11g Release 1 (11.1.2)

Part Number E20384-02

Contents

Previous

Next

|

Oracle® Fusion

Applications Project Management Implementation Guide 11g Release 1 (11.1.2) Part Number E20384-02 |

Contents |

Previous |

Next |

This chapter contains the following:

Manage Burden Cost Base Types, Bases, and Codes

Update Burden Options on Project Types

Extensions for Define Burdening

Burdening provides a buildup of raw and burden costs to represent the total cost of doing business accurately. You can calculate burdened costs as a buildup of costs using a precedence of multipliers. Taking the raw cost, Oracle Fusion Project Costing performs a buildup of burden costs on raw costs to provide a true representation of costs. Using burdening, you can perform internal costing, revenue accrual, and billing for any type of burdened costs that your company applies to raw costs.

You define the projects that need to be burdened by enabling project types for burdening. When you specify that a project type is burdened, you must then specify the burden schedule to be used. The burden schedule stores the burden multipliers and indicates the transactions to be burdened, based on cost bases defined in the burden structure. You specify the expenditure types that are included in each cost base. With burdening, you can use an unlimited number of burden cost codes, easily revise burden schedules, and retroactively adjust multipliers. You can define different burden schedules for costing, revenue, and billing purposes.

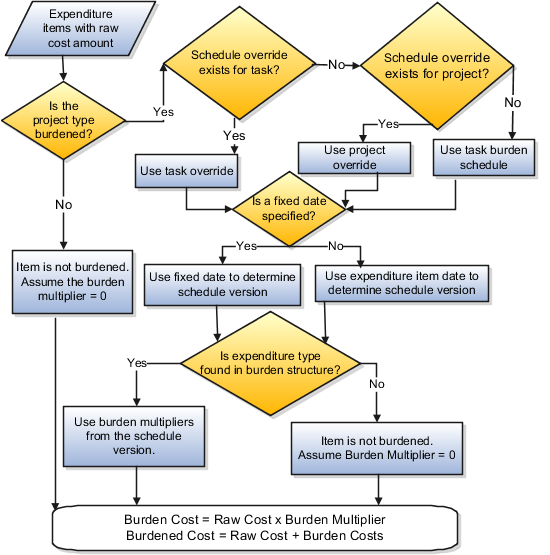

The calculation of burden cost includes the following processing decision logic and calculations:

The following is a diagram of the burden cost calculation process and its explanation:

Expenditure items with a raw cost amount are selected for processing.

The process determines if the related project type of the expenditure item is defined for burdening.

If the project type is enabled for burdening, then the process determines the burden schedule to be used.

If the project type is not enabled for burdening, then the expenditure item is not burdened. The process assumes the burden multiplier is zero; therefore, burden cost is zero and thus burdened cost equals raw cost.

To determine which burden multiplier to use, the process determines if there is a burden schedule override for the expenditure.

If a burden schedule override exists, then the process uses the task burden schedule override on the associated task.

If no task burden schedule override exists on the associated task, then the process uses the project burden schedule override on the associated project.

If there are no burden schedule overrides, the process determines the burden schedule to use for burden cost calculations in the following order:

Burden schedule assigned at the task level

Burden schedule assigned at the project level

The process checks if a fixed date is specified for burdening. If yes, it uses the fixed date to determine the schedule version.

If fixed date is not specified, then the process uses the expenditure item to determine the burden schedule version.

After a schedule version is determined, the process verifies that the expenditure type of the expenditure item is found in any of the cost bases of the selected burden schedule version.

If an expenditure type is excluded from all cost bases in the burden structure, then the expenditure items that use that expenditure type are not burdened (burden cost equals zero, thus burdened cost equals raw cost).

The application calculates burden cost and burdened cost amounts according to the following calculation formulas:

Burden cost equals raw cost multiplied by a burden multiplier.

Burdened cost equals the sum of raw cost and burden costs.

The burden structure assigned to the burden schedule version determines whether calculations are additive or based on the precedence assigned to each cost code. A burden structure can be additive or precedence based.

