11. Processing of Non SWIFT Incoming Payment Messages

11.1 Introduction

One of the most important features of the Funds Transfer module of Oracle FLEXCUBE is the facility of processing incoming payment messages to their logical end without manual intervention. Even though the term Straight Through Processing (STP) refers to the processing of all sorts of incoming messages (without manual intervention), in this chapter, the term refers to STP of non SWIFT incoming Payment Messages alone.

The Common Payment Gateway infrastructure is used to upload data into FT and PC modules from sources that supply the data in a non SWIFT Format. Such non SWIFT sources will populate a single Oracle FLEXCUBE Upload data structure. Subsequently you can define rules to determine the module to which the uploaded contract belongs viz. PC or FT.

11.2 Common Payment Gateway Message Parameters

This section contains the following topics:

- Section 11.2.1, "Maintaining Common Payment Gateway Message Parameters"

- Section 11.2.2, "Maintaining Common Payment Gateway Messages"

- Section 11.2.3, "Viewing Payment Gateway Browser"

- Section 11.2.4, "Viewing ‘Main’ Tab Details"

- Section 11.2.5, "Viewing Settlement Details"

- Section 11.2.6, "Viewing ‘Additional’ Tab Details"

- Section 11.2.7, "Viewing ‘Other Details’ Tab"

- Section 11.2.8, "Maintaining ‘Other Details1’ Tab"

- Section 11.2.9, "Viewing Incoming File Details"

11.2.1 Maintaining Common Payment Gateway Message Parameters

For non SWIFT, incoming, payment message processing of uploaded funds transfer contracts, you would need to maintain all the reference information that you would typically maintain for normal funds transfer contracts, maintenances specific to straight through processing and a few other parameters which are specific to non SWIFT incoming payment message processing.

The basic information to be set up before the Common Payment Gateway message becomes operational can be broadly classified under:

- FT Product Maintenance

- Settlement Instructions Maintenance

- BIC Directory Maintenance

- Messaging Maintenance

- Media Maintenance

- Queue Maintenance

- Customer address maintenance

- Message Format Maintenance

- Product-Queue Message Type Mapping Maintenance

- STP Error Codes Maintenance (User Defined Error Codes)

- STP Rule Maintenance

- Branch-level STP Preferences

- Upload Source Preferences Maintenance

- External Account Maintenance (Reconciliation sub-system) Maintenance

- Overrides Maintenance

Maintenances specific to Non SWIFT Incoming Payment Messages

- Maintaining Common Payment Gateway Message

- Capturing preferences specific to common payment gateway messages

- Maintaining Labels for the user defined fields for common payment gateway messages

11.2.2 Maintaining Common Payment Gateway Messages

You can invoke the ‘Common Payment Gateway Messages’ screen by typing ‘MSDCOMPT

’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

In the Common Payment Gateway Message Type screen, you have to maintain the following information:

Message Type

Specify the message type applicable for Common Payment Gateway Processing.

For more details on SEPA transactions, refer section ‘Handling SEPA Credit Transfers and Direct Debits’ in the chapter ‘Processing a Payment or Collection Transaction’ in Payment and Collections User Manual.

Description

Enter a brief description of the message type maintained.

11.2.2.1 Queues Maintenance

For more information about the Queues Maintenance screen, refer the STP chapter of this module.

11.2.2.2 Mapping Message Types to Products and Queues

For more information on Mapping Message Types to Product and Queues, refer the STP chapter of this module.

11.2.2.3 Maintaining Branch-Level STP Preferences

For more information on Maintaining Branch level STP preferences, refer the STP chapter of this module.

11.2.2.4 STP Rule Maintenance

For more information on STP Rule Maintenance, refer the STP chapter of this module.

11.2.2.5 Maintaining Error Codes

For more information on Error Code Maintenance, refer the STP chapter of this module.

