14 Working with Cenvat Credit in India

This chapter contains the following topics:

-

Section 14.3, "Offsetting Cenvat Credit and Calculating Duty Liability"

-

Section 14.4, "Generating the Entry Books of Duty Credits for Inputs and Capital Reports"

-

Section 14.7, "Offsetting Cenvat Credit Against Service Tax"

-

Section 14.8, "Setup Requirements for Offsetting Cenvat Credit Against Excise Tax"

-

Section 14.9, "Setup Requirements for Offsetting Cenvat Credit Against Service Tax"

14.1 Understanding Cenvat Credit

The credit that can be claimed by a manufacturer, producer of final products, or a provider of taxable services is called Cenvat credit. Cenvat credit can be applied against both excise and service taxes for these types of items:

-

Excise duty on a final product (for manufacturers or producers of final products only)

-

Inputs and capital goods, if they are removed or are being partially processed

For these item types, you can apply the amount equal to the Cenvat credit to the tax payment

-

Service tax on any output services (for providers of taxable and exempted services only)

For this item type, you can apply Cenvat credit if you maintain separate accounts for the receipt, consumption, and inventory for the taxable service, and nontaxable services. If separate accounts are not maintained, only 20 percent of the credit can be applied for payment of service tax.

You use the Credit Redistribution process after you run both the purchase order and sales order cycles. The Credit Distribution program (P75I012) and the Credit Distribution - Services program (P75I013) pass the amount and the account details to create a pair of credit and debit entries in the Account Ledger table (F0911) for the amounts being redistributed. The system generates and displays a batch number when the F0911 table entries are made.

|

Important: You generate general ledger entries for the taxes in the F0911 table only after you run the Sales Update program. |

14.1.1 Cenvat Credit on Common Inputs

You might use common inputs in the manufacture of excisable goods as well as in the manufacture of nonexcisable goods. In some cases, you might not be able to track the issue of the common inputs based on its end use. In such circumstances, you can claim Cenvat credit on the entire consignment and can issue such inputs for the manufacture of nonexcisable goods. To claim Cenvat credit on the entire consignment, you must calculate the excise duty liability at 10 percent of the value of the goods, excluding sales tax.

To claim Cenvat credit:

-

Verify that the credit claimed during the procurement process are not off set.

-

Define a price adjustment so that the system calculates 10 percent on the value of the item excluding sales tax.

The system uses the price adjustment when you sell or transfer the goods.

14.2 Assigning Percentage of Cenvat Credit

This section provides an overview of the assignment of the percentage of Cenvat credit, and discusses how to assign the percentage of Cenvat credit to an item type.

14.2.1 Understanding the Assignment of the Percentage of Cenvat Credit

You use the Credit Distribution Percentage program (P75I011) to assign the percentage of Cenvat credit to an item type, such as CAP (capital goods) or INP (input). You can also use this program to:

-

Identify ways in which to recover amounts for a tax type.

-

Identify ways in which to recover the partial percentage of the Cenvat credit.

-

Move the credits for an item type from one tax type to another.

14.2.2 Forms Used to Assign the Percentage of Cenvat Credit

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Work With Credit Distribution Percentage | W75I011A | Excise System Setup (G75IEXC4), Credit Distribution Percentage | Review existing records for item types and their associated tax types. |

| Credit Distribution Percentage | W75I011B | Click Add on the Work With Credit Distribution Percentage form. | Assign the percentage of Cenvat credit to an item type. Add or update records to transfer the credit of an item type from one tax type to another. |

14.2.3 Assigning the Percentage of Cenvat Credit to an Item Type

Access the Credit Distribution Percentage form.

Figure 14-1 Credit Distribution Percentage form

Description of ''Figure 14-1 Credit Distribution Percentage form''

- Model Year (YYYY)

-

Enter the model year of the appliance in the YYYY format.

- Item Type

-

Enter a user-defined code from UDC table 75I/EA that identifies the type of item. Examples are:

AII: Account for Inputs

CII: Account for Capital goods

EXA: Expense Account

PLA: Personal Ledger Account

SRV: Accounts for Services

- From Tax Type

-

Enter a user-defined code from UDC table 75I/GT that identifies the tax type. Values are:

AED: Additional Excise Duty

BED: Basic Excise Duty

Cess: Education Cess

CVD: Counter Veiling Duty

CVHC: HCess - CVD

CVDCS: Education Cess - CVD

FT: Freight for JST adj

INTR:INTR: Interest - TDS

OTHROther - TDS

PF: Packaging & Forwarding

SED: Special Excise Duty

ST: Service Tax

STCS: Education Cess - ST

SUR: Surcharge

TCS: Tax Collected at Source

TDS: Tax Deducted at Source

TOT: Turn Over Tax

VAT: Value Added Tax

- To Tax Type

-

Enter a user-defined code from UDC table 75I/GT that identifies the tax type. Values are:

AED: Additional Excise Duty

BED: Basic Excise Duty

Cess: Education Cess

HCess: Higher Education Cess

CVD: Counter Veiling Duty

CVDCS: Education Cess - CVD

FT: Freight for JST adj

INTR:INTR: Interest - TDS

OTHROther - TDS

PF: Packaging & Forwarding

SED: Special Excise Duty

ST: Service Tax

STCS: Education Cess - ST

SUR: Surcharge

TCS: Tax Collected at Source

TDS: Tax Deducted at Source

TOT: Turn Over Tax

VAT: Value Added Tax

- Annual Percentage

-

Enter the credit percentage that is used for distributing credit.

