11g Release 1 (11.1.2)

Part Number E20375-02

Contents

Previous

Next

|

Oracle® Fusion

Applications

Financials Implementation Guide 11g Release 1 (11.1.2) Part Number E20375-02 |

Contents |

Previous |

Next |

This chapter contains the following:

Corporate Card Transaction Files: How They Are Processed

Payment Liability: Critical Choices

File Format and Delivery: Points to Consider

Creating Corporate Cards: Points to Consider

Downloading Corporate Card Transaction Files From American Express: How They Are Processed

Corporate Card Issuer Payment Requests for Company Pay Transactions: How They Are Processed

FAQs for Define Credit Card Data

Before you can begin processing corporate card transaction files, your company must work with the corporate card issuers to establish connectivity and to determine the transaction file format and the transaction file delivery frequency. After establishing a secure connection, your company receives transaction files. The application loads the transaction file and validates the transactions. The application loads eFolio summary and detail transactions if they are present in the file. All valid transactions are created as expense items and are available to employees for inclusion in the expense reports. All invalid transactions are available for corporate card administrators to review and correct. After correction, these transactions are validated again and become available for expense reporting.

When you implement the corporate credit card functionality for Oracle Fusion Expenses, one of the essential decisions you need to make is whether your company or its employees are responsible for paying the credit card issuer. The three payment options that you can implement in Expenses are the following:

Individual Pay where the employee pays the corporate card issuer for all corporate card transactions

Company Pay where your company pays the corporate card issuer for all transactions

Both Pay where your company pays the corporate card issuer for business expenses and the employee pays the corporate card issuer for personal expenses

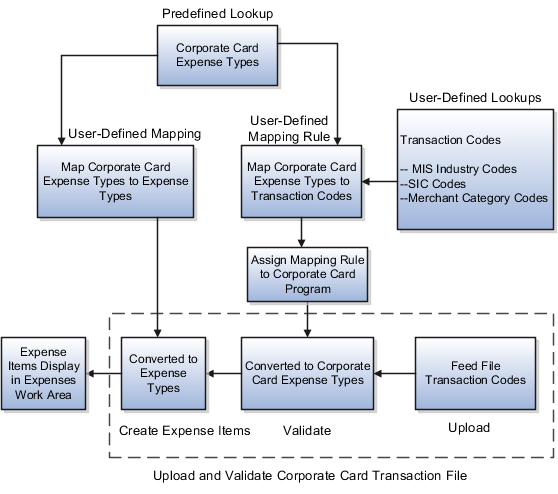

This figure shows an overview of the corporate card transaction files processing.

The process flow of corporate card transaction files is based on which of the three payment options your company decides to implement. Your company can implement one, two, or all three of the payment options by geographical region. For example, a global company might have Both Pay implemented in the US and Individual Pay implemented in the UK.

When creating a new company account for a specific corporate card program, you select a payment option from the Payment Due From choice list on the Create Company Account page.

This section provides examples of the corporate card transaction files process flow for each payment option. For each example, assume that an employee reports cash and categorizes corporate card transactions as both business and personal when creating and submitting an expense report.

The Individual Pay payment option is simpler than Both Pay or Company Pay. Whether you identify corporate card transactions as business or personal expenses, the employee pays the corporate card issuer for both business and personal expenses. When the employee creates an expense report, both business and personal transactions are reported. The employee is, however, reimbursed by your employer for the corporate card business expenses.

The following table provides an example of Individual Pay corporate card transaction files processing:

|

Action |

Description |

|---|---|

|

Set up company account and download data file. |

Obtain the corporate card transactions data file from your corporate card provider. |

|

Upload data file into Expenses. |

Upload and validate your corporate card transactions files. |

|

Create and submit expense report. |

When you create an expense report, you select the corporate card transactions that you want to submit on the report. You determine if transactions are business or personal expenses. By default, transactions are identified as Business. Note You are only reimbursed by your employer for business expenses. Once processed on an expense report, corporate card transactions are no longer available in the list of transactions to be added to expense reports. This is true for both business and personal expenses. |

|

Review and approve expense report. |

After you submit the expense report, your manager must approve it. After managerial approval, the expense report is verified to ensure that required receipts are attached and that the report is in compliance with your company's business policies. |

|

Reimbursement. |

After the expense report has been reviewed and approved, it is ready for invoice creation in Payables to facilitate payment processing. To create an invoice with the amount due to the employee, run the Process Expense Reimbursements program. Then the payment to the employee is processed through Oracle Fusion Payments. |