If you have multiple burden cost codes, an additive burden structure applies each burden cost code to the raw costs in the appropriate cost base. The examples in the following tables illustrate how Oracle Fusion Projects calculates burdened cost as a buildup of raw and burden costs and how different burden structures using the same cost codes can result in different total burdened costs:

The following table shows the cost codes and multipliers for calculating burdened cost using the additive burden structure.

|

Cost Code |

Precedence |

Multiplier |

|---|---|---|

|

Overhead |

1 |

.10 |

|

Material Handling |

1 |

.10 |

|

General Administrative Costs |

1 |

.10 |

|

Cost Type |

Calculation |

Amount |

|---|---|---|

|

Raw Cost |

Not Applicable |

1000.00 |

|

Overhead |

1000.00 X 0.10 |

100.00 |

|

Material Handling |

1000.00 X 0.10 |

100.00 |

|

General Administrative Costs |

1000.00 X 0.10 |

100.00 |

|

Burdened Cost |

1000.00+100.00+1000.00+100.00 |

1300.00 |

A precedence burden structure is cumulative and applies each cost code to the running total of the raw costs, burdened with all previous cost codes. The calculation applies the multiplier for the cost code with the lowest precedence number to the raw cost amount.

The calculation applies the cost code with the next lowest precedence to the subtotal of the raw cost plus the burden cost for the first multiplier. The calculation logic continues in the same way through the remaining cost codes. If two cost codes have the same precedence number, then both are applied to the same subtotal amount.

The following table shows the cost codes and multipliers for calculating burdened cost using the precedence burden structure for a nonrate-based expenditure item:

|

Cost Code |

Precedence |

Multiplier |

|---|---|---|

|

Overhead |

10 |

.10 |

|

Material Handling |

20 |

.10 |

|

General Administrative Costs |

30 |

.10 |

|

Cost Type |

Calculation |

Amount |

|---|---|---|

|

Raw Cost |

Not Applicable |

1000.00 |

|

Overhead |

1000.00 X 0.10 |

100.00 |

|

Material Handling |

(1000.00+100.00) X 0.10 |

110.00 |

|

General Administrative Costs |

(1000.00+100.00+110.00) X 0.10 |

121.00 |

|

Burdened Cost |

1000.00 +100.00 +110.00+121.00 |

1331.00 |

Note

The order of the burden cost codes has no effect on the total burdened cost with either additive or precedence burden structures.

You use burden cost bases in burden structures to group the burden cost codes with the expenditure types to which they will be applied. As a result, you need to create burden cost bases to support each unique grouping of burden cost codes and expenditure types.

The following scenario illustrates burden cost bases that are used to group raw costs for the purpose of calculating burdened costs.

Burden cost bases with the type Burden Cost, as shown in the following table, are used to group raw costs for the purpose of calculating burdened costs. Reports sort cost bases first by the report order value and then by the cost base name.

|

Cost Base |

Report Order |

Cost Base Type |

|---|---|---|

|

Labor |

10 |

Burden Cost |

|

Material |

20 |

Burden Cost |

|

Expense |

30 |

Burden Cost |

Note

Oracle Fusion Projects predefines the cost base types Burden Cost and Other.

The following scenario illustrates burden cost codes that represent distinct types of burden to apply to raw costs.

Burden cost codes are created for each type of burden that will be applied to raw costs. In this example, assume that labor raw costs are burdened with fringe benefits, overhead, and administrative costs. Material raw costs are burdened with material handling fees and administrative costs. Expenses are burdened only with administrative costs.

You can optionally assign an expenditure type to any burden cost code to capture burden costs on separate, summarized expenditure items. Only expenditure types with a Burden Transactions expenditure type class are available for assignment to a burden cost code. The assigned expenditure type becomes the expenditure type for that type of burden cost.

Note

Expenditure types that you assign to burden cost codes must be classified as a Burden Transactions expenditure type.

Note

Ensure that the expenditure types that you assign to burden cost codes are assigned to the reference data sets for each project unit that will own projects receiving summarized burden transactions.

