1 JD Edwards EnterpriseOne System Reports

This chapter provides report navigation, overview information, and a report sample for the following reports:

-

Section 1.1, "Automatic Accounting Instructions Report (R0012P)"

-

Section 1.2, "AAI Report - One Line Per AAI Report (R0012P1)"

-

Section 1.7, "Tax Summary Report by Tax Authority Report (R0018P3)"

-

Section 1.8, "Tax Detail Report by Tax Authority Report (R0018P5)"

-

Section 1.9, "VAT Exception Report by Tax Area Report (R0018P7)"

-

Section 1.11, "Populate Tax Reporting Repository Report (R0018R)"

-

Section 1.12, "Tax Reconciliation File by Account ID Report (R0018R01)"

-

Section 1.13, "Tax Reconciliation File by Tax Rate Area Report (R0018R02)"

-

Section 1.14, "Batch Approval / Post Security by Manager Report (R0024P)"

-

Section 1.16, "Supplemental Data by Data Type Report (R00640)"

-

Section 1.17, "Supplemental Data by Business Unit Report (R00650)"

|

Note: This reports guide discusses reports that are commonly used in the JD Edwards EnterpriseOne system. This reports guide does not provide an inclusive list of every report that exists in the system.This guide is intended to provide overview information for each report. You must refer to the appropriate JD Edwards EnterpriseOne implementation guide for complete report information. |

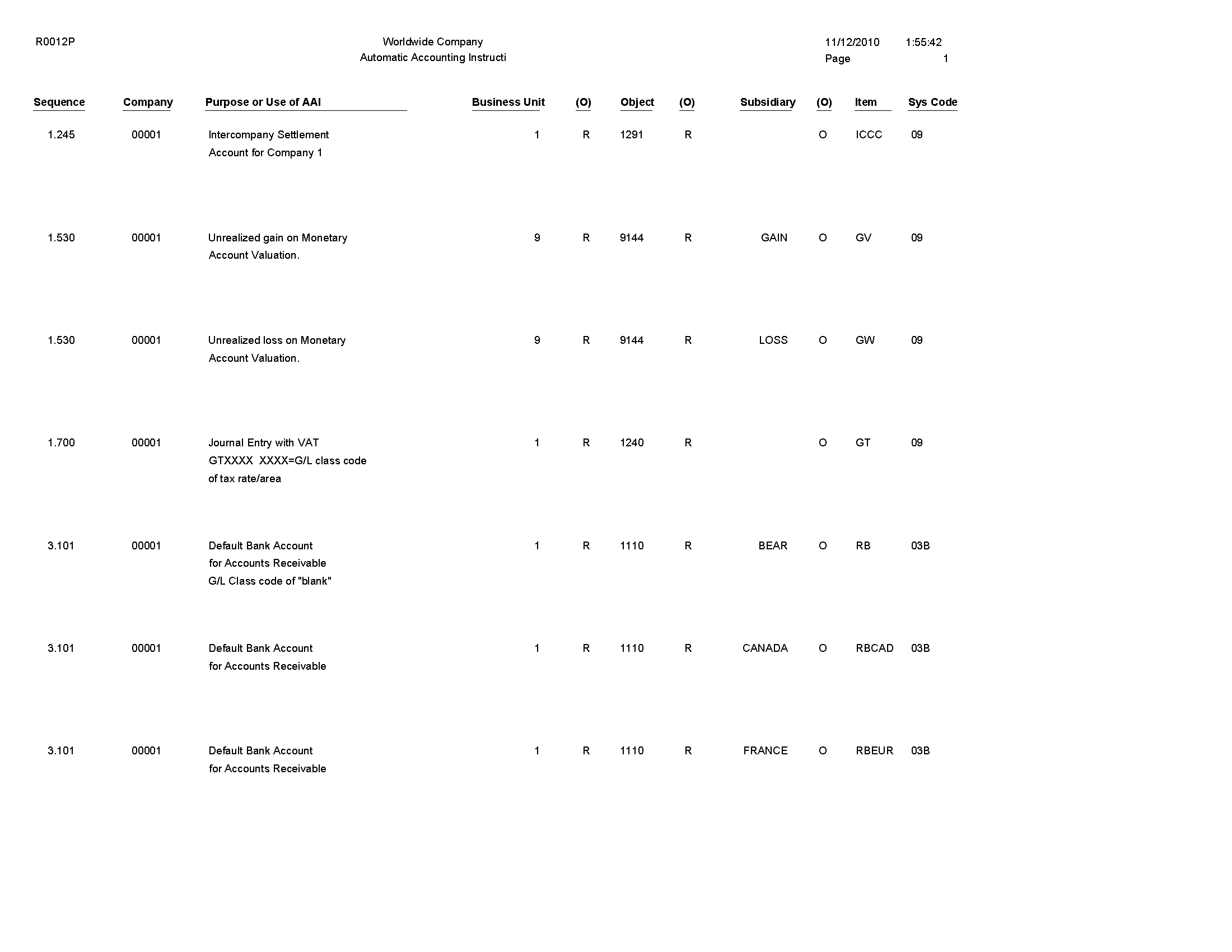

1.1 Automatic Accounting Instructions Report (R0012P)

On the General Accounting System Setup menu (G0941), select Automatic Acctg Instructions. On the Work With Automatic Accounting Instructions form, select Full AAI Report from the Report menu.

Use this report to review detailed Automatic Accounting Instructions (AAI) setup information such as purpose, business unit, object and subsidiary.

Review the Automatic Accounting Instructions report (R0012P):

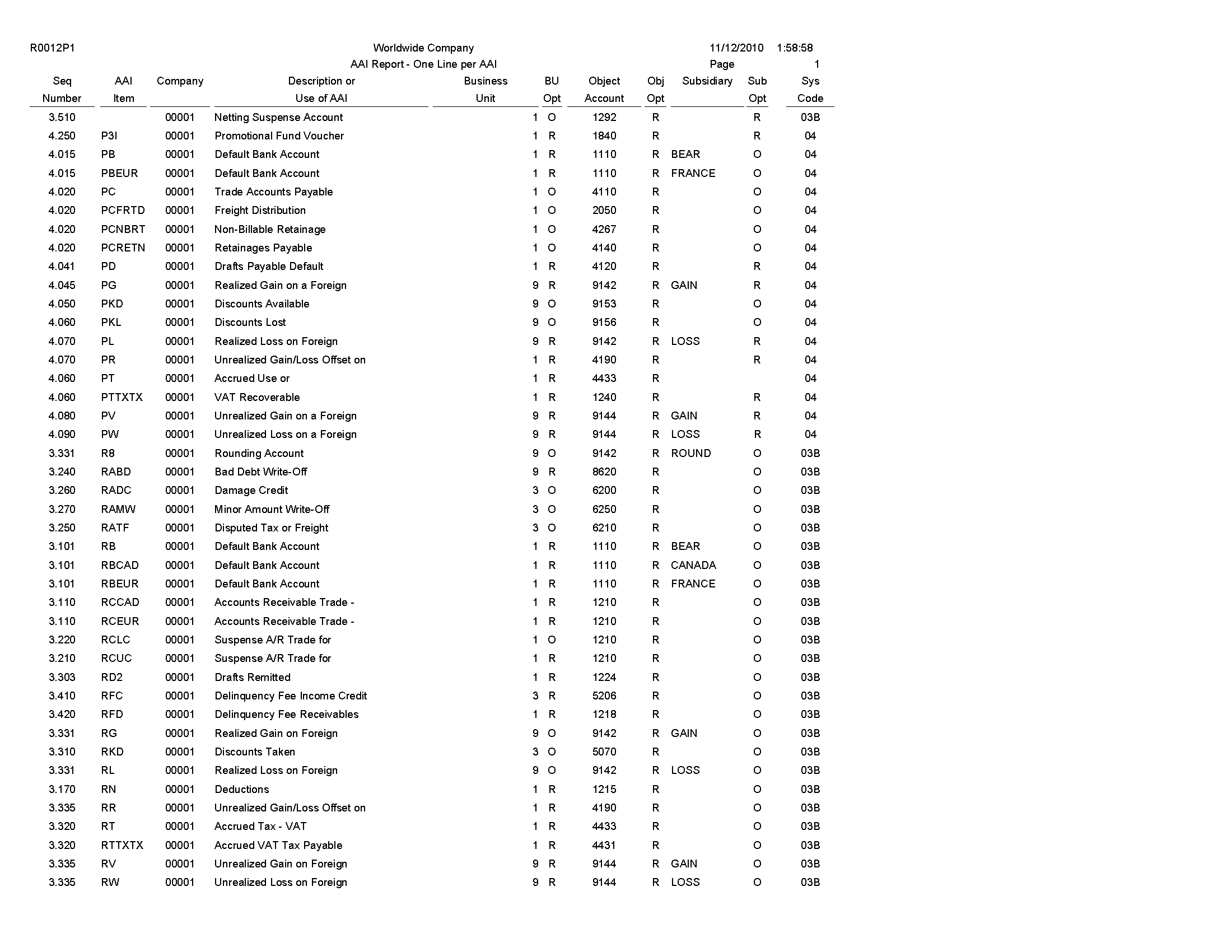

1.2 AAI Report - One Line Per AAI Report (R0012P1)

On the General Accounting System Setup menu (G0941), select Automatic Acctg Instructions. On the Work With Automatic Accounting Instructions form, select One Line per AAI from the Report menu.

