41 Processing Tax Invoices for GST (Release 9.1 Update)

This chapter discusses these topics:

-

Section 41.2, "Understanding Tax and Export Invoices for GST Sales Transactions"

-

Section 41.3, "Printing Tax and Export Invoices for GST Sales Transactions"

-

Section 41.4, "Adding Invoice Reference Number (IRN) for GST Invoices"

41.1 Understanding Invoice Templates for GST

At the time of supply of goods and services, the supplier issues the tax invoice that contains information required by Indian tax authorities. Every supplier registered under GST must issue the tax invoice to the recipient.

To print the necessary tax invoices for GST, the system provides you these invoice templates:

-

Tax invoice template (to be issued when the sales or services transaction is domestic)

-

(Currently only for sales transaction) Export invoice template (to be issued when the sales transaction is an export transaction)

You can maintain three copies of an invoice:

-

The original copy should be marked ORIGINAL FOR BUYER.

-

The duplicate copy should be marked DUPLICATE FOR TRANSPORTER.

-

The triplicate copy should be marked TRIPLICATE FOR ASSESSEE.

Legal Numbering for Invoices with GST

The legal requirements are:

-

The legal number is consecutive and is generated by the system.

-

The legal numbering sequence is unique for the combination of the company, legal document type, GST unit, and issue place.

Each invoice series (issue place) is unique for a GST unit. You cannot use the same invoice series for multiple GST units. This helps in identifying the GST unit from the invoice number that is printed on the invoice template.

The schedule defines the sequence in which the system applies the discounts and taxes to the goods.You must place the adjustments for India taxes at the end of the schedule sequence.

41.2 Understanding Tax and Export Invoices for GST Sales Transactions

A tax invoice is a legal document that contains information that is required by Indian tax authorities and complies with the regulatory obligations. You generate a domestic tax invoice or an export invoice depending on the type of the sales transactions.

41.2.1 Tax Invoice Template for GST Sales Transactions

For sales within the country, you generate the tax invoice using the tax invoice template.

The tax invoice template for GST includes this information:

-

(Release 9.1 Update) Address of the company and the GSTIN of the GST unit linked to the supplier business unit

-

Addresses of the recipient (the sold to and ship to business units)

-

Invoice number for the sales order, which is system-generated and is a concatenation of the issue place (invoice series) and legal next number

Each sales order included in the report has a unique legal invoice number that is of 16 characters.

-

Place of supply along with the name of state

-

Document number

Note:

If a document type for the document number exists in the Modified Documents UDC table (75I/MD), the system includes the original invoice number and date in the report. -

Item information: the description of the item, HSN or SAC, quantity of the item, unit of measure, unit price of the item, and extended price of the item

HSN code is used for stock items, and SAC for non-stock items.

-

Tax lines for CGST, SGST, IGST, and Cess as applicable

Each tax line includes the tax type, the tax rate, unit tax price, and net tax amount.

-

Discounts and adjustments, if any

-

Total unit price and total item price

The total item price is derived by deducting any discounts or abatements, if applicable.

-

Total invoice amount

41.2.2 Canceling the Tax Invoice for GST Sales Transactions

To modify a sales order for which you have already printed the tax invoice for GST, you must generate the tax invoice again. Before regenerating the tax invoice, you must cancel the invoice from the GST Tax File Information program (P75I807).

(Release 9.1 Update) You can view and cancel sales order invoices using the GST Invoice Cancellation for Sales Order program(P75I816). This program displays all the sales order invoices, including those invoices without tax information.

If you regenerate the tax invoice after it has already been printed using the Invoice Print program (R42565), the system verifies that the invoice is canceled. The system will create a new invoice number on regenerating the tax invoice.

When you cancel the tax invoice, the system:

-

Updates the cancellation status for the canceled invoices in the Sales Order Entry program (P4210) and the Sales Order Detail Data table (F4211).

-

Updates the void flag in the GST Tax File table (F75I807) for the canceled invoices. The invoices with the void flag is not shown in P75I807 program.

-

Updates the details for canceled invoices in the F75I300T [F7430010 GST Tag File - IND - 75I] tag file.

|

Notes:

|

You can cancel the invoice by selecting Cancel Invoice from the Row menu of the P75I807 program or by using the P75I816 program. You can also cancel multiple sales order invoices using the P75I816 program.

41.2.2.1 Prerequisites

Before you complete the tasks in this section, set up the processing options for P75I807 and P75I816.

