4 Monitoring Financial Metrics

This chapter contains the following topics:

4.1 Understanding the JD Edwards EnterpriseOne Financial Management and Compliance Console Components

JD Edwards EnterpriseOne FMCC consists of metric groupings to measure financial performance:

| Metric Grouping | Metrics Within Grouping |

|---|---|

| Accounts Payable (AP) Activities | Counts and Amounts: The system displays the number and amount of the vouchers and payments entered each day.

Count and Amount of Open Liabilities: The system displays the number and amount of open vouchers and vouchers that are past due. Vouchers Paid Late Discount Information: The system displays the amount of discounts available, taken, and not taken on paid vouchers. The system also displays the percentage of discounts not taken compared to the gross amount vouchered. |

| Accounts Receivable (AR) and Collection Activities | Counts and Amounts: The system displays the number and amount of the invoices and receipts entered each day.

Count and Amount of Open Invoices: The system displays the number and amount of open invoices. Delinquency Information: The system displays the number and amount of past due invoices, as well as the amount of all delinquency fees and number of past-due invoices. Chargeback Information: The system displays the number and amount of all chargebacks and chargebacks by reason code. Discount Information: The system displays the amount and percentage of discounts not taken, earned discounts taken, and unearned discounts taken. Days Sales Outstanding (DSO): The system displays DSO by customer and company. |

| Activity Ratios | The system displays these activity ratios:

|

| Leverage and Liquidity Ratios | The system displays these leverage ratios:

The system displays these liquidity ratios:

|

| Profit | The system displays the actual and planned income, expense, and profit based on the actual and budget ledger types that you specify.

The system displays the expected cash flow according to the information that you provide from the JD Edwards EnterpriseOne Cash Forecasting system. |

| Profitability Ratios | The system displays these profitability ratios:

|

| Profitability Management | The system displays the most profitable customers, brands, and products in separate graphs. You must be using the JD Edwards EnterpriseOne Advanced Cost Accounting system (16) to display these metrics. |

| Revenue Trends | The system displays the revenue trends by customer, product, and brand. You must be using the JD Edwards EnterpriseOne Sales Order Management system (42) to display these metrics. |

| Unposted Transactions | The system displays the amount of vouchers and invoices not posted. Unposted transactions affect the cash flow. |

4.2 Understanding Automatic Accounting Instructions

JD Edwards EnterpriseOne FMCC uses the financial AAIs to determine the account ranges to use for the financial ratios. The system stores the AAIs in the Automatic Accounting Instruction Master table (F0012).

You must set up AAI items according to your chart of accounts before you run the batch programs to load the G/L Balances Fact table (F80D020). This table lists the AAI information that is shipped with the JD Edwards EnterpriseOne FMCC system:

| Item Number | Description | Company | Object Account |

|---|---|---|---|

| F01 | Beginning Assets | 00000 | 1000 |

| F02 | Beginning Accounts Receivable | 00000 | 1200 |

| F03 | Ending Accounts Receivable | 00000 | 1299 |

| F04 | Beginning Inventory | 00000 | 1400 |

| F05 | Ending Inventory | 00000 | 1499 |

| F06 | Ending Current Assets | 00000 | 1999 |

| F07 | Beginning Fixed Assets | 00000 | 2000 |

| F08 | Ending Fixed Assets | 00000 | 2999 |

| F09 | Ending Assets | 00000 | 3999 |

| F10 | Beginning Liabilities | 00000 | 4000 |

| F11 | Ending Current Liabilities | 00000 | 4599 |

| F12 | Beginning Long Term Debt | 00000 | 4600 |

| F13 | Ending Long Term Debt | 00000 | 4699 |

| F14 | Ending Liabilities | 00000 | 4899 |

| F15 | Beginning Revenues / Sales | 00000 | 5000 |

| F16 | Ending Revenue / Sales | 00000 | 5999 |

| F17 | Beginning Cost of Goods (COG) Sold | 00000 | 6000 |

| F18 | Ending COG Sold / Direct Expenses | 00000 | 6999 |

| F19 | Ending COG Sold | 00000 | 7999 |

| F20 | Beginning Interest | 00000 | 8900 |

| F21 | Ending Interest | 00000 | 8999 |

| F22 | Beginning Other Income | 00000 | 9000 |

| F23 | Ending Other Income | 00000 | 9199 |

| F24 | Beginning Other Expense | 00000 | 9200 |

| F25 | Ending Other Expense | 00000 | 9699 |

| F26 | Beginning Tax Expense | 00000 | 9700 |

| F27 | Ending Tax Expense | 00000 | 9799 |

| F28 | Ending Profit and Loss Accounts | 00000 | 9999 |

|

Note: Only AAIs for company 00000 are set up without a business unit. |

4.3 Prerequisites

Before using the Dashboard program, complete these tasks:

-

Set up the console.

-

Run the Date Dimension program (R80D100).

-

Run the appropriate data load batch programs.

4.4 Managing Accounts Payable

This section provides an overview of AP metrics and discusses how to:

-

Set processing options for the AP Discount Information Data Load program (R80D254).

-

Run the AP Discount Information Data Load program.

-

Analyze AP discounts.

-

Set processing options for the AP Daily Counts and Amounts program (R80D253).

-

Run the AP Daily Counts and Amounts program.

-

Analyze AP daily counts and amounts.

-

Set processing options for the AP Open Payables Data Load program (R80D255).

-

Run the AP Open Payables Data Load program.

-

Analyze AP open payables.

-

Set processing options for the AP Vouchers Paid Late Data Load program (R80D256).

-

Run the AP Vouchers Paid Late Data Load program.

-

Analyze AP vouchers paid late.

4.4.1 Understanding AP Metrics

To manage cash flow and profits, companies need to understand the volume and flow of their accounts payable. The JD Edwards EnterpriseOne FMCC AP metrics provide information about:

-

Discounts available and taken from suppliers.

AP discount information enables you to determine whether you are taking all available discounts from your suppliers and, if not, how much you are overpaying.

-

Amount and volume of vouchers and payments entered daily.

-

Outstanding liabilities, which are the amounts vouchered for payment in the near future.

-

Volume and amount of vouchers that were paid after the due date.

If late payments are subject to delinquency fees by your suppliers, you can better manage avoidable expense by understanding the amount that is potentially subject to a fee.

These AP metrics help in determining the overall financial health of the company and how well the capital of the company is managed:

| Metric | Metric Segment | Description |

|---|---|---|

| Amount of Discounts | Available | Shows the total amount of discounts that are available for all paid vouchers by general ledger date by business unit. |

| Amount of Discounts | Taken | Shows the total amount of discounts taken by each general ledger date by business unit. |

| Amount of Discounts | Not Taken | Shows the total amount of discounts not taken by general ledger date by business unit. The system calculates the Amount of Discounts Not Taken as:

Amount of Discounts Available – Amount of Discounts Taken |

| Percentage of Discounts Not Taken | N/A | Calculates the percentage of discounts not taken for the period. The system calculates the Percentage of Discounts Not Taken as:

=Total discount not taken Total gross amount of paid vouchersÃ100 |

| Daily Amounts | Vouchered for the Day | Shows the total amount of vouchers that are generated for each day. The system calculates the Amount Vouchered for the Day by summing the gross amount of the vouchers retrieved from the Accounts Payable Ledger table (F0411) for each general ledger date by business unit. |

| Daily Amounts | Paid for the Day | Shows the total amount of vouchers paid for each day. The system calculates the Amount Paid for the Day by summing the amount of the payments retrieved from the Accounts Payable - Matching Document table (F0413) for each general ledger date by business unit. |

| Daily Counts | Number of Vouchers Entered for the Day | Shows the number of vouchers that are generated for each general ledger date by business unit. The system counts each record in the F0411 table where the combination of document number, document type, and document company is unique. |

| Daily Counts | Number of Payments Entered for the Day | Shows the number of payments processed from the F0413 table for each general ledger date by business unit. |

| Voucher Amounts | Open Vouchers | Shows the total amount of open vouchers by business unit. |

| Voucher Amounts | Open Vouchers That are Past Due | Shows the amount of open vouchers by business unit for which the voucher due date is before the run date of the batch program. |

| Voucher Counts | Number of Open Vouchers | Shows the number of open vouchers for which the combination of document number, document type, and document company is unique by business unit. |

| Voucher Counts | Number of Open Vouchers That are Past Due | Shows the number of open vouchers that are past-due by business unit. The system counts each record in the F0411 table for which the combination of document number, document type, and document company is unique. The system determines whether the voucher is past due by comparing the due date to the run date of the batch program. |

| Amount of Vouchers Paid Late | N/A | Shows the total amount of vouchers paid late for each general ledger date by business unit. |

| Number of Vouchers Paid Late | N/A | Shows the number of vouchers paid late for each general ledger date by business unit. The system counts each past-due voucher for which the document number, document type, and document company combination is unique. |

4.4.2 Setting Processing Options for the AP Discount Information Data Load Program (R80D254)

Processing options enable you to specify the default processing for the AP Discount Information Data Load program.