Use this report to review detailed Automatic Accounting Instructions (AAI) setup information such as description, business unit, object and subsidiary.

Review the AAI Report - One Line per AAI report (R0012P1):

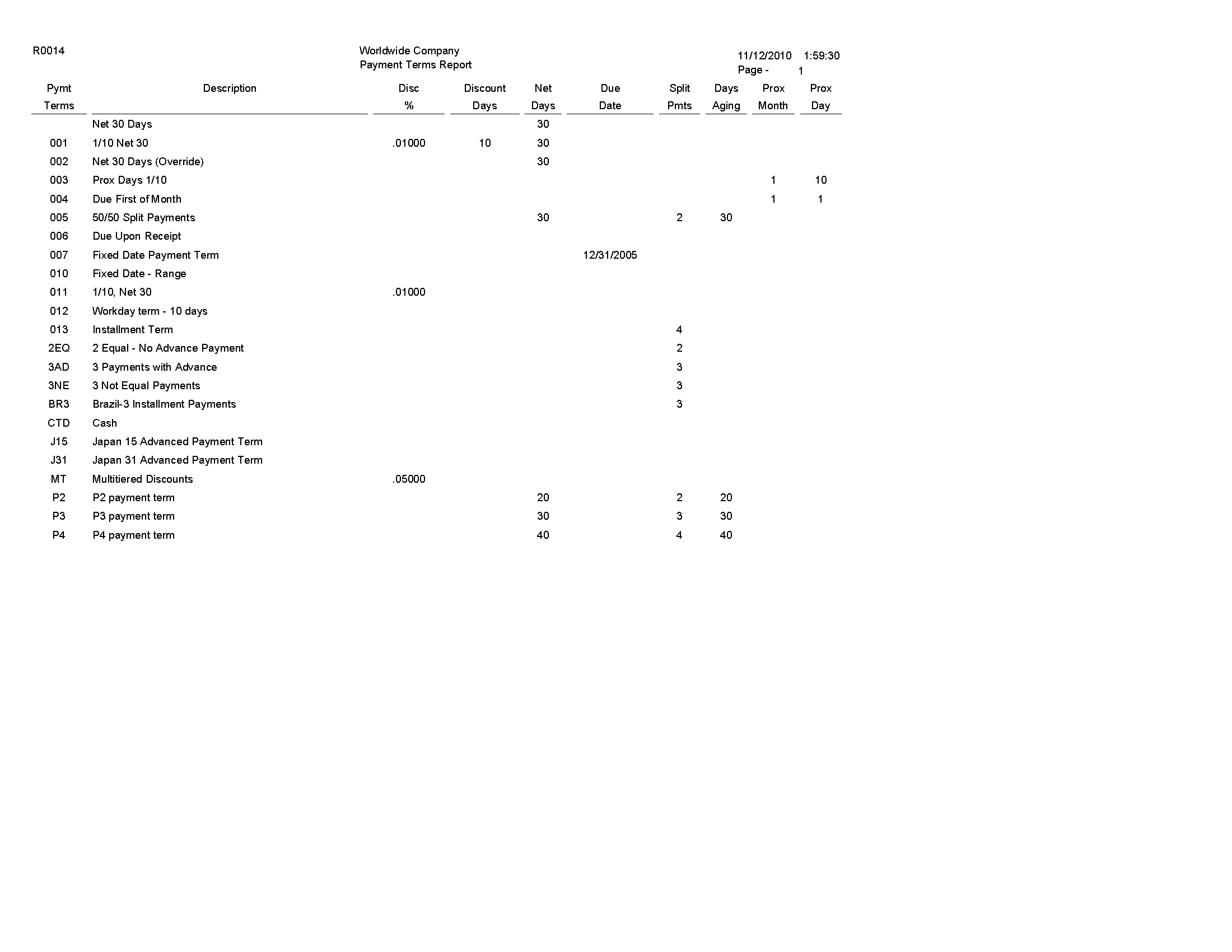

1.3 Payment Terms Report (R0014)

In the Work With Payment Terms program (P0014), select Print from the Report menu on the Work With Payment Terms form.

Use this report to review payment terms information such as discount, due dates and payment details.

Review the Payment Terms report (R0014):

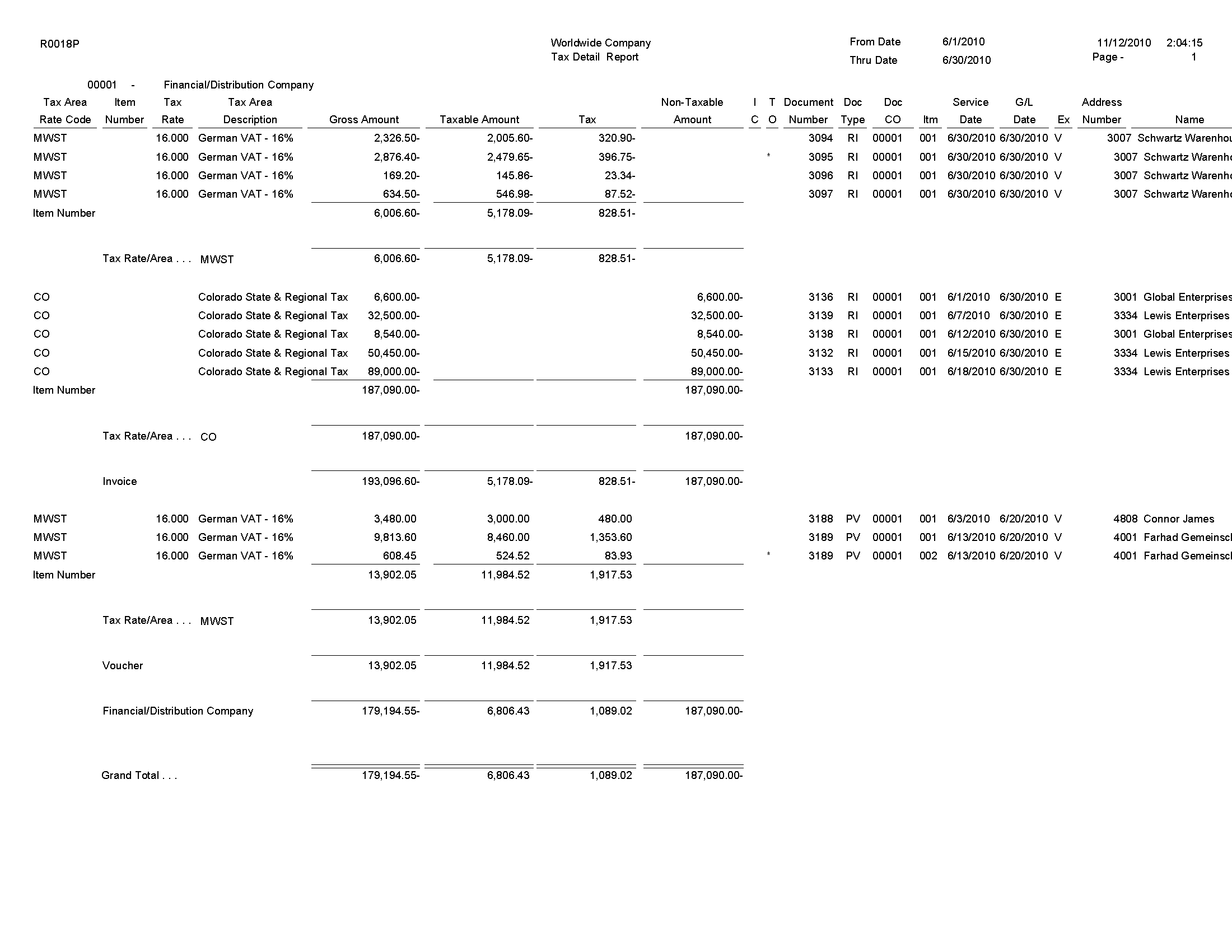

1.4 Tax Detail Report (R0018P)

On the Tax Processing and Reporting menu (G0021), select Tax Detail/Summary.

Use this program to print a list of transaction details from the Taxes table (F0018) and the totals for each tax rate/area for each document type by company.

