11g Release 1 (11.1.4)

Part Number E20374-04

Contents

Previous

Next

|

Oracle® Fusion

Accounting Hub Implementation Guide 11g Release 1 (11.1.4) Part Number E20374-04 |

Contents |

Previous |

Next |

This chapter contains the following:

Enterprise Structures: Overview

Enterprise Structures Business Process Model: Explained

Global Enterprise Configuration: Points to Consider

Modeling Your Enterprise Management Structure in Oracle Fusion: Example

Define Initial Configuration with the Enterprise Structures Configurator

Define Enterprise for Fusion Accounting Hub

Oracle Fusion Applications have been designed to ensure your enterprise can be modeled to meet legal and management objectives. The decisions about your implementation of Oracle Fusion Applications are affected by your:

Industry

Business unit requirements for autonomy

Business and accounting policies

Business functions performed by business units and optionally, centralized in shared service centers

Locations of facilities

Every enterprise has three fundamental structures, legal, managerial, and functional, that are used to describe its operations and provide a basis for reporting. In Oracle Fusion, these structures are implemented using the chart of accounts and organizations. Although many alternative hierarchies can be implemented and used for reporting, you are likely to have one primary structure that organizes your business into divisions, business units, and departments aligned by your strategic objectives.

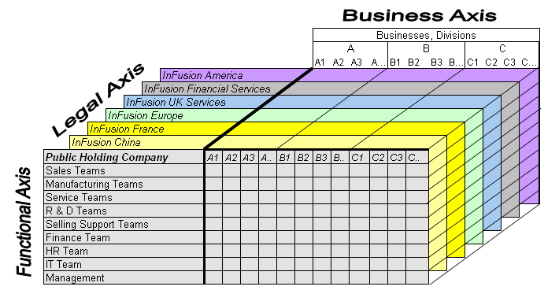

The figure above shows a typical group of legal entities, operating various business and functional organizations. Your ability to buy and sell, own, and employ comes from your charter in the legal system. A corporation is a distinct legal entity from its owners and managers. The corporation is owned by its shareholders, who may be individuals or other corporations. There are many other kinds of legal entities, such as sole proprietorships, partnerships, and government agencies.

A legally recognized entity can own and trade assets and employ people in the jurisdiction in which it is registered. When granted these privileges, legal entities are also assigned responsibilities to:

Account for themselves to the public through statutory and external reporting

Comply with legislation and regulations

Pay income and transaction taxes

Process value added tax (VAT) collection on behalf of the taxing authority

Many large enterprises isolate risk and optimize taxes by incorporating subsidiaries. They create legal entities to facilitate legal compliance, segregate operations, optimize taxes, complete contractual relationships, and isolate risk. Enterprises use legal entities to establish their enterprise's identity under the laws of each country in which their enterprise operates.

In the figure above, a separate card represents a series of registered companies. Each company, including the public holding company, InFusion America, must be registered in the countries where they do business. Each company consists of various divisions created for purposes of management reporting. These are shown as vertical columns on each card. For example, a group might have a separate company for each business in the United States (US), but have their United Kingdom (UK) legal entity represent all businesses in that country. The divisions are linked across the cards so that a business can appear on some or all of the cards. For example, the air quality monitoring systems business might be operated by the US, UK, and France companies. The list of business divisions is on the Business Axis. Each company's card is also horizontally striped by functional groups, such as the sales team and the finance team. This functional list is called the Functional Axis. The overall image suggests that information might, at a minimum, be tracked by company, business, division, and function in a group environment. In Oracle Fusion Applications, the legal structure is implemented using legal entities.

Successfully managing multiple businesses requires that you segregate them by their strategic objectives, and measure their results. Although related to your legal structure, the business organizational hierarchies do not need to be reflected directly in the legal structure of the enterprise. The management structure can include divisions, subdivisions, lines of business, strategic business units, and cost centers. In the figure above, the management structure is shown on the Business Axis. In Oracle Fusion Applications, the management structure is implemented using divisions and business units.

Straddling the legal and business organizations is a functional organization structured around people and their competencies. For example, sales, manufacturing, and service teams are functional organizations. This functional structure is represented by the Functional Axis in the figure above. You reflect the efforts and expenses of your functional organizations directly on the income statement. Organizations must manage and report revenues, cost of sales, and functional expenses such as research and development (R&D) and selling, general, and administrative (SG&A) expenses. In Oracle Fusion Applications, the functional structure is implemented using departments and organizations, including sales, marketing, project, cost, and inventory organizations.

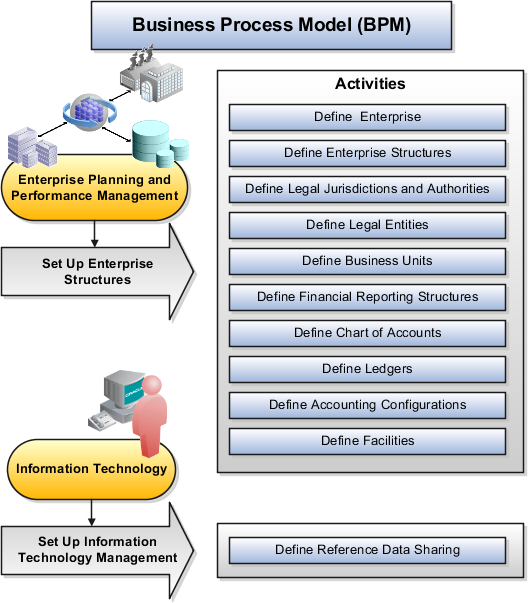

In Oracle Fusion Applications, the Enterprise Performance and Planning Business Process Model illustrates the major implementation tasks that you perform to create your enterprise structures. This process model includes the Set Up Enterprise Structures business process, which consist of implementation activities that span many product families. Information Technology is a second Business Process Model which contains the Set Up Information Technology Management business process. Define Reference Data Sharing is one of the activities in this business process and is important in the implementation of the enterprise structures. This activity creates the mechanism to share reference data sets across multiple ledgers, business units, and warehouses, reducing the administrative burden and decreasing the time needed to implement.

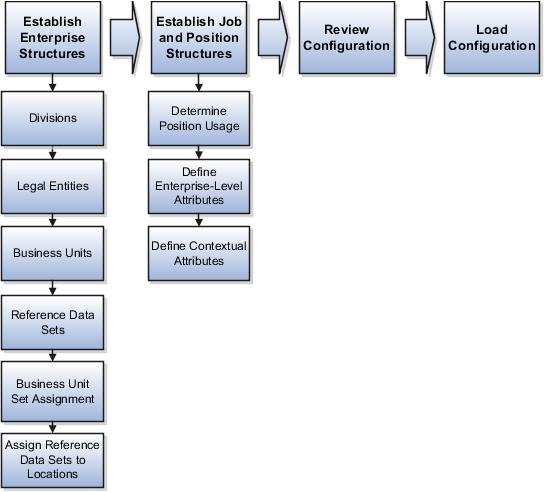

The following figure and chart describes the Business Process Model structures and activities.