14.3 Offsetting Cenvat Credit and Calculating Duty Liability

This section provides overviews of VAT and Cenvat credit offset on raw materials, calculation of duty liability on manufactured goods, and calculation of duty liability on personal consumption of manufactured goods, lists prerequisites, and discusses how to:

-

Set processing options for Personal Consumption (P75I309).

-

Review the offset Cenvat and Cenvat credits amounts.

-

Calculate duty liability for goods consumed.

14.3.1 Understanding VAT and Cenvat Credit Offset on Raw Materials

You use the Item used For Personal Consumption program (P75I309) to offset the Cenvat credit claimed during the procurement of raw materials in these scenarios:

-

Personal consumption of raw materials

You must offset the Cenvat credit for raw materials that the manufacturer consumes internally.

-

Nonsubmission of documentary evidence

You must submit a document to claim the Cenvat credit, which identifies the excise duty liability incurred by the shipping organization. You must delete the records for which you have no documents before you process the Cenvat claim.

-

Manufacture of exempted goods

You cannot claim the Cenvat credit for manufacturing nonexcisable goods from excisable inputs.

14.3.2 Understanding Calculation of Duty Liability on Manufactured Goods

You use the Item used For Personal Consumption program (P75I309) to calculate the duty liability on manufactured goods for these scenarios:

-

Personal consumption of manufactured goods

You must pay duty on goods that you manufacture and that you consume internally.

-

Manufacture of exempted goods and input credit claimed

You can claim the Cenvat credit on an entire consignment when you use common inputs to manufacture both excisable and nonexcisable goods. When you claim Cenvat credit in this situation, you must determine the excise duty liability at the applicable percentage on the value of the goods excluding the sales tax.

14.3.3 Understanding Calculation of Duty Liability for Personal Consumption of Manufactured Goods

You must account for personal consumption of manufactured goods to calculate the duty credit offset. To generate stock transfers to account for the goods:

-

Define a branch/plant for personal consumption.

-

Use the Item used For Personal Consumption program (P75I309) to process a stock transfer from the manufacturing branch/plant to the personal consumption branch/plant.

Set the processing option to indicate manufactured items. There is no actual movement of goods.

-

Process an inventory issue from the personal consumption branch/plant in the amount of the consumed goods to reduce the available quantity in the branch/plant.

14.3.4 Prerequisites

Before you complete the tasks in this section:

-

Define a separate branch/plant for personal consumption.

-

Create a request for a stock transfer from the manufacturing branch/plant to the personal consumption branch/plant.

-

Perform an inventory issue from the personal consumption branch/plant.

-

Set the value of the processing option Consumption Mode to 0 to review existing records for purchase order receipts.

-

Set the value of the processing option Consumption Mode to 1 to review existing stock transfer orders.

14.3.5 Forms Used to Offset Cenvat Credit and Calculate Duty Liability

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Work With Purchase Order Receipts | W75I309A | Purchase tax (G75I2212), Item used For Personal Consumption | Review existing records for purchase order receipts. |

| Personal Consumption And Duty Credit Setoff - Inputs | W75I309B | Select a record on the Work With Purchase Order Receipts forms and click Select. | Review the offset Cenvat and Cenvat credits amounts claimed during the purchase. |

| Work With Stock transfers | W75I309D | Purchase tax (G75I2212), Item used For Personal Consumption | Review existing stock transfer orders. |

| Personal Consumption And Duty Credit Setoff - Manufactured items | W75I309E | Select a record on the Work With Stock Transfers form and click Select. | Calculate the duty liability for goods consumed. |

14.3.6 Setting Processing Options for Item used For Personal Consumption (P75I309)

Processing options enable you to specify the default processing for programs and reports.

14.3.6.1 Defaults

- Consumption Mode

-

Specify the mode of internal consumption to offset credit. Values are:

0: Offset credit on raw materials and other inputs.

1: Offset credit on manufactured items.

The purchase order receipts are the reference documents when you offset credit on raw materials.

The stock transfer orders to the internal consumption branch plant are the reference documents when you offset credit on manufactured items.

14.3.6.2 Tax Type

- Additional Excise Duty

-

Specify a user-defined code from UDC table 75I/GT that identifies the tax type for the additional excise duty component of the tax.

