11g Release 1 (11.1.2)

Part Number E20373-02

Contents

Previous

Next

|

Oracle® Fusion

Applications Sales Implementation Guide 11g Release 1 (11.1.2) Part Number E20373-02 |

Contents |

Previous |

Next |

This chapter contains the following:

Enterprise Structures: Overview

Enterprise Structures Business Process Model: Explained

Global Enterprise Configuration: Points to Consider

Modeling Your Enterprise Management Structure in Oracle Fusion: Example

Define Initial Configuration with the Enterprise Structures Configurator

Define Legal Entities for Sales: Manage Legal Entity

Define Legal Entities for Sales: Manage Legal Entity HCM Information

Define Business Units for Sales: Specify Customer Contract Management Business Function Properties

Define Business Units for Sales: Specify Supplier Contract Management Business Function Properties

Define Business Units for Sales: Assign Business Unit Business Function

Define Business Units for Sales: Manage Business Units

Define Workforce Structures for CRM: Manage Locations

Define Workforce Structures for CRM: Manage Divisions

Define Workforce Structures for CRM: Manage Departments

Define Workforce Structures for CRM: FAQs for Manage Job Families

Define Workforce Structures for CRM: Manage Jobs

Define Facilities for Sales: Manage Facility Shifts, Workday Patterns, and Schedules

Define Facilities for Sales: Manage Inventory Organizations

Define Facilities for Sales: Manage Item Organizations

Oracle Fusion Applications have been designed to ensure your enterprise can be modeled to meet legal and management objectives. The decisions about your implementation of Oracle Fusion Applications are affected by your:

Industry

Business unit requirements for autonomy

Business and accounting policies

Business functions performed by business units and optionally, centralized in shared service centers

Locations of facilities

Every enterprise has three fundamental structures, legal, managerial, and functional, that are used to describe its operations and provide a basis for reporting. In Oracle Fusion, these structures are implemented using the chart of accounts and organizations. Although many alternative hierarchies can be implemented and used for reporting, you are likely to have one primary structure that organizes your business into divisions, business units, and departments aligned by your strategic objectives.

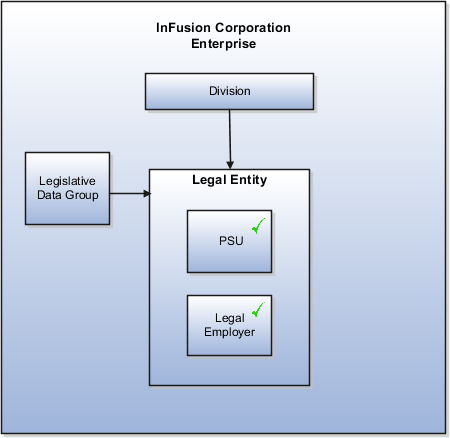

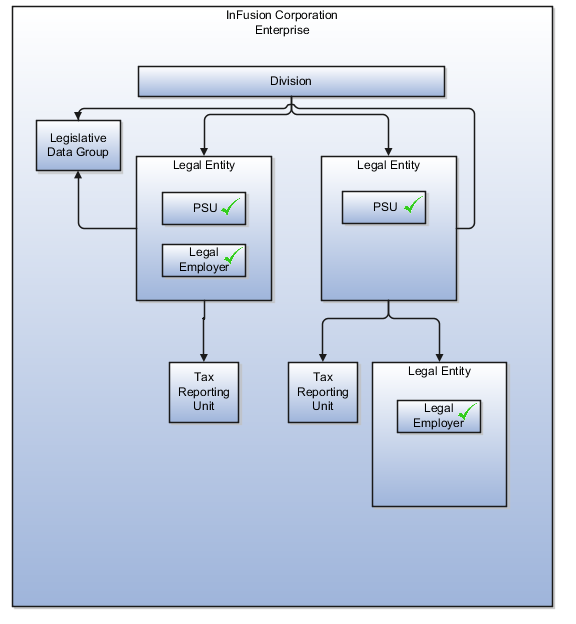

The figure above shows a typical group of legal entities, operating various business and functional organizations. Your ability to buy and sell, own, and employ comes from your charter in the legal system. A corporation is a distinct legal entity from its owners and managers. The corporation is owned by its shareholders, who may be individuals or other corporations. There are many other kinds of legal entities, such as sole proprietorships, partnerships, and government agencies.

A legally recognized entity can own and trade assets and employ people in the jurisdiction in which it is registered. When granted these privileges, legal entities are also assigned responsibilities to:

Account for themselves to the public through statutory and external reporting

Comply with legislation and regulations

Pay income and transaction taxes

Process value added tax (VAT) collection on behalf of the taxing authority

Many large enterprises isolate risk and optimize taxes by incorporating subsidiaries. They create legal entities to facilitate legal compliance, segregate operations, optimize taxes, complete contractual relationships, and isolate risk. Enterprises use legal entities to establish their enterprise's identity under the laws of each country in which their enterprise operates.

In the figure above, a separate card represents a series of registered companies. Each company, including the public holding company, InFusion America, must be registered in the countries where they do business. Each company consists of various divisions created for purposes of management reporting. These are shown as vertical columns on each card. For example, a group might have a separate company for each business in the United States (US), but have their United Kingdom (UK) legal entity represent all businesses in that country. The divisions are linked across the cards so that a business can appear on some or all of the cards. For example, the air quality monitoring systems business might be operated by the US, UK, and France companies. The list of business divisions is on the Business Axis. Each company's card is also horizontally striped by functional groups, such as the sales team and the finance team. This functional list is called the Functional Axis. The overall image suggests that information might, at a minimum, be tracked by company, business, division, and function in a group environment. In Oracle Fusion Applications, the legal structure is implemented using legal entities.

Successfully managing multiple businesses requires that you segregate them by their strategic objectives, and measure their results. Although related to your legal structure, the business organizational hierarchies do not need to be reflected directly in the legal structure of the enterprise. The management structure can include divisions, subdivisions, lines of business, strategic business units, and cost centers. In the figure above, the management structure is shown on the Business Axis. In Oracle Fusion Applications, the management structure is implemented using divisions and business units.

Straddling the legal and business organizations is a functional organization structured around people and their competencies. For example, sales, manufacturing, and service teams are functional organizations. This functional structure is represented by the Functional Axis in the figure above. You reflect the efforts and expenses of your functional organizations directly on the income statement. Organizations must manage and report revenues, cost of sales, and functional expenses such as research and development (R&D) and selling, general, and administrative (SG&A) expenses. In Oracle Fusion Applications, the functional structure is implemented using departments and organizations, including sales, marketing, project, cost, and inventory organizations.

In Oracle Fusion Applications, the Enterprise Performance and Planning Business Process Model illustrates the major implementation tasks that you perform to create your enterprise structures. This process model includes the Set Up Enterprise Structures business process, which consist of implementation activities that span many product families. Information Technology is a second Business Process Model which contains the Set Up Information Technology Management business process. Define Reference Data Sharing is one of the activities in this business process and is important in the implementation of the enterprise structures. This activity creates the mechanism to share reference data sets across multiple ledgers, business units, and warehouses, reducing the administrative burden and decreasing the time needed to implement.

