Withhold Payment Inquiry).

Entering Search Criteria

|

Vendor SetID |

Select the setID of the vendors for which you want to run the report. |

|

From Vendor ID and To Vendor ID |

Select the vendor ID. The From Vendor ID is a required field. You can also include a range of vendors using the From Vendor ID and To Vendor ID fields. |

|

From Date and To Date |

Enter the date range you want to inquire on. |

Payment Details

The Payment Details group box shows details on the withholding payment information for each withholding payment. If you are using the federal payment option, the payment details display by payment schedule.

|

(USF) Schedule ID |

Shows the payment schedule ID. This field only displays if you are a U.S. federal agency and have selected the federal payment option on the Installation options page. |

|

Payment Amount |

Displays the payment amount in the payment currency for the remit vendor. |

|

Vendor Liability Amount Paid |

Displays the portion of the payment amount that has been paid to the specified vendor in the transaction currency. |

The system displays payment and withholding information for each payment or payment schedule. In addition, the system displays:

|

Gross Payment Amount |

Displays the amount of payment paid to the remit vendor to cover the invoicing vendor's liability. |

|

Withholding Basis Amount |

Displays the basis amount of the withholding for the payment or payment schedule. |

|

Withhold Liability |

Displays the amount to be withheld and paid to the withholding entity for the payment or payment schedule. |

|

Remit SetID and Remit Vendor Name |

Displays the setID and name of the remit vendor for the payment or payment schedule. |