Understanding the Accounting Structure

Understanding the Accounting Structure

This chapter provides an overview of the accounting structure and discusses how to:

Define the accounting structure.

Define location accounting.

Establish commitment control.

Define interunit transfers.

Set up intraunit processing.

Design shipment on behalf of.

Create and reverse interunit expensed issues.

Understanding the Accounting Structure

Understanding the Accounting Structure

This chapter explains the elements that the Accounting Line Creation job process (CM_ALC) uses to create accounting entries. PeopleSoft Cost Management enables you to create accounting entries, at any level of detail, for all transactions that have a financial impact on PeopleSoft Inventory and PeopleSoft Manufacturing. When setting up the accounting structure, you decide how you want to post transactions. You can post transactions for any combination of business unit, transaction group, distribution type, and either item or item group. You can design transaction accounting for the basic transactions, location accounting, budget checking, interunit transfers, fund accounting, shipments on behalf of another revenue stream, and interunit expensed issues. The Accounting Line Creation process is discussed in the "Costing Transactions and Creating Accounting Entries" chapter.

See Also

Structuring Your Cost Management System

Common Elements Used in This Chapter

Common Elements Used in This Chapter

|

FERC Code (Federal Energy Regulatory Commission code) |

Federal Energy Regulatory Commission identification codes. This field appears only if you select FERC reporting on the PeopleSoft Inventory Options page. |

|

ChartFields |

Chart of accounts used to record accounting entries and journal entries in PeopleSoft. |

|

Cost Element |

Code used to categorize the different components of an item's cost and also define the debit and credit ChartFields for accounting entries. |

|

Transaction Group |

Predefined codes attached to different types of transactions, such as stocking, issues and adjustments. |

|

Distribution Type |

User-defined codes that are a subset of transaction groups. This enables you to break down a transaction group into customized categories. |

|

Item Group |

A grouping of items that enable you to design the accounting structure for a group of similar items, such as sporting equipment or dress shoes. The item group is attached to an item using the Item Definition - General page. |

Defining the Accounting Structure

Defining the Accounting Structure

Using the Accounting Rules page, you can create your steps for accounting entries, at any level of detail, for all transactions that have a financial impact on inventory. When a transaction is created, it contains the information that is used to find and create the accounting entries, including:

|

Transaction Group |

A system-defined code automatically embedded in each inventory transaction that defines the type of transaction. For example, the transaction code 030 (Usage and Shipments) is embedded on the Express Issues page for external issues. Any transaction that is recorded by using this page is coded with the transaction group 030. |

|

Distribution Type |

(Optional) A subset of transaction groups that can further define the transactions. This code is user-defined and can be added during transaction entry. For example, you could decide that the transaction group 030 (Usage & Shipments) is too general and opt to use distribution types to further define it as shipments to wholesale customers and shipments to retail customers. |

|

Unit |

The PeopleSoft Inventory business unit in which the transaction is recorded. |

|

Item ID or Item Group |

The item used in the transaction or the item group to which this transaction belongs. |

|

Cost Element |

A code used to categorize the different components of an item's cost and also define the debit and credit ChartFields for accounting entries. Adding a cost element to the Define Business Unit Item - General page, identifies an item's material cost. |

When you run the Accounting Line Creation process, the system searches through the accounting rules definition data that you defined on the Accounting Rules page, looking for a match to the transaction's data going from most granular to least granular. For example, suppose that you process an entry from the Express Issues page (using the transaction group 030) for item ID 10001 in the business unit US008. The process searches for an Accounting Rules page with business unit US008, transaction group 030, and item ID 1001. If the system finds this combination, then it creates the accounting entries based on this transaction accounting rule. If more than one accounting rule can be used for the transaction, then the process uses the more specific rule, for example, item ID instead of item group.

If location accounting is turned on, then the process searches storage area accounts to find the credit account and uses the transaction accounting rule to find the debit account. Additional information about the Accounting Line Creation process is located in the Costing Transactions and Creating Accounting Entries chapter.

To define the inventory accounting structure:

Verify that the PeopleSoft financial structure has been defined including ChartFields and combination editing.

Verify that the cost elements have been defined and attached to the various PeopleSoft pages that generate costs including:

The Define Business Unit Item page.

A purchased item must always have a cost element defined.

The Misc Charge/Landed Cost Definition page.

The Conversion Rates page.

The Costing Conversion Overhead Rates page.

The Additional Item Costs page.

The Forecasted Purchase Costs page.

Review the list of transaction groups codes.

Define any distribution types needed to further breakdown the transaction groups.

(Optional) Use the Default Distribution Type page to establish any default distribution types by transaction group.

Define any item groups.

Establish the accounting entries to be created using the Accounting Rules page.

After establishing the accounting structure, the Transaction Costing process (CM_COSTING) costs transactions and the Accounting Line Creation job process creates accounting entries. Both process are initiated using the Cost Accounting Creation process page.

See Also

Costing Transactions and Creating Accounting Entries

Pages Used to Define the Accounting Structure

Pages Used to Define the Accounting Structure

|

Page Name |

Definition Name |

Navigation |

Usage |

|

CM_ELEMENT |

Set Up Financials/Supply Chain, Product Related, Cost Accounting, Cost Elements |

Define cost elements to categorize different components of an item's cost. |

|

|

CM_DISTR_TYPE |

Set Up Financials/Supply Chain, Product Related, Cost Accounting, Distribution Type |

Use to define debit and credit account ChartFields at a finer level of granularity. |

|

|

CM_TRANS_GROUP |

Set Up Financials/Supply Chain, Product Related, Cost Accounting, Distribution Type Default, Default Distribution Type |

Assign default distribution types for transactions. |

|

|

INV_ITEM_GROUP |

Items, Define Controls, Item Groups |

Create groups of similar items that should use the same ChartField combinations in their accounting entries. |

|

|

CM_ACCTG_DIST |

Set Up Financials/Supply Chain, Product Related, Cost Accounting, Transaction Accounting Rules, Accounting Rules |

Create the debit and credit lines for the accounting entries based on the business unit, transaction group, distribution type, item or item group, and cost element. |

|

|

INV_ITEMS_DEFIN1 |

|

Define the item group to which this item belongs. |

See Also

Defining General Item Information

Verifying Your PeopleSoft Financial Structure

Verifying Your PeopleSoft Financial Structure

Verify that the PeopleSoft financial structure has been defined, including ChartFields and combination editing. Note whether ChartField combination edits are being used. ChartField combination editing displays an error message when incorrect combinations are used. Combo edits are always based on the COMBO_DATA_TBL record. When the combo rules are changed, the new rules are not used until the Build Combo Data process is run to repopulate the record.

See Also

Defining and Using ChartFields

Editing ChartField Combinations

Defining Financials and Supply Chain Management Common Definitions

Activating Optional Business Unit Features

Verifying That Cost Elements are Defined

and Applied to Items

Verifying That Cost Elements are Defined

and Applied to Items

Use the Cost Elements page to define or maintain cost elements, that you use to categorize different components of an item's cost. When you perform a cost roll-up, you maintain an item's standard cost by cost element. You can use cost element categories to define the costs at a summarized or very detailed level by using one or many cost elements. Cost elements also help define the ChartField combinations that you used to create accounting entries during the Accounting Line Creation process. Once you define the cost elements, attach the appropriate cost elements to the different costs that PeopleSoft Cost Management generates including:

Attach a default cost element to each item on the Define Business Unit Item page.

Use landed cost elements to categorize landed costs on the Misc Charge/Landed Cost Definition page.

For make items, use the cost elements to define costing conversion rates, costing conversion overhead rates, additional item costs, and forecasted purchase costs.

