11g Release 1 (11.1.4)

Part Number E20374-04

Contents

Previous

Next

|

Oracle® Fusion

Accounting Hub Implementation Guide 11g Release 1 (11.1.4) Part Number E20374-04 |

Contents |

Previous |

Next |

This chapter contains the following:

Manage Subledger Accounting: Overview

Create Subledger Journal Adjustment

Review Subledger Journal Entry

In the Manage Subledger Accounting activity, you can generate journal entries for source system transactions, create adjustment entries, and review accounting results.

You can:

Create accounting for a batch of transactions by submitting an offline process.

Create manual adjustment entries.

Review generated journal entries and projected balances on views and reports.

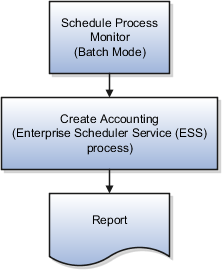

The Create Accounting process is an Enterprise Scheduler Service (ESS) process. It can be submitted as a request from the Scheduled Processes Monitor window to create journal entries for a batch of events. It has input parameters that determine the execution mode and the selection criteria for events.

The figure below shows the submission of the Create Accounting process.

The following table describes the parameters for the Create Accounting process as submitted in the Scheduled Processes Monitor window.

|

Prompt |

Description |

|---|---|

|

Subledger Application |

Source system for which the Create Accounting process is being executed. |

|

Ledger |

Ledger name for which the Create Accounting process is being executed. |

|

Process Category |

Selecting a process category indicates that all associated accounting event classes and their assigned accounting event types are selected for processing. |

|

End Date |

End date puts a filter on the selection of events. Only events having event date before the end date are selected for accounting. Defaults to SYSDATE. |

|

Accounting Mode |

Accounting mode; Draft or Final Default value is Final. |

|

Process Events |

Adds other filter criteria for the Create Accounting process to select events. All: Process all events. Errors: Process only those events that have previously been processed in error. Invalid Accounts: Process only those events that have previously been processed in error. Replace any invalid accounts with the suspense account. Default value is All. |

|

Report Style |

Users can choose to decide on the details of the report. The report can be printed in Summary,, Detail, or No report. Default value is Summary. |

|

Transfer to General Ledger |

Indicates whether the Create Accounting process should submit the Transfer to GL process; Yes, No. Default value is Yes. |

|

Post in General Ledger |

Indicates if users want to submit General Ledger posting; Yes or No. Default value is No. |

|

Journal Batch |

Batch name used by Transfer to GL to decide on the batch name for the batch created in Oracle Fusion General Ledger. When a value for the batch name is not provided, journal import defaults will be used. This is a free text field. |

|

Include User Transaction Identifiers |

Default value is No. |

When you submit the Create Accounting process, the Create Accounting Execution Report is submitted automatically upon the completion of the Create Accounting process in success or in warning status. The Create Accounting process output will contain a message with the Create Accounting Execution Report request identifier. Use this request identifier to access the execution report output.

This report can be recreated as needed by running the process, Create Accounting Report, using the request identifier of the desired Create Accounting process run previously.

If you choose to transfer the entries to Oracle Fusion General Ledger when submitting the Create Accounting process, the report indicates if accounting entries have been transferred or not transferred.

You may also run the Post Journal Entries to General Ledger process to transfer and post the journal entries to General Ledger at a later time, as a separate process. When you use this method, you can view the output of the Post Journal Entries to General Ledger process to view the summary of the transfer process.

Importing information from Oracle Fusion subledgers is done using Oracle Subledger Accounting. Posting from the subledger systems transfers data to the general ledger interface and journal entry tables.

As part of your configuration, you can specify whether the Create Accounting program is to split the creation process into multiple workers, (processors). The benefit of splitting the creation process is that accounting can be generated more efficiently with more resources allocated to complete the process. You can have multiple processors running in parallel to create the entries in a shorter period of time.

One restriction is the capacity of the hardware that is being used by the application. The more available processors, the more you are able to allocate to the create accounting program.

The decision for how many processors to use is made based upon expected volumes and the processing window, in other words, how much time is allocated to creating accounting. Accounting is often done as a nightly batch process, which has to finish by a certain time so that the systems can be available during work hours on the following day.

There are dependencies between the overall completion status of the create accounting process and the workers. In general, the parent does not update to the Completed status until all the workers successfully complete.

The process that allows transfer of subledger journal entries to general ledger uses separate processing workers that are specialized in general ledger transfer. A lightweight general ledger transfer parent process is used to distribute the workload to the workers. In order to transfer entries even faster, you can choose to have a number of parallel processing workers used for high volume general ledger transfer flow. If not specified, the corresponding accounting processors are used.