- Basic Excise Duty

-

Specify a user-defined code from UDC table 75I/GT that identifies the tax type for the basic excise duty component of the tax.

- Special Excise Duty

-

Specify a user-defined code from UDC table 75I/GT that identifies the tax type for the special excise duty component of the tax.

- Education Cess

-

Specify a user-defined code from UDC table 75I/GT that identifies the tax type for the education cess component of the tax.

- Secondary Higher Education Cess

-

Specify a user-defined code from UDC table 75I/GT that identifies the tax type for the higher secondary education cess component of the tax.

14.3.7 Reviewing the Offset Cenvat and Cenvat Credits Amounts

Access the Personal Consumption And Duty Credit Setoff – Inputs form.

- Reason Code

-

Enter a user-defined code from UDC table 75I/RC that identifies the duty or duty credit offset. Values are:

DOC: Non-Submission of Documents

EXMPT: Manufacture of Exempted Goods

INCON: Internal Consumption

14.3.7.1 Calculate Duty/Tax - Setoff

- Consumption Qty (consumption quantity)

-

Enter the quantity of raw materials or finished goods used for personal consumption, that is, the goods not meant for sale.

- Setoff VAT

-

Enter the total amount of duty charges liable for offset.

14.3.7.2 CENVAT Break up

- BED

-

Enter the basic excise duty (BED). BED is an excise component that is applicable for any item.

- CESS

-

Enter the education cess. Education cess is a tax component which can be levied on taxes or duties.

- AED

-

Enter the additional excise duty (AED). AED is an excise component that is applicable for any item.

- SED

-

Enter the special excise duty (SED). SED is an excise component that is applicable on any item.

- Others

-

Enter any tax component to be used in future.

14.3.8 Calculating Duty Liability for Goods Consumed

Access the Personal Consumption And Duty Credit Setoff – Manufactured items form.

- Reason Code

-

Enter a user-defined code from UDC table 75I/RC that identifies the duty or duty credit offset. Values are:

DOC: Non-Submission of Documents

EXMPT: Manufacture of Exempted Goods

INCON: Internal Consumption

14.3.8.1 Calculate Duty

- Consumption Qty (consumption quantity)

-

Enter the quantity of raw materials or finished goods used for personal consumption, that is, the goods not meant for sale.

- BED

-

Enter the basic excise duty (BED). BED is an excise component that is applicable for any item.

- CESS

-

Enter the education cess. Education cess is a tax component which can be levied on taxes or duties.

- AED

-

Enter the additional excise duty (AED). AED is an excise component that is applicable for any item.

- SED

-

Enter the special excise duty (SED). SED is an excise component that is applicable on any item.

- Others

-

Enter any tax component to be used in future.

14.4 Generating the Entry Books of Duty Credits for Inputs and Capital Reports

This section provides an overview of the Entry Books of Duty Credits for Inputs and Capital reports, lists prerequisites, and discusses how to:

-

Run the Entry Book of Duty Credit on Inputs report.

-

Set processing options for Entry Book of Duty Credit on Inputs (R75I313S).

-

Run the Entry Book of Duty Credit on Capitals report.

-

Set processing options for Entry Book of Duty Credit on Capitals (R75I317S).

14.4.1 Understanding the Entry Books of Duty Credits for Inputs and Capital Reports

Run the Entry Book of Duty Credit on Inputs program to print the CENVAT details for input goods. This report includes information about CENVAT credits against raw material receipts, debits taken from excise duty payments, and other transactions taken from RG23A-II account.

The Entry Books of Duty Credits for Inputs report reads data from these tables:

-

Excise - RG23A - II Chapter Wise Transaction File (F75I313Y)

-

Excise - MODVAT/PLA Summary File - YARN SPECIFIC (F75I310Y)

-

Customer and Supplier master with VAT Reg No. (F75I210)

-

Excise - RG23A - II Item Wise Transaction File (F75I314Y)

-

F75I310Y - Tag File (F75I311)

(This pertains to Release 9.1 Update) The Entry Book of Duty Credit on Inputs program prints opening balances, closing balances, credit and debit details of excise taxes of input items for an excise unit by month. It prints CVD, CVD Cess, and CVD Hcess in these ways:

-

In the Opening Balance of Duty in Credit section of the report under the CVD, the CVD Cess, and the CVD Hcess columns. The system retrieves these values from the AII CVD Opening Balance and the AII CVD Cess Opening Balance columns in F75I310Y, and from the opening balance corresponding to the CVHC Tax type in F75I311, respectively.

-

In the Fresh Credit Allowed section of the report under the CVD, the CVD Cess, and the CVD Hcess columns. The system retrieves these values from the Counter Vailing Duty, the CVD Cess, and the Taxable Rounding columns respectively, if the value in YIRF (Issuing / Receiving Branch Plant) field is R, and the value in IOTY (Input/Output Type) is I in the F75I313Y table.