See Also

Understanding Standard Costing for Purchased Items

Creating Cost Conversion Rates

Creating Cost Conversion Overhead Rates

Establishing Inventory Business Unit Pairs

Defining Basic Business Unit Item Attributes

Defining Miscellaneous Charges and Landed Costs

Using Transaction Group Codes

Using Transaction Group Codes

Each transaction, with a financial impact, is embedded with a predetermined transaction group. The transaction group identifies the type of transaction entered and determines what records are populated, how costing is calculated, and what ChartFields are used to record accounting entries. PeopleSoft Cost Management maintains a transaction history for all transactions with a transaction group. See Appendix A for a complete description of these transaction groups. This table lists the transaction group codes and descriptions:

|

Transaction Group Code |

Transaction Group Description |

|

001 |

CM Only NegQty Costing Opt |

|

010 |

Receipt to Inspection |

|

012 |

Return to Vendor |

|

013 |

Return to Vendor from Inspection |

|

020 |

Putaway |

|

021 |

Receipts from Production* |

|

022 |

IBU Transfer Receipts |

|

024 |

Customer Returns |

|

025 |

InterCompany Receipts |

|

026 |

Expensed Issue Return |

|

030 |

Usage & Shipments |

|

031 |

InterBU Transfer Shipments |

|

032 |

Non Stock Shipments |

|

034 |

Ship on Behalf of Other BU |

|

035 |

InterCompany Transfers |

|

036 |

InterUnit Expensed Issue |

|

037 |

VMI Interunit shipment |

|

038 |

VMI Consumption |

|

040 |

Physical Count Adjustments |

|

041 |

Cycle Count Adjustments |

|

042 |

IBU Transfer Adjustments |

|

050 |

User Adjustments |

|

051 |

Inventory Scrap |

|

052 |

Shipping Adjustment |

|

053 |

Floor Stock Issues/Ret* |

|

054 |

Inventory Scrap for RTV |

|

060 |

Bin-to-Bin Transfers |

|

200 |

Inventory Revalue |

|

201 |

Inventory Reval - Inspection |

|

205 |

Value Adjustment |

|

206 |

Value Adjust/ActCost Items |

|

210 |

WIP Revalue (Comps, Assys)* |

|

211 |

WIP Revalue (Conv Costs)* |

|

212 |

WIP Revaluation (Scrap)* |

|

220 |

Component Kit* |

|

221 |

Route to Production Kit* |

|

222 |

Waste Completion |

|

223 |

Component/Output Transfers |

|

230 |

Component Consumption* |

|

231 |

WM Usage (Maintenance Management Usage) |

|

240 |

Earned Labor* |

|

250 |

Assembly Scrap* |

|

261 |

Material Variances* |

|

262 |

Conversion Variances* |

|

263 |

Rework Expense* |

|

264 |

Outside Processing PPV* |

|

265 |

Teardown Variance* |

|

300 |

Gain/Loss on Transfer Price |

|

301 |

InterCompany Cost of Goods |

|

302 |

ShipOnBehalf Gain/Loss |

|

400 |

Std Cost Variance Receipts |

|

401 |

Wt Avg Updates from AP |

|

402 |

Std Cost Exchange Rate Var |

|

403 |

Wt Avg Cost Updates - ERV |

|

405 |

Wt Avg Update Writeoffs |

|

407 |

Subcontract Standard Cost PPV2* |

|

408 |

Subcontract Standard Cost PPV2 ERV* |

|

415 |

RTV Variances |

|

461 |

Voucher Variance Writeoffs |

|

500 |

Miscellaneous Charges |

|

501 |

Freight Charges |

|

601 |

Wt Avg Upd Production Var* |

|

605 |

Wt Avg Upd Prod Writeoffs* |

|

606 |

Avg Rev Compl Write-off* |

|

622 |

Actual Waste Cost* |

|

630 |

Overhead* |

|

640 |

Actual Labor Costs* |

|

645 |

Actual Machine Costs* |

|

651 |

Production Cost Writeoff* |

|

661 |

Actual Cost Variances* |

|

664 |

Subcontracted Cost |

*Indicates a transaction group that is related to transactions generated in PeopleSoft Manufacturing.

See Also

Defining Distribution Types

Defining Distribution Types

To define distribution types, use the Distribution Type (CM_DISTR_TYPE) component. Use the Distribution Type component interface (CM_DISTR_TYPE_CI) to load data into the tables for this component.

Access the Distribution Type page (Set Up Financials/Supply Chain, Product Related, Cost Accounting, Distribution Type).

In most instances, the transaction determines the debit and credit account to charge. For example, a customer shipment typically debits a cost of goods sold account and credits inventory. For some transactions, like a miscellaneous issue from stock, the transaction accounting rule can depend on the party to whom you issue the material. You could charge different departmental expense accounts for the receipt of inventory, depending on who requisitions the material from stock. Use distribution types to have the option to define different departments or cost centers.

When used in conjunction with the transaction group, distribution types enable you to define debit and credit ChartFields at a finer level of granularity. A manufacturing organization, for example, can set up a distribution type for each of its production departments. You assign these distribution types to the appropriate work center when you define the manufacturing data. When you record assembly completions at an operation or to stock, the system records the earned labor, machine, and overhead costs. If you have assigned a distribution type to the work center, the system records this distribution type along with the costs. This identifies the department or cost center that earned the labor, machine, and overhead costs. You can then set up transaction accounting rules for the transaction group Earned Labor (240) and the distribution type (for example, one of the assembly departments). Debit the production area account for the value of costs added to WIP and credit each department expense for the earned labor and applied overhead.

You can set up distribution sets in PeopleSoft Order Management with a distribution type that can be transferred to PeopleSoft Inventory and PeopleSoft Cost Management. This enables you to use the distribution type to classify costs of sales appropriate to the sales account.

See Also

Setting Up Order Processing Options

Using the Default Distribution Type Page

Using the Default Distribution Type Page

To define default distribution types, use the Default Distribution Types (CM_TRANS_GROUP) component.

Access the Default Distribution Type page (Set Up Financials/Supply Chain, Product Related, Cost Accounting, Distribution Type Default, Default Distribution Type).

Use the Default Distribution Type page to assign default distribution types for transactions. Once you define at least one distribution type, you can also assign a default distribution type that appears whenever you process a transaction. It is not required that you define a default distribution type for every transaction group; however, it can reduce entry errors. For example, you can assign a distribution type to the transaction group User Adjustments (050). Then, if an inventory adjustment occurs, the distribution type associated with the transaction appears as the default. You can override the default distribution type on a transaction by transaction basis. The use of distribution types for a transaction group is optional.

Using Item Groups

Using Item Groups

You can assign transaction accounting rules to a grouping of items by using item groups.

To use item groups for defining transaction accounting rules:

Define the item groups using the Item Group page.

Attach the item groups to the corresponding items using the Item Definition - General: Common page.

Use the item groups on the Accounting Rules page to define the ChartField combinations to be used for the accounting entries.

See Also

Defining General Item Information

Setting Up the Accounting Rules page

Setting Up the Accounting Rules page

To define accounting distribution, use the Account Distribution component (CM_ACCTG_DIST). This component is also know as the Transaction Accounting Rules component.

Access the Accounting Rules page (Set Up Financials/Supply Chain, Product Related, Cost Accounting, Transaction Accounting Rules, Accounting Rules).

On this page, create a template of the ChartField combinations (chart of accounts) to be used for creating accounting entries. Use separate rows for the debit and credit entries. Create a separate page (or template) for each type of transaction. Once you determine how you want to model accounting entries, you can assign the debit and credit ChartFields for any combination of business Unit, Transaction Group, Distrib. Type (distribution type), either Item ID or Item Group, and Cost Element. Business Unit and Transaction Group are the only required fields.

To save maintenance time, three of the transaction groups do not need to be created or maintained on the Accounting Rules page. The transaction group 206 uses the account distribution setup defined for the transaction group 205. The transaction groups 211 and 212 use the account distribution setup defined for the transaction group 210.

