6. Manually Processing a Corporate Action

The corporate actions that are discussed in this chapter concern only internal funds (funds created and managed entirely in Oracle FLEXCUBE). The corporate actions that you can process for a fund are:

- Subscription

- Redemption

- Dividend Payment

This chapter contains the following sections:

6.1 Corporate Action for Funds

This section contains the following topics:

- Section 6.1.1, "Maintaining Corporate Action for Funds"

- Section 6.1.2, "Settlement Button"

- Section 6.1.3, "Events Button"

- Section 6.1.4, "Reversing a Corporate Action"

- Section 6.1.5, "Saving the Details of a Corporate Action Record"

- Section 6.1.6, "An Example in Processing Corporate Actions"

6.1.1 Maintaining Corporate Action for Funds

If you are calling a corporate action for funds record that has already been defined, choose the Summary option. From the ‘Summary’ screen double-click a class of your choice to open it. You can invoke the ‘Corporate Manual Action – Summary’ screen by typing ‘AMSCAONL’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

In cases where there are no Investor services, you would need to enter details of the corporate actions manually. You can invoke the ‘Corporate Action For Funds’ screen by typing ‘AMDCAONL’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Oracle FLEXCUBE assigns a unique reference number to each corporate action that you process. This reference number bears a sequence in which the action was performed. You can assign your own identification to the action.

Settlement Currency

The settlement of a corporate action can be in the base currency of the fund or in another currency. Depending on the type of corporate action you are processing, it could be the currency in which:

- A subscription is made to the fund

- Units of the fund are redeemed

- Dividend is paid

If the corporate action is in the base currency of the fund, choose the option ‘In Fund Currency’. If the corporate action is not in the base currency, indicate the currency in which the corporate action is settled. The equivalent of the transaction amount denominated in the base currency of the fund is displayed. The standard rate is used in the currency conversion.

Action Type

The Corporate actions that can be processed during the lifecycle of a fund are:

- Redemption

- Subscription

- Dividend payment

Choose the appropriate option based on the type of corporate action you are processing on the fund.

Basis Type

Subscription and redemption can be enlisted in two ways:

- Units (500 units of a fund)

- As Nominal (units worth USD 5000)

For a corporate action that is denominated in units it is mandatory for you to indicate the number of units involved in the action. The transaction nominal amount is calculated based on the number of units that you specify and the load applicable to the fund. Fractional units will be handled based on the rounding and decimal unit preferences that you specified for the fund.

If the basis type is nominal, you should indicate the transaction amount. The number of units allocated is calculated based on the transaction nominal, the transaction load and the NAV of a unit of the fund.

If the basis type is nominal, you should indicate the transaction nominal amount and then click the ‘RECALC’ button. The number of units allocated is calculated based on the transaction nominal, the transaction load and the NAV of a unit of the fund. If the basis type is unit then need to mention the number of units.

Transaction Details

You can specify the following details here:

Transaction Units

If the quotation basis for the corporate action is expressed in Units, you should also specify the number of units that are involved in the corporate action. Based on the number of units that you specify, the transaction nominal amount is calculated.

If the quotation basis is Nominal, Oracle FLEXCUBE calculates the number of units based on the transaction nominal and load that you specify.

Transaction Price

The transaction price of an action is the price at which a single unit of the fund is transacted. Oracle FLEXCUBE calculates the transaction price as follows:

For a subscription,

NAV + Subscription Load

For a redemption,

NAV – Redemption Load

This amount is expressed in the base currency of the fund. You can change the price that is defaulted. If you change the defaulted transaction price the other related components like the transaction load will be automatically adjusted.

Transaction Load

The load applicable to a corporate action is defaulted from the fund to which the corporate action is associated. Depending on the type of corporate action you are processing, the buy/sell load will apply. For instance, if you process:

- A subscription the buy load will apply

- A redemption the sell load will apply

You have the option to use or change the defaulted buy or sell load. If you change the defaulted transaction load amount, the other related components like the transaction price will be automatically adjusted.