The following figure and chart describes the Business Process Model structures and activities.

|

BPM Activities |

Description |

|---|---|

|

Define Enterprise |

Define the enterprise to capture the name of the deploying enterprise and the location of the headquarters. There is normally a single enterprise organization in a production environment. Multiple enterprises are defined when the system is used to administer multiple customer companies, or when you choose to set up additional enterprises for testing or development. |

|

Define Enterprise Structures |

Define enterprise structures to represent an organization with one or more legal entities under common control. Define internal and external organizations to represent each area of business within the enterprise. |

|

Define Legal Jurisdictions and Authorities |

Define information for governing bodies that operate within a jurisdiction. |

|

Define Legal Entities |

Define legal entities and legal reporting units for business activities handled by the Oracle Fusion Applications. |

|

Define Business Units |

Define business units of an enterprise to allow for flexible implementation, to provide a consistent entity for controlling and reporting on transactions, and to be an anchor for the sharing of sets of reference data across applications. |

|

Define Financial Reporting Structures |

Define financial reporting structures, including organization structures, charts of accounts, organizational hierarchies, calendars, currencies and rates, ledgers, and document sequences which are used in organizing the financial data of a company. |

|

Define Chart of Accounts |

Define chart of accounts including hierarchies and values to enable tracking of financial transactions and reporting at legal entity, cost center, account, and other segment levels. |

|

Define Ledgers |

Define the primary accounting ledger and any secondary ledgers that provide an alternative accounting representation of the financial data. |

|

Define Accounting Configurations |

Define the accounting configuration that serves as a framework for how financial records are maintained for an organization. |

|

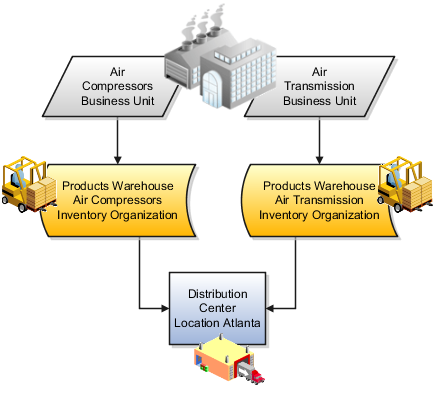

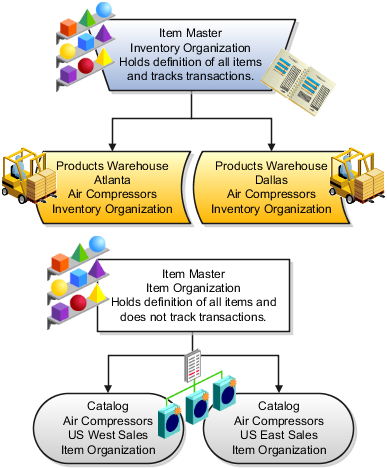

Define Facilities |

Define inventory, item, and cost organizations. Inventory organizations represent facilities that manufacture or store items. The item master organization holds a single definition of items that can be shared across many inventory organizations. Cost organizations group inventory organizations within a legal entity to establish the cost accounting policies. |

|

Define Reference Data Sharing |

Define how reference data in the applications is partitioned and shared. |

Note

There are product specific implementation activities that are not listed here and depend on the applications you are implementing. For example, you can implement Define Enterprise Structures for Human Capital Management, Project Management, and Sales Management.

Start your global enterprise structure configuration by discussing what your organization's reporting needs are and how to represent those needs in the Oracle Fusion Applications. Consider deployment on a single instance, or at least, on as few instances as possible, to simplify reporting and consolidations for your global enterprises. The following are some questions and points to consider as you design your global enterprise structure in Oracle Fusion.

Enterprise Configuration

Business Unit Management

Security Structure

Compliance Requirements

What is the level of configuration needed to achieve the reporting and accounting requirements? What components of your enterprise do you need to report on separately? Which components can be represented by building a hierarchy of values to provide reporting at both detail and summary levels? Where are you on the spectrum of centralization versus decentralization?

What reporting do I need by business unit? How can you set up your departments or business unit accounts to achieve departmental hierarchies that report accurately on your lines of business? What reporting do you need to support the managers of your business units, and the executives who measure them? How often are business unit results aggregated? What level of reporting detail is required across business units?

What level of security and access is allowed? Are business unit managers and the people that report to them secured to transactions within their own business unit? Are the transactions for their business unit largely performed by a corporate department or shared service center?

How do you comply with your corporate external reporting requirements and local statutory reporting requirements? Do you tend to prefer a corporate first or an autonomous local approach? Where are you on a spectrum of centralization, very centralized or decentralized?

This example uses a fictitious global company to demonstrate the analysis that can occur during the enterprise structure configuration planning process.

Your company, InFusion Corporation, is a multinational conglomerate that operates in the United States (US) and the United Kingdom (UK). InFusion has purchased an Oracle Fusion enterprise resource planning (ERP) solution including Oracle Fusion General Ledger and all of the Oracle Fusion subledgers. You are chairing a committee to discuss creation of a model for your global enterprise structure including both your US and UK operations.

InFusion Corporation has 400 plus employees and revenue of $120 million. Your product line includes all the components to build and maintain air quality monitoring (AQM) systems for homes and businesses. You have two distribution centers and three warehouses that share a common item master in the US and UK. Your financial services organization provides funding to your customers for the start up costs of these systems.

The following are elements you need to consider in creating your model for your global enterprise structure.

Your company is required to report using US GAAP standards and UK Statements of Standard Accounting Practice and Financial Reporting Standards. How many ledgers do you need to achieve proper statutory reporting?

Your managers need reports that show profit and loss (revenue and expenses) for their lines of business. Do you use business units and balancing segments to represent your divisions and businesses? Do you secure data by two segments in your chart of accounts which represents each department and legal entity or one segment that represents both to produce useful, but confidential management reports?

Your corporate management requires reports showing total organizational performance with drill down capability to the supporting details. Do you need multiple balancing segment hierarchies to achieve proper rollup of balances for reporting requirements?

Your company has all administrative, account payables, procurement, and human resources functions performed at their corporate headquarters. Do you need one or more business unit in which to perform all these functions? How will your shared service center be configured?

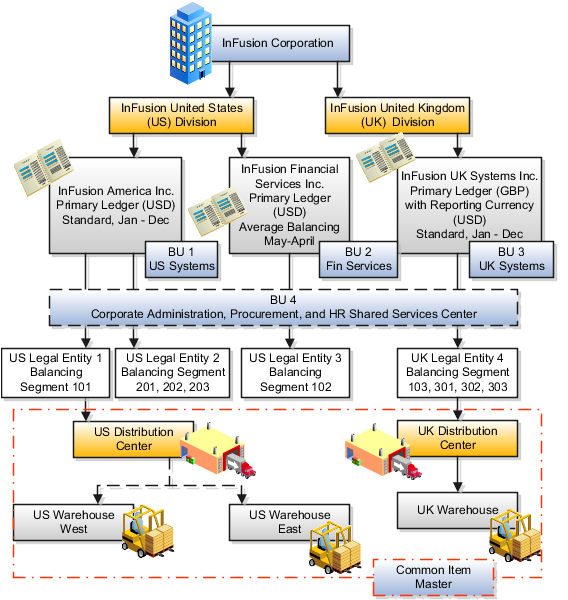

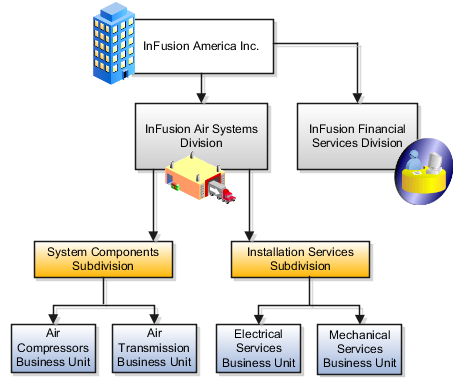

The following figure and table summarize the model that your committee has designed and uses numerical values to provide a sample representation of your structure. The model includes the following recommendations:

Creation of three separate ledgers representing your separate legal entities:

InFusion America Inc.

InFusion Financial Services Inc.

InFusion UK Services Inc.

Consolidation of results for system components, installations, and maintenance product lines across the enterprise

All UK general and administrative costs processed at the UK headquarters

US Systems' general and administrative costs processed at US Corporate headquarters

US Financial Services maintains its own payables and receivables departments

In this chart, the green globe stands for mandatory and gold globe stands for optional setup. The following statements expand on the data in the chart.

The enterprise is mandatory because it serves as an umbrella for the entire implementation. All organizations are created within an enterprise.

Legal entities are also mandatory. They can be optionally mapped to balancing segment values or represented by ledgers. Mapping balancing segment values to legal entities is mandatory if you plan to use the intercompany functionality.

At least one ledger is mandatory in an implementation in which you record your accounting transactions.

Business units are also mandatory because financial transactions are processed in business units.

A shared service center is optional, but if used, must be a business unit.

Divisions are optional and can be represented with a hierarchy of cost centers or by a second balancing segment value.

Departments are mandatory because they track your employees.

Optionally, add an item master organization and inventory organizations if you are tracking your inventory transactions in Oracle Fusion Applications.

Note

Some Oracle Fusion Human Capital Management (HCM) and Customer Relationship Management (CRM) implementations do not require recording of accounting transactions and therefore, do not require implementation of a ledger.