For the Company Pay payment option, your employer pays the corporate card issuer for all corporate card transactions incurred by its employees. The employee is only reimbursed for cash business expenses. Corporate card transactions reported as business expenses have no effect on the amount that is reimbursed to the employee.

Note

If the employee reports any transactions as personal expenses, these transactions are offset against any cash business expenses reported. Therefore, the amount reimbursable to the employee is reduced by the amount of the corporate card personal expenses.

The following table provides an example of Company Pay corporate card transaction files processing:

|

Action |

Description |

|---|---|

|

Set up company account and download data file. |

Obtain the corporate card transactions file from your corporate card provider. |

|

Upload data file into Expenses. |

Upload and validate your corporate card transactions files. |

|

Create and submit expense report. |

When you create an expense report, select the corporate card transactions that you want to submit. You determine if transactions are business or personal expenses. Cash expenses are not charged to the company corporate card but are considered business expenses. Cash expenses are not reimbursed as corporate card business expenses. Corporate card transactions designated as personal expenses reduce the amount you are reimbursed. Note You are only reimbursed by your employer for cash business expenses. Once processed on an expense report, corporate card transactions are no longer available in the list of transactions to be added to expense reports. This is true for both business and personal expenses. |

|

Review and approve expense report. |

After you submit the expense report, your manager must approve it. After managerial approval, your expense report is verified to ensure that required receipts are attached and that the report is in compliance with your company's business policies. Any corporate card transactions designated as personal expenses are also displayed to the managers for review. |

|

Export the expense report from Expenses to Payables. |

After the expense report has been reviewed and approved, it is ready for invoice creation in Payables to facilitate payment processing. To create the invoice with the amount due to the employee, run the Process Expense Reimbursements program. Then the payment to the employee is processed through Oracle Fusion Payments. To create an invoice with the amount due to the card issuer, run the Create Corporate Card Issuer Payment Requests process. Then the payment to the employee is processed through Oracle Fusion Payments. The card issuer can be paid at any time, regardless of the status of the expense report. |

For the Both Pay payment option, your company pays the corporate card issuer for transactions that are categorized as business expenses. The employee pays the corporate card issuer for all corporate card transactions reported as personal expenses. An invoice cannot be created for the corporate card issuer until the expense report is exported to Payables as an invoice.

The following table provides an example of Both Pay corporate card transaction files processing:

|

Action |

Description |

|---|---|

|

Set up company account and download data file. |

Obtain the corporate card transactions data file from your corporate card provider. |

|

Upload data file into Expenses. |

Upload and validate your corporate card transactions files. |

|

Create and submit expense report. |

When you create an expense report, select the corporate card transactions that you want to submit. Note You will only be reimbursed by your employer for cash business expenses. Once processed on an expense report, corporate card transactions are no longer available in the list of transactions to be added to expense reports. This is true for both business and personal expenses. |

|

Review and approve expense report. |

After you submit the expense report, your manager must approve it. After managerial approval, your expense report is verified to ensure that required receipts are attached and that the report is in compliance with your company's business policies. Once the Payables review process is complete for an expense report, a new expense report containing only corporate card transactions is created based on the existing report by copying only the corporate card transactions categorized as business, which is used to pay the card issuer. If the expense report contains transactions charged to two corporate cards, two reports will be created to pay the corporate card issuers. These reports are named 1 and 2 respectively. |

|

Process expense reimbursements. |

After the card issuer expense report is created, it is ready for invoice creation in Payables to facilitate payment processing. To create the invoice with the amount due to the employee and to the card issuer, run the Process Expense Reimbursements program. Then the payment to the employee and the corporate card issuer is processed through Oracle Fusion Payments. The invoice due to the employee contains accounting distributions and project accounting, when applicable, for both the cash and corporate card expenses. The corporate card issuer invoice contains a single accounting distribution for all corporate card expenses against the expense clearing account. |

Oracle Fusion Expenses enables you to decide payment liability. That is, whether you, your company or both you and your company are responsible for paying the corporate card issuer. You can choose from the following options:

Individual Pay where the employee pays the corporate card issuer for all corporate card transactions.

