5 Processing Suspended VAT for Spain (Release 9.1 Update)

|

Note: If you used the JD Edwards EnterpriseOne software for Spain prior to the enhancement that enables you to set up the suspended VAT functionality, then after creating the suspended VAT setup, you must run the R704CONV table conversion program to copy existing records for GLC and tax explanation codes from the Taxes table (F0018) to the Suspended VAT table (F704100). Also, if the Suspended IVA Generation table (F743B14I) has transactions processed with the solution prior to the enhancement, you must run the R703B14IC table conversion program to copy records from F73B141 table to F704200 table. R703B141C copies only those records that also exist in the F704100 table. You run the conversion programs once only. |

This chapter contains the following topics:

5.1 Understanding Suspended VAT

The system enables companies to defer paying VAT until they are able to do so. Since January 1, 2014, Spanish law allows companies with annual turnover less than 2 million Euros, to defer the booking of VAT payable until receipt of complete or partial payment for the invoice. Instead of booking VAT to an active VAT payable account at the time of the sale, the companies must hold the VAT in suspense until they receive the payment. This deferment of VAT payable is called suspended VAT. In Spain, the suspended VAT works on these conditions:

-

Suspended VAT must be reclassified and posted to the final VAT account on the payment receipt. For deferred payments, they are posted on the bank confirmation date.

-

Companies must perform the reclassification latest by December 31st of the year following the one the invoice was created. For example, if the invoice was created in January, 2014, the last date for performing VAT reclassification is December 31st, 2015.

In Spain, businesses report and remit VAT to the government on a periodic basis. The amount that a business owes is calculated as the difference between the VAT payable (generated in the JD Edwards EnterpriseOne Accounts Receivable system) and the VAT recoverable (generated in the JD Edwards EnterpriseOne Accounts Payable system) amounts.

When you post a voucher, the system inserts into F704100.

With the suspended VAT processing, the system updates the F704100 table with AP tax detailed information after successfully completing the voucher posting.

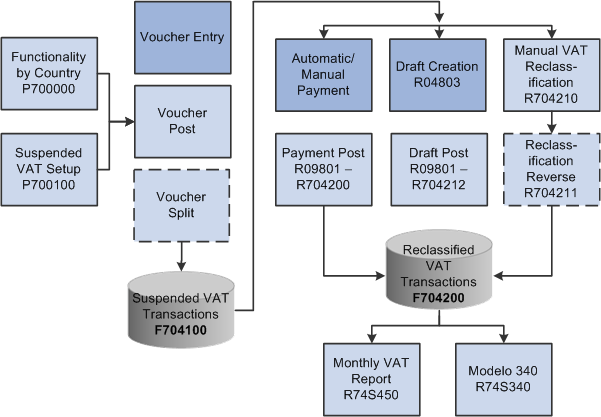

This diagram illustrates the suspended VAT process for Spain:

5.2 Processing Suspended VAT for Spain

This section provides overviews of tax explanation codes and AAIs for suspended VAT in Spain, voucher voids processing for suspended VAT transactions, and system setup for suspended VAT in Spain, and discusses how to set up suspended VAT functionality in Spain.

5.2.1 Understanding Tax Explanation Codes and AAIs for Suspended VAT in Spain

To process suspended VAT, you must set up tax explanation codes to be included in suspended VAT processing. The system allows tax explanation codes V and VT for suspended VAT.

When you make a payment, post a draft, or manually run the Suspended VAT Generation program, the system uses the tax rate for VAT recoverable to post the recognized VAT to a VAT recoverable account.

You must set up the PTxxxx automatic accounting instructions (AAIs) for the GL offsets.

