11g Release 1 (11.1.3)

Part Number E20376-03

Contents

Previous

Next

|

Oracle® Fusion

Applications Compensation Management Implementation Guide 11g Release 1 (11.1.3) Part Number E20376-03 |

Contents |

Previous |

Next |

This chapter contains the following:

Manage Benefit Programs and Plans

Define Benefit Rates and Coverage

Defining benefits involves three categories of setup tasks.

Set up benefits objects. Organize the objects into hierarchies to help efficiently configure and maintain benefits packages. While defining benefits objects, you can also make configurations to automate administration of corporate policies regarding eligibility, enrollment, rates, and coverages.

Set up benefits peripheral components. You typically use or reuse these components while defining different benefits objects.

Set up general components, such as third-party administrators, benefits carriers, regulatory bodies, and reporting groups.

Fusion Benefits configuration flexibly supports a wide variety of implementation strategies. While making trade-off decisions, such as processing time versus ongoing maintenance effort, you consider whether to control characteristics such as participant eligibility at a general level, at a detailed level, or at a combination of general and detailed levels.

Later documentation details the benefits object hierarchy, setup override rules, and configuration examples. At this point of this overview topic, the important points are:

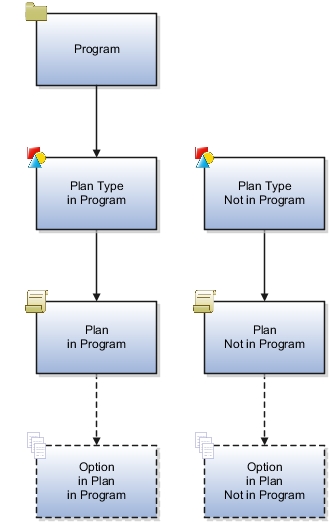

A benefits object hierarchy organizes a benefits program, plan types, plans in program or plans not in program, and options from top to bottom, general to detailed.

Depending on the outcomes of strategic implementation trade-off decisions, you have the flexibility to configure most aspects of a benefits package at more than one level in the hierarchy.

Population of all four levels of a benefits object hierarchy is not required.

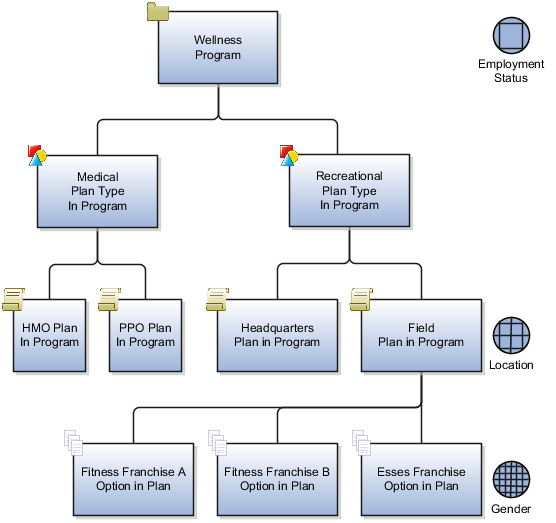

The following diagram shows the four levels of benefits object hierarchy: benefits program, plan types in program or not in program, plans in program or plans not in program, and options from top to bottom, general to detailed.

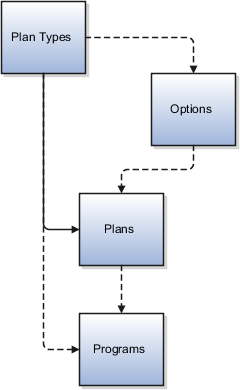

The sequence for creating benefits hierarchy objects differs from the resulting hierarchical order. You can create new objects as needed at any time. However, because some benefits hierarchy objects are referenced during the definition of other benefits hierarchy objects, it is more efficient to create these objects in the order shown in the figure. Benefits object hierarchy architecture is further described in the related topic: Benefits Hierarchy Objects: How They Work Together.

This figure illustrates the most efficient sequence for creating benefits hierarchy objects: plan types, options (if used), plans, then programs.

Begin by creating one or more plan types. Plan types organize plans into groups that provide similar categories of benefits, such as health, savings, education, and so on. At the plan type level of the hierarchy, you can efficiently administer corporate benefits policies that apply across all plans within that benefit category or type.

When creating an option, you can optionally associate one or more existing plan types. This restricts the availability of the option to plans that belong to the named plan types.

When using the plan configuration process to define benefit plan details, you must associate one existing plan type, and can optionally tie existing options to the plan.

When using the program configuration process to define program details, you can associate existing plan types and existing plans with the program.

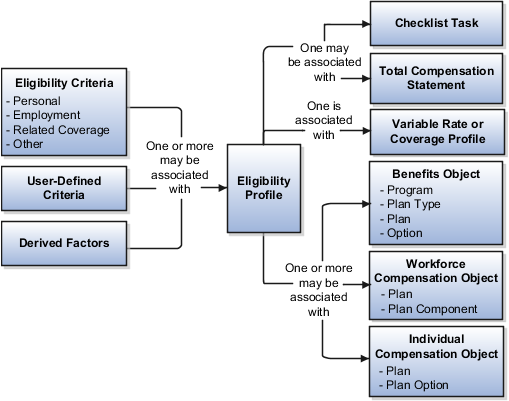

The following figure illustrates some of the dependencies among setup data components, showing several types of setup components organized around the periphery of the main benefits objects. Some types of components are delivered and some types are not.

Here is additional information about some of the setup components in the figure.

A lengthy list of derived factors is delivered.

Various combinations of derived factors can be used to define different eligibility profiles.

Some temporal and scheduled life events are delivered.

On the Create Life Events page, you can extend the list of available life events by creating as many of your own unique life events as you need. You can set up life events so that they will be triggered by certain temporal derived factors, such as age or length of service. Life events are reusable, and can be used to control enrollment at the program, plan, and option levels.

The enrollment certification types and determination rules are delivered.

You cannot extend the available list of certification types or determinations rules, but you can rename the existing lookup values that appear in those fields. You can select different combinations of types and rules, and then set up the association with plans on the plan configuration process certification page.

A set of action items is delivered.

You cannot extend the list of available action items, but you can rename them on the Manage Action Items page. You can associate action items with designation requirements at the plan type level or at the plan level, but not at both levels within the same object hierarchy.

No eligibility profiles are delivered.

You can create as many eligibility profiles as you need. Eligibility profiles are reusable. You can associate eligibility profiles at the following levels: option in plan, plan, plan in program, plan type in program, and program. Eligibility profiles are also used in definitions for variable rate and variable coverage profiles. An eligibility profile must be specified when you create variable rate or variable coverage profiles.

A set of option types is delivered for selection when you define your plan type objects.

Option types control internal processing. For example, plan types in the Health coverage category are processed differently than plan types for Savings . The delivered list of option types is not extensible.

Rates and coverages setup follows plan and option setup because rates and coverages are specific to named plans and options.

Rates and coverages can be associated at many levels in your configuration, such as plan, option in plan, and option in plan in program.

Variable rate and coverage profiles can be associated with rates and coverages, respectively, so that the calculated results vary with factors that change over time, such as age group or work location.

If you define coverage across plan types, that setup occurs after setting up the affected programs.

You must select one existing program and one or more existing plan types during setup of coverage across plan types.

Note

You will not always perform setup for all of the components shown in the figure.

