32 Understanding Reporting for SPED Accounting in Brazil

This chapter contains the following topics:

32.1 Understanding SPED Accounting

Companies in Brazil are required to build a text file from their accounting systems with information about transactions that occurred in the last calendar year. This text file is uploaded to the Sped Contabil, a government system provided by Brazilian Federal Tax Authority, and then transmitted through the Internet to the Brazilian Federal Tax Authority database. The process for reporting this information is referred to as SPED (Sistema Publico de Escrituracao Digital or Public System of Digital Accounting) accounting.

This section discusses:

-

Blocks, Registers, and UBEs for SPED Accounting

-

Block 0 Registers for SPED Accounting

-

Block I Registers for SPED Accounting

-

Block J Registers for SPED Accounting

-

Block 9 Registers for SPED Accounting

32.1.1 Blocks, Registers, and UBEs for SPED Accounting

The SPED accounting reporting process consists of generating data for reporting and then sending that data to the government.

The data that you generate includes:

-

Blocks

Blocks include groupings of registers with similar information. For example, block J includes financial statement information.

-

Registers

Registers include records, which are detailed information for each register. Oracle programming creates all of the registers for the blocks that it generates, but populates the detailed information for only required data that resides in the JD Edwards EnterpriseOne tables.

For example, registers for block J include balance sheet information (register J100) and income statement information (register J150).

-

Records

Records are the details of the information for the register.

For example, register J005 (Accounting Statements) includes the beginning and ending dates of the statements, as well as other information.

You use the SPED Job Administrator program (P76B940) to generate the blocks, the registers for the blocks, and to populate the fields for the registers for which data resides in the JD Edwards EnterpriseOne tables. If you set up the Block Setup program (P76B0730) with custom programs, the system also generates blocks, registers, and records for which you run your custom programs.

After you generate the data, you can review the text files and copy the text files to media that you submit to the government.

32.1.2 Block 0 Registers for SPED Accounting

The system writes records for block 0 registers in the electronic file that you send for SPED accounting reporting when you run the Block 0 Generation program (R76B952) from the SPED Job Administrator program (P76B940).

Block 0 contains company information, including company registration numbers, and subsidiary and participant information. The system reads these tables to obtain the data for block 0 registers:

-

Address Book Master (F0101)

-

Address Book - Who's Who (F0111)

-

Address by Date (F0116)

-

Address Book Brazilian Tag Table (F76011)

-

Address Book Inscription - BR (F76B140)

-

Legal Company Constants - BR (F76B010)

-

Legal Company - Subsidiaries (F76B015)

-

Ato Cotepe Header Blocks Template (F76B0730)

-

Ato Cotepe Detail Blocks Template (F76B0731)

-

SPED Jobs - BR (F76B940)

-

SPED Book Type Definition Tag File F76B935 (F76B0935)

-

Legal Company Constants Tag File F76B010 (F76B0010)

-

ECD Type - Tag File F76B010 (F76B010T)

-

SCP Identification and Name (F76B045)

This table describes the contents of the registers for block 0:

| Registers | Description of Contents | Compliance and Occurrence |

|---|---|---|

| 0000

Flat File Opening and Company Identification |

Includes information about the date of the file and company information from the company address book record and related tables. | One only register 0000 must be present in the electronic file. |

| 0001

Block 0 Opening |

Includes a hard-coded value to indicate that records exist in the block. | Only one register 0001 must be present in the electronic file. |

| 0007

Others Company Registers Inscriptions |

Includes company registration information that you enter in a Brazil-specific address book program. | One or more register 0007 must be present in the electronic file. |

| 0020

Decentralized Accounting Bookkeeping |

Includes information about the legal company from the Legal Company Constants table (F76B010), and company information for subsidiaries. | This register must be present in the electronic file if the company uses decentralized bookkeeping.

Multiple registers 0020 can exist in the electronic file. |

| 0035

SCP Identification |

Includes information about the ostensible partners. The system only generates this register if the ECD type for the company is set to 1. The system obtains this information from the SCP Identification and Name table (F76B045). | This register must be present in the electronic file if the company has ostensible partners.

Multiple records can exist in register 0035 in the electronic file. |

| 0150

Participant Register Table |

Includes information about the subsidiaries or related participants of a company from the Legal Company - Subsidiaries table (F76B015), and inscription, or registration, information from the Address Book Inscription table (F76B140). | This register must be present in the electronic file if the company has qualifying subsidiaries or participants.