The processing options are the same for both the programs. The processing options are:

- Cancellation Last Status

-

A code (40/AT) indicating the last step in the processing cycle that this order line has successfully completed.

- Cancellation Next Status

-

A user defined code (40/AT) indicating the next step in the order flow of the line type.

41.2.2.2 Canceling Tax Invoices for Sales Order

To cancel tax invoices for sales orders using the P75I807 program:

-

From the GST Module, click GST Periodic Processing (G75IGST5H), and then select GST Tax File Information.

-

On the GST Tax File Information form, search for the tax invoices of the sales orders that you want to cancel.

-

To cancel a single tax invoice, perform the following tasks:

-

Select the invoice and then select Cancel Invoice from the Row menu.

This option is not available for the sales orders that are at Completed (999) status.

-

The system displays the GST Cancel Invoice form with all the detail lines of the tax invoice that you have selected to cancel.

-

-

Click OK to proceed with the cancellation.

The system cancels the tax invoices and updates the associated tables.

To cancel active or multiple tax invoices for sales orders using the P75I816 program:

-

From the GST Module, click GST Periodic Processing (G75IGST5H), and then select GST Invoice Cancellation for Sales Order.

You can also access the P75I816 program by clicking Cancel Invoice in the Form menu of the P75I807 program.

-

On the GST Invoice Cancellation for Sales Order form, search for and select the tax invoices for the sales orders that you want to cancel.

This option is not valid for the sales orders that are at Completed (999) status

The system displays the GST Cancel Invoice form with the detail lines of the tax invoices that you have selected to cancel.

-

Click OK to proceed with the cancellation.

The system cancels the tax invoices and updates the associated tables.

41.2.3 Export Invoice Template for GST Sales Transactions

An export invoice is a legal document that does not include taxes. You use the export invoice template to generate export invoices only for foreign customers who are not located in India. The export invoice prints in a foreign currency, whereas the tax invoice prints in the local currency.

|

Note: If a document type for the document number exists in the Modified Documents UDC table (75I/MD), the system includes the original invoice number and date in the report. |

41.3 Printing Tax and Export Invoices for GST Sales Transactions

You (as the supplier) run the standard Invoice Print program (R42565) to generate legal documents for tax and export invoices. The Invoice Print program retrieves the sales orders that are specified in the data selection, performs validations and calculations, and then reads the processing options for the PO - Print Legal Document from Sales Order program (P7420565) for additional localized information about the invoice.

The R42565 program uses the domestic invoice template or the export invoice template based on the setup in the Legal Document/UBE Relationship program (P7430024). Based on the template that is used, the system launches one of these programs:

-

Tax Invoice (R75I809)

If you revise the information in sales orders after the tax invoice has already been printed, the system uses the R75I809 program.

-

Export Invoice (R75I810)

When you run the R42565 program for an export sales order that has been revised, the system stores the original invoice number and revised tax details in the GST Supplementary Invoice table (F75I829), but does not print the supplementary invoice report.

The PO - Print Legal Document from Sales Order program (P7420565) has the processing option that allows you to run the report in proof mode or final mode. When you run the R42565 program in final mode, the system generates the invoice number and updates the GST Tax File table (F75I807).

|

Note: The JD Edwards EnterpriseOne system for GST does not generate a consolidated invoice for multiple sales orders even when the Invoice Consolidation option in the Customer Master program (P03013) is set to apply consolidated invoice. |

41.3.1 Prerequisites

Before you complete the tasks in this section:

-

Verify that the GSTIN record exists in the system for the supplier business unit.

You must verify that the GSTIN record exists for the receiver Ship To address entity if you have set the processing option for the PO - Print Invoices R42565 (P75I2565) to validate the GSTIN for the Ship To customer.

-

(Release 9.1 Update) You must also verify that the GST unit is applicable to all the lines in an invoice. If there are multiple branch plants in a sales order, the branch plants should be linked to the same GST unit, otherwise the system will not generate the invoice and will display an error in the work center.

-

The system will print the company address from the address book master table (F0101) for the supplier details in the invoice header.

-

Attach the business unit to a GST unit using the GST Cross Reference Setup program (P75I803).

-

Create adjustment schedules for GST using the advanced pricing solution. To create adjustment schedules:

-

Set up adjustment names in the Price Adjustment Definition program (P4071) for the GST types (CGST, SGST, IGST, and Cess) and discounts.