4.4.2.1 Defaults

This processing option controls the number of days the system uses to load data.

- 1. Number of Days to Rebuild

-

Enter the number of days that the system uses to rebuild the data.

If you leave this processing option blank, the system retrieves records for which the general ledger date is greater than or equal to the last processing date in the AP Discount Information Aggregate table (F80D254) and less than or equal to the current date. If no processing date is in the table, the system runs an initial full load of data.

For incremental loads that specify to rebuild the table for a specific number of days, the system subtracts the number of days entered in the processing option from the current date. The system retrieves only records with a general ledger date that is on or after the calculated rebuild date.

If you run the program twice in the same day, the system replaces the existing records for the day in the F80D254 table with new records.

4.4.2.2 Display

This processing option controls the print output.

- 1. Level of Detail to Print

-

Specify whether the system prints a detailed report or errors only. Values are:

-

Blank: The system prints errors only.

-

1: The system prints a detailed report of the processed records and any errors generated.

-

4.4.3 Running the AP Discount Information Data Load Program

Enter BV in the Fast Path field, and then enter R80D254 in the Batch Application field.

The AP Discount Information Data Load program (R80D254) calculates the Amount of Discounts Available, the Amount of Discounts Taken, the Amount of Discounts Not Taken, and the Percentage of Discounts Not Taken metrics.

The system retrieves transactions from the Accounts Payable Ledger table (F0411) based on these criteria:

-

Pay Status (PST) is set to P.

-

Document Type (DCT) is not equal to P1.

-

Adjustment Document Type (DCTA) is not equal to PE.

-

Discount Available (ADSC) is not equal to zero.

-

Void (VOD) is blank.

-

G/L Date (DGJ) is equal to the starting date specified in the processing option.

The system uses the value in the Number of Days to Rebuild processing option to determine the general ledger date to retrieve transactions.

The system also retrieves the business unit from the F0411 table and the company from the Business Unit Master table (F0006) based on the business unit in the AP Discount Information Aggregate table (F80D254).

The system performs these calculations to derive the AP discounts metrics:

-

Amount of Discounts Available: Sums the Discounts Available field (ADSC) for all transactions retrieved for each general ledger date by business unit.

(Amount of Discounts Available = Sum of all available discounts)

-

Amount of Discounts Taken: Sums the Discount Taken field (ADSA) for all transactions retrieved for each general ledger date by business unit.

(Amount of Discounts Taken = Sum of all discounts taken)

-

Amount of Discounts Not Taken: Subtracts the Amount of Discounts Taken from the Amount of Discounts Available for each general ledger date by business unit.

(Amount of Discounts Not Taken = Amount of Discounts Available − Amount of Discounts Taken)

-

Percentage of Discounts Not Taken: Percentage of the total paid vouchered amount. For the records on which a discount not taken is calculated, the system sums the Gross Amount field (AG) and then divides the total discount not taken amount by the total gross amount of paid vouchers and multiplies the result by 100.

(Percentage of Discounts Not Taken = (Discount not taken amount ÷ Total gross amount of paid vouchers) à 100)

The system stores the Amount of Discounts Available, the Amount of Discounts Taken, and the Amount of Discounts Not Taken values in the F80D254 table. The AP discount metrics are accurate as of the last date you ran the R80D254 program. Oracle recommends that you run the program weekly for trending purposes.

|

Note: If you change the data store currency, modify the business units associated with accounts, or update the company associated with the business unit, you must run a full load of data to the F80D254 table. To do this, either clear the table or set the Number of Days to Rebuild processing option beyond the general ledger date of the first eligible record. |

4.4.3.1 AP Discounts Calculation Example

This table shows the vouchers, discounts available, discounts taken, and voucher general ledger dates:

| Voucher Number | Gross Amount | Discounts Available | Discounts Taken | General Ledger Date |

|---|---|---|---|---|

| 100 | 100 USD | 100 USD | 100 USD | February 13 |

| 101 | 200 USD | 200 USD | 200 USD | February 13 |

| 102 | 200 USD | 200 USD | 200 USD | February 13 |

| 103 | 200 USD | 200 USD | 0 USD | February 13 |

| 104 | 100 USD | 100 USD | 0 USD | February 13 |

If you run the R80D254 program on February 13, the system performs these calculations:

-

Amount of Discounts Available = (100 + 200 + 200 + 200 + 100) = 800 USD.

-

Amount of Discounts Taken = (100 + 200 + 200) = 500 USD.

-

Amount of Discounts Not Taken = (800 − 500) = 300 USD.

-

Total Gross Amount Paid = (100 + 200 + 200 + 200 + 100) = 800 USD.

-

Percentage of Discounts Not Taken = (300 ÷ 800) à 100 = 37.5 percent.

4.4.4 Analyzing AP Discounts

Access the appropriate metric group on the Fin Mgmt & Compliance Console form.

The system presents the three AP discount metrics (Amount of Discounts Available, Amount of Discounts Taken, and Amount of Discounts Not Taken) in a cluster bar chart that shows the amount of discounts (Y axis) for the date the system calculated the metric (X axis):

Day is the default value for the date range. You can also review the chart by week, month, quarter, or year date ranges. The system displays the values for all previous AP discounts in the chart. If an AP discount calculation is zero, the system displays a zero value bar for the date. If no calculation was performed for a period, the system does not display a bar.

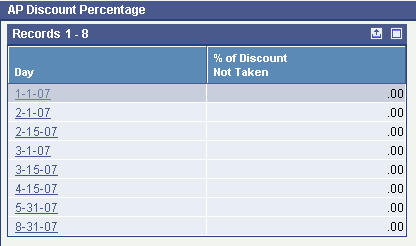

The system presents the Percentage of Discounts Not Taken metric as a grid with a line for each date period that the metric was calculated:

4.4.5 Setting Processing Options for the AP Daily Counts and Amounts Program (R80D253)

Processing options enable you to specify the default processing for the AP Daily Counts and Amounts program.

4.4.5.1 Defaults

This processing option controls the number of days the system uses to load data.

- 1. Number of Days to Rebuild

-

Enter the number of days the system uses to rebuild the data.

If you leave this processing option blank, the system retrieves records where the general ledger date is greater than or equal to the last processing date in the AP Daily Counts and Amounts Aggregate table (F80D253) and less than or equal to the current date. If no processing date is in the table, the system runs an initial full load of data.

For incremental loads that specify to rebuild the table for specific number of days, the system subtracts the number of days entered in the processing option from the current date. The system retrieves only records with a general ledger or payment date that is on or after the calculated rebuild date.

If you run the program twice in the same day, the system replaces the existing records for the day in the F80D253 table with new records.

4.4.5.2 Display

This processing option controls the print output.

- 1. Level of Detail to Print

-

Specify whether the system prints a detailed report or errors only. Values are:

-

Blank: The system prints errors only.

-

1: The system prints a detailed report of the processed records and any errors generated.

-

4.4.6 Running the AP Daily Counts and Amounts Program

Enter BV in the Fast Path field, and then enter R80D253 in the Batch Application field.