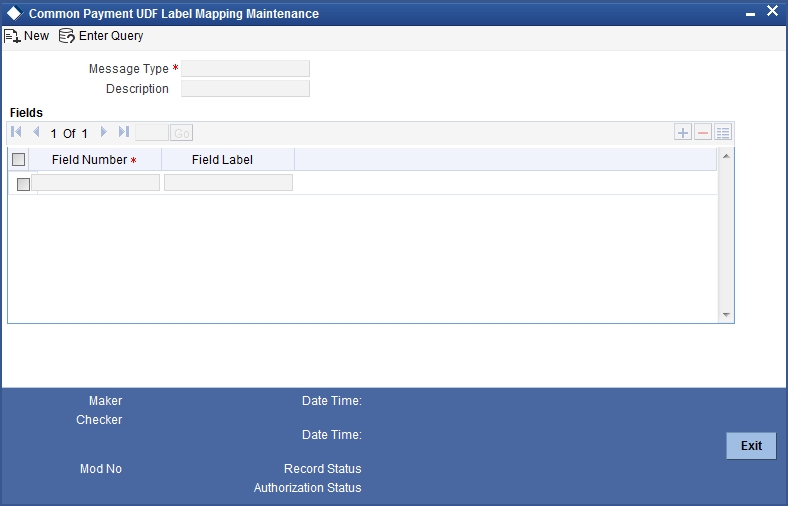

11.2.2.6 UDF Label Maintenance

You can maintain labels for the thirty user defined fields of Common Payment Gateway messages in the UDF Label Mapping screen. You can invoke the ‘Common Payment UDF Label Mapping Maintenance’ screen by typing ‘MSDCPGUD’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You need to maintain the following information:

Message Type

Choose the message for which you need to maintain a label. Select the appropriate one from the adjoining option list.

Description

This will display a brief description of the chosen message type.

Field Number

Enter a UDF serial number ranging between one and thirty.

Field Label

Specify the label you wish to assign for the UDF. This label will be populated in the Common Payment Message Browser screen.

11.2.2.7 Maintaining Common Payment Gateway Message Type Preferences

You can maintain the details of the amendable fields for a common payment gateway message type in the Common Payment Gateway Message Type Preferences screen. You can invoke the ‘Common Payment Message Type Preference Maintenance’ screen by typing ‘MSDPMTPR’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The following details need to be maintained:

Message Type

Choose the message type for which maintenance has to be performed. The adjoining option list displays all valid message types for the chosen source will be available for selection.

Message Description

Enter a brief description of the message type maintained.

For more details on SEPA transactions, refer section 'Handling SEPA Credit Transfers and Direct Debits' in the chapter 'Processing a Payment or Collection Transaction' in Payment and Collections User Manual.

11.2.3 Viewing Payment Gateway Browser

The Payment Gateway Browser acts as the repository of all common payment gateway transactions.

You can invoke the ‘Common Payment Message Browser Summary’ screen by typing ‘MSSPMBRW’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can set certain filters as follows for viewing the details on this screen:

- Authorization Status

- File Reference Number

- Version Number

- Source Code

- Record Status

- External Reference

- Branch Code

Once you have set the filters you want, click ‘Search’ button to view the payment summary.

The screen will display a summarized version of the upload instructions and will contain the following details:

- Authorization Status

- Record Status

- File Reference Number

- External Reference

- Version Number

- Branch Code

- Message Type

- Source Code

- Queue

- Amount

- Value Date

- Currency

- Status

- Error Reason

- Contract Reference

- Message Reference

- Message Name

- Message Creation Date

You can do the following operations in the Common Payments Gateway Browser:

- Unlock -

- This operation will allow amendment of contract details in the CPG browser. The fields allowed for amendment will be based on the field list maintained in the Message Type preferences maintenance.

- The contracts in the repair status can be amended and a new version with the changes will be created with status as ‘Unprocessed’.

- The unauthorized contracts can be changed and the latest version of the contract will be updated with the changes.