The following table shows burden cost codes that represent distinct types of burden to apply to raw costs.

|

Burden Cost Code |

Description |

Expenditure Type |

|---|---|---|

|

Administrative |

Corporate expenses such as corporate staff and marketing |

General and Administrative |

|

Fringe - Faculty |

Employer paid payroll costs, insurance, and pension for faculty |

Fringe Benefits |

|

Fringe - Staff |

Employer paid payroll costs and insurance for staff |

Fringe Benefits |

|

Material Handling |

Material handling fees |

Material |

|

Overhead |

Support staff, equipment rental, supplies, building rent, and facilities |

Overhead |

Identifies whether the burden cost base is used for burden cost calculations or grouping expenditure items for different purposes. Oracle Fusion Projects provides two predefined cost base types: Burden Cost and Other. Cost bases with the type Burden Cost are used in burden calculations. Cost bases with a type other than Burden Cost are not included in burden calculations; these cost bases are used for grouping expenditure types for different purposes, such as for billing extension calculations.

Before you create burden cost codes, you define an expenditure type for burden cost codes that will be processed as separate, summarized burden transactions. The expenditure type assigned to a burden cost code must be classified as a burden transaction and belong to the reference data set for the project unit.

After you create burden cost codes, you can add it to a burden structure and specify what cost base it is applied to, the expenditure types it is associated with, and the order in which it is applied to raw costs within the cost base.

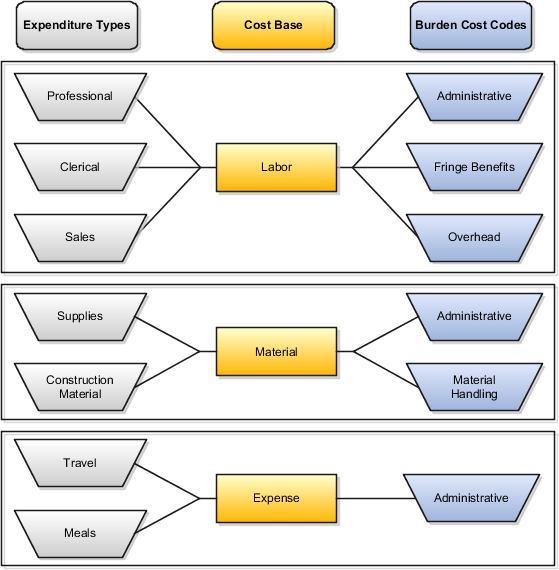

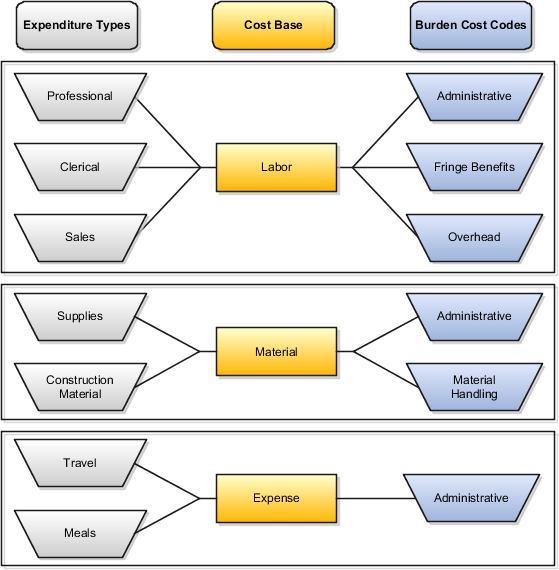

The following scenario illustrates the relationship between expenditure types and burden cost codes in a burden structure. This relationship determines what burden costs Oracle Fusion Project Costing applies to specific raw costs.

Note

Before you can define burden structures, you must define expenditure types, burden cost bases, and burden cost codes.

The following diagram shows the expenditure types and burden cost codes that are assigned to the Labor, Material, and Expense burden cost bases.

The following table shows the multipliers that are used to calculate burden costs for raw costs in the Labor, Material, and Expense cost bases. This is an additive burden structure that applies each burden cost code to the raw costs in the appropriate cost base.

Note

Multipliers are defined on the burden schedule.

|

Burden Cost Base |

Raw Cost Amount (USD) |

Administrative Cost Code Multiplier |

Labor Fringe Benefit Cost Code Multiplier |

Labor Overhead Cost Code Multiplier |

Material Handling Cost Code Multiplier |

|---|---|---|---|---|---|

|

Labor |

1,000 |

.20 |

.20 |

.40 |

|

|

Material |

500 |

.20 |

|

|

.25 |

|

Expense |

400 |

.20 |

|

|

|

The following diagram shows the resulting burdened costs for labor, material, and expenses.