Company Pay where your company pays the corporate card issuer for all transactions.

Both Pay where the employee pays the corporate card issuer for personal expenses and your company pays the corporate card issuer for business expenses.

For the Individual Pay payment option, whether the employee identifies corporate card transactions as business or personal expenses, the employee pays the corporate card issuer for both transactions. When the employee creates an expense report, both business and personal expenses are reported. Then the employee's expense report is verified to ensure that required receipts are attached and that the report is in compliance with your company's business policies. When the report is approved by the employee's manager, the employee is reimbursed for the corporate card business expenses and cash business expenses.

|

Employee Pays Corporate Card Issuer for... |

Employer Pays Corporate Card Issuer for... |

Employer Does Not Pay for... |

Employee Reimbursed By Employer for... |

|---|---|---|---|

|

Not Applicable |

Corporate Card Personal Expenses |

|

For the Company Pay payment option, the employee does not pay the corporate card issuer. Your employer pays the corporate card issuer for corporate card and cash business transactions incurred by the employee. When the employee creates an expense report, business and personal transactions must be reported, but the employee is reimbursed by your employer only for corporate card and cash business expenses. Any personal expenses are deducted from the cash business expenses and recouped by the company.

Note

The company can choose to pay the corporate card issuer at any time, depending on the payment terms. Submission or approval of expense reports is not required for payment to the card issuer.

|

Employee Pays Corporate Card Issuer for... |

Employer Pays Corporate Card Issuer for... |

Employee Reimburses the Employer for... |

Employee Reimbursed By Employer for... |

|---|---|---|---|

|

Not Applicable |

|

Corporate Card Personal Expenses |

Cash Business Expenses |

For the Both Pay payment option, the employee pays the corporate card issuer for corporate card transactions reported as personal expenses. Your employer pays the corporate card issuer for transactions that are categorized as business expenses. When the employee creates an expense report, the employee selects the corporate card business transactions that he or she wants to submit. When the expense report is approved, the corporate card issuer is reimbursed for corporate card business expenses. The employee is only reimbursed by your employer for cash business expenses. This is also referred to as joint liability.

|

Employee Pays Corporate Card Issuer for... |

Employer Pays Corporate Card Issuer for... |

Employer Does Not Pay for... |

Employee Reimbursed By Employer for... |

|---|---|---|---|

|

Corporate Card Personal Expenses |

Corporate Card Business Expenses |

Corporate Card Personal Expenses |

Cash Business Expenses |

Before your company can receive transaction files from a corporate card issuer, your administrator must perform the following steps:

Choose the correct transaction file format.

Establish file transfer connectivity.

Test sample transaction files.

Your company must verify that the corporate card issuer's file format is supported by Oracle Fusion Expenses. Expenses supports the following corporate card transaction file formats:

American Express KR1025 format

American Express GL1025 format

American Express GL1080 format

Diner's Club Standard Data File format

MasterCard Common Data Format, version 2.0 (CDF 2.0)

MasterCard Common Data Format, version 3.0 (CDF 3.0)

Visa VCF3 format

Visa VCF4 format

Corporate card issuers require your company to provide organizational hierarchy information that they set up in their system to satisfy your company's reporting and billing needs. The organizational hierarchy associates the corporate cards issued to your employees with the appropriate organizations within your company.

Corporate card issuers can provide your company with a single file containing all company transactions or a separate transaction file for each organizational hierarchy. Expenses processes both types of transactions files. To obtain the appropriate file for your company, communicate your preference to the corporate card issuer.