The tasks included in the Define General Benefits task list are independent of specific benefit programs and plans, and are not required to deploy benefits. However, if you intend to use objects included in the task list, you should complete those tasks before setting up benefits programs and plans.

Some of these tasks are related to setting up organizations. For example, you set up beneficiary organizations so that employees can select them when they make benefits elections. You set up benefits carriers as external organizations to associate with benefits plans. You set up third-party administrators to identify organizations that are benefits suppliers or that provide services to your benefits programs.

Another organizational setup task is Manage Regulatory Bodies. After you complete it you might record and update statutory requirements, or the rules that are enacted by governmental bodies that regulate how you administer certain programs and plans.

Another task in this task list is Configure Enrollment Action Items. Complete this task before you enable enrollment. During this task, you can edit the text of action items to better conform to the needs of your organization. Enrollment actions include items such as beneficiary and dependent certification requirements and primary care physician designation.

This topic identifies benefits extensible lookups. Review these lookups, and update them as appropriate to suit enterprise requirements.

Extensible benefits lookups are categorized as follows:

Benefits relationships lookups

Person factors lookups

Process name lookups

Regulations lookups

Health care services and primary care physician lookups

The extensible benefits relationships lookup is described in the following table:

|

Lookup Type |

Description |

|---|---|

|

BEN_BENEFIT_RELATION_NAME |

Benefits usage, such as absence, default, or unrestricted |

Extensible person factors lookups are described in the following table:

|

Lookup Type |

Description |

|---|---|

|

BEN_STUDENT_STATUS |

Student type, such as full-time or part-time |

|

REGISTERED_DISABLED |

Registered disabled values, such as yes, yes-fully disabled, yes-partially disabled, or no |

The extensible process name lookup is described in the following table:

|

Lookup Type |

Description |

|---|---|

|

BEN_PROCESS |

Benefits process name, such as evaluate absence plan participation, or assign corrective potential life event |

Extensible regulations lookups are described in the following table:

|

Lookup Type |

Description |

|---|---|

|

BEN_REGN_ADMN |

The type of regulatory administration by a governing agency, such as enforced by or issued by |

|

BEN_REGY_PL_TYP |

The type of regulatory plan, such as fringe, other, pension, or welfare |

|

BEN_REGY_PRPS |

The purpose of a regulatory body associated with a benefits object, such as audit, enforces, qualifies, or requires plan disclosure |

Extensible health care services type and primary care physician lookups are described in the following table:

|

Lookup Type |

Description |

|---|---|

|

BEN_PRDCT |

Provider category, such as exclusive provider organization, medium, point of service, or premium |

|

BEN_PCP_CD |

Requirement or ability of participants to select a primary care physician during enrollment, such as optional |

|

BEN_PCP_DSGN |

Primary care physician designation status for a plan, such as none, optional, or required |

|

BEN_PCP_SPCLTY |

Primary care physician specialty, such as emergency medicine |

|

BEN_PCP_STRT_DT |

Primary care physician started date, such as first of next month, first of next month occurring after 15 days, later of enrollment start or when designated |

|

BEN_PRMRY_CARE_PRVDR_TYP |

Primary care physician type, such as dentist, general practitioner, cardiologist, or pediatrician |

Configure how benefits relationships are associated by default when you hire a worker or add additional assignments. Benefits professionals group worker assignments for benefits enrollment and processing. You must make the following choices for each combination of legal entity and benefits usage, such as unrestricted or life events:

Specify the default benefits relationship for new hire assignments.

Specify whether to use different benefits relationships for workers who have multiple assignments.

If you enable multiple assignment processing for benefits, you must also specify the pattern to associate additional worker assignments with benefits relationships by default. Benefits professionals can update or modify the default relationships for individual workers.

Every worker has at least one benefits relationship. Specify the default benefits relationship at the legal entity level for different usages, such as unrestricted or life events, within the enterprise for the initial worker assignment when a worker is hired.

Initially, you must make one choice between two mutually exclusive options for each combination of usage and legal entity within the enterprise:

Disable multiple assignment processing for benefits processing.

Enable and configure multiple assignment processing for benefits processing.

If you do not enable multiple assignment processing for benefits processing, then all worker assignments are associated with the default benefits relationship that you select for the combination of usage and legal entity. In this configuration, benefits professionals cannot select alternative benefits relationships because each worker has only one benefits relationship. Consequently, you cannot configure other options for multiple assignment processing for benefits for the usage and legal entity combination.

If you enable multiple assignment processing for benefits processing, configure the default pattern of associating the benefits relationships with additional worker assignments for each legal entity and usage.

Select one default option for new assignments from among these choices:

Include new assignments in the configured default benefits relationship.

Do not include new assignments in any benefits relationship.

Include new assignments in the primary benefits relationship for the worker, which might be the default benefits relationship or another benefits relationship designated as primary.

Additionally, if the newly created assignment can be included in a benefits relationship, configure whether or not it becomes the primary assignment in the benefits relationship when another assignment is already designated as the primary assignment.

Note

When you enable multiple assignment processing for benefits processing for a usage and legal entity combination, benefit relationship-related processing options and user interface fields are displayed on the user interface. User interface pages in benefits service center that display the option to select a benefits relationship for a worker include participant benefits summary, override enrollment, manage person life events, process open enrollment, and process life event.

Benefits relationships control how a worker's benefits are grouped for processing. A worker might have different sets of benefits attached to different benefits relationships.

Benefits entities that are affected by benefits relationships include:

Potential life events

Life events

Eligibility records

Electable choices

Enrollment options

Dependent coverage

Beneficiary designations

Primary care physician designations

Deductions

A default benefits relationship is configured for each legal entity and usage of benefits processing within the enterprise. It is automatically associated with new hires and workers with only one assignment. If multiple assignment processing is enabled for benefits processing, the pattern of benefits relationships associated with additional worker assignments by default is configured for each legal entity and usage. Benefits professionals can change the configuration of benefits relationships associated with individual workers and can change the work assignments associated with the worker's benefits relationships.

A worker might have assignments that are associated with different benefits relationships. The following six examples list different ways that worker assignments might be structured within an organization and how the benefits relationships would be associated. The configuration table for each example lists the legal entities, work relationships, employment terms, assignments, and benefits relationships. Each scenario lists the impact that each structure has on life events, electable choices or enrollment options, and benefits eligibility.

Configuration: Only one assignment and one benefits relationship exist.

|

Legal Entity |

Work Relationship |

Employment Terms |

Assignment |

Benefits Relationship |

|---|---|---|---|---|

|

Galaxy UK |

1 |

Architect |

Architect |

A (default) |

Processing: Life events, electable choices or enrollment options, and benefits eligibility are evaluated based on the assignment in this benefits relationship.