- Delete –

- This operation will allow deletion of contracts from the CPG browser. Only unauthorized contracts will be allowed for deletion.

- Close –

- The contracts in the repair status can be rejected in the common payments gateway message browser.

- On rejection the status of the message will be marked as rejected and reject message will be generated if the same is specified in the message type maintenance.

- This operation will create a new version with the status change and should be authorized.

- No further operation will be allowed on contracts with status ‘Rejected’

- The following reject messages will be generated in the Common Payments Gateway browser on reject operation -

- Customer payment status report – (pain.002.001.02) for customer initiated payments and direct debits.

- Reject payment status Report – (pacs.002.001.02) for indirect participants outgoing payments and outgoing direct debits.

- Re-open –

- This operation will mark the queue status as ‘Waiting for queue exchange’.

- This can be done only on contracts with status as ‘Repair’.

- This operation will create a new version with status as ‘Waiting for Queue Exchange’ and needs to be authorized.

- Authorize –

- This operation will authorize an unauthorized contract.

- Contracts that are repaired or closed or reopened need to be authorized.

You can query for common payment messages with different criteria by clicking the ‘Search’ button.

To get a detailed view of an upload instruction, click the ‘View’ button. It invokes the Common Payment Message Browser screen.You can also invoke this screen by typing 'MSDPMBRW' in the field at the top right corner of the application toolbar and clicking the adjoining arrow button..

The following details pertaining to an upload transaction will be displayed in the Common Payment Message Browser screen:

Source Code

The source code is defaulted from the upload instruction and cannot be overridden by you during the edit operation.

Queue

The system displays the queue number of the transaction. This number is generated by the system based on the rule definition for a source. You cannot override it during the edit operation.

Currency

The currency of the customer’s account will be displayed here.

This is defaulted from the original instruction and you can modify this during edit operation if it has been defined as ‘amendable’ in the maintenance.

Amount

The transaction amount will be displayed here.

This is defaulted from the original instruction and you can modify this during edit operation if it has been defined as ‘amendable’ in the maintenance.

External Reference

The system defaults the external reference number of the source from which the contract has been uploaded.

Value Date

The value date of the transaction will be displayed here.

This is defaulted from the original instruction and you can modify this during edit operation if it has been defined as ‘amendable’ in the maintenance.

Instruction Date

The system displays the instruction date.

Message Type

Specify the message type applicable for Common Payment Gateway Processing.

Status Movement

The transaction status viz. Processed, Repair, Unprocessed, Waiting for Queue is system generated and you cannot override it during the edit operation.

Error Reason

This will display the reason for the error if any. You cannot override this value during the edit operation.

Contract Reference

This system generates and displays the unique reference number which is used to identify the contract. It is generated automatically and sequentially.

Version

This will display the version number of the change. If there are no changes, the version number will be 1 and for every change hence, it will be incremented with an audit trail.

11.2.4 Viewing ‘Main’ Tab Details

The following details of the transaction are displayed in the ‘Main’ tab of the Common Payment Message Browser screen and can be modified if you have defined it as an ‘amendable’ field in the Message Type Maintenance.

- Customer Account Number

- Customer Currency

- Customer Value Date

- Customer Amount

- Customer Bank Code

- Exchange Rate

- Remarks

- Counterparty Account Number

- Counterparty Currency

- Counterparty Value Date

- Counterparty Amount

- Message Reference Number

- Message name

- Message Creation Date

- File Reference Number

- Service Identification

- File Type

- Customer consolidation required

- Reject Code which will display the reject code

- Reject Details

- Reference Number

- Originator Name

- Originator Bank

- Reject Code Additional

- Debtor Reference Party

- Creditor Reference Party

- Bank Operation Code

- Instruction Code

- Service ID

- UDF Details

Bank Name

Specify the Bank name of the customer.

Bank Address 1

Specify the address of the customer's bank name specified.