Review the Tax Detail report (R0018P):

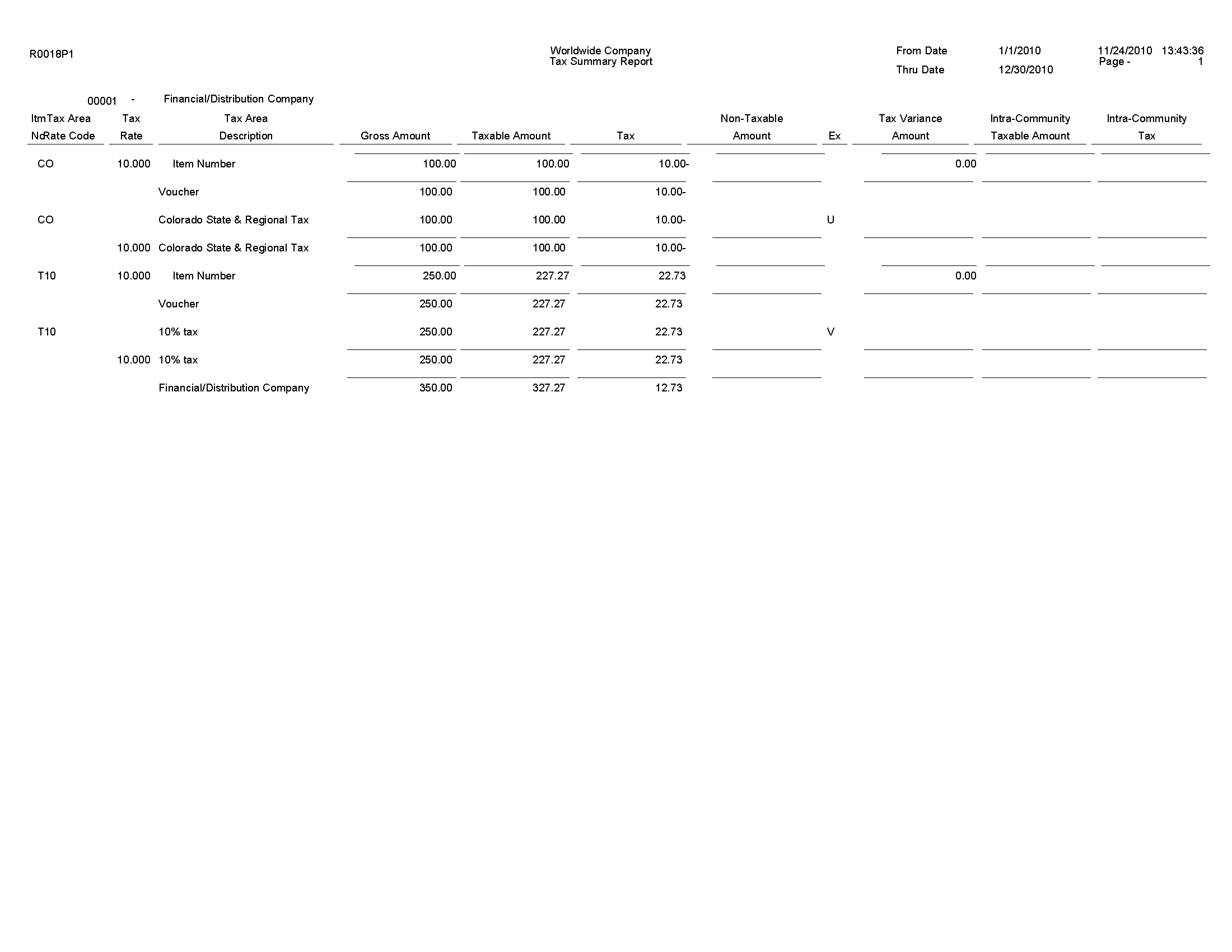

1.5 Tax Summary Report (R0018P1)

On the Tax Processing and Reporting menu (G0021), select Tax Summary Report/Use VAT.

Use this program to print totals only for each tax area and tax rate for each company.

Review the Tax Summary report (R0018P1):

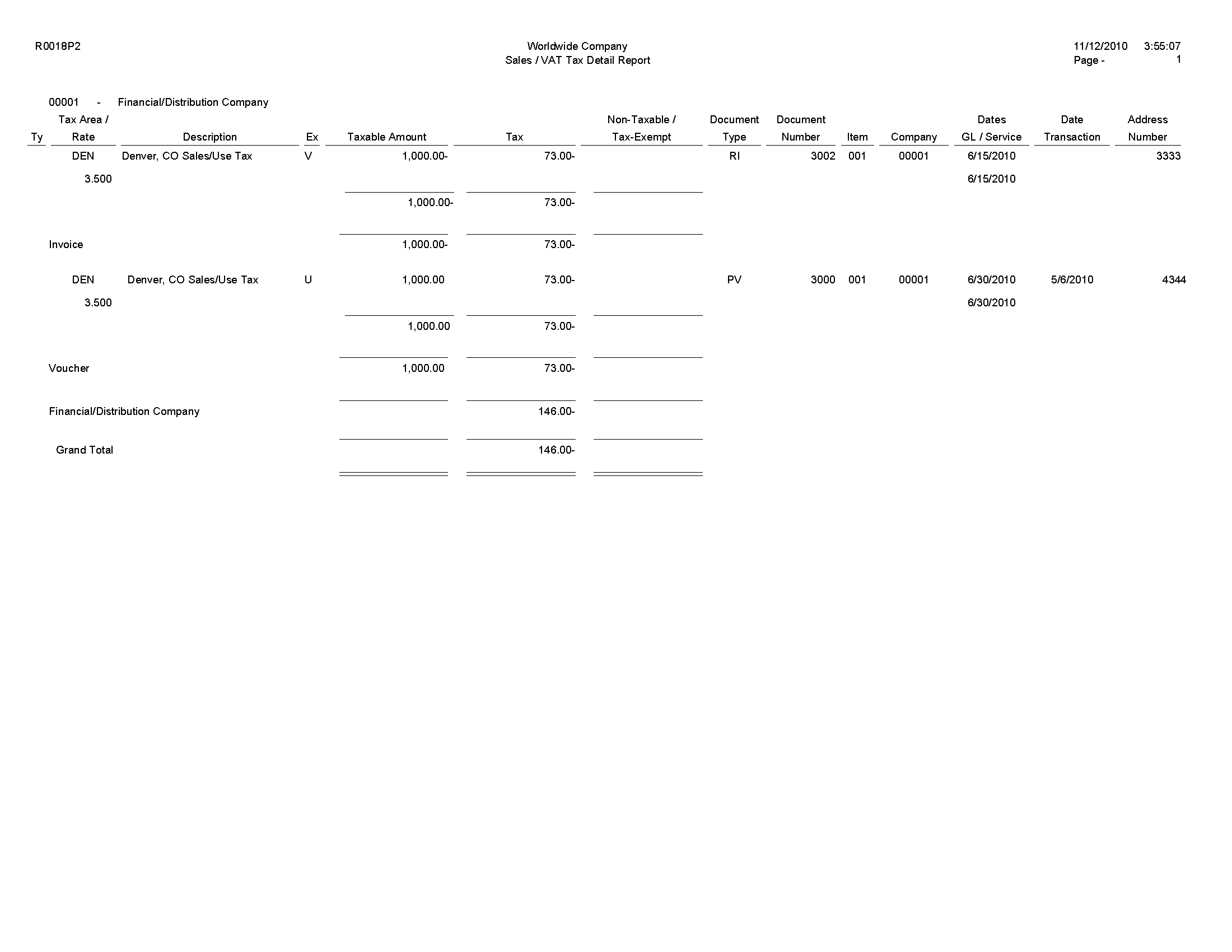

1.6 Sales / VAT Tax Detail Report (R0018P2)

On the Tax Processing and Reporting menu (G0021), select Sales Tax.

Use this program to print the transaction details from the Taxes table (F0018) and provide totals for each tax rate/area for each document type by company.

When you select to print this report, the system additionally processes and prints the Tax Summary Report by Tax Authority (R0018P3) and the Tax Detail Report by Tax Authority (R0018P5) reports. This report provides processing options for you to specify the versions of the Tax Summary Report by Tax Authority report and Tax Detail Report by Tax Authority report.

Review the Sales/VAT Tax Detail report (R0018P2):

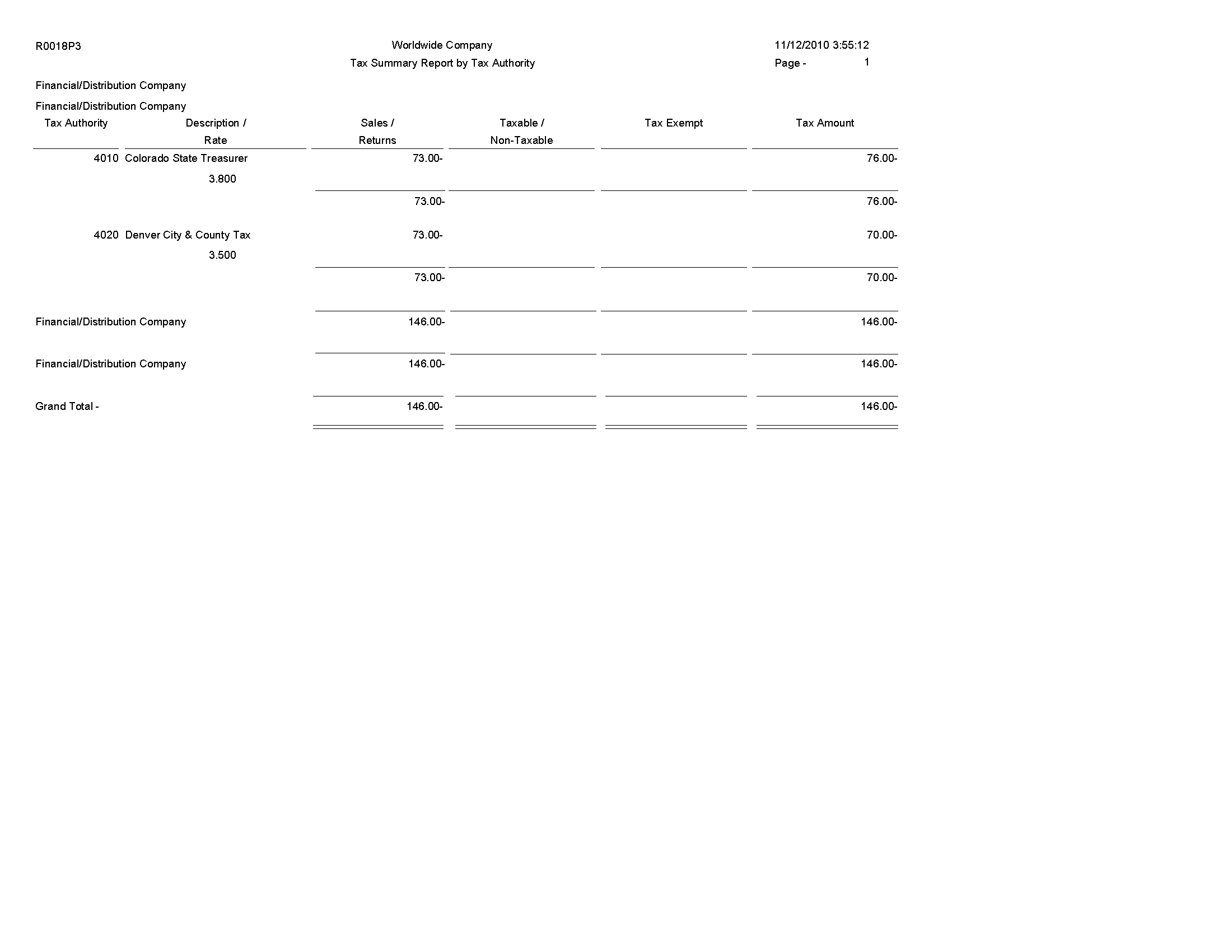

1.7 Tax Summary Report by Tax Authority Report (R0018P3)

When you print the Sales/VAT Tax Detail report (R0018P2), the system also prints the Tax Summary Report by Tax Authority report (R0018P3).