A burden structure can be additive or precedence based. If you have multiple burden cost codes, an additive burden structure applies each burden cost code to the raw cost in the appropriate cost base. A precedence burden structure is cumulative and applies each cost code to the running total of the raw cost, burdened with all previous cost codes. You assign the multiplier on the burden schedule that Oracle Fusion Project Costing uses to perform the cost buildup for each detailed transaction.

Create an additive burden structure to apply each burden cost code assigned to a cost base using the same precedence when calculating burden costs, as shown in the following table.

|

Cost Code |

Precedence |

Multiplier |

Formula |

Amount (USD) |

|---|---|---|---|---|

|

Raw Cost |

|

|

|

100.00 |

|

Overhead |

1 |

0.50 |

0.50 * 100.00 |

50.00 |

|

Fringe Benefits |

1 |

0.30 |

0.30 * 100.00 |

30.00 |

|

General and Administrative |

1 |

0.20 |

0.20 * 100.00 |

20.00 |

|

Burdened Cost |

|

|

|

200.00 |

Note

Each burden cost code in an additive burden structure is automatically assigned a default precedence value of 1.

Create a precedence burden structure to specify the order in which each burden cost code assigned to a cost base is applied to raw costs, as shown in the following table.

|

Cost Code |

Precedence |

Multiplier |

Formula |

Amount (USD) |

|---|---|---|---|---|

|

Raw Cost |

|

|

|

100.00 |

|

Overhead |

10 |

0.50 |

0.50 * 100.00 |

50.00 |

|

Fringe Benefits |

20 |

0.30 |

0.30 * 150.00 |

45.00 |

|

General and Administrative |

30 |

0.20 |

0.20 * 195.00 |

39.00 |

|

Burdened Cost |

|

|

|

234.00 |

You define the project cost buildup using a burden structure. A burden structure determines how you group expenditure types into burden cost bases and establishes the method of applying burden costs to raw costs. Before creating burden structures you must define expenditure types, cost bases, and burden cost codes, which are the main components of a burden structure.

The diagram illustrates a burden structure with the following cost bases.

Labor

Includes the expenditure types Professional, Clerical, and Sales.

Is assigned the burden cost codes Administrative, Fringe Benefits, Overhead.

Material

Includes the expenditure types Supplies and Construction Material.

Is assigned the burden cost codes Administrative and Material Handling.

Expense

Includes the expenditure types Travel and Meals.

Is assigned the burden cost code Administrative.

Cost bases are the groups of raw costs used for applying burden costs. You assign cost bases to burden structures, and then specify the types of raw costs, represented by expenditure types, that are included in the cost base, and the types of burden costs that are applied to the cost base.

You can also use cost bases to group expenditure types for other purposes, such as in billing extension calculations. These cost bases are not used for burdening, and are defined with a cost base type other than Burden Cost. When you assign cost bases with a type other than Burden Cost to a burden structure, you can specify expenditure types for the cost base, but you cannot specify burden cost codes for the cost base since the cost base is not used for burdening.

Burden cost codes represent the distinct type of burden to apply to raw costs. For example, if labor costs receive both fringe benefits and overhead burden, then define a cost code for each type of burden. Assign an expenditure type to each burden cost code that Oracle Fusion Project Costing processes as separate, summarized expenditure items. The assigned expenditure type becomes the expenditure type for that type of burden cost.

Cost base types refer to the use of cost bases. Oracle Fusion Project Costing provides the following cost base types.

Burden Cost: Assign to cost bases that are used to calculate burden costs.

Other: Assign to cost bases that are used for other purposes than to calculate burden costs.

You can define additional cost base types to use for non-burden transactions.

Expenditure types classify raw costs and burden cost codes classify burden costs. The relationship between expenditure types and burden cost codes within each cost base determines what burden costs are applied to specific raw costs, and the order in which processing applies the burden costs.

In a burden structure, each expenditure type can belong to only one cost base with a cost base type of Burden Cost. This restriction ensures that Oracle Fusion Project Costing does not burden an expenditure type more than once. If you do not assign an expenditure type to a cost base, then burden costs are not applied to the raw costs with those expenditure types. In other words, the burdened cost for these transactions is the same as the raw cost of the transaction.

Burden costs are not applied to a transaction if either of these situations exist:

The expenditure type associated with the transaction is not assigned to a cost base.