Bank Address 2

Specify the address of the customer's bank name specified.

The field is a display field that indicates that the message received is a reject message.

The routines for the Payment Status Report (Pacs.002) upload into CPG layer will be changed to enable the 'Reject Message'.

The routines for all other file upload, except Payment Status Report file into CPG layer will be changed to disable 'Reject Message'

11.2.5 Viewing Settlement Details

The following details of the transaction are displayed in the 'Settlement' tab of the screen:

- By Order Of

- Our Correspondent Account

- Receiver Correspondent

- Intermediary

- Beneficiary Institution

- Payment Schedules

- Send to Receiver Information

Account with Institution

The system displays the counterparty Bank name and address details here from the message tags of an incoming message, during the upload process.

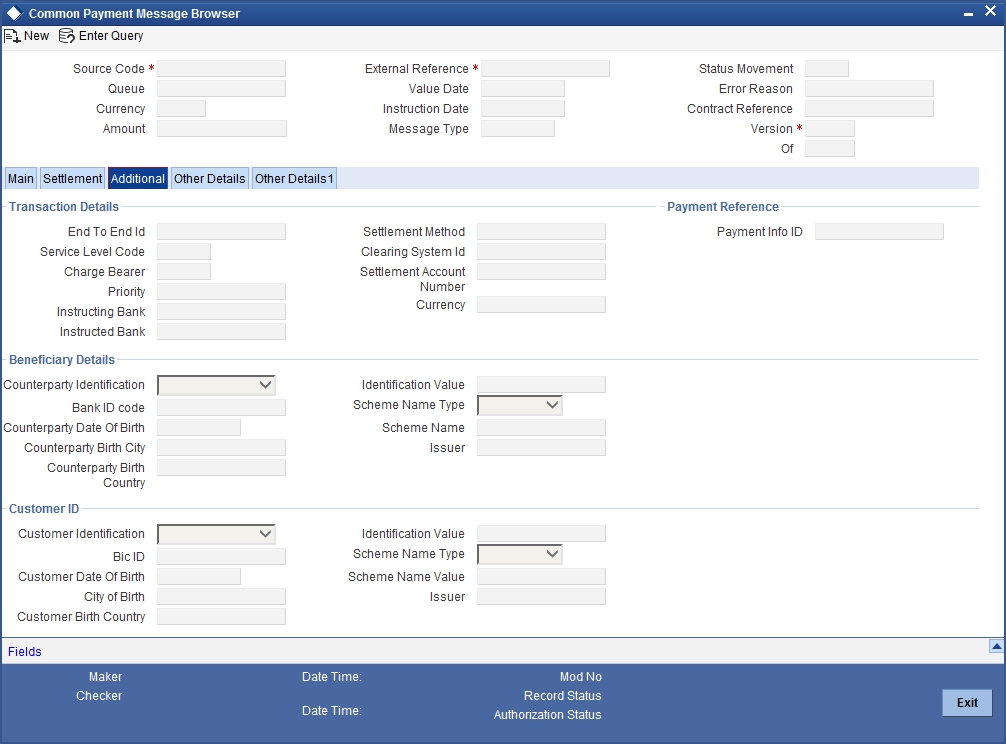

11.2.6 Viewing ‘Additional’ Tab Details

The following details of the transaction are displayed in the ‘Additional’ tab of the Common Payment Message Browser screen.

Note

You can amend most of the below mentioned fields if you have defined it as an ‘amendable’ field in the message type maintenance.

11.2.6.1 Viewing Transaction Details

Charge Bearer

This indicates which party will bear the charges associated with payment. This will always have the value ‘SLEV’ for SCT and SDD.

Service Level Code

This indicates the service level rules under which the transaction should be processed.

Priority

This indicates the processing priority of the transaction.

End to End Id

This indicates the unique reference assigned by the initiating party for end to end identification of the transaction.

Instructing bank

This indicates the bank sending the transaction. You cannot modify this field.