Use this report to review totals only for each tax authority by tax rate for each company. This report does not have processing options. If you want to change the data selection for this report, you must create a new version of the Sales/VAT Tax Detail report (R0018P2). In the new version, set up data selection, check the version in, and run the version locally.

Review the Tax Summary Report by Tax Authority report (R0018P3):

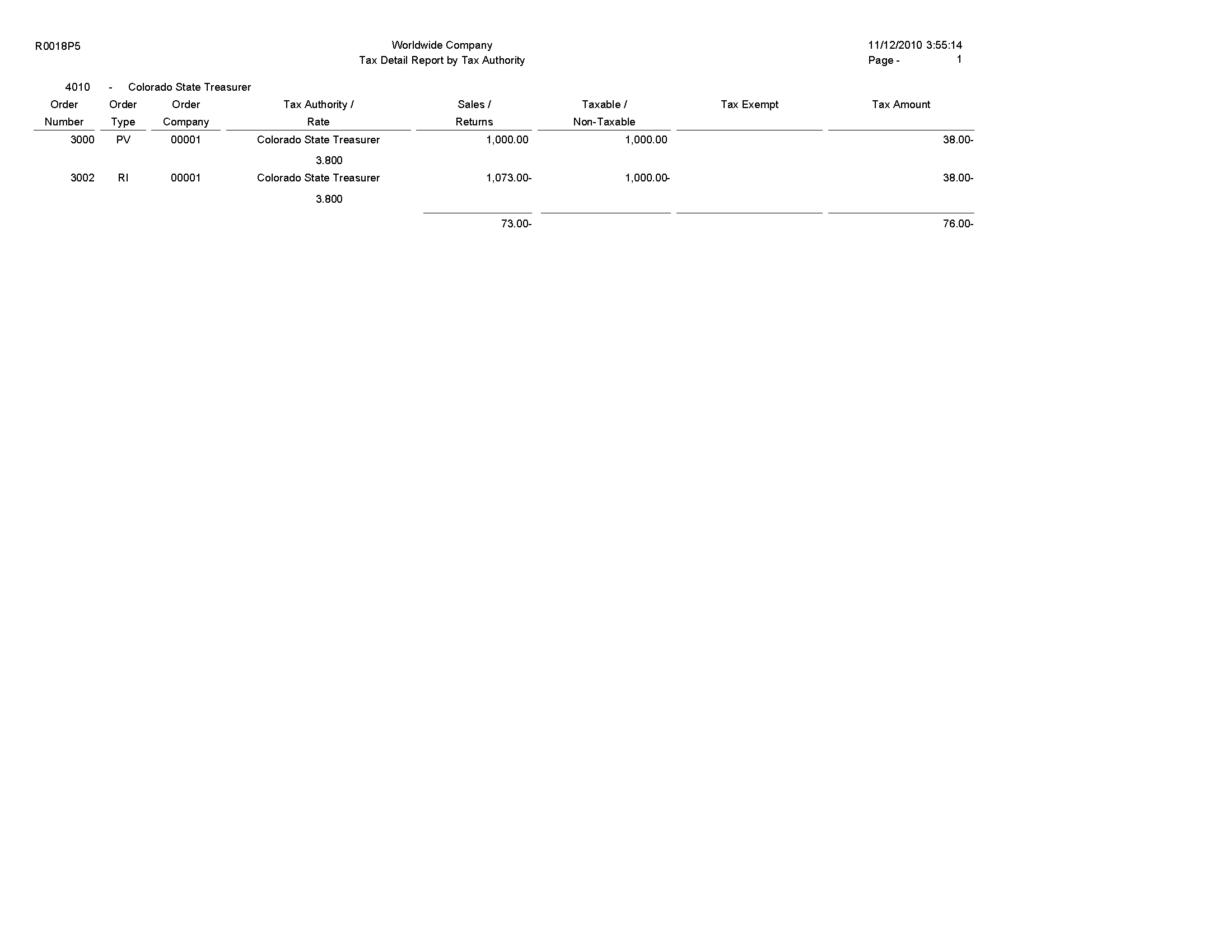

1.8 Tax Detail Report by Tax Authority Report (R0018P5)

When you print the Sales/VAT Tax Detail report (R0018P2), the system also prints the Tax Detail Report by Tax Authority (R0018P5).

Use this report to review each transaction for each tax authority and rate and the totals by tax authority for each company.

Review the Tax Detail Report by Tax Authority report (R0018P5):

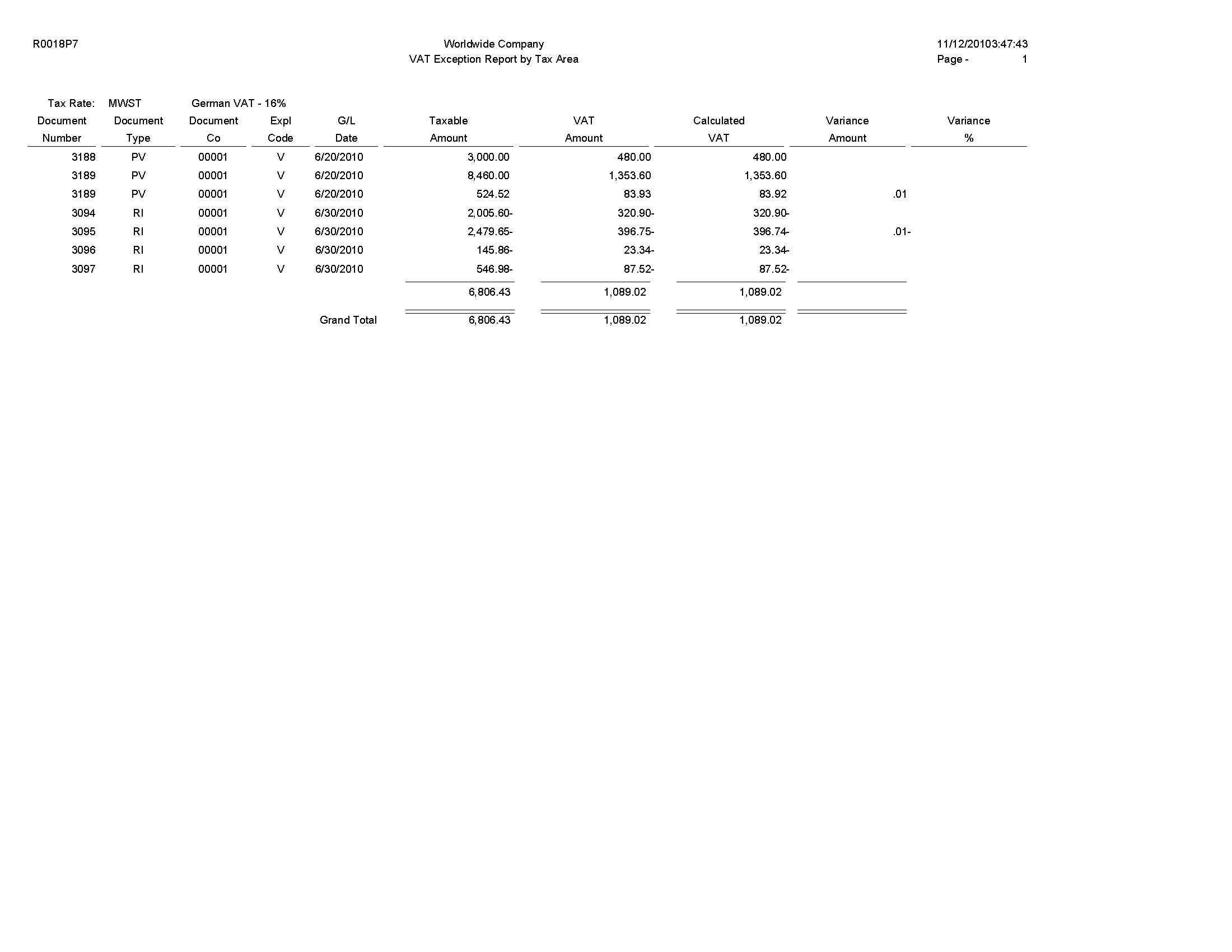

1.9 VAT Exception Report by Tax Area Report (R0018P7)

On the Tax Processing and Reporting menu (G0021), select VAT Exception Report by Tax Area.