|

BPM Activities |

Description |

|---|---|

|

Define Enterprise |

Define the enterprise to capture the name of the deploying enterprise and the location of the headquarters. There is normally a single enterprise organization in a production environment. Multiple enterprises are defined when the system is used to administer multiple customer companies, or when you choose to set up additional enterprises for testing or development. |

|

Define Enterprise Structures |

Define enterprise structures to represent an organization with one or more legal entities under common control. Define internal and external organizations to represent each area of business within the enterprise. |

|

Define Legal Jurisdictions and Authorities |

Define information for governing bodies that operate within a jurisdiction. |

|

Define Legal Entities |

Define legal entities and legal reporting units for business activities handled by the Oracle Fusion Applications. |

|

Define Business Units |

Define business units of an enterprise to allow for flexible implementation, to provide a consistent entity for controlling and reporting on transactions, and to be an anchor for the sharing of sets of reference data across applications. |

|

Define Financial Reporting Structures |

Define financial reporting structures, including organization structures, charts of accounts, organizational hierarchies, calendars, currencies and rates, ledgers, and document sequences which are used in organizing the financial data of a company. |

|

Define Chart of Accounts |

Define chart of accounts including hierarchies and values to enable tracking of financial transactions and reporting at legal entity, cost center, account, and other segment levels. |

|

Define Ledgers |

Define the primary accounting ledger and any secondary ledgers that provide an alternative accounting representation of the financial data. |

|

Define Accounting Configurations |

Define the accounting configuration that serves as a framework for how financial records are maintained for an organization. |

|

Define Facilities |

Define inventory, item, and cost organizations. Inventory organizations represent facilities that manufacture or store items. The item master organization holds a single definition of items that can be shared across many inventory organizations. Cost organizations group inventory organizations within a legal entity to establish the cost accounting policies. |

|

Define Reference Data Sharing |

Define how reference data in the applications is partitioned and shared. |

Note

There are product specific implementation activities that are not listed here and depend on the applications you are implementing. For example, you can implement Define Enterprise Structures for Human Capital Management, Project Management, and Sales Management.

Start your global enterprise structure configuration by discussing what your organization's reporting needs are and how to represent those needs in the Oracle Fusion Applications. Consider deployment on a single instance, or at least, on as few instances as possible, to simplify reporting and consolidations for your global enterprises. The following are some questions and points to consider as you design your global enterprise structure in Oracle Fusion.

Enterprise Configuration

Business Unit Management

Security Structure

Compliance Requirements

What is the level of configuration needed to achieve the reporting and accounting requirements? What components of your enterprise do you need to report on separately? Which components can be represented by building a hierarchy of values to provide reporting at both detail and summary levels? Where are you on the spectrum of centralization versus decentralization?

What reporting do I need by business unit? How can you set up your departments or business unit accounts to achieve departmental hierarchies that report accurately on your lines of business? What reporting do you need to support the managers of your business units, and the executives who measure them? How often are business unit results aggregated? What level of reporting detail is required across business units?

What level of security and access is allowed? Are business unit managers and the people that report to them secured to transactions within their own business unit? Are the transactions for their business unit largely performed by a corporate department or shared service center?

How do you comply with your corporate external reporting requirements and local statutory reporting requirements? Do you tend to prefer a corporate first or an autonomous local approach? Where are you on a spectrum of centralization, very centralized or decentralized?

This example uses a fictitious global company to demonstrate the analysis that can occur during the enterprise structure configuration planning process.

Your company, InFusion Corporation, is a multinational conglomerate that operates in the United States (US) and the United Kingdom (UK). InFusion has purchased an Oracle Fusion enterprise resource planning (ERP) solution including Oracle Fusion General Ledger and all of the Oracle Fusion subledgers. You are chairing a committee to discuss creation of a model for your global enterprise structure including both your US and UK operations.

InFusion Corporation has 400 plus employees and revenue of $120 million. Your product line includes all the components to build and maintain air quality monitoring (AQM) systems for homes and businesses. You have two distribution centers and three warehouses that share a common item master in the US and UK. Your financial services organization provides funding to your customers for the start up costs of these systems.

The following are elements you need to consider in creating your model for your global enterprise structure.

Your company is required to report using US Generally Accepted Accounting Principles (GAAP) standards and UK Statements of Standard Accounting Practice and Financial Reporting Standards. How many ledgers do you need to achieve proper statutory reporting?

Your managers need reports that show profit and loss (revenue and expenses) for their lines of business. Do you use business units and balancing segments to represent your divisions and businesses? Do you secure data by two segments in your chart of accounts which represents each department and legal entity or one segment that represents both to produce useful, but confidential management reports?

Your corporate management requires reports showing total organizational performance with drill down capability to the supporting details. Do you need multiple balancing segment hierarchies to achieve proper rollup of balances for reporting requirements?

Your company has all administrative, account payables, procurement, and human resources functions performed at their corporate headquarters. Do you need one or more business unit in which to perform all these functions? How will your shared service center be configured?

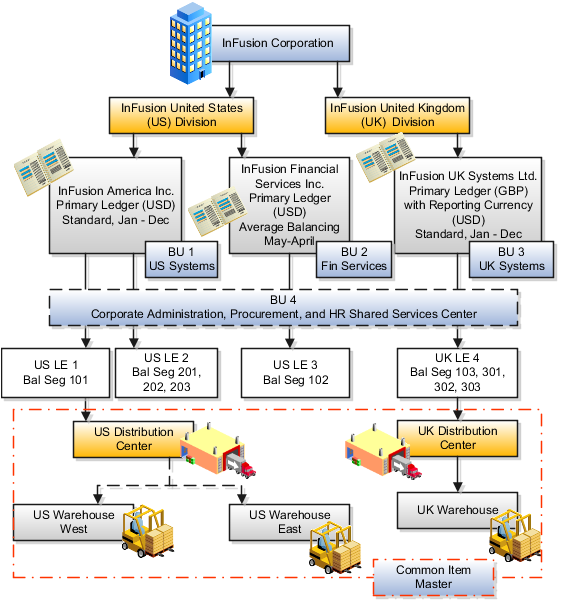

The following figure and table summarize the model that your committee has designed and uses numerical values to provide a sample representation of your structure. The model includes the following recommendations:

Creation of three separate ledgers representing your separate legal entities:

InFusion America Inc.

InFusion Financial Services Inc.

InFusion UK Services Ltd.

Consolidation of results for system components, installations, and maintenance product lines across the enterprise

All UK general and administrative costs processed at the UK headquarters

US Systems' general and administrative costs processed at US Corporate headquarters

US Financial Services maintains its own payables and receivables departments

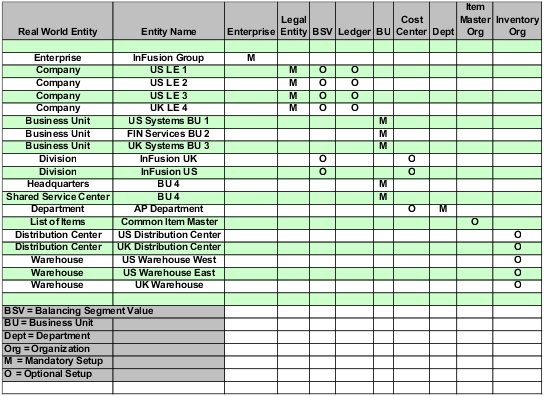

In this chart, the green globe stands for mandatory and gold globe stands for optional setup. The following statements expand on the data in the chart.

The enterprise is mandatory because it serves as an umbrella for the entire implementation. All organizations are created within an enterprise.

Legal entities are also mandatory. They can be optionally mapped to balancing segment values or represented by ledgers. Mapping balancing segment values to legal entities is mandatory if you plan to use the intercompany functionality.

At least one ledger is mandatory in an implementation in which you record your accounting transactions.

Business units are also mandatory because financial transactions are processed in business units.

A shared service center is optional, but if used, must be a business unit.

Divisions are optional and can be represented with a hierarchy of cost centers or by a second balancing segment value.

Departments are mandatory because they track your employees.

Optionally, add an item master organization and inventory organizations if you are tracking your inventory transactions in Oracle Fusion Applications.

Note

Some Oracle Fusion Human Capital Management and Customer Relationship Management implementations do not require recording of accounting transactions and therefore, do not require implementation of a ledger.