Configuration: Two sets of work relationships, employment terms and assignments exist, one for each legal entity. The person has two sets of benefits, one for each legal entity. Each assignment is associated with a different benefits relationship.

|

Legal Entity |

Work Relationship |

Employment Terms |

Assignment |

Benefits Relationship |

|---|---|---|---|---|

|

Galaxy UK |

1 |

Architect |

Architect |

A (default for the legal entity) |

|

Galaxy US |

2 |

Consultant |

Consultant |

B (default for the legal entity) |

Processing: This table shows the basis for benefits evaluation and processing for each data type:

|

Data Type |

Benefits Evaluation Processing Basis |

|---|---|

|

Life events |

Primary assignment from each legal entity |

|

Electable choices or enrollment options |

One set of data for each legal entity |

|

Eligibility |

Use eligibility to provide benefits from the appropriate legal entity. Eligibility criteria are defined at the legal entity level or globally. |

Configuration: One benefits relationship is associated with different employment terms and assignments.

|

Legal Entity |

Work Relationship |

Employment Terms |

Assignment |

Benefits Relationship |

|---|---|---|---|---|

|

Galaxy US |

1 |

Architect |

Architect |

A (default) |

|

Galaxy US |

1 |

Consultant |

Consultant |

A |

Processing: This table shows the basis for benefits evaluation and processing for each data type:

|

Data Type |

Benefits Evaluation Processing Basis |

|---|---|

|

Life events |

Primary assignment |

|

Electable choices or enrollment options |

One set of data for each life event |

|

Eligibility |

Attributes defined at global person level are used for both life events. Assignment-level attributes are used in the respective life events. |

Configuration: Separate benefits relationships are associated with each assignment.

|

Legal Entity |

Work Relationship |

Employment Terms |

Assignment |

Benefits Relationship |

|---|---|---|---|---|

|

Galaxy US |

1 |

Architect |

Architect |

A (default) |

|

Galaxy US |

1 |

Consultant |

Consultant |

B |

Processing: This table shows the basis for benefits evaluation and processing for each data type:

|

Data Type |

Benefits Evaluation Processing Basis |

|---|---|

|

Life events |

Separate life events created for Architect and Consultant assignments |

|

Electable choices or enrollment options |

One set of data for each life event |

|

Eligibility |

Attributes defined at global person level are used for both life events. Assignment-level attributes are used in the respective life events. |

Configuration: Two assignments are associated with one benefits relationship, and another assignment with a second benefits relationship.

|

Legal Entity |

Work Relationship |

Employment Terms |

Assignment |

Benefits Relationship |

|---|---|---|---|---|

|

Galaxy US |

1 |

Architect |

Architect |

A (default) |

|

Galaxy US |

1 |

Product Manager |

Product Manager |

A |

|

Galaxy US |

1 |

Consultant |

Consultant |

B |

Processing: This table shows the basis for benefits evaluation and processing for each data type:

|

Data Type |

Benefits Evaluation Processing Basis |

|---|---|

|

Life events |

Separate life events are created for the assignments in benefits relationships A and B |

|

Electable choices or enrollment options |

One set of data for each life event |

|

Eligibility |

Attributes defined at the global person level and assignment level are used for life events. |

Configuration: Many assignments are associated with one or more benefits relationships.

|

Legal Entity |

Work Relationship |

Employment Terms |

Assignment |

Benefits Relationship |

|---|---|---|---|---|

|

Galaxy US |

1 |

Product Manager |

Orlando |

A |

|

Galaxy US |

1 |

Product Manager |

Dallas |

A |

|

Galaxy US |

1 |

Product Manager |

Atlanta |

B |

|

Galaxy US |

1 |

Consultant |

San Francisco |

C |

|

Galaxy US |

1 |

Consultant |

Los Angeles |

D |

Processing: This table shows the basis for benefits evaluation and processing for each data type:

|

Data Type |

Benefits Evaluation Processing Basis |

|---|---|

|

Life events |

Separate life events created for the assignments in each benefits relationship |

|

Electable choices or enrollment options |

One set of data for each life event |

|

Eligibility |

Attributes defined at global person level are used for all life events. Assignment-level attributes are used in the respective life events. |

You add eligibility criteria to an eligibility profile, and then associate the profile with an object that restricts eligibility.

The following figure shows the relationships between eligibility components.

You can add different types of eligibility criteria to an eligibility profile. For many common criteria, such as gender or employment status, you can select from a list of predefined criteria values. However, you must create user-defined criteria and derived factors before you can add them to an eligibility profile.

When you add an eligibility criterion to a profile, you define how to use it to determine eligibility. For example, when you add gender as a criterion, you must specify a gender value (male or female) and whether to include or exclude persons who match that value.

You can associate an eligibility profile with different kinds of objects:

Associate an eligibility profile with a variable rate or variable coverage profile to establish the criteria required to qualify for that rate or coverage.

Associate an eligibility profile with a checklist task to control whether that task appears in an allocated checklist.

Associate an eligibility profile with a total compensation statement to apply additional eligibility criteria after statement generation population parameters.

Associate one or more eligibility profiles with a benefits or compensation object to establish the eligibility criteria for specific plans and options.

Derived factors define how to calculate certain eligibility criteria that change over time, such as a person's age or length of service. You add derived factors to eligibility profiles and then associate the profiles with objects that restrict eligibility.

You can create six different types of derived factors: age, compensation, length of service, hours worked, full-time equivalent, and a combination of age and length of service.

For each factor that you create, you specify one or more rules about how eligibility is determined. For example, the determination rule for an age derived factor specifies the day on which to evaluate the person's calculated age for eligibility. If the determination rule is set to the first of the year, then the person's age as of the first of the year is used to determine eligibility.

For the full-time equivalent factor, you specify the minimum and maximum full-time equivalent percentage and whether to use the primary assignment or the sum of all assignments when evaluating eligibility. For example, if the percentage range is 90 to 100 percent for the sum of all assignments, then a person who works 50 percent full-time on two different assignments is considered eligible.

Other settings define the unit of measure for time or monetary amounts, rounding rules, and minimums and maximums.

The following scenarios illustrate how to define different types of derived factors:

Benefits administrators frequently use age factors to determine dependent eligibility. You can also use age as a factor when determining life insurance rates. Age factors typically define a range of ages, referred to as age bands, and rules for evaluating the person's age. The following table illustrates a set of age bands that could be used to determine eligibility for life insurance rates that vary based on age.

|

Derived Factor Name |

Greater Than or Equal To Age Value |

Less Than Age Value |

|---|---|---|

|

Age Under 25 |

1 |

25 |

|

Age 25 to 34 |

25 |

35 |

|

Age 35 to 44 |

35 |

45 |

|

Age 45 to 54 |

45 |

55 |

|

Age 55 to 64 |

55 |

65 |

|

Age 64 or Older |

65 |

75 |

The determination rule and other settings for each age band are the same:

|

Field |

Value |

|---|---|

|

Determination Rule |

First of calendar year |

|

Age to Use |

Person's |

|

Units |

Year |

|

Rounding |

None |

A derived factor for length of service defines a range of values and rules for calculating an employee's length of service. The following table illustrates a set of length-of-service bands that could be used to determine eligibility for compensation objects such as bonuses or severance pay.

|

Derived Factor Name |

Greater Than or Equal To Length of Service Value |

Less Than Length of Service Value |

|---|---|---|

|

Service Less Than 1 |

0 |

1 |

|

Service 1 to 4 |

1 |

5 |

|

Service 5 to 9 |

5 |

10 |

|

Service 10 to 14 |

10 |

15 |

|

Service 15 to 19 |

15 |

20 |

|

Service 20 to 24 |

20 |

25 |

|

Service 25 to 29 |

25 |

30 |

|

Service 30 Plus |

30 |

999 |

The determination rule and other settings for each length-of-service band are the same:

|

Field |

Value |

|---|---|

|

Period Start Date Rule |

Date of hire (This sets the beginning of the period being measured.) |

|

Determination Rule |

End of year (This sets the end of the period being measured.) |

|

Age to Use |

Person's |

|

Units |

Year |

|

Rounding |

None |

A derived factor for compensation defines a range of values and rules for calculating an employee's compensation amount. The following table illustrates a set of compensation bands that could be used to determine eligibility for compensation objects such as bonuses or stock options.