Note

You can process a subscription or redemption on a fund with or without the transaction load.

Transaction Nominal

If the quotation basis for the corporate action is Nominal, you should specify the transaction amount expressed in the currency in which the action is settled. Based on the amount that you specify, the number of units is calculated.

If the quotation basis is Units, Oracle FLEXCUBE calculates the transaction nominal based on the number of units involved in the action and transaction load.

Transaction Discount or Premium

The transaction discount or premium indicates the profit or loss applicable for the corporate action you are processing.

Discount or Premium = (Transaction Price - FV per unit - Load per unit) x No of Units

It is computed as the difference between the Face value and the NAV of the Fund.

Fund Details

The following details of the fund for which you are processing corporate actions are displayed:

- The Face value per unit

- The number of units of the fund that have been issued

- The NAV of the fund

- The NAV of a single unit of the fund

6.1.2 Settlement Button

To recall, a corporate action can be settled in the fund base currency or in another currency. While processing a corporate action on a fund, you can indicate the currency in which it is to be settled.

If you specify a settlement currency that is different from the base currency, Oracle FLEXCUBE calculates the LCY equivalent of the transaction nominal in the fund base currency. The standard rate as of the transaction date of the action is used in the currency conversion.

Subscriptions and redemption can be made to a fund in a currency that is different from the base currency; but entitlement and benefits will be calculated in the fund base currency.

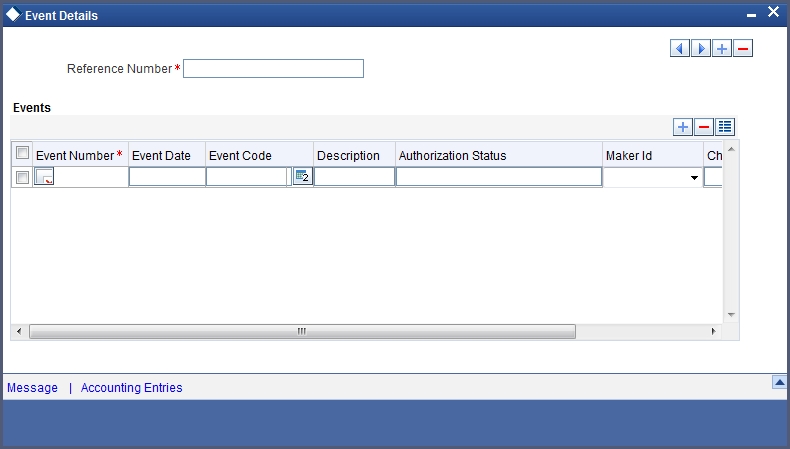

6.1.3 Events Button

Click the ‘Events’ button from the ‘Fund On-Line’ screen, to view the accounting entries that are passed for each event. The details of events that have already taken place for the deal leg will be displayed, along with the date on which the event took place.

You can specify the following details:

- Reference Number

The system displays the following details of the events associated with the specified reference number:

- Event No

- Event Date

- Event Code

- Description

6.1.3.1 Specifying Accounting Entries

Highlight the event for which you want to view accounting entries. All the accounting entries that were passed and the overrides that were encountered for the event will be displayed.

The following information is provided for each event:

- Branch

- Account

- Dr/Cr indicator

- The amount tag

- The date on which the entry was booked

- Value Date

- The deal currency

- Amount in deal CCY

- The foreign currency equivalent (if applicable)

- The exchange rate that was used for the conversion

- Amount in local currency

- All the overrides that were encountered for the event will also be displayed.

Click the ‘Exit’ or ‘Cancel’ button to return to the ‘Corporate Action For Funds’ screen.

6.1.4 Reversing a Corporate Action

After you have saved and authorized a corporate action you can reverse it. You can reverse an action from the detailed view of the ‘Corporate Actions for Funds’ screen. To reverse an action:

- Select ‘Reverse’ from the Processing sub-menu of the Actions Menu in the Application tool bar

- Click the reverse icon on the Toolbar

For a subscription

If you reverse a subscription that you have made to the fund:

- The units in issue will be reduced to reflect the subscription reversal

- The accounting entries passed for the action will be reversed with the event code RSUB.