Use this report to identify the transactions on which the tax amount entered by the user differs from the system-calculated tax amount. The report displays each amount, the amount variance, and the variance percent.

Review the VAT Exception Report by Tax Area report (R0018P7):

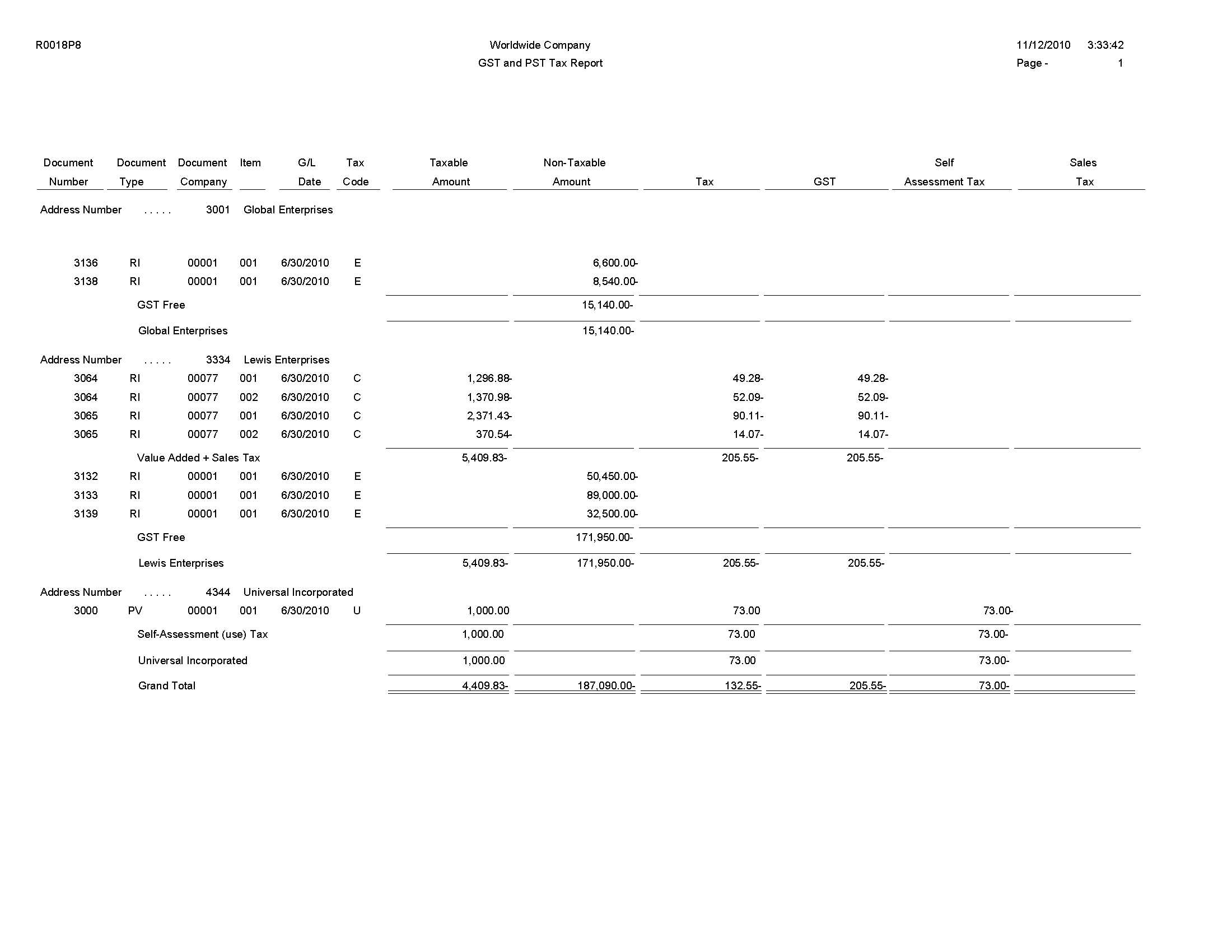

1.10 GST and PST Tax Report (R0018P8)

On the Tax Processing and Reporting menu (G0021), select GST/PST Tax.

Use this report to review the GST and PST and subdivides PST into seller-assessed PST and self-assessed PST for each address book number. The GST/ PST Tax report is specifically designed to meet Canadian reporting needs.

Review the GST and PST Tax report (R0018P8):

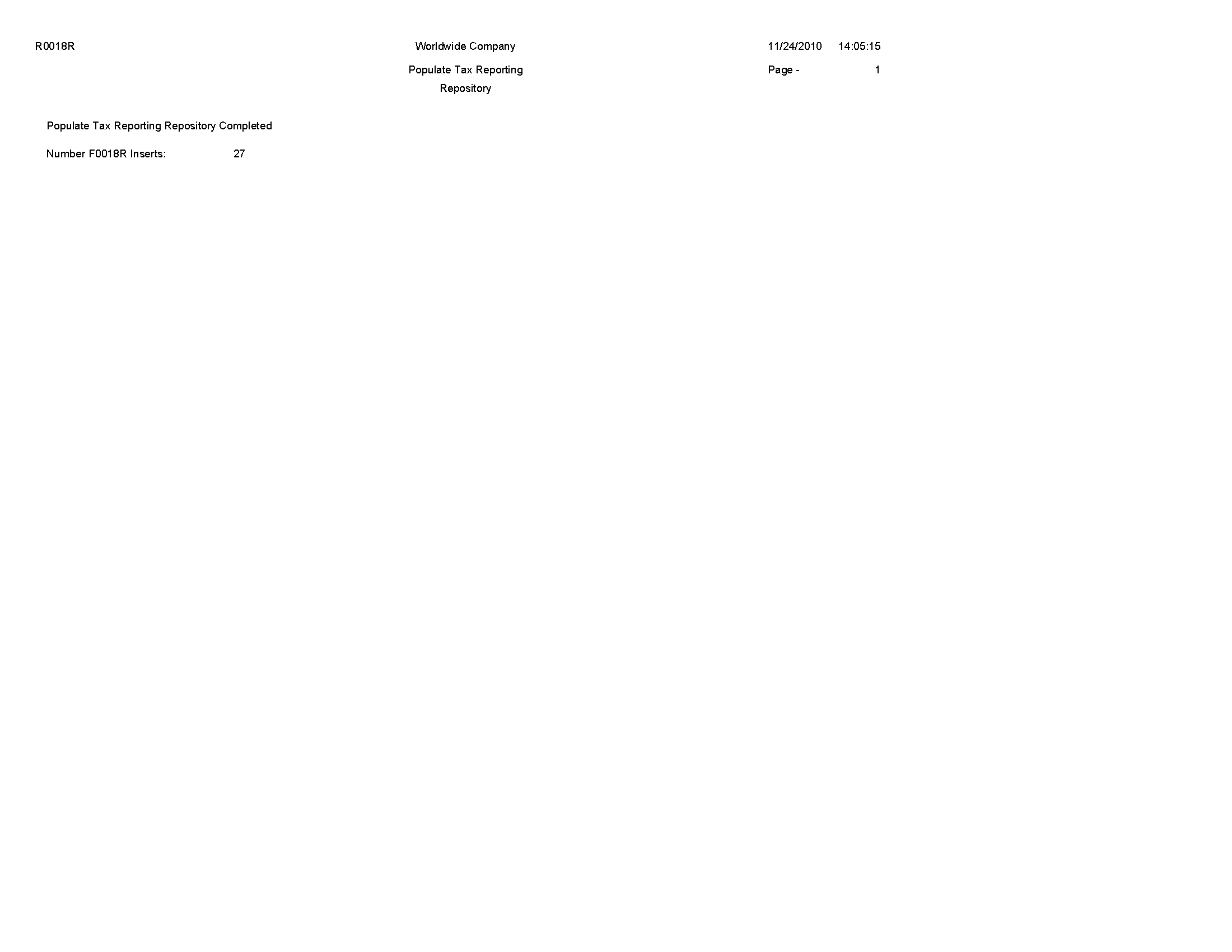

1.11 Populate Tax Reporting Repository Report (R0018R)

On the Global Tax Reconciliation menu (G00217), select Update Tax Reconciliation Repository.

Use this report to specify the records that the system selects from the Taxes table (F0018) to locate corresponding records from the Account Ledger table (F0911).