Note

The InFusion Corporation is a legal entity but is not discussed in this example.

The Enterprise Structures Configurator is an interview-based tool that guides you through the process of setting up a basic enterprise structure. By answering questions about your enterprise, the tool creates a structure of divisions, legal entities, business units, and reference data sets that reflects your enterprise structure. After you create your enterprise structure, you also follow a guided process to determine whether or not to use positions, and whether to set up additional attributes for jobs and positions. After you define your enterprise structure and your job and position structures, you can review them, make any necessary changes, and then load the final configuration.

This figure illustrates the process to configure your enterprise using the Enterprise Structures Configurator.

To be able to use the Enterprise Structures Configurator, you must select the Enterprise Structures Guided Flow feature within the offerings in the Functional Setup Manager (FSM). If you do not select this feature, then you must set up your enterprise structure using individual tasks provided elsewhere in the offerings, and you cannot create multiple configurations to compare different scenarios.

To define your enterprise structures, you use the guided flow within the Establish Enterprise Structures task to enter basic information about your enterprise, such as the primary industry and the location of your headquarters. You then create divisions, legal entities, business units, and reference data sets. The Establish Enterprise Structures task enables you to create multiple enterprise configurations so that you can compare different scenarios. Until you load a configuration, you can continue to create and edit multiple configurations until you arrive at one that best suits your enterprise.

In addition to using the Establish Enterprise Structures task to create the basic structure of your enterprise, you also use a guided process to determine whether you want to use jobs only, or jobs and positions. The primary industry that you select in the Establish Enterprise Structures task provides the application with the information needed to make an initial recommendation. You can either accept the recommendation, or you can answer additional questions about how you manage people in your enterprise, and then make a selection. After you select whether to use jobs or positions, the guided process prompts you to set up a descriptive flexfield structure for jobs, and for positions if you have chosen to use them. Descriptive flexfields enable you to capture additional information when you create jobs and positions.

After you create enterprise configurations and job and position structures, you can review a summary of the results of the two interview processes. For each configuration, the online summary lists the divisions, legal entities, business units, reference data sets, and job and position structures that the application will create when you load the configuration.

For a more detailed analysis of a configuration, you can access the Technical Summary Report. This report lists the same information as the online summary, but also lists the following information that will be created by the application when you load the configuration, based on your configuration:

Legislative data groups (the application creates one legislative data group for each country that is identified in the configuration.)

Name of the legislative data group that will be assigned to the payroll statutory unit that is generated for each legal entity.

Organization hierarchy.

The Technical Summary report also lists the default settings that will be loaded for these fields, which you access from the Manage Enterprise HCM Information task: Worker Number Generation, Employment Model and Allow Employment Terms Override. You can print the Technical Summary Report for each of your configurations and compare each scenario.

You can load only one configuration. When you load a configuration, the application creates the divisions, legal entities, business units, and so on. After you load the configuration, you then use individual tasks to edit, add, and delete enterprise structures.

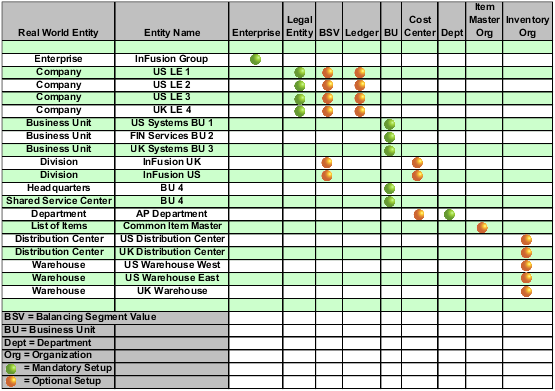

This example illustrates how to set up an enterprise based on a global company operating mainly in the US and the UK with a single primary industry.

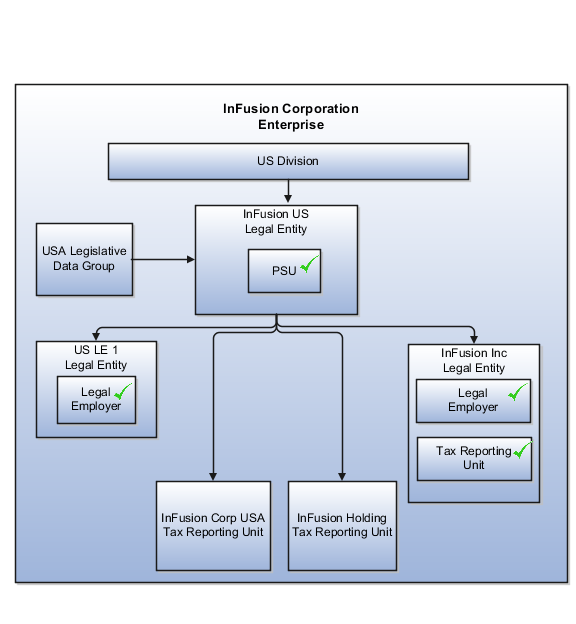

InFusion Corporation is a multinational enterprise in the high technology industry with product lines that include all the components that are required to build and maintain air quality monitoring (AQM) systems for homes and businesses. Its primary locations are in the US and the UK, but it has smaller outlets in France, Saudi Arabia, and the United Arab Emirates (UAE).

In the US, InFusion employs 400 people and has a company revenue of $120 million. Outside the US, InFusion employs 200 people and has revenue of $60 million.

InFusion requires three divisions. The US division will cover the US locations. The Europe division will cover the UK and France. Saudi Arabia and the UAE will be covered by the Middle East division.

InFusion requires legal entities with legal employers, payroll statutory units, tax reporting units, and legislative data groups for the US, UK, France, Saudi Arabia, and UAE, in order to employ and pay its workers in those countries.

InFusion requires a number of departments across the enterprise for each area of business, such as sales and marketing, and a number of cost centers to track and report on the costs of those departments.

InFusion requires business units for human capital management (HCM) purposes. Infusion has general managers responsible for business units within each country. Those business units may share reference data. Some reference data can be defined within a reference data set that multiple business units may subscribe to. Business units are also required for financial purposes. Financial transactions are always processed within a business unit.

Based on this analysis, InFusion requires an enterprise with multiple divisions, ledgers, legal employers, payroll statutory units, tax reporting units, legislative data groups, departments, cost centers, and business units.

This figure illustrates the enterprise configuration that results from the analysis of InFusion Corporation.

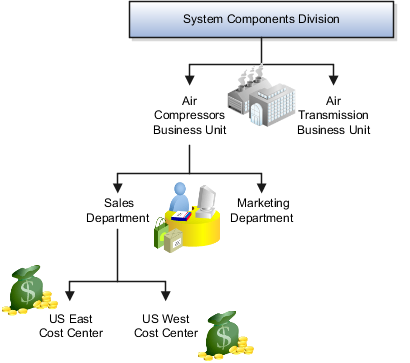

Managing multiple businesses requires that you segregate them by their strategic objectives and measure their results. Responsibility to reach objectives can be delegated along the management structure. Although related to your legal structure, the business organizational hierarchies do not need to reflect directly the legal structure of the enterprise. The management entities and structure can include divisions and subdivisions, lines of business, and other strategic business units, and include their own revenue and cost centers. These organizations can be included in many alternative hierarchies and used for reporting, as long as they have representation in the chart of accounts.

A division refers to a business oriented subdivision within an enterprise, in which each division organizes itself differently to deliver products and services or address different markets. A division can operate in one or more countries, and can be comprised of many companies or parts of different companies that are represented by business units.

A division is a profit center or grouping of profit and cost centers, where the division manager is responsible for attaining business goals including profit goals. A division can be responsible for a share of the company's existing product lines or for a separate business. Managers of divisions may also have return on investment goals requiring tracking of the assets and liabilities of the division. The division manager reports to a top corporate executive.

By definition a division can be represented in the chart of accounts. Companies may choose to represent product lines, brands, or geographies as their divisions: their choice represents the primary organizing principle of the enterprise. This may coincide with the management segment used in segment reporting.

Oracle Fusion Applications supports a qualified management segment and recommends that you use this segment to represent your hierarchy of business units and divisions. If managers of divisions have return on investment goals, make the management segment a balancing segment. Oracle Fusion applications allows up to three balancing segments. The values of the management segment can be comprised of business units that roll up in a hierarchy to report by division.

