15 Setting Up and Generating Fixed Assets Information for CNAO Audit Files

This chapter contains the following topics:

-

Section 15.1, "Understanding the Fixed Assets Information Required for CNAO Audit Files"

-

Section 15.3, "Setting Up the Fixed Asset Card Usage Information"

-

Section 15.5, "Generating the CNAO Audit Files for Fixed Assets"

15.1 Understanding the Fixed Assets Information Required for CNAO Audit Files

You must generate an XML file to report your fixed assets transactions. The JD Edwards EnterpriseOne software for China includes methods that enable you to easily set up the fixed asset information and store it in the Modification Methods Information - CHINA (F75C201) and Asset Disposal Amounts - CHINA (F75C202) tables. The system generates an XML file with these fixed asset details:

-

Basic information

-

Category setting

-

Modification method

-

Depreciation method

-

Fixed asset usage

-

Fixed asset card

-

Fixed asset card - Real asset information

-

Fixed asset card usage information

-

Fixed asset decreasing information

-

Fixed asset decreasing information - Real asset information

-

Fixed asset modification information

This area includes all modifications except AT.

-

Fixed asset modification information

This area is applicable only for transfer locations.

-

Fixed asset modification information

This area includes only AT transactions.

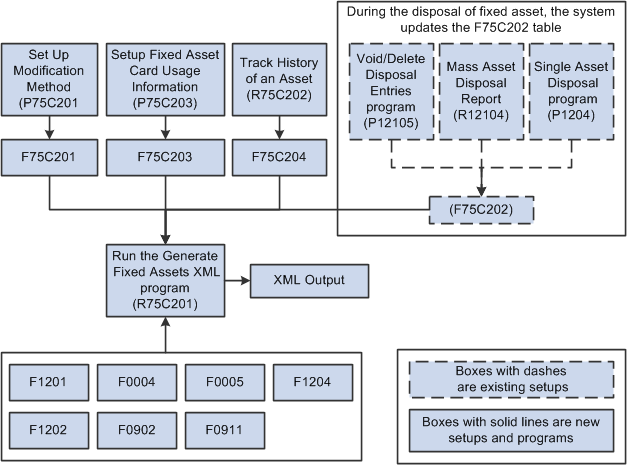

15.1.1 Process Flow for Setting Up and Generating the CNAO Audit File for Fixed Asset Details

This process flow shows the set up that you need to complete and the relationships between the setup programs to generate the fixed assets XML:

Figure 15-1 Process Flow for Setup of Fixed Assets

Description of ''Figure 15-1 Process Flow for Setup of Fixed Assets''

15.1.2 Checklist for Setting Up and Generating the CNAO Audit File for Fixed Assets Information

Use this table to assure that you complete all necessary steps to successfully generate the CNAO audit file for fixed assets information:

| Complete | Action | Comments |

|---|---|---|

| Verify that alternate descriptions of currency code translations are set up. | You set up the alternate descriptions in the Translation (75C/TR) UDC table. | |

| Track the history of an asset. | You run the Track Fixed Asset History program (R75C202) to track the history of assets. | |

| Set up the fixed asset card usage information. | You use the Setup Fixed Asset Card Usage Information program (P75C203) to set up the card usage information for the asset. | |

| Set up the modification types and accounts for an asset. | You use the Setup Modification Method program (P75C201) to set up the modification method for an asset. | |

| Generate the Fixed Asset CNAO XML file. | You run the Generate Fixed Asset XML (R75C201) to generate the XML file. |

15.2 Setting Up the Modification Method

This section provides an overview of the modification method setup, lists the forms used to set up the modification method, and discusses how to enter modification method details.

15.2.1 Understanding the Modification Method Setup

You use the Setup Modification Method program (P75C201) to create a link amongst the modification method, asset transaction description, and account information. You use this program to set up modification types and accounts for an asset.

The system saves the data that you enter to the F75C201 table, and writes the data to the fixed assets XML file when you run the Generate Fixed Asset XML - China - 12 program (R75C201).

15.2.2 Forms Used to Set Up the Modification Method

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Work with Modification Methods Information | W75C201A | Fixed Assets (G75C060), Setup Modification Method | Review and select existing asset ID records. |

| W75C201B | Select a record and click Select on the Work with Modification Methods Information form. | Enter the modification method and account ID for the asset record. |

15.2.3 Entering Modification Method Details

Access the Enter Modification Methods form.

Figure 15-2 Enter Modification Methods Form

Description of ''Figure 15-2 Enter Modification Methods Form''

- Asset ID

-

Enter an asset ID from the Asset Master table (F1201) for which you want to add details.

- Modification Method

-

Enter a value from UDC table 00/DT. The system stores this value in the F75C201 table.

- Account ID

-

Enter a value from the Account Master table (F0901). The system stores this value in the F75C201 table.

15.3 Setting Up the Fixed Asset Card Usage Information

This section provides an overview of fixed asset card usage information setup, lists the forms used to enter fixed asset card usage details, and discusses how to enter fixed asset card usage details.

15.3.1 Understanding Fixed Asset Card Usage Information Setup

You use the Setup Fixed Asset Card Usage Information program (P75C203) to enter the fixed asset card usage information. You use this program to set up depreciation ratio for an asset for a period. You can also use this program to modify, copy, and delete existing information.

The system saves the data that you enter to the Fixed Assets Card Usage Information - CHINA table (F75C203), and writes the data to the fixed assets XML file when you run the Generate Fixed Asset XML - China - 12 program (R75C201).