Review the Populate Tax Reporting Repository report (R0018R):

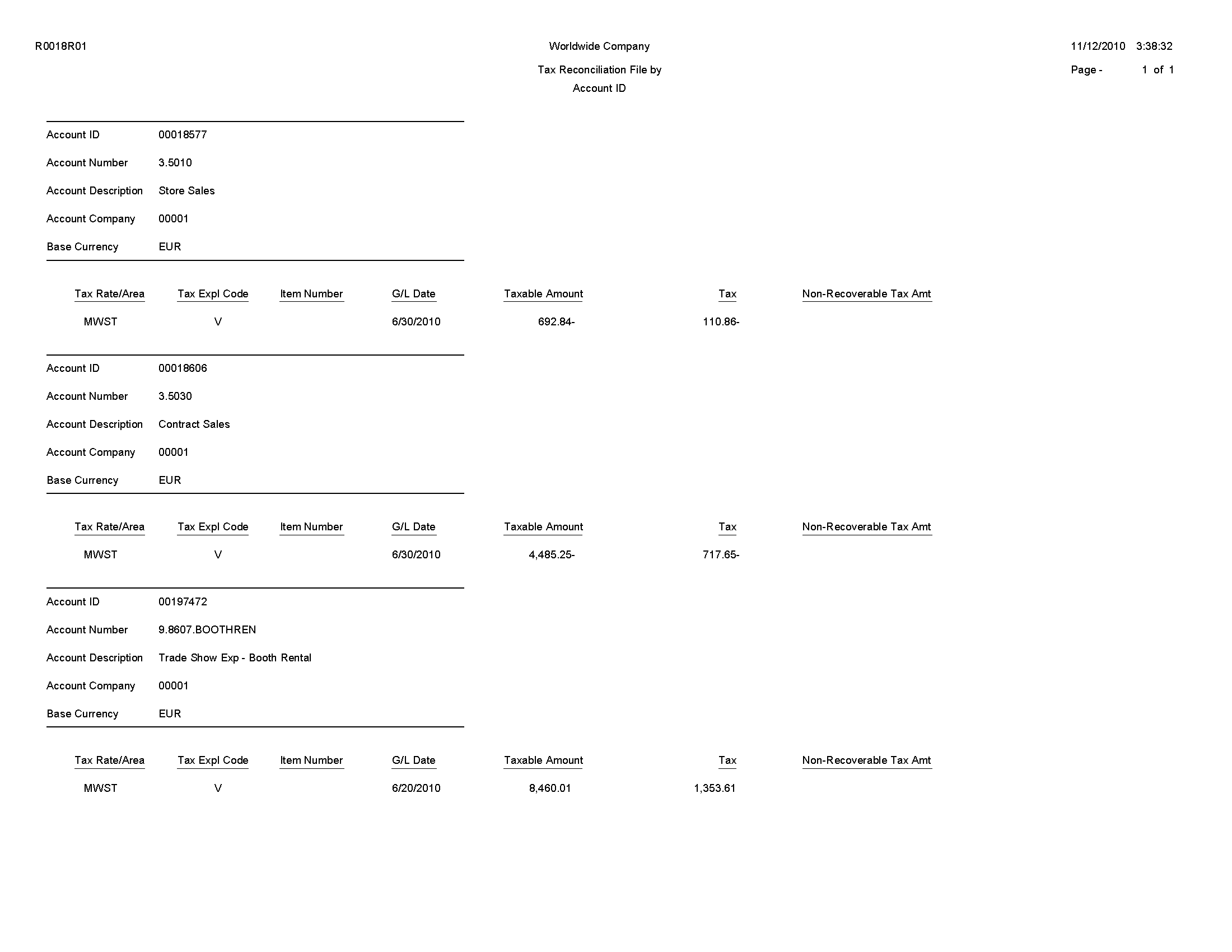

1.12 Tax Reconciliation File by Account ID Report (R0018R01)

On the Global Tax Reconciliation menu (G00217), select Report on Reconciled Taxes by Account ID.

Use this program to print each transaction (totaled by document number) by account ID from the Tax Reconciliation Repository table (F0018R). The system does not provide totals on the report.

This report provides the Country for Tax Rate/Area processing processing option for you to specify the country for which you want to run the report. The system applies an additional filter excluding the tax rate/areas which were not identified for that country in the Alternate Tax Rate/Area by Country program (P40082). You can leave this option blank to prevent tax rate/areas additional filtering. (Release 9.1 Update)

Review the Tax Reconciliation File by Account ID report (R0018R01):

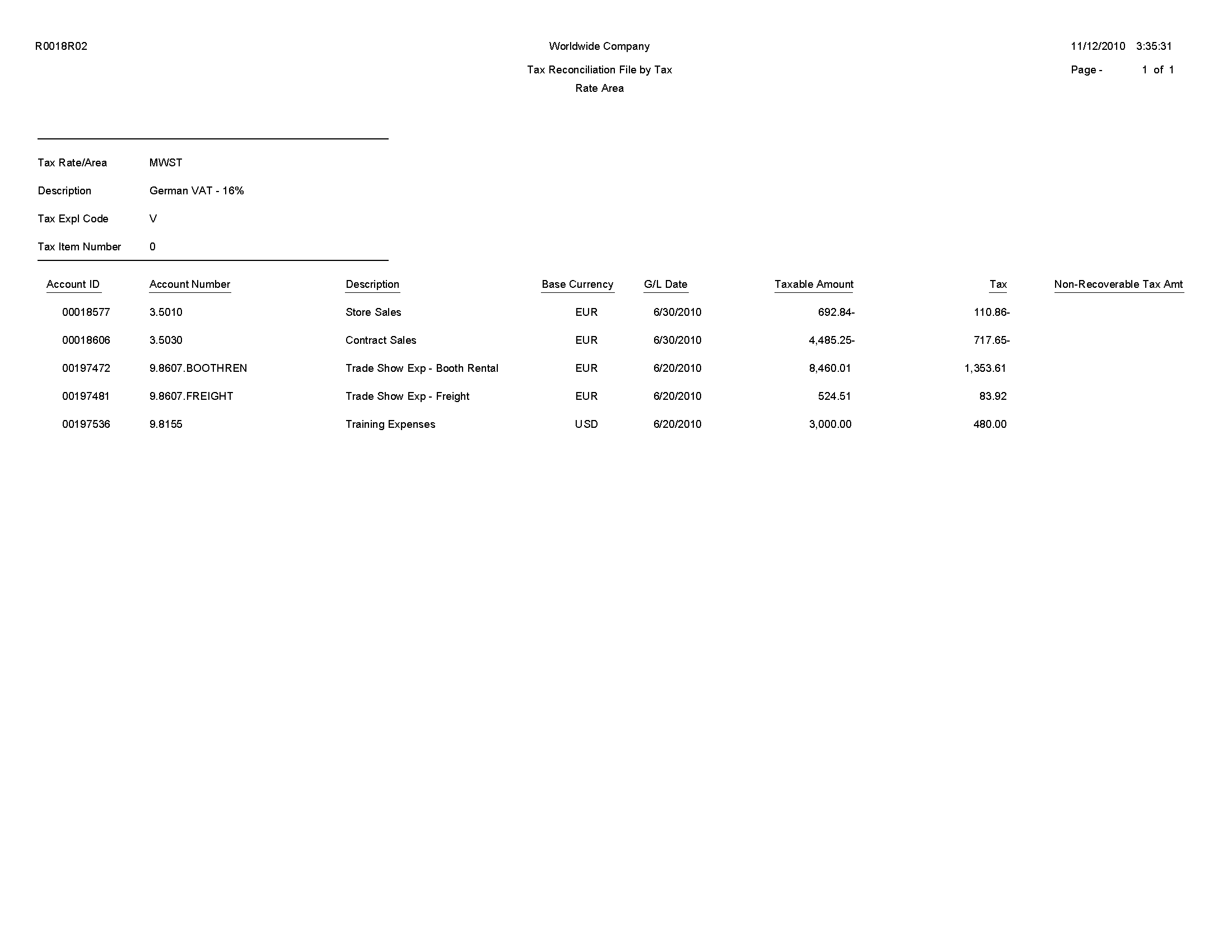

1.13 Tax Reconciliation File by Tax Rate Area Report (R0018R02)

On the Global Tax Reconciliation menu (G00217), select Report on Reconciled Taxes by Tax Rate Area.

Use this program to print each transaction (totaled by document number) by tax rate/area from the Tax Reconciliation Repository table (F0018R). The system does not provide totals on the report.

This report provides the Country for Tax Rate/Area processing processing option for you to specify the country for which you want to run the report. The system applies an additional filter excluding the tax rate/areas which were not identified for that country in the Alternate Tax Rate/Area by Country program (P40082). You can leave this option blank to prevent tax rate/areas additional filtering. (Release 9.1 Update)

Review the Tax Reconciliation File by Tax Rate Area report (R0018R02):