-

In the Debit section of the report under the CVD, the CVD Cess, and the CVD Hcess columns. The system retrieves these values from the Counter Vailing Duty, the CVD Cess, and the Taxable Rounding columns respectively, if the value in YIRF (Issuing / Receiving Branch Plant) is I, and the value in IOTY (Input/Output Type) is O in the F75I313Y table.

-

The system also displays the CVD, the CVD Cess, and the CVD Hcess columns under the Balances section. If the value in YIRF (Issuing / Receiving Branch Plant) is R, and the value in IOTY (Input/Output Type) is I in F75I313Y, then the system displays values in these columns equal to the sum of values in the corresponding columns of the Opening Balance of Duty in Credit and Fresh Credit Allowed sections. Otherwise, the system displays values in these columns by subtracting values in the Debit section of the report from values in the corresponding columns of the Opening Balance of Duty in Credit section.

Run the Entry Book of Duty Credit on Capitals program to print the CENVAT details for capital goods. This report prints all excise financial transactions from the RG23C-II ledger for a given period, CENVAT credits against capital goods receipts, the debits from excise duty payments, and other transactions affecting the RG23C-II account.

The Entry Books of Duty Credits for Capitals report reads data from these tables:

-

Excise - RG23C - II Chapter Wise Transaction File (F75I317Y)

-

Excise - MODVAT/PLA Summary File - YARN SPECIFIC (F75I310Y)

-

Customer and Supplier master with VAT Reg No. (F75I210)

-

Excise - RG23C - II Item Wise Transaction File (F75I318Y)

-

F75I310Y - Tag File (F75I311)

(This pertains to Release 9.1 Update) The Entry Book of Duty Credit on Capitals program prints opening balances, closing balances, credit and debit details of excise taxes of capital goods for an excise unit by month. It prints CVD, CVD Cess, and CVD Hcess in these ways:

-

In the Opening Balance of Duty in Credit section of the report under the CVD, the CVD Cess, and the CVD Hcess columns. The system retrieves these values from the AII CVD Opening Balance and the AII CVD Cess Opening Balance columns in F75I310Y, and opening balance corresponding to CVHC Tax type in F75I311, respectively.

-

In the Fresh Credit Allowed section of the report under the CVD, the CVD Cess, and the CVD Hcess columns. The system retrieves these values from the Counter Vailing Duty, the CVD Cess, and the Taxable Rounding columns respectively, if the value in YIRF (Issuing / Receiving Branch Plant) field is R, and the value in IOTY (Input/Output Type) is I in the F75I313Y table.

-

In the Debit section of the report under the CVD, the CVD Cess, and the CVD Hcess columns. The system retrieves these values from the Counter Vailing Duty, the CVD Cess, and the Taxable Rounding columns respectively, if the value in YIRF (Issuing / Receiving Branch Plant) is I, and the value in IOTY (Input/Output Type) is O in the F75I317Y table.

-

The system also displays the CVD, the CVD Cess, and the CVD Hcess columns under the Balances section. If the value in YIRF (Issuing / Receiving Branch Plant) is R and in IOTY (Input/Output Type) is I in F75I317Y, then the system displays values in these columns equal to the sum of values in the corresponding columns of the Opening Balance of Duty in Credit and Fresh Credit Allowed sections. Otherwise, the system displays values in these columns by subtracting values in the Debit section of the report from values in the corresponding columns of the Opening Balance of Duty in Credit section.

|

Note: In the reports, the field labeled Other includes only AED and SED data, and the Customs Duty field is not populated. |

14.4.2 Prerequisites

Before you run the Entry Book of Duty Credit on Inputs and Capital programs, perform the following tasks:

-

Create a tax type and tax regime. It should include BED, CESS, HCESS, AED, and SED.

-

Complete the setup in Credit Distribution Percentage program for mapping tax types to populate CVD components.

-

Set the item branch category code as input or capital goods.

-

For the procure-to-pay cycle, create a landed cost with the tax type created, create a purchase order with the landed cost, and receive it.

-

For the order-to-cash cycle, create an adjustment schedule with the tax types created, create a sales order with the adjustment schedule, update the sales order, and, distribute the credit using the Credit Distribution program to create debit entry in F75I313Y or F75I317Y.

-

Perform a credit distribution in the Credit Distribution program.

14.4.3 Running the Entry Book of Duty Credit on Inputs Report

Select Reports (G75IEXC7), Entry Book of Duty Credit on Inputs.

14.4.4 Setting Processing Options for Entry Book Credit on Inputs (R75I313S)

Processing options enable you to specify the default processing for programs and reports.

14.4.4.1 Data Selection

- Enter the Excise Unit To Be Processed

-

Specify the address number of the excise units to be processed.

- Enter the From Period

-

Specify the beginning date of the range of dates during which the transactions were executed.

- Enter the To Period

-

Specify the end date of the range of dates during which the transactions were executed.

