25 Integrity Reports

You can use integrity programs and reports to verify information and resolve problems with consistency across different tables.

This chapter contains the following topics:

-

Section 25.5, "Validating the Billing Detail Service Tax Dates"

-

Section 25.6, "Validating Lessee Accounting Multicurrency Integrity (Release 9.1 Update)"

25.1 Reviewing Billing Control Information

This section provides overviews of billing control information and the Billing Control Integrity report, and discusses how to run the Billing Control Integrity program.

25.1.1 Understanding Billing Control Information

Billing control information prevents you from billing a tenant multiple times for the same period. You can use the Billing Control Information program (P150111) to review the information that is stored in the Billings Generation Control table (F15011B) for a specific lease. The billing information for a lease includes:

-

Generation type

-

Billing control ID

-

Status of each billing period

You use the P150111 program to review transactions for these generation types:

-

1: Recurring Billing

-

2: Expense Participation

-

3: Sales Overage

-

4: Escalation

-

6: Estimated Expense Participation

When the system generates billing records, it assigns to them a billing control ID. The system uses this number and the billing status to track the periods for which billings have been generated.

Review the four billing status values:

-

Blank: No billing activity exists.

-

G: The billing record (F1511B) has been generated.

-

B: The billing record has been billed (generation types 2 and 6 only).

-

X: The billing record has been generated and posted.

If necessary, you can remove the billing control status after you delete unposted billing or calculation batches and want to rerun billing generation programs.

|

Important: Because you can easily create an integrity problem by updating the billing control status, only persons thoroughly knowledgeable with the billing processes should have access to this program. |

25.1.2 Understanding the Billing Control Integrity Program

Use the Billing Control Integrity program (R15905) to validate that each record in the Billings Generation Control table (F15011B) has a corresponding record in one of these tables:

-

Tenant E.P. Class Master (F15012B).

-

Sales Overage Master File (F15013B).

-

Tenant Escalation Master (F15016B).

-

Recurring Billings Master (F1502B).

The system processes one billing control record at a time. The generation type of the billing determines the appropriate table. For example, if the generation type is 1, the system searches the Recurring Billings Master table for a record with the same lease and billing control number. If the system does not find a corresponding record, it deletes the billing control record.

25.1.3 Forms Used to Review Billing Control Information

| Form Name | FormID | Navigation | Usage |

|---|---|---|---|

| Work with Billing Generation Control | W150111A | Integrities (G15313), Billing Control Information. | Review billing control statuses for each type of billing generation by lease. |

| Billings Generation Control Revisions | W150111B | Select a billing control record for the lease by generation type on Work with Billing Control Information. | Review and revise billing control status information by period. |

25.1.4 Running the Billing Control Integrity Program

Select Integrities (G15313), Billing Control Integrity.

25.2 Validating Batch Control Integrity

This section provides an overview of the batch control integrity and discusses how to:

-

Run the Batch Control Integrity.

-

Set processing options for Batch Control Integrity (R15703).

25.2.1 Understanding the Batch Control Integrity Report

When you run the Batch Control Integrity program (R15703), the system validates that each batch header record in the Batch Control Records table (F0011) has a corresponding record in the Lease Billings Master table (F1511B).

You use processing options to specify whether the system performs one or both of these actions:

-

Deletes the batch headers that do not correspond to Lease Billings Master records.

-

Generates a report that lists the Lease Billings Master records that do not correspond to batch header records.

25.2.2 Running the Batch Control Integrity Program

Select Integrities (G15313), Batch Control Integrity.

25.2.3 Setting Processing Options for Batch Control Integrity (R15703)

Processing options enable you to specify the default processing for programs and reports.

25.2.3.1 Process

- 1. Delete Batch Headers

-

Specify whether to delete batch header records from the Batch Control Records table (F0011) that do not have a corresponding record in the Tenant/Lease Billings Detail Master table (F1511B). Values are:

Blank: Do not delete.

1: Delete.

- 2. Print Detail Report

-

Specify whether to print a report of the Lease Billings Master records (F1511B) that do not have a corresponding batch header record (F0011). The system prints all transactions that meet this criteria regardless of whether they have been posted. Each transaction must be associated with a batch header record to post it to the appropriate tables. Values are:

Blank: Do not print.

1: Print.

25.3 Validating Log Line Integrity

This section discusses how to:

-

Run the Log Line Integrity program.

-

Set processing options for Log Line Integrity (R15431).

25.3.1 Running the Log Line Integrity Program

Select Integrities (G15313), Log Line Integrity.