Note

The InFusion Corporation is a legal entity but is not discussed in this example.

The Enterprise Structures Configurator is an interview-based tool that guides you through the process of setting up a basic enterprise structure. By answering questions about your enterprise, the tool creates a structure of divisions, legal entities, business units, and reference data sets that reflects your enterprise structure. After you create your enterprise structure, you also follow a guided process to determine whether or not to use positions, and whether to set up additional attributes for jobs and positions. After you define your enterprise structure and your job and position structures, you can review them, make any necessary changes, and then load the final configuration.

This figure illustrates the process to configure your enterprise using the Enterprise Structures Configurator.

To be able to use the Enterprise Structures Configurator, you must select the Enterprise Structures Guided Flow feature for your offerings on the Configure Offerings page in the Setup and Maintenance work area. If you do not select this feature, then you must set up your enterprise structure using individual tasks provided elsewhere in the offerings, and you cannot create multiple configurations to compare different scenarios.

To define your enterprise structures, you use the guided flow within the Establish Enterprise Structures task to enter basic information about your enterprise, such as the primary industry and the location of your headquarters. You then create divisions, legal entities, business units, and reference data sets. The Establish Enterprise Structures task enables you to create multiple enterprise configurations so that you can compare different scenarios. Until you load a configuration, you can continue to create and edit multiple configurations until you arrive at one that best suits your enterprise.

You also use a guided process to determine whether you want to use jobs only, or jobs and positions. The primary industry that you select in the Establish Enterprise Structures task provides the application with the information needed to make an initial recommendation. You can either accept the recommendation, or you can answer additional questions about how you manage people in your enterprise, and then make a selection. After you select whether to use jobs or positions, the guided process prompts you to set up a descriptive flexfield structure for jobs, and for positions if you have chosen to use them. Descriptive flexfields enable you to capture additional information when you create jobs and positions.

Finally, you can review a summary of the results of the two interview processes. For each configuration, the online summary lists the divisions, legal entities, business units, reference data sets, and job and position structures that the application will create when you load the configuration.

For a more detailed analysis of a configuration, you can access the Technical Summary Report. This report lists the same information as the online summary, but also lists the following information that will be created by the application when you load the configuration, based on your configuration:

Legislative data groups (the application creates one legislative data group for each country that is identified in the configuration.)

Name of the legislative data group that will be assigned to the payroll statutory unit that is generated for each legal entity.

Organization hierarchy.

The Technical Summary report also lists the default settings that will be loaded for these fields, which you access from the Manage Enterprise HCM Information task: Worker Number Generation, Employment Model and Allow Employment Terms Override. You can print the Technical Summary Report for each of your configurations and compare each scenario.

Note

If your PDF viewer preferences are set to open PDFs in a browser window, the Technical Summary report replaces the Oracle Fusion application. Use your browser's Back button to return to the application.

You can load only one configuration. When you load a configuration, the application creates the divisions, legal entities, business units, and so on. After you load the configuration, you then use individual tasks to edit, add, and delete enterprise structures.

This example illustrates how to set up an enterprise based on a global company operating mainly in the US and the UK with a single primary industry.

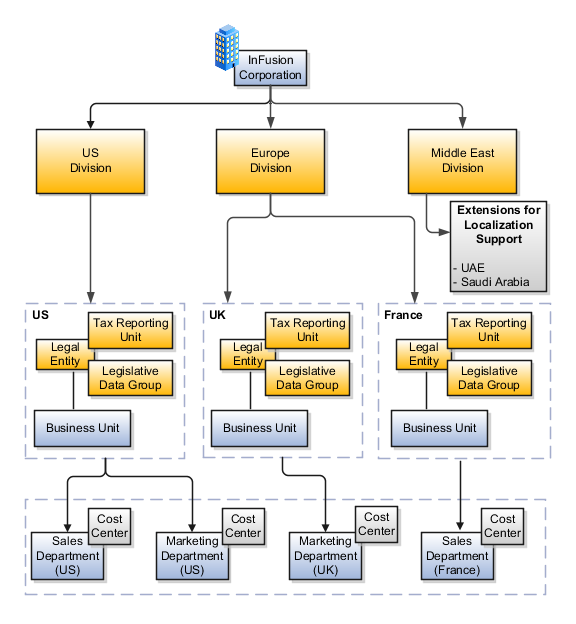

InFusion Corporation is a multinational enterprise in the high technology industry with product lines that include all the components that are required to build and maintain air quality monitoring (AQM) systems for homes and businesses. Its primary locations are in the US and the UK, but it has smaller outlets in France, Saudi Arabia, and the United Arab Emirates (UAE).

In the US, InFusion employs 400 people and has a company revenue of $120 million. Outside the US, InFusion employs 200 people and has revenue of $60 million.

InFusion requires three divisions. The US division will cover the US locations. The Europe division will cover the UK and France. Saudi Arabia and the UAE will be covered by the Middle East division.

InFusion requires legal entities with legal employers, payroll statutory units, tax reporting units, and legislative data groups for the US, UK, France, Saudi Arabia, and UAE, in order to employ and pay its workers in those countries.

InFusion requires a number of departments across the enterprise for each area of business, such as sales and marketing, and a number of cost centers to track and report on the costs of those departments.

InFusion requires business units for human capital management (HCM) purposes. Infusion has general managers responsible for business units within each country. Those business units may share reference data. Some reference data can be defined within a reference data set that multiple business units may subscribe to. Business units are also required for financial purposes. Financial transactions are always processed within a business unit.

Based on this analysis, InFusion requires an enterprise with multiple divisions, ledgers, legal employers, payroll statutory units, tax reporting units, legislative data groups, departments, cost centers, and business units.

This figure illustrates the enterprise configuration that results from the analysis of InFusion Corporation.

Managing multiple businesses requires that you segregate them by their strategic objectives and measure their results. Responsibility to reach objectives can be delegated along the management structure. Although related to your legal structure, the business organizational hierarchies do not need to reflect directly the legal structure of the enterprise. The management entities and structure can include divisions and subdivisions, lines of business, and other strategic business units, and include their own revenue and cost centers. These organizations can be included in many alternative hierarchies and used for reporting, as long as they have representation in the chart of accounts.

A division refers to a business oriented subdivision within an enterprise, in which each division organizes itself differently to deliver products and services or address different markets. A division can operate in one or more countries, and can be comprised of many companies or parts of different companies that are represented by business units.

A division is a profit center or grouping of profit and cost centers, where the division manager is responsible for attaining business goals including profit goals. A division can be responsible for a share of the company's existing product lines or for a separate business. Managers of divisions may also have return on investment goals requiring tracking of the assets and liabilities of the division. The division manager reports to a top corporate executive.

By definition a division can be represented in the chart of accounts. Companies may choose to represent product lines, brands, or geographies as their divisions: their choice represents the primary organizing principle of the enterprise. This may coincide with the management segment used in segment reporting.

Oracle Fusion Applications supports a qualified management segment and recommends that you use this segment to represent your hierarchy of business units and divisions. If managers of divisions have return on investment goals, make the management segment a balancing segment. Oracle Fusion applications allows up to three balancing segments. The values of the management segment can be comprised of business units that roll up in a hierarchy to report by division.

Historically, divisions were implemented as a node in a hierarchy of segment values. For example, Oracle E-Business Suite has only one balancing segment, and often the division and legal entity are combined into a single segment where each value stands for both division and legal entity.

Divisions are used in HCM to define the management organization hierarchy, using the generic organization hierarchy. This hierarchy can be used to create organization based security profiles.

