2. Istisna Corporate Islamic Financing

Oracle FLEXCUBE facilitates Corporate Islamic Financing through a process flow. Istisna' is a sale transaction where a commodity is transacted before it comes into existence. The price in Istisna' does not necessarily need to be paid in full in advance. It is not even necessary to pay the full price at delivery. It can be deferred to any time according to the agreement of the parties. The payment may also be made in instalments.

This chapter contains the following topics:

- Section 2.1, "Process Flow Diagram"

- Section 2.2, "Process Matrix"

- Section 2.3, "Stages in Corporate Islamic Financing Process Flow"

- Section 2.4, "Corporate Islamic Financing Application Details"

- Section 2.5, "Manual Liquidation"

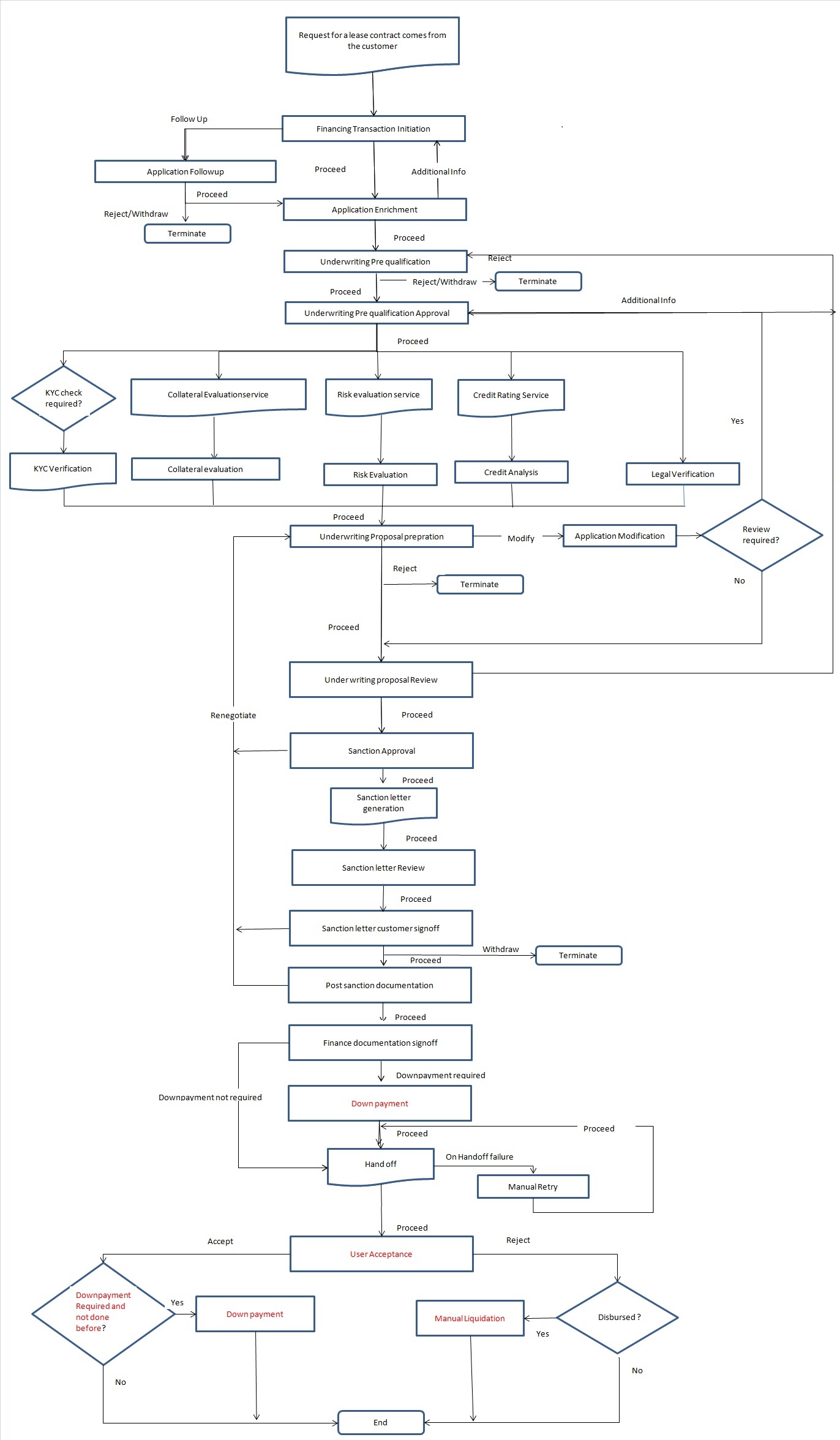

2.1 Process Flow Diagram

The process flow diagram given below illustrates the activities carried out during various stages of Corporate Islamic Financing.