When you run the Log Line Integrity program (R15431), the system validates that the building and unit for a lease in the Lease Master Header table (F1501B) and Lease Master Detail table (F15017) corresponds to the building and unit for the related log lines in the Log Standard Master table (F1523). You use processing options to specify whether the system performs the update or just prints a report so that you can preview the effect of the update. You can also specify whether the update is associated with leases that are associated with one or more units.

25.3.2 Setting Processing Options for Log Line Integrity Report (R15431)

Processing options enable you to specify the default processing for programs and reports

25.3.2.1 Process

- 1. Proof or Final Mode

-

Specify whether to run the program in proof or final mode, and which leases to update. Values are:

Blank: Proof mode. Prints a report of the log lines that have buildings and units that do not correspond to the buildings and units on the lease.

1: Final mode for single-unit leases. The system replaces the building or unit on the log standard with the building or unit from the lease.

2: Final mode for multi-unit leases. The system replaces the building or unit on the log standard with the first building or unit from the lease.

- 2. Search Default for Lease Version

-

Specify whether the system validates log lines using the version of the lease that is based on today's date (the system date) or the latest effective date. Values are:

Blank: Uses the version of the lease that is effective as of the system date.

1: Uses the version of the lease with the latest (future) effective date. For example, if today's date is June 30, 2007 and the lease has two versions dated January 1, 2007 and October 1, 2007, respectively, the system displays the version dated October 1, 2007.

2: Uses all versions of the lease regardless of the date.

Note:

If versioning is not set up in the Real Estate Management Constants table (F1510B), the system ignores this processing option.

25.3.2.2 Print

- 1. Print All Log Lines for Mulit-Unit Leases

-

Specify whether to print only the log lines in error or all log lines for multiple-unit leases. Values are:

Blank: Print only the log lines in error for multi-unit leases.

1: Print all log lines for multi-unit leases.

25.4 Updating the Invoice Posted Status

This section provides an overview of the Invoice Posted Status Update Program (R15912) and discusses how to run the Invoice Posted Status Update program.

25.4.1 Understanding the Invoice Posted Status Update Program (R15912)

If you run the Post RE Invoices or Post RE Vouchers program (R15199) and the processing is interrupted (for example, as a result of a power outage), some records in the Lease Billings Master table (F1511B) might remain unposted. You run the Invoice Posted Status Update program (R15912) to update the posted status on the F1511B records to D.

The system updates the records only under these conditions:

-

The corresponding Customer Ledger (F03B11) or Accounts Payable Ledger (F0411) record is posted.

-

The corresponding Account Ledger (F0911) record is posted.

-

The corresponding Batch Control Records (F0011) for batch type 1 is posted.

If the system cannot locate one of the corresponding records, or if one of the records is posted, it does not update the posted code on the F1511B record.

This program does not provide a report of the records that are updated.

25.4.2 Running the Invoice Posted Status Program

Select Integrities (G15313), Invoice Posted Status Update.

25.5 Validating the Billing Detail Service Tax Dates

This section provides an overview of the Billing Detail Serv/Tax Date Integrity program (R15906) and discusses how to:

-

Run the Billing Detail Serv/Tax Date Integrity program.

-

Set processing options for Billing Detail Serv/Tax Date Integrity (R15906).

25.5.1 Understanding the Billing Detail Serv/Tax Dates Integrity Program (R15906)

When you run the post program (R15199) to generate invoices and vouchers, the system updates the service/tax date from the first detail line of the billing record in the Lease Billings Master table (F1511B) to all of the pay items on the transaction. To update the invoice and voucher transactions with the service/tax date that was entered on each billing detail record, you run the Billing Detail Serv/Tax Date Integrity program (R15906).

When you run the R15906 program, the system compares the service/tax date in each billing detail record to the transaction pay item that was generated from it, and updates the service/tax date on the transaction record if necessary.

You can run this program in edit (proof) or update mode. When you run the program in edit mode, the system generates a report of the transactions to be updated. The report includes the relevant information about the F1511B record and the service/tax date from the corresponding F03B11 or F0411 transaction. The report displays an asterisk on every line for which a discrepancy exists. When you run the program in update mode, the system updates the service/tax date on the discrepant lines.

|

Note: When you run the R15906 program in update mode, the service/tax date that appears (under the Posted Serv/Tax Date column) is the date of transaction record before the update. |

Processing options enable you to specify a date range for the billing records (F1511B), so that the program does not have to validate all of the billing records each time that you run it.

25.5.2 Running the Billing Detail Serv/Tax Integrity Program

Select Integrities (G15313), Billing Detail Serv/Tax Date Integrity.

25.5.3 Setting Processing Options for Billing Detail Serv/Tax Integrity (R15906)

Processing options enable you to specify the default processing for programs and reports.