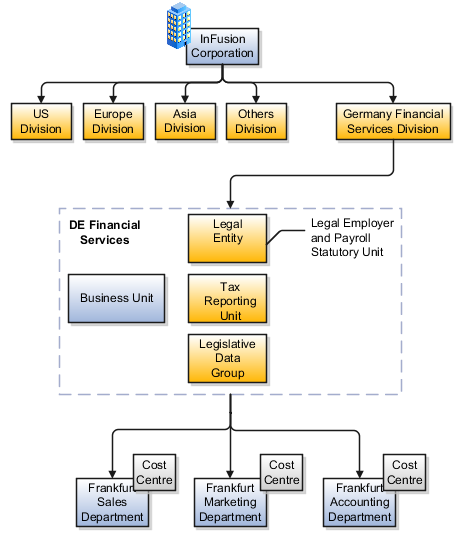

This example shows how to restructure your enterprise after acquiring a new division.

You are part of a senior management team at InFusion Corporation. InFusion is a global company with organizations in the United States (US), the United Kingdom (UK), France, China, Saudi Arabia, and the United Arab Emirates (UAE). Its main area of business is in the high tech industry, and it has just acquired a new company. You must analyze their current enterprise structure and determine what new organizations you need to create to accommodate the new company.

The acquired company is a financial services business based in Germany. Because the financial services business differs significantly from the high tech business, you want to keep the financial services company as a separate business with all the costs and reporting rolling up to the financial services division.

The following table summarizes the key decisions that you must consider when determining what new organizations to set up and how to structure the enterprise.

|

Decision to Consider |

In This Example |

|---|---|

|

Create location? |

The financial services company is based in Frankfurt as are the departments, so you need to create only one location. |

|

Create separate division? |

Yes. Although the new division will exist within the current enterprise structure, you want to keep the financial services company as a separate line of business. Creating a separate division means you can manage the costs and reporting separately from the InFusion Corporation. It also means you do not have to modify any existing organizations in the enterprise setup. |

|

Create business unit? |

Yes. The financial services business requires you to create several jobs that do not exist in your high tech business. You can segregate the jobs that are specific to financial services in a new business unit. |

|

How many departments? |

The financial services company currently has three departments for sales, accounting, and marketing. As you have no plans to downsize or change the company, you can create three departments to reflect this structure. |

|

How many cost centers? |

Although you can have more than one cost center tracking the costs of a department, you decide to create one cost center for each department to track costs. |

|

How many legal entities? |

Define a legal entity for each registered company or other entity recognized in law for which you want to record assets, liabilities, and income, pay transaction taxes, or perform intercompany trading. In this case, you need only one legal entity. You must define the legal entity as a legal employer and payroll statutory unit. As the new division operates in Germany only, you can configure the legal entity to suit Germany legal and statutory requirements. Note When you identify the legal entity as a payroll statutory unit, the application transfers the legal reporting unit that is associated with that legal entity to Oracle Fusion HCM as a tax reporting unit. |

|

Create legislative data group? |

Yes. Because you currently do not employ or pay people in Germany, you must create one legislative data group to run payroll for the workers in Germany. |

Based on the analysis, you must create the following:

One new division

One new location

Three new departments

Three new cost centers

One new legal entity

One new legislative data group

The following figure illustrates the structure of InFusion Corporation after adding the new division and the other organizations.

Address cleansing provides a way to validate, correct, and standardize addresses that are entered in a user interface. Geography validation only validates the geography attributes of an address, for example, State, City, and Postal codes; address cleansing validates both the geography attributes and the address line attributes.

Address cleansing can only be used through the Oracle Fusion Trading Community Data Quality product, because the feature is delivered using Data Quality integration. You need to ensure that you have a license for the countries that will use Trading Community Data Quality data cleansing.

You can specify the real time address cleansing level for each country by choosing either None, meaning that there is no real time address cleansing, or by choosing Optional, meaning that you will have the choice to cleanse addresses. Once you have enabled address cleansing for a country a Verify Address icon appears at address entry points in the application. You can then click the icon to perform address cleansing and receive a corrected, standardized address. If Trading Community Data Quality does not find a matching address the application will alert you.

There are three components that are dependent on each other when defining a country: geography structure, geography hierarchy, and geography validation. Every country has to have the geography structure defined first before the hierarchy can be defined, and the geography hierarchy has to be defined before the validation can be defined.

Firstly, you need to create a geography structure for each country to define which geography types are part of the country structure, and how the geography types are hierarchically related within the country structure. For example, you can create geography types called State, City, and Postal Code. Then you can rank the State geography type as the highest level within the country, the City as the second level, and the Postal Code as the lowest level within the country structure. Geography structure can be defined using the Manage Geographies task, or can be imported using tasks in the Define Geographies activity.

Once the geography structure is defined, the geographies for each geography type can be added to the hierarchy. For example, below the United States you can create a geography called California using a State geography type.

As part of managing the geography hierarchy you can view, create, edit, and delete the geographies for each geography type in the country structure. You can also add a primary and alternate name and code for each geography. A geography hierarchy can be created using the Manage Geographies task, or can be imported using tasks in the Define Geographies activity.

After defining the geography hierarchy, you need to specify the geography validations for the country. You can choose which address style formats you would like to use for the country, and for each selected address style format you can map geography types to address attributes. You can also select which geography types should be included in geography or tax validation, and which geography types will display in a list of values during address entry in other user interfaces. The geography validation level for the country, such as error or warning, can also be selected.

A geography structure is a hierarchical grouping of geography types for a country. For example, the geography structure for the United States is the geography type of State at the top, then followed by the County, then the City, and finally the Postal Code.

You can use the geography structure to establish:

How geographies can be related

The types of geographies you can define for the country

You can determine how a country's geographies are hierarchically related by creating the hierarchy of the geography types in the geography structure. When you define a country's structure the country geography type is implicitly at the top of the geography structure, and the numbering of the subsequent levels start with 1 as the next geography level after country.

You must add a geography type as a level in the country structure before you can define a geography for that geography type in a country. For example, before defining the state of California, the State geography type must be added to the United States country structure. Only one geography type can be used for each level, you cannot define more than one geography type at the same level.

Note

After you first define a country structure you can only add geography types below the current lowest level, and delete geography types without defined geographies.

To simplify the creation of a country structure you can copy a structure from another country, and then amend the geography type hierarchy for the country.

The application provides you with a set of available master reference geography types. If required, you can create a geography type before adding it to the country structure. Each geography type is added below the current lowest level.

Note

If you want to delete a geography type that is not at the lowest level in the country structure, then you have to delete the geography type level and all the levels below it.

A geography type that you create within the country structure can be used for other country structures as well.

Geography hierarchy is a data model that lets you establish conceptual parent-child relationships between geographies. A geography, such as Tokyo or Peru, describes a boundary on the surface of the earth. The application can extrapolate information based on this network of hierarchical geographical relationships.

For example, in the geography hierarchy the state of California is defined as the parent of San Mateo county, which is the parent of Redwood City, which is the parent of the postal code 94065. If you enter just 94065, the application can determine that the postal code is in California, or that the corresponding city is Redwood City.

The application leverages geography hierarchy information to facilitate business processes that rely on geography information, for example, tax calculation, order sourcing rules, sales territory definition. The geography hierarchy information is centrally located in the Trading Community Model and shared among other application offerings.

The top level of the geography hierarchy is Country, so the hierarchy essentially contains countries and their child geographies. Other aspects of the geography hierarchy include:

Geography

Geography type

Geography usage

Master reference geography hierarchy

User defined zones

A geography is a boundary such as a country, state, province or city. It is a physical space with boundaries that is a defined instance of a geography type. For example, San Jose is a geography of the City geography type.

Geography types are a divisional grouping of geographies, which can be either geopolitical (for example, City, Province, and District) or user defined (for example, Continent, Country Regions, Tax Regions).