The project type for the project is not enabled for burden calculation. In this situation, raw cost is equal to burdened cost.

Burden schedules establish the multipliers used to calculate the burdened cost, revenue, or bill amount of each expenditure item charged to a project. The burden schedule determines which transactions are burdened, based on burden cost bases defined in the burden structure. The project type determines which projects are burdened and contains the default burden schedule. A burden schedule type can be firm or provisional. Rates can be overridden by using a schedule of multipliers negotiated for a specific project or task.

Use a firm burden schedule if you do not expect the multipliers to change. Firm burden schedules can have multiple versions, but never more than one version for a date range.

Use a provisional burden schedule if the multipliers are based on estimates, such as a yearly forecast budget. Provisional schedules can have provisional and actual versions active for the same date range. When the actual multipliers are available, replace the provisional version with the actual version. When the actual burden schedule is built, the impacted expenditure items are automatically reprocessed to adjust the burden cost amounts.

The multiplier specifies the rate by which to multiply the raw cost amount to obtain the burden cost amount. You assign a multiplier to a combination of burden cost code and either a unique organization or a parent organization.

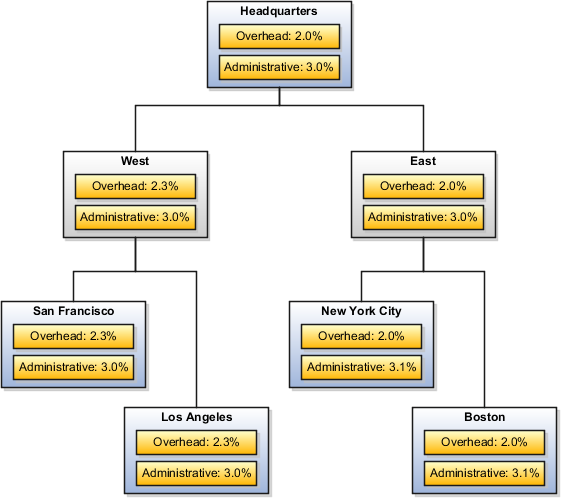

The organization hierarchy is used to cascade rates down to lower level organizations where multipliers are not explicitly defined. If Oracle Fusion Projects finds a level in the hierarchy that does not have a multiplier defined, the application uses the multipliers of the parent organization. Therefore, an organization multiplier schedule hierarchy is used to identify the exceptions. You define the multipliers for an organization only if you want to override the multipliers of the parent organization.

The following diagram shows an example of multipliers that are used by organizations. The parent organization, Headquarters, has two defined multipliers: Overhead with a multiplier of 2.0, and Administrative with a multiplier of 3.0.

When the application processes transactions for the East organization, no multipliers are found. Therefore, the application uses the multipliers from the parent organization, Headquarters.

The Boston and New York City organizations are assigned an Administrative multiplier of 3.1, and no Overhead multiplier. Therefore, the application uses the Administrative multiplier of 3.1, and the Overhead multiplier from the Headquarters organization, when processing transactions for the Boston and New York City organizations.

The West organization is assigned an Overhead multiplier of 2.3, and no Administrative multiplier. Therefore, the application uses the Overhead multiplier of 2.3, and the Administrative multiplier from the Headquarters organization, when processing transactions for the West organization.

No multipliers are assigned to the San Francisco and Los Angeles organizations. Therefore, the application uses the Overhead multiplier from the West organization, and the Administrative multiplier from the Headquarters organization, when processing transactions for the San Francisco and Los Angeles organizations.

Burden schedule versions define the date range within which multipliers are effective. You build the burden schedule to make the burden schedule versions active and available for use.

Note

If an organization is added to the hierarchy after the schedule is built, then submit the Build New Organization Burden Multipliers process. A burden schedule version must be active to add multipliers for a new organization.

The Build New Organization Burden Multipliers process adds burden multipliers to burden schedules for an organization when you add a new organization to your organization hierarchy. If you do not add the organization to a specific burden schedule version, this process builds multipliers for the organization in all burden schedule versions using the multipliers of the parent organization as defined in the organization hierarchy. A burden schedule version must be active to add multipliers for a new organization.

Important

Run this process after you create the organization and before you charge transactions using this organization as the expenditure organization.

