Understanding the Settlements Payment Process

Understanding the Settlements Payment Process

This chapter provides an overview of the settlements payment process, lists prerequisites and common elements, and discusses how to:

Select settlements for outbound submission.

Review Settlements for Financial Sanctions

Manually approve settlements.

Dispatch settlements.

Review payment files.

Use the Settlement Manager.

Specify deal settlement netting.

Understanding the Settlements Payment Process

Understanding the Settlements Payment Process

This section discusses the process for handling settlements within Treasury.

Settlements are cash-flow transactions that the system transforms into payment instructions for different financial institutions. In Cash Management you can generate settlements from bank account transfers, electronic funds transfer (EFT) requests, and fee entries. You can also generate a settlement by entering a deal in Deal Management. The settlement process involves three steps: selection, approval (an optional step), and dispatch. You first select settlements that are to be processed as payments by using the Select Settlements page. Depending on system settings, certain selected settlements must be approved prior to being processed. You can establish one of three following settlement approval methods:

No approval required.

Manual settlement approval, performed by an authorized user (or users) by using the Settlement Approval page.

Automatic settlement approval, performed by PeopleSoft Workflow.

If the financial sanctions service is enabled and the bank that is being used to pay requires validation, the system automatically performs a search for the matches between the names and addresses entered on the settlement with those on the financial sanctions list. This functionality is enabled on the Financial Sanctions Options page by selecting the Enable in Treasury Settlements check box.

See Setting Financial Sanctions Options.

Next, the Financial Sanction Validation check box must be selected on the Bank Information page. Settlements transacted through these banks will initiate the financial sanctions comparison upon there selection.

See Defining Bank Information.

Once the settlements are approved, they are either sent to Financial Gateway where they are dispatched to a financial institution using the Dispatch Payments page or obtained by the Pay Cycle Manager for processing. The system processes payments according to the pay method that is defined on the External Accounts - Payment Methods page. Depending on the payment method type, you can specify that the payment be settled through one of two methods: PeopleSoft Enterprise Financial Gateway or the Payables Pay Cycle Manager. Within Financial Gateway, the dispatch process transforms these settlements into payment files, and submits them to the appropriate institution.

For payments that are set to be processed through Financial Gateway, you use the pages and functionality that is discussed in the Financial Gateway PeopleBook.

For payments that are set to be processed through Payables Pay Cycle Manager, you should refer to the Payables chapter Processing Pay Cycles to process these types of payments.

Note. If deal approval is required, then related deal transactions do not appear for selection on the Select Settlements page until the deal is approved.

See Also

Working with Payments in Financial Gateway

Setting Up and Using the Financial Sanctions Service

Settlement Workflow

Settlement Workflow

Settlement selection and settlement approval functionality are integrated with PeopleSoft Workflow. When you select or approve settlements, the system routes workflow notifications to defined user's worklists, alerting them that the settlements are being processed.

If you implement multiple levels of approval, the system automatically routes the approval through the levels until the appropriate user authorizes it.

For example, you establish the following two levels of approval:

Administrator, with a 50,000 USD limit.

Manager, with a 100,000 USD limit.

If the administrator approves a settlement of 75,000 USD, the system does not set the settlement status to approved as the amount is over the defined approval limit. Instead, the system routes the settlement to the manager's worklist for approval. The manager can then select settlement approval work items on the worklist to access the Settlement Approval page, and approve the settlement.

See Also

Delivered Workflows for Cash Management

Settlement Approval

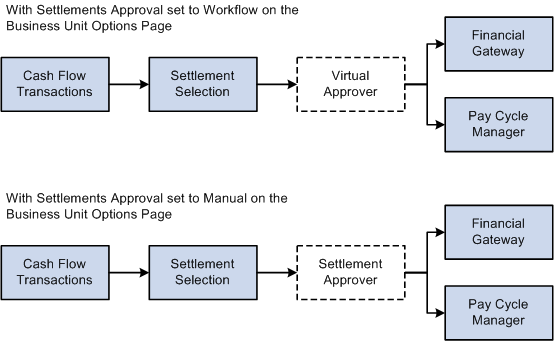

Settlement ApprovalYou use one of two approval methods: manual settlement approval, or automatic settlement approval using a PeopleTools Workflow process called Virtual Approver. Once authorized, whether manually or automatically by the Virtual Approver, you process the settlements for payment.