Historically, divisions were implemented as a node in a hierarchy of segment values. For example, Oracle E-Business Suite has only one balancing segment, and often the division and legal entity are combined into a single segment where each value stands for both division and legal entity.

Divisions are used in HCM to define the management organization hierarchy, using the generic organization hierarchy. This hierarchy can be used to create organization based security profiles.

A legal entity is a recognized party with rights and responsibilities given by legislation.

Legal entities have the right to own property, the right to trade, the responsibility to repay debt, and the responsibility to account for themselves to regulators, taxation authorities, and owners according to rules specified in the relevant legislation. Their rights and responsibilities may be enforced through the judicial system. Define a legal entity for each registered company or other entity recognized in law for which you want to record assets, liabilities, and income, pay transaction taxes, or perform intercompany trading.

A legal entity has responsibility for elements of your enterprise for the following reasons:

Facilitating local compliance

Taking advantage of lower corporation taxation in some jurisdictions

Preparing for acquisitions or disposals of parts of the enterprise

Isolating one area of the business from risks in another area. For example, your enterprise develops property and also leases properties. You could operate the property development business as a separate legal entity to limit risk to your leasing business.

In configuring your enterprise structure in Oracle Fusion Applications, you need to understand that the contracting party on any transaction is always the legal entity. Individual legal entities own the assets of the enterprise, record sales and pay taxes on those sales, make purchases and incur expenses, and perform other transactions.

Legal entities must comply with the regulations of jurisdictions, in which they register. Europe now allows for companies to register in one member country and do business in all member countries, and the US allows for companies to register in one state and do business in all states. To support local reporting requirements, legal reporting units are created and registered.

You are required to publish specific and periodic disclosures of your legal entities' operations based on different jurisdictions' requirements. Certain annual or more frequent accounting reports are referred to as statutory or external reporting. These reports must be filed with specified national and regulatory authorities. For example, in the United States (US), your publicly owned entities (corporations) are required to file quarterly and annual reports, as well as other periodic reports, with the Securities and Exchange Commission (SEC), who enforces statutory reporting requirements for public corporations.

Individual entities privately held or held by public companies do not have to file separately. In other countries, your individual entities do have to file in their own name, as well as at the public group level. Disclosure requirements are diverse. For example, your local entities may have to file locally to comply with local regulations in a local currency, as well as being included in your enterprise's reporting requirements in different currency.

A legal entity can represent all or part of your enterprise's management framework. For example, if you operate in a large country such as the United Kingdom or Germany, you might incorporate each division in the country as a separate legal entity. In a smaller country, for example Austria, you might use a single legal entity to host all of your business operations across divisions.

Using the Enterprise Structures Configurator (ESC), you can create legal entities for your enterprise automatically, based on the countries in which divisions of your business operate, or you can upload a list of legal entities from a spreadsheet.

If you are not certain of the number of legal entities that you need, you can create them automatically. To use this option, you first identify all of the countries in which your enterprise operates. The application opens the Map Divisions by Country page, which contains a matrix of the countries that you identified, your enterprise, and the divisions that you created. You select the check boxes where your enterprise and divisions intersect with the countries to identify the legal entities that you want the application to create. The enterprise is included for situations where your enterprise operates in a country and acts on behalf of several divisions within the enterprise and is a legal employer in a country. If you select the enterprise for a country, the application creates a country holding company.

The application automatically creates the legal entities that you select, and identifies them as payroll statutory units and legal employers. For each country that you indicated that your enterprise operates in, and for each country that you created a location for, the application also automatically creates a legislative data group.

Any legal entities that you create automatically cannot be deleted from the Create Legal Entities page within the Enterprise Structures Configurator. You must return to the Map Divisions by Country page and deselect the legal entities that you no longer want.

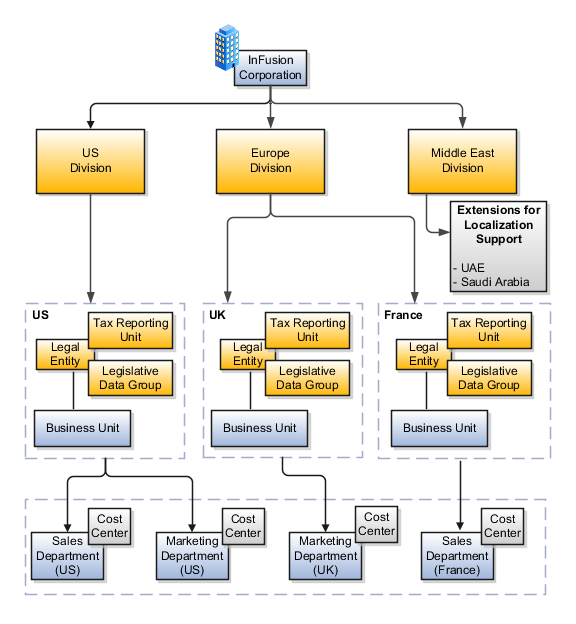

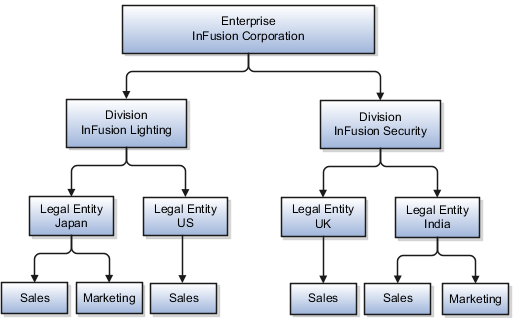

InFusion Corporation is using the ESC to set up their enterprise structure. They have identified two divisions, one for Lighting, and one for Security. The Lighting division operates in Japan and the US, and the Security division operates in the UK and India.

This figure illustrates InFusion Corporation's enterprise structure.

This table represents the selections that InFusion Corporation makes when specifying which legal entities to create on the Map Divisions by Country page.

|

Country |

Enterprise |

InFusion Lighting |

InFusion Security |

|---|---|---|---|

|

Japan |

No |

Yes |

No |

|

US |

No |

Yes |

No |

|

UK |

No |

No |

Yes |

|

India |

No |

No |

Yes |

Based on the selections made in the preceding table, the ESC creates the following four legal entities:

InFusion Lighting Japan LE

InFusion Lighting US LE

InFusion Security UK LE

InFusion Security India LE

If you have a list of legal entities already defined for your enterprise, you can upload them from a spreadsheet. To use this option, you first download a spreadsheet template, then add your legal entity information to the spreadsheet, and then upload directly to your enterprise configuration. You can export and import the spreadsheet multiple times to accommodate revisions.

Oracle Fusion Applications support the modeling of your legal entities. If you make purchases from or sell to other legal entities, define these other legal entities in your customer and supplier registers, which are part of the Oracle Fusion Trading Community Architecture. When your legal entities are trading with each other, you represent both of them as legal entities and also as customers and suppliers in your customer and supplier registers. Use legal entity relationships to determine which transactions are intercompany and require intercompany accounting. Your legal entities can be identified as legal employers and therefore, are available for use in Human Capital Management (HCM) applications.

There are several decisions that need to be considered in creating your legal entities.

The importance of legal entity in transactions

Legal entity and its relationship to business units

Legal entity and its relationship to divisions

Legal entity and its relationship to ledgers

Legal entity and its relationship to balancing segments

Legal entity and its relationship to consolidation rules

Legal entity and its relationship to intercompany transactions

Legal entity and its relationship to worker assignments and legal employer

Legal entity and payroll reporting

Legal reporting units

All of the assets of the enterprise are owned by individual legal entities. Oracle Fusion Financials allow your users to enter legal entities on transactions that represent a movement in value or obligation.

For example, the creation of a sales order creates an obligation for the legal entity that books the order to deliver the goods on the acknowledged date, and an obligation of the purchaser to receive and pay for those goods. Under contract law in most countries, damages can be sought for both actual losses, putting the injured party in the same state as if they had not entered into the contract, and what is called loss of bargain, or the profit that would have made on a transaction.