Run this process for the parent organization before you run it for the child organization.

If the new organization requires multipliers that are different than the multipliers assigned to the parent organization, you can manually add multipliers for each burden cost code on the burden schedule versions, and then rebuild the versions.

The process parameter is the new organization for which you want to build multipliers for existing burden schedule versions. Typically you run this process during implementation as part of the Burden Definition setup task list.

Process results are summarized in the Build New Organization Burden Multipliers Execution Report that displays the impacted burden schedules and burden schedule versions.

Oracle Fusion Projects identifies existing transactions that are eligible for burden cost recalculation and marks the transactions for reprocessing. For example, when a multiplier for an organization and burden cost code changes on a burden schedule version, the application marks for recalculation all transactions for the organization that are charged to an expenditure type that is linked to the burden cost code.

Burden cost recalculation is required in any of the following situations:

A build occurs on a burden schedule version that was previously built.

An actual burden schedule version is built to replace a provisional burden schedule version.

During recalculation, one or more transactions are not marked for recalculation of burden cost amounts, such as when an expenditure item is locked by another unprocessed adjustment, or a technical error occurs in the process.

Select the Recalculate Burden Cost Amounts button on the burden schedule for the process to identify and mark eligible transactions for burden cost recalculation.

Note

A burden schedule can have multiple versions. The Burden Cost Calculation Required button is available for selection on the burden schedule if at least one version requires recalculation.

After the impacted transactions are marked for burden cost recalculation, the Recalculate Burden Cost Amounts process starts the Import and Process Cost Transactions process to create expenditure items and cost distribution lines for the transactions.

If burden cost recalculation is still required after the Recalculate Burden Cost Amounts process completes, then review the process execution report to determine why the process did not mark eligible transactions for recalculation.

Burden cost recalculation is not required in the following situations:

All burden schedule versions for the build are in a new status.

Changes are made to burden schedule versions prior to the build.

The Recalculate Burden Cost Amounts process is complete and all impacted transactions are successfully marked for burden cost recalculation.

If burden cost recalculation is not required, the Recalculate Burden Cost Amounts button is not available for selection on the burden schedule.

Test burden cost calculations to view a breakdown of the total burdened cost for a specific project transaction and to verify your burden structure and burden schedule implementation. The test emulates an actual burden cost transaction for a set of criteria consisting of the project, task, burden schedule, expenditure type, expenditure organization, raw cost, quantity, and transaction date.

The application uses the burden schedule that you specify as burden cost criteria to calculate burden amounts. If you specify a project as burden cost criteria, and you do not specify a task or burden schedule, then the application uses the burden schedule on the project. If you specify a project and task, and you do not specify a burden schedule, then the application uses the burden schedule on the task.

Test burden cost calculations to:

Verify that the amounts for each burden cost code and for the total burdened cost are calculated correctly according to the specified criteria.

Confirm that the correct schedule is used for the given project and task.

Confirm that the desired burden cost codes and rates are used for the organization and expenditure type.

Note

When the Burden Cost Calculation Override extension is enabled, the transaction quantity is passed to the extension. If you do not enter the quantity, the application considers the transaction quantity as one.

Before you create burden schedules, you must define business units, the organization hierarchy, implementation options, and burden structures.

Burden schedules establish the multipliers that are applied to the raw cost amount of each expenditure item to calculate the burdened cost, revenue, or bill amount charged to a project. You assign burden schedules to project types, projects, or tasks. The project type provides the default burden schedule for a project. You can override the default burden schedules for each project by using a schedule of multipliers negotiated for the project or task.

In planning, if you use planning rates, then you assign a burden schedule in the project or financial planning options. If you use Oracle Fusion Project Integration Gateway to export resource rates to a scheduling application, then you must specify the burden schedule to use, because the set of resources and rates are global and have no project context from which to derive a burden schedule.

A method of applying burden costs to raw costs that enables you to track the total burdened costs of your projects.

Use firm burden schedules if you do not expect your burden multipliers to change. Firm schedules are typically used for internal costing or commercial billing schedules. Firm burden schedules can have multiple versions, but never more than one version for an effective date range.