See PeopleTools PeopleBook: Workflow Technology, "Defining Approval Processes," Understanding Virtual Approver

This diagram illustrates the settlement process:

Understanding the settlement process

Note. If you're enabling Virtual Approver, you must select Workflow as the approval method on the Treasury Options page. Also, you can only authorize settlements up to the maximum approval limit with Virtual Approver.

Common Elements in this Chapter

Common Elements in this Chapter|

Account |

Displays the account from which payment originates. |

|

Bank |

Displays the bank from which payment originates. |

|

Cpty (counterparty) |

Displays the counterparty receiving the payment. |

|

Cutoff Time |

Enter the time by which the payment must be received. |

|

Cutoff Date |

Enter the date by which the payment must be received. |

|

Filter by Source |

Select Bank Fees, Bank Transfers, Deal Fees, Deals, Facility Fees, Hedges, Interest Calculated, Letter of Credit Fees, Treasury Wires, or Wire Fees to limit the search results. |

|

Preferences |

Click to establish the default search criteria for settlement selection or settlement approval. |

|

Stlmt Inst (settlement instructions) |

Enter payment instructions for the settlement, including recipient address and bank information. |

|

Sort By |

You can also sort the results by Account, Amount, Bank, Method, or Source ID, using this field. |

|

Src BU (source business unit) |

Displays the Treasury Management source business unit. |

|

Source Code |

Displays the original Treasury Management source for the transaction. Source codes are represented by a single letter in the transaction results. Bank Fees: B. Bank Xfers (bank transfers): X. Deals: F. Deal Estimated Maturity Accrual: M. Deal Fees: E. EFT Fees: R.g EFT's: W. Fac Fees (facility fees): F. Hedges: H. Interest Calculated: I. LC Fees (letter of credit fees): T. |

|

Source ID |

Displays the source identifier code for the specific transaction. |

|

Status |

Indicates the payment status: Selected for payment, Unselected for payment, or Pending approval. When you select a payment on this page, its status changes to Pending. |

|

Total Payment Amount |

Displays the sum of all payment results, and currency code. |

|

Value Date |

Enter the effective date of the settlement. |

|

|

Click to access payment details and events in the settlement's lifecycle. |

Selecting Settlements for Outbound Submission

Selecting Settlements for Outbound Submission

This section discusses how to:

Select settlements for outbound submission.

Use payment-life-cycle functionality.

Pages Used to Select Settlements

Pages Used to Select Settlements|

Page Name |

Definition Name |

Navigation |

Usage |

|

Select Settlements |

STL_SELECTION |

Cash Management, Settlements, Select Settlements |

Review and select payments that are scheduled for outbound submission. |

|

Settlements User Preferences |

STL_SELECTION_PREF |

Click Preferences on the Review Settlements page. |

Set up the default criteria for searching settlements. |

|

Sanction Review |

STL_VIOLATIONS |

Select payments on the Select Settlements page that fail the financial sanctions validation. |

Lists selected settlements where the names or addresses match those found on the list of Specially Designation Nationals (SDN) published by the US Department of the Treasury's Office of Foreign Asset Control (OFAC), the European Union, or an enterprise-defined list. |

|

Treasury Payment Life-Cycle |

PMT_LIFE_CYCLE_PG |

Click View Payments Life Cycle on the

Select Settlements page.

|

View detailed and summary information for a payment, from the initial creation through payment and reconciliation. |

|

Review Settlements |

STL_SELECTION |

Cash Management, Settlements, Review Settlements |

View the payments that are scheduled for authorization and release. |

Selecting Settlements for Outbound Submission

Selecting Settlements for Outbound Submission

Access the Select Settlements page (Cash Management, Settlements, Select Settlements).

Settlement Search Criteria

Enter the search criteria for payments and click Search to display a list of payments.

|

Status |

Select a status value of Denied, Selected, or Unselected. The selected value determines what settlement action buttons are available to you. |

Payments - (All)

|

Source ID |

Click to view a settlement's details. |

|

Stlmt Inst (settlement instructions) |

Click to view the specified settlement instructions. |

|

Cutoff Time and Cutoff Date |

Payments arriving by this time and date are processed by the bank that day. Payments arriving afterwards are processed on the next business day. |

|

Method |

Displays the payment method for the settlement, as defined in the settlement instructions. |