You must define the exception reclassification method for the combination of document type and tax area, if applicable. If the system does not find any exception method setup, it processes based on the default method for the country.

|

Note: You must correctly set up AAI PTxxxx with Suspended VAT account for suspended transactions. |

5.2.2 Understanding Voucher Voids Processing for Suspended VAT Transactions

When you use the General Ledger Post program (P09801) to post vouchers, the system creates the automatic entries for the vouchers according to the AAIs that you set up, and the processing options that you set up. The General Ledger Post program selects the unposted transactions for the selected batch from the Accounts Payable Ledger table (F0411). During the post process, the system processes records for voided or modified vouchers in the F704100 table based on their reclassification status. This table shows the voucher status and system actions for updating the F704100 table:

| Voucher Status | Voucher Reclassification Status | System Action on F704100 |

|---|---|---|

| Voided | Not reclassified | Updates tax amount with a value of 0 and VOD with V. |

| Modified | Not reclassified | Updates tax amount and VOD with value of C. |

| Voided | Reclassified | Creates a new line in the F704100 with a value of C for void amount as well as for VOD. |

| Modified | Reclassified | Creates a new line in the F704100 with a value of C for modification amount as well as for VOD. |

5.2.2.1 Special Consideration in Voucher Reclassification Process

To reclassify suspended vouchers at payment or draft post, it is required that voucher is posted first. If voucher is posted after it is inserted in F704100, the system posts the voucher lines in F704100 with status X. This unique status enables the system to select those voucher lines while processing the manual reclassification UBE. The system updates F704100 if one of the following conditions are true:

-

Reclassification method is P and the payment is posted before voucher posting.

-

Reclassification method is D, document type is not P1, and the payment is posted before voucher posting

-

Reclassification method is D, document type is P1, and the draft is posted.

5.2.3 Understanding the System Setup for Suspended VAT in Spain

Use the Functionality by Country Setup program (P700000) to specify the country to create active suspended VAT functionality for AP. You must specify the functionality for the country as SUSPVATAP.

Use the Suspended VAT Setup APPL program (P700100) to hold the activation mechanism of suspended VAT by country at these two levels:

-

Suspended VAT Setup By Country: Use this setup to define the AAI prefix for the final VAT account and the suspended VAT default method by country.

-

Other Setup: Use this setup to define:

-

GLC included by country and by company.

-

Tax explanation codes to be included in suspended VAT processing.

-

Exceptions method for specific combinations of document type and tax area.

-

5.2.4 Forms Used to Set Up Suspended VAT Functionality in Spain

| Form Name | FormID | Navigation | Usage |

|---|---|---|---|

| Functionalities By Country | W700000A | General Functionalities by Country (G7010), Functionality by Country Setup | Enter the country for VAT suspended functionality. |

| Working with Suspended VAT Setup by Country | W700100A | Suspended VAT (G701010), Suspended VAT Setup | Review the suspended VAT setup by country. |

| Suspended VAT Setup by Country | W700100B | Click Add on the Working with Suspended VAT Setup by Country form. | Specify the AAI prefix for the final VAT account and the suspended VAT default method. |

| Suspended VAT - G/L Offset | W700100F | Select the Suspended GL Offsets option from the Row menu on the Working with Suspended VAT Setup by Country form. | Set up GLC. |

| Tax Explanation Code | W700100D | Select the Suspended Tax Exp. option from the Row menu on the Working with Suspended VAT Setup by Country form. | Set up tax explanation codes. |

| Exception Method by Document Type & Tax Area | W700100E | Select the Exception Method option from the Row menu on the Working with Suspended VAT Setup by Country form. | Set up exceptions by document type and tax area. |

5.2.5 Setting Up Suspended VAT Functionality in Spain

Access the Functionalities By Country form.

Figure 5-2 Functionalities By Country form

Description of ''Figure 5-2 Functionalities By Country form''

- Country

-

Enter a user-defined code (00/LC) that identifies the identifies a localization country.

You can attach the country-specific functionality that is triggered based on this country code using the country server methodology in the base EnterpriseOne product.

- Functionality

-

Enter a user-defined code (00/FC) to specify the functionality to be enabled by the specified country. The value allowed to enable suspended VAT functionality is SUSPVATAP.

Access the Suspended VAT Setup By Country form.

Figure 5-3 Suspended VAT Setup By Country form

Description of ''Figure 5-3 Suspended VAT Setup By Country form''

- AAI Prefix for Final VAT Account

-

Enter a code that identifies the AAI item that the system concatenates with the Tax Area G/L Offset to locate the final VAT account. For example, if you have the G/L Offset XXXX and you enter PI as the value for prefix, the system searches for the AAI item PIXXXX.

- Reclassification Method

-

Enter a value to specify when the system reclassifies tax amount from the suspended VAT account to the final VAT account. Values are:

D (Draft): Reclassifies VAT during the payment post process except for drafts. Draft (P1) documents are reclassified when the draft is posted successfully.