Searching for the Correct Transaction Accounting Rule

As you define transaction accounting rules, there are some situations where more than one Accounting Rules page can be used for the same transaction. The system uses the transaction accounting rules with the most specific information matching the transaction. The search for the correct Accounting Rules page uses the logic in the table starting with the first row and continuing until a match is found.

|

Row |

Unit |

Trans Group |

Item ID |

Item Group |

Distrib Type |

Cost Element |

|

1 |

Business Unit |

Transaction Group |

Item ID |

blank |

Distribution Type |

Cost Element |

|

2 |

Business Unit |

Transaction Group |

Item ID |

blank |

Distribution Type |

blank |

|

3 |

Business Unit |

Transaction Group |

Item ID |

blank |

blank |

Cost Element |

|

4 |

Business Unit |

Transaction Group |

Item ID |

blank |

blank |

blank |

|

5 |

Business Unit |

Transaction Group |

blank |

Item Group |

Distribution Type |

Cost Element |

|

6 |

Business Unit |

Transaction Group |

blank |

Item Group |

Distribution Type |

blank |

|

7 |

Business Unit |

Transaction Group |

blank |

Item Group |

blank |

Cost Element |

|

8 |

Business Unit |

Transaction Group |

blank |

Item Group |

blank |

blank |

|

9 |

Business Unit |

Transaction Group |

blank |

blank |

Distribution Type |

Cost Element |

|

10 |

Business Unit |

Transaction Group |

blank |

blank |

Distribution Type |

blank |

|

11 |

Business Unit |

Transaction Group |

blank |

blank |

blank |

Cost Element |

|

12 |

Business Unit |

Transaction Group |

blank |

blank |

blank |

blank |

Working with Cost Elements and Using Blank Spaces for Cost Elements

An item can have one or more cost elements defined in its product structure. The Transaction Costing process calculates and stores the costs by cost element. In the Accounting Line Creation process, the system attempts to match up the item's transaction costs (categorized by cost element) to a transaction accounting rule with the same information. The system finds the correct ChartField combination by searching for a row in the Accounting Rules page with a cost element matching the transaction costs of the item. If the system does not locate this, then it uses a row with a blank cost element. Therefore, you add flexibility to the system by adding different combinations of cost elements using different rows on the same Accounting Rules page. You can use any combination of debit and credit rows. You can use rows with a blank cost element for any unspecified cost elements. If you can use the same ChartFields, regardless of the cost element, leave the Cost Element field blank.

Adjustments can be either an increase or decrease. You only need to define the accounting to record an expense. The system reverses the entry to record an income transaction. For example, a cycle count adjustment could increase or decrease inventory stock. For adjustments in PeopleSoft Cost Management where you are using location accounting, you need only define the decrease (expense) scenario and the system knows to reverse the entry for any increase in stock or income. For example, when defining the transaction accounting rules for the Cycle Count Adjustments transaction group, you define the inventory adjustment expense as the debit account. The credit account in this example is an inventory location's asset account. When creating accounting lines for cycle count adjustments, the system creates an entry debiting the expense account and crediting the inventory account for all inventory losses. For any inventory gains, the system creates the entry in reverse, debiting the inventory account and crediting the expense account.

This table lists the adjustment and variance transaction groups for which this rule applies:

|

Transaction Group |

Description |

|

040 |

Physical Count Adjustments |

|

041 |

Cycle Count Adjustments |

|

042 |

IBU Transfer Adjustments |

|

050 |

User Adjustments |

|

052 |

Shipping Adjustments |

|

053 |

Floor Stock Issues/Ret |

|

200 |

Inventory Revalue |

|

201 |

Inventory Reval - Inspection |

|

205 |

Value Adjustment |

|

206 |

Value Adjust/ActCost Items |

|

210 |

WIP Revalue (Comps, Assys) |

|

211 |

WIP Revalue (Conv Costs) |

|

212 |

WIP Revaluation (Scrap) |

|

261 |

Material Variances |

|

262 |

Conversion Variances |

|

263 |

Rework Expense |

|

264 |

Outside Processing PPV |

|

265 |

Teardown Variance |

|

300 |

Gain/Loss on Transfer Price |

|

302 |

ShipOnBehalf Gain/Loss |

|

400 |

Std Cost Variance Receipts |

|

401 |

Wt Avg Updates from AP* |

|

402 |

Std Cost Exchange Rate Var |

|

403 |

Wt Avg Cost Updates - ERV* |

|

405 |

Wt Avg Update Writeoffs |

|

407 |

Subcontract Standard Cost PPV2 |

|

408 |

Subcontract Standard Cost PPV2 ERV |

|

415 |

RTV Variances |

|

461 |

PO Voucher Variance |

|

601 |

Wt Avg Upd Production Var* |

|

605 |

Wt Avg Upd Prod Writeoffs |

|

606 |

Avg Rev Compl Write-off* |

|

651 |

Production Cost Writeoff* |

|

661 |

Actual Cost Variances* |

*In the case of transaction groups 401 (Wt Avg Updates from AP), 403 (Wt Avg Cost Updates - ERV), and 601 (Wt Avg Upd Production Var) the debit account is really the inventory account. The system updates the inventory value with any unfavorable purchase price variance or exchange rate variance.

Using the Accounting Rules page with Location or Production Area Accounting

If you are using the Location Accounting function, define only the debit or the credit side for certain transactions. The system derives the offsetting entry line from the ChartField combinations that you define for the production area, storage area, or the interunit ownership setup.

See Also

Using the Accounting Rules Page with Location Accounting

Defining Location Accounting

Defining Location Accounting

One option for structuring accounting rules is with the location accounting approach. Location accounting enables you to define different ChartField combinations for each storage area within an inventory business unit. For example, you can assign a raw material account to one storage area and a finished goods account to another storage area. Any material residing in the raw material storage area debits or credits the raw material inventory account when material moves in or out of that storage area. Any material residing in the finished goods storage area debits or credits the finished goods inventory account.

When using the location accounting option in a manufacturing environment, assign ChartFields to both storage areas and production areas. By assigning ChartFields to storage and production areas, you can segregate raw material, in process material, and finished goods inventory for accounting purposes.

Note. For location accounting, you perform many of the same steps used to define the basic accounting structure. Please read the preceding section, " Defining the Accounting Structure" before setting up location accounting.

To define the location accounting structure:

Select the Location Accounting Required check box on the Inventory Options page.

This page is defined by setID. Any inventory business unit using this setID for the record group IN_01 (business unit attributes) uses location accounting.

Define cost profiles to use storage area control.

Use the Storage Area Accounting page to establish ChartField combinations for each storage area within the inventory business unit.

(Manufacturing environment only) Use the Production Area Accounts page to define the ChartField combinations for each production area.

Use the Accounting Rules page to define ChartField combinations that are not included in the Storage Area Accounting page.

The system uses both pages to create the complete accounting entries.

After establishing the accounting structure, the Transaction Costing process costs transactions and the Accounting Line Creation process creates accounting entries. Both processes are initiated from the Cost Accounting Creation process page.