For export transactions, set the Adjustment Control Code option to 4 (Accrued to G/L).

For domestic transactions, set the Adjustment Control Code option to 6 (Print on Invoice - Detached).

-

Define the tax percentages of the GST adjustments in the Price Adjustment Detail Revisions program (P4072).

Discounts must have a negative percentage value.

-

Group all the adjustment names into an adjustment schedule in the Price Adjustment Schedule program (P4070).

See Chapter 6, "Setting Up the Advanced Pricing System for India Taxes".

-

-

Map the adjustment name with the tax type in the Relation Adjustment Name / Tax Type program (P75I006).

Discounts adjustment names must not be mapped with tax type.

When printing invoices using the Invoice Print program (R42565), the system checks the setup in the P75I006 program to validate that the selected records are mapped to the GST tax regime.

-

Map the adjustment schedule with the GST rule using the GST Adjustment Schedules Setup program (P75I826).

-

Create the sales order in the Sales Order Entry program (P4210) and enter the adjustment schedule (that you set up for GST) when you create the sales order.

-

Run the Print Pick Slip program (R42520) for the sales order.

-

Confirm the shipment in the Shipment Confirmation program (P4205).

-

Verify that:

-

The GST state codes are set up for domestic invoices in the Work With GST State Code program (P75I845).

-

The state and country of supplier business units and sold to addresses are set up in the Address Book Revision program (P01012).

-

-

Set up the processing options for these programs:

-

Invoice Print (R42565)

For domestic sales orders, set the Print in Foreign Currency processing option to blank. For exports, set this processing option to 1 (Print).

This processing option is in the Print tab of the Processing Options form.

See Section 29.7.2, "Setting Processing Options for Base Software Print Invoice (R42565)".

-

PO - Print Legal Document from Sales Order (P7420565)

See Section 29.7.3, "Setting Processing Options for Print Invoice (P7420565)".

-

PO - Print Invoices R42565 (P75I2565)

In the processing options for the P75I2565 program, you specify:

-

Whether to apply GST

The system validates and prints the GST template only when the processing option is set to apply GST. If the option is set to not apply GST, the system does not process the GST validations and allows you to print invoices for other non-GST India taxes.

-

Whether to skip the validation of the GSTIN for the Ship To customer

-

-

-

Run the Legal Doc Default Setup program (R75I807) to populate information that you need to print legal documents. Also, set up the next numbering sequence for printing invoices using the GST Legal Document Next Numbers program (P75I818).

See Chapter 40, "Setting Up Legal Documents for GST Invoices (Release 9.1 Update)".

-

Set up titles for various types of invoices per the government regulation in the Legal Document Title Print UDC table (74/PT) or the Work with Legal Document Types program (P7400002).

Note:

You use the P7400002 program to set up the titles only if they do not exist in the 74/PT table.

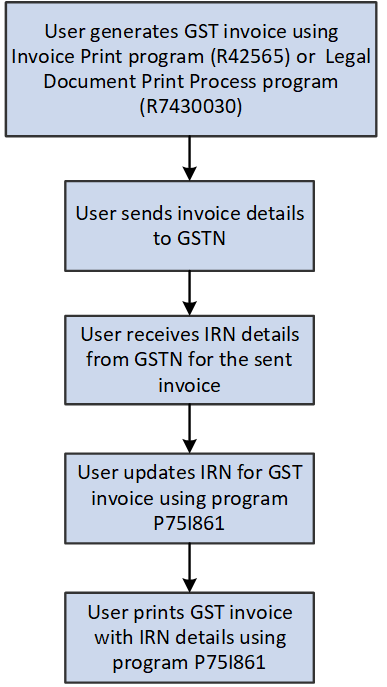

41.4 Adding Invoice Reference Number (IRN) for GST Invoices

After you receive the Invoice Reference Number (IRN) from the GSTN portal for your GST invoices, you can update the IRN with your invoices in the system using the Work With GST Invoice Reference Details (IRN) program (P75I861). The program also enables you to reprint the GST invoices with the IRN details.

IRN is a unique legal number generated by GSTN for an electronic tax invoice. IRN must be referenced in all relevant documents for a taxable supply including tax invoices, commercial or AR invoices, receipts, and documents issued for post-supply adjustments (for example, debit notes, supplementary invoices, credit notes, and so on).

You can review the invoice details by accessing the GST Tax File Information program (P75I807) from the Row menu of the P75I861 program.