Geography usage indicates how a geography type or geography is used in the application. A master reference geography always has the usage of Master Reference. User defined zones can have the usages of Tax, Shipping, or Territory, based on what is relevant for their purpose.

The geography hierarchy data is considered to be the single source of truth for geographies. It is all the data, including geography types and geographies, that you define and maintain in the Trading Community Model tables.

The geography usage for the entire hierarchy is the master reference, and defined geography types and geographies are considered as master reference geography types and geographies. For example, Country is a universally recognized geography type, and United States is considered a master geography.

User defined zones are a collection of geographical data, created from master reference data for a specific purpose. For example, territory zones are collections of master reference geographies ordered in a hierarchy. Tax and shipping zones are collections of master reference geographies without a hierarchical grouping.

Geography validation determines the geography mapping and validation for a country's address styles, as well as the overall geography validation control for a country.

The No Styles Format address style format is the default address style format for a country. By defining the mapping and validation for this format you will ensure that validations can be performed for any address in the country. After the No Styles Format is defined you can set up additional mapping for specific address styles.

For each address style format, you can define the following:

Map to attribute

Enable list of values

Tax validation

Geography validation

Geography validation control

For every address style format, you can map each geography type to an address attribute. For example, you can map the State geography type to the State address attribute for the United States, or map the State geography type to the County address attribute for the United Kingdom. The geography types that appear are based on how the country structure is defined. The list of address attributes that appear are based on address formats delivered with the application, or your customer defined address formats.

Note

You only need to map geography types that you want to use for geography or tax validation purposes.

Once a geography type is mapped to an attribute, then you can specify whether the geography type will appear in a list of values during address entry in user interfaces. It is very important to review carefully if you want to enable a list of values. You should only enable a list of values if you have sufficient geography data imported or created for that geography. Once you have enabled a list of values for an address attribute, you can only select the geography data available for the geography type. This means that if a specific geography value is not available in the geography hierarchy, you cannot create an address with a different geography value.

You can also specify whether a geography type will be included in tax validation. For example, for the United States North America address style format you specify that County, State, and City are used for tax validation. This will mean that when a transaction involves an address with the North America address style, the address must have the correct county, state, and city combination based on the geography hierarchy data, to be considered valid for tax calculation.

You can specify whether a geography type will be included in geography validation. This will mean that, for example, when the user enters a United States address using the North America address style format, the address must have the correct country, state, and postal code combination based on geography hierarchy data to be considered geographically valid.

If an address element is mapped to a geography type, but not selected for geography validation usage, then during address entry suggested values will be provided for the address element, but the address element will not be validated.

Note

For either the tax or geography validation, do not skip more than one consecutive level unless you are certain that the selected geography types can uniquely identify geographies. For example, the United States country structure is: State, County, City, and Postal Code, and you want to select just State and Postal Code for geography or tax validation. However, for the combination of California and 94065, the city can be either Redwood Shores or Redwood City. In this case, you should also select at least the City geography type for geography or tax validation.

You can select the geography validation level for a country. Validation will check if the entered address maps to the geography hierarchy data available for the country, and the geography validation control determines whether you can save an address that did not pass validation during address entry. For example, if the validation level is Error, then an address cannot be saved if the values do not match the geography hierarchy data.

These are the geography validation levels you can choose:

Error - only completely valid addresses can be saved, with all mandatory address elements entered.

No Validation - all addresses can be saved including incomplete and invalid addresses.

Regardless of the result of validation, the validation process will try to map any address attribute to a geography of the country, and store any mapping it could establish based on the available data. This is called Geography Name Referencing and it is executed as part of validation. The result of this referencing is used in several business processes in the application to map an address to a specific geography or zone.

A geography, such as Tokyo or Peru, describes a boundary on the surface of the earth. You can create new geographies by importing data through interface tables. There are two options for populating the interface tables: using the tool of your preference to load the data or using file-based data import. If you plan to provide the data details in a source file, use the file-based import feature. If you will populate the interface table directly, run the geography loader process to import the data. Having a good understanding of the import entity, interface table, and destination table will help you prepare your import data.

Consider the following when importing geographies:

File-based import option

Geography loader process option

Import object entity, interface table, and destination tables

The file-based import process reads the data included in your XML or text file, populates the interface tables, and imports the data into the application destination tables. The File-Based Data Import Setup and Maintenance task list includes the tasks needed to configure the geography import object, create source file mappings, and schedule the import activities.

Populate the interface table with your import data, then navigate to the Run Geography Loader Setup and Maintenance task to schedule the import of data from the interface table to the destination table.

The geography import object consists of one entity and interface table that forms the geography. If you are using file-based import, you can map your source file data to import entity attributes that correspond to the interface table columns. The import activity process populates the interface table based on the mapping and your source file. If using the geography loader scheduled process, populate the interface table directly using your preferred tool. If you need the unique IDs of existing application data for your import data, use the Define Data Export Setup and Maintenance task list to export the information.

Note

Spreadsheets containing detailed information about each interface table, including the import attributes, corresponding interface table columns, defaults, and validations, are available from the Oracle Enterprise Repository by searching on a specific interface table name or initiating a search using the FusionApps: Interface Table asset type.

The following lists the object entity, tables, and resulting application object:

|

File-Based Import Entities |

Interface Tables |

Destination Tables |

Application Object |

|---|---|---|---|

|

ImpGeography |

HZ_IMP_GEOGRAPHIES_T |

HZ_GEOGRAPHIES HZ_GEOGRAPHY_IDENTIFIERS HZ_GEOGRAPHY_TYPES_B HZ_HIERARCHY_NODES |

Geography |

This example demonstrates how to import data using the File-Based Data Import tool. In this particular example you have a source file containing geography data that you want to import into the application, so that the geography data can be used for uses related to locations, such as real time address validation and tax purposes.

The following table summarizes the key decisions for this scenario:

|

Decisions to Consider |

In This Example |

|---|---|

|

What type of object are you importing? |

Geography |

|

What file type are you using for your source data? |

Text file |

|

Where are you uploading your source data file from? |

Your desktop |

|

What data type is your source data file? |

Comma separated |

|

Which fields are you importing into Oracle Fusion applications? |

All, except for the RecordTypeCode field |

|

When do you want to process the import? |

Immediately |

These are the steps that are required to create an import activity and submit the import:

Determine what information is in the source file.

Create and schedule the import activity.

Monitor the import results.

|

Geography Level |

Name |

Source ID |

Parent Source ID |

|---|---|---|---|

|

1 (Country) |

US |

1 |

|

|

2 (State) |

CA |

11 |

1 |

|

3 (County) |

Alameda |

111 |

11 |

|

4 (City) |

Pleasanton |

1111 |

111 |

|

4 (City) |

Dublin |

1112 |

111 |

You create an import activity, enter the import details, and schedule the import. An import activity definition provides the instructions for the import processing - this includes selecting the source file, or file location; mapping fields from the source file to the Oracle Fusion object and attribute; and scheduling the import.

|

Field |

Value |

|---|---|

|

Name |

Master Reference Geographies |

|

Object |

Geography |

|

File Type |

Text File |

|

File Selection |

Specific file |

|

Upload From |

Desktop |

|

File Name |

Choose relevant file from desktop |

|

Data Type |

Comma separated |

Note

Ensure that the file type that you select in the Create Import Activity: Set Up page matches the file type of the source data file.

|

Column Header |

Example Value |

Ignore |

Object |

Attribute |

|---|---|---|---|---|

|

Primary Geography Name |

Primary Geography Name |

United States |

Imp Geography |

Primary Geography Name |

|

Country Code |

US |

No |

Imp Geography |

Country Code |

|

Record Type Code |

0 |

Yes |

Imp Geography |

Record Type Code |

|

Source ID |

10265 |

No |

Imp Geography |

Source ID |

|

Parent Source ID |

1053 |

No |

Imp Geography |

Parent Source ID |

If you do not want to import a column in the text file you can select Ignore.