Use provisional multipliers if you do not know the burden multipliers at the time that you are calculating total burdened costs. Provisional multipliers are typically estimates based on the annual forecast budget. When you determine the actual multipliers to apply to raw costs, then you replace the provisional multipliers with the actual multipliers. Oracle Fusion Project Costing processes the adjustments from provisional to actual changes for costing, revenue, and billing.

Note

The actual burden schedule version, when created, is automatically placed on hold. You must remove the hold prior to building the actual rates and recalculating costs.

Burdening is a method of applying one or more burden cost components to the raw cost amount of each individual transaction to calculate burden cost amounts. Use project types to control how burden transactions are created and accounted. If you enable burdening for a project type, you can choose to account for the individual burden cost components or the total burdened cost amount.

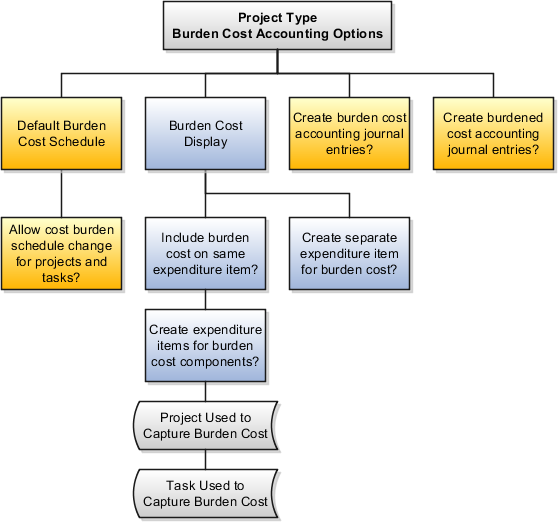

The following diagram illustrates the burden cost accounting options for project types.

You specify the following options when setting up burdening options for project types.

Default Cost Burden Schedule

Allow Cost Burden Schedule Change for Projects and Tasks

Include Burden Cost on Same Expenditure Item

Create Expenditure Items for Burden Cost Components

Create Separate Expenditure Item for Burden Cost

Create Burden Cost Accounting Journal Entries

Create Burdened Cost Accounting Journal Entries

If you enable burdening for the project type, you must select the burden schedule to use as the default cost burden schedule for projects that are defined with this project type.

Enable this option to allow a change of the default cost burden schedule when entering and maintaining projects and tasks. Do not enable this option if you want all projects of a project type to use the same schedule for internal costing.

Enable this option to include the burden cost amount in the same expenditure item. You can store the total burdened cost amount as a value with the raw cost on each expenditure item. Oracle Fusion Projects displays the raw and burdened costs of the expenditure items on windows and reports.

If you include burden cost amounts on the same expenditure item, but wish to see the burden cost details, enable the option to create expenditure items for each burden cost amount on an indirect project and task.

Enable this option to account for burden cost amounts as separate expenditure items on the same project and task as the raw expenditures. The expenditure items storing the burden cost components are identified with a different expenditure type that is classified by the expenditure type class Burden Transaction. Oracle Fusion Projects summarizes the cost distributions to create burden transactions for each applicable burden cost code. The most important summarization attributes are project, lowest task, expenditure organization, expenditure classification, supplier, project accounting period, and burden cost code. You can use the Burden Summarization Grouping Extension to further refine the grouping.

Indicate whether to create an entry for the burden cost amount.

If burdened costs are calculated for reporting purposes only, and you do not want to interface burdened costs to the general ledger, you can disable the creation of accounting journal entries. If you select this option, only the burden cost, which is the difference between the burdened cost and raw cost, is interfaced to general ledger.

Indicate whether to account for the total burdened cost amount of the items. You typically use this option to track the total burdened cost amount in a cost asset or cost work-in-progress account.

The burdened cost is the sum of raw and burden costs. Therefore, selecting this option may result in accounting for raw cost twice. For example, assume that the raw cost of an item is 100 USD, the burden cost is 50 USD, and the burdened cost is 150 USD. When the application creates a journal entry for 150 USD, it accounts for the 100 USD that was already accounted for as raw cost, plus the 50 USD burden cost.

Oracle Fusion Projects calls the Burden Cost Calculation Override extension to override the default burden amounts calculated for each of the burden cost codes. The extension is called after the burden amounts are calculated using the latest built multipliers. The extension then overrides the burden costs using transaction attributes specified in the extension. These amounts are summed to derive a new total burdened cost.