The AP Daily Counts and Amounts program (R80D253) calculates the Amount Vouchered for the Day, the Amount Paid for the Day, the Number of Vouchers Entered for the Day, and the Number of Payments Entered for the Day metrics.

For the voucher metrics, the system retrieves transactions from the F0411 table based on these criteria:

-

Document Type (DCT) is not equal to P1.

-

Adjustment Document Type (DCTA) is not equal to PE.

-

Void (VOD) is blank.

-

G/L Date (DGJ) is equal to the starting date specified in the processing option.

The system uses the value in the Number of Days to Rebuild processing option to determine the general ledger date to retrieve transactions.

For the payment metrics, the system retrieves transactions from the Accounts Payable – Matching Document table (F0413) based on these criteria:

-

Void Date (VDGJ) is blank.

-

Payment Date (DMTJ) is equal to the starting date specified in the processing option.

The system uses the value in the Number of Days to Rebuild processing option to determine the general ledger date to retrieve transactions.

The system retrieves transactions from the Account Master table (F0901) based on the value of the G/L Bank Account (GLBA) from the F0413 table being equal to the value of the Account ID (AID) in the F0901 table.

The system also retrieves the business unit from the F0411 table and the company from the F0006 table based on the business unit in the AP Daily Counts and Amounts Aggregate table (F80D253).

The system performs these calculations to derive the AP daily counts and amounts metrics:

-

Amount Vouchered for the Day: Sums the Gross Amount field (AG) of the vouchers retrieved for each general ledger date by business unit.

(Amount Vouchered for the Day = Sum of the amounts for all vouchers entered for the day)

-

Amount Paid for the Day: Sums the Payment Amount field (PAAP) of the payments for each general ledger date by business unit.

(Amount Paid for the Day = Sum of the amounts for all payments entered for the day)

-

Number of Vouchers Entered for the Day: Counts the number of vouchers retrieved for each general ledger date by business unit. The system counts each record in the F0411 table where the combination of document number, document type, and document company is unique.

-

Number of Payments Entered for the Day: Counts the number of payments retrieved for each general ledger date by business unit.

The system stores the calculated metric values in the F80D253 table. The system records data to the F80D253 table only when the R80D253 program runs successfully. If any errors appear on the report, the system does not create any records in the F80D253 table. The AP daily counts and amounts metrics are accurate as of the last date you ran the R80D253 program. Oracle recommends that you run the program daily for trending purposes.

|

Note: If you change the data store currency, modify the business units associated with accounts, or update the company associated with the business unit, you must run a full load of data to the F80D253 table. To do this, either clear the table or set the Number of Days to Rebuild processing option beyond the general ledger date of the first eligible record. |

|

Note: The system does not use data selection criteria for the R80D253 program. The system processes all data from the source tables regardless of the values you enter in the data selection categories. |

4.4.7 Analyzing AP Daily Counts and Amounts

Access the appropriate metric group on the Fin Mgmt & Compliance Console form.

The system presents the AP daily amount metrics, Amount Vouchered for the Day and Amount Paid for the Day in a cluster bar chart that shows the amount vouchered and paid (Y axis) for the date that the system calculated the metric (X axis):

Figure 4-3 AP Voucher and Payment Amounts chart

Description of "Figure 4-3 AP Voucher and Payment Amounts chart"

Day is the default value for the date range, you can also review the chart by week, month, quarter, or year date ranges. The system displays the values for all previous AP daily amounts in the chart. If an AP daily amount calculation is zero, the system displays a zero value bar for the date. If no calculation was performed for a period, the system does not display a bar.

The system presents the AP daily count metrics, Number of Vouchers Entered for the Day, and Number of Payments Entered for the Day in a cluster bar chart that shows the number of vouchers and payments (Y axis) for the date that the system calculated the metric (X axis):

Figure 4-4 AP Voucher and Payment Counts chart

Description of "Figure 4-4 AP Voucher and Payment Counts chart"

Day is the default value for the date range. You can also review the chart by month, quarter, or year date ranges. The system displays the values for all previous AP daily counts in the chart. If an AP daily count calculation is zero, the system displays a zero value bar for the date. If no calculation was performed for a period, the system does not display a bar.

4.4.8 Setting Processing Options for the AP Open Payables Data Load Program (R80D255)

Processing options enable you to specify the default processing for the AP Open Payables Data Load program.

4.4.8.1 Display

This processing option controls the print output.

- 1. Level of Details to Print

-

Specify whether the system prints a detailed report or errors only. Values are:

-

Blank: The system prints errors only.

-

1: The system prints a detailed report of the processed records and any errors generated.

-

4.4.9 Running the AP Open Payables Data Load Program

Enter BV in the Fast Path field, and then enter R80D255 in the Batch Application field.

The AP Open Payables Data Load program (R80D255) calculates the Amount of Open Vouchers, the Amount of Open Vouchers That are Past Due, the Number of Open Vouchers, and the Number of Open Vouchers That are Past Due metrics.

The system retrieves transactions from the F0411 table based on these criteria:

-

Open Amount (AAP) is not equal to zero.

-

G/L Date (DGJ) is less than or equal to the run date of the R80D255 program plus one month.

The system does not include open vouchers that have a general ledger date that is more than one month into the future from the date that you run the R80D255 program. For example, if the current date is August 15, the system considers only the open vouchers that have a general ledger date of September 15 or less. This enables the system to exclude recurring vouchers that are open further in the future.

The system also retrieves the business unit from the F0411 table and the company from the F0006 table based on the business unit in the AP Open Payables Aggregate table (F80D255).

The system performs these calculations to derive the AP open payables metrics:

-

Amount of Open Vouchers: Sums the value of the Open Amount field (AAP) for all records retrieved by business unit.

(Amount of Open Vouchers = Sum of open amounts)

-

Amount of Open Vouchers That are Past Due: Sum the Open Amount field (AAP) of the vouchers by business unit where the voucher due date is before the run date of the R80D255 program.

(Amount of Open Vouchers Past Due = Sum of open amounts)

-

Number of Open Vouchers: Counts the number of vouchers retrieved by business unit. The system counts each record in the F0411 table where the combination of document number, document type, and document company is unique.

-

Number of Open Vouchers That are Past Due: Counts the number of vouchers retrieved by business unit where the value in the Voucher Due Date field (DDNJ) is before the run date of the R80D255 program. The system counts each record in the F0411 table where the combination of document number, document type, and document company is unique.

The system calculates the open payables information only on the date that you run the R80D255 program and stores the values in the F80D255 table. You cannot review information based on whether vouchers were open or past due as of a specific date. The AP open payables metrics are accurate as of the last date that you ran the R80D255 program. Oracle recommends that you run the program daily for trending purposes.

|

Note: If you change the data store currency, modify the business units associated with accounts, or update the company associated with the business unit, you must run a full load of data to the F80D255 table. |

4.4.9.1 Open Payables Amount Example

You have this information in the F0411 table:

| Voucher Number | Voucher Due Date | Open Amount | GL Date | Business Unit |

|---|---|---|---|---|

| 100 | February 09 | 100 | February 10 | 001 |

| 101 | February 10 | 200 | February 11 | 001 |

| 102 | February 11 | 200 | February 12 | 001 |

| 103 | February 16 | 200 | February 16 | 002 |

| 104 | April 16 | 200 | March 17 | 001 |

| 105 | April 17 | 200 | March 18 | 001 |

If you run the R80D255 program on February 16, the system sums the open amount from the run date of the program plus one month, or March 16. The system calculates:

-

Amount of Open Vouchers as 700 using vouchers 100, 101, 102, and 103.

-

Amount of Open Vouchers That are Past Due as 500 using vouchers 100, 101, and 102.

The total does not include voucher 103 because it is not past due until February 17.