|

Derived Factor Name |

Greater Than or Equal To Compensation Value |

Less Than Compensation Value |

|---|---|---|

|

Less than 20000 |

0 |

20,000 |

|

Salary 20 to 34000 |

20,000 |

35,000 |

|

Salary 35 to 49000 |

35,000 |

50,000 |

|

Salary 50 to 75000 |

50,000 |

75,000 |

|

Salary 75 to 99000 |

75,000 |

100,000 |

|

Salary 100 to 200000 |

100,000 |

200,000 |

|

Salary 200000 Plus |

200,000 |

999,999,999 |

The determination rule and other settings for each compensation band are the same:

|

Field |

Value |

|---|---|

|

Determination Rule |

First of year |

|

Unit of Measure |

US Dollar |

|

Source |

Stated compensation |

|

Rounding |

Rounds to nearest hundred |

The Age to Use value that you select is an important aspect of an age derived factor. This value determines whose birth date is used to calculate the derived age.

In most cases, you use the Person's value in the Age to Use field to define an age derived factor for either a participant or dependent eligibility profile. In this case, each person's birth date is used to calculate the age criterion by which eligibility is evaluated for that person.

For example, if you select Person's as the Age to Use value, and associate the age derived factor with a dependent eligibility profile, each dependent's eligibility is evaluated based on the age calculated from his or her own birth date.

You might select another predefined value in the Age to Use field if you intend to evaluate participant or dependent eligibility or rates based on someone else's age, such as a spouse, child, or other dependent.

Note

If you choose Inherited Age, the evaluation is based on the date of birth as defined in the person extra information flexfield.

If you select Person's oldest child as the Age to Use value, and associate this derived factor with a dependent eligibility profile, eligibility for all dependents is evaluated based on the age of the participant's oldest child. Consequently, when the oldest child reaches the maximum age of eligibility, for instance, all dependents become ineligible.

You can define your own criteria to meet any special needs of your organization. For example, if your organization employs deep sea divers and offers different benefits or benefits rates based on how deep they dive, you can create Depth of Diving as a new eligibility criterion.

The data for the eligibility criterion must be stored in a table that is accessible to the application. If the data is stored in either the Person or Assignment table, you can select the table and column from a list, and then specify the lookup type used to validate input values. You can also allow a range of valid values if the field stores a numeric value or a date.

Note

To select the correct values for the column and lookup fields, you must have a basic understanding of the structure of the table that stores the eligibility criterion information.

If the data is stored in a table other than the Person or Assignment table, you must first create a formula to retrieve the data from the table, and then set the formula type to User-Defined Criteria.

You can define two sets of criteria on the User-Defined Criteria page. The participant must meet the criteria defined in either set to be considered eligible (or to be excluded from eligibility if the Exclude check box is selected when the criteria is added to an eligibility profile).

After you have created your user-defined criteria, you can add it to an eligibility profile.

The following scenarios illustrate how to define different types of user-defined criteria. In each example, you must first create the user-defined criteria and then add it to an eligibility profile and set the criteria values to use in the profile.

A commercial diving company wants to offer different benefit rates to employees who dive to depths greater than 330 feet. This data is stored for each employee in a custom attribute called Dive_Depth in the Person table. To define eligibility based on diving depth, set the following values on the Create or Edit User-Defined Criteria page:

|

Field |

Value |

|---|---|

|

Table |

Person |

|

Column |

Dive_Depth_Attribute |

|

Lookup |

Dive_Depth_Validation |

|

Enable range validation one |

Selected |

Save the user-defined criteria, and then add it to an eligibility profile. Set the following values on the User-Defined Criteria tab, which is under the Other tab on the Create or Edit Eligibility Profile page:

|

Field |

Value |

|---|---|

|

Set 1 Meaning |

329 |

|

Set 1 To Meaning |

9999 |

|

Exclude |

Deselected |

Save the eligibility profile and associate it with a variable rate profile.

An employer wants to exclude work-at-home assignment from eligibility for a transportation benefit option. To accomplish this, set the following values on the Create or Edit User-Defined Criteria page:

|

Field |

Value |

|---|---|

|

Table |

Assignment |

|

Column |

Work_at_home |

|

Lookup |

YES_NO |

|

Enable range validation one |

Deselected |

Save the user-defined criteria, and then add it to an eligibility profile. Set the following values on the User-Defined Criteria tab:

|

Field |

Value |

|---|---|

|

Set 1 Meaning |

Yes |

|

Exclude |

Selected |

Save the eligibility profile and associate it with the transportation benefit option.

A company wants to offer a spot incentive bonus to hourly employees who worked 100 percent of their scheduled shift hours in a three month period. To determine eligibility for the bonus, create a formula that calculates scheduled hours less worked hours for each week in the previous three months. If the result of successive calculations is less than or equal to zero, then the formula returns a result of Yes. The first step is to create the formula. Once the formula has been defined, create a user-defined criterion to run the formula. Enter the following values on the Create or Edit User-Defined Criteria page:

|

Field |

Value |

|---|---|

|

Access One Formula |

Worked_Sched_Hours_Percent |

|

Enable range validation one |

Deselected |

Save the user-defined criteria, and then add it to an eligibility profile. Set the following values on the User-Defined Criteria tab:

|

Field |

Value |

|---|---|

|

Set 1 Meaning |

Yes |

|

Exclude |

Deselected |

Save the eligibility profile and associate it with the bonus compensation object.

Note

For very complex scenarios, your organization or implementation team can write a custom program to evaluate eligibility, and then create a formula that calls the custom program.

This example illustrates how to define eligibility criteria based on the number of hours an employee is scheduled to work within a specified period of time.

You want to limit eligibility for a benefits offering to employees who were scheduled to work between 30 and 40 hours each week or between 130-160 each month as of the end of the previous quarter. To do this, add two different ranges on the Range of Scheduled Hours tab, which is under the Employment tab on the Create or Edit Eligibility Profile page.

Set the values for the first range as shown in this table:

|

Field |

Value |

|---|---|

|

Sequence |

1 |

|

Minimum Hours |

30 |

|

Maximum Hours |

40 |

|

Scheduled Enrollment Periods |

Weekly |

|

Determination Rule |

End of previous quarter |

Set the values for the second range as shown in this table:

|

Field |

Value |

|---|---|

|

Sequence |

2 |

|

Minimum Hours |

130 |

|

Maximum Hours |

160 |

|

Scheduled Enrollment Periods |

Monthly |

|

Determination Rule |

End of previous quarter |

An eligibility profile defines criteria used to determine whether a person qualifies for a benefits offering, variable rate profile, variable coverage profile, compensation object, checklist task, or other object for which eligibility must be established.

The following are key aspects of working with eligibility profiles:

Planning and prerequisites

Specifying the profile type and usage

Defining eligibility criteria

Excluding from eligibility

Assigning sequence numbers

Adding multiple criteria

Viewing the criteria hierarchy

Before you create an eligibility profile, consider the following:

If an eligibility profile uses derived factors, user-defined formulas, or user-defined criteria to establish eligibility, you must create these items before you create the eligibility profile.

If you are defining eligibility criteria for a checklist task, variable rate profile, or variable coverage profile, you must include all criteria in a single eligibility profile, because these objects can be associated with only one eligibility profile. You can, however, associate multiple eligibility profiles with benefits offerings and compensation objects.