You can use the Burden Cost Calculation Override extension when:

You multiply the transaction quantity with a fixed rate instead of multiplying the raw cost with a multiplier. For example, the number of hours a person has worked multiplied with a fixed rate is used instead of applying multipliers to the transactions raw cost amount.

You do not include a specific cost code or choose to override the multiplier. The Burden Cost Calculation Override extension can update the multiplier for a cost code to zero so that the cost code is not included for the transaction. For example, do not apply a specific cost code after the actual cost for the project reaches a specified amount.

You define a fixed burden rate for a cost code in the descriptive flex field and choose to use this rate for a specific project or task.

Note

The extension is not called when calculating revenue and invoice amounts or when calculating rates for the Oracle Fusion Project Integration Gateway or Oracle Fusion Projects Integration for Microsoft Project.

The extension is identified by the following components.

|

Extension Component |

Name |

|---|---|

|

Specification template |

pjf_client_extn_calc_burden.pkh |

|

Body template |

pjf_client_extn_calc_burden.pkb |

|

Package |

pjf_client_extn_calc_burden |

|

Function |

is_client_extn_implemented |

|

Procedure |

override_burden cost |

The API details for the extension component, Function, is as follows:

API Name: Is_client_extn_implemented

API Type: Function

API Purpose: Indicates whether Burden Cost Calculation Override extension is enabled or not.

Parameters: None

Return Values:

Y indicates that the client extension is enabled.

N indicates that the client extension is not enabled. This is the default value hard coded in the function.

The API details for the extension component, Procedure, is as follows:

API Name: Override_burden_cost

API Type: Procedure

API Purpose: Allow you to override the calculated burden cost amounts in PJF_BURDEN_RATE_EXTN table.

Parameters

|

Parameter Name |

Parameter Data Type |

Description |

|---|---|---|

|

p_calling_module |

VARCHAR2 |

Identifies the calling module, which invokes the extension. The valid values are:

|

|

p_current_run_id |

NUMBER |

This is the identifier of the set of transactions that need to be processed in a given run. |

Return Values: None

Note

To implement the extension, modify the function to enable the extension and modify the procedure to override the burden amounts. Do not change the name of the extension procedures or parameters. Also, do not change the parameter types or parameter order in your procedure. After you write or implement a written procedure, compile it and store it in the database.

Use the Burden Schedule Override Extension to override the default burden schedule version identifier for transactions charged to a burdened project.

Oracle Fusion Projects calls the Burden Schedule Override Extension during costing processes. You can modify the extension to meet your business rules for assigning burden schedules.

The extension is identified by the following items:

|

Extension Component |

Name |

|---|---|

|

Specification template |

pjf_client_extn_burden.pkh |

|

Body template |

pjf_client_extn_burden.pkb |

|

Package |

PJF_CLIENT_EXTN_BURDEN |

|

Procedure |

override_rate_rev_id |

Important

Do not change the name of the extension procedures or parameters. Also, do not change the parameter types or parameter order in your procedure. After you write a procedure, compile it and store it in the database.

You can use the Burden Summarization Grouping Extension to control the reporting, accounting and display of burden transactions. By including certain attributes in the grouping, you can also ensure that the summarized burden transactions are rolled up to, and reported under, the same resource as the source transactions.

The extension is identified by the following items:

|

Extension Component |

Name |

|---|---|

|

Specification template |

pjc_client_extn_burden_summary.pkh |

|

Body template |

pjc_client_extn_burden_summary.pkb |

|

Package |

PJC_CLIENT_EXTN_BURDEN_SUMMARY |

The CLIENT_GROUPING function returns a VARCHAR2 value which is a concatenated string of the parameter values. You can customize the function to create the return string using the attributes by which you want to group each transaction. This string can be used as an additional grouping criterion.

The CLIENT_COLUMN_VALUES procedure works in conjunction with the CLIENT_GROUPING function to return NULL for the parameters that are not used for additional grouping in the CLIENT_GROUPING function. This ensures that the attributes used for the grouping are also included on the expenditure items created for burden transactions, and therefore impact how these expenditure items are rolled up in the resource breakdown structures for reporting.

Important

Do not change the name of the extension procedures or parameters. Also, do not change the parameter types or parameter order in your procedure. After you write a procedure, compile it and store it in the database.