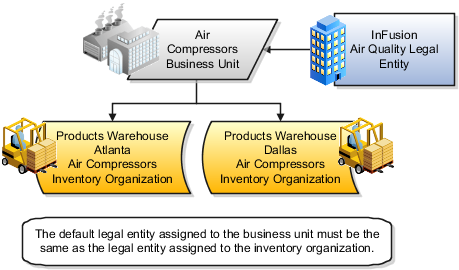

In another example, if you revalued your inventory in a warehouse to account for raw material price increases, the revaluation and revaluation reserves must be reflected in your legal entity's accounts. In Oracle Fusion Applications, your inventory within an inventory organization is managed by a single business unit and belongs to one legal entity.

A business unit can process transactions on behalf of many legal entities. Frequently, a business unit is part of a single legal entity. In most cases the legal entity is explicit on your transactions. For example, a payables invoice has an explicit legal entity field. Your accounts payables department can process supplier invoices on behalf of one or many business units.

In some cases, your legal entity is inferred from your business unit that is processing the transaction. For example, your business unit A agrees on terms for the transfer of inventory to your business unit B. This transaction is binding on your default legal entities assigned to each business unit. Oracle Fusion Procurement, Oracle Fusion Projects, and Oracle Fusion Supply Chain applications rely on deriving the legal entity information from the business unit.

The division is an area of management responsibility that can correspond to a collection of legal entities. If desired, you can aggregate the results for your divisions by legal entity or by combining parts of other legal entities. Define date-effective hierarchies for your cost center or legal entity segment in your chart of accounts to facilitate the aggregation and reporting by division. Divisions and legal entities are independent concepts.

One of your major responsibilities is to file financial statements for your legal entities. Map legal entities to specific ledgers using the Oracle Fusion General Ledger Accounting Configuration Manager. Within a ledger, you can optionally map a legal entity to one or more balancing segment values.

Oracle Fusion General Ledger supports up to three balancing segments, Best practices recommend that one of these segments represents your legal entity to ease your requirement to account for your operations to regulatory agencies, tax authorities, and investors. Accounting for your operations means you must produce a balanced trial balance sheet by legal entity. If you account for many legal entities in a single ledger, you must:

Identify the legal entities within the ledger

Balance transactions that cross legal entity boundaries through intercompany transactions

Decide which balancing segments correspond to each legal entity and assign them in Oracle Fusion General Ledger Accounting Configuration Manager. Once you assign one balancing segment value in a ledger, then all your balancing segment values must be assigned. This recommended best practice facilitates reporting on assets, liabilities, and income by legal entity.

Represent your legal entities by at least one balancing segment value. You may represent it by two or three balancing segment values if more granular reporting is required. For example, if your legal entity operates in multiple jurisdictions in Europe, you might define balancing segment values and map them to legal reporting units. You can represent a legal entity by more than one balancing segment value, do not use a single balancing segment value to represent more than one legal entity.

In Oracle Fusion General Ledger, there are three balancing segments. You can use separate balancing segments to represent your divisions or strategic business units to enable management reporting at the balance sheet level for each division or business unit. For example, use this solution to empower your business unit and divisional managers to track and assume responsibility for their asset utilization or return on investment. Using multiple balancing segments is also useful when you know at the time of implementation that you are disposing of a part of a legal entity and need to isolate the assets and liabilities for that entity.

Note

Implementing multiple balancing segments requires every journal entry that is not balanced by division or business unit, to generate balancing lines. Also, you cannot change to multiple balancing segments easily after you have begun to use the ledger because your historical data is not balanced by the new multiple balancing segments. Restating historical data must be done at that point.

To use this feature for disposal of a part of a legal entity, implement multiple balancing segments at the beginning of the legal entity's corporate life or on conversion to Oracle Fusion.

If you decided to account for each legal entity in a separate ledger, there is no requirement to identify the legal entity with a balancing segment value within the ledger.

Note

While transactions that cross balancing segments don't necessarily cross legal entity boundaries, all transactions that cross legal entity boundaries must cross balancing segments. If you make an acquisition or are preparing to dispose of a portion of your enterprise, you may want to account for that part of the enterprise in its own balancing segment even if it is not a separate legal entity. If you do not map legal entities sharing the same ledger to balancing segments, you will not be able to distinguish them using the intercompany functionality or track their individual equity.

In Oracle Fusion Applications you can map legal entities to balancing segments and then define consolidation rules using your balancing segments. You are creating a relationship between the definition of your legal entities and their role in your consolidation.

Use Oracle Fusion Intercompany functionality for automatic creation of intercompany entries across your balancing segments. Intercompany processing updates legal ownership within the enterprise's groups of legal entities. Invoices or journals are created as needed. To limit the number of trading pairs for your enterprise, set up intercompany organizations and assign then to your authorized legal entities. Define processing options and intercompany accounts to use when creating intercompany transactions and to assist in consolidation elimination entries. These accounts are derived and automatically entered on your intercompany transactions based on legal entities assigned to your intercompany organizations.

Intracompany trading, in which legal ownership isn't changed but other organizational responsibilities are, is also supported. For example, you can track assets and liabilities that move between your departments within your legal entities by creating departmental level intercompany organizations.

Note

In the Oracle Fusion Supply Chain applications, model intercompany relationships using business units, from which legal entities are inferred.

Legal entities that employ people are called legal employers in the Oracle Fusion Legal Entity Configurator. You must enter legal employers on worker assignments in Oracle Fusion HCM.

Your legal entities are required to pay payroll tax and social insurance such as social security on your payroll. In Oracle Fusion Applications, you can register payroll statutory units to pay and report on payroll tax and social insurance on behalf of many of your legal entities. As the legal employer, you might be required to pay payroll tax, not only at the national level, but also at the local level. You meet this obligation by establishing your legal entity as a place of work within the jurisdiction of a local authority. Set up legal reporting units to represent the part of your enterprise with a specific legal reporting obligation. You can also mark these legal reporting units as tax reporting units if the legal entity must pay taxes as a result of establishing a place of business within the jurisdiction.

A business unit is a unit of an enterprise that performs one or many business functions that can be rolled up in a management hierarchy. A business unit can process transactions on behalf of many legal entities. Normally, it will have a manager, strategic objectives, a level of autonomy, and responsibility for its profit and loss. Roll business units up into divisions if you structure your chart of accounts with this type of hierarchy. In Oracle Fusion Applications, you assign your business units to one primary ledger. For example, if a business unit is processing payables invoices they will need to post to a particular ledger. This assignment is mandatory for your business units with business functions that produce financial transactions.

In Oracle Fusion Applications, use business unit as a securing mechanism for transactions. For example, if you run your export business separately from your domestic sales business, secure the export business data to prevent access by the domestic sales employees. To accomplish this security, set up the export business and domestic sales business as two separate business units.

The Oracle Fusion Applications business unit model:

Allows for flexible implementation

Provides a consistent entity for controlling and reporting on transactions

Anchors the sharing of sets of reference data across applications

Business units process transactions using reference data sets that reflect your business rules and policies and can differ from country to country. With Oracle Fusion Application functionality, you can choose to share reference data, such as payment terms and transaction types, across business units, or you can choose to have each business unit manage its own set depending on the level at which you wish to enforce common policies.

In countries where gapless and chronological sequencing of documents is required for subledger transactions, define your business units in alignment with your ledger definition, because the uniqueness of sequencing is only ensured within a ledger. In these cases, define a single ledger and assign one legal entity and business unit.

In summary, use business units in the following ways:

Management reporting

Processing of transactions

Security of transactional data

Reference data definition and sharing

Business units are used by a number of Oracle Fusion Applications to implement data security. You assign data roles to your users to give them access to data in business units and permit them to perform specific functions on this data. When a business function is enabled for a business unit, the application can trigger the creation of data roles for this business unit base on the business function's related job roles.

For example, if a payables invoicing business function is enabled, then it is clear that there are employees in this business unit that perform the function of payables invoicing, and need access to the payables invoicing functionality. Therefore, based on the correspondence between the business function and the job roles, appropriate data roles are generated automatically. Use Human Capital Management (HCM) security profiles to administer security for employees in business units.

Business units are used within Oracle Fusion applications for management reporting, processing of transactions, and security of transactional data. Using the Enterprise Structures Configurator (ESC), you create business units for your enterprise either automatically or manually.

To create business units automatically, you must specify the level at which to create business units. Business units within your enterprise may be represented at the business function level, such as Sales, Consulting, Product Development, and so on, or they may be represented at a more detailed level, where a business unit exists for each combination of countries in which you operate and the functions in those countries.