M (Manual): Reclassifies VAT amount when you define it at an instance different from payment or draft posting moment.

P (Payment): Reclassifies VAT during the payment post process.

5.3 Reclassifying Suspended VAT for Spain

This section provides overviews of reclassification of suspended VAT process for Spain and VAT reclassification reports, and discusses how to:

-

Run the VAT Reclassification at Payment Setup report for Spain.

-

Set processing options for the VAT Reclassification at Payment Setup report (R704200).

-

Run the Manual VAT Reclassification report for Spain.

-

Run the Manual VAT Reclassification report (R704210).

-

Run the Reverse VAT Reclassification report for Spain.

-

Run the Reverse VAT Reclassification report (R704211).

-

Run the VAT Reclassification on Draft Post Setup report for Spain.

-

Run the VAT Reclassification on Draft Post Setup report (R704212).

5.3.1 Understanding the Reclassification of Suspended VAT Process for Spain

Use JD Edwards EnterpriseOne localized software to reclassify suspended VAT for Spain based on method and payment document types. The system reclassifies VAT in this way:

| Method | Payment Document Type (DCTM) | VAT Reclassification |

|---|---|---|

| Payment | PN, PK, or P1 | Payment post |

| Draft | PN or PK | Payment post |

| Draft | P1 | Draft post |

| Manual | Any method | Manual selection |

The system performs the reclassification at voucher exchange rate excluding VAT on the exchange rate differences.

During the reclassification process, the system:

-

Selects suspended VAT transactions from F704100.

-

Updates suspended VAT transactions in F704100.

-

Inserts reclassifications in F704200.

-

Generates reclassification journal entries for suspended VAT voucher lines.

|

Note: Do not modify a voucher line that is partially reclassified. |

5.3.1.1 Selection from F704100 During Reclassification

Based on the status of voucher lines in F704100, the system selects lines from F704100 based on these conditions:

| Voucher lines Status in F704100 | Process | Selects lines from table |

|---|---|---|

| P | Payment Post | Lines identified with method P and D (if not drafts (DCTM <>P1)) |

| P | Draft Post | Lines identified with method D if they are drafts (DCTM = P1) |

| P | Manual Reclassification | Lines identified with any method |

5.3.1.2 Update of F704100 During Reclassification Process

After selecting voucher lines from F704100, the system updates those lines with a status of R when it is completely reclassified. If the voucher line is partially reclassified, the status for that line remains P. When the system changes the status to R, it sets the open tax amount for that line to 0.

5.3.2 Understanding the VAT Reclassification Reports

You can run reports to perform the VAT reclassification process.

5.3.2.1 Suspended VAT Reclassification at Payment Setup (R704200)

The VAT Reclassification at Payment Setup program reclassifies VAT amount at the time of payment post.

The system executes VAT Reclassification at Payment Setup with the same version name as the General Ledger Post Report program. If it does not find the same version name, it executes the ZJDE0001 version. The VAT Reclassification at Payment Setup report runs by the payment batch number. The UBE checks the F704100 table for suspended voucher lines that are included in the payment batch. Then, it selects lines with status P and method in this way:

-

P (Payments) for all payment document types

-

D (Drafts) with value for payment document type (DCTM) different from P1

The VAT Reclassification at Payment Setup program:

-

Updates F704100 with the tax open amount for domestic and foreign transactions. If the tax open amount is 0, it updates the reclassification status of those records with R.

-

Inserts reclassification details in F704200.

-

Generates reclassification journal entries for suspended VAT voucher lines in F0911.

During the payment post process when the base system has tax rules and the G/L Post version set up to adjust the VAT amount with discount taken, the system updates F0018 for the paid document. The system also updates F704100 when F0018 is updated for discounts in the base AP module.

5.3.2.1.1 Reverse Reclassification on Payment Void

During the payment post for a void payment, the VAT Reclassification at Payment Setup program voids the reclassification. You can set the processing option to specify whether to reverse the VAT reclassification when voiding a payment with draft.

During the post of a payment void, the system:

-

Reverses reclassification if it exists in F704200 with method P or D.

-

Updates suspended VAT transactions in F704100 to increase the open tax amount and modifies status to P if required.