25.5.3.1 Process

These processing options enable you to specify whether the system updates the accounts payable or accounts receivable records and whether the program is submitted in proof mode or final mode. In addition, these processing options enable you to specify, according to the general ledger dates, the records that the system updates.

- 1. Table Update Selection

-

Specify whether to update the service/tax date on invoices (F03B11) or vouchers (F0411). The system uses the value of the Service/Tax Date field (DSV) from the Tenant/Lease Billings Detail Master table (F1511B) to update the selected records. Values are:

Blank: Update the invoice records in the Customer Ledger table (F03B11).

1: Update the voucher records in the Accounts Payable Ledger table (F0411).

- 2. Proof or Final Mode

-

Specify whether to run the program in proof or final mode. In proof mode, the system prints a report of the records selected to update from the table selected in the Table Update Selection processing option. In final mode, the system updates the service/tax date on the records in the selected table with the service tax date from the Tenant/Lease Billings Detail Master table (F1511B). Values are:

Blank: Proof mode. The system prints a report of the records selected to update.

1: Final mode. The system updates the records in the selected table and prints a report.

- 3. From G/L Date

-

Specify the range of GL dates to use to select the records from the Tenant/Lease Billings Detail Master table (F1511B) to use in the update; use this processing option with the Through G/L Date processing option.

If you leave this processing option blank, the system includes all records through the date entered in the Through G/L Date processing option. If you leave both the From G/L Date and Through G/L Date processing options blank, the system includes all records.

- 4. Through G/L Date

-

Specify the range of GL dates to use to select the records from the Tenant/Lease Billings Detail Master table (F1511B) to use in the update; use this processing option with the From G/L Date processing option.

If you leave this processing option blank, the system includes all records from the date entered in the From G/L Date processing option. If you leave both the From G/L Date and Through G/L Date processing options blank, the system includes all records.