- Type of Report

-

Specify whether to print a summary or a detailed report. Values are:

Blank: Detail

1: Summary

14.4.5 Running the Entry Book of Duty Credit on Capitals Report

Select Reports (G75IEXC7), Entry Book of Duty Credit on Capitals.

14.4.6 Setting Processing Options for Entry Book Credit on Capitals (R75I317S)

Processing options enable you to specify the default processing for programs and reports.

14.4.6.1 Data Selection

- Enter the Excise Unit To Be Processed

-

Specify the address number of the excise units to be processed.

- Enter the From Period

-

Specify the beginning date of the range of dates during which the transactions were executed.

- Enter the To Period

-

Specify the end date of the range of dates during which the transactions were executed.

- Type of Report

-

Specify whether to print a summary or a detailed report. Values are:

Blank: Detail

1: Summary

14.5 Setup Requirements for Cenvat Credit

This table lists the setup requirements for cenvat credit:

| Setup Requirement | Comments | Cross-Reference |

|---|---|---|

| Assign the percentage of cenvat credit to an item type. | You use the Credit Distribution Percentage program (P75I011) to assign the percentage of cenvat credit to an item type, such as CAP (capital goods) or INP (input). | |

| Create a request for a stock transfer from the manufacturing branch/plant to the personal consumption branch/plant. | You use P75I213A to create a request for a stock transfer from the manufacturing branch/plant to the personal consumption branch/plant. | |

| Perform an inventory issue from the personal consumption branch/plant. | You use the Purchase Order program (P4310) to perform an inventory issue. | |

| Set the value of the processing option Consumption Mode to 0 for purchase order receipts. | You set the processing option consumption mode to 0 in the Personal Consumption program (P75I309) to review existing records for purchase order receipts. | |

| Set the value of the processing option Consumption Mode to 1 for stock transfer orders. | You set the processing option consumption mode to 1 in the Personal Consumption program (P75I309) to review existing stock transfer orders. | |

| Offset the cenvat credit on raw materials. | You use the Item used For Personal Consumption program (P75I309) to offset the cenvat credit claimed during the procurement of raw materials. | |

| Calculate the duty liability on manufactured goods | You use the Item used For Personal Consumption program (P75I309) to calculate the duty liability on manufactured goods. |

14.6 Offsetting Cenvat Credit Against Excise Tax

This section provides an overview of how to offset Cenvat credit against excise tax, lists prerequisites, and discusses how to:

-

Set processing options for Credit Distribution (P75I012).

-

Offset Cenvat credit for excise and services against excise tax.

14.6.1 Understanding Cenvat Credit Offset Against Excise Tax

You use the Credit Distribution program (P75I012) to offset Cenvat credit for excise and services against the excise tax. For imports, you use this program to offset Cenvat credit for countervailing duty (CVD). You can also use this program to issue payments to the tax authority for any excise tax liabilities after offsetting the liabilities against Cenvat credit from excise and services. You can review all invoices for a particular period for which the excise has not been paid. You can make excise tax payments from the Cenvat accounts of raw materials, capital goods, and personal ledger account (PLA).

The excise-to-service transactions update the Credit Distribution table (F75I013). After you issue payments for excise or services, the system displays the voucher number generated when issuing payments to the tax authorities.

|

Note: You use the Credit Distribution Percentage program to define the percentage for CVD and services. |

The Credit Distribution program passes amount and account details to create a pair of credit and debit entries in the Account Ledger table (F0911) for the amounts being redistributed. The system generates and displays a batch number when the F0911 table entries are made.

|

Important: You generate general ledger entries for the taxes in the F0911 table only after you run the Sales Update program. |

14.6.1.1 Example of Credit Redistribution From Excise to Cenvat Accounts

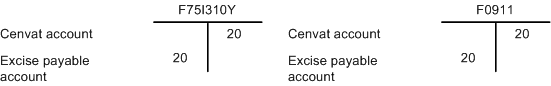

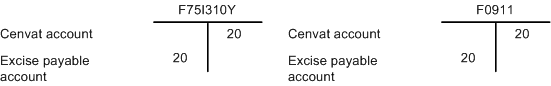

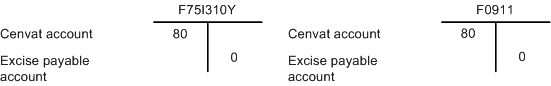

You run the Credit Distribution program to redistribute cenvat credit against excise tax. Suppose that you have a debit balance in your cenvat account of INR 100, and you generate an invoice to pay INR 20 for excise tax.

This example shows the accounting entries in the Excise - MODVAT/PLA Summary File table (F75I310Y) and the Account Ledger table (F0911):

When you redistribute the excise amount to the cenvat account, the system debits the cenvat account and credits the excise payable account:

After you reconcile the excise and cenvat accounts at the end of the month, the balances in the F75I310Y and F0911 tables are:

14.6.2 Prerequisites

Before you perform the tasks in this section, you must:

-

Set up the excise unit and the branch/plant relationship.

