9 Setting Up Costing

This chapter contains the following topics:

9.1 Understanding Costing Setup

Before you use the JD Edwards EnterpriseOne Grower Management system, you must set up information that the system uses during processing. The costing setup enables you to accommodate specific business requirements and set up default values that can save time when you are processing transactions. For example, you must set up the AAIs in order to process journal entries to the appropriate accounts.

You set up the system to attach costs to the entities that you use when you perform an operation on a lot of wine. This enables you to attach costs to an operation for farming, spraying, weigh tags, equipment, quality analysis tests, staff, and so forth. Each time an operation, such as spraying pesticide takes place on a lot, the system attaches those costs to the harvest. The system applies these costs to various general ledger accounts, depending on how you set up the system

9.1.1 Winery Constants

On the Costing tab in the Winery Constants program (P31B13), you select whether you want to perform standard or operational (actual) cost accounting when creating journal entries in the general ledger. For JD Edwards EnterpriseOne Grower Management, you must use operational cost accounting for operations associated with harvest records. As you close operations, the system creates transactions for the operations. When you use operational costing, the system calculates the lot costs and uses them as the basis for creating journal entries.

If operational costing is selected, the system tracks costs at the cost component level. In this case, no variances are created because the system records transactions at actual costs that accrue from operations.

9.1.2 Costing

Each lot contains the costs for operations. For example, costs might include consumables (inventory items), additives, equipment, or staffing costs. When you use standard costing, the system uses the EUR standard cost as the basis for the journal entries. All EURs must be associated with an ERP item; this serves as the basis of the cost of the EUR.

Operations that you use in the JD Edwards EnterpriseOne Grower Management system only use operational costing. All the operational costs for the operations are based on the planted area of the associated harvest. However, these operations use standard costs for additives and consumables.

When a weigh tag is created, the system uses the item base price from the Item Cost File table (F4105). The system also applies any costs that are associated with the configured operation. When you close the weigh tag operation, the receipt costs on the Purchase Order Receiver File table (F43121) override the base price. The receipt cost is derived using the JD Edwards EnterpriseOne Advanced Pricing system.

When you set up items for additives, equipment and item cross-references, and EURs, you also enter item costs that the system uses for costing and accounting.

9.1.3 Prerequisites

Ensure that you have set up the chart of accounts and companies.

9.2 Setting Up Cost Components

This section provides an overview of cost component setup and discusses how to set up cost components.

9.2.1 Understanding Cost Component Setup

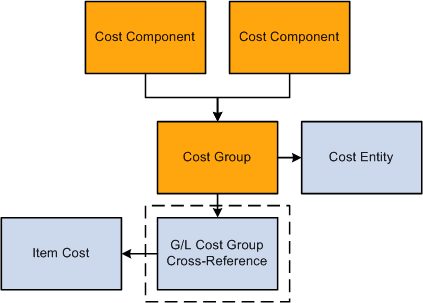

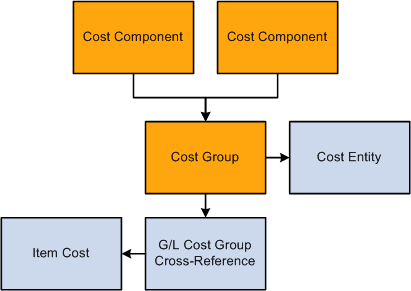

This diagram illustrates the setup for cost components and cost groups:

Figure 9-1 Cost Components and Cost Groups

Description of "Figure 9-1 Cost Components and Cost Groups"

You set up cost components and cost groups to track operational costs of the entities that you use to produce your crop. You define the unit cost on the cost group. You use the cost component that is associated with the cost group to retrieve the unit cost.

You set up the system to attach costs to the operations that you use when growing crops. This enables you to attach costs to farming, spray, quality, harvest, or weigh tag operations. When you set up entities for which you want to retrieve costs, you associate the entity with the appropriate cost group. Each time an operation, such as spraying your crop, takes place the system attaches those costs to the harvest.