Multiple registers 0150 can exist in the electronic file. |

| 0180

Participant Relationship Identification |

Includes information about the subsidiaries or related participants of a company from the F76B015 table. | This register includes one record for each record in the 0150 register.

Multiple registers 0180 can exist in the electronic file. |

| 0990

Block 0 Closing |

Includes the total number of lines for block 0. | One only register 0990 exists in the electronic file.

This register is generated by the Block 9 Generation program (R76B995). |

32.1.3 Block I Registers for SPED Accounting

The system writes records for block I registers in the electronic file that you send for SPED accounting reporting when you run the programs for block I from the SPED Job Administrator program (P76B940). Block I includes account journal information, such as the chart of accounts and account balances.

The system reads these tables to obtain the data for block I registers:

-

Address Book Master (F0101)

-

Address Book Brazilian Tag Table (F76011)

-

Address Book Inscription- BR (F76B140)

-

Legal Company - Subsidiaries (F76B015)

-

Account Master (F0901)

-

Account Balances (F0902)

-

Account Ledger (F0911)

-

Referential Chart of Account - BR (F76B920)

-

Brazilian Account Information (F76B925)

-

SPED Job Accounts - BR (F76B955)

-

Related Accounts (F76B927)

-

SPED Book Type Definition (F76B935)

-

SPED Book Type Relation (F76B936)

-

SPED Book Ledger Types (F76B937)

-

SPED Job Hash Codes (F76B947)

-

Ato Cotepe Header Blocks Template (F76B0730)

-

Ato Cotepe Detail Blocks Template (F76B0731)

-

SPED Jobs - BR (F76B940)

You run these programs from the SPED Job Administrator program to populate the registers for block I:

| Programs | Description |

|---|---|

| Block I - General Information (R76B954). | This program generates information about books and auxiliary books; and opening terms. It populates the records for registers I001, I010, I012, I015, and I130. The system generates the register for I120, but does not populate the fields. |

| Block I - Open: Chart of Accounts & Cost Center (R76B955). | This program generates information about the chart of accounts and cost centers that you set up in the Account Master (F0901) and Brazilian Account Information (F76B925) tables. The system uses the values in this register to determine the opening and balance sheet values used in registers in block J.

This program populates the registers for I050, I051, I052, and I053. Note: Set the processing options for this program before running it from the SPED Job Administrator program. |

| Block I - Balances/PL Balances (R76B960). | This program generates information about the beginning and ending PL balances. It populates the records for registers I150, I155, I157, I350, and I355.

Note: Set the processing option for this program before running it from the SPED Job Administrator program. The processing option determines which registers to populate. |

| Block I - Accounting Journal (R76B965). | This program generates information about journal entry batches and the journal entry lines of each batch. It populates the records for registers I200 and I250. |

| Block I - Daily Balances (R76B970). | This program generates information about daily balances. It populates the records for registers I300 and I310. |

| Block I - Auxiliary Ledger - Blank Registers (R76B950). | This program generates the I500, I510, I550, I555 registers, but populates only certain fields with hard-coded values. |

This table describes the contents of the registers for block I:

| Registers | Description of Contents | Compliance and Occurrence |

|---|---|---|

| I001

Block I Opening |

Includes a hard-coded value to indicate that records exist in the block. | One only register I001 must exist in the electronic file. |

| I010

Accounting Bookkeeping Identification |

Includes a value from the SPED Book Type Definition table (F76B035) to define the type of book. | One only register I010 must be present in the electronic file. |

| I012

Daily Auxiliary Books |

Includes information about auxiliary books, including the hash code that you obtain from the fiscal authority. | For book types R or B, the system generates one register 012 for each associated auxiliary book.

For book types A or Z the system generates one unique register with the parent book ID information. The system does not populate this register for book type G. |

| I015

Accounts ID from Resumed Bookkeeping Referred to the Auxiliary Bookkeeping |

Includes the account ID for the auxiliary books as specified in the Book Type Definition program (P76B935). | Multiple registers I015 can exist for each record in the I012 register. The system populates these records only when the book type in register I010 is R, A, or Z. |

| I020

Additional Fields |

The system does not generate this register. | The system does not generate this register. |

| I030

Opening Term |

Includes company information from the address book tables (F0101, F76011 and F76B140), and book information that you set up in the Book Type Definition program. | This register must be present in the electronic file.

One record exists in this register. |

| I050

Chart of Accounts |

Includes account information including dates, level of the account, and referential account.