Eligibility profiles are reusable, so use names that identify the criteria being defined rather than the object with which the profile is associated. For example, use "Age-20-25+NonSmoker" rather than "Supplemental Life-Min Rate."

When you create an eligibility profile, you specify whether the profile applies to participants or dependents. Use participant profiles to define criteria for employees or ex-employees who are eligible for company-sponsored benefits. Use dependent profiles for participants' spouses, family members, or other individuals who qualify as dependents. Dependent profiles can be associated only with plans and plan types.

An eligibility profile's usage determines the type of objects the profile can be associated with. For example, if you set the profile usage to Benefits, the profile is available for selection when you are associating eligibility profiles with benefits objects, such as programs, plans, plan types, options, variable rate profiles, and variable coverage profiles. You can also set the usage to Compensation, Checklist, or Global.

Criteria defined in an eligibility profile are divided into categories:

Personal: Includes gender, person type, postal code ranges, and other person-specific criteria

Employment: Includes assignment status, hourly or salaried, job, grade, and other employment-specific criteria

Derived factors: Includes age, compensation, length of service, hours worked, full-time equivalent, and a combination of age and length of service

Other: Includes miscellaneous and user-defined criteria

Related coverage: Includes criteria based on whether a person is covered by, eligible for, or enrolled in other benefits offerings.

Some criteria, such as gender, provide a fixed set of choices. The choices for other criteria, such as person type, are based on values defined in tables. You can define multiple criteria for a given criteria type.

For each eligibility criterion that you add to a profile, you can indicate whether persons who meet the criterion are considered eligible or are excluded from eligibility. For example, an age factor can include persons between 20 and 25 years old or exclude persons over 65. If you exclude certain age bands, then all age bands not explicitly excluded are automatically included. Similarly, if you include certain age bands, then all age bands not explicitly included are automatically excluded.

You must assign a sequence number to each criterion. The sequence determines the order in which the criterion is evaluated relative to other criteria of the same type.

If you define multiple values for the same criteria type, such as two postal code ranges, a person needs to satisfy at least one of the criteria to be considered eligible. For example, a person who resides in either postal range is eligible.

If you include multiple criteria of different types, such as gender and age, a person must meet at least one criterion defined for each criteria type.

Select the View Hierarchy tab to see a list of all criteria that you have saved for this profile. The list is arranged by criteria type.

You can define multiple criteria in an eligibility profile or create separate profiles for individual criterion. To determine the best approach, consider the following:

Does the object you are defining eligibility for support multiple eligibility profiles?

What is the best approach in terms of efficiency and performance?

If you are defining eligibility criteria for a checklist task, variable rate profile, or variable coverage profile, you must include all criteria in a single eligibility profile, because these objects can be associated with only one eligibility profile. You can, however, associate multiple eligibility profiles with benefits offerings and compensation objects.

For optimum performance and efficiency, you should usually attach profiles at the highest possible level in the benefits object hierarchy and avoid duplicating criteria at lower levels. Plan types in program, plans in program, plans, and options in plans inherit the eligibility criteria associated with the program. For example, to be eligible for a benefits plan type, a person must satisfy eligibility profiles defined at the program level and at the plan type in program level.

However, it is sometimes faster to create more than one profile and attach the profiles at various levels in the hierarchy. For example, you might exclude employees from eligibility at the program level who do not have an active assignment. At the level of plan type in program, you might exclude employees who do not have a full-time assignment. Finally, at the plan level, you might exclude employees whose primary address is not within a service area you define.

Note

Eligibility criteria can be used to include or exclude persons from eligibility. Sequencing of criteria is more complicated when you mix included and excluded criteria in the same profile. For ease of implementation, try to keep all excluded criteria in a separate eligibility profile.

This example demonstrates how to create a participant eligibility profile used to determine eligibility for variable life insurance rates. The profile includes two eligibility criteria: age and tobacco. Once the eligibility profile is complete, you can associate it with a variable rate profile.

The following table summarizes key decisions for this scenario.

|

Decisions to Consider |

In this Example |

|---|---|

|

What is the profile type? |

Participant |

|

What type of object is associated with this profile? |

Variable rate for benefits offering |

|

What types of eligibility criteria are defined in this profile? |

Age derived factor (must have been previously defined) Uses Tobacco criteria |

|

What are the criteria values? |

Age: Under 30 Tobacco Use: None |

|

Should persons meeting these criteria be included or excluded from eligibility? |

Included |

The following figure shows the tasks to complete in this example:

Note

In this example, you create one eligibility profile that defines the requirements for a single variable rate. Typically, you create a set of eligibility profiles, one for each variable rate. When you have completed all steps described in this example, you can repeat them, varying the age and tobacco use criteria, to create a separate profile for each additional rate.

|

Field |

Value |

|---|---|

|

Name |

Age Under 30+Non-Smoking |

|

Profile Usage |

Benefits |

|

Description |

Participant, age under 30, non smoker |

|

Status |

Active |

|

Assignment to Use |

Any assignment |

Note

You can reuse this eligibility profile by associating it with other objects that restrict eligibility, including benefits offerings, compensation plans, and checklist tasks.

The following examples illustrate scenarios where eligibility profiles are needed and briefly describe the setup required for each scenario.

A 401(k) savings plan is restricted to full-time employees under 65 years of age. To restrict eligibility for the plan, you must first create a derived factor for the age band of 65 and older, if one does not already exist. Then create an eligibility profile. Set the Profile Usage to Benefits and the Profile Type to Participant. Add the following criteria:

|

Criteria Type |

Name |

Values |

|---|---|---|

|

Employment |

Assignment Category |

Full-Time |

|

Derived Factor |

Age |

Select the age derived factor you created previously, and then select the Exclude check box. |

Associate the eligibility profile with the 401(k) plan.

A bonus is offered to all employees who received the highest possible performance rating in all rating categories. To restrict eligibility for the bonus, create an eligibility profile. Set the Profile Usage to Compensation and the Profile Type to Participant. Add the following criteria for each rating category:

|

Criteria Type |

Name |

Values |

|---|---|---|

|

Employment |

Performance Rating |

Select the performance template and rating name, and then select the highest rating value. |

Associate the eligibility profile with the bonus compensation object.

A new hire checklist contains tasks that do not apply to employees who work in India. To restrict eligibility for the tasks, create a participant eligibility profile. Set the Profile Usage to Checklist and the Profile Type to Participant. Add the following criteria:

|

Criteria Type |

Name |

Values |

|---|---|---|

|

Employment |

Work Location |

Select India as the work location, and then select the Exclude check box. |

Associate the eligibility profile with each checklist task that does not apply to workers in India.

Grandfathered eligibility enables participants who have been enrolled in a benefit to retain eligibility to elect that benefit when they would otherwise not be eligible to elect it.

Setting up grandfathered eligibility involves creating a benefits group and an eligibility profile based on the benefits group. You associate the eligibility profile with the benefits offering, and associate the benefits group with the individuals who qualify to be grandfathered into the offering.

This figure shows creating a benefits group, using it in an eligibility profile, and associating the profile to a benefits offering and the group to its members.

These are the basic steps:

Create a benefits group named descriptively, such as Grandfathered Eligibility. Select Navigator - Plan Configuration. Then click Manage Benefit Groups in the task pane.