Work with your card issuer to determine the secure file transfer method that meets your company's security requirements. A secure connection between the card issuer and your company is required to receive the transaction file from the card issuer's server. To process the transaction files, Expenses must have read access to the directory location in which the transaction files are stored.

Note

For American Express files, Expenses supports automatic download of corporate card transaction files from the American Express server.

Transactions file format specifications and the test files applicable to your company are provided by the corporate card issuer. Work with your card issuer to identify the transactions that you want to include in the test files and the number of test files you require.

Note

Before you can test the transaction files, you must complete the corporate card program setup. The setup includes obtaining a company account number, card issuer number, processor-assigned number, and market code, in addition to defining a billing control account based on your card brand.

The following table shows the location of the setup data that you are required to test in the sample files. Using the table, locate the data in the card issuer's transaction files and copy that data into the applicable fields in the Create Corporate Card Program page to test the sample files.

Tip

Use this table with the file specification from the card issuer.

|

Transaction File Format |

Field Name in the Create Corporate Card Program Page |

Type of Record |

Data Element Name |

Data Location in the Card Issuer's Transaction File |

Tag |

|---|---|---|---|---|---|

|

American Express KR1025 format |

Company Account Number |

Type 1 |

Corporate Identifier Number |

215-233 |

N/A |

|

Billing Control Account Number |

Type 1 |

Billing Basic Control Account Number |

56-74 |

N/A |

|

Market Code |

Type 0 |

Report Number |

30-32 |

N/A |

|

American Express GL1025 format |

Company Account Number |

Type 1 |

Global Client Origin Identifier |

5-19 |

N/A |

|

Market Code |

Type 1 |

Global Client Origin Identifier |

5-19 |

N/A |

|

Diner's Club Standard Data File format |

Company Account Number |

N/A |

Link_acct |

71-89 |

N/A |

|

MasterCard Common Data Format, version 2.0 (CDF 2.0) MasterCard Common Data Format, version 3.0 (CDF 3.0) |

Company Account Number |

N/A |

N/A |

N/A |

<CorporateEntity> <CorporationNumber> |

|

Card Issuer Number |

N/A |

N/A |

N/A |

<IssuerEntity> <IssuerNumber> |

|

Processor-Assigned Number |

N/A |

N/A |

N/A |

<IssuerEntity> <ICANumber> |

|

Visa VCF3 format Visa VCF4 format |

Company Account Number |

Block Header |

Company Identification |

Field #2 |

N/A |

|

Card Issuer Number |

Block Header |

Issuer Identification Number |

Field #9 |

N/A |

|

Processor-Assigned Number |

Block Header |

Processor Identification Number |

Field #10 |

N/A |

There are two ways to create corporate cards. You can choose either of the following options at different points in time or you can perform both simultaneously.

Automatic corporate card creation

Manual corporate card creation

Automatic corporate card creation applies only to travel cards. Travel cards are corporate cards that are used for travel. New employees are typically handed new corporate cards, but the information on the cards is not manually entered into the application at that time. You can create corporate cards automatically by selecting an employee matching rule for new cards on the Upload Rules tab on the Create Corporate Card Program page. Then, when the corporate card transaction file containing transactions for the new card is uploaded for the first time to the application, the corporate card transaction upload and validation process uses the matching rule to uniquely match the new corporate card to the new employee. The application automatically enters the transaction data for the new corporate card and associates it with the applicable employee using the specified rule. If the rule fails to identify a unique match, the application leaves the corporate card unassigned. If desirable, each corporate card program can have a different matching rule.

Note

To reduce or eliminate manual effort, automatic corporate card creation is recommended.

You can manually create corporate cards for employees in the Create Corporate Card popup where you enter the following data:

Corporate card program

Company account number

Corporate card number

Employee name and number

Expiration date

Maximum amount per transaction (applicable only for procurement cards)

Maximum amount per billing period (applicable only for procurement cards)

Note

Manual creation of corporate cards is the exception, rather than the rule.

Corporate cards are company account-specific. For example, if an employee transfers to another organization within your company and the organization belongs to another company account, then you must create the corporate card again with the applicable company account number.