For a redemption

- The units in issue will go up to the extent of the reversal

- The accounting entries passed for the action will be reversed with the event code RRED.

For a dividend payment

In the case of a reversal of dividend payment, the accounting entries passed for the action will be reversed.

Note

You can reverse dividend payments only for internal funds.

6.1.5 Saving the Details of a Corporate Action Record

After you have entered the applicable details of the corporate action, save the fund by either clicking on the save icon on the tool bar or by selecting ‘Save’ from the Actions menu in the Application tool bar.

On saving the record, your User Id will be displayed in the Input By field at the bottom of the screen. The date and time at which you saved the fund will be displayed in the Date/Time field.

A user bearing a different login ID should authorize a corporate action record that you have entered, before the EOD is run. Once the record is authorized, the ID of the user who authorized it will be displayed in the Auth By field together with the date and time at which it was authorized. The status of the fund is also displayed.

Click 'Exit' or 'Cancel' button to exit the ‘Corporate Actions For Funds’ screen and return to the Application Browser.

6.1.6 An Example in Processing Corporate Actions

You have set up a fund 'Lucrative Money Pool'. The following are the features of the fund:

Net Asset Value per unit = USD 200

Face Value of a Unit = USD 100

The buy load = 2%

The sell Load = 2%

Base currency = USD

Non Base currency = DEM

Rate USD - DEM = 1:2

Using this example, we will discuss each type of corporate action in terms of the manner in which the action is denominated and the currency in which it is settled.

6.1.6.1 Subscription

Specify the following details:

Units based in the fund base currency

We will first examine the case of a units based subscription made in the fund base currency. In this case, you should specify the number of units that are subscribed.

Units subscribed = 100

Based on the subscription units and the load percentage, Oracle FLEXCUBE will compute the following details:

| Component | Calculation method | Result | ||||

|---|---|---|---|---|---|---|

| Load Amount | Load % x Transaction units | 2% of NAV x 100 | 400 | |||

| Transaction Nominal | Transaction units x NAV + Load % | 100 x (200 + 4) | USD 20,400 | |||

| Transaction price | Nominal LCY / Transaction units | 20,400 / 100 | USD 204 | |||

| Premium | Transaction price - FV - Load per unit x Transaction units | 204-100 - 4 x 100 | USD 10000 |

You have the option to change the transaction price and the load amount that is defaulted. However you will not have an option to change the Transaction nominal and the premium that is calculated.

Units based in FCY

Take the case of a units based subscription that needs to be settled in a currency (DEM) other than the fund base currency (USD). In this case, you should specify the number of units that are subscribed.

Units subscribed = 100

Oracle FLEXCUBE will compute the components of the action in the same manner as discussed earlier except that the FCY equivalent of the Nominal LCY will also be computed.

You have the option to change the transaction price and the load amount that is defaulted. However you will not have an option to change the Transaction nominal, the Transaction FCY and the premium that is calculated.

| Component | Calculation method | Result | ||||

|---|---|---|---|---|---|---|

| Load Amount | Load % x Transaction units | 2% of NAV x 100 | 400 | |||

| Transaction Nominal | Transaction units x NAV + Load % | 100 x (200 + 4) | USD 20,400 | |||

| Transaction price | Nominal LCY / Transaction units | 20,400 / 100 | USD 204 | |||

| Nominal FCY | Nominal LCY x Exchange rate | 20,400 x 2 | DEM 40800 | |||

| Premium | (Transaction price - FV - Load per unit) x Transaction units | (204-100 - 4) x 100 | USD 10000 |

Nominal based in the base currency

In the case of nominal based subscription made in the fund base currency, you should specify the Transaction Nominal in the fund base currency.