Cost components are created to account for the cost of items that are associated with the harvest. For example, costs for producing a crop may include planting, tilling, irrigating, and picking. For JD Edwards EnterpriseOne Grower Management costing, cost groups are often attached to:

-

Configured operations

-

Equipment

-

G/L category cross-reference

-

Staff (resources)

9.2.2 Forms Used to Set Up Cost Components

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| View Cost Components | W31B20D | Farming Activities (G40G1412), Cost Component | View existing cost components. |

| Edit Cost Components | W31B20A | Click Add on the View Cost Components form. | Set up cost components. |

9.2.3 Setting Up Cost Components

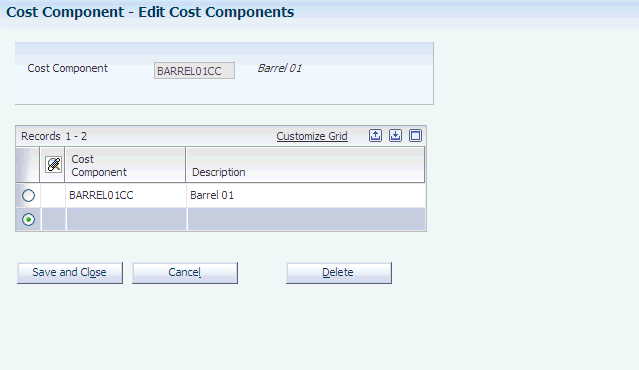

Access the Edit Cost Components form.

- Cost Component

-

Enter a user-defined cost that identifies a cost bucket into which the system accumulates costs. The system summarizes individual rates defined for a Cost Group by Cost Component. The system costs lots at the Cost Component level. A rate is defined as a cost per unit or cost per unit per period. You can use the same cost components for the JD Edwards EnterpriseOne Grower Management and Blend Management systems. For example, you can accumulate all labor costs, whether for farm labor or cellar labor, into the same cost component.

9.3 Setting Up Cost Groups

This section provides an overview of cost group setup and discusses how to set up cost groups

9.3.1 Understanding Cost Group Setup

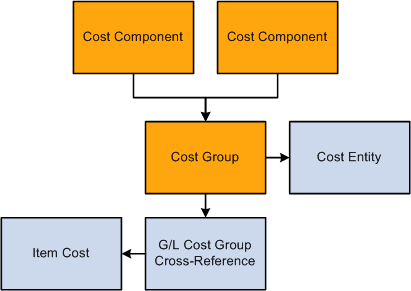

This diagram illustrates the setup for cost components and cost groups:

Figure 9-3 Cost Components and Cost Groups

Description of "Figure 9-3 Cost Components and Cost Groups"

You use cost groups to group cost components. You attach the cost groups to the entities that you use in the growing process. For example, you might want to group all of the costs for the various farming tasks that you perform. You might also group cost components for equipment and attach the cost group to the equipment that you use for tilling soil. Each cost group contains a set of the costs or rates from each cost component.

You use cost groups to group cost components and assign a basis for calculating costs. Cost can be based on:

-

A flat rate, such as 50 USD per use.

-

A time-based cost, such as 12 USD per hour

-

A quantity-based cost, such as 35 USD per ton.

A cost group can be made up of multiple cost basis and cost components. Examples include:

-

An equipment cost of 50 USD per use, plus an hourly rate of 75 USD.

-

An equipment cost of 40 USD per ton per hour.

To assign both a flat rate and time-based cost to a cost group, you must add two lines, one for the flat rate and one that represents the time-based cost. Similar to cost components, you can use the same cost groups for the JD Edwards EnterpriseOne Grower Management and Blend Management systems.

|

Note: The One-Time Cost option applies only to barrels in the JD Edwards EnterpriseOne Blend Management system. |

The system stores cost groups in the Cost Groups Header (F31B21) and the Cost Groups Detail (F31B211) tables.

9.3.2 Forms Used to Set Up Cost Groups

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| View Cost Groups | W31B21B | Farming Activities (G40G1412), Cost Group Setup | View existing cost groups. |

| Edit Cost Groups | W31B21C | Click Add on the View Cost Groups form. | Set up cost groups. |

9.3.3 Setting Up Cost Groups

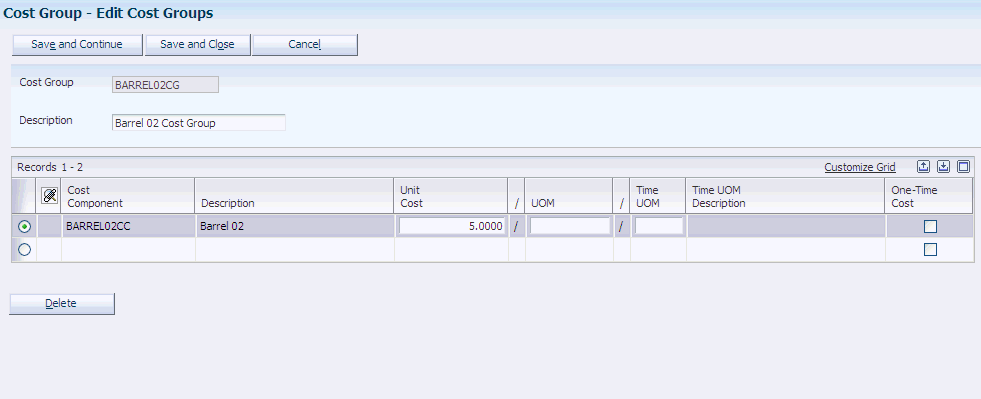

Access the Edit Cost Groups form.