4.4.9.2 Open Payables Count Example

You have this information in the F0411 table:

| Voucher Number | Line Number | Business Unit | Voucher Due Date | GL Date | Document Number | Document Type | Company |

|---|---|---|---|---|---|---|---|

| 1 | 1 | 001 | February 09 | February 10 | 2000 | RI | 00001 |

| 2 | 2 | 001 | February 10 | February 11 | 2000 | RI | 00001 |

| 3 | 1 | 001 | February 11 | February 12 | 2000 | RF | 00001 |

| 4 | 1 | 002 | February 15 | February 16 | 2001 | RI | 00001 |

| 5 | 1 | 001 | February 16 | February 16 | 2002 | RI | 00002 |

| 6 | 1 | 001 | April 17 | March 18 | 2003 | RI | 00002 |

The first voucher has two pay items; however, the document number, document type, and company are the same, so the system counts it as one voucher. The system does not include voucher number 6 because it is outside of the date range (February 16 plus one month). The rest of the vouchers are unique. The system calculations are:

-

Number of Open Vouchers metric as 4.

-

Number of Open Vouchers That are Past Due metric as 3.

The total does not include voucher 103 because it is not past due until February 17.

4.4.10 Analyzing AP Open Payables

Access the appropriate metric group on the Fin Mgmt & Compliance Console form.

The system presents the AP open payables amount metrics (Amount of Open Vouchers and Amount of Open Vouchers That are Past Due) in a cluster bar chart that shows the open voucher amounts (Y axis) for the date that the system calculated the metric (X axis):

Day is the value for the date range. The system displays the values for all previous AP open payables amounts in the chart. If an AP open payables amount calculation is zero, the system displays a zero value bar for the date. If no calculation was performed for a period, the system does not display a bar.

The system presents the AP open payables count metrics (Number of Open Vouchers and Number of Open Vouchers That are Past Due) in a cluster bar chart that shows the number of vouchers (Y axis) for the date that the system calculated the metric (X axis):

Day is the value for the date range. You can also review the chart by week, month, quarter, or year date ranges. The system displays the values for all previous AP open payables counts in the chart. If an AP open payables count calculation is zero, the system displays a zero value bar for the date. If no calculation was performed for a period, the system does not display a bar.

4.4.11 Setting Processing Options for the AP Vouchers Paid Late Data Load Program (R80D256)

Processing options enable you to specify the default processing for the AP Vouchers Paid Late Data Load program.

4.4.11.1 Defaults

This processing option controls the number of days the system uses to load data.

- 1. Number of Days to Rebuild

-

Enter the number of days the system uses to rebuild the data.

If you leave this processing option blank, the system retrieves records for which the general ledger date is greater than or equal to the last processing date in the AP Voucher Paid Late Aggregate table (F80D256) and less than or equal to the current date. If no processing date is in the table, the system runs an initial full load of data.

For incremental loads that specify to rebuild the table for a specific number of days, the system subtracts the number of days entered in the processing option from the current date. The system retrieves only records with a payment date that is on or after the calculated rebuild date.

If you run the program twice in the same day, the system replaces the existing records for the day in the F80D256 table with new records.

4.4.11.2 Display

This processing option controls the print output.

- 1. Level of Detail to Print

-

Specify whether the system prints a detailed report or errors only. Values are:

-

Blank: The system prints errors only.

-

1: The system prints a detailed report of the processed records and any errors generated.

-

4.4.12 Running the AP Vouchers Paid Late Data Load Program

Enter BV in the Fast Path field, and then enter R80D256 in the Batch Application field.

The AP Vouchers Paid Late Data Load program (R80D256) calculates the Amount of Vouchers Paid Late and the Number of Vouchers Paid Late metrics.

The system retrieves transactions from the F0413 table based on these criteria:

-

Void Date (VDGJ) is blank.

-

Payment Date (DMTJ) is equal to the starting date specified in the processing option.

The system uses the value in the Number of Days to Rebuild processing option to determine the general ledger date to retrieve transactions. The payment date is the general ledger date of the payment.

To determine whether the voucher was paid late, the system retrieves transactions from the Accounts Payable Matching Document Details table (F0414) that the system uses to locate corresponding records in the F0411 table. The system retrieves transactions based on the value of the Payment ID (PYID) from the F0413 table being equal to the value of the Payment ID (AID) in the F0414 table.

The system retrieves transactions from the F0411 table based on these criteria:

-

Document Number (DOC) from F0414 table is equal to the DOC from the F0411 table.

-

Document Type (DCT) from F0414 table is equal to the DCT from the F0411 table.

-

Document Company (KCO) from F0414 table is equal to the KCO from the F0411 table.

-

Adjusting Document Type (ADCT) is not equal to PE.

The system does not retrieve or consider P1 draft documents for the metrics.

The system also retrieves the business unit from the F0411 table and the company from the F0006 table based on the business unit in the AP Voucher Paid Late Aggregate table (F80D256).

The system performs these calculations to derive the AP voucher paid late metrics:

-

Amount of Vouchers Paid Late: Retrieves the value from the Payment Amount field (AAP) for each voucher that is paid late and then sums the amounts for each general ledger date by business unit.

(Amount of Vouchers Paid Late = Sum of payment amounts)

-

Number of Vouchers Paid Late: Compares the Due Date (DDNJ) in the F0411 table against the Payment Date (DMTJ) of the corresponding record in the F0413 table and then counts the records in the F0411 table where the due date is before the payment date and the document number, document type, and document company combination is unique for each payment date by business unit.

The system stores the Amount of Vouchers Paid Late and the Number of Vouchers Paid Late values in the F80D256 table. The AP vouchers paid late metrics are accurate as of the last date that you ran the R80D256 program. Oracle recommends that you run the program daily for trending purposes.

|

Note: If you change the data store currency, modify the business units associated with accounts, or update the company associated with the business unit, you must run a full load of data to the F80D256 table. To do this, either clear the table or set the Number of Days to Rebuild processing option beyond the general ledger date of the first eligible record. |

4.4.12.1 Amount of Vouchers Paid Late Example

This table shows the vouchers, due dates, payment amounts, and payment dates:

| Voucher Number | Due Date | Payment Amount | Payment Date |

|---|---|---|---|

| 100 | February 14 | 100 USD | February 16 |

| 101 | February 15 | 200 USD | February 16 |

| 102 | February 1 | 200 USD | February 10 |

| 103 | February 9 | 200 USD | February 8 |

If you run the R80D256 program on February 16, the system considers only the vouchers with payment dates greater than the due date, in this case 100 and 101. Therefore, the amount of vouchers paid late for February 16 is 300 USD and 200 USD for February 10.

4.4.12.2 Number of Vouchers Paid Late Example

You have this data in the F0411 table:

| Document Number | Document Type | Document Company | Line ID | Due Date | Payment Amount | Payment Date | Business Unit |

|---|---|---|---|---|---|---|---|

| 2000 | PV | 00001 | 001 | February 14 | 100 USD | February 16 | 001 |

| 2000 | PV | 00001 | 002 | February 14 | 100 USD | February 12 | 001 |

| 2000 | PV | 00001 | 003 | February 14 | 100 USD | February 16 | 001 |

| 2001 | PL | 00001 | 001 | February 14 | 100 USD | February 16 | 001 |

| 2001 | PV | 00001 | 001 | February 15 | 200 USD | February 16 | 002 |

| 2002 | PV | 00002 | 001 | February 1 | 200 USD | February 10 | 001 |

| 2004 | PV | 00001 | 001 | February 9 | 200 USD | February 8 | 002 |

If you run the R80D256 program on February 16, the system:

-

Counts document number 2000 as one voucher for the given payment date, even though it has three pay items.

-

Does not consider voucher 2004 because it was paid before the due date.

-

Counts the remainder of the vouchers because they have unique document number, document type, and document company combinations.

Therefore, the number of vouchers paid late for February 16 is 3 and the number of vouchers paid late for February 10 is 1.

4.4.13 Analyzing AP Vouchers Paid Late

Access the appropriate metric group on the Fin Mgmt & Compliance Console form.