Instructed bank

This indicates the bank receiving the transaction. You cannot modify this field.

Settlement Method

This indicates the method used to settle the transactions. You cannot modify this field.

Settlement Account Number

This indicates the settlement account used for the message bulk. This is applicable only for settlement method INDA or INGA.

Clearing System Id

This indicates the identification code of the clearing system. This is applicable only for settlement method ‘CLRG’. You cannot modify this field.

Currency

This indicates the settlement currency used for the message bulk. This is applicable only for settlement method INDA or INGA.

11.2.6.2 Specifying Payment References

Payment Info ID

Indicates the unique identification, as assigned by the sending party, to unambiguously identify the payment information group (or reversed payment information group) within the message.

This field maps to field Payment Info ID of Common Payment Gateway.

Viewing Beneficiary Details

Counterparty Identification Type

This indicates the identification type of the creditor.

CounterParty BIC ID

Specify the Bank Identification Code for the CounterParty.

Counterparty Identification Value

This indicates the identification value for the type selected.

CounterParty Date of Birth

Specify the Date Of Birth of the CounterParty.

Counterparty Birth City

This indicates the beneficiary's city of birth.

Counterparty Birth Country

This indicates the beneficiary's country of birth.

CounterParty Scheme NameType

Specify the Identification Scheme Type of the CounterParty.

The valid values are:

- C - Code

- P - Proprietary.

CounterParty SchemeName

If SchemeName type is C then select the SchemeName from the values mentioned in the LOV depending on Organization Identification or Private Identification.

If SchemeName type is P then enter the SchemeName your own which can contain free format text and should of length 35

11.2.6.3 Viewing Customer Identification

Customer Identification Type

This indicates the identification type of the Debtor.

Customer ID Value

This indicates the identification value for the type selected.

Customer BIC ID

Specify the Bank Identification Code for the Customer.

Customer Scheme Name Type

If Scheme Name type is C then select the Scheme Name from the values mentioned in the LOV depending on Organization Identification or Private Identification.

If Scheme Name type is P then enter the Scheme Name your own which can contain free format text and should of length 35.

Issuer

This indicates the identification issuer of the debtor.

Customer Date of Birth

Specify the Date Of Birth of the customer.

Customer Birth City

This indicates the customer’s city of birth.

Customer Birth Country

This indicates the customer’scountry of birth

11.2.7 Viewing ‘Other Details’ Tab

The following details of the transaction are displayed in the ‘Other Details’ tab of the ‘Common Payment Message Browser’ screen.

11.2.7.1 Viewing Initiation Party Details

Initiating Party Name

This indicates the name of the initiating party.

Initiating Party Address Line 1

This Indicates address line1 (like the Door No., street name etc) of the initiating party

Initiating Party Address Line 2

This indicates address line2 (like the Location etc) of the initiating party.

Initiating Party Country

This indicates the country code of the initiating party.

Initiating Party Type

This indicates the initiating party identification as Organization Id or Private Id.

Initiating Party Id Type

This indicates the identification type of the initiating party.

Initiating Party Id Value

This indicates the identification value for the type selected.

Initiating Party Other Id Type

This indicates the type of other identification details.

Initiating Party Id Issuer

This indicates the Identification Issuer of the initiating party.

Initiating Party Birth City

This indicates the initiating party’s city of birth.

Initiating Party Birth Country

This indicates the initiating party’s country of birth.

11.2.7.2 Viewing Original Message Details

Original Message Name

This indicates the name identifier of the original message bulk. This is applicable only for payment return/refund and payment status report. You cannot modify this value.

Message Reference Number

This indicates the reference number of the original message bulk. This is applicable only for payment return/refund and payment status report. You cannot modify this value.

Original Source Reference

This indicates source reference number of the original transaction. You cannot modify this field.

Original Settlement Date

This indicates the original settlement date of the rejected/recalled transaction. You cannot modify this value.