41.4.1 Prerequisites

Before you complete the tasks in this section:

-

Verify that an active GST invoice exists in the system.

-

Ensure that the issue place of the GST invoice is set up in the Work With GST Legal Document Next Numbers program (P75I818).

-

Set up the following processing options for the Work With GST Invoice Reference Details (IRN) program (P75I861):

Processing options enable you to specify default processing values.

-

Legal Document Date - From

Specify the beginning date of the range of dates during which the GST invoices were generated.

-

Legal Document Date - To

Specify the ending date of the range of dates during which the GST invoices were generated.

-

41.4.2 Entering the IRN Details for a GST Invoice

To enter the IRN details for a GST invoice:

-

From the GST Module, select GST Daily Processing (G75IGST3H), and then GST Invoice Reference Details (IRN).

The system displays the Work With GST Invoice Reference Details (IRN) form with all the GST invoices (with or without) that are generated in the system.

-

To enter the IRN details for the GST invoices, click Add.

The system displays the GST Invoice Reference Details (IRN) Revisions form, with the GST invoices that are without the IRN details (that is the Invoice Reference Number and the Invoice Reference Date) in the grid.

-

Enter values in the following fields:

-

Invoice Reference Number:

IRN can be a maximum of 30 characters.

-

Invoice Reference Date:

This is the date of issue of IRN.

-

-

Click OK.

The IRN details are updated for the respective GST invoices in the Work with GST Invoice Reference Details (IRN) form.

Note:

IRN should be unique for an invoice.

41.4.3 Updating the IRN Details for a GST Invoice

To modify or delete IRN details for a GST invoice:

-

On the Work with GST Invoice Reference Details (IRN) form, select the GST invoice for which you want to modify the IRN.

The system displays the GST Invoice Reference Details (IRN) Revisions form where the Invoice Reference Number and Invoice Reference Date fields are enabled.

-

Update the Invoice Reference Number field or manually remove the IRN entry as needed.

41.4.4 Reprinting Invoice with IRN

-

On the Work with GST Invoice Reference Details (IRN) form, select the GST invoice then click Print Inv. with IRN from the Row menu.

Note:

If the IRN field is blank, the system displays a warning that IRN is not available for the invoice.The system displays the Work with Legal Document Reprint (P7430031) with information about the selected GST invoice.

-

Select the GST invoice that you want to reprint and click Print Inv. with IRN from the Row menu.

41.5 Reprinting Invoices for GST

You can use the Reprint Invoices program (P7430031) to reprint selected documents. The system does not create new invoice numbers or update any tables when you reprint the documents.

|

Note: The P7430031 program does not display information about the void or canceled invoices. |

To reprint documents, click GST Module, GST System Setup (G75IGST4H), Invoice, Print Setup, and then Reprint Invoice.

41.6 Entering the Bill of Export Details

You must record the bill of export details when you supply goods in the GST regime. You use the bill of export details when you print the GSTR1 report.

You use the GST Bill Of Export Information program (P75I834) to enter the bill of export details for export invoices. The system saves this information in the GST Bill Of Export Information table (F75I834).

41.6.1 Prerequisite

Before you complete the task in this section, you must set up the Export Legal Document Type processing options for the P75I834 program. The system retrieves export invoices that has the document type set up in these processing options.

41.6.2 Entering the Bill of Export Details for an Invoice

To enter the bill of export details:

-

From the GST Module, click GST Periodic Processing (G75IGST5H), and then GST Bill Of Export Information.

-

On the Work With GST Export Invoices form, enter the company for which you want to retrieve the invoices.

By default, the Export Invoices option is selected and the system displays only export invoices for the company based on the legal document type set up in the processing option. To view all invoices, deselect the Export Invoices option.

The system does not display invoices that are void in the F0411 table.

-

To enter the bill of export information for an invoice, select the invoice from the grid.

-

On the GST Bill of Export Details, enter the bill of export number and bill of export date.

Note:

The bill of export number can be a maximum of 13 characters. The number consists of the port code, which can be a maximum of 6 characters, followed by the shipping bill number, which can be a maximum of 7 characters. -

Click OK on the form to save your entry.

-

To view the GST information for the selected invoice, click GST Information on the Row menu of the Work With GST Export Invoice form.