-

Inserts the void reclassification entries in F704200.

-

Generates reverse reclassification journal entries.

5.3.2.2 Manual VAT Reclassification(R704210)

Run the Manual VAT Reclassification report to reclassify pending suspended VAT transactions for any reclassification method including the erroneous reclassifications. When you run this report, the system processes suspended voucher lines that exist in F704100 based on the processing options. This report selects voucher lines from F704100 with tax open amount different from 0 and with status of P, X, or E.

|

Note: When you post a payment or a draft, the system automatically initiates the reclassification depending on the method specified, but the reclassification happens after posting. So, in this case, if a reclassification ends in error, the system changes voucher status for these erroneous reclassifications to E in F704100. |

5.3.2.3 Reverse VAT Reclassification (R704211)

Run the Reverse VAT Reclassification report to reverse reclassifications saved in F704200. You must specify the execution number in the processing options to specify the reclassified voucher line that you want to reverse. This report inserts void reclassifications in F704200 thereby reversing the journal entries.

5.3.2.4 VAT Reclassification on Draft Post Setup (R704212)

When you run the Post Outstanding Drafts program (R04803) in final mode and the system runs the General Ledger Post Report program successfully, the system automatically executes the VAT Reclassification on Draft Post Setup program (R704212) to reclassify the VAT amount at the time of draft post. The system executes the VAT Reclassification on Draft Post Setup report with the same version name as the General Ledger Post Report program. If the system does not find the same version name for General Ledger Post Report program, it executes the ZJDE0001 version based on R04803, to which the ZJDE0001 version is assigned.

The VAT Reclassification on Draft Post Setup program checks the F704100 table for suspended voucher lines that are included in the payment batch. Then, it selects lines with status P and method D with payment document type P1. If draft corresponds to a partial payment, then this program reclassifies the VAT amount proportionally.

The VAT Reclassification on Draft Post Setup program:

-

Updates F704100 with the tax open amount for domestic and foreign transactions. If the tax open amount is 0, it updates the reclassification status of those records with R.

-

Inserts reclassification details in F704200.

-

Generates reclassification journal entries for suspended VAT voucher lines in F0911.

|

Note: To reclassify suspended VAT transactions during draft post, you must leave the Summary Journal Entries processing option of the Post Outstanding Drafts program (R04803) program blank. |

5.3.2.5 Voucher Split for Reclassified Vouchers

You use the Speed Status Change program (P0411S) to split the voucher and assign the appropriate due dates rather than changing the voucher to accommodate multiple pay items with different due dates. However, when you run the Speed Status Change program for Spain, these guidelines apply:

-

For suspended vouchers that are not reclassified, the program splits vouchers in F0411, F0018, and F704100 tables.

-

For suspended vouchers that are reclassified, the program does not split any vouchers due to data integrity reasons. It displays this error message: Voucher with Suspended VAT Not Eligible for Split.

The error message also advises you to use the manual payment method for partial payments.

5.3.3 Running the VAT Reclassification at Payment Setup Report for Spain

Select Suspended VAT (G701010), VAT Reclassification at Payment Setup

5.3.4 Setting Processing Options for the VAT Reclassification at Payment Setup Report (R704200)

Processing options enable you to specify the default processing for programs and reports.

5.3.4.1 Process

- 1. Journal Entry Document Type

-

Enter a value from UDC table 00/DT to identify reclassification journal entries with a different document type.

Leave it blank to create the entries with document type JE.

- 2. Final Account ID to reclassify the VAT Suspended

-

Specify the VAT account to which the system should post the VAT amounts. If you leave this processing option blank, the system uses the account related to AAI prefix defined in the suspended VAT setup.

5.3.4.2 Void Draft

- 1. Paid Draft Void Reclassification Flag

-

Use this processing option to specify whether to reverse the VAT reclassification when voiding a payment associated to a draft payment void. Values are:

Blank: Void the VAT reclassification associated with the draft.

1: Do not void the VAT reclassification associated with the draft.

Note:

If this processing option is disabled, you should use the Reverse Reclassification UBE (R704211) to reverse the reclassification.

5.3.5 Running the Manual VAT Reclassification Report for Spain

Select Suspended VAT (G701010), Manual VAT Reclassification

5.3.6 Setting Processing Options for the Manual VAT Reclassification Report (R704210)

Processing options enable you to specify the default processing for programs and reports.