The corporate card expense type mapping rule is a correspondence between the transaction code that appears in the card feed file and the applicable predefined corporate card expense type. This linkage enables the application to automatically populate expense types for transactions in the expense report.

To automatically default expense types in expense reports, you must perform the following steps:

Define corporate card feed file transaction codes as lookup types.

Map predefined corporate card expense types to feed file transaction codes.

Assign the mapping rule to the corporate card program.

Map predefined corporate card expense types to user-defined expense types in the default expense template for each business unit.

This figure shows the setup to automatically default expense types in expense reports, in conjunction with uploading and validating corporate card transaction files, which ultimately display as expense items in the Expenses work area.

Corporate card issuers provide the transaction codes for each transaction in a corporate card feed file. These transaction codes, whether MIS Industry Codes, SIC Codes, or merchant category codes, must be set up in the application as lookups. Oracle Fusion Expenses provides predefined lookup types so you can define these transaction codes.

Expenses provides predefined corporate card expense types in a single lookup type. This lookup type can be extended to include your company's specific expense types. Then you must associate the predefined corporate card expense types with the corporate card transaction codes. This association is known as a mapping rule.

To enable the upload process to use the correct mapping rule, you must assign a mapping rule to the corporate card program. You can set up multiple mapping rules to default expense types into expense reports for both summary transactions, known as eFolio or Level 2, and detail transactions, known as Level 3.

To default expense types into expense reports, you must perform a final setup. In the expense template, you associate the predefined corporate card expense types with your user-defined expense types. The upload process uses the mapping in the default expense template for the business unit of the transaction to derive the expense type to be displayed for the corporate card expense.

Oracle Fusion Expenses allows you to hold the main corporate card transactions from use by users until the detail corporate card transactions arrive. This ensures that users can include the itemization provided by the card issuer in their expense reports.

Two types of wait days control the maximum duration that the application waits for the detail transactions to arrive:

Transaction detail wait days

Merchant wait days

These wait days are applicable only when the merchant provides Level 3 detail transaction data. That is, there is no wait period for transactions from merchants who do not provide Level 3 transaction detail.

Transaction detail wait days is the number of days the application is set up to hold the main transaction data while waiting for Level 3 detail transaction data from a merchant, which may or may not arrive.

You can set a wait period at the corporate card program level by selecting a value in the Transaction Detail Wait Days choice list in the Upload Rules tab on the Create Corporate Card Program page. If defined, the application uses the smaller value between the transaction detail wait days and the merchant wait days as the wait period for the main transaction.

Merchant wait days, which is calculated by the application, is the difference in the number of days between receiving the main transactions and receiving Level 3 detail transactions when the detail transactions arrive for the first time. Thereafter, the merchant wait days is computed as follows:

[(Detail transactions arrival date - Main transactions arrival date) + Most recent merchant wait days for the main transactions upload]/2

A merchant can provide Level 3 detail transactions either with the main transactions or as a separate delivery. If they are provided as a separate delivery, the Upload Corporate Card Transaction File process holds the main transactions for a specified time period while waiting for the Level 3 detail transactions. During this wait period, which is expressed in days, the main transactions are not available in expense reports. After each delivery of Level 3 detail transactions, the merchant's wait days is updated by the application according to the preceding formula.

Note

The actual time that data arrives is not a factor in the merchant wait days or the application transaction wait days' calculation.

The following table shows the calculations associated with detail transactions and merchant wait days based on transaction data arrival dates using sample data. The table is based on a transaction detail wait days setting of 5 days.

|

Data Upload |

Main Transactions Arrival Date |

Detail Transactions Arrival Date |

Merchant Wait Days |

Application Transaction Wait Days |

Latest Date Transactions are Available in Expense Report |

Actual Date Transactions are Available in Expense Report |

|---|---|---|---|---|---|---|

|

|

|

First Time: Detail transactions arrival date minus main transactions arrival date Thereafter: Detail transactions arrival date minus main transactions arrival date plus most recent merchant wait days for the main transactions upload divided by two. |