Select the Manage Eligibility Profiles task and create an eligibility profile using these criteria:

|

Criteria Type |

Criteria Name |

Value |

|---|---|---|

|

Other |

Benefit Groups |

Select the grandfathered benefits group that you created. |

On the eligibility step of the plan configuration process, select the grandfathered eligibility profile for the benefits offering and make it required.

Assign the benefits group to workers who qualify for the benefit.

Either assign to individuals using the Manage Person Habits and Benefit Groups task in the Benefits Service Center, or assign to many workers in a batch load.

If you define multiple values for the same criteria type, such as two postal code ranges, a person needs to satisfy at least one of the criteria to be considered eligible. For example, a person who resides in either postal range is eligible. If you include multiple criteria of different types, such as gender and age, a person must meet at least one criterion defined for each criteria type.

If you add only one eligibility profile to an object, then the criteria in that profile must be satisfied, even if the Required option is not selected. If you add multiple eligibility profiles, the following rules apply:

If all profiles are optional, then at least one of the profiles must be satisfied.

If all profiles are required, then all of the profiles must be satisfied.

If some but not all profiles are required, then all required profiles must be satisfied and at least one optional profile must also be satisfied.

A life event is a change to a person or a person's employment that affects benefits participation. Examples of life events are changes in worker assignment, anniversary of employment, and marriage. Life events affect benefits processing for a worker.

Aspects of life events that are related to benefits processing are:

Type

Status

The four types of life events are explicit, temporal, scheduled, and unrestricted. You configure explicit life events during implementation. They can include either personal or work-related changes, such as an address change or assignment transfer. Temporal life events occur with the passage of time, such as the sixth month of employment, and are predefined. For temporal events, you use derived factors associated with plan design eligibility factors. Scheduled life events are assigned. Open enrollment periods are an example of a scheduled life event. Unrestricted life events are for benefit enrollments that are not time-dependent, such as savings plan enrollments. Participants can make enrollment changes at any time.

Two life event statuses are important for benefits processing, potential and active. Potential life events are detected life events, but they do not generate enrollment actions. Potential life events are processed by the participation evaluation process. If potential life events meet plan design requirements, they become active life events, which can generate enrollment opportunities.

In addition to life events statuses that affect benefits processing, you can update individual life event statuses for a worker. Life events statuses that you can set include closed, backed out, and voided. Closing a life event prevents further enrollment processing of the life event. Backing out a life event rescinds any updates to worker records that are generated by the participation evaluation process. You can back out only life events in the started status or processed status. Voiding a life event rescinds any updates and prevents further processing.

You configure explicit life events during implementation. They can include either personal or work-related changes, such as an address change or assignment transfer. Define an explicit life event by specifying its processing characteristics and the database changes that generate it. Use criteria similar to those that define eligibility profiles and variable rate profiles.

Aspects of explicit life events include:

Type

Definition

Detection

The two types of explicit life events are person change and related person change. A person change is a change in HR data that you define to indicate that a person has experienced a life event. A related person change is a change in HR data that you define to indicate that a person has experienced a related-person life event.

To define changes to a person's record that generate a life event, you specify database table and column values that, when changed, are detected and processed as a life event. For example, you might define that a life event occurs when the database value of a person's marital status changes from single to married. An example of a related-person life event is when a participant's child, who is older than 26, becomes disabled. The participant's record can be updated to reflect this and the child can be designated as a dependent.

Note

If you do not find criteria among choices in selection lists of table and column objects, you can use a formula to generate a life event.

Associate the person change that you define with a life event. You can link multiple person changes to a single life event and you can link a single person change to more than one life event.

Specify the new value for this combination of database table and column that, when detected, indicates that a life event has occurred. A person change can be defined to be detected based on:

A new value

A change from a specific old value to a specific new value

Any change to a value

A change from any value to no value

A change from no value to any value

You can use a formula to define more complex conditions for detecting a life event.

If you define a life event based on changes to more than one table, the life event is detected when a data change in one of the tables meets the person change criteria. For life events that entail multiple changes to the same table, the person must satisfy all person change criteria associated with the table for the life event to be detected.

A scheduled life event is an assigned life event, such as an open enrollment period.

Types of scheduled life events are:

Administrative

Open enrollment

Assign administrative life events to a person or group when the terms and conditions of a benefit plan change significantly and participants must be allowed to re-evaluate their elections. This type of life event is also used during implementation to upload data initially. Examples of administrative life events include renegotiation of contract rates or addition of a new benefit.

The open enrollment life event determines eligibility for an open enrollment period. Open enrollment periods typically recur on a scheduled basis, such as an annual health and welfare benefits enrollment or a quarterly savings plan enrollment.

Use unrestricted life events for benefit enrollments that are not time-dependent, such as savings plan enrollments. Participants can make enrollment changes at any time.

The two types of unrestricted life event are:

Unrestricted

Unrestricted life events have a one day enrollment period and remain in the started status until the next unrestricted life event is started.

Unrestricted Open

You can configure the enrollment period for unrestricted open life events.

These aspects are common to both unrestricted and unrestricted open life events:

A new unrestricted life event is started every time an attempt is made to alter the benefits enrollment. Any previous unrestricted life event is closed at that time. Consequently, from the worker's or benefits professional's perspective, unrestricted life events have no enrollment period limitation.

Unrestricted life events in started status are closed when evaluation processing occurs.

Processing an unrestricted life event with an effective date that is prior to existing unrestricted events will result in the later events being backed out, but does not affect any other types of life events.

All temporal life events are predefined. Temporal life events occur with the passage of time, such as the sixth month of employment.

Aspects of temporal life events include:

Types

Detection rules

Implementation

The predefined temporal life events use derived factors and include:

Derived age

Derived combination of age and length of service

Derived compensation

Derived hours worked in period

Derived length of service

Derived total percentage of full time

When you run the participation evaluation process in scheduled, life event, or temporal mode, a life event is created when the minimum or maximum boundary is crossed as specified in the definition of the applicable derived factor.

When you create or edit a life event, select from among these options for the temporal detection rule:

Do not detect past or future temporal events

This option prevents the detection of past temporal events while the application processes this life event.

Do not detect past temporal events

The second option prevents temporal event detection while the application processes the specified life event. Use this rule with open and administrative events, or explicit events, when you do not want to detect temporal events.

Never detect this temporal life event

This option prevents the automatic detection of a specific temporal event. Set this rule for any seeded temporal event, for example, age change or length of service change, that you do not want to detect, such as during mid-year changes.

Use predefined temporal life events that are calculated from derived factors in plan and program design configuration, in conjunction with eligibility profiles or variable rate profiles attached to eligibility profiles.

Use one or more benefit object hierarchies to organize and maintain your benefits offerings. Administrative policies and procedures, such as eligibility requirements, life event definitions, costs, and coverage limits that are set at a higher level cascade to objects at lower levels, unless overridden by more specific rules defined at a lower point in the hierarchy.

This figure shows a benefits object hierarchy for a health insurance benefits offering that is populated at all four available levels: program, plan type, plan, and option.

Note

The icons shown in the figure also appear next to benefits objects in various places throughout the application. The icons serve to quickly identify the benefits object function: program, plan type, plan, or option

Within the health insurance program are two plan types: medical and dental. Two medical plans are within the medical plan type, and two dental plans are within the dental plan type.