The system presents the Amount of Vouchers Paid Late metric in a bar chart that shows the voucher amounts (Y axis) for the date that the system calculated the metric (X axis):

Figure 4-7 AP Vouchers Paid Late Amount chart

Description of "Figure 4-7 AP Vouchers Paid Late Amount chart"

Day is the default value for the date range. You can also review the chart by week, month, quarter, or year date ranges. The system displays the values for all previous Amount of Vouchers Paid Late amounts in the chart. If an Amount of Vouchers Paid Late calculation is zero, the system displays a zero value bar for the date. If no calculation was performed for a period, the system does not display a bar.

The system presents the Number of Vouchers Paid Late metric in a bar chart that shows the number of vouchers (Y axis) for the date that the system calculated the metric (X axis):

Figure 4-8 AP Vouchers Paid Late Count chart

Description of "Figure 4-8 AP Vouchers Paid Late Count chart"

Day is the default value for the date range. You can also review the chart by week, month, quarter, or year date ranges. The system displays the values for all previous Number of Vouchers Paid Late counts in the chart. If a Number of Vouchers Paid Late calculation is zero, the system displays a zero value bar for the date. If no calculation was performed for a period, the system does not display a bar.

4.5 Managing Accounts Receivable

This section provides overviews of accounts receivable (AR) metrics and days sales outstanding (DSO), and discusses how to:

-

Analyze days sales outstanding.

-

Set processing options for the AR Discount Information Data Load program (R80D282).

-

Run the AR Discount Information Data Load program.

-

Analyze AR discounts.

-

Set processing options for the AR Daily Counts and Amounts program (R80D280).

-

Run the AR Daily Counts and Amounts program.

-

Analyze AR daily counts and amounts.

-

Set processing options for the AR Open Receivables Data Load program (R80D284).

-

Run the AR Open Receivables Data Load program.

-

Analyze AR open receivables.

-

Set processing options for the AR Delinquency Data Load program (R80D281).

-

Run the AR Delinquency Data Load program.

-

Analyze AR delinquency information.

-

Set processing options for the AR Open Chargeback Information Data Load program (R80D283).

-

Run the AR Open Chargeback Information Data Load program.

-

Analyze AR open chargebacks.

-

Set processing options for the AR Total Chargeback Information Data Load program (R80D285).

-

Run the AR Total Chargeback Information Data Load program.

-

Analyze AR total chargebacks.

4.5.1 Understanding Accounts Receivable Metrics

To manage cash flow and profits, companies need to understand the volume and flow of their accounts receivable. The JD Edwards EnterpriseOne FMCC AR metrics provide information about:

-

Days Sales Outstanding (DSO), which is a widely used metric that measures how much capital a manufacturer has tied up in outstanding receivables.

The result of the DSO calculation informs managers how many days worth of product sales have been shipped to customers and are yet to be paid. When products are shipped on credit, companies must wait a certain number of days before receiving cash to recover the investments that were made in the shipped product.

-

Discount offered and taken by customers.

AR discount information enables you to view how your customers pay. Discount information can help in determining whether the discounts that are offered provide enough customer incentive to make early payments. Discounts also enable you to understand how much revenue is being lost by discounting goods.

-

Amount and volume of invoices and receipts entered daily.

Daily amounts and counts represents both daily revenue and future revenue.

-

Amount and volume of past due invoices in relation to the customers who are delinquent.

By tracking the volume and amount of past-due invoices in relation to the customers who are delinquent, a company can determine whether to increase or decrease a customer's credit, increase delinquency fees, or terminate the relationship.

-

Open and total chargeback amounts, which are the invoice amounts that are charged back to customers due to failure to pay.

A chargeback is an invoice record generated in a receipt batch that replaces an invoice that has purposefully not been paid. When you enter a chargeback, the system generates a receipt record to close the original invoice and creates a new invoice in the Customer Ledger table (F03B11) with an RB document type. You should associate all chargebacks with a chargeback reason code that describes why the original invoice was not paid.

-

Open and total chargeback amounts by reason code.

By tracking the chargeback reason codes, you can better understand and address the issues and concerns of your customers.

These AR metrics help in determining the overall financial health of the company and how well the capital of the company is managed:

| Metric | Metric Segment | Description |

|---|---|---|

| Days Sales Outstanding (DSO) | N/A | Calculates how much capital is tied up in the outstanding accounts receivables of the manufacturer. |

| Amount of Discounts | Taken | Shows the total amount of discounts taken by each general ledger date by business unit. |

| Amount of Discounts | Unearned Taken | Shows the total amount of discounts taken that were not earned by general ledger date by business unit. |

| Amount of Discounts | Not Taken | Shows the total amount of discounts that were not taken for each general ledger date by business unit. The system calculates the amount of Discounts Not Taken as: Amount of Discounts Available – Amount of Discounts Taken |

| Percentage of Invoices | Which a Discount was Taken | Calculates the percentage of discounts taken for the period. The system calculates the Percentage of Invoices for Which a Discount was Taken as:

=Number of invoices with an earned discount taken Number of invoices with a discount availableÃ100 |

| Percentage of Invoices | Which an Unearned Discount was Taken | Calculates the percentage of discounts taken that were not earned for the period. The system calculates the Percentage of Invoices for Which an Unearned Discount was Taken as:

=Number of invoices for which a discount was not taken Number of invoices with a discount availableÃ100 |

| Percentage of Invoices | Which a Discount was Available but Not Taken | Calculates the percentage of discounts that were available but not taken for the period. The system calculates the Percentage of Invoices for Which a Discount was Available but Not Taken as:

Shows the amount of revenue that is open for collection. |

| Amount of Open Invoices | N/A | Shows the amount of revenue that is open for collection. |

| Number of Open Invoices | N/A | Shows the number of invoices that are open for collection. |

| Daily Amounts | Invoiced for the Day | Shows the total amount of invoices generated for each day. |

| Daily Amounts | Received for the Day | Shows the average amount of payments received for each day. |

| Average Amount Invoiced for the Day | N/A | Shows the average amount of invoices generated for each day. |

| Daily Counts | Number of Invoices Entered for the Day | Shows the number of invoices generated for each general ledger date by business unit. The system counts each record in the F03B11 table where the combination of document number, document type, and document company is unique. |

| Daily Counts | Number of Receipts Entered for the Day | Shows the number of receipts retrieved from the Receipts Header table (F03B13) for each general ledger date by business unit. |

| Past Due Amounts | Open Amount of Past Due Invoices | Shows the open amount for all invoices with an invoice due date in the past. |

| Past Due Amounts | Amount of Open Delinquency Fees | Shows the open amount of delinquency fees that have been applied from past due invoices. |

| Past Due Counts | Number of Past Due Invoices | Shows the number of invoices with a due date in the past. |

| Past Due Counts | Number of Customers with Past Due Invoices | Shows the number of customers with invoice due dates in the past. |

| Open Chargeback Amount | N/A | Shows the open amount that has been charged back to customers for failure to pay invoices. |

| Open Chargeback Amount by Reason Code | N/A | Shows the open amount that has been charged back to customers by reason code for the nonpayment of invoices. |

| Total Chargeback Amount | N/A | Shows the total amount that has been charged back to customers for failure to pay for each general ledger date. |

| Total Chargeback Amount by Reason Code | N/A | Shows the total amount that has been charged back to customers by reason code for each general ledger date for the nonpayment of invoices. |

4.5.2 Understanding Days Sales Outstanding

DSO measures how much capital a company has tied up in outstanding receivables. Companies use DSO to estimate the length of time credit customers take to settle their balances:

-

A high number can indicate that customers are slow in paying bills, so the company has to wait a long time to collect cash.

The higher the DSO number, the more capital the company has tied up in AR.

-

A low number indicates that customers pay quickly and, as a result, the company has a relatively small amount of capital tied up in receivables.

A company that bills the customer's credit cards immediately upon receipt of an online order has a very low DSO number because they have very little money owed to them at any time.

Although companies strive to keep DSO as low as possible, an extremely low DSO can indicate a very restrictive credit and collection policy, which may curtail sales and hence adversely affect profit.

-

The shorter the collection period, the better the quality of debtors, because a short collection period implies the prompt payment by debtors.

You should compare the average collection period against your companies credit terms and policies to judge your credit and collection efficiency.

-

An excessively long collection period implies a very liberal and inefficient credit and collection performance.