Note

If you have any difficulties mapping the fields from your source file to the relevant Oracle Fusion applications object, you can use the import object spreadsheets for reference.

Instead of immediately importing the data, you can choose a date and time to start the import. You can also specify if the import will be repeated, and the frequency of the repeated import.

You monitor the progress of the Import Activity processing, and view completion reports for both successful records and errors.

Once the import activity has completed, the Status field value will change to Completed.

Territory geography zones are geographical boundaries that you can set up to replicate your organization's regions, such as a Pacific Northwest sales region.You can set up territory geography zones in one Oracle Fusion applications instance, and then after the territory geography zones are defined you can export the territory zones and import them into another Oracle Fusion applications instance.

To define your territory geography zones and then import your territory zones into another Oracle Fusion applications instance, you need to complete the following steps:

Import the master reference geography data into the Oracle Fusion application.

Define your territory geography zones using the Manage Territory Geographies task.

Export the territory geography zones.

Import the territory geography zones into another Oracle Fusion applications instance.

Firstly, you need to import the master reference geography data. Master reference geography data consists of geography elements such as country, state, and city, and is required for any geographical information you store in the application, such as address information used in customer and sales records. For more information, refer to the Geography Hierarchy: Explained topic listed in the related topics section. Master reference geography data can be imported into the application using the Manage File Import Activities task in Setup and Maintenance - refer to the Importing Master Reference Geography Data: Worked Example topic listed in the related topics section for more information.

Once the master reference geography data has been imported, you can then create your territory geography zones in the application using the Manage Territory Geographies task in Setup and Maintenance. For more information, refer to the Managing Territory Geographies: Worked Example topic listed in the related topics section.

Once you have completed importing the master reference geography data and defining your territory geography zone tasks, you can create a configuration package to export the territory zone data. For more information, refer to the Exporting Setup Data demo listed in the related topics section.

Once you have downloaded your configuration package for your territory geography zone setup, you can import the territory zones into another Oracle Fusion application instance. For more information, refer to the Importing Setup Data listed in the related topics section.

Note

Ensure that you import your master reference geography data into the new Oracle Fusion instance before you import the configuration package.

This example shows how to start the configuration of the geography structure, hierarchy, and validation for the country geography of the United Kingdom.

The following table summarizes the key decisions for this scenario.

|

Decisions to Consider |

In This Example |

|---|---|

|

Copy an existing country structure? |

No, create a new country structure. |

|

What is the structure of the geography types? |

Create geography types with the following ranking structure:

|

|

What is the geography hierarchy? |

Create the following hierarchy:

|

|

Which address style format will you use when mapping geography validations? |

The default address style format, called the No Styles Format. |

|

Are you using Oracle Fusion Tax for tax purposes? |

No, do not select Tax Validation for the geography types. |

Add the County and Post Town geography types to the geography structure. Then add the geographies for the County and Post Town geography types to define the geography hierarchy. Finally, specify the geography validations for the geography types you have added to the geography structure.

You add the County and Post Town geography types to the United Kingdom geography structure.

You want to begin to create the geography hierarchy for the United Kingdom, so you add the geographies for the County and Post Town geography types using the geography hierarchy User Interfaces. You can also use the Manage File Import Activities task to import geography hierarchies using a csv or xml file.

Now you want to specify the geography validations for the geography types you have added to the United Kingdom. You define the geography mapping and validation for the United Kingdom default address style format. You map the geography types to attributes, enable the geography types for Lists of Values and Geography validation, and set the geography validation level.

When address data entered into the application needs to conform to a particular format, in order to achieve consistency in the representation of addresses. For example, making sure that the incoming data is stored following the correct postal address format.

You can only update a geography structure by adding existing geography types, or by creating new geography types and then adding them to the geography structure. You can only copy an existing country structure when you are defining a new country structure.

If a geography exists for a country geography structure level then you cannot delete the level. For example, if a state geography has been created for the United States country geography structure, then the State level cannot be deleted in the country geography structure.

Yes. However, the geography type for the geography that you want to add must be already added to the country geography structure.

Yes. In the Manage Geography Hierarchy page you can edit details such as the geography's date range, primary and alternate names and codes, and parent geographies.

Select the geography that you want your geography to be created below, and then click the Create icon. This will allow you to create a geography for a geography type that is the level below the geography type you selected. The structure of the country's geography types are defined in the Manage Geography Structure page.

You are required to register your legal entities with legal authorities in the jurisdictions where you conduct business. Register your legal entities as required by local business requirements or other relevant laws. For example, register your legal entities for tax reporting to report sales taxes or value added taxes.

Define jurisdictions and related legal authorities to support multiple legal entity registrations, which are used by Oracle Fusion Tax and Oracle Fusion Payroll. When you first create a legal entity, the Oracle Fusion Legal Entity Configurator automatically creates one legal reporting unit for that legal entity with a registration.

Jurisdiction is a physical territory such as a group of countries, country, state, county, or parish where a particular piece of legislation applies. French Labor Law, Singapore Transactions Tax Law, and US Income Tax Laws are examples of particular legislation that apply to legal entities operating in different countries' jurisdictions. Judicial authority may be exercised within a jurisdiction.

Types of jurisdictions are:

Identifying Jurisdiction

Income Tax Jurisdiction

Transaction Tax Jurisdiction

For each legal entity, select an identifying jurisdiction. An identifying jurisdiction is your first jurisdiction you must register with to be allowed to do business in a country. If there is more than one jurisdiction that a legal entity needs to register with to commence business, select one as the identifying jurisdiction. Typically the identifying jurisdiction is the one you use to uniquely identify your legal entity.

Income tax jurisdictions and transaction tax jurisdictions do not represent the same jurisdiction. Although in some countries, the two jurisdictions are defined at the same geopolitical level, such as a country, and share the same legal authority, they are two distinct jurisdictions.

Create income tax jurisdictions to properly report and remit income taxes to the legal authority. Income tax jurisdictions by law impose taxes on your financial income generated by all your entities within their jurisdiction. Income tax is a key source of funding that the government uses to fund its activities and serve the public.

Create transaction tax jurisdictions through Oracle Fusion Tax in a separate business flow, because of the specific needs and complexities of various taxes. Tax jurisdictions and their respective rates are provided by suppliers and require periodic maintenance. Use transaction tax jurisdiction for legal reporting of sales and value added taxes.

A legal authority is a government or legal body that is charged with powers to make laws, levy and collect fees and taxes, and remit financial appropriations for a given jurisdiction.

For example, the Internal Revenue Service is the authority for enforcing income tax laws in United States. In some countries, such as India and Brazil, you are required to print legal authority information on your tax reports. Legal authorities are defined in the Oracle Fusion Legal Entity Configurator. Tax authorities are a subset of legal authorities and are defined using the same setup flow.

Legal authorities are not mandatory in Oracle Fusion Human Capital Management (HCM), but are recommended and are generally referenced on statutory reports.

Define legal jurisdictions and related legal authorities to support multiple legal entity registrations, which are used by Oracle Fusion Tax and Oracle Fusion Payroll.

Create a legal jurisdiction by following these steps:

Navigate to the Manage Legal Jurisdictions page from the Setup and Maintenance work area by querying on the Manage Legal Jurisdictions task and selecting Go to Task.

Select Create.

Enter a unique Name, United States Income Tax.

Select a Territory, United States.

Select a Legislative Category, Income tax.