Transaction Nominal = USD 20400

Based on the Nominal LCY and the load percentage, Oracle FLEXCUBE will compute the following details:

| Component | Calculation method | Result | ||||

|---|---|---|---|---|---|---|

| Units | Nominal LCY / NAV | 20000 / 200 | 100 Units | |||

| Load Amount | Load % x Transaction units | 2% of NAV x 100 | 400 | |||

| Transaction Price | Nominal LCY / Transaction units | 20,000 / 100 | USD 200 | |||

| Premium | Transaction price - FV - Load per unit x Transaction units | 200-100 x 100 | USD 10000 |

You have the option to change the transaction price and the load amount that is defaulted. However, you will not have an option to change the number of units, and the premium that is calculated.

Nominal based in an FCY

Now we will examine a subscription to a nominal based fund in FCY. In this case, you should specify the FCY Nominal that is invested into the fund.

FCY Nominal = DEM 83500

Based on the FCY Nominal and the exchange rate, Oracle FLEXCUBE computes the following details:

| Component | Calculation method | Result | ||||

|---|---|---|---|---|---|---|

| Transaction Nominal | Exchange rate | 83500 / 2 | USD 41750 | |||

| Units | Transaction Nominal / NAV | 41750 / 200 | 208.75 Units | |||

| Load Amount | Load % x Transaction units | 2% of NAV x 208.75 | USD 835 | |||

| Transaction Price | Nominal LCY / Transaction units | USD 41750 / 208.75 Units | USD 200 | |||

| Premium | NAV- FV x Transaction units | 200-100 x 208.75 | USD 20875 |

You have the option to change the transaction price and the load amount that is defaulted. However you will not have an option to change the number of units, the LCY Nominal and the premium that is calculated.

6.1.6.2 Redemption

Specify the following details.

Units based in the fund base currency

We will first examine the case of units based redemption made in the fund base currency. In this case, you should specify the number of units that are redeemed.

Units redeemed = 100

Based on the number of units that are redeemed and the redemption load percentage, Oracle FLEXCUBE will compute the following details:

| Component | Calculation method | Result | ||||

|---|---|---|---|---|---|---|

| Load Amount | Load % x No of units subscribed | 2% of NAV x 100 | 400 | |||

| Transaction Nominal | No of Units x NAV + Load % | 100 x (200 - 4) | USD 19600 | |||

| Transaction price | Nominal LCY / No of Units | 19600 / 100 | USD 196 | |||

| Premium | NAV- FV X Transaction units | 200-100 x 100 | USD 10000 |

You have the option to change the transaction price and load that is defaulted. However you will not have an option to change the Nominal LCY and the premium that is calculated.

Units based in FCY

Take the case of units based redemption in a currency (DEM) other than the fund base currency (USD). In this case, you should specify the number of units that are redeemed.

Units redeemed = 100

Oracle FLEXCUBE will compute the components of the action in the same manner as discussed earlier for the units based redemption in fund base currency, except that the FCY equivalent of the Transaction nominal will also be calculated.

| Component | Calculation method | Result | ||||

|---|---|---|---|---|---|---|

| Load Amount | Load % x Transaction units | 2% of NAV x 100 | 400 | |||

| Nominal LCY | Transaction units x NAV - Load % | 100 x (200 - 4) | USD 19,600 | |||

| Transaction price | Nominal LCY / Transaction units | 19600 / 100 | USD 196 | |||

| Nominal FCY | Nominal LCY x Exchange rate | 19600 x 2 | DEM 39200 | |||

| Premium | (NAV- FV) x Transaction units | (200-100) x 100 | USD 10000 |

You have the option to change the transaction price and the load amount that is defaulted. However you will not have an option to change the Nominal LCY, FCY and the premium that is calculated.

Nominal based in the base currency

In the case of nominal based redemption in the fund base currency, you should specify the Transaction Nominal.

Nominal LCY = USD 20000

Based on the Nominal LCY and the load percentage, Oracle FLEXCUBE will compute the following details:

| Component | Calculation method | Result | ||||

|---|---|---|---|---|---|---|

| Units | Nominal LCY / NAV | 20000 / 200 | 100 Units | |||

| Load Amount | Load % x No of units subscribed | 2% of NAV x 100 | 400 | |||

| Transaction Price | Nominal LCY / No of Units | 20,400 / 100 | USD 204 | |||

| Premium | (NAV- FV) x No of units | (200-100) x 100 | USD 10000 |

You have the option to change the transaction price and the load amount that is defaulted. However you will not have an option to change the number of units, and the premium that is calculated.