The delay in collection of cash impairs a company's liquidity.

The DSO metric displays the trend over time and compares the trend to the DSO goal of the company. Increasing trends can indicate trouble collecting receivables from large customers and can result from surges in shipments, which increases the outstanding AR. DSO is considered an important aspect in accessing the overall financial health of a company.

The system displays the DSO metric information in two different bar charts, DSO by company and DSO by customer. When you review the DSO charts on the console summary page, they appear the same. The difference between the two charts is not apparent until you drill down on the console detail page. For DSO by company, you drill down using date, company, and then customer. For DSO by customer, you drill down using date, customer, and then company. Because date is the first drill-down level for both charts, the summary page appears the same for both charts. No business unit drilldown is available for the DSO metric.

For the DSO metric, you cannot search for a specific company. If you enter a specific company in the Search By Company field, the system displays a blank console. You can review information by company using the drilldown and view by features. For example, if you view by date, the system displays the information by date and then you can drill into a date and see the information by company. You can also view by company to see information for all companies displayed on the console.

JD Edwards EnterpriseOne FMCC does not have a batch program that generates the DSO values. The system uses the date in the AR Statistical History table (F03B16) and then performs the DSO calculations at runtime of the Dashboard program (P80D350). For example, if you inquire on DSO by quarter date ranges, the system:

-

Adds the DSO values for the periods that make up the quarter.

-

Divides the total by 3.

-

Displays the value in the chart on the console.

|

Note: You must run the A/R Statistical History Refresh (A) program (R03B16A) to populate the F03B16 table. |

The DSO value that is calculated in JD Edwards EnterpriseOne FMCC can be different from the DSO value that is calculated in the JD Edwards Plant Manager's Dashboard (PMD). JD Edwards EnterpriseOne FMCC uses the data that is calculated based on the processing option settings of the R03B16A program. Depending on how you set the processing options when loading the data into the table, the system can produce different DSO numbers.

4.5.3 Analyzing Days Sales Outstanding

Access the appropriate metric group on the Fin Mgmt & Compliance Console form.

The system retrieves transactions from the AR Statistical History table (F03B16) and the Credit/Collection Date Pattern table (F03B08) based on the company, fiscal year, and period number.

The system presents the DSO metric in two bar charts, DSO by customer and DSO by company.

The first chart shows the number of days of sales outstanding (Y axis) for the date that the system calculated the metric (X axis) by customer:

The second chart shows the number of days of sales outstanding (Y axis) for the date that the system calculated the metric (X axis) by company:

Month is the default value for the date range. You can also review the chart by quarter or year date ranges. The system displays the values for all previous DSO calculations in the chart. If the DSO calculation was zero days, the system displays a zero value bar for the date. If no calculation was performed for a period, the system does not display a bar.

You can define goals for DSO at the customer and company levels. Goals are numerical values that represent a target for the customers. If the metric exceeds the goal, the system considers the goal breached. The system displays the goal value as a diamond marker for each bar on the chart.

4.5.4 Setting Processing Options for the AR Discount Information Data Load Program (R80D282)

Processing options enable you to specify the default processing for the AR Discount Information Data Load program.

4.5.4.1 Defaults

This processing option controls the number of days that the system uses to load data.

- 1. Number of Days to Rebuild

-

Enter the number of days that the system uses to rebuild the data.

If you leave this processing option blank, the system retrieves records where the general ledger date is greater than or equal to the last processing date in the AR Discount Information Aggregate table (F80D282) and less than or equal to the current date. If no processing date is in the table, the system runs an initial full load of data.

For incremental loads that specify to rebuild the table for specific number of days, the system subtracts the number of days entered in the processing option from the current date. The system retrieves only records with a general ledger date that is on or after the calculated rebuild date.

If you run the program twice in the same day, the system replaces the existing records for the day in the F80D282 table with new records.

4.5.4.2 Display

This processing option controls the print output.

- 1. Level of Detail to Print

-

Specify whether the system prints a detailed report or errors only. Values are:

-

Blank: The system prints errors only.

-

1: The system prints a detailed report of the processed records and any errors generated.

-

4.5.5 Running the AR Discount Information Data Load Program

Enter BV in the Fast Path field, and then enter R80D282 in the Batch Application field.

The AR Discount Information Data Load program (R80D282) calculates these metrics:

-

Earned Discounts Taken

-

Unearned Discounts Taken

-

Discounts Not Taken

-

Percentage of Invoices for Which an Earned Discount was Taken

-

Percentage of Invoices for Which an Unearned Discount was Taken

-

Percentage of Invoices for Which a Discount was Available but Not Taken

The system retrieves transactions from the Receipts Detail table (F03B14) table based on these criteria:

-

Discount Available (ADSC) is not equal to zero.

-

Voided Flag (VDGJ) is blank.

-

Receipt G/L Date (GDJ) is equal to the starting date specified in the processing option.

The system uses the value in the Number of Days to Rebuild processing option to determine the general ledger date to retrieve transactions.

The system also retrieves the business unit from the F03B14 table and the company from the F0006 table based on the business unit in the AR Discount Information Aggregate table (F80D282).

|

Note: The system considers discounts on paid invoices only when you run the R80D282 program. |

The system performs these calculations to derive the AR discount metrics:

-

Earned Discounts Taken: Sums the earned discount taken for all transactions retrieved for each general ledger date by business unit.

To determine whether the discount taken was earned, the system compares the general ledger date of the receipt against the discount due date of the invoice. If the receipt general ledger date is on or before the discount due date of the invoice, the discount is earned. The only time that the discounts not taken will be different from the discounts available is when a partial discount is taken.

(Earned Discounts Taken = Sum earned discounts taken)

-

Unearned Discounts Taken: Sums the unearned discount taken for all transactions retrieved for each general ledger date by business unit.

To determine whether the discount taken was unearned, the system compares the general ledger date of the receipt against the discount due date of the invoice. If the receipt general ledger date is on or after the discount due date of the invoice, the discount is unearned.

(Unearned Discounts Taken = Sum unearned discounts taken)

-

Discounts Not Taken: Sum the Discount Available (ADSC) for all transactions retrieved and subtracts the discounts taken, both earned and unearned, for each general ledger date by business unit.

(Discounts Not Taken = Sum discounts available – Earned Discounts taken)

-

Percentage of Invoices for Which a Discount was Taken: Divides the number of invoices with an earned discount taken by the number of invoices with a discount available and then multiples by 100.

=Number of invoices with an earned discount taken Number of invoices with a discount availableÃ100

-

Number of invoices with an earned discount taken: Counts the number of invoices for which an earned discount was taken (ADSA is not equal to zero) and the receipt date is on or before the invoice due date for each general ledger date by business unit.

-

Number of invoices with a discount available: Counts the number of paid invoices for which a discount was available (ADSC is not equal to zero) for each general ledger date by business unit.

-

Percentage of Invoices for Which an Unearned Discount was Taken: Divides the number of invoices with an unearned discount taken by the number of invoices with a discount available and then multiples by 100.

=Number of invoices with an unearned discount taken Number of invoices with a discount availableÃ100

-

Number of invoices with an unearned discount taken: Counts the number of invoices for which an unearned discount was taken (ADSA is not equal to zero) and the receipt date is after the discount due date on the invoice for each general ledger date by business unit.

-

Percentage of Invoices for Which a Discount was Available but Not Taken: Divides the number of invoices for which a discount was not taken by the number of invoices with a discount available and then multiples by 100.

P=Number of invoices for which a discount was not taken Number of invoices with a discount availableÃ100

-

Number of invoices for which a discount was not taken: Counts the number of invoices for which a discount was not taken (the difference between ADSC and ADSA is not equal to zero) for each general ledger date by business unit.