41.7 Printing AR Tax and Export Invoices for GST

You run the Legal Document Print Process program (R7430030) to generate legal documents for accounts receivable invoices. Every service provider registered under GST must issue the tax invoice to the recipient. The R7430030 program uses the domestic invoice template or the export invoice template that you set up in the Legal Document/UBE Relationship program (P7430024). The R7430030 program launches the Tax Invoice program (R75I809) for domestic transactions and the Export Invoice program (R75I810) for export transactions.

The R75I809 program prints the invoice information in a format that meets the regulatory tax invoice requirement and includes this information:

-

Address of the legal document company and the GSTIN of the GST unit linked to the supplier business unit

-

Addresses of the recipient (the billed-to and shipped-to business units)

According to GST regulatory requirement, the billed-to entity must be the payor.

-

Invoice number, which is system-generated and is a concatenation of the issue place (invoice series) and legal next number

The system retrieves the issue place that you have specified in the processing option for the PO - Localization Invoice Entry (P03B11) program (P7433B11).

-

Pay item details: SAC and its description, gross amount, payment term, discounts (if applicable), and the net amount.

The net amount is derived by deducting any discounts or abatements, if applicable.

-

Tax lines for CGST, IGST, SGST, and Cess as applicable for each pay item

Each tax line includes information such as the description of the tax type, tax rate, whether reverse charge is applicable, and the net tax amount.

If reverse charge applies to a pay item line, the system displays the GST reverse charge amount based on the provider's percentage set up in the GST Rules Setup program (P75I802).

-

Text attachments

To add text attachment to the order's header section, select Order, Attachments, and then Header Attachment from the Row menu. To add text attachment to the order's detail section, select Order, Attachments, and then Detail Attachment from the Row menu.

Define the number of rows for sales order attachments and line attachments for the print template in the Print Template Def. Legal Doc. program (P7430021). To print text attachments, set the Print Associated Text processing option to 1 (Print) for the Invoice Print program (R42565).

-

Total net amount for each pay item

-

Total invoice amount for all the pay items in the invoice

-

For the sales orders for which a credit order is created, the original invoice number, original invoice date, credit order amount, and tax lines with negative values

-

For the export transactions that are associated with a bond/LOU, the country of destination, bond/LOU number, and the following statement is included:

SUPPLY MEANT FOR EXPORT/SUPPLY TO SEZ UNIT OR SEZ DEVELOPER FOR AUTHORISED OPERATIONS UNDER BOND OR LETTER OF UNDERTAKING WITHOUT PAYMENT OF INTEGRATED TAX.

-

For the export transactions that are not associated with a bond/LOU, the Bond/LOU Number field is blank and the following is included:

SUPPLY MEANT FOR EXPORT/SUPPLY TO SEZ UNIT OR SEZ DEVELOPER FOR AUTHORISED OPERATION ON PAYMENT OF INTEGRATED TAX.

|

Note: The export invoice template includes the tax lines for CGST, IGST, SGST, and Cess if the Print Tax Details processing option for the R75I810 report is set to 1. |

The R7430030 program includes the processing option that allows you to run the report in proof mode or final mode. When you run the program in final mode, the system generates the invoice number and:

-

Creates ledger entries in the GST Ledgers table (F75I823) with the batch number and the GST amounts for each applicable GST type (IGST, SGST, CGST, and Cess)

-

Updates the TL (Tax Liability) ledger in the GST Ledgers Setup table (F75I804) with the confirmed liability amounts

-

Creates journal entries in the Account Ledger table (F0911)

The system credits the permanent liability accounts for the GST type and debits the intermediate liability accounts for the GST type that you have set up in the GST Account Master Setup program (P75I805).

-

For export transactions that are associated with a bond or LOU:

-

For accounts receivable, the system credits the bond or LOU offset account and debits the intermediate liability account, and does not update the tax liability ledger.

-

For sales orders, the system credits the bond or LOU offset account and debit accounts for GST adjustments.

-

Updates the batch number and batch type in the GST Bond/LOU - AR Register table (F75I854) and GST Bond/LOU -SO table (F75I853).

-

|

Note: After you run the R7430030 program in final mode and the legal invoice number has been generated, the system does not allow you to print the tax invoice template again.You can run the standard Invoice Print program (R03B505) to generate a printable PDF version of the invoice before you run the R7430030 program for the invoice. |

41.7.1 Prerequisites

Before you complete the tasks in this section:

-

Set up the issue place for legal document number in the processing option for the PO - Localization Invoice Entry (P03B11) program (P7433B11). The issue place must be maximum 6 (six) characters long. This processing option is in the Legal Number tab of the processing option form.