Application: Uses the minimum of transaction detail wait days or merchant wait days for the main transactions upload plus one day. |

Date the transaction detail wait days end. |

Actual date the main and detail transactions are available in the expense report. |

|

Main Transactions 1 |

May 1 |

N/A |

N/A The merchant has never provided Level 3 detail transactions. Hence, there are no merchant wait days in the application. |

0 Days The merchant did not provide Level 3 details transactions. Hence, the application does not wait. |

May 1 Available immediately. |

May 1 Available immediately. |

|

Detail Transactions 1 |

N/A |

May 5 |

4 Days |

N/A |

N/A |

May 5 |

|

Main Transactions 2 |

May 7 |

N/A |

4 Days Previously calculated merchant wait days. |

5 Days The application waits for the minimum of 5 transaction detail wait days or 4 merchant wait days plus one day. |

May 11 May 7 + 5 application wait days = May 12. |

N/A |

|

Detail Transactions 2 |

N/A |

May 9 |

3 Days (May 9 minus May 7) +4 /2. |

N/A |

N/A |

May 9 |

|

Main Transactions 3 |

May 12 |

N/A |

3 Days Previously calculated merchant wait days. |

4 Days The application waits for the minimum of 5 transaction detail wait days or 3 merchant wait days plus one day. |

May 15 May 12 + 4 application wait days = May 16. |

N/A |

To download corporate card transaction files from American Express, you must set up Oracle Fusion Expenses to download data files in conjunction with the Upload Corporate Card Transaction File program.

Note

The ability to download files is available only for American Express transaction files.

Before you can download transaction files from American Express servers, you must set up a Secure File Transfer (SFT) account with American Express and obtain the user name and password that identifies your customer account on the SFT server, as well as create a download directory for the American Express transaction files. The application must have read and write access to this directory.

The following proxy server settings affect the download of corporate card transaction files from American Express:

WEB_PROXY_HOST profile option set with the proxy server name if the transaction file downloads occur through a proxy server

WEB_PROXY_PORT profile option set with the proxy server port if the transaction file downloads occur through a proxy server

To set up the transaction file transfer parameters for the American Express corporate card program, enter the values in the following table in the Transfer Parameters tab on the Create Corporate Card Program page.

|

Parameter Name |

Description |

|---|---|

|

Download Profile Name |

The name entered by the user to identify the download parameters. |

|

Username |

The user name provided by American Express that identifies your customer account. |

|

Password |

The password for the American Express customer account. |

|

File Name Prefix |

The file name prefix provided by American Express. |

|

Secure Directory |

The full path to the directory where the downloaded transaction files are stored. |

|

Server |

The name of the American Express server to connect to for the transaction file download. Note American Express also provides a server at fsgatewaytest.aexp.com for transaction file transfer testing. |

After you complete the tasks for corporate card transaction download, you can use the Upload Corporate Card Transaction File program with the profile name as a download parameter to download corporate card transaction files from American Express. The Upload Corporate Card Transaction File program downloads the file into the secure directory that you created and names the file <process id>.amx. The program does not delete any files from the directory.

Note

American Express places one or multiple transaction files at a time in a folder called Outbox in your customer account, but the Upload Corporate Card Transaction File program processes only one file at a time. The process picks up the oldest file each time. To pick up multiple files, you must schedule the Upload Corporate Card Transaction File process to run multiple times.

The corporate card administrator runs the Create Corporate Card Issuer Payment Requests process to generate the payment requests for corporate card issuers when there are corporate cards that use the Company Pay payment option. The Create Corporate Card Issuer Payment Requests process is run only when the Company Pay payment option is used.

Note

This process can be run at any time. Since the company's objective is to pay the card issuer on time, running the Create Corporate Card Issuer Payment Requests process is not dependent on when the employee submits the expense report.

This figure shows how the:

Create Corporate Card Issuer Payment Requests process generates payment requests to pay corporate card issuers when the corporate cards use the Company Pay payment option.

Process Expense Reimbursement process generates payment requests to pay employees when the corporate cards use the Company Pay plus cash payment option.