The system stores the AR discounts information values in the F80D282 table. The AR discount metrics are accurate as of the last date that you ran the AR Discounts program. Oracle recommends that you run the program daily for trending purposes.

|

Note: If you change the data store currency, modify the business units associated with accounts, or update the company associated with the business unit, you must run a full load of data to the F80D282 table. To do this, either clear the table or set the Number of Days to Rebuild processing option beyond the general ledger date of the first eligible record. |

4.5.5.1 Discount Information Example

You have this discount information in the F03B14 table:

| Invoice Number | Discount Due Date | Discount Available | Discount Taken | Receipt General Ledger Date |

|---|---|---|---|---|

| 100 | February 14 | 100 USD | 100 USD (earned) | February 13 |

| 101 | February 15 | 200 USD | 200 USD (earned) | February 13 |

| 102 | February 1 | 200 USD | 200 USD (unearned) | February 10 |

| 103 | February 9 | 200 USD | 200 USD (earned) | February 8 |

| 104 | February 9 | 200 USD | 0 USD | February 11 |

If you run the R80D282 program on February 13, the system calculates:

- Earned Discount Taken

-

The system considers only invoices that have a receipt general ledger date on or before the discount due date, invoices 100, 101, and 103. The earned discount taken amount is 500 USD.

- Unearned Discount Taken

-

The system considers only invoices that have a receipt general ledger date after the discount due date, invoice 102. The unearned discount taken is 200 USD.

- Discount Not Taken

-

The system considers only invoices for which a discount was available but has not been taken, invoice 104. The discount not taken is 200 USD.

4.5.5.2 Discount Percentage Calculation Example

Using the data in the discount information example, if you run the R80D282 program on February 13, the system calculates:

- Percentage of Invoices for Which an Earned Discount was Taken

-

The number of paid invoices for which a discount was available is 5. The number of paid invoices for which an earned discount was taken is 3. Therefore, the percentage of invoices for which an earned discount was taken = (3 ÷ 5) à 100 or 60 percent.

- Percentage of Invoices for Which an Unearned Discount was Taken

-

The number of paid invoices for which a discount was available is 5. The number of paid invoices for which an unearned discount was taken is 1.Therefore, the percentage of invoices for which an unearned discount was taken = (1 ÷ 5) à 100 or 20 percent.

- Percentage of Invoices for Which a Discount was Available but Not Taken

-

The number of paid invoices for which a discount was available is 5. The number of paid invoices for which a discount was not taken is 1. Therefore, the percentage of invoices for which a discount was available but not taken = (1 ÷ 5) à 100 or 20 percent.

4.5.6 Analyzing AR Discounts

Access the appropriate metric group on the Fin Mgmt & Compliance Console form.

The system presents the AR discount information metrics (Earned Discounts Taken, Unearned Discounts Taken, and Discounts not Taken) in a cluster bar chart that shows the discount amount (Y axis) for the date that the system calculated the metric (X axis):

Day is the default value for the date range. You can also review the chart by week, month, quarter, or year date ranges. The system displays the values for all previous AR discount amounts in the chart. If an AR discount information amount calculation is zero, the system displays a zero value bar for the date. If no calculation was performed for a period, the system does not display a bar.

The system presents the AR discount percentage metrics (Percentage of Invoices for Which an Earned Discount was Taken, Percentage of Invoices for Which an Unearned Discount was Taken, and Percentage of Invoices for Which a Discount was Available but Not Taken) in a pie chart that shows the percentage of discounts (Y axis) for the date that the system calculated the metric (X axis):

Pie charts do not have a variant; therefore, you cannot drill into detail data for the metric.

4.5.7 Setting Processing Options for the AR Daily Counts and Amounts Program (R80D280)

Processing options enable you to specify the default processing for the AR Daily Counts and Amounts program.

4.5.7.1 Defaults

This processing option controls the print output and the number of days that the system uses to load data.

- 1. Number of Days to Rebuild

-

Enter the number of days that the system uses to rebuild the data.

If you leave this processing option blank, the system retrieves records where the general ledger date is greater than or equal to the last processing date in the AR Daily Counts and Amounts Aggregate table (F80D280) and less than or equal to the current date. If no processing date is in the table, the system runs an initial full load of data.

For incremental loads that specify to rebuild the table for a specific number of days, the system subtracts the number of days entered in the processing option from the current date. The system retrieves only records with a general ledger date that is on or after the calculated rebuild date.

If you run the program twice in the same day, the system replaces the existing records for the day in the F80D280 table with new records.

4.5.7.2 Display

This processing option controls the print output.

- 1. Level of Detail to Print

-

Specify whether the system prints a detailed report or errors only. Values are:

-

Blank: The system prints errors only.

-

1: The system prints a detailed report of the processed records and any errors generated.

-

4.5.8 Running the AR Daily Counts and Amounts Program

Enter BV in the Fast Path field, and then enter R80D280 in the Batch Application field.

The AR Daily Counts and Amounts program (R80D280) calculates the Amount Invoiced for the Day, the Amount Received for the Day, the Number of Invoices Entered for the Day, the Number of Receipts Entered for the Day, and the Average Amount Invoiced for the Day metrics.

The system retrieves transactions from the F03B11 table based on theses criteria:

-

Void Date (VDGJ) is blank.

-

Document Type (DCT) is not equal to RU, R1, or R5.

-

G/L Date (DGJ) is equal to the starting date specified in the processing option.

The system uses the value in the Number of Days to Rebuild processing option to determine the general ledger date to retrieve transactions.

The system retrieves transactions from the F03B13 table based on these criteria:

-

Void Date (VDGJ) is blank.

-

Receipt G/L Date (DGJ) is equal to the starting date specified in the processing option.

The system uses the value in the Number of Days to Rebuild processing option to determine the general ledger date to retrieve transactions.

The system also retrieves the business unit from the F0901 table and the company from the Business Unit Master table (F0006) based on the business unit in the AR Daily Counts and Amounts Aggregate table (F80D280).

The system performs these calculations to derive the AR daily counts and amounts metrics:

-

Amount Invoiced for the Day: Sums the value of the Gross Amount field (AG) for the invoices retrieved for each day by business unit.

(Amount Invoiced for the Day = Sum gross amount of invoices)

-

Amount Received for the Day: Sums the value of the Receipt Amount field (CKAM) for the receipts retrieved for each day by business unit.

(Amount Received for the Day = Sum receipt amounts)

-

Average Amount Invoiced for the Day: Divides the total invoice amount by the number of invoices entered for the day by business unit.

(Average Amount Invoiced for the Day = Total invoice amount ÷ Number of invoices)

-

Number of Invoices Entered for the Day: Counts the number of invoices retrieved for the day by business unit where the document number, document type, and document company combination is unique.

-

Number of Receipts Entered for the Day: Counts the number of records retrieved for the day by business unit.

The system stores the AR daily counts and amounts values in the F80D280 table. The system records data to the F80D280 table only when the R80D280 program runs successfully. If any errors appear on the report, the system does not create any records in the F80D280 table. The AR daily counts and amounts metrics are accurate as of the last date that you ran the R80D280 program. Oracle recommends that you run the program daily for trending purposes.

|

Note: If you change the data store currency, modify the business units associated with accounts, or update the company associated with the business unit, you must run a full load of data to the F80D280 table. To do this, either clear the table or set the Number of Days to Rebuild processing option beyond the general ledger date of the first eligible record. |

|

Note: The system does not use data selection criteria for the R80D280 program. The system processes all data from the source tables regardless of the data selection criteria. |

4.5.9 Analyzing AR Daily Counts and Amounts

Access the appropriate metric group on the Fin Mgmt & Compliance Console form.

The system presents the AR daily amount metrics (Amount Invoiced for the Day and Amount Received for the Day) in a cluster bar chart that shows the amount invoiced and received (Y axis) for the date that the system calculated the metric (X axis):

Figure 4-13 AR Invoice and Receipts Amounts chart

Description of "Figure 4-13 AR Invoice and Receipts Amounts chart"

Day is the default value for the date range. You can also review the chart by week, month, quarter, or year date ranges. The system displays the values for all previous AR daily amounts in the chart. If an AR daily amount calculation is zero, the system displays a zero value bar for the date. If no calculation was performed for a period, the system does not display a bar.