-

Update the debit amount with AR information and the credit amount with AP information at the recovery moment for the services in the Service Tax Cenvat table (F75I750).

-

Complete the order-to-cash and procure-to-pay cycles for excise and service taxes.

-

Set up the credit distribution percentage.

-

Set up the combination of Tax Type and Excise Unit account information using the Excise Account Master Maintenance program (P75I306).

The system retrieves account information for writing general ledger entries from the Excise Account Master table (F75I306).

-

Set up the combination of Tax Type and Excise Unit account information using the Excise Account Credit Redistribution Entry program (P75I3061).

The system retrieves account information for writing credit general ledger entries from the Excise Account Master - Credit Redistribution table (F75I3061).

14.6.3 Forms Used to Offset Cenvat Credit Against Excise Tax

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Credit Distribution - Excise | W75I012H | Excise periodic Processing (G75IEXC2H), Credit Distribution | Offset Cenvat credit for excise and services against excise tax.

Offset credits from different accounts and update the F75I750 table and the Excise - MODVAT/PLA Summary File table (F75I310Y). Update the cross-transactional settlement details in the F75I013 table. Update the Excise Payment Details table (F75I320Y). |

14.6.4 Setting Processing Options for Credit Distribution (P75I012)

Processing options enable you to specify the default processing for programs and reports.

14.6.4.1 Defaults

- Excise Unit

-

Specify the address book number of the excise unit.

- Operating Unit

-

Specify the operating unit of services.

- Service Category Code

-

Specify the a user-defined code from UDC table 41/01 that indicates the service category classification. Examples are:

01: Telephone

02: Transport

03: Cleaning

- Tax Authority - Excise

-

Specify the address book number for the tax authority of the excise unit.

- Tax Authority - Service

-

Specify the address book number for the tax authority of the service unit.

14.6.4.2 Tax Type

- Additional Excise Duty

-

Specify a user-defined code from UDC table 75I/GT that identifies the tax type for the additional excise duty component of tax.

- Basic Excise Duty

-

Specify a user-defined code from UDC table 75I/GT that identifies the tax type for the basic excise duty component of tax.

- Special Excise Duty

-

Specify a user-defined code from UDC table 75I/GT that identifies the tax type for the special excise duty component of tax.

- Education Cess

-

Specify a user-defined code from UDC table 75I/GT that identifies the tax type for the education cess component of tax.

- Secondary Higher Education Cess

-

Specify a user-defined code from UDC table 75I/GT that identifies the tax type for the higher secondary education cess component of tax.

- Counter Veiling Duty

-

Specify the user-defined code CVD (Counter Vailing Duty) from UDC table 75I/GT to indicate the tax type.

- Education Cess on CVD

-

Specify the user-defined code CVDCS (Education Cess - CVD) from UDC table 75I/GT to indicate the tax type.

- Higher Education Cess on CVD

-

Specify the user-defined code CVHC (Higher Education Cess - CVD) from UDC table 75I/GT to indicate the tax type.

- Service Tax

-

Specify the user-defined code ST (Service Tax) from UDC table 75I/GT to indicate the tax type.

- Education Cess on ST

-

Specify the user-defined code STCS (Education Cess - ST) from UDC table 75I/GT to indicate the tax type.

14.6.4.3 Item Type

- Services

-

Specify the value that describes the item type for services.

- Raw Material

-

Specify the value that describes the item type for raw materials.

- Capital Goods

-

Specify the value that describes the item type for capital goods.

- Personal Ledger Account

-

Specify the value that describes the item type for personal ledger account.

14.6.5 Offsetting Cenvat Credit for Excise and Services Against Excise Tax

Access the Credit Distribution - Excise form.

- Date From

-

Enter the beginning date in the date range for which you want to display invoices.

- Payment Date

-

Enter the date on which the payments are made to the tax authority.

14.6.5.1 Raw Materials, Capital Goods, PLA

These fields appear under the Credit Utilised heading for various tax types.

- Basic Excise Duty, Education Cess, Special Excise Duty, Additional Excise Duty, Higher Education Cess

-

Enter the credit utilized for the appropriate tax.

|

Note: (Release 9.1 Update) In the Credit Distribution - Excise program (P75I012) if you select the Education Cess (CESS) tax type or the Higher Education Cess (HCESS) tax type, the credit distribution does not happen in the Services, Raw Material, and Capital Goods tab. The CESS and HCESS tax types are removed as part of the budget; therefore, you must not add these tax types. |

14.6.5.2 Service Tax

These fields appear under the Credit Utilised heading on the Service Tax tab.

- Service Tax Education Cess

-

Enter the credit utilized for the appropriate tax.

14.6.5.3 CVD

These fields appear under the Credit Utilised heading on the CVD tab.

- Counter Veiling Duty - RM, Education Cess - RM, Counter Veiling Duty - CG, Education Cess - CG

-

Enter the credit utilized for the appropriate tax.