Original Settlement Amount

This indicates the original settlement amount of the rejected/recalled transaction. You cannot modify this value.

Original Settlement Currency

This indicates the currency of the rejected/recalled transaction. You cannot modify this value.

11.2.7.3 Viewing Mandate Details

Mandate ID

This indicates the reference of the direct debit mandate that has been signed by the debtor and the creditor. You cannot modify this value.

Mandate Signature Date

This indicates the date on which the direct debit mandate has been signed by the debtor. You cannot modify this value.

Mandate Amendment Indicator

This indicates if the mandate has been amended or not. You cannot modify this value.

Mandate Amendment Type

Indicates type of the mandate amendment.

Original Mandate ID

This indicates the mandate ID of the original mandate if the original mandate is amended. You cannot modify this value.

Sequence Type

This indicates the direct debit sequence. The valid values are -

- FNAL - Final

- FRST - First

- OOFF - One Off collection

- RCUR - Recurring

You cannot modify this value.

Original Debtor Bank

This indicates the original debtor bank. You cannot modify this field.

Original Debtor Account

This indicates the original debtor bank. You cannot modify this field.

11.2.7.4 Viewing Recall Message Details

The following recall message details are maintained here:

Cancellation Status Identification

The system defaults the unique identifier of a cancellation request, for incoming Camt.029.001.03 message.

Additional Recall Information

Specify additional recall information, if any.

Recall Reason

Specify the reason for recall.

11.2.7.5 Mapping between Common Payment Gateway Fields and FT Fields

| Common Payment Gateway Field Name | FT Field Name | ||

|---|---|---|---|

| Source Code | Source Code | ||

| Source Reference | Source Reference, User Reference | ||

| Customer Account Branch | If FT type is “O” or “N”, then it is Dr Account Branch, else it is Cr Account Branch | ||

| Customer Account Number | If FT type is “O” or “N”, then it is Dr Account Number, else it is Cr Account Number | ||

| Customer Currency | If FT type is “O” or “N”, then it is Dr Currency, else it is Cr Currency | ||

| Value Date | If FT type is “O” or “N”, then it is Dr Value Date, else it is Cr Value Date | ||

| Amount | If FT type is “O” or “N”, then it is Dr Amount, else it is Cr Amount | ||

| Exchange Rate | Exchange Rate | ||

| Counterparty Account Branch | If FT type is “I”, then it is Dr Account Branch, else it is Cr Account Branch | ||

| Counterparty Account Number | If FT type is “I”, then it is Dr Account Number, else it is Cr Account Number | ||

| Counterparty Currency | If FT type is “I”, then it is Dr Currency, else it is Cr Currency | ||

| Counterparty Value Date | If FT type is “I”, then it is Dr Value Date, else it is Cr Value Date | ||

| Amount | If FT type is “I”, then it is Dr Amount, else it is Cr Amount | ||

| By Order Of | By Order Of | ||

| Our Correspondent Account | Our Correspondent Account | ||

| Our Correspondent | Our Correspondent | ||

| Receiver’s Correspondent | Receiver’s Correspondent | ||

| Account With Institution | Account With Institution | ||

| Beneficiary Account | Beneficiary Line 1 | ||

| Beneficiary | Beneficiary | ||

| Bank Operation Code | Bank Operation Code | ||

| Instruction Code | Instruction Code | ||

| Related Reference | Not Mapped | ||

| Reject Code | Not Mapped | ||

| Reject Detail | Not Mapped |

11.2.7.6 Common Payments Gateway Message Upload

Common Payments Gateway Messages upload will process the payment as an instrument if an instrument type is linked as the product. In such a case, the instruments data store is populated based on the mappings mentioned above and the system shall invoke the instruments routine to upload the instrument record.

The upload of instruments with the following status will be through the common payments gateway – INIT, LIQD, CNCL and LOST. The other operations of upload will include reversal and amendment of issued drafts.