The system presents the AR daily count metrics (Number of Invoices Entered for the Day and Number of Receipts Entered for the Day) in a cluster bar chart that shows the number of invoices and receipts (Y axis) for the date that the system calculated the metric (X axis):

Figure 4-14 AR Invoice and Receipt Counts chart

Description of "Figure 4-14 AR Invoice and Receipt Counts chart"

Day is the default value for the date range. You can also review the chart by week, month, quarter, or year date ranges. The system displays the values for all previous AR daily counts in the chart. If an AR daily count calculation is zero, the system displays a zero value bar for the date. If no calculation was performed for a period, the system does not display a bar.

The system displays the Average Amount Invoiced for the Day in a bar chart that shows the average amount (Y axis) for the date that the system calculated the metric (X axis):

Figure 4-15 AR Average Invoice Amounts chart

Description of "Figure 4-15 AR Average Invoice Amounts chart"

Day is the default value for the date range. You can also review the chart by week, month, quarter, or year date ranges. The system displays the values for all previous averages in the chart. If the average is zero, the system displays a zero value bar for the period. If no calculation was performed for a date, the system does not display a bar.

4.5.10 Setting Processing Options for the AR Open Receivables Data Load Program (R80D284)

Processing options enable you to specify the default processing for the AR Open Receivables program.

4.5.10.1 Display

This processing option controls the print output.

- 1. Level of Details to Print

-

Specify whether the system prints a detailed report or errors only. Values are:

-

Blank: The system prints errors only.

-

1: The system prints a detailed report of the processed records and any errors that were generated.

-

4.5.11 Running the AR Open Receivables Data Load Program

Enter BV in the Fast Path field, and then enter R80D284 in the Batch Application field.

The AR Open Receivables Data Load program (R80D284) calculates the Amount of Open Invoices and Number of Open Invoices metrics.

The system retrieves transactions from the F03B11 table based on these criteria:

-

Void Date (VDGJ) is blank.

-

Open Amount (AAP) is not equal to zero.

-

Document Type (DCT) is not equal to RU, R1, or R5.

-

G/L Date (DGJ) is less than the date that you run the program plus one month.

The system does not include open invoices that have a general ledger date that is more than one month in the future from the run date of the R80D284 program.

The system also retrieves the business unit from the F03B11 table and the company from the F0006 table based on the business unit in the AR Open Receivables Aggregate table (F80D284).

The system performs these calculations to derive the open receivables metrics:

-

Amount of Open Invoices: Sums the value of the Open Amount field (AAP) for all records retrieved.

(Amount of Open Invoices = Sum of open amounts)

-

Number of Open Invoices: Counts the number of invoices retrieved where the document number, document type, and document company combination is unique.

The system stores the Amount of Open Invoices and the Number of Open Invoices values in the F80D284 table. The AR open receivables metrics are accurate as of the last date that you ran the R80D284 program. Oracle recommends that you run the program weekly for trending purposes.

|

Note: If you change the data store currency, modify the business units associated with accounts, or update the company associated with the business unit, you must run a full load of data to the F80D284 table. |

4.5.11.1 Amount of Open Invoices Example

You have invoices with these open amounts and dates in the F03B11 table:

| Invoice Number | General Ledger Date | Open Amount |

|---|---|---|

| 101 | February 15 | 200 USD |

| 102 | February 20 | 300 USD |

| 103 | March 1 | 200 USD |

If you run the R80D284 program on February 15, the system considers the open amount from the run date of the program plus one month, in this case March 15. Therefore, the amount of open invoices is equal to 700 USD.

4.5.11.2 Number of Open Invoices Example

This table shows the data in the F03B11 table:

| Invoice Number | Line Number | Business Unit | General Ledger Date | Document Number | Document Type | Company |

|---|---|---|---|---|---|---|

| 101 | 1 | 001 | February 15 | 2000 | RI | 00001 |

| 102 | 2 | 001 | February 16 | 2000 | RI | 00001 |

| 103 | 1 | 001 | February 17 | 2000 | RF | 00001 |

| 104 | 1 | 002 | February 18 | 2001 | RI | 00001 |

| 105 | 1 | 001 | February 19 | 2002 | RI | 00002 |

| 106 | 1 | 001 | March 19 | 2003 | RI | 00002 |

If you run the R80D284 program on February 15, the system:

-

Counts document number 2000 as 1, even though two pay items are on the invoice.

-

Does not include invoice 106 because the general ledger date is later than February 15 plus 30 days.

-

Counts the other items as one each, because they have unique document number, document type, and document company combinations.

4.5.12 Analyzing AR Open Receivables

Access the appropriate metric group on the Fin Mgmt & Compliance Console form.

The system presents the Amount of Open Invoices metric as a bar chart that shows the amount (Y axis) for the date that the system calculated the metric (X axis):

Day is the default value for the date range. The system displays the values for all previous Amount of Open Invoices in the chart. If an Amount of Open Invoices calculation is zero, the system displays a zero value bar for the date. If no calculation was performed for a period, the system does not display a bar.

The system presents the Number of Open Invoices metric as a bar chart that shows the count (Y axis) for the date that the system calculated the metric (X axis):

Day is the default value for the date range. The system displays the values for all previous Number of Open Invoices in the chart. If a Number of Open Invoices calculation is zero, the system displays a zero value bar for the date. If no calculation was performed for a period, the system does not display a bar.

4.5.13 Setting Processing Options for the AR Delinquency Data Load Program (R80D281)

Processing options enable you to specify the default processing for the AR Delinquency Data Load program.

4.5.13.1 Display

This processing option controls the print output.

- 1. Level of Detail to Print

-

Specify whether the system prints a detailed report or errors only. Values are:

-

Blank: The system prints errors only.

-

1: The system prints a detailed report of the processed records and any errors that were generated.

-

4.5.14 Running the AR Delinquency Data Load Program

Enter BV in the Fast Path field, and then enter R80D281 in the Batch Application field.

The AR Delinquency Data Load program (R80D281) calculates the Open Amount of Past Due Invoices, the Amount of Open Delinquency Fees, the Number of Past Due Invoices, and the Number of Customers with Past Due Invoices metrics.

The system retrieves transactions from the F03B11 table based on these criteria:

-

Voided Flag (VDGJ) is blank.

-

Open Amount (AAP) is not equal to zero.

-

Document Type (DCT) is not equal to RU, R1, or R5.

The system also retrieves the business unit from the F03B11 table and the company from the F0006 table based on the business unit in the AR Delinquency Aggregate table (F80D281).

The system performs these calculations to derive the AR delinquency metrics:

-

Open Amount of Past Due Invoices: Sums the value of the Open Amount field (AAP) for all invoices where the invoice due date is before the run date of the R80D281 program.

(Open Amount of Past Due Invoices = Sum of the open amounts)

-

Amount of Open Delinquency Fees: Sums the value of the Open Amount field (AAP) for all invoices retrieved that have a RF document type.

(Amount of Open Delinquency Fees = Sum of open amounts with RF document type)

-

Number of Past Due Invoices: Counts the invoice records retrieved where the invoice due date is before the run date of the R80D281 program, and the document number, document type, and document company combination is unique.

-

Number of Customers with Past Due Invoices: Counts the records retrieved where the invoice due date is before the run date of the R80D281 program and the address book number (AN8) is unique.

The system stores the Open Amount of Past Due Invoices, Amount of Open Delinquency Fees, Number of Past Due Invoices, and Number of Customers with Past Due Invoices values in the F80D281 table. The AR delinquency information metrics are accurate as of the last date that you ran the AR Delinquency Information program. Oracle recommends that you run the program weekly for trending purposes.

|

Note: If you change the console data store currency, modify the business units associated with accounts, or update the company associated with the business unit, you must run a full load of data to the F80D281 table. |

4.5.14.1 Delinquency Amounts Example

You have invoices with these due dates and open amounts:

| Invoice Number | Due Date | Open Amount | Document Type |

|---|---|---|---|

| 100 | February 14 | 100 USD | RI |

| 101 | February 15 | 200 USD | RI |

| 102 | April 01 | 200 USD | RI |

| 103 | February 09 | 200 USD | RI |