14.7 Offsetting Cenvat Credit Against Service Tax

This section provides overviews of how to offset Cenvat credit against service tax and credit distribution services for advance service tax payments. This section also lists prerequisites, and discusses how to:

-

Set processing options for Credit Distribution - Services (P75I013).

-

Offset Cenvat credit for excise and services against service tax.

14.7.1 Understanding How to Offset Cenvat Credit Against Service Tax

You use the Credit Distribution - Services program (P75I013) to offset Cenvat credit for excise and services. You also use this program to issue payments to the tax authority for any service tax liabilities after offsetting the liabilities against Cenvat credit from excise and services. You must pay the services from the Cenvat accounts for services, raw materials, and capital goods in accordance with the percentage defined in the Credit Distribution Percentage application, and then create an AP voucher in a specified order.

The service-to-excise transactions update the F75I013 table. After you issue payments for excise or services, the system displays the voucher number generated when issuing payments to the tax authorities.

The Credit Distribution - Services program passes amount and account details to create a pair of credit and debit entries in the Account Ledger table (F0911) for the amounts being redistributed. The system generates and displays a batch number when the F0911 table entries are made.

|

Important: You generate general ledger entries for the taxes in the F0911 table only after you run the Sales Update program. |

14.7.2 Understanding Credit Distribution Services for Advance Service Tax Payments

Each month, before you pay tax amounts due, you can offset your liabilities with credits. For example, if you made an advance service tax payment, you can use that credit amount to offset amounts due for service tax, education cess, and higher education cess.

You use the Credit Distribution Services program to apply advance service tax payments to liabilities. The Services tab on the Service Payments form includes:

-

Rows for service tax, education cess, and higher education cess

-

Columns for the actual balance, available balance, credit utilized, and advanced service tax utilized for each of the tax types

-

A field for the available advance service tax

You use the amount in the Available Advance Service Tax field to offset the liabilities for the service tax, education cess, and higher education cess. As you enter amounts in the Advanced Service Tax Utilized column for the tax types, the values in other fields change to reflect the amount of the advance service tax that you apply to the taxes. The value in the Net Amount To be Paid field in the header of the form also changes as you apply the advanced service tax payment to the taxes. After you offset the liabilities with the advance payment amount, you click OK to create a voucher for the amount in the Net Amount To be Paid field.

14.7.3 Prerequisites

Before you perform the tasks in this section, you must:

-

Set up the relationship between an operating unit and a business unit or cost center.

-

Update the debit amount with AR information and the credit amount with the AP information at the recovery moment for the services in the F75I750 table.

-

Complete the order-to-cash and procure-to-pay cycles for the excise and service taxes.

-

Set up the credit distribution percentage.

-

Set up the combination of Tax Type and Excise Unit account information using the Excise Account Master Maintenance program (P75I306).

The system retrieves account information for writing general ledger entries from the Excise Account Master table (F75I306).

-

Set up the combination of Tax Type and Excise Unit account information using the Excise Account Credit Redistribution Entry program (P75I3061).

The system retrieves account information for writing credit general ledger entries from the Excise Account Master - Credit Redistribution table (F75I3061).

Before you apply advance service tax payments to liabilities:

-

Post and pay vouchers that you created for advance service tax payments.

-

Post the payment.

-

Reclassify journal entries as necessary.

-

Run the Supplementary TR6 program (R75I705) to update the Service Tax Cenvat File - 09 (F75I750), Advance Service Tax Balance File (F75I760), and Advance Service Tax Payment File (F75I754) tables.

14.7.4 Forms Used to Offset Cenvat Credit Against Service Tax

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Service Payments | W75I013G | Excise periodic Processing (G75IEXC2H), Credit Distribution - Services | Offset Cenvat credit for excise and services against service tax.

Offset credits from different accounts, and updates the F75I750 table and the Excise - MODVAT/PLA Summary File table (F75I310Y). Update the cross-transactional settlement details in the F75I013 table. To apply advance service tax payments to liabilities, specify the amount of prepaid service tax to apply to service tax, education cess, and higher education cess on the Services tab. |

14.7.5 Setting Processing Options for Credit Distribution - Services (P75I013)

Processing options enable you to specify the default processing for programs and reports.

14.7.5.1 Defaults

- Operating Unit

-

Specify the operating unit of the services.

- Year

-

Specify the year for which you want to make the payments.

- Calender Month

-

Specify the number of the month for which you want to run the report. For example, enter 01 for January.

- Excise Unit

-

Specify the address book number of the excise unit.

- Address Number-Excise Tax Authority

-

Specify the address book number for the tax authority of the excise unit.

