11g Release 1 (11.1.3)

Part Number E20374-03

Contents

Previous

Next

|

Oracle® Fusion

Accounting Hub Implementation Guide 11g Release 1 (11.1.3) Part Number E20374-03 |

Contents |

Previous |

Next |

This chapter contains the following:

Accounting Transformation Configuration: Overview

Implement Accounting Event Interfaces

Secure Accounting Transformations

Create and Process Subledger Journal Entries

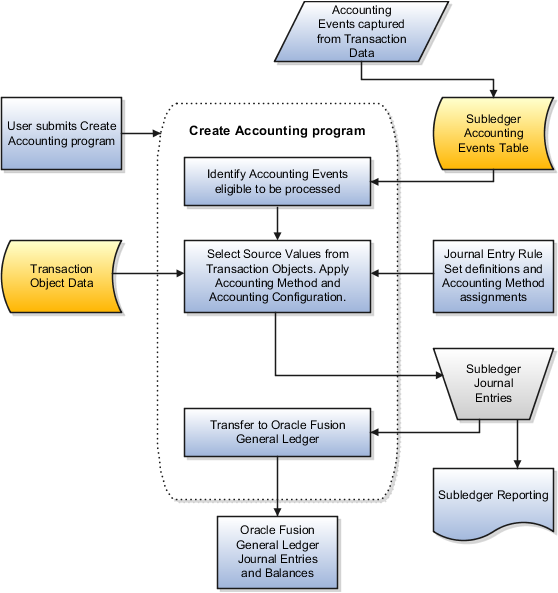

Oracle Fusion Accounting Hub creates detailed, auditable journal entries for source system transactions. The subledger journal entries are transferred to the Oracle Fusion General Ledger. These general ledger journals are posted and update the general ledger balances. Then the balances are used by the Financial Reporting Center for reporting and analysis. The following figure depicts this process.

Accounting transformations refer to the process of converting transactions or activities, referred to as accounting events, from source systems into journal entries. Source systems may be diverse applications that have been purchased from non-Oracle software providers or created internally. Often, source systems are industry specific solutions. Examples of source systems are core banking applications, insurance policy administration systems, telecommunications billing systems, and point of sales systems.

When using the accounting transformation implementation process:

Start with an analysis of your current system.

Determine which source systems have transactions or activities that need to be accounted and reported via the Oracle Fusion Accounting Hub.

Register the source system transactions and activities which have financial impact in the Accounting Hub to make them eligible for accounting.

Create accounting rules that indicate how each of the accounting events is accounted.

Group these rules together and assign them to ledgers to create a complete definition of the accounting treatment for the transactions and activities from the source system.

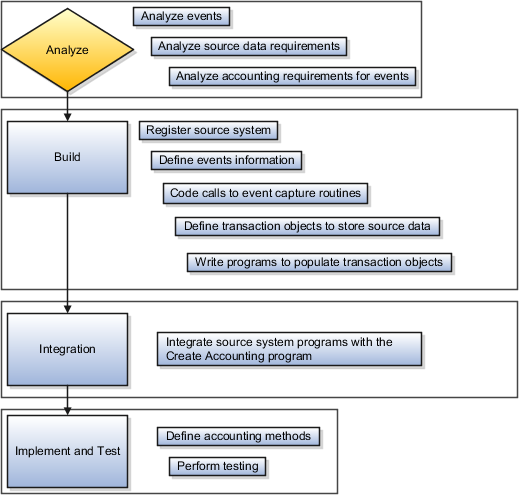

The following figure summarizes the accounting transformation process.

Complete the steps described in the following table in the order listed to account for accounting events of each of your source systems.

|

Implementation Phase |

Step Number |

Description |

|---|---|---|

|

Analysis |

1 |

Analyze source system transactions or activities to determine what accounting events to capture. |

|

2 |

Analyze transaction objects requirements.

|

|

3 |

Analyze and map the source system's current accounting. |

|

Definition and Build |

4 |

Register source systems and define event model, including: process categories, event classes, and event types. |

|

5 |

Code calls to event capture routines. |

|

6 |

Build programs to extract the information from the source systems and populate it in the Accounting Hub transaction objects. |

|

7 |

Run the Create and Assign Sources program and revise source definitions and map accounting attributes. |

|

Integration |

8 |

Create programs that capture accounting events and their related information and send it to the Accounting Hub. |

|

Implement and Test |

9 |

Create accounting rules. |

|

10 |

Perform comprehensive testing to ensure that all accounting is correctly generated. |

The analysis phase of accounting transformation implementation includes three steps.

The steps are:

Analyze Accounting Events

Analyze Source Data Requirements

Analyze Accounting Requirements for Events

Some business events have financial accounting significance and require the recording of financial information. These business events are known as accounting events and provide the data used in accounting transformations.

Examples of business events from a revenue recognition or billing system include:

Complete an invoice

Record a payment

Record late charges

Examples of business events from a point of sale system include:

Record an order

Accept a payment

Receive a return

Examples of business events from a loan (core banking) system include:

Originate a loan

Fund a loan

Record late charges for a loan

An accounting event and its associated transaction data typically relate to a single document or transaction. However, the nature of source systems may prevent them from extracting this discrete information and sending it to Oracle Fusion Accounting Hub for processing. In some cases, summarized event information, such as overall customer activity for the day, is sent for accounting transformation.

The first task is to carry out a complete analysis to determine which accounting events are captured. This analysis incorporates both the functional requirements for accounting for the source system events, as well as a review of how the events can be captured. There may be limitations on the source system, as well as volume considerations that make it desirable to capture summarized event information such as total customer activity for a day.

Complete the following analysis to identify accounting events:

Identify the life cycle of documents or business objects and the transactions that affect their status.

Identify events in the life cycle that may have financial implications to ensure that they are captured and accounted.

Identify all business events for which contextual data and transaction amounts are available.

This is not a mandatory requirement, but it provides maximum flexibility for defining accounting transformation rules.

Verify that all the required sources, such as accounting amount and date, that can potentially be used to create subledger journal entries are included in the accounting transaction objects. Sources are the appropriate contextual and reference data of transactions. They provide the information that is used to create subledger journal entries. For example, the following items could be used:

Transaction amount as the debit amount

Transaction date as the accounting date

Customer account ID as part of the description

Complete the analysis to determine what source data is necessary to successfully create subledger journal entries from transactions.

Flexibility in creating accounting rules is dependent on the number of sources available. There is a balance between providing all the information that can be extracted versus how much is practical to send based on your processing resources. The following list provides examples of source data:

Amounts including entered, accounted, and conversion data

Dates

Descriptions

Accounts

Customer information

Transaction type information

Study the transaction objects data model used by the Oracle Fusion Accounting Hub. The data model provides detailed information about the different types of transaction objects. Transaction objects are the views and tables that store transaction data in the standardized form required by the Create Accounting process.

When specifying optional header and line objects, use single table views. If you specify optional objects as multi-table views, it can result in poor performance.

Data stored in transaction objects must also satisfy accounting transaction objects validation rules. These rules verify both completion and validity of the data.