As the system processes accounts for this register, it saves the account data to the SPED Job Accounts - BR table so that the information can be used to validate data required for fields in this register and in other block I and block J registers. |

Multiple records can exist in this register. |

| I051

Referential Chart of Accounts |

Includes referential account information that you set up in the Referential Chart of Accounts program (P76B920). | Multiple records can exist in this register.

The system populates this register for analytical accounts only. Analytical accounts are those that have a value of A in field 4 of the I050 register. |

| I052

Agglutination Codes Indicator |

Includes the agglutination code for each analytical account, which is the OBJ.SUB of the parent account from the immediate superior level. | Multiple records can exist in this register. The system populates this register for analytical accounts only. Analytical accounts are those that have a value of A in field 4 of the I050 register. |

| I053

Related Accounts |

Includes information about the related account that you set in the form Related Accounts Revisions in the Brazil Account Information (P76B925). | Multiple records can exist in this register.

The system populates this register for analytical accounts only. Analytical accounts are those that have a value of A in field 4 of the I050 register. |

| I075

Standard Historic Table |

The system does not generate this register. | The system does not generate this register. |

| I100

Costs Center |

Includes information about the cost centers for the accounts. | This register is mandatory.

Multiple records can exist in this register. |

| I150

Periodic Balances – Period Identification |

Includes the first and last calendar date for the month. | This register is mandatory. This register contains a single record. |

| I151 | ||

| I155

Periodic Balances Details |

Includes the initial balance, sum of the positive transactions, sum of the negative transactions, and the final account balance. | Multiple records can exist in this register.

The system includes records for each analytical account with a balance or that had transactions. |

| I157

Chart of Accounts Balance Forwards Amounts |

Includes the account code, the cost center code, the balance forward from the previous chart of accounts and whether the balance is debit or credit.

This information is not provided by JD Edwards EnterpriseOne and is entered manually. |

This register is optional.

Multiple records can exist in this register. |

| I200

Accounting Journal |

Includes information about all F0911 batches generated for a date range defined in the job. | Multiple records can exist in this register. |

| I250

Journal Entry Lines |

Includes the details of posted journal entries identified in the I200 register for the ledger types identified in the Book Type Definition program (P76B935). | Multiple records can exist in this register. |

| I300

Daily Balances – Data Identification |

Includes the journal entries from the F0911 table. | This register includes multiple records. The system generates a I300 register for each transaction date found in the F0911 for the reporting month. |

| I310

Daily Balances Details |

Includes daily balance details for the G/L date identified in register I300. The report accumulates amounts for each transaction date and account. | Multiple records can exist in this register. |

| I350

P/L Accounts Balances Before Closing – Date Identification |

Includes the last day of the processed month. | This register is mandatory. This register contains a single record. |

| I355

P/L Accounts Details Balances Before Closing |

Includes the accumulated Final Account Balance by PL account for the month indicated in register I350. These amounts are retrieved from F0902 table. | This register can include multiple records. |

| I500

Auxiliary General Ledger Book Printing / Visualization Parameters with Configurable Layout |

The system generates the register and populates the first field with the value of REG. | This register must be present in the electronic file if the book type is Z.

One register is generated for the file. |

| I510

Auxiliary General Ledger Book Fields Definition with Configurable layout |

The system generates the register and populates the first field with the value of REG. | This register must be present in the electronic file if the book type is Z.

Multiple registers can exist in the electronic file. |

| I550

Auxiliary General Ledger Book Details with Configurable Layout |

The system generates the register and populates the first field with the value of REG. | This register must be present in the electronic file if the book type is Z.

Multiple registers can exist in the electronic file. |

| I555

Auxiliary General Ledger Totals with configurable Layout |

The system generates the register and populates the first field with the value of REG. | This register is optional.

Multiple registers can exist in the electronic file. |

| I990

Block I Closing |

Includes the total number of lines in the block. | This register must be present in the electronic file.

This register is generated by the Block 9 Generation program (R76B995). |

32.1.4 Block J Registers for SPED Accounting

The system writes records for block J registers that the system includes in the electronic file that you send for SPED accounting reporting when you run these programs from the SPED Job Administrator program (P76B940):

-

Block J - Opening Balance Sheet and Income Statement (R76B985).

This program generates information about accounting statements and generates registers J001, J005, J100, J150, J200, J210, and J215.

-

Block J - Signatories (R76B990).

This program generates information about the signatories for the SPED accounting file and auditors; and generates registers J930 and J935.

This table describes the contents of the registers for block J:

| Registers | Description of Contents | Compliance and Occurrence |

|---|---|---|

| J001

Block J Opening |

Includes a hard-coded value to indicate that records exist in the file. | This register must be present in the electronic file.