See Also

Defining the Accounting Structure

Pages Used to Define Location Accounting

Pages Used to Define Location Accounting

|

Page Name |

Definition Name |

Navigation |

Usage |

|

BUS_UNIT_OPT_IN |

Set Up Financials/Supply Chain, Business Unit Related, Inventory, Inventory Options |

Select the Location Accounting Required check box to turn on location accounting. |

|

|

Set Control - Record Group |

SET_CNTRL_TABLE1 |

PeopleTools, Utilities, Administration, TableSet Control, Record Group |

Verify that the inventory business unit uses the setID from the Inventory Options page. Check the record group IN_01. |

|

CM_PROFILE_DEFN |

Set Up Financials/Supply Chain, Product Related, Cost Accounting, Cost Profiles, Profiles |

Use cost profiles to determine how the system costs items in the business unit's cost book. When using location accounting, select the Storage Area Control for Costs check box. |

|

|

STORAGE_ACCT_INV |

Set Up Financials/Supply Chain, Product Related, Cost Accounting, Storage Area Accounting Rules, Storage Area Accounting |

Define the ChartField combinations for each storage area. The system debits and credits these ChartFields when material is moved in and out of the storage area. |

|

|

SF_PRAREA_ACCT |

Production Control, Define Production, Production IDs/Schedules, Production Area, Accounts |

Define the ChartField combinations for each production area. The system debits and credits these ChartFields when material is received into or issued from the production ID or schedule. This page applies to a manufacturing environment only. |

|

|

CM_ACCTG_DIST |

Set Up Financials/Supply Chain, Product Related, Cost Accounting, Transaction Accounting Rules, Accounting Rules |

Create the debit and credit lines for the accounting entries based on the business unit, transaction group, distribution type, item or item group, and cost element. The system uses this page in combination with the Storage Area Accounting page. |

Defining the Inventory Options page

Defining the Inventory Options page

Access the Inventory Options page (Set Up Financials/Supply Chain, Business Unit Related, Inventory, Inventory Options).

To use storage location accounting, select the Location Accounting Required check box on the Inventory Options page. This page enables you to set up storage location structures and attributes (such as stocking units and dimensions) at the TableSet level. You can share these attributes with one or more inventory business units. Use the Set Control - Record Group page to attach these inventory options to an inventory business unit by setting the record group IN_01 to the same setID that you used to define the Inventory Options page.

See Also

Defining Default Storage Location Structures and Attributes

Using Storage Area Control

Using Storage Area Control

It is highly recommended that if you are using location accounting, you should use the storage area control option located on the Cost Profile page (Set Up Financials/Supply Chain, Product Related, Cost Accounting, Cost Profiles, Profiles). Select the Storage Area Control for Costs check box to apply the FIFO or LIFO depletion method (defined in the cost profile) at the storage-area level. The system uses FIFO or LIFO as the cost based on the receipts to the specific storage area from which the item was depleted. In PeopleSoft Cost Management, you assign cost profiles to items to determine how to cost inventory transactions.

Storage area control can be used even with storage area accounting off. This enables you to stratify the granularity of FIFO and LIFO layers. For example, suppose that there is a FIFO cost flow method on the cost profile. Three receipts are putaway in an inventory business unit (receipts 1, 2, and 3). Each has a separate receipt cost. Receipt 1 is placed in the storage area Zone A. Receipts 2 and 3 are placed in Zone B. Then, items are issued from Zone B. Without storage area control, the deplete cost would be from receipt 1 in a FIFO environment, but with storage area control, the deplete cost comes from receipt 2, because it is the first within Zone B.

See Also

Using the Storage Area Accounting Page

Using the Storage Area Accounting Page

To define accounting by storage area, use the Storage Area Accounting component (STORAGE_ACCTS). Use the Storage Area Accounting Rules component interface (STORAGE_ACCTS_CI) to load data into the tables for this component.

Access the Storage Area Accounting page (Set Up Financials/Supply Chain, Product Related, Cost Accounting, Storage Area Accounting Rules, Storage Area Accounting).

If you are using location accounting, enter the ChartField combinations for each storage area using the Storage Area Accounting page. Use these ChartField combinations to create the debit entry when materials are received in the storage area and to create the credit entry when materials are issued from the storage area. The other side of the entry comes from the matching Accounting Rules page.

This page remains available to edit, thus, giving you the ability to alter the ChartField combinations over time.

An item can have one or more cost elements defined in its product structure. The Transaction Costing process calculates and stores the costs by cost element. During the Accounting Line Creation process, the system attempts to match up the item's transaction costs by cost element to any rows using the same cost element on the Storage Area Accounting page. If this is not found, then the system uses a row with a blank cost element. Therefore, you add flexibility to the system by adding different combinations of cost elements using different rows on the same page. Rows with a blank cost element can be used for any unspecified cost elements. If you can use the same ChartFields, regardless of the cost element, leave the Cost Element field blank.

Defining Production Area Accounts (Manufacturing

Environments)

Defining Production Area Accounts (Manufacturing

Environments)

Access the Production Area Accounts page (Production Control, Define Production, Production IDs/Schedules, Production Area, Accounts).

If you are using location accounting in a manufacturing environment, use this page to define the ChartField combinations for the production areas to track in-process inventory. As material is received or issued from a production ID or production schedule, the system uses the ChartField combinations of the production area to create debit or credit entries. When you create accounting entries, the system debits the ChartFields specified here for any material consumption, earned labor, applied overhead, or favorable variances. The system also credits the ChartFields for any assembly completions to stock or to another production area, assembly scrap, or unfavorable variances. The other side of the entry comes from the matching Accounting Rules page.

This page remains available to edit, thus, giving you the ability to alter the ChartField combinations over time.

Select the production type for which the ChartFields are defined. You can define a set of accounts for Production, Rework, and Teardown production types.

In the Accounting Line Creation process, the system attempts to match up the item's transaction costs by cost element to any rows using the same cost element on the Production Area Accounts page. If this is not found, then the system uses a row with a blank cost element. If you can use the same ChartFields, regardless of the cost element, leave the Cost Element field blank.

Using the Accounting Rules Page with Location

Accounting

Using the Accounting Rules Page with Location

Accounting

Access the Accounting Rules page (Set Up Financials/Supply Chain, Product Related, Cost Accounting, Transaction Accounting Rules, Accounting Rules).

The Storage Area Accounting page and Production Area Accounts page defines one side of the accounting entry when material is putaway, issued, or adjusted within a storage or production area. The other side of the accounting entry comes from the corresponding Accounting Rules page based on the business Unit, Transaction Group, Item ID or Item Group, and Distribution Type fields. If the transaction is not directly related to a storage or production area, then they system derives both sides of the transaction from the appropriate Accounting Rules page.

If you are using location accounting, the system derives ChartField combinations that it uses to create accounting entries from these pages:

|

Transaction Group |

Description |

DR |

CR |

|

010 |

Receipt to Inspection |

Storage Area Accounting |

Accounting Rules |

|

012 |

Return to Vendor |

Accounting Rules |

Storage Area Accounting |

|

013 |

Return to Vendor From Inspection |

Accounting Rules |

Storage Area Accounting |

|

020 |

Putaway |

Storage Area Accounting |

Accounting Rules |

|

021 |

Receipts from Production |

Storage Area Accounting |

Production Area Accounts |

|

024 |

Customer Returns |

Storage Area Accounting |

Accounting Rules |

|

030 |

Usages & Shipments |

Accounting Rules |

Storage Area Accounting |

|

032 |

Non Stock Shipment |

Accounting Rules |

Accounting Rules |

|

037 |

VMI Interunit shipment |

Accounting Rules |

Storage Area Accounting |

|

038 |

VMI Consumption |

Accounting Rules |

Storage Area Accounting |

|

040 |

Physical Count Adjustments |

Accounting Rules |

Storage Area Accounting |

|

041 |

Cycle Count Adjustment |

Accounting Rules |

Storage Area Accounting |

|

050 |

User Adjustments |

Accounting Rules |

Storage Area Accounting |

|

051 |

Inventory Scrap |

Accounting Rules |

Storage Area Accounting |

|

052 |

Shipping Adjustment |

Accounting Rules |

Storage Area Accounting |

|

053 |

Floor Stock Issues/Ret |

Accounting Rules |

Storage Area Accounting |

|

054 |

Inventory Scrap for RTV |

Accounting Rules |

Storage Area Accounting |

|

060 |

Bin-to-Bin Transfers |

Storage Area Accounting |

Storage Area Accounting |

|

200 |

Inventory Revalue |

Accounting Rules |

Storage Area Accounting |

|

201 |

Inventory Reval - Inspection |

Accounting Rules |

Storage Area Accounting |

|

205 |

Value Adjustment |

Accounting Rules |

Storage Area Accounting |

|

206 |

Value Adjust/ActCost Items |

Accounting Rules |

Storage Area Accounting |

|

210 |

WIP Revalue (Comps, Assys) |

Accounting Rules |

Production Area Accounts |

|

211 |

WIP Revalue (Conv Costs) |

Accounting Rules |

Production Area Accounts |

|

212 |

WIP Revaluation (Scrap) |

Accounting Rules |

Production Area Accounts |

|

220 |

Component Kit |

Production Area Accounts |

Storage Area Accounting |

|

221 |

Route to Production Kit |

Production Area Accounts |

Production Area Accounts |

|

222 |

Waste Completion |

Production Area Accounts |

Accounting Rules |

|

223 |

Component/Output Transfers |

Production Area Accounts |

Production Area Accounts |

|

230 |

Component Consumption |

Production Area Accounts |

Storage Area Accounting |

|

231 |

WM Usage (Maintenance Management Usage) |

Accounting Rules |

Storage Area Accounting |

|

240 |

Earned Labor |

Production Area Accounts |

Accounting Rules |

|

250 |

Assembly Scrap |

Accounting Rules |

Production Area Accounts |

|

261 |

Material Variances |

Accounting Rules |

Production Area Accounts |

|

262 |

Conversion Variances |

Accounting Rules |

Production Area Accounts |

|

263 |

Rework Expense |

Accounting Rules |

Production Area Accounts |

|

264 |

Outside Processing PPV |

Accounting Rules |

Accounting Rules |

|

265 |

Teardown Variance |

Accounting Rules |

Production Area Accounts |

|

400 |

Std Cost Variance Receipts |

Accounting Rules |

Accounting Rules |

|

401 |

Wt Avg Updates from AP |

Storage Area Accounting |

Accounting Rules |

|

402 |

Std Cost Exchange Rate Var |

Accounting Rules |

Accounting Rules |

|

403 |

Wt Avg Cost Updates - ERV |

Storage Area Accounting |

Accounting Rules |

|

405 |

Wt Avg Update Writeoffs |

Accounting Rules |

Accounting Rules |

|

407 |

Subcontract Standard Cost PPV2* |

Accounting Rules |

Accounting Rules |

|

408 |

Subcontract Standard Cost PPV2 ERV* |

Accounting Rules |

Accounting Rules |

|

415 |

RTV Variances |

Accounting Rules |

Accounting Rules |

|

461 |

Voucher Variance Writeoffs |

Accounting Rules |

Accounting Rules |

|

500 |

Miscellaneous Charges |

Accounting Rules |

Accounting Rules |

|

501 |

Freight Charges |

Accounting Rules |

Accounting Rules |

|

601 |

Wt Avg Upd Production Var |

Storage Area Accounting |

Accounting Rules |

|

605 |

Wt Avg Upd Prod Writeoffs |

Accounting Rules |

Accounting Rules |

|

606 |

Avg Rev Compl Write-off* |

Accounting Rules |

Accounting Rules |

|

622 |

Actual Waste Cost |

Production Area Accounts |

Accounting Rules |

|

630 |

Overhead |

Production Area Accounts |

Accounting Rules |

|

640 |

Actual Labor Costs |

Production Area Accounts |

Accounting Rules |

|

645 |

Actual Machine Costs |

Production Area Accounts |

Accounting Rules |

|

651 |

Production Cost Writeoff |

Production Area Accounts |

Accounting Rules |

|

661 |

Actual Cost Variances |

Production Area Accounts |

Accounting Rules |

|

664 |

Subcontracted Cost |

Accounting Rules |

Accounting Rules |

If the transaction involves interunit or intercompany transfers, then part of the accounting entries are derived from pages defined for the interunit model explained in the "Managing Interunit Transfer Pricing and Additional Costs" chapter. The interunit and intercompany transaction groups include:

022 - IBU Transfer Receipts.

025 - InterCompany Receipts.

031 - InterBU Transfer Shipments.

035 - InterCompany Transfers.

042 - IBU Transfer Adjustments.

300 - Gain/Loss on Transfer Price.

301 - InterCompany Cost of Goods.

If the transactions involve Shipment On Behalf Of or InterUnit Expensed Issues, see the sections in this chapter related to these subjects. These transaction groups are:

034 - Ship on Behalf of Other BU.

036 - InterUnit Expensed Issue.

026 - Expensed Issue Return.

302 - ShipOnBehalf Gain/Loss.

See Also

Managing Interunit Transfer Pricing and Additional Costs

Designing Shipment On Behalf Of

Creating and Reversing Interunit Expensed Issues

Setting Up the Accounting Rules page

Transferring Stock Between Business Units

Establishing Commitment Control

Establishing Commitment Control

The PeopleSoft commitment control feature enables you to check expenditures against a predefined budget. In PeopleSoft Cost Management, these expenditures typically occur when you expense inventory material to the department or to an expense account. Commitment control considers actual expenditures and imminent future obligations (encumbrances and pre-encumbrances). To use commitment control, select the commitment control option at both the installation options level and ledger group (product) level. Set up ChartField combinations as budgetary accounts for commitment control. There is a predefined source transaction definition, CM_TRNXTN, for PeopleSoft Cost Management. For further information on setting up PeopleSoft Cost Management to use commitment control, see the PeopleSoft Commitment Control PeopleBook.

See PeopleSoft Commitment Control PeopleBook Preface.

If you select the commitment control option, then the Accounting Line Creation process page includes the check box for running the Commitment Control (Budget Checking) process (FSPKBDP3) against accounting lines prior to posting them to the general ledger. Any transaction using a ChartField combination setup as a budgetary account for commitment control will be processed through the Budget Checking process.

Commitment control can be used in PeopleSoft Cost Management by:

A requisition or purchase order is entered in PeopleSoft Purchasing using commitment control and a pre-encumbrance or encumbrance is established. If the purchase order is sourced from PeopleSoft Inventory, then the encumbrance is relieved and replaced with a expenditure against the budget when the Accounting Line Creation process is run with the Budget Check Accounting Lines check box selected to run the Commitment Control Budget Processor.

A material stock request is created and stock is issued from PeopleSoft Inventory using a ChartField combination set up as a budgetary account for commitment control. The deduction to the budget occurs when you run Accounting Line Creation, no pre-encumbrance or encumbrance is created or relieved.

Note. Budget checking is not applied to manufacturing transactions.

See Also

Managing Interunit Transfer Pricing and Additional Costs

Processing Source Transactions Against Control Budgets

Using Commitment Control in General Ledger

Using Interunit and Intraunit Accounting and ChartField Inheritance

Defining Interunit Transfers

Defining Interunit Transfers

Interunit transfers include any transfer of inventory stock between two inventory business units. PeopleSoft Cost Management creates the transactions related to the stock transfer using the Accounting Line Creation process.

See Also

Managing Interunit Transfer Pricing and Additional Costs

Using Interunit and Intraunit Accounting and ChartField Inheritance

Setting Up Intraunit Processing

Setting Up Intraunit Processing

Intraunit processing creates balancing entries for transfers between ChartFields (such as Fund) within the same business unit. You can perform intraunit balancing on any ChartField within the business unit except account. You must first define the ChartField combinations for intraunit receivables and interunit payables that the system uses to create offsetting accounting entries. When you run the Accounting Line Creation process, the system checks for intraunit entries and creates the balancing entries using a subprocessor called ChartField Balancing (CM_IU_ACCTG).

The ChartField Balancing process compares debit and credit ChartFields (except Account) for the same item and cost element. If the ChartFields are not the same, the system creates the intraunit receivables or intraunit payables accounting entry.