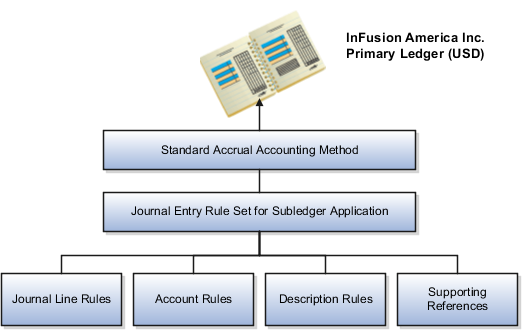

Some source systems may already produce accounting entries, while others may produce raw transactions with no associated accounting. As part of the analysis, determine how much transformation is required to produce subledger journal entries. Once this is done, examine the subcomponents of the journal entry rule set to determine how to complete rules to produce the required subledger journal entries. This exercise helps determine which subledger journal entry rule set subcomponents must be defined for the source systems data to be properly transformed into subledger journal entries.

Journal entry rule set subcomponents include the description rule, account rules, journal line rules, and supporting references.

Such an analysis should, at a minimum, answer the following questions:

Under what conditions is each of the lines in the subledger journal entry created?

What is the line type, debit or credit, of each subledger journal entry line?

What description is used for the subledger journal entry?

How are the accounts derived for the entry?

What information may be useful for reconciling the subledger journal entry to the source system?

Note

This list is not comprehensive.

This section describes the steps for the accounting transformation definition and build phase of the Oracle Fusion Accounting Hub implementation.

After registering the source system, set up the accounting event model. The accounting events from the source system are registered in the Oracle Fusion Accounting Hub.

Define Process Categories

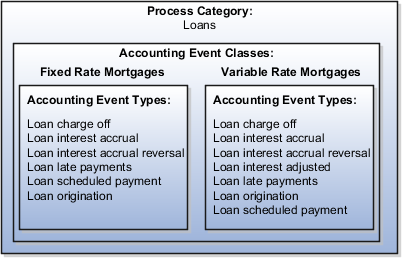

Process categories group event classes, and can be used to restrict the events selected for accounting when users submit the Create Accounting process. Selecting a process category when submitting the Create Accounting process indicates that all associated event classes and their assigned event types are selected for processing. This may be useful for segmenting events due to processing volumes.

Define Event Classes

Event classes represent transaction types and are used to group event types. For example, when accounting for transactions from a banking system, group the event types Loan Origination, Loan Scheduled Payment, and Loan Late Payments into an accounting event class for Loans.

For each event class, register the transaction objects that will hold source data for the event types in that class.

Define Event Types

For each transaction type specify each business event that can have an accounting impact.

Using application programming interfaces (APIs), create programs to capture the accounting events. The Create Accounting process combines the event information with the transaction object information and the accounting rules to create subledger journal entries. The Create Accounting process reads the event type for each event. Based upon the event type and the primary ledger, it determines which set of accounting rules should be applied to create the subledger journal entry. Once it determines which rules to use, it gets the information from the event and the transaction object rows related to the event to create the journal entry.

The following APIs for creating and updating accounting events are provided:

Get Event Information APIs to get event information related to a document or a specific event

Create Event APIs to create accounting events, individually or in bulk

Update Event APIs to update events and keep them consistent with related transaction data

Delete Event APIs to delete events

Transaction objects are tables or views defined for each event class, capturing source transaction data for accounting events. The Create Accounting process gets the source transaction data from the transaction objects to generate journal entries.

To build transaction objects, perform following tasks:

Create and register transaction objects

under ORACLE FUSION schema that are

used to store the source transaction data.

Write programs that populate the transaction objects with source values for each accounting event.

There are different types of transaction objects, indicating whether they are used at the header or line level, and whether they hold translated values:

Transaction object headers for header level sources that are not translated

Transaction object headers Multi Language Support (MLS) for translated header level sources

Transaction object lines for line level source values that are not translated

Transaction object lines MLS for translated line level sources

Header sources have the same value for all transaction lines or distributions associated with an accounting event. These sources are typically associated with a transaction header or with transaction reference data. An example of a header standard source for a mortgage loan is the loan number. A mortgage loan can have only one loan number. This number would be on the header transaction object and would not vary by line number.

Line sources have values that can vary by the transaction lines or distributions associated with an accounting event. They must be stored in the transaction objects at the line level.

Transaction objects can be mandatory or optional. At least one header transaction object is mandatory.

When creating optional transaction objects, specify them as single table views. Specifying optional objects as multi-table views may result in poor performance.

It is also possible for accounting event classes to share transaction objects. For example, when accounting for a core banking system, use the same transaction objects line table or view for both of the event classes: Fixed Rate Mortgages and Variable Rate Mortgages.

Transaction objects need to be populated before the accounting for the events occurs; otherwise, the source transaction information will not be available to generate the journal entries for the events.

Transaction objects can be populated in advance of

running the Create Accounting process or they can be populated as

part of the Create Accounting process by customizing xla_acct_hooks_pkg to automate this coordination.

Transaction objects should be created under the FUSION schema. Then, select, insert, update

and delete access should be granted to FUSION_RUNTIME for all the transaction view and objects.

A sample grant command is: Grant SELECT, INSERT, UPDATE, DELETE ON FUSION.XXFAH_TRX_HEADERS_V TO FUSION_RUNTIME; if XXFAH_TRX_HEADERS_V is created

as a transaction object.

After the transaction objects are registered, sources and source assignments to event classes are created based on these objects. Assigning sources to event classes makes them available for creating accounting rules for those classes. The transaction objects column names are used to generate sources. Each column in each transaction object is registered as a separate source. These sources are used in the definition of accounting rules used in creating journal entries.

Create and Assign Sources process also validates the transaction objects by verifying that.

All transaction objects, defined for the event class, exist in the database.

All transaction objects, based on the transaction object type, contain the appropriate primary key columns of the correct data type.

The syntax of all join conditions between the transaction and reference objects is correct.

A reference object is not registered multiple times for an event class.

A reference object is not assigned to another reference object.

Existing sources or source assignments created from previous run of this process continue to be consistent with the transaction objects.

Any existing accounting attributes mapping previously done continue to be consistent with the transaction objects and accounting attribute definitions.

Once sources have been created, revise the source definitions before they can be used. These revisions are:

Source names are the same as the transaction object column names. These can be revised to be more business user friendly so they are easily understood when configuring accounting rules.

Sources that correspond to accounting flexfield identifiers are marked as accounting flexfield.

Whenever appropriate, sources can have lookup types or value sets assigned. Assigning a value set or lookup type allows you to predefine valid values for the source that is used to create accounting rules.

After the sources are created, they need to be mapped to the accounting attributes for each event class. An accounting attribute is a piece of the journal entry; the mapping of sources to accounting attributes specifies how the Create Accounting process gets the value for each piece of the journal entry. For example, an attribute of entered currency is used to map source values to the entered currency field for subledger journal entry lines.

This section describes the accounting transformation implementation steps for the integration of source system programs with the Create Accounting process in the Oracle Fusion Accounting Hub.

For Oracle Fusion Subledger Application, integrate source system programs to create accounting events using application programming interfaces (APIs).

For Oracle Fusion Accounting Hub, you need to customize

the xla_acct_hooks_pkg.

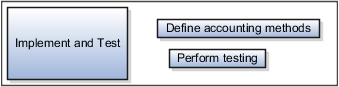

This section describes the steps in the accounting transformations implement and test phase of the Oracle Fusion Accounting Hub implementation.

Accounting methods group subledger journal entry rule sets together to define a consistent accounting treatment for each of the accounting event classes and accounting event types for all source systems.

The following steps must be completed:

Define accounting methods

Perform testing

Define accounting methods to group subledger journal entry rule sets to determine how the source system transactions are accounted for a given ledger. Your goals in defining accounting methods are to:

Ensure regulatory compliance

Facilitate corporate financial reporting

Enable audits

Facilitate reconciliation to source systems

Assign journal entry rule sets to event class and event type combinations in an accounting method to determine how the subledger journal entries for that class or type are created.