14.7.5.2 From Tax Type

Use these processing options to specify a value from the UDC table 75I/GT to indicate the tax type. You specify these tax types:

-

Basic Excise Duty

-

Education Cess- Basic Excise Duty

-

Special Excise Duty

-

Higher Education Cess- Basic Excise Duty

-

Special Excise Duty

-

Additional Excise Duty

-

Counter Veiling Duty

-

Education Cess-Counter Veiling Duty

-

Higher Education Cess-Counter Veiling Duty

-

Service Tax

-

Education Cess-Service Tax

-

Higher Education Cess- Service Tax

-

(Release 9.1 Update) Krishi Kalyan Cess- Service Tax

14.7.5.3 Item Type

- Raw Material

-

Specify the accounts from which the credits are utilized for offsetting taxes on raw materials.

- Capital Goods

-

Specify the accounts from which the credits are utilized for offsetting taxes on capital goods.

- Services

-

Specify the accounts from which the credits are utilized for offsetting taxes on services.

14.7.6 Offsetting Cenvat Credit for Excise and Services Against Service Tax

Access the Service Payments form.

14.7.6.1 Assign to

- Operating Unit

-

The system displays the operating unit number that you entered in the Operating Unit processing option. You must specify the unit number in the processing option; you cannot change it on this form.

- Tax Type

-

Enter a user-defined code from UDC table 75I/GT that identifies the tax type.

- Service Category Code

-

Enter a user-defined code from UDC table 41/01 that indicates the service category classification. Examples are:

01: Telephone

02: Cleaning

03: Transport

- Net Amount To be Paid

-

The system displays the amount that needs to be paid for the tax type selected. The value in this field changes as you apply the advance service tax to the liabilities. When you click OK, the system creates a voucher for the amount in this field.

14.7.6.2 Services

These fields are located under the Credit Utilised heading for the Services tab.

- Actual Balance

-

The Actual Balance column includes fields for Service Tax, Education Cess, and Higher Education Cess. The value that the system displays in this field is the beginning balance plus the credit amount, minus the amount utilized.

- Available Balance

-

The Available Balance column includes fields for Service Tax, Education Cess, and Higher Education Cess. The value that the system displays in this field is the ending balance.

- Credit Utilised

-

The Credit Utilised column includes fields for Service Tax, Education Cess, and Higher Education Cess.

Note:

(Release 9.1 Update) In the Service Payments program (P75I013) if you select the Education Cess (CESS) tax type or the Higher Education Cess (HCESS) tax type, the credit distribution does not happen in the Services, Raw Material, and Capital Goods tab. The CESS and HCESS tax types are removed as part of the budget; therefore, you must not add these tax types. - Advance Service Tax Utilized

-

The Advance Service Tax Utilized column includes fields for Service Tax, Education Cess, and Higher Education Cess. Enter the amount of advance service tax that you use to offset the amount due for each taxes.

- Available Advance Service Tax

-

The system displays the amount of service tax that was prepaid and that is available to offset the liabilities of taxes that are due. As you enter amounts in the Advance Service Tax Utilized field, the value in this field decreases.

14.8 Setup Requirements for Offsetting Cenvat Credit Against Excise Tax

This table lists the tax setup requirements for offsetting cenvat credit against excise tax:

| Setup Requirement | Comments |

|---|---|

| Set up the excise unit and the branch/plant relationship. | You use the Excise Unit Branch Plant Cross Reference program (P75I304) to create a relationship between an excise unit and a business unit. |

| Update the debit amount with AR information and the credit amount with AP information. | Update the debit amount with AR information and the credit amount with AP information at the recovery moment for the services in the Service Tax Cenvat table (F75I750). |

| Complete the O2C and P2P cycles for excise and service taxes. | See Setup Requirements for Excise Tax for P2P and O2C Cycles. |

| Set up the credit distribution percentage. | You use the Credit Distribution Percentage program (P75I011) to set up credit distribution percentage. |

| Offset cenvat credit for excise and services against excise tax. | You use the Credit Distribution program (P75I012) to offset Cenvat credit for excise and services against the excise tax. |

14.9 Setup Requirements for Offsetting Cenvat Credit Against Service Tax

This table lists the setup requirements for offsetting cenvat credit against service tax:

| Setup Requirement | Comments |

|---|---|

| Set up the relationship between an operating unit and a business unit or cost center. | You use the Excise Unit Branch Plant Cross Reference program (P75I304) to create a relationship between an excise unit and a business unit. |

| Complete the O2C and P2P cycles for excise and service taxes. | See Setup Requirements for Excise Tax for P2P and O2C Cycles. |

| Update the debit amount with AR information and the credit amount with the AP information. | Run the Service Tax Reclassification AP program to review the service payments for a defined period and also determine whether the tax lines require classification. Run the Service Tax Reclassification AR program to review the receipts for a defined period and also determine whether the tax lines require classification. |

| Set up the credit distribution percentage. | You use the Credit Distribution Percentage program (P75I011) to set up credit distribution percentage. |

| Offset cenvat credit against excise tax | You use the Credit Distribution - Services program (P75I013) to offset Cenvat credit for excise and services. |