For example, suppose that you enter this transaction for the same item and cost element. The system is set up for intraunit balancing on the fund ChartField. The intraunit payable account is 4003 and the interunit receivables account is 4002 for the transaction:

|

|

Account |

Fund |

Dept ID |

Program |

Class |

Bdgt Pd |

|

Expense |

5002 |

100 |

20 |

88 |

10 |

2000 |

|

Inventory |

1001 |

200 |

30 |

99 |

20 |

2000 |

The Accounting Line Creation process creates the Due To and Due From transaction:

|

|

Account |

Fund |

DeptID |

Program |

Class |

Bdgt Pd |

|

Offsetting Inventory |

4003 |

200 |

30 |

99 |

20 |

2000 |

|

Offsetting Expense |

4002 |

100 |

20 |

88 |

10 |

2000 |

See Also

Using Interunit and Intraunit Accounting and ChartField Inheritance

Using Standard ChartField Configuration

Designing Shipment On Behalf Of

Designing Shipment On Behalf Of

Shipment On Behalf Of is an order that issues stock to a customer from an inventory business unit on behalf of an order management business unit when each unit posts to a different general ledger unit. In a centralized order-taking environment, the order management business unit taking the customer order may or may not have a corresponding inventory business unit from which to ship the order. The customer order is then passed to the appropriate inventory business unit to fulfill the customer demand. When the order is shipped and inventory is depleted, the system checks to see whether the general ledger business unit associated with the order management and billing unit matches that of the inventory business unit. When they differ, the system posts the shipment as transaction group 034 - Shipment on Behalf Of Other Business Unit. To correctly match the revenue recognition in the billing business unit's general ledger with the cost of goods sold for the inventory, the Accounting Line Creation process generates accounting entries using interunit accounts.

This diagram illustrates the shipment on behalf of process flow. The stock is shipped from the inventory business unit to the customer and the associated PeopleSoft Cost Management business unit creates accounting entries for the revenue-side general ledger and the expense-side general ledger:

Shipment on Behalf Of process flow where the Order Management business unit reports to a different General Ledger business unit than the shipping Inventory business unit

Determining the Amounts for a Shipment On Behalf Of Transaction

The Shipment On Behalf Of transactions are created in two parts:

The Deplete On Hand Qty process calculates the cost of the items shipped, the transfer price, and any additional transfer costs.

The Accounting Line Creation process generates the accounting entries using the inventory account, interunit accounts, cost of goods sold account, and any gain or loss accounts.

The interunit accounts include an accounts receivable (A./R) or Due From account in the shipping organization and an accounts payable (A/P) or Due To account in the organization recording the sale. The amount entered in the interunit A/R or A/P accounts can be the item cost or the transfer price. Additional transfer costs can also be added. In the shipping inventory business unit, your entry in the Ship on Behalf Transfer Price field of the Inventory Definition- Business Unit Definition page determines if the Deplete On Hand Qty process uses item cost or transfer price.

Using Item Cost: The item cost based on the item's deplete cost method defined on the cost profile.

Using a Transfer Price: The transfer price can be a flat amount, price markup, or both. The Transfer Pricing Definition page determines the transfer price. If no transfer pricing definition has been established for the shipping Inventory business unit, then the system uses item cost. The difference between the transfer price and the item cost is recorded as in a gain/loss account using the transaction group 302 (ShipOnBehalf Gain/Loss).

Using Additional Transfer Costs: Additional transfer costs, such as freight or handling, can be added to the shipment using the Transfer Pricing Definition component. These additional costs are added to the gain/loss account and the interunit accounts.

During demand fulfillment, the MSR is located in the IN_DEMAND table. Once the transfer price has been calculated by the Deplete On Hand Qty process, the transfer price is located in a child table, IN_DEMAND_TPRC, where it is broken out into several parts by cost elements. Cost elements can be created for material costs and additional transfer costs. The transfer price details can be viewed using the Transfer Price Inquiry component. The material and additional transfer costs are both included in the total transfer price. The transfer price details are retained by cost element in the accounting entries recorded for the Shipment On Behalf Of transaction.

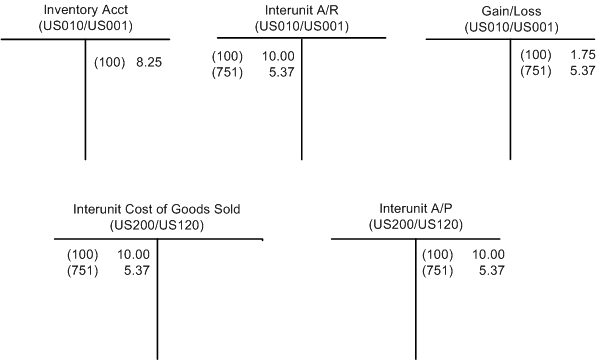

The following diagram illustrates a Shipment On Behalf Of transaction shipping stock from the inventory business unit US010 on behalf of the order management business unit US200. The inventory business unit, US010, reports to the general ledger business unit US001. The order management business unit, US200, is linked to the billing unit, US200, receivables unit US120, and general ledger unit US120. In the inventory business unit, transfer price has been chosen using the Ship on Behalf Transfer Price field of the Inventory Definition- Business Unit Definition page.

The following information is used:

Transfer price (material portion): 10.00

Freight costs: 5.37

Item cost: 8.25

Cost element 100 (Material- General)

Cost element 751 (Addl Trans- Freight)

Shipment On Behalf Of transaction

The above diagram illustrates the accounting entries for a Shipment On Behalf Of transaction using the transaction group 034 (Ship on Behalf Of Other BU) and the transaction group 302 (ShipOnBehalf Gain/Loss). The inventory account is credited for the material costs. The interunit A/R and A/P accounts contains the transfer price of material and additional transfer costs. The gain and loss account contains the additional transfer cost plus any difference between the transfer price and the cost of the item. The cost of goods sold account and interunit A/P account move the cost of the item to the correct OM/BI/GL business unit chain that contains the revenue from the sale.

Setting Up Shipment On Behalf Of Transactions

To setup your organization for Ship On Behalf Of transactions:

Select to use item cost or transfer price for the interunit accounts. In the shipping inventory business unit, select Use Item Cost or Use Transfer Price in the Ship on Behalf Transfer Price field of the Inventory Definition- Business Unit Definition page.

(optional) If you have selected Use Transfer Price in the Ship on Behalf Transfer Price field of the Inventory Definition- Business Unit Definition page, then you should create a transfer pricing definition for the shipping inventory business unit. The information on the Transfer Pricing Definition component should be defined for the source unit (inventory business unit) and a blank destination unit. This component provides the calculation of the item cost, transfer price, and any additional transfer costs. In addition, the transfer pricing definition gives the cost elements to be used for additional transfer costs plus any additional material costs. The transfer price default hierarchy is used to determine the transfer price.

Define the ChartField combinations for the following entry types of your inventory transaction code; interunit receivable, interunit payable, and interunit customer shipments. The entry type interunit customer shipments is for the cost of goods sold for shipments on behalf of.

Where you define these entry types depends on the value that you selected in the InterUnit Method field on the General Options - Overall page. If the value is:

Direct: The ChartField combinations for the entry types are entered on the InterUnit Template page defined for both GL business units.

Indirect: The ChartField combinations for the entry types are entered on the InterUnit Template page defined for both GL business units.

Pairs: The ChartField combinations for the entry types are entered on the InterUnit Pair page. The sending GL unit must be entered in the From GL Unit field and the receiving unit must be defined in the To GL Unit field. A separate pair is defined for every combination of GL units using the Shipment on Behalf Of feature.

If you use the direct or indirect interunit methods, then enter the interunit template ID on the General Ledger Definition - Inter/IntraUnit page.

Define the ChartField combinations for your inventory account:

For environments not using location accounting, define the ChartFields on the Accounting Rules page using the transaction group 034 (Shipments on Behalf of Other Business Unit).

For environments using location accounting, define the ChartFields on the Storage Area Accounting page for each location that can ship goods.