The following are the subcomponents of a journal entry rule set:

Journal Line Rules: Determine basic information about a subledger journal entry line. Such information includes whether the line is a debit or credit, the accounting class, and if matching lines are merged.

Description Rules: Determine the descriptions that are included on subledger journal entry headers and lines. Include constant and source values in descriptions.

Account Rules: Determine which account should be used for a subledger journal entry line.

Supporting References: Optionally used to store additional source information about a subledger journal entry and are useful for reconciliation of accounting to source systems.

You can attach conditions to journal line rules, description rules, and account rules components. A condition combines constants, source values, and operands to indicate when a particular journal line rule, description, or account rule is used. For example, for mortgage loans, you can elect to use a specific loan receivable account based on the loan type.

Once the setup is complete, testing should be comprehensive to ensure that all accounting is correctly generated. To complete testing, use accounting events and information from the source system, that is populate the transaction objects. This should, at a minimum, include testing that:

Accounting events are successfully created.

Sources are available for creating subledger journal entries.

Subledger journal entries accurately reflect the accounting rules. Test that:

Subledger journal entries contain the appropriate dates, amounts, descriptions, and accounts.

Conditions used to determine journal line rules, account rules, or descriptions are valid.

Entries are successfully summarized when transferred to the general ledger.

Subledger journal entries are successfully transferred and posted to general ledger.

Note

The above list is not intended to be comprehensive.

Accounting events have financial accounting significance and are used as a basis for recording financial information.

The diagram below describes the process to create subledger journal entries from accounting events using a custom Loans application as an example and is explained in the succeeding text.

As illustrated in the above diagram, after transactions occur, accounting events are captured to record their accounting impact. Accounting events can be captured as transactions are generated in the source system, or they can be captured in bulk as part of a standard daily close or batch process. When accounting events are captured is based upon the flexibility of the source system and the frequency with which accounting should be created. For each eligible event, the transaction object contains contextual information about the event, such as source values.

The setups associated with a ledger use the source data for the event to create the appropriate subledger journal entry. Each accounting event can be used to create one or more subledger journal entries. Subsequently, the accounting event links transactions to their corresponding subledger journal entries.

All business events that can have an accounting impact should be captured as accounting events.

The following procedures can assist in the analysis and identification of accounting events:

Identify transactions that may have a financial impact on your organization.

Identify the life cycles of these transactions and the business events that change the state of the transactions throughout their life cycles.

Business events vary by industry and organization. Examples of business events include the contract, order and delivery of goods and services, and receipts and payments to third parties.

Some business events have financial significance. Their impact must be accounted.

The following examples have a financial accounting impact and therefore are accounting events:

Originating a loan

Funding a loan

Applying payment to a loan

Not all events are accounted. As an example, consider a loan application. The loan origination event results in accounting if the accounting method is Accrual, but may not result in accounting if the accounting method is Cash Basis.

When an accounting event is captured, different event attributes are passed to the Oracle Fusion Accounting Hub.

The following table lists some of the attributes that are stored for an accounting event along with their corresponding descriptions.

|

Attribute |

Description |

|---|---|

|

Event ID |

Accounting event internal identifier; provided by Create Accounting. |

|

Event Number |

Unique event sequence number within a document. Create Accounting processes events in the order of their event number. |

|

Event Type |

Represents the business operation that can be performed on the end user transaction type event class and has accounting significance. |

|

Transaction Identifiers |

Identifies the document or transaction in the subledger tables and constitute the primary key of the transaction. |

|

Event Status |

Available statuses are:

|

|

Event Date |

Date of the accounting event that originated the journal entry. |

|

Transaction Context Values |

|

|

Application Specific Attributes |

Additional columns are provided for implementers to store data drawn from the transaction model (state) at the time the event is captured. These can be useful in cases where the transaction data changes and information is needed on the original event. |

|

Security Context Values |

Provide the event's security context. Examples include organization identifier and asset book. |

|

On Hold Flag |

Indicates whether there is a gap ahead of an accounting event. If there is a gap, the event is put on hold. The Oracle Fusion Accounting Hub does not process accounting events on hold due to a gap. |

The Oracle Fusion Accounting Hub event tables store the event data for these attributes. The presence of this data enables the creation of individual subledger journal entries for each accounting event. It also provides an audit trail between the subledger journal entry and the transaction data of the accounting event.

Event capture routines populate these tables when the events are created.

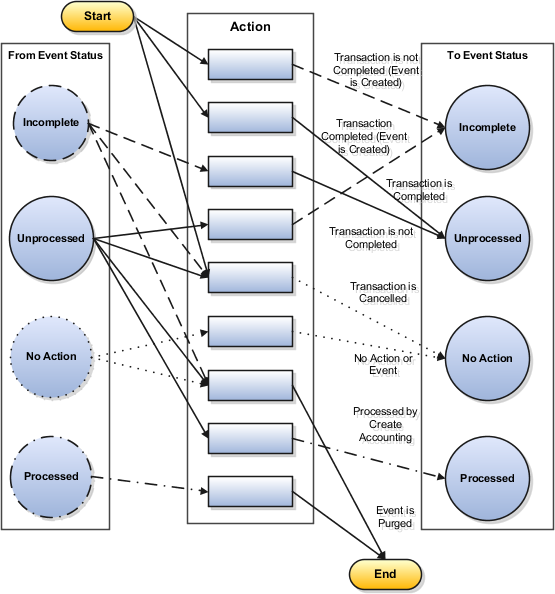

The event status is an indicator of what actions have been completed on the transaction and what operations are yet to be done.

The Create Accounting process makes updates to this status as the accounting process progresses. Once Create Accounting successfully processes the accounting event, the status of the event will be updated to Processed.

The table below lists the event statuses along with their corresponding details. At any point of time, an event can have only one of these statuses.

|

Status |

Details |

|---|---|

|

Incomplete |

The accounting event data is in the process of being created. Some of the accounting event data cannot be created at this point. There can be validations that have not yet been performed. No subledger journal entry exists for the accounting event. If Create Accounting is run, it does not process accounting events with a status of Incomplete. The subledger application updates this event status. |

|

Unprocessed |

All of the transaction data for this accounting event has been created and all validations have been performed. At this point of time, the subledger journal entry can be created. When Create Accounting is run, it processes accounting events with a status of unprocessed. |

|

No action |

This status is set when creating or updating events using APIs. No subledger journal entry is needed for this accounting event. |

|

Processed |

All of the transaction data for this accounting event is created, all validations are performed and, if appropriate, the final subledger journal entry is created. The transaction data associated with the accounting event should not be changed. For those transactions where multiple accounting events are allowed, any changes to the transaction data at this point of time results in a new accounting event. The changed transaction data is tracked under the new accounting event. After successfully creating subledger journal entries, Create Accounting updates the event status. However, you can enter new lines provided the subledger functionality allows such a change. New lines entered are recorded with new accounting events. |

Every event has a life cycle. The event status indicates what actions have been completed on a event. An accounting event does not necessarily go through each of the statuses.

Possible event statuses are displayed below.

The above diagram illustrates all the possible status changes for accounting events. An accounting event will not necessarily go through each of the statuses.

The diagram has three blocks. The left block, From Event Status, shows the possible initial statuses of an event. These statuses are Incomplete, Unprocessed, No Action, and Processed.

The center block, Action, represents actions that you complete in subledger applications. These actions result in events being created, processed, or deleted.