|

Select a payment and click to process. After you select a payment, the system changes the Status field to Pending (pending approval). If the payment is designated for financial sanctions validation, the system will compare the names and addresses of the financial sanctions list with those entered on the To Account for EFT Requests and the settlement instructions for all other settlements. If potential matches are found, the Sanction Review page appears displaying the payments that require a closer review. If you enable settlement authorization workflow, the system submits payments to the appropriate worklists for approval. If you enable auto approval, the system marks the payments as approved and ready for dispatch. If you enable manual settlement approval, you must manually approve the payments on the Settlement Approval page. If you do not enable automatic settlement approval, the system automatically marks the payments as approved and ready for dispatch. Note. Settlements associated with a deal that requires deal approval, will not be available for approval until the deal itself is first approved. |

|

|

Deny Payments |

Click to deny settlements for payment. After you deny a payment, the system changes the Status field to Denied. Note. You cannot deny a payment once the automated accounting process is run for the settlement. |

|

Edit Bank Account |

Select a payment and click to change the settlement bank account. If more than one payment is selected, the payments must be in the same currency. |

|

UnSelect Payments |

Click to reverse the status of settlements that are pending approval. After you clear a payment, the system changes the Status field to unselected. |

See Also

Delivered Workflows for Cash Management

Reviewing Settlements for Financial Sanctions

Reviewing Settlements for Financial SanctionsAccess the Sanction Review page (Select payments on the Select Settlements that fail the financial sanctions validation).

This page displays settlements that have payees who potential match those listed on the financial sanctions list.

|

Sanction Detail |

Click to view details of the payee on the Financial Sanctions Entry page. |

|

Clear Settlement |

After selecting and reviewing the settlement, click to allow further processing of the settlement. |

|

Deny Settlement |

After selecting and reviewing the settlement, click to deny further processing of the settlement. |

|

Return |

Click to return to the Select Settlements page. |

Using Payment Life Cycle Functionality

Using Payment Life Cycle Functionality

Access the Treasury Payment Life-Cycle page (click View Payments Life Cycle on the Select Settlements page).

The buttons at the top of the page—Payment Created, Awaiting Selection, Awaiting Approval, Awaiting Dispatch, Payment Processed, and Payment Reconciled—become linked and change from black and white to color when that specific action occurs for the payment. Click a button to access the associated page and view the indicated life-cycle information.

|

Payment Details |

View summary information about the settlement. The Status and Recon Status field values change as you process the settlement. |

|

Payment Events |

View date, time, and descriptive information about each event that you perform on the settlement. |

See Also

Delivered Workflows for Cash Management

Manually Approving Settlements

Manually Approving Settlements

This section discusses how to manually approve settlement payments. You need to manually approve or deny settlements if you do not configure automatic Settlement Approval Workflow.

Pages Used to Manually Approve Settlements

Pages Used to Manually Approve Settlements|

Page Name |

Definition Name |

Navigation |

Usage |

|

Approve Settlements |

STL_SELECTION |

Cash Management, Settlements, Approve Settlements |

Authorize the release of scheduled treasury settlement transactions. |

|

Settlement Approval - Preferences |

STL_SELECTION_PREF |

Click Preferences on the Approve Settlements page. |

Set up the default criteria for searching for settlements for approval. |

Manually Approving Settlement Payments

Manually Approving Settlement Payments

Access the Approve Settlements page (Cash Management, Settlements, Approve Settlements).

Settlement Search Criteria

Enter the search criteria and click Search to display a list of payments.

|

Status |

Select a status value of Approved, Denied, or Selected. The selected value determines what settlement action buttons are available to you. |

Payments - (All)

|

Approve Payments |

Select payments and click to approve settlements for payment processing. The Status of the payments changes to Approved and is sent to Financial Gateway. Note. The status will not change immediately to Approved if the system is configured to use workflow for settlements requiring additional approval based on the dollar amount. Note. Settlements associated with a deal that requires deal approval, will not be available for approval until the deal itself is first approved. |

|

Deny Payments |

Select payments and click to deny settlements for payment processing. The Status of the payments changes to Denied. Note. You cannot deny a payment once the automated accounting process is run for the settlement. |

Note. You define settlement approval options on the Treasury

Options page. If you enable settlement approval workflow, do not use this

page to approve settlements. Instead, the system changes the settlement status

to Approved when Virtual Approver finds that the

item passes the approval rules that are defined under workflow.

You establish the workflow approval rule definition at implementation.

PeopleSoft delivers a rule in the database for the Approval Rule Set called

Execute Treasury Settlements.