One record exists in this register. |

| J005

Accounting Statements |

Includes the dates of the statement and a code to identify the source of the statements. | Multiple registers can exist in the electronic file. |

| J100

Balance Sheet |

Includes information about the balance sheet including whether the account is an asset or liability account, the agglutination codes, and the totals by agglutination code. | Multiple registers can exist in the electronic file. |

| J150

Income Statement |

Includes information about the income statement including the agglutination codes and the totals by agglutination code. | Multiple registers can exist in the electronic file. |

| J200

Historic Table of Accounting Journals that modify accrued profits, accrued losses or liquid assets in general |

The system generates the register and populates the first field with the value of REG.

The information in this register is not provided by JD Edwards EnterpriseOne and is entered manually. |

This register is optional.

Multiple records can exist in this register. |

| J210

DMPL - Accrued Profits and Losses - Changes in liquid assets |

The system generates the register and populates the first field with the value of REG.

The information in this register is not provided by JD Edwards EnterpriseOne and is entered manually. |

This register is optional.

Multiple records can exist in this register. |

| J215

Accounting journals that modify accrued profits or losses or liquid assets |

The system generates the register and populates the first field with the value of REG.

The information in this register is not provided by JD Edwards EnterpriseOne and is entered manually. |

This register is optional.

Multiple records can exist in this register. |

| J800

Other Information |

The system does not generate this register. | This register is optional in the electronic file.

The system does not generate this register |

| J900

Closing Term |

Includes closing book information including dates and company. | One register J900 exists in the electronic file.

This register must be present in the electronic file. |

| J930

Bookkeeping Signatories identification |

Includes the signatory information for the SPED accounting electronic file. | Multiple registers J930 can exist in the electronic file. |

| J935

Auditors |

Includes the information about auditors for the SPED accounting electronic file. | Multiple registers J935 can exist in the electronic file. |

| J990

Block J Closing |

Includes the total number of lines in the block. | This register must be present in the electronic file.

This register is generated by the Block 9 Generation program (R76B995). |

32.1.5 Setting Processing Options for Block J - Signatories (R76B990) (Release 9.1 Update)

Processing options enable you to specify default processing values.

- Signatory

-

Specify a value from the Signatory qualification Codes (76B/SG) UDC table to specify the title of the person who is signing the SPED accounting electronic file.

32.1.6 Block 9 Registers for SPED Accounting

The system writes records for block 9 registers and includes them in the electronic file that you send for SPED accounting reporting when you run the Block 9 Generation (R76B995) program from the SPED Job Administrator program (P76B940). In addition to the registers in block 9, the Block 9 Generation programs writes the data to the closing registers for blocks 0, I, and J.

This table describes the contents of the registers for block 9:

| Registers | Description of Contents | Compliance and Occurrence |

|---|---|---|

| 9001

Block 9 Opening |

Includes a hard-coded value to indicate that records exist in the file. | This register is mandatory.

One register 9001 exists in the electronic file. |

| 9900

Block 9 File Registers |

Includes information about the total number of records for each type in the flat file. | This register is mandatory.

Multiple register 9900s can exist in the file. |

| 9990

Block 9 Closing |

Includes the total number of lines for block 9. | This register is mandatory.

One register 9990 exists in the electronic file. |

| 9999

Flat File Closing |

Includes the total number of lines for the electronic file. | This register is mandatory.

One register 9999 exists in the electronic file. |

32.2 SPED Accounting Process

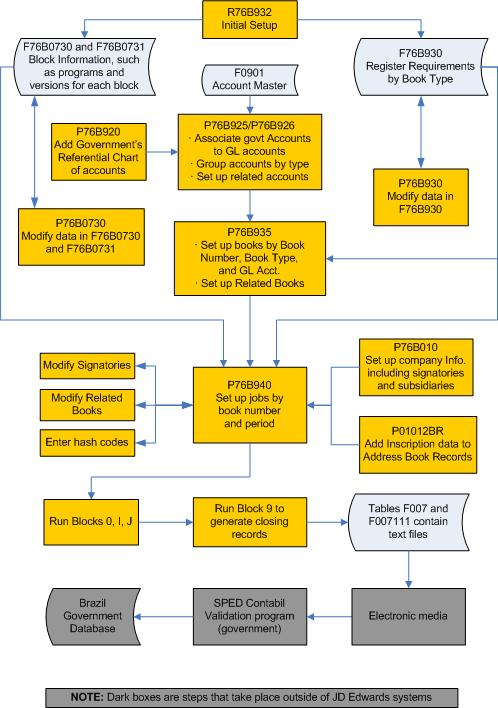

This flowchart shows the SPED accounting process:

Figure 32-1 Process flow for SPED accounting

Description of ''Figure 32-1 Process flow for SPED accounting''

To use the JD Edwards EnterpriseOne solution for SPED accounting:

-

Run the Initial Setup - UBEs by Block and Required Registers program (R76B932) to load initial setup data to your system.