The right block, To Event Status, shows the possible final status based on the action in the central block. The status values include Incomplete, Unprocessed, No Action, and Processed Program.

All of the possible status changes are displayed in the diagram. Not all accounting event types can support all of these status changes. For example, some accounting events, once they have a status of Unprocessed, cannot be updated to an Incomplete status. Implementers are responsible for determining the supported status changes for an event.

There may also be conditions that determine whether the accounting event can move from one status to another. These conditions can vary by accounting event.

For example, a loan that has not been processed for accounting may be cancelled and will be set to a No Action event status. However, if unprocessed loan interest accrual events cannot be cancelled, the event status cannot be set to a No Action status.

Each accounting event must have one and only one event date. If there are multiple dates for a particular event type, then one accounting event must be created for each accounting date.

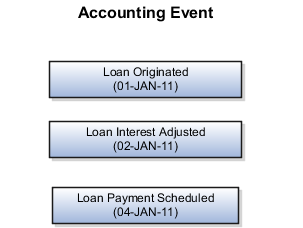

For example assume a loan is originated and accounted. The next day the loan interest is adjusted. Later, a loan payment is scheduled.

This creates three accounting events:

If the transaction has the potential to create multiple events, then both the event date and status of the previous event determines whether a new accounting event is created. Consider the following examples:

A user cancels the loan before accounting for the loan origination event.

If the event date for the cancellation is the same as that of the accounting event created for the loan, then the status of the loan origination accounting event is updated to No Action. No accounting event is created for the cancellation.

An loan origination is canceled after it has been accounted.

The accounting event created for the loan origination is not affected by the cancellation. A new event for the cancellation is created and requires processing to create a subledger journal entry.

Subledger applications can support third party control account type and calculate reporting currency amounts.

If the subledger application is configured to calculate reporting currency amount, there is no need to provide reporting currency information in the transaction objects.

The following are additional considerations when creating a subledger application:

Determine the subledgers requirement. For example, how many subledgers are to be created? This may depend on what security your company wants to have over its accounting rules.

Using the same subledger allows you to share subledger accounting rules, and lets you report across all data easily.

Using separate subledgers provides more security across applications and less data in each process run providing better performance. Specific benefits are:

If you run two Create Accounting requests at the same time for different applications, they are much less likely to contend for database resources. The requests will perform better, as the indexes are tuned for running with different applications instead of running for different process categories within the same application.

It allows you to efficiently process different sets of data (different applications) at different times during the day instead of running it as one process.

Determine the transaction objects requirements. These requirements determine what source data is required to successfully create subledger journal entries from transactions that are captured in transaction objects and shared in reference objects.

Analyze accounting events to determine what events to capture for the subledger application.

Create programs to capture accounting events using APIs (application programming interfaces) that are provided as follows:

Get Event Information APIs to get event information related to a document or a specific event.

Create Event APIs to create accounting events, individually or in bulk.

Update Event APIs to update events and keep them consistent with related transaction data.

Delete Event APIs to delete events.

Determine how often to capture accounting events, populate transaction objects, and run the Create Accounting process. This may depend on the immediacy and volumes of accounting requirements in your company.

Accounting events represent transactions that may have financial significance, for example, issuing a loan and disposing of an asset. Financial accounting information can be recorded for these events and accounted by the Create Accounting process. When you define accounting events, determine from a business perspective which activities or transactions that occur in your source system may create a financial impact.

Events with significantly different fiscal or operational implications are classified into different accounting event types. Event types are categorized into accounting event classes. Accounting definitions in the Oracle Fusion Accounting Hub are based on event types. An event type must be unique within an application, process category, and event class.

Events are captured when transactions are committed in the subledgers, or they may be captured during end-of-day or period-end processing. For example, a loan is originated, possibly adjusted, interest is accrued, and then the loan is paid or canceled. The accounting events representing these activities can create one or more subledger journal entries, and subsequently link the originating transaction to its corresponding journal entries.

The following is an example of an accounting event model for a loan application:

A process category consists of specific event classes and the event types within those classes. To restrict the events selected for accounting, users can select a process category when they submit the Create Accounting process.

You can assign a transaction view, system transaction identifiers, and optionally user transaction identifiers and processing predecessors for an event class in the Edit Event Class section. The transaction view should include all columns that have been mapped to system transaction identifiers for the accounting event class as well as the user transaction identifiers.

System Transaction Identifiers

System transaction identifiers provide a link between an accounting event and its associated transaction or document. An identifier is the primary key of the underlying subledger transaction, usually the name of the surrogate key column on the transaction (header) associated with the accounting event. At least one system transaction identifier must be defined for the accounting event class.

When an accounting event is captured, system transaction identifiers, along with other required event data, are validated for completeness.

User Transaction Identifiers

User transaction identifiers constitute the user-oriented key of the underlying subledger transaction, and are typically drawn from one or more database tables. These identifiers are primarily used in accounting events inquiry and on accounting event reports, to uniquely identify transactions. You can specify up to ten columns from the transaction views that are available for inquiry and reports.

The transaction data that identifies the transaction varies by accounting event class. Accounting event reports and inquiries display the transaction identifiers and their labels appropriate for the corresponding event class. The user transaction identifiers can be displayed for an event regardless of its status. This includes the case where the accounting event has not been used to create subledger journal entries due to an error or the cases where it has not been processed. The user transaction identifier values are displayed at the time that the accounting event reports and inquiries are run. If a transaction identifier value has changed after the accounting event was captured, the accounting event reports and inquiries reflect the change.

Processing Predecessors

The processing predecessor establishes an order in which the Create Accounting process processes events selected for accounting.

For accounting event types, specify whether their accounting events have accounting or tax impact. When the Create Accounting process is submitted, it only accounts business events that are enabled for accounting.

You may assign transaction and reference objects for each accounting event class in the subledger application. Sources are generated based on the transaction objects and are assigned to the corresponding accounting event classes.

Sources are used to create accounting rules. Subledgers pass information to the application by populating transaction object tables. The columns in these tables are named after the source codes. Transaction and reference objects hold transaction information that is useful when creating journal entry rules for accounting. The transaction and reference objects are defined for an accounting event class so that source assignments to accounting event class can be generated using these objects.

Transaction objects refer to the tables or views from which the Create Accounting process takes the source values to create subledger journal entries. Source values, along with accounting event identifiers, are stored in the transaction objects. The Create Accounting process uses this information to create subledger journal entries.

You have several options. You can:

Create new tables as the transaction objects and create a program to populate them.

Use views of your transaction data as the transaction objects.

Use your transaction data tables as the transaction objects.

The transaction objects and or views must be accessible to the Create Accounting process. Typically, an ETL (extract, transformation, and load) program is used to take values from the source system and load them into the database used by the Create Accounting process. The ETL process is done outside of the Create Accounting process.

The following are transaction object types:

Header transaction objects

Implementers need to provide at least one header transaction object for each accounting event class. Header transaction objects store one row with untranslated header source values for each accounting event. The primary key of a header transaction object is the event identifier.

Transaction details that are not translated, and whose values do not vary by transaction line or distribution, should normally be stored in header transaction objects. Examples of sources normally stored in header transaction objects include the Loan Number for a loan or the Contract Number for a contract.