11.2.8 Maintaining ‘Other Details1’ Tab

You can maintain the following details of the SEPA transaction in the ‘Other Details1’ tab of the ‘Common Payment Message Browser’ screen.

11.2.8.1 Maintaining Ultimate Debtor Identification Details

Id

Select the identification code of the ultimate debtor from the drop-down list. Following are the options available in the drop-down list:

- Organization Identification

- Private Identification

Initiating Party Id Type

Specify the identification type of the ultimate debtor from the option list.

Id Value

Specify the identification value of the ultimate debtor.

Other Id Type

Specify the identification type of other identification specified for the ultimate debtor.

Customer Id Issuer

Specify the other identification type issuer of ultimate debtor.

Counterparty Birth City

Specify the city of birth of ultimate debtor.

Counterparty Birth Country

Specify the country of birth of ultimate debtor.

11.2.8.2 Maintaining Ultimate Creditor Identification Details

Id

Select the identification code of the ultimate creditor from the drop-down list. Following are the options available in the drop-down list:

- Organization Identification

- Private Identification

Id Type

Specify the identification type of the ultimate creditor from the option list.

Id Value

Specify the identification value of the ultimate creditor.

Other Id Type

Specify the identification type of other identification specified for the ultimate creditor.

Counterparty Identification Issuer

Specify the other identification type issuer of ultimate creditor.

Counterparty Birth City

Specify the city of birth of ultimate creditor.

Counterparty Birth Country

Specify the country of birth of ultimate creditor.

11.2.8.3 Maintaining Purpose Details

Category Purpose

Specify the purpose of the credit transfer from the option list.

Purpose Type

Select the purpose type of the credit transfer from the drop-down list. Following are the options available in the drop-down list:

- Proprietary

- Code

Purpose Value

Specify the purpose value of the credit transfer.

Local Instrument Type

Select the local instrument type from the drop-down list. Following are the options available in the drop-down list:

- Proprietary

- Code

Local Instrument Value

Specify the local instrument value.

Electronic Signature

Specify the electronic signature of the debtor.

Compensation Currency

Specify the currency of the compensation amount that the debtor bank has to receive from the option list.

Note

It should always be Euro (EUR)

Compensation Amount

Specify the amount that the debtor bank has to receive from the creditor bank.

Note

It should always be Euro (EUR)

11.2.8.4 Maintaining Creditor Scheme Details

Id

Select the scheme identification code of the creditor from the drop-down list. Following are the options available in the drop-down list:

- Private Identification

Scheme Id Type

Specify the scheme identification type of the creditor from the option list.

Scheme Id Value

Specify the scheme identification value of the creditor.

Scheme Type

Specify the scheme type of the creditor.

11.2.8.5 Maintaining Original Creditor Scheme Details

Id

Select the scheme identification code of the original creditor from the drop-down list. Following are the options available in the drop-down list:

- Private Identification

Name

Specify the name of the original creditor.

Id Type

Specify the scheme identification type of the original creditor from the option list.

Id Value

Specify the scheme identification value of the original creditor.

Scheme Type

Specify the scheme type of the original creditor.

11.2.9 Viewing Incoming File Details

You can view the details of incoming files received by Oracle FLEXCUBE using ‘Payment Gateway - Incoming File Details’ screen. To invoke this screen, type ‘PCSSINFD’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

You can search for the incoming files based on one of more of the following parameters:

- Service type, whether FT or PC

- File reference

- Sender of the file

- Whether customer consolidation required or not

Once you have specified the search parameters, click ‘Search’ button. The system displays the following details of the incoming files that match with the search criteria.

- Service type

- File reference

- File type

- File date

- Sender

- Receiver

- File business date

- File cycle

- Rounding indicator

- Original reference

- Original file name

- File reject code

- Total instrument bulks

- File status

- Error code

- Error parameters

- Customer consolidation required or not