Settings that affect expense report payment requests for Company Pay transactions are the following:

Employee Liability Account, which is set up as a system option in the Edit Expenses System Options page

Note

This account is used only if there are cash expenses in the expense report and reimbursement is due to the employee.

Corporate Card Issuer Payment Liability Account, which is set up in Oracle Fusion Payables

This account records the amount the company reimburses the corporate card issuers for expenses incurred by the employees on their corporate cards.

Expense Clearing Account and Payment Option, which are set up in the Create or Edit Company Account popup

This account holds accounting for corporate card transactions temporarily. The account is cleared when the expense reports containing the corporate card transactions are processed by Oracle Fusion Payables.

The Create Corporate Card Issuer Payment Requests process has the following components:

Populate Payables Open Invoice Interface tables

Create corporate card issuer payment requests

Handle processed and rejected expense reports

For each corporate card, the Create Corporate Card Issuer Payment Requests process creates one invoice header record in the Payables Open Invoice Interface table. All corporate card transactions for the corporate card are created as child lines. The accounting distributions for the transactions are created using the Expense Clearing Account for the corporate card.

After populating the Payables Open Invoice Interface table, the Create Corporate Card Issuer Payment Requests process invokes the Import Payables Invoices process in Payables. Payables creates payment requests using the information in the Payables Open Invoice Interface table. Tax processing is not applicable for corporate card issuer payment requests.

During payment request creation, Payables rejects records in the Payables Open Invoice Interface table if there are errors, such as dates in closed accounting periods or invalid payment methods. After payment requests creation is complete, the Create Corporate Card Issuer Payment Requests process removes any rejected records from the interface table. The corporate card administrator must then take the necessary action to reprocess the corporate card transactions for reimbursement.

Finally, all expense items corresponding to the corporate card transactions, for which payment requests are created, are updated with a corresponding payment request identifier.

The following table describes the types of payment options for corporate card transactions in expense reports and the processes that are run to generate their associated payment requests.

|

Expense Report Payment Options for Corporate Card Transactions |

Process Run |

Payment Requests Created |

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

Corporate Card Issuer Payment Requests |

|

|

|

|

|

|

|

Company Pay only |

|

Corporate Card Issuer Payment Requests |

A corporate card program is an agreement between the corporate card issuer and your company that governs the issuance of corporate cards to the employees of your company and the payment to the card issuer. Your company can have a single card provider that provides corporate cards for the employees globally, which is referred to as a global card program, or you can have multiple card providers that provide corporate cards for the employees based on the region and the services needed.

A corporate card program consists of one or more company accounts that represent a specific organizational hierarchy in your company. Corporate cards are issued under each company account. Each company account is associated with:

A card issuing bank, known as a card issuer

Payment terms

Other agreements

Your company can choose to receive electronic files containing the corporate card transactions of their employees on a regular basis. The file format and method of delivery are agreed to and set up before your company starts processing the corporate card transaction files through Oracle Fusion Expenses.

You can set up a corporate card issuer, which is a bank that issues corporate cards, through the Manage Corporate Card Issuers page by entering the card issuer's site information, as well as the corporate card issuer's payment information. To enable your company to pay a corporate card issuer, you enter a default payment method, whether check, EFT, or wire, in the Address Payment Information region of the Edit Corporate Card Issuer page, as well as bank account information. Then you associate the newly created card issuer with your company account in the Create Company Account page. By selecting a payment currency and payment terms in the Create Company Account page, you complete the payment information necessary to pay the corporate card issuer.

Oracle Fusion Expenses enables your company to set up corporate card usage rules to enforce its policies regarding the use of corporate cards. On the Manage Corporate Card Usage Policies page, you can define the allowable amount for each expense category that can be charged as a cash expense. Above this allowable amount, employees are required to use their corporate cards. Employees who exceed the allowable limit receive a warning message, while completing expense entry, that reminds them to use the corporate card or an error message that actually prevents submission of the expense report. The application also notifies the auditor and manager of the policy violations. Alternatively, if no limits are defined, Expenses allows you to submit cash expenses of any amount.