You can automatically create business units at the following levels:

Country

Country and Division

Country and business function

Division

Division and legal entity

Division and business function

Business function

Legal entity

Business function and legal entity

Select the option that best meets your business requirements, but consider the following:

If you use Oracle Fusion Financials, the legal entity option is recommended because of the manner in which financial transactions are processed.

The business unit level that you select determines how the application automatically creates reference data sets.

After you select a business unit level, the application generates a list of business units, and you select the ones you want the application to create. If you select a level that has two components, such as country and division, then the system displays a table listing both components, and you select the check boxes at the intersections of the components.

The business units listed by the application are suggestions only, and are meant to simplify the process to create business units. You are not required to select all of the business units suggested. When you navigate to the next page in the ESC guided flow, which is the Manage Business Units page, you cannot delete any of the business units that were created automatically. You must return to the Create Business Units page and deselect any business units that you no longer want.

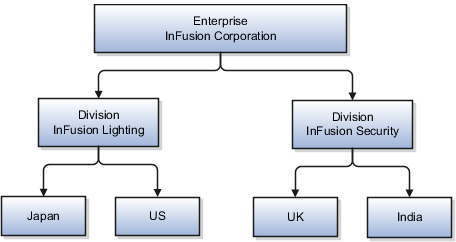

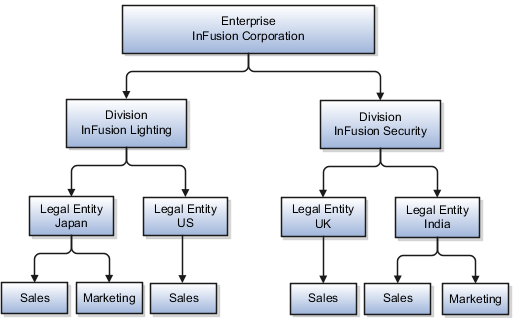

InFusion Corporation is using the Enterprise Structures Configurator to set up their enterprise structure. They have identified two divisions, one for Lighting, and one for Security. They operate in four countries: US, UK, Japan, and India, and they have created a legal entity for each of the countries. The sales and marketing functions are based in both India and Japan, while the US and the UK have only the sales function.

This figure illustrates InFusion Corporation's enterprise structure.

The following table lists the options for business unit levels and the resulting business units that the application suggests for InFusion Corporation.

|

Business Unit Level |

Suggested Business Units |

|---|---|

|

Country |

|

|

Country and Division |

|

|

Country and business function |

|

|

Division |

|

|

Division and Legal Entity |

|

|

Division and Business Function |

|

|

Business Function |

|

|

Legal Entity |

|

|

Legal Entity and Business Function |

|

If none of the levels for creating business units meets your business needs, you can create business units manually, and you create them on the Manage Business Units page. If you create business units manually, then no reference data sets are created automatically. You must create them manually as well.

Oracle Fusion Applications reference data sharing feature is also known as SetID. The reference data sharing functionality supports operations in multiple ledgers, business units, and warehouses, thereby reducing the administrative burden and decreasing the time needed to implement new business units. For example, you can share sales methods, transaction types, or payment terms across business units or selected other data across asset books, cost organizations, or project units.

The reference data sharing features use reference data sets to which reference data is assigned. The reference data sets group assigned reference data. The sets can be understood as buckets of reference data assigned to multiple business units or other application components.

You begin this part of your implementation by creating and assigning reference data to sets. Make changes carefully as changes to a particular set will affect all business units or application components using that set. You can assign a separate set to each business unit for the type of object that is being shared. For example, assign separate sets for payment terms, transaction types, and sales methods to your business units.

Your enterprise can decide that some aspects of corporate policy should affect all business units and leave other aspects to the discretion of the business unit manager. This allows your enterprise to balance autonomy and control for each business unit. For example, if your enterprise holds business unit managers accountable for their profit and loss, but manages working capital requirements at a corporate level, you can let managers define their own sales methods, but define payment terms centrally. In this case, each business unit would have its own reference data set for sales methods, and there would be one central reference data set for payment terms assigned to all business units.

The reference data sharing is especially valuable for lowering the cost of setting up new business units. For example, your enterprise operates in the hospitality industry. You are adding a new business unit to track your new spa services. The hospitality divisional reference data set can be assigned to the new business unit to quickly setup data for this entity component. You can establish other business unit reference data in a business unit specific reference data set as needed

There are variations in the methods used to share data in reference data sets across different types of objects. The following list identifies the methods:

Assignment to one set only, no common values allowed. The simplest form of sharing reference data that allows assigning a reference data object instance to one and only one set. For example, Asset Prorate Conventions are defined and assigned to only one reference data set. This set can be shared across multiple asset books, but all the values are contained only in this one set.

Assignment to one set only, with common values. The most commonly used method of sharing reference data that allows defining reference data object instance across all sets. For example, Receivables Transaction Types are assigned to a common set that is available to all the business units without the need to be explicitly assigned the transaction types to each business unit. In addition, you can assign a business unit specific set of transaction types. At transaction entry, the list of values for transaction types includes transaction types from the set assigned to the business unit, as well as transaction types assigned to the common set that is shared across all business units.

Assignment to multiple sets, no common values allowed. The method of sharing reference data that allows a reference data object instance to be assigned to multiple sets. For instance, Payables Payment Terms use this method. It means that each payment term can be assigned to one or more than one set. For example, you assign the payment term Net 30 to several sets, but the payment term Net 15 is assigned to only your corporate business unit specific set. At transaction entry, the list of values for payment terms consists of only one set of data; the set that is assigned to the transaction's business unit.

Note: Oracle Fusion Applications contains a reference data set called Enterprise. Define any reference data that affects your entire enterprise in this set.

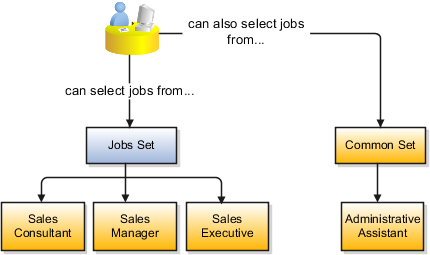

Reference data sharing is a feature within Oracle Fusion that enables you to group set-enabled reference data such as jobs or grades so that the data can be shared across different parts of the organization. Sets also enable you to filter reference data at the transaction level so that only data that has been assigned to certain sets is available to select. To filter reference data, Oracle Fusion Human Capital Management (HCM), applications use the business unit on the transaction. To set up reference data sharing in Oracle Fusion HCM, you create business units and sets, and then assign the sets to the business units.

Some reference data in your organization may be considered global, and should therefore be made available for use within the entire enterprise. You can assign this type of data to the Common Set, which is a predefined set. Regardless of the business unit on a transaction, reference data that has been assigned to the Common Set will always be available, in addition to the reference data that has been assigned to the set that corresponds to the business unit on the transaction.

Other types of reference data may be specific to certain business units, so you want to restrict the use of the data to those business units. In this case, you can create sets specifically for this type of data, and assign the sets to the business units.

When you assign reference data sets to business units, you assign a default reference data set that will be used for all reference data types for that business unit. You can override the set assignment for one or more data types.

InFusion Corporation has two divisions: Lighting and Security, and the divisions each have two locations. Each location has one or more business functions.

The following figure illustrates the structure of InFusion Corporation.

When deciding how to create business units, InFusion decides to create them using the country and business function level. Therefore, they created the following business units:

Sales_Japan

Marketing_Japan

Sales_US

Sales_UK

Marketing_India

Sales_India

Because locations, departments, and grades are specific to each business unit, InFusion does not want to share these types of reference data across business units. They will create a reference data set for each business unit so that data of those types can be set up separately. Because the jobs in the Sales business function are the same across many locations, InFusion decides to create one additional set called Jobs and they will override the set assignment for the Jobs reference data group and assign it to the Jobs set. Based on these requirements, they create the following sets:

Sales_Japan_Set

Mktg_Japan_Set

Sales_US_Set

Sales_UK_Set

Mktg_India_Set

Sales_India_Set

Grades_Set

InFusion assigns business units to sets as follows:

|

Business Unit |

Default Set Assignment |

Set Assignment Overrides |

|---|---|---|

|

Sales_Japan |

Sales_Japan_Set for grades, departments, and locations |

Jobs set for jobs |

|

Marketing_Japan |

Mktg_Japan_Set for grades, departments, and locations |

None |

|

Sales_US |

Sales_US_Set for grades, departments, and locations |

Jobs set for jobs |

|

Sales_UK |

Sales_UK_Set for grades, departments, and locations |

Jobs set for jobs |

|

Marketing_India |

Mktg_India_Set for grades, departments, and locations |

None |

|

Sales_India |

Sales_India_Set for grades, departments, and locations |

Jobs set for jobs |

When setting up grades, departments, and locations for the business units, InFusion will assign the data to the default set for each business unit. When setting up jobs, they will assign the Jobs set and will assign the Common Set to any jobs that may be used throughout the entire organization.