Select Identifying, Yes. Identifying indicates the first jurisdiction a legal entity must register with to do business in a country.

Enter a Start Date if desired. You can also add an End Date to indicate a date that the jurisdiction may no longer be used.

Select a Legal Entity Registration Code, EIN or TIN.

Select a Legal Reporting Unit Registration Code, Legal Reporting Unit Registration Number.

Optionally enter one or more Legal Functions.

Select Save and Close.

Create a legal address for legal entities and reporting units by following these steps:

Navigate to the Manage Legal Address page from the Setup and Maintenance work area by querying on the Manage Legal Address task and selecting Go to Task.

Select Create.

Select Country.

Enter Address Line 1, Oracle Parkway.

Optionally enter Address Line 2, and Address Line 3.

Enter or Select Zip Code, 94065.

Select Geography 94065 and Parent Geography Redwood Shores, San Mateo, CA.

Optionally enter a Time Zone, US Pacific Time.

Select OK.

Select Save and Close.

Create a legal authority by following these steps:

Navigate to the Manage Legal Authorities page from the Setup and Maintenance work area by querying on the Manage Legal Authorities task and selecting Go to Task.

Enter the Name, California Franchise Tax Board.

Enter the Tax Authority Type, Reporting.

Note

Create an address for the legal authority.

Select Create.

The Site Number is automatically assigned.

Optionally enter a Mail Stop.

Select Country, United States

Enter Address Line 1, 121 Spear Street, Suite 400.

Optionally enter Address Line 2, and Address Line 3.

Enter or Select Zip Code, 94105.

Select Geography 94105 and Parent Geography San Francisco, San Francisco, CA.

Select OK.

Optionally enter a Time Zone, US Pacific Time.

Optionally click the One-Time Address check box.

The From Date defaults to today's date. Update if necessary.

Optionally enter a To Date to indicate the last day the address can be used.

Note

You can optionally enter Address Purpose details.

Select Add Row.

Select Purpose.

The Purpose from Date will default to today's date.

Optionally enter a Purpose to Date.

Select OK.

Select Save and Close.

Define a legal entity for each registered company or other entity recognized in law for which you want to record assets, liabilities, and income, pay transaction taxes, or perform intercompany trading.

From within an implementation project, create a legal entity by following these steps:

Note

Working within an implementation project is required because you select a scope value within an implementation project. The scope value is the legal entity that you will create or select to work within for your implementation project.

Navigate to an implementation project that contains the Define Legal Entities task list from the Setup and Maintenance work area.

Select Go to Task for the Define Legal Entities task list within the implementation project.

Note

The following message appears:

You must first select a scope value to perform the task.

Select and add an existing scope value to the implementation project.

Create a new scope value and then add it to the implementation project.

Select Create New.

From the Manage Legal Entities page select Create.

Accept the default Country, United States.

Enter Name, InFusion USA West.

Enter Legal Entity Identifier, US0033.

Optionally enter Start Date. When the start date is blank the legal entity is effective from the creation date.

Optionally enter an End Date.

Optionally, if your legal entity should be registered to report payroll tax and social insurance, select the Payroll statutory unit check box.

Optionally, if your legal entity has employees, select the Legal employer check box.

Optionally, if this legal entity is not a payroll statutory unit, select an existing payroll statutory unit to report payroll tax and social instance on behalf of this legal entity.

Note

Enter the Registration Information.

Accept the default Identifying Jurisdiction, United States Income Tax.

Search for and select a Legal Address, 500 Oracle Parkway, Redwood Shores, CA 94065.

Note

The legal address must have been entered previously using the Manage Legal Address task.

Select OK.

Optionally enter a Place of Registration.

Enter the EIN or TIN.

Enter the Legal Reporting Unit Registration Number.

Select Save and Close to navigate back to the Manage Legal Entities page.

Select Done to return to your implementation project. An issue with the done button has been fixed in 11g Release 1 (11.1.4).

In the Legal Entity choice list in the implementation project (just below the implementation project name and code), click Select and Add Legal Entity to choose the legal entity that you just created, and set the scope for the remainder of your setup.

Search for and select your legal entity from the Manage Legal Entities page.

Select Save and Close.

This sets the scope for your task list to the selected legal entity, as indicated in the Legal Entity choice list above the Tasks and Task Lists table.

A legal entity registration with the same name as that of the legal entity will be created by default. To verify this, locate the Manage Legal Entity Registrations task and then select Go to Task. To create another registration for the legal entity follow these steps:

Navigate to your implementation project from the Setup and Maintenance work area. Verify that the parent Legal Entity scope value is set correctly.

Expand the Define Legal Entities task list within the implementation project.

Select Manage Legal Entity Registrations Go to Task.

Select Create.

Enter Jurisdiction.

Enter Registered Address.

Enter Registered Name.

Optionally enter Alternate Name, Registration Number, Place of Registration, Issuing Legal Authority, and Issuing Legal Authority Address, Start Date, and End Date.

Save and Close.

When a legal entity is created, a legal reporting unit with the same name as that of the entity is also automatically created. To create more legal reporting units or modify the settings follow these steps:

Navigate to your implementation project from the Setup and Maintenance work area. Verify that the parent Legal Entity scope value is set correctly.

Select Go to Task for the Define Legal Entities task list within the implementation project.

Select Create.

Enter Territory, United States.

Enter Name.

Optionally enter a Start Date.

Note

Enter Registration Information.

Search for and select Jurisdiction.

Note

Enter Main Legal Reporting Unit information.

Select the value Yes or No for the Main Legal Reporting Unit. Set value to yes only if you are creating a new main (primary) legal reporting unit.

Enter the Main Effective Start Date, 1/1/11.

Save and Close.

A legal entity is a recognized party with rights and responsibilities given by legislation.

Legal entities have the right to own property, the right to trade, the responsibility to repay debt, and the responsibility to account for themselves to regulators, taxation authorities, and owners according to rules specified in the relevant legislation. Their rights and responsibilities may be enforced through the judicial system. Define a legal entity for each registered company or other entity recognized in law for which you want to record assets, liabilities, expenses and income, pay transaction taxes, or perform intercompany trading.

A legal entity has responsibility for elements of your enterprise for the following reasons:

Facilitating local compliance

Taking advantage of lower corporation taxation in some jurisdictions

Preparing for acquisitions or disposals of parts of the enterprise

Isolating one area of the business from risks in another area. For example, your enterprise develops property and also leases properties. You could operate the property development business as a separate legal entity to limit risk to your leasing business.

In configuring your enterprise structure in Oracle Fusion Applications, you need to understand that the contracting party on any transaction is always the legal entity. Individual legal entities own the assets of the enterprise, record sales and pay taxes on those sales, make purchases and incur expenses, and perform other transactions.

Legal entities must comply with the regulations of jurisdictions, in which they register. Europe now allows for companies to register in one member country and do business in all member countries, and the US allows for companies to register in one state and do business in all states. To support local reporting requirements, legal reporting units are created and registered.

You are required to publish specific and periodic disclosures of your legal entities' operations based on different jurisdictions' requirements. Certain annual or more frequent accounting reports are referred to as statutory or external reporting. These reports must be filed with specified national and regulatory authorities. For example, in the United States (US), your publicly owned entities (corporations) are required to file quarterly and annual reports, as well as other periodic reports, with the Securities and Exchange Commission (SEC), who enforces statutory reporting requirements for public corporations.

Individual entities privately held or held by public companies do not have to file separately. In other countries, your individual entities do have to file in their own name, as well as at the public group level. Disclosure requirements are diverse. For example, your local entities may have to file locally to comply with local regulations in a local currency, as well as being included in your enterprise's reporting requirements in different currency.