At the fourth level are options to enroll the employee plus family, employee plus spouse, or employee only. Once defined, options can be reused. For example, the option to enroll the employee plus spouse is available to both the health maintenance organization and the preferred provider organization medical plans, but is not available to either dental plan. The employee option is associated with all plans in this hierarchy.

Note

It is not necessary to populate all four levels of the benefits object hierarchy.

When plans do not offer options, the options level of the hierarchy is not populated.

When a benefits offering such a savings plan is not organized under a program, and is subsequently identified as a plan not in program, the program level is not populated. The plan type becomes the top level, followed by the plan not in program at the next lower level. Options, if any, would populate the lowest level of the hierarchy.

The following figure shows a hierarchy where the program level is not populated.

The plan type contains a plan not in program. The dashed lines indicate that if the plan not in program does not offer options, then the option in plan level is not populated. In that case, the hierarchy would have only two levels: plan type and plan not in program.

Each program represents a package of related benefits and appears at the top level of its own hierarchy. Plan types, plans, and options appear at subordinate levels of the hierarchy. For example, a health insurance program spans medical, dental, and vision categories of expense coverage. All plans in a program inherit the program's currency definition.

A plan type is a category of plans, such as medical or dental insurance. Use plan types to efficiently define, maintain, and apply one set of administrative rules for all benefit plans of the same type.

A plan is a specific offering within the plan type. A health maintenance organization and a preferred provider organization are examples of specific medical insurance plans.

An option is an electable choice within a plan, such as coverage for an employee, employee plus spouse, or the employee's immediate family. Options are reusable. Once defined, you can associate an option with one or more plans and plan types. When you associate an option with a plan type, you make that option available for selection in all plans of that plan type.

You typically set up several components for later use while implementing and maintaining program and plan configurations.

The components specify rules that validate values or determine benefits eligibility. You can set up new, or edit existing components at any time. Because some components are used while defining other components, set up the components in the following sequence when possible.

Action items

Derived factors

Eligibility profiles

Life events

Variable rate profiles and variable coverage profiles

Variable rates and coverages

Standard rates and coverages

You can define enrollment and beneficiary designation requirement action items which, if not provided, cause either enrollment in the benefit offering to be suspended or beneficiary enrollment to be suspended. You can define different certification requirements for different action items.

Derived factors typically change with time, such as age, length of service, and compensation. You can use any of the available derived factors as decision criteria in a participant eligibility profile. You can use the Age derived factor in a dependent coverage eligibility profile.

After you define participant eligibility profiles and dependent coverage eligibility profiles, you can attach them to the appropriate level of the benefits object hierarchy to administer policies regarding who can participate in the benefits objects. You can attach multiple profiles to one object. Each profile can contain required criteria and optional criteria. For example, a profile could specify that eligible employees must work full time, and either have been employed for at least two years, or be assigned to a manager grade. You also associate eligibility profiles to a variable rate profiles and variable coverage profiles.

You can administer benefits policies based on life events that occur to participants, such as the birth of a dependent or a work location change. You can set up certification requirements, designation requirements, and adjust rates and coverages based on predefined life events or events that you define. You can set up life events based on derived factors, such as age, length of service, and compensation.

Life events are defined separately from any benefits object or rate so that a single life event can have multiple uses.

Enrollment requirements - You can link qualifying life event definitions to the enrollment requirements for a benefits object. Subsequent occurrence of the life event causes participation evaluation processing to consider the person's eligibility for that object.

Enrollment coverage - You can vary the amount of coverage available for a plan based on a life event. You define the standard coverage amount for the plan or option in plan and the coverage level available for those participants who experience the life event. You can also limit a currently enrolled participant's ability to change coverage levels.

Depending on your business requirements, you can associate one or more variable rate profiles and variable coverage profiles with rates and coverages, respectively.

The variable rate profile definition offers several delivered calculation methods. Also, the selected variable rate profile calculation can be defined to either replace or add to the standard rate calculation. Each eligibility profile can have one or more associated derived factor criteria, such as Age, Length of Service, and Compensation.

For example, you want the calculated rate for a participant's life insurance to vary depending on the participant's age. Participants in the 31 to 40 age group pay $3, those aged 41 to 50 pay $4, and those 51 to 60 pay $5. Configure three variable rate profiles, each with an eligibility profile matching the appropriate Age temporal attribute.

Note

Eligibility Profile is a required field when defining variable rate and coverage profile details.

You attach standard rates to a benefits object to specify monetary contributions and distributions to be made by the employee and employer. A variety of standard rate calculation methods are predefined, or you can define your own formulas for this purpose. When a participant enrolls in a plan, participation evaluation processing enters the calculated result on a payroll element for the employee. Informational rates typically used for additional reporting do not use payroll elements.

Standard and variable coverages work similarly to standard and variable rates. Several calculation methods are predefined. You can create and attach variable coverage profiles to coverages using a method that is similar to the way that you create and attach variable rate profiles to rates. Also, variable coverage profile definitions require that you specify an eligibility profile, to which you can optionally attach one or more derived factors. Therefore, variable coverage calculated results can vary depending on the calculation method, associated eligibility profile, and temporal events.

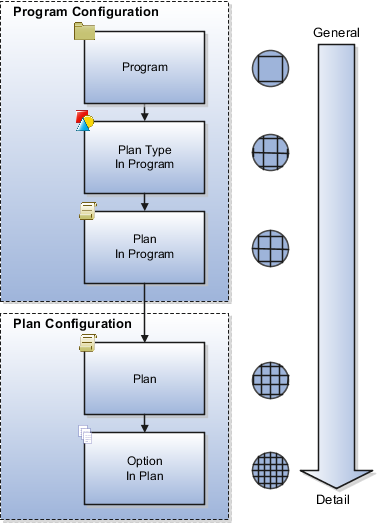

Setup effort and operating performance vary depending on where eligibility criteria are defined within the benefits object hierarchy. Generally, you should associate criteria at the highest level that provides the needed degree of control. If a plan or option has specific requirements that are not common to the levels above it, then it is appropriate to associate criteria at that lower level.

Within the program configuration eligibility page, eligibility requirements can be defined at three levels: program, plan type in program, and plan in program. Within the plan configuration eligibility page, eligibility requirements can be defined at two additional levels: plan and option in plan.

When more than one set of eligibility requirements apply to a given circumstance, the eligibility criteria are cumulative. In other words, criteria set at a detailed level are in addition to, and do not override, criteria set at a general level.

The following figure shows the eligibility determination hierarchy with components organized from top to bottom, general to detailed.

This example of wellness program eligibility illustrates an efficient approach to specifying eligibility requirements when criteria change at different levels of the hierarchy.

A legal employer is setting up a benefits offering. Eligibility for the program and its plans and options vary, depending on employment status, location, and gender criteria. The wellness program is for current and retired employees only. The program contains two plan types: medical and recreational. Within the medical plan type are two plans: the health maintenance organization plan and the preferred provider organization plan. Within the recreational plan type are two plans. The headquarters plan provides access to an on campus recreation facility for current and retired employees who work or live near headquarters. The field plan is for retired employees and current employees located at remote locations. Field options in plan consist of several national fitness franchises. The Esses franchise restricts membership to the female gender.

The following figure shows the wellness program eligibility determination hierarchy, with eligibility requirements set at the wellness program, field plan in program, and Esses franchise option in plan levels.

The intended program eligibility configuration requires three eligibility profiles set at three different levels of the hierarchy.

An employment status eligibility profile at the wellness program.