If you have selected Use Transfer Price on the Inventory Definition- Business Unit Definition page, then define the ChartField combinations for your gain or loss account for the transaction group 302 (ShipOnBehalf Gain/Loss) using the Accounting Rules page.

Determining ChartField Combinations

For the transaction group 034 (Ship on Behalf of Other BU), the system uses these pages to derive ChartField combinations (accounts) for each accounting line. It uses different pages based on the choice of interunit method (selected on the General Options - Overall page in the installation setup) and location accounting (selected on the Inventory Options page when defining the inventory business unit):

|

InterUnit Method |

Location Accting |

Page for DR Source BU |

Page for CR Source BU |

Page for DR Dest BU |

Page for CR Dest BU |

|

Direct |

Off |

InterUnit Template (defined on the source GL) |

Accounting Rules |

InterUnit Template (defined on the destination GL) |

InterUnit Template (defined on the destination GL) |

|

Direct |

On |

InterUnit Template (defined on the source GL) |

Storage Area Accounting |

InterUnit Template (defined on the destination GL) |

InterUnit Template (defined on the destination GL) |

|

Indirect |

Off |

InterUnit Template (defined on the destination GL) |

Accounting Rules |

InterUnit Template (defined on the source GL) |

InterUnit Template (defined on the source GL) |

|

Indirect |

On |

InterUnit Template (defined on the destination GL) |

Storage Area Accounting |

InterUnit Template (defined on the source GL) |

InterUnit Template (defined on the source GL) |

|

Pair |

Off |

InterUnit Pair |

Accounting Rules |

InterUnit Pair |

InterUnit Pair |

|

Pair |

On |

InterUnit Pair |

Storage Area Accounting |

InterUnit Pair |

InterUnit Pair |

See Also

Using Transfer Pricing Definitions

Setting Overall Installation Options

Using Interunit and Intraunit Accounting and ChartField Inheritance

Pages Used to Design Shipment on Behalf

Of

Pages Used to Design Shipment on Behalf

Of

|

Page Name |

Definition Name |

Navigation |

Usage |

|

Inventory Definition - Business Unit Definition |

BUS_UNIT_INV1 |

Set Up Financials/Supply Chain, Business Unit Related, Inventory, Inventory Definition, Business Unit Definition |

Define the basic attributes of a PeopleSoft Inventory business unit including the amount to be used in a Shipment On Behalf Of transaction. Select Use Item Cost or Use Transfer Price in the Ship on Behalf Transfer Price field of the Inventory Definition- Business Unit Definition page. |

|

CM_TRAN_PRICE_DEFN |

Cost Accounting, Item Costs, Define Rates and Costs, Transfer Pricing Definition |

Define the transfer prices, markup percentages, and additional transfer costs to be used for a source business unit or a source and destination unit pair. |

|

|

INSTALLATION_FS1 |

Set Up Financials/Supply Chain, Install, Installation Options, General Options, Overall |

Select an interunit method. |

|

|

BUS_UNIT_TBL_GL1 |

Set Up Financials/Supply Chain, Business Unit Related, General Ledger, General Ledger Definition, Definition |

If using interunit templates, identify the template for both receiving and sending GL units. |

|

|

IU_INTER_TMPLT |

Set Up Financials/Supply Chain, Common Definitions, Inter/Intra Unit, InterUnit Template |

Set up the following entry types of your inventory transaction code; interunit receivable, interunit payable, and interunit customer shipments. Define the ChartField combinations (accounts) for each of these entry types. |

|

|

IU_INTER_PR_BASIC |

Set Up Financials/Supply Chain, Common Definitions, Inter/Intra Unit, InterUnit Pair |

If the pairs method is selected on the General Options - Overall/GL page, then set up the following entry types of your inventory transaction code; interunit receivable, interunit payable, and interunit customer shipments. Define the ChartField combinations (accounts) for each of these entry types. |

See Also

Setting Overall Installation Options

Defining General Ledger Business Units

Creating and Reversing Interunit Expensed

Issues

Creating and Reversing Interunit Expensed

Issues

An interunit expensed issue is a stock request that issues material from an Inventory business unit to an internal department that is not reporting to the same GL unit as the inventory unit. If you are shipping stock from a centralized inventory location to various internal departments within the organization, then interunit expensed issues can create the proper accounting entries when multiple GL units are involved. The system creates an interunit expensed issue when you enter a stock request using the internal issue request type and then override the GL unit on the order. You can enter an interunit expense issue using the Material Stock Request or Express Issue pages in PeopleSoft Inventory. The system also processes interunit expense issues when demand is passed from a purchasing requisition and the GL unit on the requisition line is not the same as the inventory's GL unit. Use the Stock Request Maintenance page to add or change the destination GL unit. Use the Par Location Header page to define a destination GL unit for issues to a par location. When you override the GL unit, the system validates the destination ChartFields against the new GL unit.

Occasionally, the stock from an interunit expensed issue must be returned to inventory. Use the Expense Issue Return page to record the receipt of stock originally shipped as an interunit expensed issue. The stock can be received into the original sending inventory business unit or another inventory business unit. If the stock is received into a different inventory unit than the one from which it was initially shipped, then both inventory units must share the same set of items. You can enter the returned items on the Expense Issue Return page with or without the original interunit expensed issue stock request. To create an audit trail that goes back to the original shipment, you must retrieve and use the original interunit expensed issue transaction. You can return the full shipment or just part of the items or quantities shipped that you shipped.

Note. To run an interunit expensed issue, the currency and ChartFields must be the same for all the GL business units. For transactions with multiple currencies and accounting structures, enter an intercompany transaction (interunit sales approach) described in the "Managing Interunit Transfer Pricing and Additional Costs" chapter.

See Managing Interunit Transfer Pricing and Additional Costs.

Costing and Accounting Interunit Expensed Issues

The system uses the transfer price to cost the material issue. Define the method for interunit transfer pricing in the sending inventory business unit using the Transfer Pricing Definition component and the transfer price default hierarchy.

See Applying Transfer Prices to a Material Stock Request.

See Using Transfer Pricing Definitions.

You can change the transfer price manually on any line of a material stock request. The sending inventory business unit reduces its inventory stock based on the deplete cost method that you selected on the Cost Profiles page. The system records any difference between the transfer price and the item's depletion cost as a gain or loss on transfer.

When you create an interunit expensed issue, the Accounting Line Creation process creates accounting entries that debit the interunit receivables of the sending GL unit and credit the interunit payables of the recipient's GL unit. The system identifies interunit expensed issues with the transaction group 036 (InterUnit Expensed Issue). Set up the accounting distribution for this transaction group in a different manner than the other transaction accounting rules. With this group, set up the debit for the destination GL unit and the ChartField validation against the destination GL unit. You cannot enter a cost element for the debit side of this entry. Set up the credit side for the inventory unit, if you are not using location accounting or if location accounting reports that it is using the function. Any difference between the transfer price and the item cost creates an additional entry using the transaction group 300 (Gain/Loss on Transfer Price).

The following diagram illustrates an example of the accounting entries generated for an interunit expensed issue transaction. The cost of the item is removed from the shipping organization's inventory account using the deplete cost method of the item's cost profile. In this case the item cost is 1,400 stored in the cost element 100 (material- general). The transfer price for the item is used to record the interunit accounts receivable in the shipping organization and the interunit accounts payable and expense accounts in the receiving organization. In this case, the transfer price is 1,500 stored in the cost element 100 (material- general). The transfer price is computed by the Deplete On Hand Qty process and placed in the IN_DEMAND_TRPC table. In the shipping organization, any difference between the item cost and the item transfer price is recorded in a gain/loss account using the transaction group 300 (Gain/Loss on Transfer Price).