2.2 Process Matrix

The process matrix given below lists out the different stages, condition to move to next stage, target stage and remarks for each condition.

Sl. No |

Source stage |

Rules / Conditions for the flow Movement |

Target stage |

Remarks |

1 |

Financing transaction initiation |

outcome = "PROCEED" |

Application Enrichment |

Instance is moved to ‘Application Enrichment’ stage, when the user selects the outcome "PROCEED" and saves the task. |

outcome = "FOLLOW UP" |

Application Follow up |

Instance is moved to ‘Application Follow up’ stage, when the user selects the outcome “FOLLOW UP" and saves the task. |

||

2 |

Application Follow up

|

outcome = "PROCEED" |

Application Enrichment |

Instance is moved to ‘Application Enrichment’ stage, when the user selects the outcome "PROCEED" and saves the task. |

outcome = "REJECT" |

Terminate |

Instance will be terminated when the user selects the outcome "REJECT" and saves the task. |

||

3 |

Application Enrichment

|

outcome = "PROCEED" |

Underwriting Pre-qualification |

Instance is moved to ‘Underwriting Pre-qualification’ stage, when the user selects the outcome "PROCEED" and saves the task. |

outcome = "RETURN" |

Financing transaction initiation |

Instance is moved to ‘Financing transaction initiation’ stage, when the user selects the outcome "RETURN" and saves the task. |

||

4 |

Underwriting Pre-qualification

|

outcome = "PROCEED" |

Underwriting Pre-qualification Approval |

Instance is moved to ‘Underwriting Pre-qualification Approval’ stage, when the user selects the outcome "PROCEED" and saves the task. |

outcome = "REJECT" |

Terminate |

Instance will be terminated when the user selects the outcome "REJECT" and saves the task. |

||

5 |

Underwriting Pre-qualification Approval |

outcome = "PROCEED" and if Risk evaluation is required |

Risk evaluation |

Instance is moved to ‘Risk evaluation’ stage, when the user selects the outcome "PROCEED" and saves the task. |

outcome = "PROCEED" and if Legal Verification is required |

Legal Verification |

Instance is moved to ‘Legal Verification’ stage, when the user selects the outcome "PROCEED" and saves the task. |

||

outcome = "PROCEED" and if KYC verification is required |

Invoke KYC Verification service call |

KYC verification service call will be invoked when the user selects the outcome "PROCEED" and saves the task. |

||

outcome = "PROCEED" and if Collateral evaluation is required |

Invoke Collateral evaluation service call |

Invoke the Collateral evaluation service call and move to collateral evaluation stage, when the user selects the outcome "PROCEED" and saves the task. |

||

outcome = "PROCEED" and if Risk evaluation, collateral evaluation, KYC verification and Legal Verification are not required |

Underwriting Proposal preparation |

Instance is moved to ‘Underwriting Proposal preparation’ stage, when the user selects the outcome "PROCEED" and saves the task. |

||

outcome = "RETURN" |

Underwriting Pre-qualification |

Instance is moved to ‘Underwriting Pre-qualification’ stage, when the user selects the outcome "RETURN" and saves the task. |

||

6 |

Risk Evaluation |

outcome = “PROCEED" |

Underwriting proposal preparation |

Instance is moved to ‘Underwriting proposal preparation’ stage, when the user selects the outcome "PROCEED" and saves the task. |

7 |

Legal Verification |

outcome = "PROCEED" |

Underwriting proposal preparation |

Instance is moved to ‘Underwriting proposal preparation’ stage, when the user selects the outcome "PROCEED" and saves the task. |

8 |

Credit analysis |

outcome = "PROCEED" |

Underwriting proposal preparation |

Instance is moved to ‘Underwriting proposal preparation’ stage, when the user selects the outcome "PROCEED" and saves the task. |