A location eligibility profile at the field plan in program. This is the highest level in the hierarchy at which this filter can be applied without inadvertently screening (for example, medical plan participants by location).

A gender eligibility profile at the Esses option in plan. Again, this filter is positioned at the highest level in the hierarchy that affords control of membership gender for only the Esses franchise.

The eligibility determination hierarchy works like a set of increasingly finer sieves, with the program level serving as the coarse sieve.

Because program-level eligibility criteria are evaluated first, the employment status criteria associated at the wellness program level includes only current and retired employees, which causes all persons who are not current or retired employees to be ineligible for further consideration for any objects at lower levels of the hierarchy.

Next, the location eligibility profile on the field plan excludes current employees who live near headquarters from joining off-campus facilities.

Finally, the gender eligibility profile associated with the Esses field plan option includes female membership only.

Eligibility criteria set at lower levels in the hierarchy are in addition to and do not override higher-level criteria. For example, the gender eligibility profile set up at the Esses plan option level includes females, but those females must also satisfy the employment status and location criteria set up at higher levels.

This strategy reduces processing time because the eligible population for consideration diminishes as the eligibility evaluation proceeds down the hierarchy. Although it is possible to attach an eligibility profile to each plan or option individually, that approach is much less efficient both in terms of setup and performance.

John is a retired employee who still lives near headquarters. As a retired employee, John meets the high-level criteria and therefore has access to the on-campus recreation facility plan. Because John is not a current employee working at headquarters, he is not excluded by the field-plan-level criteria for joining a national fitness franchise. Finally, the Esses plan option is not available to John, due to the plan-option-level gender criterion.

Setup effort and operating performance vary depending on where enrollment criteria are defined in the hierarchy. Generally, you should associate criteria at the highest level that provides the needed degree of control. If a plan or option has specific requirements that are not common to the levels above it, then it is appropriate to associate criteria at that lower level.

The following figure shows the enrollment determination hierarchy organized from top to bottom, left to right, general to detailed.

Enrollment requirements defined at a lower level in the hierarchy override those definitions cascading from above.

At the left, the hierarchy shows the three enrollment configuration levels that are available on the program configuration enrollment page. The three enrollment requirement levels available during program configuration (organized from general to detailed) are program, plan type in program, and plan in program. Below the program enrollment configurations are the two enrollment configuration levels that are available on the plan configuration Enrollment page: plan and option in plan. Option in plan enrollment requirements set up on the plan configuration enrollment page override any definitions that have been set up at a higher level, such as the plan in program level of the program configuration enrollment page.

From the life event tabs that appear on the program configuration enrollment page and the plan configuration enrollment page, you can set up enrollment requirements associated with one or more life events at any of the available hierarchy levels.

Shown at the right side of this figure is a hierarchy of five enrollment configurations that are available from the Life Event tabs on the program and plan enrollment pages. Again arranged from general to detailed, these life event enrollment configurations are life event in program, life event in plan type in program, life event in plan in program, life event in plan, and life event in option in plan. Because life events are more specific, the life event configurations override their corresponding parallel configurations appearing immediately to their left in this figure.

For example, enrollment requirements at the life event in option in plan override those set up above, such as for the life event in plan. The life event in option in plan setup also overrides setup at the left for the option in plan.

This wellness program enrollment example illustrates an efficient approach for specifying enrollment requirements when criteria change at different levels of the hierarchy.

A legal employer is setting up an open enrollment period for the wellness program to recur every November. The wellness program contains two plan types: recreational and medical. The medical plan type includes a health maintenance organization (HMO) plan in program and a preferred provider organization (PPO) plan in program. Within the medical plans are options for covering the employee, employee plus spouse, and employee plus family.

This program enrollment configuration requires two enrollment period requirements set at different levels of the hierarchy.

An open enrollment period at the program level

An additional enrollment period at the life event in plan level

First, we set up the open enrollment period at the wellness program level, because during that period, enrollment is available for all objects within the wellness program. Enrollment requirements set at a general level of the hierarchy cascade to lower levels, unless you specifically override them at a lower point in the hierarchy. To provide additional enrollment opportunities when a life event istriggered by adding a child to the participant's family, we attach an overriding enrollment requirement at the level of the medical plan.

Enrollment criteria set at lower levels in the hierarchy override higher-level criteria. For example, the program level enrollment period does not allow enrollment at any time other than November. However, life event set up at the plan level overrides the program level criteria. This set up creates an overriding enrollment opportunity whenever a child joins a participant's family.

This strategy reduces maintenance and processing time because the program level criteria controls enrollment for all persons, with one exception for a specific life event.

Jane adopts a child into her family during June. As a current employee, Jane participates in the wellness program, medical plan type, PPO medical plan, employee plus spouse option. Although the open enrollment period for the wellness program occurs only in November, Jane does not need to wait for the open enrollment period. The life event in plan override provides an immediate enrollment opportunity to change the enrollment option to employee plus family. However, Jane must wait for the open enrollment period to change enrollment in any object within the recreational plan type.

Four methods are available for creating benefits plans:

Complete the Quick Create Plan page

Prepare and upload a spreadsheet

Complete the plan configuration process

Complete the Create Plan page accessed from the Quick Create Program page

The Quick Create Plan page is useful when you want to quickly set up the essential framework of a plan configuration, or create many standard rates associated with the plan or option in plan. This process provides the ability to create one new plan type and multiple options without needing to exit to the Manage Plan Types or Manage Benefit Options tasks.

You can immediately associate an existing, or the newly created plan type and options with the plan.

You can quickly configure essential characteristics for a plan in program or not in program. When you specify the Usage as Not in program, an additional section appears for specifying currency, defined rate frequency and communicated rate frequency, which would otherwise be inherited from the overarching program configuration.

When you use the Quick Create Plan page, several plan characteristics are automatically set to commonly used values. If those default settings do not fit your needs, you can use the plan configuration process to retrieve the plan in program or plan not in program and then edit or add details at any time. You cannot use quick create functionality to edit any existing object.

The spreadsheet upload method is useful when you want to quickly set up one or more plans that you enter into a spreadsheet and upload to the plan configuration pages, where you can edit and add configuration details. This option offers the ability to quickly upload the basic details of many plans at one time, along with the advantages of a spreadsheet, such as saving the file locally and sharing the design with others before uploading.

The automatic settings for plans created by uploading from a spreadsheet are the same as those set when you use the Quick Create Plan method. You cannot edit an existing plan using this method.

The plan configuration process offers the complete set of plan characteristics and therefore the greatest flexibility for setting up and maintaining Benefits plans.

It is the only means to edit a plan after it has been saved, regardless of the method used to create the plan.

On the other hand, if you are midway through the plan configuration process and discover that you have not completed the setup for an object that you need to use in the plan configuration, you will need to exit to those tasks and complete that auxiliary setup before you can return and complete the plan configuration.

Another method to create a plan in program is available while you are using the Quick Create Program page to set up the essential framework of a program configuration. Click the Create Plan button to open the Create Plan Basic Details window where you can specify the essential characteristics of a plan in program without needing to exit to the Manage Benefit Plan Details task.

The Create Plan Basic Details page provides the ability to associate the new plan with an existing plan type and multiple existing options. Upon returning to the Quick Create Program page, you can immediately associate the just created plan with the program.

Quick create plan functionality defines essential configuration for benefits plans.

Consider the following aspects of quick create plan functionality while deciding whether this method is appropriate for configuring a particular benefits plan:

Capabilities