5.3.6.1 Process

- 1. Journal Entry Document Type

-

Enter a value from UDC table 00/DT to identify reclassification journal entries with a different document type. Leave it blank to create the entries with document type JE.

- 2. Final Account ID to reclassify VAT Suspended

-

Specify the VAT account to which the system should post the VAT amounts. If you leave this processing option blank, the system uses the account related to AAI prefix defined in the suspended VAT setup.

- 3. Final of Proof Mode

-

Specify whether to run the report in proof or final mode. Values are:

Blank: Proof mode.

1: Final mode.

- 4. Reclassification Date

-

Enter the value for journal entry reclassification date. If you leave this field blank, the system uses the current date.

Note:

If you run the Manual VAT Reclassification report for voucher lines with status X or E, you must enter payment or draft post date in this processing option.

5.3.7 Running the Reverse VAT Reclassification Report for Spain

Select Suspended VAT (G701010), Reverse VAT Reclassification

5.3.8 Setting Processing Options for Reverse VAT Reclassification Report (R704211)

Processing options enable you to specify the default processing for programs and reports.

5.3.8.1 Process

- 1. Execution Number to be Reversed

-

Specify the reclassification execution number to select reclassifications to be reversed. If you leave this blank, the system does not run the report.

- 2. Reverse Date

-

Enter the value for journal entry reclassification date in case of reversals. If you leave this processing option blank, the system reverses the journal entry with the date same as original reclassification date.

- 3. Final of Proof Mode

-

Specify whether to run the report in proof or final mode. Values are:

Blank: Proof mode.

1: Final mode.

5.3.9 Running the VAT Reclassification on Draft Post Report for Spain

Select Suspended VAT (G701010), VAT Reclassification on Draft Post Setup

5.3.10 Setting Processing Options for VAT Reclassification on Draft Post Setup (R704212)

Processing options enable you to specify the default processing for programs and reports.

5.3.10.1 Process

- 1. Journal Entry Document Type

-

Enter a value from UDC table 00/DT to identify reclassification journal entries with a different document type. Leave it blank to create the entries with document type JE.

- 2. Enter the Final Account ID to reclassify the VAT Suspended

-

Use this processing option to specify the VAT account to which VAT amounts should be posted. If you leave this processing option blank, the system uses the account related to AAI prefix defined in the Suspended VAT Setup APPL program.

5.4 Printing the VAT Report by Tax Rate/Area for Spain

This section provides an overview of VAT report for Spain and discusses how to:

-

Run the VAT Report By Tax Rate/Area.

-

Set processing options for VAT Report By Tax Rate/Area (R74S450).

5.4.1 Understanding the VAT Report for Spain

You can run reports that include VAT amounts for payable amounts and accounts receivable.

5.4.1.1 VAT Report By Tax rate/Area (R74S450)

You can print the VAT Report By Tax Rate/Area to document accounts payable VAT.

You use the processing options on the VAT Report By Tax Rate/Area to create an accounts payable version of the report.

You also need to indicate which rate from the Intra-Community VAT tax rate/area is included on the report. On the Accounts Payable version, include the positive tax rate. On the Accounts Receivable version, include the negative tax rate.

Also, you can define the value in the Report By Country processing option to process the tax rate/area by country for the selected transactions.

The VAT Report By Tax Rate/Area sequentially numbers vouchers with suspended VAT and vouchers with regular VAT. The report prints suspended VAT transactions based on the payment date and amount. The report selects only those suspended vouchers from the F704200 table that were reclassified in the specified period and not the ones those were received in that period. The report groups transactions by document number and the execution number in the F704200 table.

For suspended VAT transactions, the report displays GL date in the voucher records under the GL Date column and payment method from the 74S/PM UDC table under the Payment Method column. The system assigns a value of C in the Payment Method column if the payment method is not set up in the 74S/PM UDC table.The report also displays the bank account number based on the payment method. If the payment method is C, the system retrieves F0030.CBNK corresponding to this value. If the payment method is blank, the system retrieves F0030.IBAN and when the payment method is O or T, the system retrieves F0413.DOCM.