Line transaction objects

Line transaction objects are relevant when there are details for the accounting event that vary based upon transaction attributes. For example, a mortgage transaction for loan origination may have multiple amounts, each related to different components of the loan. There may be a loan origination amount, closing cost amounts, and escrow amounts. Each of these amounts could be captured as separate lines, along with an indication of the amount type

Line transaction objects store untranslated line level source values. There should be one row per distribution, identified by a unique line number. The primary key of a line transaction object is the event identifier and transaction object line number. Transaction details that are not translated and whose values vary by transaction line or distribution are normally stored in line transaction objects columns. Examples include the Loan Number for a loan payment.

Multi-Language Support (MLS) transaction objects

MLS transaction objects are relevant to applications that support the MLS feature. MLS transaction objects store translated source values. There should be one row per accounting event and language. The primary key of a header MLS transaction object is the event identifier and language. The primary key of a line MLS transaction object is the event identifier, transaction object line number, and language.

Transaction details that are translated, and whose values do not vary by transaction line or distribution, are normally stored in header MLS transaction object columns. Examples include Loan Terms for a commercial loan. Implementers can avoid having to store source values in header MLS transaction objects by using value sets and lookup types.

Transaction details that are translated, and whose values vary by transaction line or distribution, should normally be stored in the transaction object in columns defined in a line MLS transaction object.

Reference objects are useful for storing information that is used for creating subledger journal entries. This information may not be directly from the source system or may be used for many entries, thus making it redundant. Use reference objects to share sources information across applications.

For example, store customer attributes, such as the customer class or credit rating in a reference object, and then, use it to account for different journal entries in a loan cycle, such as loan origination or interest accrual. Store information, such as bond ratings and terms, and use it to account for entries across the life of bonds, such as interest accruals or bond retirement.

Reference objects can either have a direct relationship to transaction objects (primary reference object), or be related to other reference objects (secondary).

Sources are a key component for setting up accounting rules. Sources represent transaction and reference information from source systems. Contextual and reference data of transactions that are set up as sources can be used in accounting rules definitions.

When determining what sources should be available, it is helpful to begin the analysis by considering which information from your systems is accounting in nature. Examples of sources that are accounting in nature include general ledger accounts that are entered on transactions, the currency of a transaction, and transaction amounts. Sources that are not always required for accounting rules include items that are related to the transaction for other purposes than accounting. Examples of information that may not be specifically for accounting, but which may be useful for creating subledger journal entries, are transaction identification number (loan number, customer number, or billing account number), counter party information, and transaction dates.

Provide a rich library of sources from your source systems for maximum flexibility when creating definitions for subledger journal entries.

Sources are assigned to accounting event classes by submitting the Create and Assign Sources process.

There is a distinct difference between sources and source values. Sources represent the transaction attributes used to create accounting rules. Source values are used by the Create Accounting process to create subledger journal entries based upon source assignments to accounting rules.

Sources must be created prior to creating accounting rules. This is a predefined step which must be undertaken before the application can be used to create subledger journal entries.

To set up appropriate subledger journal entry rule sets, users and those implementing need to understand the origins, meaning, and context of sources. Use business oriented names for sources to allow accountants and analysts to effectively create accounting rules.

Enables users to easily identify a source.

Ensures consistency in nomenclature.

Source values are stored in transaction objects. They are the actual transaction attribute values from the source system and are used in creation of the journal entries.

The Create Accounting process uses the values of sources assigned to accounting attributes plus accounting rules to create subledger journal entries. Almost all accounting attributes have sources assigned at the accounting event class level. Depending on the accounting attribute, the accounting attribute assignment defaulted from the accounting event class can be overridden on journal line rules or subledger journal entry rule sets.

Once sources are assigned to accounting event classes, they are eligible for assignment to accounting attributes for the same accounting event classes.

The Create Accounting process uses these assignments to copy values from transaction objects to subledger journal entries. For example, you may map the invoice entered currency to the subledger journal entry entered currency.

Each accounting attribute is associated with a level:

Header: To be used when creating subledger journal entry headers.

Line: To be used when creating subledger journal entry lines.

The types of accounting attributes values are as follows:

You may have values that are subject to special processing or values that are stored in named columns in journal entry headers and lines.

Examples of accounting attributes are Entered Currency Code and Entered Amount.

You may have values that control the behavior of the Create Accounting process when processing a specific accounting event or transaction object line.

An example of accounting attributes of this type is Accounting Reversal Indicator.

In order to create a valid journal entry you must, at a minimum, set up the following accounting attribute assignments.

Accounting Date

Distribution Type

Entered Amount

Entered Currency Code

First Distribution Identifier

The details and descriptions of these attributes are included in the Accounting Attributes section.

Accounting attribute groups are represented in the tables below:

Accounted Amount Overwrite

The accounted amount overwrite accounting attribute indicates whether the accounted amount calculated by the Create Accounting process should be overwritten by the value of the accounted amount accounting attribute. If the source value mapped to Accounted Amount Overwrite is 'Y', then an accounted amount must be provided.

|

Accounting Attributes |

Data Type |

Journal Entry Level |

Assignment to Rules |

Assignment Required? |

Validation Rules |

|---|---|---|---|---|---|

|

Accounted Amount Overwrite Indicator |

Alphanumeric |

Line |

Event Class and Journal Line Rule |

No |

Y - Overwrite accounted amount N - Not overwrite accounted amount |

Accounting Date

The accounting date attribute is relevant to all applications. The Create Accounting process uses it to derive the accounting date of journal entries. Typically, the event date system source is assigned to the accounting date attribute.

The Accrual Reversal GL Date accounting attribute is relevant to applications using the accrual reversal feature. Users can assign system and standard date sources to the Accrual Reversal GL Date in the Accounting Attribute Assignments page. When the Accrual Reversal GL Date accounting attribute returns a value, the Create Accounting process generates an entry that reverses the accrual entry.

|

Accounting Attributes |

Data Type |

Journal Entry Level |

Assignment to Rules |

Assignment Required? |

Validation Rules |

|---|---|---|---|---|---|

|

Accounting Date |

Date |

Header |

Event Class and Journal Entry Rule Set |

Yes |

Should be in open general ledger period |

|

Accrual Reversal GL Date |

Date |

Header |

Event Class and Journal Entry Rule Set |

No |

Should be later than the accounting date |

Accounting Reversal

Accounting reversal accounting attributes are relevant to applications that wish to take advantage of the accounting reversal feature. The Create Accounting process uses them to identify transaction (distributions) whose accounting impact should be reversed. For the Create Accounting process to successfully create a line accounting reversal, the accounting reversal indicator, distribution type, and first distribution identifier should always be assigned to sources. The definition of the accounting reversal distribution type and distribution identifiers mirrors the definition of the distribution identifiers.

|

Accounting Attributes |

Data Type |

Journal Entry Level |

Assignment to Rules |

Assignment Required? |

Validation Rules |

|---|---|---|---|---|---|

|

Accounting Reversal Distribution Type |

Alphanumeric |

Line |

Event Class |

Yes, if another accounting reversal accounting attribute is assigned. |

|

|

Accounting Reversal First Distribution Identifier |

Alphanumeric |

Line |

Event Class |

Yes, if another accounting reversal accounting attribute is assigned. |

|

|

Accounting Reversal Second Distribution Identifier |

Alphanumeric |

Line |

Event Class |

No |

|

|

Accounting Reversal Third Distribution Identifier |

Alphanumeric |

Line |

Event Class |

No |

|

|

Accounting Reversal Fourth Distribution Identifier |

Alphanumeric |

Line |

Event Class |

No |

|

|

Accounting Reversal Fifth Distribution Identifier |

Alphanumeric |

Line |

Event Class |

No |

|

|

Accounting Reversal Indicator |

Alphanumeric |

Line |

Event Class |

Yes, if another accounting reversal accounting attribute is assigned. |

Y - Reverse without creating a replacement line B - Reverse and create a new line as replacement N or Null - Not a reversal |

|

Transaction Accounting Reversal Indicator |

Alphanumeric |

Header |

Event Class |

No |

Y - Reversal transaction object header N or null - Standard transaction object header |

Business Flow

The business flow accounting attributes are referred to as 'applied to' accounting attributes. If a transaction is applied to a prior transaction in the business flow, the transaction object must populate sources assigned to 'applied to' accounting attributes with sufficient information to allow the Create Accounting process to uniquely identify a transaction object line for a prior event in the business flow. When deriving accounting data from a previous event in the business flow, the Create Accounting process searches for a journal entry line for the prior event using a combination of the 'applied to' accounting attributes and the business flow class of both journal entries.