- Cost Component

-

A user-defined code identifying a cost bucket within an operation.

- Unit Cost

-

Defines the amount per unit. If a UOM is not defined, this cost applies as a fixed amount.

- UOM (unit of measure)

-

Defines the unit of measure to apply to the unit cost. This must be a valid value in UDC 31B/UM.

- Time UOM (time unit of measure)

-

Defines the unit of measure for time calculations, for example, the unit cost of 300.00 per day. This applies when duration is defined on an operation. Valid values are defined in UDC 31B/TU.

9.4 Setting Up Cross-References for G/L Category Cost Groups

This section provides an overview of the cross-reference setup for G/L category cost groups and discusses how to set up cross-references for G/L category cost groups.

9.4.1 Understanding the Cross-Reference Setup for G/L Category Cost Groups

The G/L group cross-reference enables you to retrieve item costs:

You set up the G/L category cost-group cross-reference to enable the system to retrieve item costs from the Item Cost table (F4105). The G/L Category to Cost Group cross-reference is a method to associate inventory items to cost components. These inventory items fall into two types:

-

Consumables.

-

Additives.

When you assign a consumable or additive to an operation, the G/L category code on the Item Branch record is cross-referenced to a cost group. The system uses the cost group to determine the cost component which it uses to carry the cost.

The system bases the consumable or additive costs on inventory costing method of the item. For example, if the item is set up to use standard cost method, then the system uses standard costs. An example of this is mulch which is assigned a G/L Category of GR04, which is then cross-referenced to the GRAPECG cost group, which contains the GRAPECC cost component.

The system stores G/L category cost group cross-references in the G/L Category Cost Group Cross-Reference (F31B23) table.

9.4.2 Forms Used to Set Up Cross-References for G/L Category Cost Groups

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| View G/L Category Cost Group Cross Reference | W31B23B | Blend System Setup (G31B01), G/L Category Cost Group Cross Reference | View G/L category cross references. |

| Edit G/L Category Cost Group Reference | W31B23C | Click Add on the View G/L Category Cost Group Cross Reference form. | Set up cross-references for G/L category cost groups. |

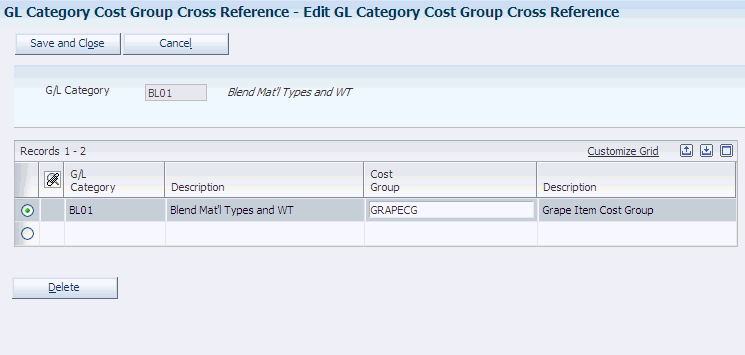

9.4.3 Setting Up G/L Cost Group Cross-Reference

Access the Edit G/L Category Cost Group Cross Reference form.

Figure 9-6 Edit G/L Category Cost Group Cross Reference form.

Description of "Figure 9-6 Edit G/L Category Cost Group Cross Reference form."

- G/L Category

-

A user defined code (41/9) that identifies the G/L offset that system uses when it searches for the account to which it posts the transaction. If you do not want to specify a class code, you can enter **** (four asterisks) in this field.

- Cost Group

-

An alphanumeric code that identifies a set of one or more cost components associated with an operation. For example, a Cost Group can be assigned to equipment, staff, spray items, overheads, or expenses.

When a cross-reference exists, the system uses the cost on the Item Cost table (F4105) rather than the unit cost that is set up in the cost group.

|

Note: Weigh tags use this cross-reference to fetch cost components to use as defaults on the Weigh Tag details record. |