See PeopleTools PeopleBook: Workflow Technology, "Defining Approval Processes," Understanding Virtual Approver

See Also

Delivered Workflows for Cash Management

Using the Settlement Manager

Using the Settlement Manager

Use the Settlement Manager to review all of the settlements from a central location. You can see the gross daily exposure, make projections, and view exposures according to counterparty. In addition, you can select a settlement category to review and approve settlements from the same page.

This section discusses how to:

Use the Settlement Manager.

Set Settlement Manager preferences.

Pages Used with the Settlement Manager

Pages Used with the Settlement Manager|

Page Name |

Definition Name |

Navigation |

Usage |

|

Settlement Manager |

STL_MGR |

Cash Management, Settlements, Settlement Manager |

Review and manage all settlement activity from a central location. |

|

Settlement Manager - Preferences |

STL_MGR_PREF |

Click Preferences on the Settlement Manager page. |

Set up default search criteria for the Settlement Manager. |

|

Cash Flow Settlements |

RUN_TRC1014 |

Click Cash Flow Settlements on the Settlement Manager page. |

Run the Cash Flow Settlements process (RUN_TRC1014) to generate the a report that lists bank, account, and settlement information for cash flows of a specified business unit and time period. |

|

Review Settlements |

STL_SELECTION |

Cash Management, Settlements, Review Settlements |

View the payments that are scheduled for authorization and release. |

|

Settlements User Preferences |

STL_SELECTION_PREF |

Click Preferences on the Review Settlements page. |

Set up the default criteria for handling settlements. |

Using the Settlement Manager

Using the Settlement Manager

Access the Settlement Manager page (Cash Management, Settlements, Settlement Manager).

This manager displays settlement categories with summarized information. To view the content of a settlement category, click the link that is located on the right in each category.

|

Show Data for |

Select to view data of:

|

|

Preferences |

Click to establish the default search criteria for Settlement Manager. |

|

Net Deal Settlements |

Click to access the Net Deal Settlements page, and view deal transactions that are coming up for netting. |

|

Select Settlements |

Click to access the Select Settlements page, and view which settlements are available for selection. |

|

Approve Settlements |

Click to access the Approve Settlements page, and view which settlements are coming up for approval. |

|

Review Settlements |

Click to access the Review Settlements page and review settlement information. |

|

Click to access the Cash Flow Settlements page and generate the Cash Flow Settlement report (RUN_TRC1014). |

Setting Settlement Manager Preferences

Setting Settlement Manager Preferences

Access the Settlement Manager Preferences page (click Preferences on the Settlement Manager page).

|

Default Time Period |

Select Today, Last 7 Days, or Last 30 Days. |

Specifying Deal Settlement Netting

Specifying Deal Settlement Netting

This section discusses how to:

Specify deal settlement netting.

Select payable and receivable cash flows.

The Deal Settlement Netting page enables you to select which cash flows to net that results from deal transactions. You can view and offset cash flows by counterparty, categorized by bank account and currency per settlement date. This creates a netted cash flow record for each counterparty and currency combination by bank account.

Page Used to Specify Deal Settlement Netting

Page Used to Specify Deal Settlement Netting|

Page Name |

Definition Name |

Navigation |

Usage |

|

Deal Settlement Netting |

STL_NETTING |

Cash Management, Settlements, Net Deal Settlements |

Select which cash flows to net that resulted from deal transactions. |

|

Settlement Details |

STL_NETTING_DTL |

Click Show Details on the Net Deal Settlements page. |

Select to include or exclude payable and receivable cash flow actions for a deal settlement net. |

|

Review Deal Netting |

STL_NETTING_INQ |

Cash Management, Settlements, Review Deal Netting |

View the results of net-deal settlements (Deal Settlement Netting page). |

Specifying Deal Settlement Netting

Specifying Deal Settlement Netting

Access the Deal Settlement Netting page (Cash Management, Settlements, Net Deal Settlements).

Note. Transactions are netted depending on the settlement netting options that are set on the Counterparty Information page. For netted cash flows, you can view the transaction detail and clear any transactions that you want to exclude.

Search Criteria

|

Netting Status |

Displays Do Not Net or Net Bulk. |

Cash Flow

|

Detail |

Click to see the individual transactions that compose the net amount. To modify which transactions are included in the net, select or clear them here. |

|

Cpty Ref (counterparty reference) |

Enter the reference ID that the counterparty provides referring to this netting transaction. |

|

CP Nettor (counterparty nettor) |

Enter the name of the person in the counterparty's organization that agreed to the net. |

|

Net |

Click to process the netting transaction. |

See Also

Capturing Deals and Trade Tickets