The Applied to Amount accounting attribute is used to calculate the accounted amount and gain or loss in cross-currency applications when business flows are implemented. This attribute value is used to calculate the accounted amount when a source is mapped to the Applied to Amount attribute on a journal line type and the entered currency is different than the original currency entered.

Note

When enabling business flow to link journal lines in the Journal Line Rule page, certain accounting attribute values are unavailable for source assignment in the Accounting Attributes Assignments window of the same page because they will be copied from the related prior journal entry.

|

Accounting Attributes |

Data Type |

Journal Entry Level |

Assignment to Rules |

Assignment Required? |

Validation Rules |

|---|---|---|---|---|---|

|

Applied to Amount |

Number |

Line |

Event Class and Journal Line Rule |

No |

|

|

Applied to First System Transaction Identifier |

Alphanumeric |

Line |

Event Class and Journal Line Rule |

Yes, if another accounting attribute in the same group has assignment. |

|

|

Applied to Second System Transaction Identifier |

Alphanumeric |

Line |

Event Class and Journal Line Rule |

No |

|

|

Applied to Third System Transaction Identifier |

Alphanumeric |

Line |

Event Class and Journal Line Rule |

No |

|

|

Applied to Fourth System Transaction Identifier |

Alphanumeric |

Line |

Event Class and Journal Line Rule |

No |

|

|

Applied to Distribution Type |

Alphanumeric |

Line |

Event Class and Journal Line Rule |

Yes, if another accounting attribute in the same group has assignment. |

|

|

Applied to First Distribution Identifier |

Alphanumeric |

Line |

Event Class and Journal Line Rule |

Yes, if another accounting attribute in the same group has assignment. |

|

|

Applied to Second Distribution Identifier |

Alphanumeric |

Line |

Event Class and Journal Line Rule |

No |

|

|

Applied to Third Distribution Identifier |

Alphanumeric |

Line |

Event Class and Journal Line Rule |

No |

|

|

Applied to Fourth Distribution Identifier |

Alphanumeric |

Line |

Event Class and Journal Line Rule |

No |

|

|

Applied to Fifth Distribution Identifier |

Alphanumeric |

Line |

Event Class and Journal Line Rule |

No |

|

|

Applied to Application ID |

Number |

Line |

Event Class and Journal Line Rule |

Yes, if another accounting attribute in the same group has assignment. |

Must be a valid application ID |

|

Applied to Entity Code |

Alphanumeric |

Line |

Event Class and Journal Line Rule |

Yes, if another accounting attribute in the same group has assignment. |

Must be a valid Entity for the application selected in Applied to Application ID |

Distribution Identifier

Distribution identifiers accounting attributes are relevant to all applications. The distribution identifier information links subledger transaction distributions to their corresponding journal entry lines. In addition, many of the Oracle Fusion Subledger Accounting features, including accounting reversals, rely on the correct definition and storing of distribution identifiers in the line transaction objects. The distribution type and first distribution identifiers are always assigned to sources. If a transaction distribution is identified by a composite primary key, additional distribution identifiers are assigned to standard sources, as appropriate. Values for the distribution type and distribution identifiers are always stored in accounting transaction objects. The combinations of the values of the system transaction identifiers with the values of the distribution identifiers uniquely identify a subledger transaction distribution line.

|

Accounting Attributes |

Data Type |

Journal Entry Level |

Assignment to Rules |

Assignment Required? |

Validation Rules |

|---|---|---|---|---|---|

|

Distribution Type |

Alphanumeric |

Line |

Event Class |

Yes |

|

|

First Distribution Identifier |

Alphanumeric |

Line |

Event Class |

Yes |

|

|

Second Distribution Identifier |

Alphanumeric |

Line |

Event Class |

No |

|

|

Third Distribution Identifier |

Alphanumeric |

Line |

Event Class |

No |

|

|

Fourth Distribution Identifier |

Alphanumeric |

Line |

Event Class |

No |

|

|

Fifth Distribution Identifier |

Alphanumeric |

Line |

Event Class |

No |

|

Document Sequence

The document sequence accounting attributes are relevant to applications that use the document sequencing feature to assign sequence numbers to subledger transactions. The Create Accounting process uses them to provide a user link between subledger transactions and their corresponding subledger journal entries. Assign all document sequence accounting attributes to sources or do not assign any. In addition, the Document Sequence Category Code is made available as an Accounting Sequence Numbering control attribute.

|

Accounting Attributes |

Data Type |

Journal Entry Level |

Assignment to Rules |

Assignment Required? |

Validation Rules |

|---|---|---|---|---|---|

|

Subledger Document Sequence Category |

Alphanumeric |

Header |

Event Class |

Yes, if another accounting attribute in the same group has assignment. |

|

|

Subledger Document Sequence Identifier |

Number |

Header |

Event Class |

Yes, if another accounting attribute in the same group has assignment. |

|

|

Subledger Document Sequence Value |

Number |

Header |

Event Class |

Yes, if another accounting attribute in the same group has assignment. |

|

Entered Currency

Entered currency accounting attributes are relevant to all applications. The Create Accounting process uses them to populate the journal entry line entered currency code and amounts. The entered currency accounting attributes must always be assigned to sources. The sources assigned to the entered currency accounting attributes must always contain a value. For event classes that support cross currency transactions and therefore, more than one entered currency and entered currency amount, multiple event class accounting attribute assignments are created.

|

Accounting Attributes |

Data Type |

Journal Entry Level |

Assignment to Rules |

Assignment Required? |

Validation Rules |

|---|---|---|---|---|---|

|

Entered Currency Code |

Alphanumeric |

Line |

Event Class and Journal Line Rule |

Yes |

A valid currency code |

|

Entered Amount |

Number |

Line |

Event Class and Journal Line Rule |

Yes |

|

Ledger Currency

Ledger currency accounting attributes are relevant to all applications that use the Create Accounting process. The Create Accounting process uses them to populate journal entry accounted amounts. If a transaction's entered currency is different from the ledger currency, the Create Accounting process copies the conversion date, conversion rate, and conversion rate type to the corresponding journal entry lines. If the entered currency is the same as the ledger currency, the Create Accounting process ignores the conversion type and conversion rate. For event classes that support foreign currency transactions and therefore more than one exchange rate and reporting currency amount, multiple event class accounting attribute assignments are created.