When using grades, departments, and locations at the transaction level, users will be able to select data from the set that corresponds to the business unit that they enter on the transaction, and any data that was assigned to the Common Set. For example, for transactions for the Marketing_Japan business unit, grades, locations, and departments from the Mktg_Japan_Set will be available to select, as well as from the Common Set.

When using jobs at the transaction level, users will be able to select jobs from the Jobs set and from the Common Set when they enter one of the Sales business units on the transaction. For example, when a manager hires an employee for the Sales_India business unit, the list of jobs will be filtered to show jobs from the Jobs set and from the Common Set.

The following figure illustrates what sets of jobs can be accessed when a manager creates an assignment for a worker.

If you created business units automatically, then the Enterprise Structures Configurator automatically creates reference data sets for you. The Enterprise Structures Configurator creates one reference data set for each business unit. You can add additional sets, but you cannot delete any of the sets that were created automatically.

A standard set called the Enterprise set is predefined.

The common set is a predefined set that enables you to share reference data across business units. When you select set-enabled data at the transaction level, the list of values includes data in both the common set and the set associated with the data type for the business unit on the transaction. For example, when you create an assignment, the list of values for grades will include both grades in the common set and in the set that is assigned to grades for the business unit in which you creating the assignment.

Jobs and positions represent roles that enable you to distinguish between tasks and the individuals who perform those tasks. The key to whether to use jobs or positions is how each is used. Positions offer a well-defined space independent of the person performing the job. Jobs are a space defined by the person. A job can be defined globally in the Common Set, whereas a position is defined within one business unit.

You can update the job and department of a position at any time. This is useful if you hire someone into a new role and want to transfer the position to another department.

During implementation, one of the earliest decisions you will make is whether to use jobs or a combination of jobs and positions. The determinants for this decision are:

The primary industry of your enterprise

How you manage your people

Primary industries and how they usually set up their workforce are listed in the table below.

|

Primary Industry |

Workforce Setup |

|---|---|

|

Mining |

Positions |

|

Utilities |

Positions |

|

Manufacturing |

Positions |

|

Retail Trade |

Positions |

|

Transportation and Warehousing |

Positions |

|

Educational Services |

Positions |

|

Public Transportation |

Positions |

|

Agriculture, Forestry, Fishing, and Hunting |

Jobs |

|

Construction |

Jobs |

|

Wholesale Trade |

Jobs |

|

Information |

Jobs |

|

Finance and Insurance |

Jobs |

|

Professional, Scientific, and Technical Services |

Jobs |

|

Management of Companies and Enterprises |

Jobs |

|

Administrative and Support and Waste Management and Remediation Services |

Jobs |

|

Arts, Entertainment, and Recreation |

Jobs |

|

Accommodation and Food Services |

Jobs |

|

Other Services (Except Public Administration) |

Jobs |

The following table displays suggestions of whether to use jobs or a combination of jobs and positions based on your industry and how you manage your employees when there is turnover.

|

Industry |

We always replace employees by rehiring to same role |

We replace the head count, but the manager can use the head count in a different job |

We rehire to the same position, but the manager can request a reallocation of budget to a different post |

|---|---|---|---|

|

Project (An industry that supports project-based forms of organization in which teams of specialists from both inside and outside the company report to project managers.) |

Positions |

Jobs |

Jobs |

|

Controlled (An industry that is highly structured in which all aspects of work and remuneration are well organized and regulated.) |

Positions |

Positions |

Positions |

|

Manufacturing |

Positions |

Jobs |

Positions |

|

Retail |

Positions |

Jobs |

Positions |

|

Education |

Positions |

Jobs |

Positions |

|

Other |

Positions |

Jobs |

Jobs |

Positions are typically used by industries that use detailed approval rules, which perform detailed budgeting and maintain head counts, or have high turnover rates.

ABC Corporation has high turnover. It loses approximately 5% of their cashiers monthly. The job of cashier includes three positions: front line cashier, service desk cashier, and layaway cashier. Each job is cross trained to take over another cashier position. When one cashier leaves from any of the positions, another existing cashier from the front line, service desk or layaway can assist where needed. . But to ensure short lines and customer satisfaction, ABC must replace each cashier lost to turnover.

Since turnover is high in retail it is better for this industry to use positions. There is an automatic vacancy when an employee terminates employment. The position exists even when there are no holders. This is important if the person who leaves the company is a manager or supervisor with direct reports. All direct reports continue reporting to the position even if it is empty. You do not need to reassign these employees to another manager or supervisor; the replacement manager is assigned to the existing position.

Also, an advantage to using positions is that when you hire somebody new many of the attributes are defaulted in from the position. This speeds up the hiring process.

This figure illustrates the retail position setup.

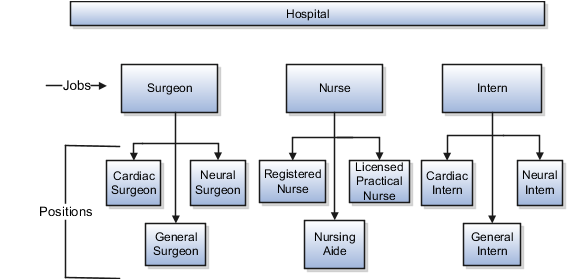

The hospital has a structured head count and detailed budgeting. For example, a specific number of surgeons, nurses, and interns of various types are needed. These positions need to be filled in order for the hospital to run smoothly. Use jobs and positions if you need to apply detailed head count rules.

Health care is an industry that needs to regulate employment, roles, and compensation according to strict policies and procedures. Fixed roles tend to endure over time, surviving multiple incumbents. Industries that manage roles rather than individuals, where roles continue to exist after individuals leave, typically model the workforce using positions.

This figure illustrates the hospital position setup.

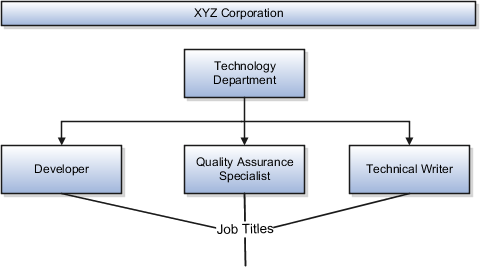

Jobs are typically used without positions by service industries where flexibility and organizational change are key features.

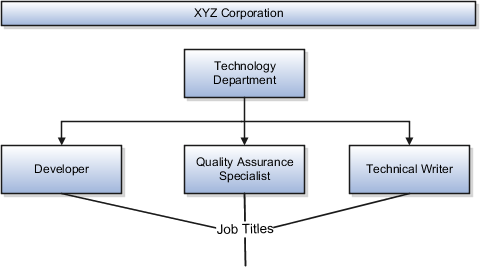

For example, XYZ Corporation has a director over the departments for developers, quality assurance, and technical writers. Recently, three developers have left the company. The director decides to redirect the head count to other areas. Instead of hiring all three back into development, one person is hired to each department, quality assurance, and technical writing.

In software industries, the organization is fluid. Using jobs gives an enterprise the flexibility to determine where to use head count, because the job only exists through the person performing it. In this example, when the three developers leave XYZ Corporation, their jobs no longer exist, therefore the corporation has the flexibility to move the headcount to other areas.

This figure illustrates the software industry job setup.

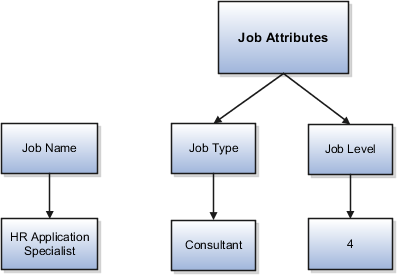

Job and position structures identify the descriptive flexfield structure that enables you to specify additional attributes that you want to capture when you define jobs and positions. Job and position attributes provide further detail to make jobs and positions more specific. You also use attributes to define the structure of your jobs and positions. You can specify attributes at the enterprise level for jobs and positions, at the business unit level for positions, and at the reference data set level for jobs. Job and position structures are optional.