On the Manage Subledger Accounting Options page accessed from the Manage Subledger Accounting Options task from your implementation project or the Setup and Maintenance work area, select your ledger, click the pencil under System Options for Subledger Accounting to set the Processor Defaults for the Transfer to GL process.

|

Column Name |

Description |

|---|---|

|

Processing Unit Size |

Approximate batch size for high volume general ledger transfer flow. This will also be the general ledger import batch size. If not specified, the corresponding accounting processing unit size will be used. |

|

Number of Processors |

Number of parallel processing workers used for high volume general ledger transfer flow. If not specified, the corresponding accounting processes will be used. |

Note

In the Manage Subledger Accounting Options page, you can select your subledgers for each ledger or ledger set and specify the Processing Unit Size for each event class.

The diagnostic framework stores data that is used in the creation of a journal entry so that the data can be used reported to analyze accounting issues. The purpose of the process is to provide the transaction data that is referenced during accounting through accounting rules and ledger setup.

The diagnostic framework provides a tool that can be used to determine why the accounting was created in a particular way or why there are errors. Errors may occur because either the source system information or the accounting rules are not as expected.

The following examples describe typical uses of the diagnostic framework features.

In the implementation phase, you can launch the Accounting Event Diagnostic report to review the source values available in the transaction objects.

On a daily basis, you can use the Accounting Event Diagnostic report to troubleshoot exceptions.

The diagnostic framework features are as follows:

SLA: Diagnostic Enabled: This option controls whether diagnostic information is gathered by the Create Accounting program. Use with caution. Selecting this option can cause slow performance.

Diagnostic Framework Execution: When the SLA: Diagnostic Enabled option is set to Yes, the diagnostic framework is executed simultaneously with the Create Accounting process. The diagnostic framework data is stored in the diagnostic tables.

Accounting Event Diagnostic Report: To view the diagnostic framework report, users submit the Accounting Event Diagnostic process with the appropriate report parameters.

Purge Accounting Event Diagnostic Data: Purging is useful when accounting is successfully created so that the volume of information in the report does not increase to a point where it becomes unusable.

Diagnostic framework data purged:

When the data collected can be purged by running the process.

When the administrator launches the Purge Accounting Event Diagnostic Data process.

The following steps describe the diagnostic framework business process flow:

The administrator sets the SLA: Diagnostics Enabled option to Yes for the user or responsibility.

Users submit the Create Accounting program that automatically executes the diagnostic framework to populate the diagnostic tables. The diagnostic framework gathers source values and other information from the transaction objects.

Users submit the Accounting Event Diagnostic process to view the diagnostic report. Based on the information in the diagnostic report, users may determine if additional or resubmission of information from source systems is required. They may also determine if any updates to the accounting rules is required.

Users run the Create Accounting process again to generate subledger journal entries for events that had an error.

The administrator submits the Purge Accounting Event Diagnostic Data process to purge the results of the diagnostic framework.

Subledger journal entries decrease audit and reconciliation costs, because you can store transaction information directly with journal entries. Using the subledger journal entry validations for online transactions ensures that your user provides the required information in the subledger journal entry header and subledger journal entry lines. The subledger journal entries, combined with accounting rules, offer full disclosure of how the accounting was created for each subledger transaction, and provide assurance that the accounting was done correctly.

You can perform the following actions on your subledger journal entries, depending on their status:

Edit

Duplicate

Reverse

Delete

Complete

When editing a subledger journal entry, you can perform the following tasks:

Edit the journal header information, if the status is not Final.

Enter new journal lines, including accounts.

Enter the debit, and credit amounts.

Enter the accounting class.

View the impact on general ledger account balances should the entry be completed.

Post the journal.

You can also edit incomplete manual subledger journal entries.

Examples of header information which can be updated:

Ledger

Accounting date

Category

Description

Examples of journal entry line information which can be updated:

Account

Accounting class

Entered amount

Journal entry lines

Edit default currency options to be assigned to a manual subledger journal entry.

Select supporting references and assign values to them.

Edit or redefine the subledger journal entry description.

As a time saving feature, you may copy an existing entry.

The duplication feature is enabled for all existing subledger journal entries, regardless of status, and includes the ability to copy complete information required for a manual subledger journal entry header and line.

Note

All fields can be edited when a manual journal is duplicated.

You may reverse manual subledger journal entries in Final status. Reversal options are defaulted from accounting options.

Switch debit and credit

Change sign

Oracle Fusion Subledger Accounting provides the ability to delete a manual subledger journal entry that is not in Final status. The ability to delete manual journal entries ensures that users have the flexibility to correct errors without technical support.