15.3.2 Forms Used to Enter Fixed Asset Card Usage Details

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Work With Fixed Asset Card Usage Information | W75C203A | Fixed Assets (G75C060), Setup Fixed Asset Card Usage Information | Review and select existing asset card usage records for an asset. |

| W75C203B | Select a record and click Select on the Work With Fixed Asset Card Usage Information form. | Enter the depreciation distribution ratio for an asset record. |

15.3.3 Entering Fixed Asset Card Usage Details

Access the Enter Asset Card Usage Information form.

Figure 15-3 Enter Asset Card Usage Information Form

Description of ''Figure 15-3 Enter Asset Card Usage Information Form''

- Accounting Period

-

Enter the accounting period for which you want to enter the card usage details.

- Department Number

-

Enter a value for department number from UDC table 75C/DE. If you leave this blank, the system retrieves the responsible business unit of the asset from the Asset Master program (P1204).

- Depreciation Ratio

-

Enter a decimal value with precision of two decimal places, for example, 0.11 to define the ration of depreciation distribution. This value should be less than or equal to 1, but should be a positive value. The default value for this field is 1.00.

15.4 Tracking the History of an Asset

This section provides an overview of the asset master history and discusses how to:

-

Run the Track Fixed Asset History program.

-

Set processing options for Track Fixed Asset History (R75C202).

15.4.1 Understanding the Asset Master History

You run the Track Fixed Asset History program to track the history of assets of a company for a specified period. You can run this report for a single asset or you can track the history of all assets of a company for a given period. You set processing options to specify data selection such as the company, asset, and accounting period.

This report retrieves data from the F1201 table and updates the Asset Master History File - CHINA table (F75C204). For ledger type AA, the report retrieves data from the Asset Account Balances File table (F1202).

If you run this report again for the same period, the system updates the asset record in the F75C204 table with the latest status of the asset. If you run this report by changing the asset value to update the past history of an asset, you must rollback the asset value to its actual current value after running the report.

15.4.2 Running the Track Fixed Asset History Program

Select Fixed Assets (G75C060), Track Fixed Asset History.

15.4.3 Setting Processing Options for Track Fixed Asset History (R75C202)

Processing options enable you to specify default values for programs and reports.

15.4.3.1 General

- Company

-

Specify the company for which you want to track history of assets. If you leave this processing option blank, the system runs the report for all companies.

- Asset Number

-

Specify the asset number for which you want to track history. If you leave this field blank, the system tracks history for all assets.

- Accounting Period

-

Specify the period for which you run the report. If you leave this processing option blank, the system selects the period of the current date.

- Accounting Year

-

Specify the year for which you run the report. If you leave this processing option blank, the system selects the year of the current date.

15.5 Generating the CNAO Audit Files for Fixed Assets

This section provides an overview of the CNAO audit file for fixed assets and discusses how to:

-

Run the Generate Fixed Asset XML program.

-

Set processing options for Generate Fixed Asset XML (R75C201).

15.5.1 Understanding the CNAO Audit File for Fixed Assets

You use the Generate Fixed Asset XML program to generate the XML file to report fixed assets data elements. You set processing options to specify data selection such as the company, accounting year, starting month, and ending month. You also use the processing options to specify the location to which the program writes the XML output and the Chinese characters that the system prints in the title of the report.

The system reads these tables to obtain the data for the XML file:

-

Asset Master File (F1201)

-

Asset Account Balances File (F1202)

-

Location Tracking (F1204)

-

Account Ledger (F0911)

-

Account Balances (F0902)

-

User Defined Code Types (F0004)

-

User Defined Code Values (F0005)

-

Modification Methods Information - CHINA (F75C201)

-

Asset Disposal Amounts - CHINA (F75C202)

-

Fixed Assets Card Usage Information - CHINA (F75C203)

-

Asset Master History File - CHINA (F75C204)

15.5.2 Running the Generate Fixed Asset XML Program

Select Fixed Assets (G75C060), Generate Fixed Asset XML.

15.5.3 Setting Processing Options for Generate Fixed Asset XML (R75C201)

Processing options enable you to specify default values for programs and reports.

15.5.3.1 General

- Company

-

Specify the company for which you generate the report. If you leave this processing option blank, the system generates the report for all companies

- Modification Type for Impairment accounts

-

Specify the modification type for impairment by entering a value from UDC table 00/DT. The system uses this value to calculate impairment amount for the fixed assets XML file.

- Period Month From (XX)

-

Specify the first period for which you run the report. If you leave this processing option blank, the system selects employee records beginning with the first payroll period of the year specified in the Accounting Year processing option.

- Period Month To (XX)

-

Specify the last payroll period for which you run the report. If you leave this processing option blank, the system selects employee records beginning with the last payroll period of the year specified in the Accounting Year processing option.

- Century/Fiscal Year

-

Specify the accounting year of the report. You must enter a value in the format YYYY. The system uses this value to select the accounting details for the given period from the F0911 and F0902 tables.

You must complete this processing option.

15.5.3.2 XML File Name

- XML File Path

-

Specify the location to which the system writes the XML file. You must have write permissions for the location that you specify. You must complete this processing option.

- Chinese Character - Beginning part of XML name

-

Specify the Chinese characters to precede the year for which you generate the XML file. For example, if you generate the file for the year 2010, the system prints the values that you enter before the numerals 2010.

15.5.3.3 FA Decreasing information

- Batch Type

-

Specify the batch type from UDC table 98/IT to indicate the value of the asset that should display in the Modification Information area on the XML.

15.5.3.4 FA Depreciation Method

- Depreciation Equation for Method 01

-

Specify a value for the depreciation method 01 that needs to be displayed in the Depreciation Equation field of the XML.

- Depreciation Equation for Method 02

-

Specify a value for the depreciation method 02 that needs to be displayed in the Depreciation Equation field of the XML.

- Depreciation Equation for Method 05

-

Specify a value for the depreciation method 05 that needs to be displayed in the Depreciation Equation field of the XML.