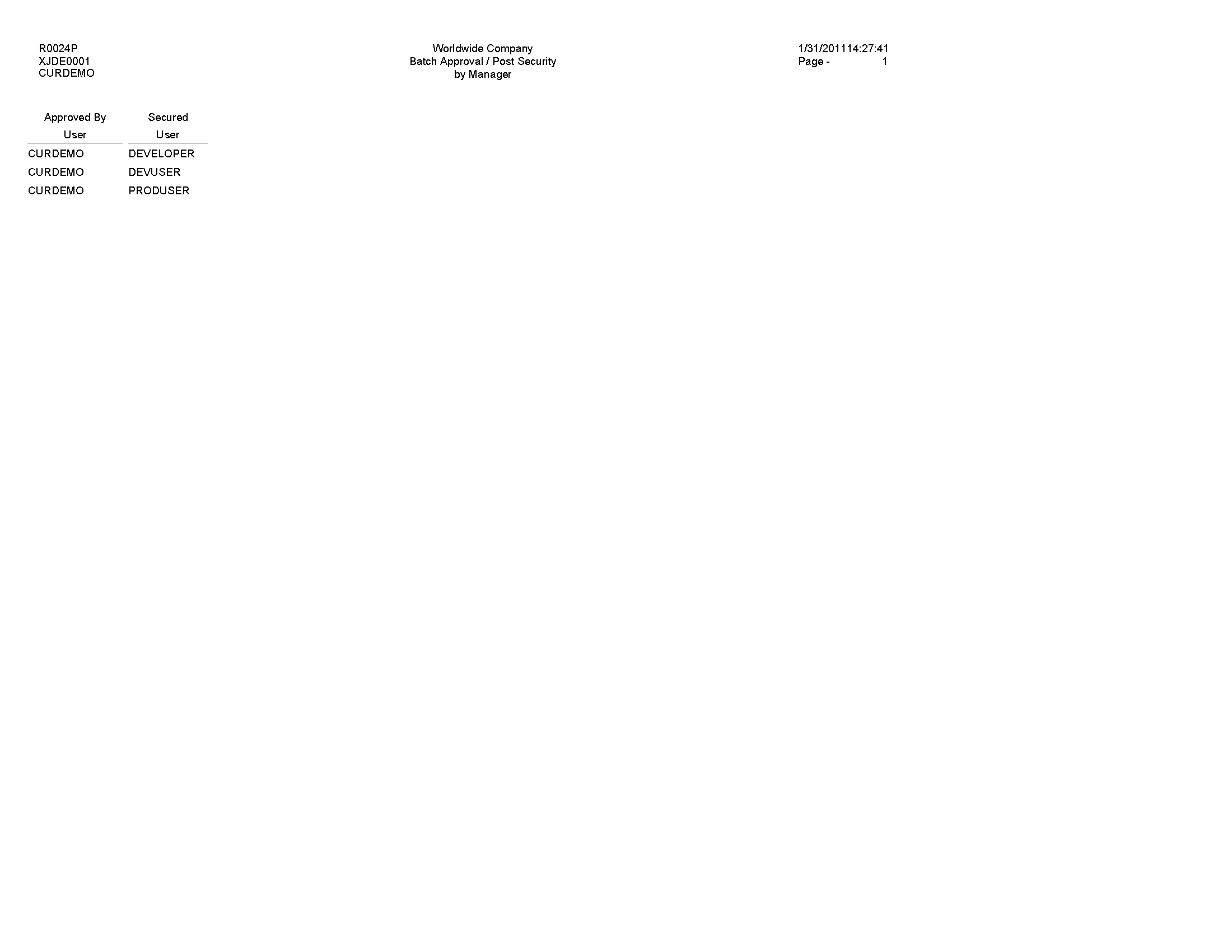

1.14 Batch Approval / Post Security by Manager Report (R0024P)

In the Batch Approval / Post Security Constants program (P00241), select Batch Security Rpt from the Report menu on the Batch Approval / Post Security Constants form.

Use this report to review a list of secured users or approved-by users.

Review Batch Approval / Post Security by Manager report (R0024P):

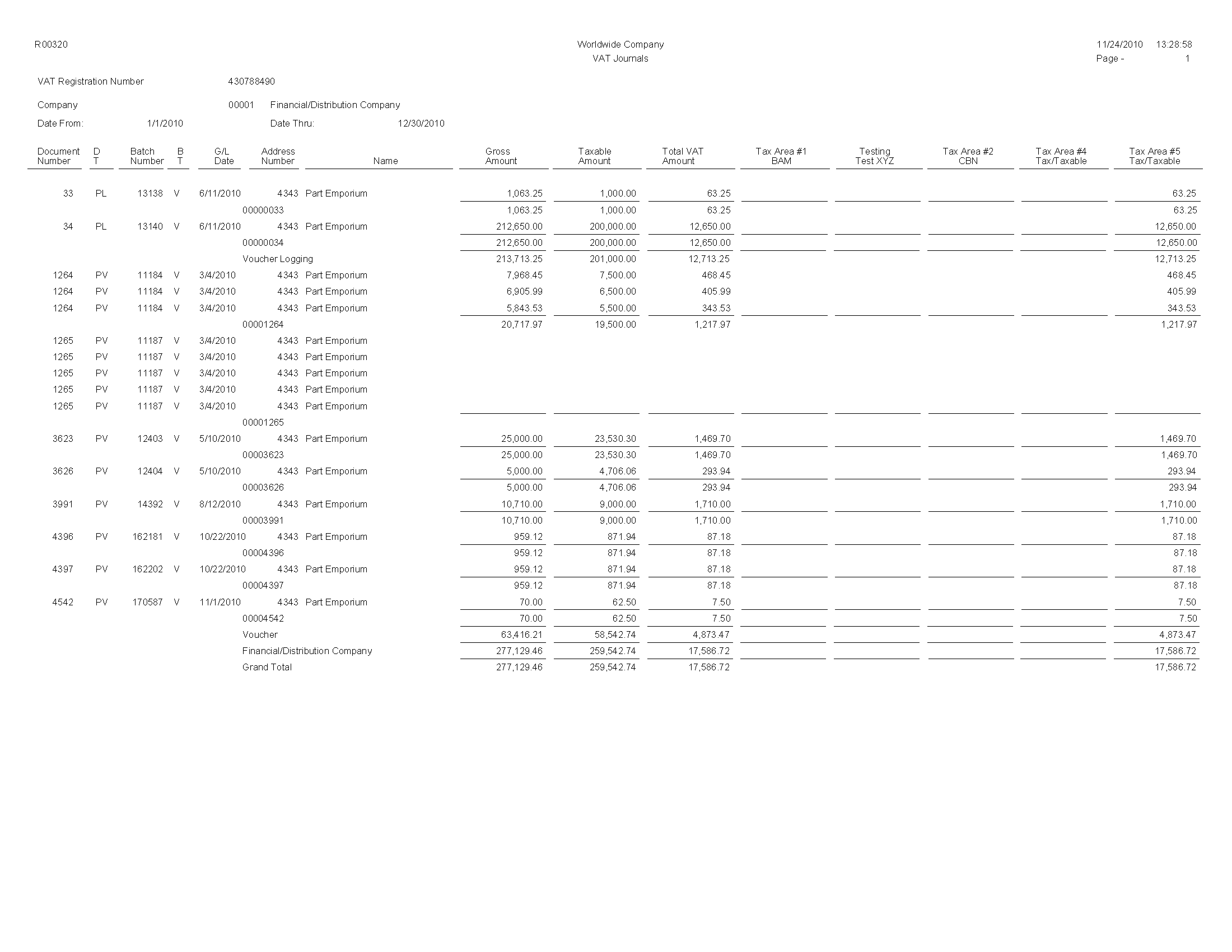

1.15 VAT Journals Report (R00320)

On the Tax Processing and Reporting menu (G0021), select VAT Journals.

Use this program to print the VAT amounts by revenue and expense account for reconciliation purposes.

Review the VAT Journals report (R00320):

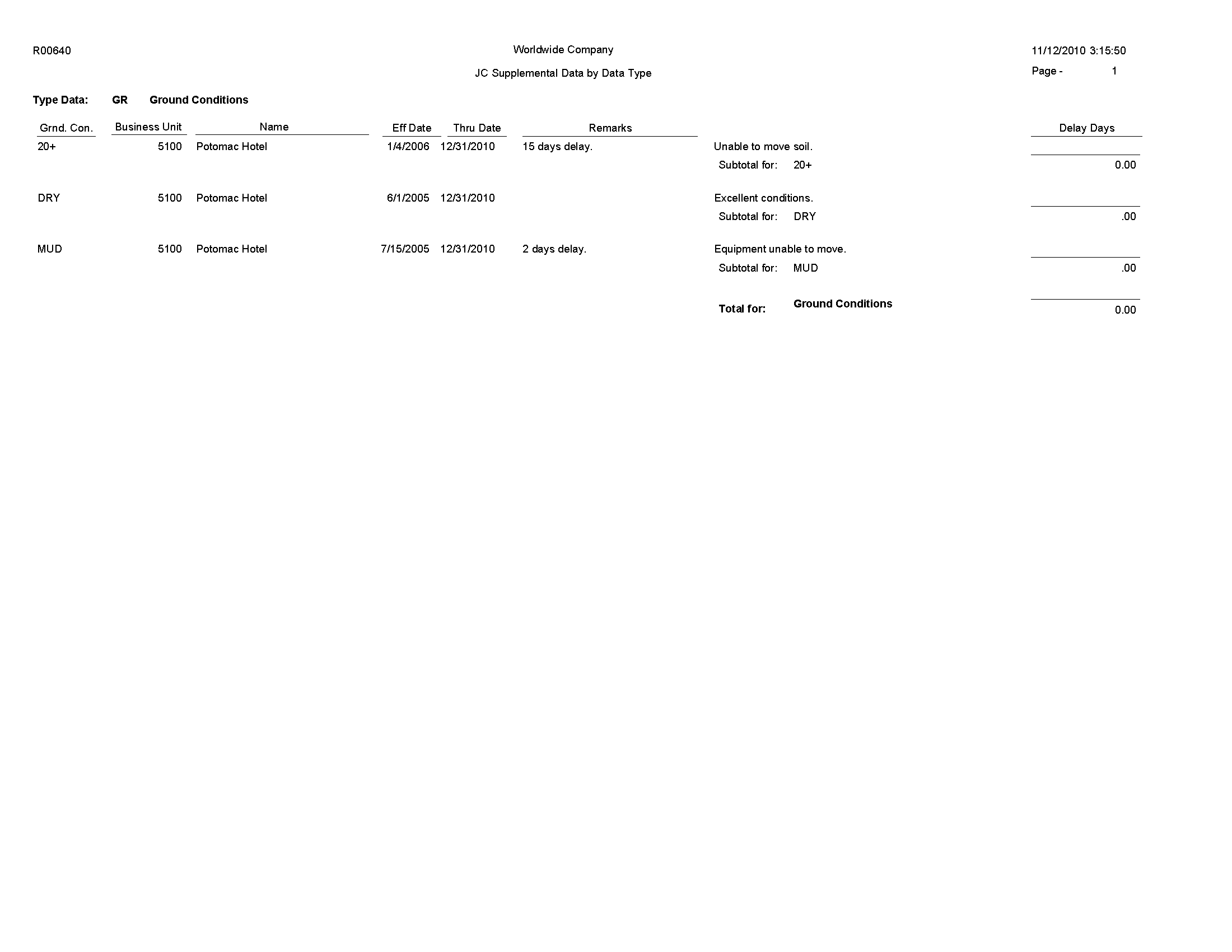

1.16 Supplemental Data by Data Type Report (R00640)

On the Business Unit Supplemental Data menu (G09312), select Data by Data Type.