5.4.1.2 VAT Summary Report

To review the total amount of VAT that is due to the Spanish government, print the summary VAT report. The report prints VAT totals by:

-

Register type

-

Register class

-

Previous balance

When you print the summary VAT Report By Tax Rate/Area, the system:

-

Creates a temporary workfile for Printing IVA Summary (F74093) that is based on the links that you establish for document type, register class, and register; and for the information in the F0018 table.

-

Prints an error report that lists records from the Taxes table that do not include register type or register class information.

-

Prints the summary VAT report.

5.4.2 Running the VAT Report By Tax Rate/Area

Select VAT Reports - Spain (G74S7011), VAT Report By Tax Rate/Area.

5.4.3 Setting Processing Options for VAT Report By Tax Rate/Area (R74S450)

Processing options enable you to specify the default processing for programs and reports.

5.4.3.1 Process

- 1. Report By Country

-

Enter a value from UDC table 00/EC to specify the country for which you want to run the report. The system applies an additional filter excluding the tax rate/areas which were not identified for that country in the Alternate Tax Rate/Area by Country program (P40082).

Leave this field blank to prevent the additional filtering for the alternate tax rate/area assignment functionality.

- 2. Process non-printed Vouchers/Invoices

-

Specify whether to print only the vouchers or invoices marked as printed, or only the ones not marked as printed, or to print all documents. Values are:

Blank: Process all documents.

1: Process only the non-printed documents.

3: Process only the printed documents.

- 3. Process documents

-

Specify whether to process the report for only suspended VAT documents or all documents.int only the vouchers or invoices marked as printed, or only the ones not marked as printed, or to print all documents. Values are:

Blank: Process only those documents that do not have suspended VAT.

1: Process only those documents that have suspended VAT.

2: Process all documents.

5.4.3.2 Print Options

- 1. Select '1' if you want to update as "printed" the selected records. If blank the records won't be marked.

-

Specify whether you want to mark the processed records as printed in the F0018 table or in the F704200 table for cash based operations.

- 2. Select the beginning number for the printed records. If blank will begin with one.

-

Specify the number from which you want to start the record numbering for the report. If you leave this field blank, the report prints record number beginning from 1.

- 3. Print report total by:

-

Specify how you want to print the total in the report. Values are:

Blank: Total by tax rate

1: Total by tax area

2: Total by tax area and tax rate

- 4. Print Detail or summarized report

-

Specify whether to print the detail report or summary report. Values are:

Blank: Print the detailed report.

1: Print the summary report.

- 5. Select '1' whether summarizing by documents the report doesn't have to print zero balance lines. Otherwise the zero balance lines will be printed

-

Specify whether the report should print zero balance lines while summarizing by documents. Enter 1 to avoid printing of zero balance lines.

- 6. Select the type of report

-

Specify whether to print the VAT Report By Tax Rate/Area (R74S450) for AR or AP. Values are:

Blank: Run the AR VAT Report By Tax Rate/Area

1: Run the AP AR VAT Report By Tax Rate/Area

Note:

The system uses this processing option in combination with the next processing option Tax Rate Line Number for Intra-Community VAT to run the AR or AP version of the report. - 7. Select the Tax Rate Line Number for Intra-Community VAT depending on the information to be printing on the report A/R or A/P.

-

Specify the tax rate for intracommunity VAT that you want to print on the report. This depends on whether you are running the AR version (Input VAT - minus sign) or the AP version (Output VAT - plus sign). Values are:

Blank: Print the tax rate on line 2 of Tax Rate/Area Revision.

1: Print the tax rate on line 3 of Tax Rate/Area Revision.

5.4.3.3 Date Selection

- From Date

-

Specify the beginning date for the system to use when it selects records for the report.

- Through Date

-

Specify the beginning date for the system to use when it selects records for the report.

5.4.3.4 Currency

- 1. Enter the Currency Code for As If currency display.

-

Specify the currency code for as-if currency reporting. This option enables you to print amounts in a currency other than the currency in which they are stored. Either enter a currency code or leave this option blank to print amounts in the currency in which they are stored.

- 2. Enter the As-Of date for processing the current exchange rate for the as-if currency.

-

Specify the as-of date for processing the exchange rate for the as-if currency. If you leave this option blank, the system uses the exchange rate that is valid for the system date.