The other processing options for the P7433B11 program are not applicable for GST.

-

Run the Legal Doc Default Setup program (R75I807) to automatically generate information that is required to print GST legal documents.

-

Set up next numbering for GST legal documents using the GST Legal Document Next Numbers program (P75I818).

-

Verify that the Send Invoice to option in the Customer Master program (P03013) is set to the payor and the Alternate Payor field is set up with data. This is required to print payor address in the domestic invoice template (R75I809). The system checks these values for the customer address number and company combination when you run the R7430030 program.

These fields are in the Invoices tab of the Customer Master Revision form.

-

Verify that:

-

The GST state codes are set up for domestic invoices in the Work With GST State Code program (P75I845).

-

The state and country of supplier business units and payor address numbers are set up in the Address Book Revision program (P01012).

-

-

Set up the following processing options for the R7430030 program:

-

Launch Legal Document Print UBE Automatically

Leave this processing option blank to enable the system to launch the Tax Invoice program (R75I809) or the Export Invoice program (R75I810) to print the GST invoice template.

-

Print Currency

Enter D in the processing option to print invoices for domestic transactions and enter F to print invoices for export transactions.

These processing options are not applicable for GST: the Print Line Attachment and Contact Information Address Number processing options on the General tab, and all of the processing options on the Range tab.

-

-

Set up the Invoice Date processing option for the PO - Legal Document Print Process (P75I3030)

The date that you enter in this processing option is printed as the invoice date in the R75I809 and R75I810 reports. If you leave this processing option blank, the system date is used.

-

Set up titles for various types of invoices per the government regulation in the Legal Document Title Print UDC table (74/PT) or the Work with Legal Document Types program (P7400002).

Note:

You use the P7400002 program to set up the titles only if they do not exist in the 74/PT table.

41.8 Printing a Self-Invoice for Reverse Charges

Self-invoice is a billing document that a customer provides to the supplier for purchase of goods and services. You print a self-invoice for purchase, accounts payable, and advance payment transactions on which reverse charge is applicable.

Self-invoice is not available in the GST Self Invoice Information program (P75I848) for the accounts payable transactions that are canceled.

41.8.1 Prerequisites

Before you complete the tasks in this section:

-

You must set up legal next numbers using the Work With GST Self Invoice Legal Next Number (P75I847). See Section 40.3, "Setting Up Legal Next Numbers for the Self-Invoice" for more information.

-

You must run voucher match for purchase orders on which reverse charge is applicable.

-

Calculate reverse charges for advance payment using the Work With Reverse Charge on Advance Payment P2P program (P75I838)

41.8.2 Printing a Self-Invoice for a Transaction

To print a self-invoice for a transaction:

-

From the India Localization module (G75I), click GST Module, GST Daily Processing, GST Self Invoice Information (P75I848).

-

On the GST Self Invoice Information form, complete the header fields, and then click Search.

-

Select the record for which you want to print the self-invoice.

-

Click Print Self Invoice from the Row menu.

41.9 Reviewing the Self-Invoice Information

You can review the self-invoice information using the GST Self Invoice Information program (P75I848).

To review self-invoice information for a transaction:

-

From the India Localization module (G75I), click GST Module, GST Daily Processing, GST Self Invoice Information (P75I848).

-

On the GST Self Invoice Information form, complete the header fields, and then click Search.

41.10 Printing the Exception Report

You run the GST Exception Report Export Bond Process report (R75I823) to print the details of the export transactions that are canceled or for which the proof of receipt is not received. The export transactions must be associated with a bond or LOU.

The R75I823 report includes information such as the GST unit, the bond or LOU details, the tax details, and the reason for exception.

41.10.1 Prerequisites

Before you complete the tasks in this section you must set the processing options for the R75I823 report:

- GST Unit

-

Specify the GST unit for which you want to run the report.

- GST Offset Date From

-

Specify the start date of the date range for which you want to run the report.

- GST Offset Date To

-

Specify the end date of the date range for which you want to run the report.

- Number of Days

-

Specify the number of days for which you want to run the report. For example, if you specify 30 in the processing option, the report is run for the last 30 days from the current date.

If values are available in the GST Offset Date From and GST Offset Date To processing options, the system does not consider the Number of Days processing option while running the report.