You can complete manual subledger journal entries in Final and Post to General Ledger status.

The application enables the user to create manual subledger journal entries online.

This includes the ability to:

Enter the complete information required for a manual subledger journal entry.

Enter subledger journal entry descriptions.

Select a supporting reference and supply the supporting reference value to a subledger journal entry or subledger journal entry line.

Assign a descriptive flexfield to a subledger journal entry or subledger journal entry line.

Populate default values for an entered currency for new subledger journal entry line.

Enter default conversion type, date, and rate information to establish a default currency for the journal that is different than its associated ledger currency.

View projected balances of entered and accounted journal line amounts.

Complete and post subledger journal entries.

You may want to analyze account balances and financial results by different transaction attributes. However, transaction information such as sales representative, customer, or vendor are typically not stored in the Oracle Fusion General Ledger because of the volume of general ledger balances it would create, so you are not able to analyze general ledger data categorized by transaction attributes.

You can perform this type of reporting and analysis using supporting reference information from subledger transactions. This feature enables you to create balances based upon transaction attributes not typically stored as segments in the general ledger chart of accounts. For example, you can report on receivables balances by sales representative, customer, credit risk category, item, or any other combination of transaction attributes.

Supporting references can be used to:

Provide additional information about a subledger journal entry at the header or line level.

Establish a subledger balance for a particular supporting reference segment value.

Assist with reconciliation of account balances.

Provide for financial managerial analysis.

You can assign supporting references at either the subledger journal entry header or the subledger journal entry line.

Assigning supporting references at the subledger journal entry header level does not keep any balances.

Assigning supporting references to subledger journal entry lines enables you to maintain detailed balances, by supporting reference value, for general ledger accounts.

If third party control accounts are enabled for the application, and the account entered is a third party control account, you must enter third party information in the journal entry.

For example, if an account is defined as a third party control account with a type of Supplier, then the subledger journal entry lines which use that account must include supplier information. When a valid third party control account is assigned to a journal line, you are required to provide third party information, such as name and site.

Submit the Third Party Balances Report to display subledger balance and account activity information for suppliers and customers. The Customer or Supplier subledger third party balances will be updated when the journal is completed to a Final status.

You can create subledger journal entries by using one of two methods:

Use the Create Accounting process to process accounting events using accounting rules.

Create manual subledger journal entries.

Subledger journal entries are always created in a given subledger application context. When the subledger journal entry is complete, the appropriate sequence names and numbers are assigned, and the corresponding secondary ledger and reporting currency journal entries are created if applicable.

Manual journal entries can be entered for primary ledgers or for secondary ledgers. Manual journals for primary ledgers are automatically created only for associated reporting currencies, not secondary ledgers.

You have the ability to review subledger journal entries, whether they were created from processing accounting events, or manually entered. You may query subledger journal entries directly, or locate them via searches for journal entries with a specific status, unprocessed accounting events, or subledger journal entry lines. Advanced search functionality, including the ability to use multiple search criteria is available.

Perform an inquiry on unprocessed accounting events, subledger journal entries and subledger journal entry lines based on multiple selection criteria.

Create, edit, duplicate, reverse or delete a manual subledger journal entry

View detailed information about the subledger journal entry

View a subledger journal entry in the T-Accounts format

View transactions underlying the accounting event or the subledger journal entry

View supporting references associated with the subledger journal entry and lines

View tagged subledger journal entries or create a tag on the subledger journal entry

Use the projected balances feature to view the impact on account balances for selected subledger journal entry lines.

The projected balances flow has the following business benefits:

Creation and validation of unposted manual journal entries by providing knowledge users with immediate and relevant information about the account balances for the selected journal lines.

Validation and reconciliation of posted journal entries by providing immediate and relevant information about the account balances for the selected journal lines.

Oracle Fusion Subledger Accounting manual journal entry and Oracle Fusion General Ledger manual journal entry, approval, and inquiry pages display projected or current balances including the current journal entry line amounts. Depending on whether the journal is posted or not, the current balance (for the period of the journal) is displayed or calculated.

The projected balance region in the contextual area is display the projected balances for the account that includes the amounts of the selected journal entry line. Additionally, if more than one journal line for same account of the selected journal line exists, then the projected balance amount will include the impact from each journal line. The Period To Date, Quarter To Date, and Year To Date balances are also available.

For unposted journals, the period balance is projected by summing the current balance with the subledger journal entry line amounts

For posted journals, the opening balance and the period activity is calculated using the current balance and journal line amount

Projected balances increases accuracy when booking entries to reconcile accounts.