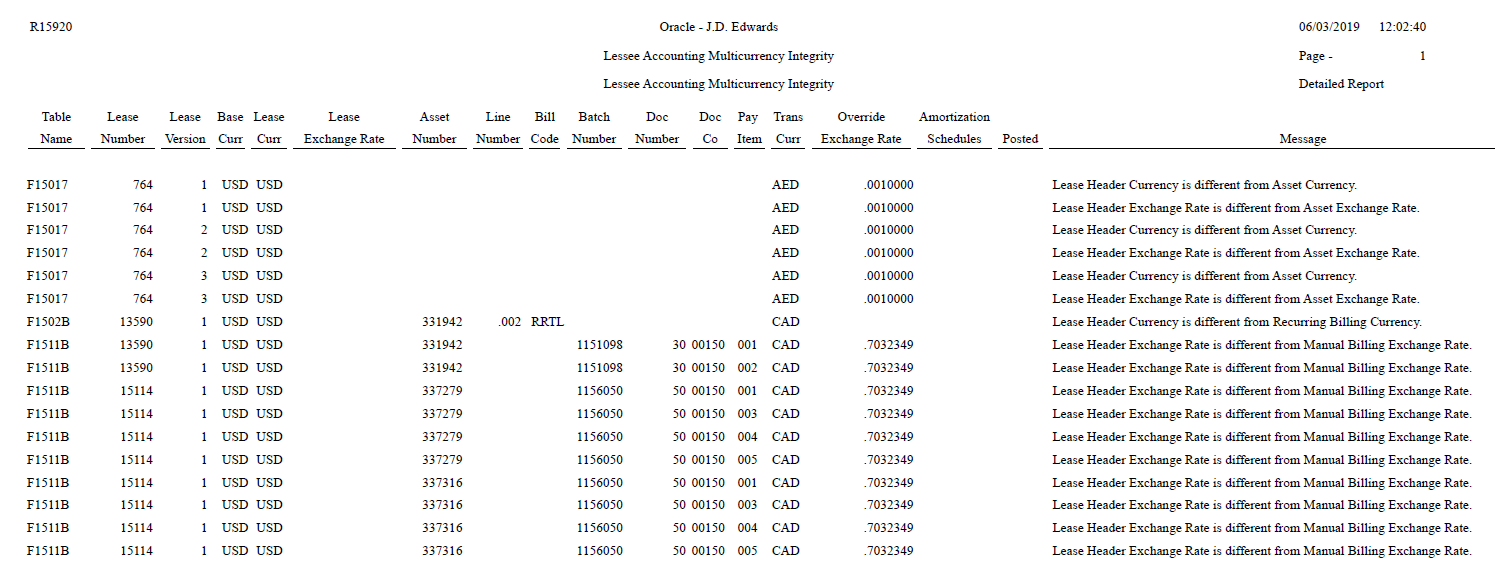

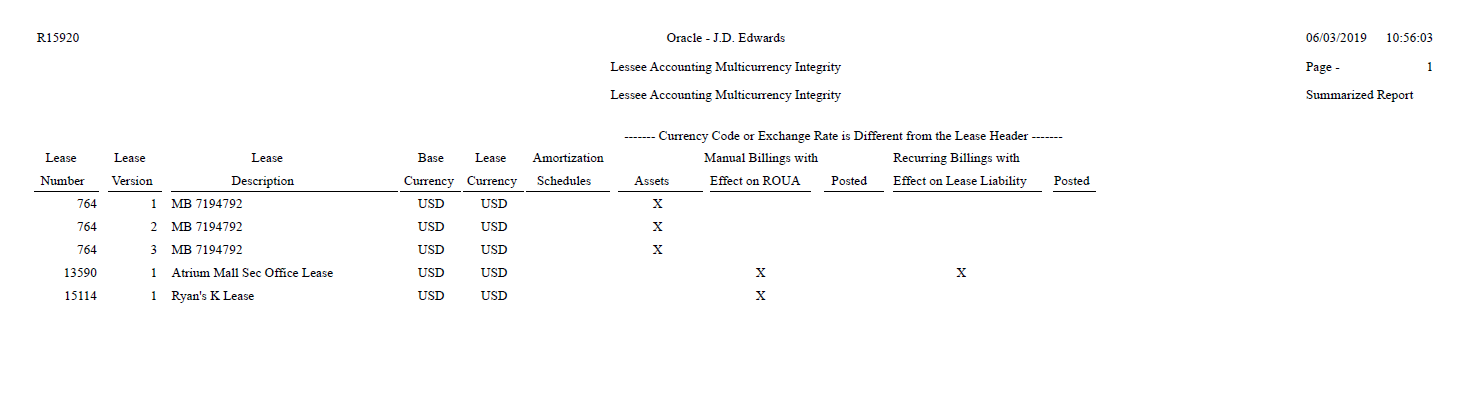

25.6 Validating Lessee Accounting Multicurrency Integrity (Release 9.1 Update)

This section provides an overview of the Lessee Accounting Multicurrency Integrity report. It also discusses how to run the Lessee Accounting Multicurrency Integrity report.

25.6.1 Understanding Lessee Accounting Multicurrency Integrity Information

The Balance Sheet Lessee Accounting feature for multicurrency leases requires certain rules to be followed for currency codes and exchange rates for lease headers, lease details, recurring billing, and manual billing information. Even if certain conditions were not met by multicurrency leases, the system enabled users to enter the leases and processed them. The system will no longer process multicurrency leases if they do not conform to the new rules and if they are classified as operating or finance leases. The Lessee Accounting Multicurrency Integrity program (R15920) has been created to assist you to identify the existing multicurrency leases that do not conform to these rules. When you run this report, you will get a list of multicurrency leases that will not be processed and the reason they will not be processed.

You will need to manually correct these leases to abide by the new rules so that these leases are processed by the Balance Sheet Lessee Accounting processes feature. Manual correction may include any combination of the following:

-

Bring the lease back to its original state and correct it by:

-

Voiding monthly balance sheet journal entries

-

Voiding recurring or manual billing entries

-

Voiding lease commencement journal entries

-

Deleting amortization schedules

-

Updating the lease header, lease details, recurring billing, or manual billing to meet the new rules

-

Creating amortization schedules

-

Commencing a lease with as of processing activated

-

-

Terminate the lease and make adjustments for previous entries for monthly amortization and recurring and manual billing then create a new lease.

For recurring billing records having an effect on lease liability and manual billing records having an effect on ROUA, the program will detect and report the following issues:

-

Any lease in which the currency code is different between the lease header (F1501B), lease details (F15017), recurring billing (F1502B), or manual billing (F1511B)

-

Any lease in which the exchange rate is different between the lease header (F1501B), lease details (F15017), recurring billing (F1502B), or manual billing (F1511B)

Apart from the above issues, the program also reports if an amortization schedule exists and if manual or recurring billing has been processed for the lease.

Use the processing option on Lessee Accounting Multicurrency Integrity program (R15920) to specify whether you want a detailed report or a summarized report.

|

Note: The lessee accounting multicurrency integrity report processes only lessee leases. |

25.6.2 Running the Lessee Accounting Multicurrency Integrity Report

Select Balance Sheet Lessee Accounting (G15201), Lessee Accounting Multicurrency Integrity.