A legal entity can represent all or part of your enterprise's management framework. For example, if you operate in a large country such as the United Kingdom or Germany, you might incorporate each division in the country as a separate legal entity. In a smaller country, for example Austria, you might use a single legal entity to host all of your business operations across divisions.

Using the Enterprise Structures Configurator (ESC), you can create legal entities for your enterprise automatically, based on the countries in which divisions of your business operate, or you can upload a list of legal entities from a spreadsheet.

If you are not certain of the number of legal entities that you need, you can create them automatically. To use this option, you first identify all of the countries in which your enterprise operates. The application opens the Map Divisions by Country page, which contains a matrix of the countries that you identified, your enterprise, and the divisions that you created. You select the check boxes where your enterprise and divisions intersect with the countries to identify the legal entities that you want the application to create. The enterprise is included for situations where your enterprise operates in a country and acts on behalf of several divisions within the enterprise and is a legal employer in a country. If you select the enterprise for a country, the application creates a country holding company.

The application automatically creates the legal entities that you select, and identifies them as payroll statutory units and legal employers. For each country that you indicated that your enterprise operates in, and for each country that you created a location for, the application also automatically creates a legislative data group.

Any legal entities that you create automatically cannot be deleted from the Create Legal Entities page within the Enterprise Structures Configurator. You must return to the Map Divisions by Country page and deselect the legal entities that you no longer want.

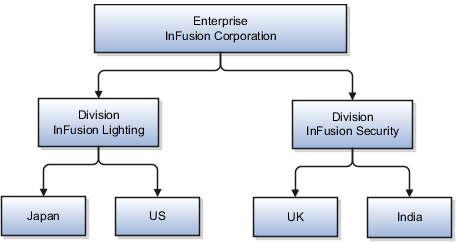

InFusion Corporation is using the ESC to set up their enterprise structure. They have identified two divisions, one for Lighting, and one for Security. The Lighting division operates in Japan and the US, and the Security division operates in the UK and India.

This figure illustrates InFusion Corporation's enterprise structure.

This table represents the selections that InFusion Corporation makes when specifying which legal entities to create on the Map Divisions by Country page.

|

Country |

Enterprise |

InFusion Lighting |

InFusion Security |

|---|---|---|---|

|

Japan |

No |

Yes |

No |

|

US |

No |

Yes |

No |

|

UK |

No |

No |

Yes |

|

India |

No |

No |

Yes |

Based on the selections made in the preceding table, the ESC creates the following four legal entities:

InFusion Lighting Japan LE

InFusion Lighting US LE

InFusion Security UK LE

InFusion Security India LE

If you have a list of legal entities already defined for your enterprise, you can upload them from a spreadsheet. To use this option, you first download a spreadsheet template, then add your legal entity information to the spreadsheet, and then upload directly to your enterprise configuration. You can export and import the spreadsheet multiple times to accommodate revisions.

Oracle Fusion Applications support the modeling of your legal entities. If you make purchases from or sell to other legal entities, define these other legal entities in your customer and supplier registers, which are part of the Oracle Fusion Trading Community Architecture. When your legal entities are trading with each other, you represent both of them as legal entities and also as customers and suppliers in your customer and supplier registers. Use legal entity relationships to determine which transactions are intercompany and require intercompany accounting. Your legal entities can be identified as legal employers and therefore, are available for use in Human Capital Management (HCM) applications.

There are several decisions that need to be considered in creating your legal entities.

The importance of legal entity in transactions

Legal entity and its relationship to business units

Legal entity and its relationship to divisions

Legal entity and its relationship to ledgers

Legal entity and its relationship to balancing segments

Legal entity and its relationship to consolidation rules

Legal entity and its relationship to intercompany transactions

Legal entity and its relationship to worker assignments and legal employer

Legal entity and payroll reporting

Legal reporting units

All of the assets of the enterprise are owned by individual legal entities. Oracle Fusion Financials allow your users to enter legal entities on transactions that represent a movement in value or obligation.

For example, the creation of a sales order creates an obligation for the legal entity that books the order to deliver the goods on the acknowledged date, and an obligation of the purchaser to receive and pay for those goods. Under contract law in most countries, damages can be sought for both actual losses, putting the injured party in the same state as if they had not entered into the contract, and what is called loss of bargain, or the profit that would have made on a transaction.

In another example, if you revalued your inventory in a warehouse to account for raw material price increases, the revaluation and revaluation reserves must be reflected in your legal entity's accounts. In Oracle Fusion Applications, your inventory within an inventory organization is managed by a single business unit and belongs to one legal entity.

A business unit can process transactions on behalf of many legal entities. Frequently, a business unit is part of a single legal entity. In most cases the legal entity is explicit on your transactions. For example, a payables invoice has an explicit legal entity field. Your accounts payables department can process supplier invoices on behalf of one or many business units.

In some cases, your legal entity is inferred from your business unit that is processing the transaction. For example, your business unit A agrees on terms for the transfer of inventory to your business unit B. This transaction is binding on your default legal entities assigned to each business unit. Oracle Fusion Procurement, Oracle Fusion Projects, and Oracle Fusion Supply Chain applications rely on deriving the legal entity information from the business unit.

The division is an area of management responsibility that can correspond to a collection of legal entities. If desired, you can aggregate the results for your divisions by legal entity or by combining parts of other legal entities. Define date-effective hierarchies for your cost center or legal entity segment in your chart of accounts to facilitate the aggregation and reporting by division. Divisions and legal entities are independent concepts.

One of your major responsibilities is to file financial statements for your legal entities. Map legal entities to specific ledgers using the Oracle Fusion General Ledger Accounting Configuration Manager. Within a ledger, you can optionally map a legal entity to one or more balancing segment values.

Oracle Fusion General Ledger supports up to three balancing segments. Best practices recommend that one of these segments represents your legal entity to ease your requirement to account for your operations to regulatory agencies, tax authorities, and investors. Accounting for your operations means you must produce a balanced trial balance sheet by legal entity. If you account for many legal entities in a single ledger, you must:

Identify the legal entities within the ledger.

Balance transactions that cross legal entity boundaries through intercompany transactions.

Decide which balancing segments correspond to each legal entity and assign them in Oracle Fusion General Ledger Accounting Configuration Manager. Once you assign one balancing segment value in a ledger, then all your balancing segment values must be assigned. This recommended best practice facilitates reporting on assets, liabilities, and income by legal entity.

Represent your legal entities by at least one balancing segment value. You may represent it by two or three balancing segment values if more granular reporting is required. For example, if your legal entity operates in multiple jurisdictions in Europe, you might define balancing segment values and map them to legal reporting units. You can represent a legal entity by more than one balancing segment value, do not use a single balancing segment value to represent more than one legal entity.

In Oracle Fusion General Ledger, there are three balancing segments. You can use separate balancing segments to represent your divisions or strategic business units to enable management reporting at the balance sheet level for each division or business unit. For example, use this solution to empower your business unit and divisional managers to track and assume responsibility for their asset utilization or return on investment. Using multiple balancing segments is also useful when you know at the time of implementation that you are disposing of a part of a legal entity and need to isolate the assets and liabilities for that entity.

Note

Implementing multiple balancing segments requires every journal entry that is not balanced by division or business unit, to generate balancing lines. Also, you cannot change to multiple balancing segments easily after you have begun to use the ledger because your historical data is not balanced by the new multiple balancing segments. Restating historical data must be done at that point.

To use this feature for disposal of a part of a legal entity, implement multiple balancing segments at the beginning of the legal entity's corporate life or on conversion to Oracle Fusion.

If you decided to account for each legal entity in a separate ledger, there is no requirement to identify the legal entity with a balancing segment value within the ledger.

Note