|

Accounting Attributes |

Data Type |

Journal Entry Level |

Assignment to Rules |

Assignment Required? |

Validation Rules |

|---|---|---|---|---|---|

|

Accounted Amount |

Number |

Line |

Event Class and Journal Line Rule |

No |

|

|

Conversion Date |

Date |

Line |

Event Class and Journal Line Rule |

No |

|

|

Conversion Rate |

Number |

Line |

Event Class and Journal Line Rule |

No |

|

|

Conversion Rate Type |

Alphanumeric |

Line |

Event Class and Journal Line Rule |

No |

A valid general ledger conversion rate type or User |

Tax

The tax accounting attributes are relevant to applications that uptake the tax initiative. The tax team uses the tax accounting attributes to link subledger transaction tax distributions to their corresponding journal entry lines. Oracle Fusion Tax specifies which tax reference values are mandatory in transaction objects and are assigned to standard sources.

|

Accounting Attributes |

Data Type |

Journal Entry Level |

Assignment to Rules |

Assignment Required? |

Validation Rules |

|---|---|---|---|---|---|

|

Detail Tax Distribution Reference |

Number |

Line |

Event Class |

No |

|

|

Detail Tax Line Reference |

Number |

Line |

Event Class |

No |

|

|

Summary Tax Line Reference |

Number |

Line |

Event Class |

No |

|

Third Party

Third party accounting attributes are relevant to subledger applications that use third party control accounts. The third party accounting attributes link suppliers and customers to their corresponding subledger journal entry lines in the supplier and customer subledgers. For all subledger transactions that represent financial transactions with third parties, all third party accounting attributes have sources assigned. If a transaction line is associated with a customer or supplier, the transaction objects need to include values for all sources mapped to third party accounting attributes for the event class.

|

Accounting Attributes |

Data Type |

Journal Entry Level |

Assignment to Rules |

Assignment Required? |

Validation Rules |

|---|---|---|---|---|---|

|

Party Identifier |

Number |

Line |

Event Class and Journal Line Rule |

Yes, if another accounting attribute in the same group has assignment. |

If party type C - Should be a valid customer account If party type is S - Should be a valid supplier identifier |

|

Party Site Identifier |

Number |

Line |

Event Class and Journal Line Rule |

Yes, if another accounting attribute in the same group has assignment. |

If party type C - Should be a valid customer account If party type is S - Should be a valid supplier identifier |

|

Party Type |

Alphanumeric |

Line |

Event Class |

Yes, if another accounting attribute in the same group has assignment. |

C for Customer S for Supplier |

Exchange Gain Account, Exchange Loss Account

The Create Accounting process determines whether there is an exchange gain or loss and derives the account combination based on whether the journal line rule is defined. If the gain or loss journal line rule is defined, the account rule assigned to the journal line rule is used to determine the gain or loss account to use. If the gain or loss journal line rule is not defined, the gain or loss account assigned to the Exchange Gain Account and Exchange Loss Account accounting attributes is used.

|

Accounting Attributes |

Data Type |

Journal Entry Level |

Assignment to Rules |

Assignment Required? |

Validation Rules |

|---|---|---|---|---|---|

|

Exchange Gain Account |

Number |

Header |

Event Class |

No |

|

|

Exchange Loss Account |

Number |

Header |

Event Class |

No |

|

Gain or Loss Reference

The Gain or Loss Reference accounting attribute groups entry lines together when calculating exchange gain or loss. The accounted debit and accounted credit amounts for lines with the same gain or loss reference are combined. The total of accounted debit and total of accounted credit are compared to calculate the exchange gain or loss.

|

Accounting Attributes |

Data Type |

Journal Entry Level |

Assignment to Rules |

Assignment Required? |

Validation Rules |

|---|---|---|---|---|---|

|

Gain or Loss Reference |

Alphanumeric |

Line |

Event Class |

No |

|

Transfer to GL Indicator

The Transfer to GL accounting attribute is relevant to applications which create subledger journal entries that will never be transferred to the general ledger. The Transfer to GL process uses this accounting attribute to determine whether to transfer subledger journal entries to the general ledger.

If the Transfer to GL accounting attribute is not assigned to a source, the Transfer to GL process transfers journal entries for the event class to the General Ledger.

If the Transfer to GL accounting attribute is assigned to a source and the source is not populated, the Transfer to GL process transfers journal entries for the event class to the General Ledger.

|

Accounting Attributes |

Data Type |

Journal Entry Level |

Assignment to Rules |

Assignment Required? |

Validation Rules |

|---|---|---|---|---|---|

|

Transfer to GL Indicator |

Alphanumeric |

Header |

Event Class |

No |

Should be Y or N |

The Oracle Fusion Accounting Hub provides a set of common APIs to capture accounting events. All event operations must be performed through these APIs. By ensuring that event operations are executed through generic APIs, the architecture meets the needs of implementers:

Insulates implementers from changes in the implementation of an API

The presence of the API reduces dependencies between the Accounting Hub and your source systems.

Implementers do not have to know the underlying Accounting Hub data model to capture accounting events. In addition, any implementation changes made by the Accounting Hub have minimum or no impact on implementers.

The Accounting Hub relies on accounting events to indicate that there are activities from source systems that require accounting.

The Create Accounting process selects accounting events based on criteria specified by users. The Create Accounting process does not check for any functional dependencies between transactions or event types.

Note

For each eligible event, the Create Accounting process retrieves source values from the transaction objects. Subledger journal entries are created using both event and source information.

Implementers must undertake the following steps to create event capture routines:

Perform accounting event setups

Write product specific wrapper routines

Integrate event APIs with source systems

As a prerequisite, you must register the application.

An additional prerequisite step is to define and register event process categories, accounting event classes, and event types before events can be captured. The event APIs use event information to perform the necessary validations when creating events.

In order to reduce dependencies and facilitate maintenance, it is recommended that you write a wrapper routine on top of the Oracle Fusion Accounting Hub APIs. Wrapper routines can encapsulate source system specific logic to perform necessary validations before creating new events. Map source system specific parameters to the API parameters

For example, if you were implementing the Accounting Hub to capture information for a loans application, you could use a package called LOAN_XLA_EVENTS_PKG, which contains all the APIs to implement accounting events in Loans. The code for this package is shown below.

Assume that this example loans application has two event classes Create Loan and Create Payment. To handle accounting events for loan transactions, you could create a procedure create_loan_event() with p_loan_id as an input parameter, instead of using a generic parameters like source_id_int_1. The procedure create_loan_event() calls the appropriate Accounting Hub API to create an event.

Similarly, create create_payment_event() to handle accounting events for the event class Create Payment.

LOAN_XLA_EVENTS_PKG

-- Procedure to create events for creating a loan

PROCEDURE create_loan_event

(p_loan_id

,p_event_type

,p_event_date

,p_event_status) IS

l_loan_source_info XLA_EVENTS_PUB_PKG.t_event_source_info;

l_security_context XLA_EVENTS_PUB_PKG.t_security; BEGIN

BEGIN

-- Perform product specific checks

...

-- Map generic event API parameter to the product specific columns

l_load_source_info.application_id = loan_application_id;

l_loan_source_info.legal_entity_id = l_legal_entity_id;

l_loan_source_info.source_id_int_1 = p_loan_id;

-- Call XLA API

XLA_EVENTS_PUB_PKG.create_event

(p_event_source_info => l_loan_source_info

,p_event_type_code => p_event_type

,p_event_date => p_event_date

,p_event_status_code => p_event_status

,p_event_number => NULL

,p_reference_info => NULL

,p_valuation_method => NULL

,p_security_context => l_security_context);

...

...

EXCEPTIONS

....

END;

It is suggested that implementers create an Enterprise Scheduler Service (ESS) process for the event capture wrapper routines. Using an ESS process instead of directly running the routines in the database will provide for the following:

Enable implementation of security where some users can be given access to create events for specific source systems but not all.