This program loads two types of data: initial block setup data and initial required registers data.

The system loads the initial block setup data to the Ato Cotepe Header Blocks Template (F76B0730) and Ato Cotepe Detail Blocks Template (F76B0731) tables. The data includes information such as the UBEs and versions to run for each block. You can use the Block Setup program (P76B0730) to modify the block setup data.

The Initial Setup - UBEs by Block and Required Registers program also loads required register data to the SPED Record Rules table (F76B930). The data includes information about which registers are required for each bookkeeping type. You can use the Required Registers program (P76B930) to modify the required register data.

-

Add the government chart of accounts to your system so that you can associate the government accounts (referential accounts) to the GL accounts for which you report data.

You use the Referential Chart of Accounts program (P76B920) to import the government chart of accounts or manually add accounts.

-

Associate your GL accounts to the referential accounts.

You use the Ref Accounts by Account program (P76B926) to associate the referential accounts that you set up in the Referential Chart of Accounts program to your GL accounts. You also group your accounts by a group type code to indicate which accounts are used for assets, liabilities, and so on.

You can also set up associations between main accounts and related accounts using the Related Accounts Revision screen in the Brazilian Account Information program (P76B125). The system writes this information to the Related Accounts - 76B - BRA table (F76B927).

-

Set up the books that you must report.

You use the Book Type Definition program (P76B935) to set up the books that you must report. You specify a book number, and a bookkeeping type from the F76B930 table to the book number. You also set up information about auxiliary books. In a later step, you will set up the jobs to extract data for each book that you define. You set up one job for each book number.

-

Set up inscription information in address book records.

Inscription information includes registration numbers and the authority that issued the registration numbers. The system reads the data that you set up when you run jobs that you set up in the SPED Job Administrator program (P76B940).

-

Set up legal companies and add information about signatories, auditors, ostensible partners (if applicable), subsidiaries, and decentralized bookkeeping data.

You use the Legal Company Constants program (P76B010) to add information about the legal company that you must report in the electronic file. The system reads this data when you run the jobs that you set up in the SPED Job Administrator program.

-

Verify that the block setup is correct for your business, and set processing options for the UBEs called by the SPED Job Administrator program.

The Initial Setup - UBEs by Block and Required Registers program loaded block, version, and sequencing data to your system. Use the Block Setup program (P76B0730) to review the data to make sure that it corresponds to your reporting needs. You can add custom UBEs to the sequence if necessary. When you verify your block setup, set up the processing options for the Block I - Open Chart of Accounts & Cost Center (R76B955) and Block I - Balances / PL Account Balances (R76B960) programs. These programs are called from the SPED Job Administrator program; you do not run them independently.

-

Set up the jobs to run to generate the text files to submit.

You use the SPED Job Administrator program to set up a job for each book that you defined in the Book Type Definition program. When you set up the job, you can also modify signatory and related book information, and add hash codes for the related books.

-

Run the jobs to generate the text files.

You run jobs from the SPED Job Administrator program. When you run a job, you select the book to run and then select the block and UBEs to run. The system displays in the SPED Job Administrator program the block setup data from the F76B0730 and F76B0731 tables. You can select or deselect the blocks and UBEs to run.

-

Review the file output.

You can view the text file output in the SPED Job Administrator program.

-

Copy the file output to the media that you use to submit the electronic files to the government.

The block 9 program is the last program to run in a job. When you run the block 9 program, the system populates the text file processor tables. You then copy the data from those tables to the electronic media that you use to submit the files to the SPED Contabil software for verification.

32.3 Custom Programming

The JD Edwards EnterpriseOne software populates all required fields that are supported by JD Edwards for SPED accounting. If you want to populate optional fields, you must create custom programs to process that data. You must include your custom programs when you set up sequencing in the Block Setup program (P76B0730).

For additional information, see document ID 2537940.1 on the My Oracle Support site: https://support.oracle.com/rs?type=doc&id=2537940.1.