Use the program to print a summary of your business unit supplemental data.

This report is based on data that is stored in the Supplemental Database Data Types (F00091) and Supplemental Data (F00092) tables. You can print two versions of this report. One version sorts business units alphabetically, and the other version sorts them numerically. You can choose whether to include the narrative text for each version. The system stores supplemental narrative text as generic text attachments.

Review the Supplemental Data by Data Type report (R00640):

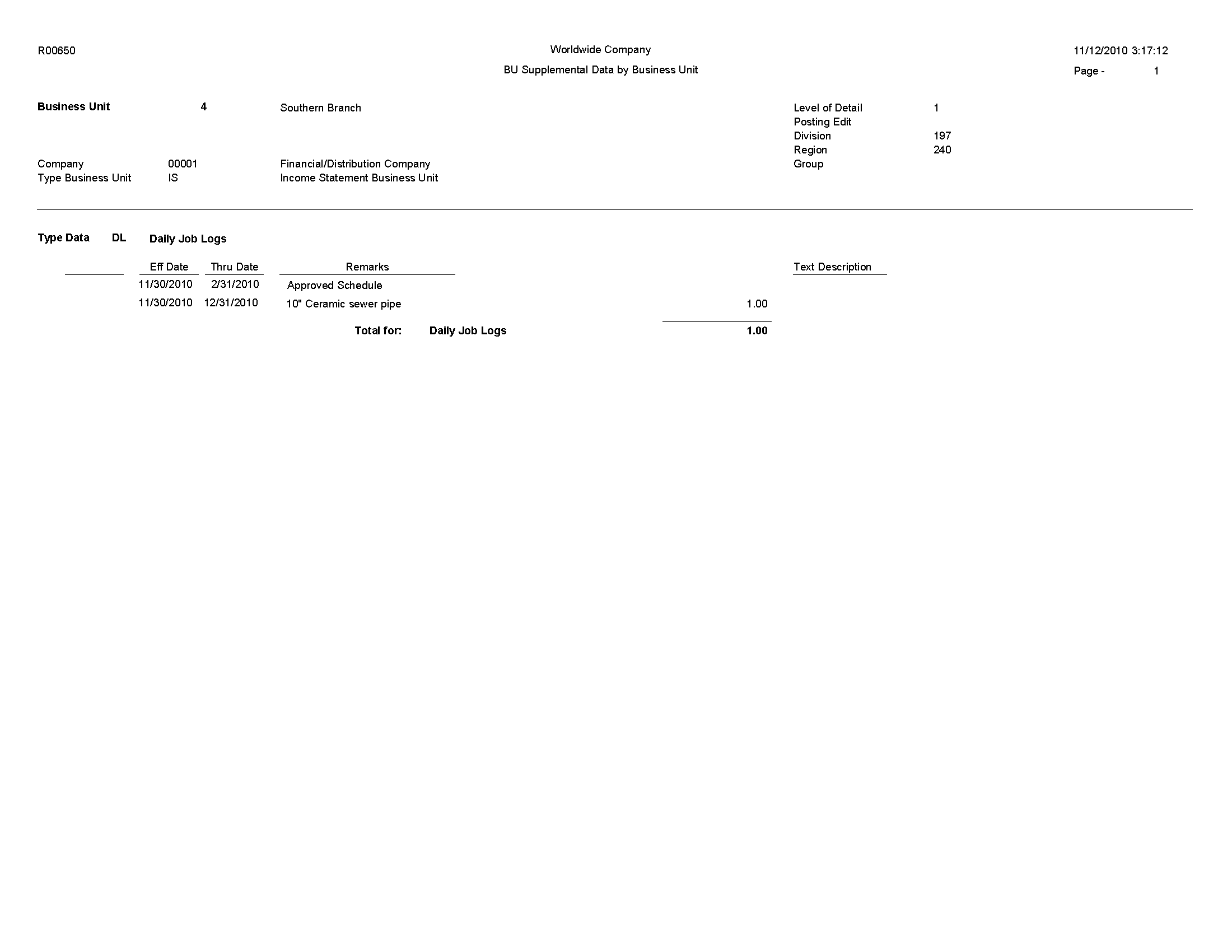

1.17 Supplemental Data by Business Unit Report (R00650)

On the Business Unit Supplemental Data menu (G09312), select Data by Business Unit.

Use this report to print a summary of your business unit supplemental data.

This report is based on data that is stored in the Supplemental Database Data Types (F00091) and Supplemental Data (F00092) tables. You can print two versions of this report. One version sorts business units alphabetically, and the other version sorts them numerically. You can choose whether to include the narrative text for each version. The system stores supplemental narrative text as generic text attachments.

Review the Supplemental Data by Business Unit report (R00650):

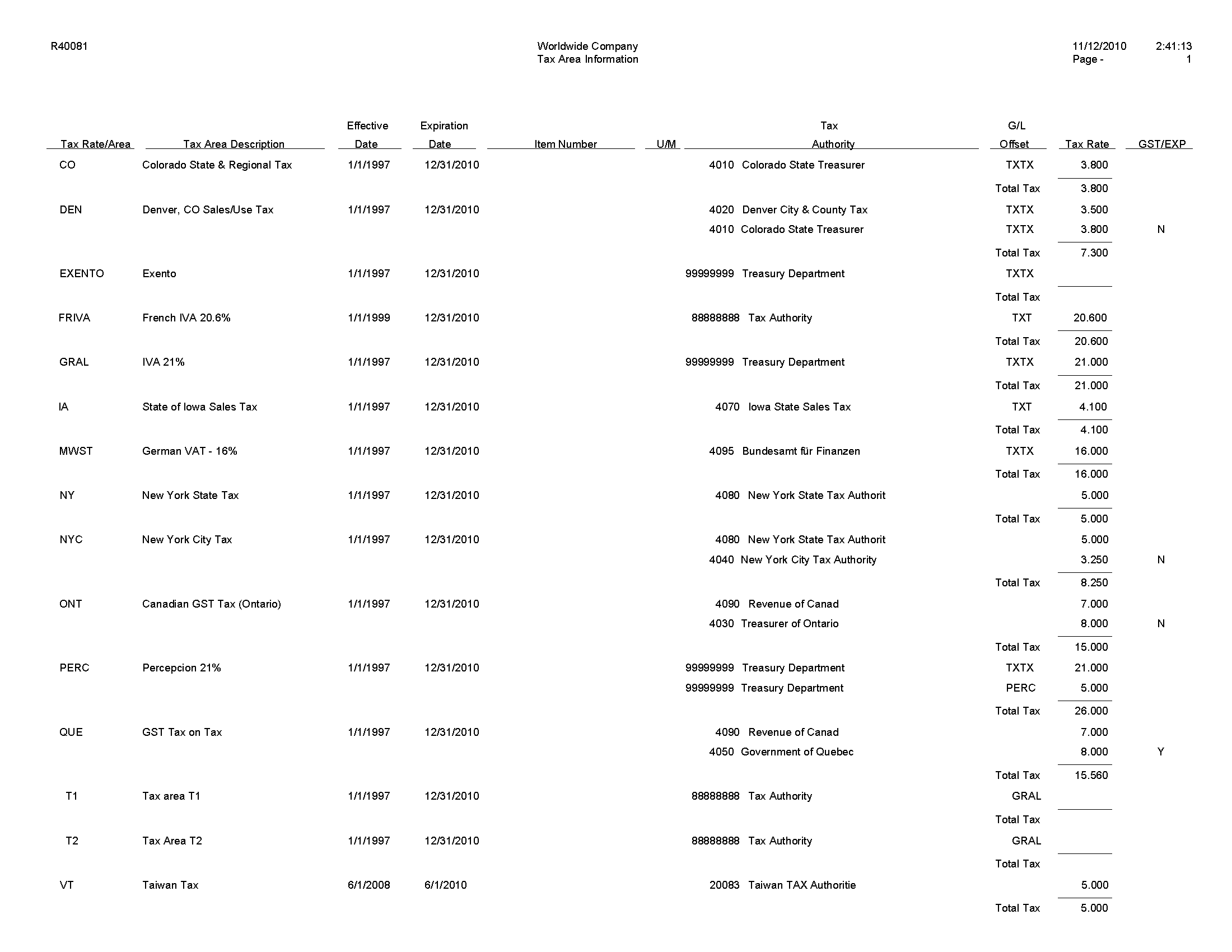

1.18 Tax Area Information Report (R40081)

In the Tax Rate/Area program (P4008), select Tax Area Report from the Report Menu.

Use this report to review detailed tax/rate area information such as description, effective and expiration dates, tax authority and G/L offset.

Review the Tax Area Information report (R40081):