Go through the proper channels of executing code on Fusion schema. The ESS job will not require the user to have write access to Fusion schema.

You may need to perform certain checks with respect to events. For example, before creating a new accounting event, it is necessary to check whether there is an existing unprocessed event for the same transaction with the same accounting event type and event date.

You may also want to know the status of a particular event or query events already created for the transaction.

To perform these checks, obtain event information for a transaction by doing the following:

Determine the system transaction identifiers and accounting event class for the transaction.

Note

System transaction identifiers identify the transaction on which events are based. The Oracle Fusion Accounting Hub uses these identifiers to search the events table and identify all the events that are related to a transaction.

Call the function Get_Array_Event_Info() with the appropriate transaction

parameters. The function returns an array of all events for a transaction.

To obtain all the events created for a particular event type within a transaction, do the following:

Determine the system transaction identifiers, event class, and event type of the transaction.

Call the function Get_Array_Event_Info() with the appropriate transaction

and event type input parameters. The function returns an array of

all accounting events for that transaction and event type. Optionally

pass the event class, event date, and event status to further restrict

the rows returned.

To get information about a specific event, do the following:

Determine the event_id.

Call the function Get_Event_Info() with the event_id parameter. This function

returns a PL/SQL record containing all information pertaining to that

particular event.

This section describes the following guidelines on creating events using the create event APIs:

Creating a single event

Creating events in bulk

To create a new event:

Determine the accounting event type, event date, and event status for the new event.

Call the Oracle Fusion Accounting

Hub function Create_Event() with the

appropriate input parameters.

The Create_Event() API

creates a single event at a time. The function returns the event_id of the created event.

Create events in bulk using the API Create_Bulk_Events().

Note

Do not use this API for existing transactions that already have events associated with them. For performance reasons, bulk event APIs do not perform checks as to whether events for the transaction already exist. Therefore, use this API only to create events for new transactions that do not have any prior events created.

Update the event to keep the transaction data and related events synchronized.

You can update an event as long as it is not processed. Once an event is accounted in Final status, you cannot update the event or the data associated with it.

Use the following APIs to update your events:

Update Event

This is an overloaded API used to update the status, type, date, number, and reference information of a single event.

Update Event Status

This API updates multiple events to a given status.

To delete all Unprocessed events associated with a transaction:

Determine the transaction source information.

Call the Oracle Fusion Accounting

Hub function Delete_Events() with the

transaction source information.

Optionally, specify the accounting event type, event status, or event date, to restrict the events deleted.

If a transaction is deleted, the Delete_Entity() API must be called to delete the row in the XLA_TRANSACTIONS_ENTITY

table.

In the case where the transaction number of the transaction has been changed, this API updates the transaction number on the events in the XLA_TRANSACTION_ENTITIES table so that they are consistent with the transaction number on the transaction.

The API checks the source information for a valid application, legal entity, event process category, and source identifiers. However, no validation is performed on the transaction number.

This section describes the event APIs accessible by implementers to perform event operations. The APIs described are generic and available to all applications.

Event APIs have the following characteristics:

Event APIs do not issue any commits.

If an API fails, any changes made are rolled back and a standard exception is raised.

All parameters are read only (IN parameters); there are no OUT parameters.

The event date is always truncated.

The Oracle Fusion Accounting Hub does not store the timestamp for an event date.

All functions return a single value or record.

The exceptions to this rule are the

functions prefixed with a Get_Array string.

For example, the function Get_Array_Event_Info() returns an array.

Input parameters must be passed in a nonpositional notation, named notation.

All the APIs called in query mode locks the event record in NOWAIT mode.

Event APIs have the following types of input parameters:

System transaction identifiers

These parameters capture information such as loan_id. This information is stored with each event to later identify the source transaction for the event. You need to pass the source identifiers when creating an event.

Transaction security identifiers

Accounting events are subject to the security of the corresponding transaction. Every accounting event is stamped with its related transaction's security context.

Transaction security parameters capture application-specific transaction security information, such as business unit or ledger.

Transaction reference information

The reference parameters enable you to capture any miscellaneous reference or contextual information for an event. This information is optional and no validations are performed against any reference parameters.

The XLA_EVENT_PUB_PKG package contains the following items:

PL/SQL record and table structures for common parameters

CONSTANTS for event statuses

Use these constants and structures when passing and reading values to and from the APIs.

This section provides details on the APIs that obtain event information.

This API returns information for a particular event. The event is identified by specifying the transaction and event identifier. The API locks the specified event before returning any event information.

The API checks all source information for valid application, legal entity, event entity, and source identifiers (IDs). It ensures that the required parameters are not passed as null and that the event ID belongs to the same transaction, as the other transaction information being passed.

The API returns a PL/SQL record containing event information.

FUNCTION XLA_EVENTS_PUB_PKG.get_event_info

(p_event_source_info IN xla_events_pub_pkg.t_event_source_info

,p_event_id IN NUMBER

,p_valuation_method IN VARCHAR2

,p_security_context IN xla_events_pub_pkg.t_security)

RETURN xla_events_pub_pkg.t_event_info;

This routine returns information for one or more events within a transaction. The calling program specifies the transaction and event selection criteria. Return information contains data on all events that belong to the specified transaction and fall under the given criteria. The API locks the specified events before returning the event information.

The API checks all source information for valid application, legal entity, event process category, and source IDs. It ensures that the required parameters are not passed as null and also validates the accounting event class, event type, and event status. Note that the API truncates the event date.

The API returns an array of event information.

FUNCTION XLA_EVENTS_PUB_PKG.get_array_event_info

(p_event_source_info IN xla_events_pub_pkg.t_event_source_info

,p_event_class_code IN VARCHAR2 DEFAULT NULL

,p_event_type_code IN VARCHAR2 DEFAULT NULL

,p_event_date IN DATE DEFAULT NULL

,p_event_status_code IN VARCHAR2 DEFAULT NULL

,p_valuation_method IN VARCHAR2

,p_security_context IN xla_events_pub_pkg.t_security)

RETURN xla_events_pub_pkg.t_array_event_info;

This API returns the event status for a specified event. The calling program needs to specify the transaction and event identifier. The API locks the specified event record before returning the status.

The API checks all source information for valid application, legal entity, event process category, and source IDs. It ensures that the required parameters are not null and the event belongs to the same transaction as the other transaction information being passed.

This API returns an event status. The Oracle Fusion Accounting Hub has defined all event statuses as Constants.

FUNCTION XLA_EVENTS_PUB_PKG.get_event_status

(p_event_source_info IN xla_events_pub_pkg.t_event_source_info

,p_event_id IN NUMBER

,p_valuation_method IN VARCHAR2

,p_security_context IN xla_events_pub_pkg.t_security)

RETURN VARCHAR2;

This API checks whether an event exists for the specified criteria. It returns True if it finds at least one event matching the criteria; otherwise, it returns False. The API locks the event rows before returning a value.

The API checks all source information for valid application, legal entity, event process category, and source IDs. It ensures that the required parameters are not null and also validates the event class, event type, and event status. The API truncates the event date.

The API returns True if an event is found for the specified criteria; otherwise, it returns False.

FUNCTION XLA_EVENTS_PUB_PKG.event_exists

(p_event_source_info IN xla_events_pub_pkg.t_event_source_info

,p_event_class_code IN VARCHAR2 DEFAULT NULL

,p_event_type_code IN VARCHAR2 DEFAULT NULL

,p_event_date IN DATE DEFAULT NULL

,p_event_status_code IN VARCHAR2 DEFAULT NULL