Interunit Expensed Issue transaction

For transaction group 036 (InterUnit Expensed Issue), use these pages to derive the ChartField combinations for each accounting line. Use different pages based on the choice of interunit method (that you selected on the Installation Options - Overall/GL page) and location accounting (that you selected on the Inventory Options page):

|

InterUnit Method |

Location Accting |

Page for DR to Source BU |

Page for CR to Source BU |

Page for DR to Dest BU |

Page for CR to Dest BU |

|

Direct |

Off |

InterUnit Template (defined on the source GL) |

Accounting Rules |

Accounting Rules (no cost element) |

InterUnit Template (defined on the destination GL) |

|

Direct |

On |

InterUnit Template (defined on the source GL) |

Storage Area Accounting |

Accounting Rules (no cost element) |

InterUnit Template (defined on the destination GL) |

|

Indirect |

Off |

InterUnit Template (defined on the destination GL) |

Accounting Rules |

Accounting Rules (no cost element) |

InterUnit Template (defined on the source GL) |

|

Indirect |

On |

InterUnit Template (defined on the destination GL) |

Storage Area Accounting |

Accounting Rules (no cost element) |

InterUnit Template (defined on the source GL) |

|

Pair |

Off |

InterUnit Pair |

Accounting Rules |

Accounting Rules (no cost element) |

InterUnit Pair |

|

Pair |

On |

InterUnit Pair |

Storage Area Accounting |

Accounting Rules (no cost element) |

InterUnit Pair |

Costing and Accounting InterUnit Expensed Issue Returns

Returns are completed using the Expense Issue Return page in PeopleSoft Inventory. To reverse the original interunit expensed issue transaction, the system uses the transfer price from the original stock request (if you have identified the interunit expensed issue transaction), or the value that you entered in the Transfer Price field on the Expense Issue Return page. The inventory business unit costs the receipt based on the receipt cost method that you selected on the Cost Profiles page. The system records any difference between the transfer price and the item's putaway cost as a gain or loss on transfer. For the GL unit that rejected the shipment, the system reverses the original entry by using the transfer price or you may override the price. When you use the original stock request (interunit expensed issue transaction), the system uses the transfer price stored in the IN_DEMAND_TRPC table where the transfer price is stored by cost elements. This granular detail is used to record the putaway. If you override the transfer price on the Expense Issue Return page, then the system uses the override transfer price and the Default Cost Element field defined on the Define Business Unit Item - General: Common page.

When you create an expensed issue return, the Accounting Line Creation process creates accounting entries that debit the interunit payables of the returning GL unit and credit the interunit receivables of the receiving inventory's GL unit, thereby reversing the original transaction. The system uses the transaction group 026 (Expensed Issue Return) to identify the ChartField combinations for the inventory account receiving the stock and the expense account to be reversed in the returning GL unit. Set up the accounting distribution for this transaction group in a different manner than the other transaction accounting rules. With this group, set up the credit to validate ChartFields against the returning GL unit. You cannot enter a cost element for the credit side of this entry. Set up the debit side for the inventory unit receiving the return, if you are not using location accounting or if location accounting reports that it is using the function. Any difference between the transfer price and the item's putaway cost creates an additional entry using the transaction group 300 (Gain/Loss on Transfer Price).

The following diagram illustrates an example of the accounting entries generated for an interunit expensed issue return transaction. The transfer price for the item is used to reverse the original entries in the returning organization's interunit accounts payable and expense accounts and the receiving organization's interunit accounts receivable account. In this case, the transfer price is 1,500 stored in the cost element 100 (material- general). The cost of the item is entered in the receiving organization's inventory account using the receipt cost method of the item's cost profile. In this case the item cost is 1,600. In the receiving organization, any difference between the item cost and the item transfer price is recorded in a gain/loss account using the transaction group 300 (Gain/Loss on Transfer Price).

Interunit Expensed Issue Return transaction

For the transaction group 026 (Expensed Issue Return), use these pages to derive the ChartField combinations for each accounting line. Use different pages based on the choice of interunit method (that you selected on the Installation Options - Overall/GL page) and location accounting (that you selected on the Inventory Options page). In this table, the receiving GL refers to the GL unit tied to the inventory unit that originally issued the stock. The returning GL refers to the GL unit returning the stock.

|

InterUnit Method |

Location Accting |

Page for DR Receiving Inv BU |

Page for CR Receiving Inv BU |

Page for DR Returning GL BU |

Page for CR Returning GL BU |

|

Direct |

Off |

Accounting Rules |

InterUnit Template (defined on the receiving GL) |

InterUnit Template (defined on the returning GL) |

Accounting Rules (no cost element) |

|

Direct |

On |

Storage Area Accounting |

InterUnit Template (defined on the receiving GL) |

InterUnit Template (defined on the returning GL) |

Accounting Rules (no cost element) |

|

Indirect |

Off |

Accounting Rules |

InterUnit Template (defined on the returning GL) |

InterUnit Template (defined on the receiving GL) |

Accounting Rules (no cost element) |

|

Indirect |

On |

Storage Area Accounting |

InterUnit Template (defined on the returning GL) |

InterUnit Template (defined on the receiving GL) |

Accounting Rules (no cost element) |

|

Pair |

Off |

Accounting Rules |

InterUnit Pair |

InterUnit Pair |

Accounting Rules (no cost element) |

|

Pair |

On |

Storage Area Accounting |

InterUnit Pair |

InterUnit Pair |

Accounting Rules (no cost element) |

Setting Up Interunit Expensed Issues

To enable Interunit Expensed Issues:

Enable interunit expense issues for PeopleSoft Inventory by selecting the Display GL BU Override check box on the Inventory Display Options page.

This option displays the GL BU Override field on the Material Stock Request, Express Issue and Stock Request Inquiry pages. On the Stock Request Maintenance page, the GL BU override is visible, but you cannot enter values if this option is not selected.

Define the interunit receivables and payables accounts.

Where you define these accounts depends on the value that you selected in the InterUnit Method field on the Installation Options - Overall page. If the value is:

Direct: the interunit receivables or payables accounts are entered on the InterUnit Template page defined for both GL business units.

Indirect: the interunit receivables or payables accounts are entered on the InterUnit Template page defined for both GL business units.

Pairs: the interunit receivables or payables accounts are entered on the InterUnit Pair page. The sending GL unit must be entered in the From GL Unit field and the receiving unit must be defined in the To GL Unit field. A separate pair is defined for every combination of GL units using the interunit expensed issues feature.

Enter the interunit template ID on the General Ledger Definition - Inter/IntraUnit page, if you use direct or indirect methods.

Define the interunit transfer pricing using the Transfer Pricing Definition page.

InterUnit expensed issues are costed using the sending inventory business unit's transfer pricing structure.

Use the Accounting Rules page to define the expense account (or accrued liability) to debit and the inventory account to credit using the transaction group 036 (InterUnit Expensed Issue).

If you are using location accounting, the inventory account (credit side) is derived from the Storage Area Accounting page. With this transaction group, the debit is set up for the returning GL business unit; you cannot enter a cost element for the debit side of this entry.

Use the Accounting Rules page to record the gain or loss account to debit or credit when the item's cost differs from the transfer price using the transaction group 300 (Gain/Loss on Transfer Price).

Use the Accounting Rules page to define the expense account (or accrued liability) to credit and the inventory account to debit using the transaction group 036 (Expensed Issue Return).

If you are using location accounting, the inventory account (debit side) is derived from the Storage Area Accounting page. With this transaction group, the credit is set up for the GL business unit returning the stock; you cannot enter a cost element for the credit side of this entry.

Add reason codes for return.

On the Reason Codes page, define reason codes to describe the reason that the stock was returned, such as over stocked, damaged in shipment, and so on. When defining the reason codes, use the Return Type of Expense Issue Return. This allows you to select the reason code on the Expense Issue Return page.

See Also

Setting Up the Accounting Rules page

Applying Transfer Prices to a Material Stock Request

Setting Overall Installation Options