When you define a job, you enter a value for the name of the job. To make job names more specific, set up attributes that enable you to identify additional details about the job, such as the nature of the work that is performed or the relative skill level required for the job. If these attributes apply to all jobs within your enterprise, set up enterprise-level job attributes. Standard capabilities mean that you can use the different segments of the name to identify common jobs or job holders for analysis or compensation, or for grouping records in reports, for example, to find all jobs of a specific job type. You should not use attributes with values that change regularly, for example, salary ranges or expense approval levels that change every year.

This figure illustrates how job type and job level provide further details for the HR Application Specialist job.

Position attributes at the enterprise level are similar to those for jobs. Each position that you define identifies a specific role in the enterprise, which you can manage independently of the person in the position, and it will belong to one specific department or organization. The name of each position must be unique. To simplify the process of managing unique names for positions, set up enterprise-level attributes to identify separate components of the position name. For example, you can set up an attribute for position title and one for position number. When defining the attributes that make up the structure of a position name you should also consider if any of your attributes are part of the definition of a common job type. Using job types for a position can help you manage common information that applies to many different positions. For example you can define a job type of Manager.Level 1 and use this for comparison of positions across departments or lines or business, or for setting common job requirements. You can then define multiple manager type positions in your HR department, each of which has responsibility for a different management function or group.

This figure illustrates how title and position number provide further details for the manager position.

If you have information that you want to capture for positions that is specific to each business unit, then you can define attributes at the business unit level for positions. When you create positions, these attributes appear in addition to any enterprise-level attributes. For example, you may want to identify the sales region for all positions in the sales business unit. You can set up a text attribute called Sales Region and use it to enter the necessary information when creating positions for the sales business unit.

If you have information for jobs that applies to specific reference data sets, set up attributes for jobs at the reference data set level. When you create jobs, these attributes appear in addition to any enterprise-level attributes. For example, you may want to identify all information technology (IT) jobs within a specific set. You can set up a text attribute called Function and use it to enter IT in jobs that you create that perform an IT function within a specific set.

The Enterprise Structures Configurator is an interview-based tool that guides you through setting up divisions, legal entities, business units, and reference data sets. The tool also enables you to assign reference data sets to business units and locations. You can set up multiple configurations to perform what-if scenarios, and then print each configuration to compare the resulting enterprise structure. If you do not use the Enterprise Structures Configurator, then you must set up your enterprise structure using the individual tasks that correspond to each enterprise component. In addition, you will not be able to set up multiple configurations and compare different scenarios. It is recommended that you use the Enterprise Structures Configurator.

The legal entity that represents the top level in your organization hierarchy, as defined by the legal name entered for the enterprise. This designation is used only to create an organization tree, with the ultimate holding company as the top level, divisions and country holding companies as the second level, and legal employers as the third level.

The reference data set that is assigned to a business unit for all reference data groups, such as grades, locations, departments, and jobs. You can override the default reference data set for any reference data group.

For the selected business unit, you can override the default reference data set for one or more reference data groups. For example, assume you have three reference data groups: Vision 1 SET, Vision 2 SET, and Vision 3 SET, where Vision SET 1 is the default set for business unit United Kingdom Vision 1 BU. You can override the default so that grades are assigned to Vision 2 SET, departments are assigned to Vision 3 SET, and jobs are assigned to the default set, Vision 3 SET.

Reference data sharing facilitates sharing of configuration data such as jobs and payment terms, across organizational divisions or business units. You define reference data sets and determine how the data is shared or partitioned. Use reference data sets to reduce duplication and maintenance by sharing common data across business entities where appropriate. Depending on the requirement (specific or common), each business unit can maintain its data at a central location, using a set of values either specific to it or shared by other business units.

You can share reference data after it is filtered on the basis of sets. A common reference data set is available as the default set, which can be assigned to several business units sharing the same reference data. For commonly used data such as currencies, you can use the common reference data set and assign it to multiple business units in various countries that use the same currency. In cases where the default set cannot be assigned to an entity, you can create specific sets. The data set visible on the transactional page depends on the sharing method used to share reference data.

For example, XYZ Corporation uses the same grades throughout the entire organization. Instead of managers in different business units setting up the same grades, XYZ Corporation decides to create a set called Grades and assign the grades reference data group for all business units in the organization to the Grades set, so that the grades can be shared.

Note

For specific information on configuring reference data sharing for a particular object or product, refer to its product documentation.

Reference data sets are logical groups of reference data that can be accessed by various transactional entities depending on the business context. Oracle Fusion Applications contains a common reference data set as well as an enterprise set that may be used as a default set. Depending on your business requirement you can create and maintain additional reference data sets, while continuing to use the common reference data set.

Consider the following scenario.

Your enterprise can decide that some aspects of corporate policy should affect all business units and leave other aspects to the discretion of the business unit manager. This allows your enterprise to balance autonomy and control for each business unit. For example, if your enterprise holds business unit managers accountable for their profit and loss, but manages working capital requirements at a corporate level, you can let managers define their own sales methods, but define payment terms centrally. In this case, each business unit would have its own reference data set for sales methods, and there would be one central reference data set for payment terms assigned to all business units.

The partitioning of reference data and creation of data sets enable you to create reference entities across tables or lookup types, and share modular information and data processing options among business units. With the help of partitioning, you can choose to create separate sets and subsets for each business unit depending upon its business requirement, or create common sets or subsets to enable sharing reference data between several business units, without the need for duplicating the reference data. Partitioning provides you the flexibility to handle the reference data in a way appropriate to your business needs.

The following figure illustrates the reference data sharing method (assignment to one set only, with common values) where the user can access the data assigned to a specific set in a particular business unit, as well as access the data assigned to the common set.

Oracle Fusion Applications reference data sharing feature is also known as SetID. The reference data sharing functionality supports operations in multiple ledgers, business units, and warehouses, thereby reducing the administrative burden and decreasing the time needed to implement new business units. For example, you can share sales methods, transaction types, or payment terms across business units or selected other data across asset books, cost organizations, or project units.

The reference data sharing features use reference data sets to which reference data is assigned. The reference data sets group assigned reference data. The sets can be understood as buckets of reference data assigned to multiple business units or other application components.

You begin this part of your implementation by creating and assigning reference data to sets. Make changes carefully as changes to a particular set will affect all business units or application components using that set. You can assign a separate set to each business unit for the type of object that is being shared. For example, assign separate sets for payment terms, transaction types, and sales methods to your business units.

Your enterprise can decide that some aspects of corporate policy should affect all business units and leave other aspects to the discretion of the business unit manager. This allows your enterprise to balance autonomy and control for each business unit. For example, if your enterprise holds business unit managers accountable for their profit and loss, but manages working capital requirements at a corporate level, you can let managers define their own sales methods, but define payment terms centrally. In this case, each business unit would have its own reference data set for sales methods, and there would be one central reference data set for payment terms assigned to all business units.

The reference data sharing is especially valuable for lowering the cost of setting up new business units. For example, your enterprise operates in the hospitality industry. You are adding a new business unit to track your new spa services. The hospitality divisional reference data set can be assigned to the new business unit to quickly setup data for this entity component. You can establish other business unit reference data in a business unit specific reference data set as needed

There are variations in the methods used to share data in reference data sets across different types of objects. The following list identifies the methods:

Assignment to one set only, no common values allowed. The simplest form of sharing reference data that allows assigning a reference data object instance to one and only one set. For example, Asset Prorate Conventions are defined and assigned to only one reference data set. This set can be shared across multiple asset books, but all the values are contained only in this one set.

Assignment to one set only, with common values. The most commonly used method of sharing reference data that allows defining reference data object instance across all sets. For example, Receivables Transaction Types are assigned to a common set that is available to all the business units without the need to be explicitly assigned the transaction types to each business unit. In addition, you can assign a business unit specific set of transaction types. At transaction entry, the list of values for transaction types includes transaction types from the set assigned to the business unit, as well as transaction types assigned to the common set that is shared across all business units.