Nominal based in FCY

Now we will examine redemption made from a nominal based fund in FCY. In this case, you should specify the number of units that are subscribed.

FCY Nominal = 83500 DEM

Based on the FCY Nominal and the exchange rate, Oracle FLEXCUBE computes the following details:

| Component | Calculation method | Result | ||||

|---|---|---|---|---|---|---|

| Nominal LCY | Exchange rate | 83500 / 2 | USD 41750 | |||

| Units | Nominal LCY / NAV | 41750 / 200 | 208.75 Units | |||

| Load Amount | Load % x No of units subscribed | 2% of NAV x 208.75 | USD 835 | |||

| Transaction Price | Nominal LCY / No of Units | USD 41750 / 208.75 Units | USD 200 | |||

| Premium | NAV- FV x No of units | 200-100 x 208.75 | USD 20875 |

You have the option to change the transaction price and the load amount that is defaulted. However you will not have an option to change the number of units, the Transaction nominal and the premium that is calculated.

6.1.6.3 Dividend Payment

Specify the following details:

Units based in the fund base currency

We will first examine the case of a dividend payment made in the fund base currency. In this case, you should specify the percentage of dividend to be paid.

Transaction price = 30% per unit

The percentage that you specify is always based on the face value of a unit of the fund. Based on this percentage, Oracle FLEXCUBE will compute the following details:

| Component | Calculation method | Result | ||||

|---|---|---|---|---|---|---|

| Transaction Nominal | Transaction price x Transaction units | 30 x 100 | USD 3000 |

The number of units that have been issued for the fund is taken to be the default number of units for which dividend is paid. You have the option to change it. If you change the number of units for which dividend is to be paid the transaction nominal is automatically updated.

Units based in FCY

Take the case of units based dividend that needs to be paid in a currency other than the fund base currency (USD). In this case, you should specify the percentage of dividend to be paid.

Transaction price = 30% per unit

Oracle FLEXCUBE will compute the components of the action in the following manner:

| Component | Calculation method | Result | ||||

|---|---|---|---|---|---|---|

| Transaction Nominal | Transaction price x No of Units | 100 x 30 | USD 3000 | |||

| Nominal FCY | Transaction Nominal x Exchange rate | 3000 x 2 | DEM 6000 |

The number of units that have been issued for the fund is taken to be the default number of units for which dividend is paid. You have the option to change it. However you will not have an option to change the Transaction nominal and the Transaction FCY that is calculated.

Nominal based in the base currency

In the case of nominal based dividend paid in the fund base currency, you should specify the dividend amount paid for each unit.

Transaction Price = USD 15

Based on the Nominal LCY and the load percentage, Oracle FLEXCUBE will compute the following details:

| Component | Calculation method | Result | ||||

|---|---|---|---|---|---|---|

| Transaction Nominal | Transaction price x Transaction Units | 15 x 100 | USD 15000 |

You have the option to change the transaction units that is defaulted. However you will not have an option to change the Transaction nominal that is calculated.

Nominal based in FCY

Take the case of dividend being paid in a currency (DEM) other than the fund base currency (USD). In this case, you should specify the amount of dividend to be paid.

Transaction price = 15 USD per unit

Oracle FLEXCUBE will compute the components of the action in the following manner:

| Component | Calculation method | Result | ||||

|---|---|---|---|---|---|---|

| Transaction Nominal | Transaction price x No of Units | 100 x 15 USD | USD 1500 | |||

| Nominal FCY | Transaction Nominal x Exchange rate | 1500 x 2 | DEM 3000 |

The number of units that have been issued for the fund is taken to be the default number of units for which dividend is paid. You have the option to change it. However, you will not have an option to change the Transaction nominal and the Transaction FCY that is calculated.