9 |

Collateral Evaluation |

outcome = "PROCEED" |

Underwriting proposal preparation |

Instance is moved to ‘Underwriting proposal preparation’ stage, when the user selects the outcome "PROCEED" and saves the task. |

10 |

Underwriting proposal preparation |

outcome = "PROCEED" |

Underwriting proposal Review |

Instance is moved to ‘Underwriting proposal Review’ stage, when the user selects the outcome "PROCEED" and saves the task. |

outcome = “ADDITIONAL INFO” |

Application Modification |

Instance is moved to ‘Application Modification’ stage, when the user selects the outcome "ADDITIONAL INFO" and saves the task. |

||

outcome = “REJECT” |

Terminate |

Instance will be terminated when the user selects the outcome "REJECT" and saves the task. |

||

11 |

Application Modification |

outcome = "PROCEED" |

Underwriting Proposal Review |

Instance is moved to ‘Underwriting proposal Review’ stage, when the user selects the outcome "PROCEED" and saves the task. |

outcome = "REVIEW" |

Underwriting Pre-qualification approval |

Instance is moved to ‘Underwriting Pre-qualification approval’ stage, when the user selects the outcome "PROCEED" and saves the task. |

||

12 |

Underwriting proposal Review |

outcome = "PROCEED" |

Sanction Approval |

Instance is moved to ‘Sanction Approval’ stage, when the user selects the outcome "PROCEED" and saves the task. |

outcome = "RETURN" |

Underwriting proposal Preparation |

Instance is moved to ‘Underwriting Proposal preparation’ stage, when the user selects the outcome "RETURN" and saves the task. |

||

13 |

Sanction Approval |

outcome = "PROCEED" |

Sanction Letter Review |

Instance is moved to ‘Sanction Letter Review’ stage, when the user selects the outcome "PROCEED" and saves the task. |

outcome = "RETURN" |

Underwriting Proposal Preparation |

Instance is moved to ‘Underwriting proposal Preparation’ stage, when the user selects the outcome "RETURN" and saves the task. |

||

14 |

Sanction letter Review |

outcome = "PROCEED" |

Sanction Letter Customer signoff |

Instance is moved to ‘Sanction Letter Customer signoff’ stage, when the user selects the outcome "PROCEED" and saves the task. |

15 |

Sanction Letter Customer Signoff

|

outcome = "PROCEED" |

Documentations and TC verification |

Instance is moved to ‘Documentations and TC verification’ stage, when the user selects the outcome "PROCEED" and saves the task. |

outcome = "WITHDRAW" |

Terminate |

Instance will be terminated when the user selects the outcome "WITHDRAW" and saves the task. |

||

outcome = "RENEGOTIATE" |

Underwriting Proposal Preparation |

Instance is moved to ‘Underwriting Proposal Preparation’ stage, when the user selects the outcome "RENEGOTIATE" and saves the task. |

||

16 |

Documentations and TC verification

|

outcome = "PROCEED" and Downpayment required = ‘Y’

|

Down payment |

Instance is moved to ‘Down payment’ stage, when the user selects the outcome "PROCEED" and saves the task. |

outcome = "PROCEED" and Downpayment required = ‘N’

|

Hand-off |

Instance is moved to ‘CI Core’ stage, when the user selects the outcome "PROCEED" and saves the task. |

||

outcome = "FOLLOW UP" |

Documentation Follow Up |

Instance is moved to ‘Documentation Follow Up’ stage, when the user selects the outcome "FOLLOW UP" and saves the task. |

||

outcome = "ADDITIONAL_INFO" |

Underwriting Proposal preparation |

Instance is moved to ‘Underwriting Proposal Preparation’ stage, when the user selects the outcome "ADDITIONAL_INFO" and saves the task. |

||

17 |

Documentation follow up |

outcome = "PROCEED" |

Documentation & TC verification |

Instance is moved to ‘Documentations and TC verification’ stage, when the user selects the outcome "PROCEED" and saves the task. |

18 |

Down payment |

outcome = "PROCEED" |

Hand-off |

Details will be hand off to CI core when the user selects the outcome "PROCEED" and saves the task. |

19 |

Hand-off |

Successful Hand off to Core & ‘Post Approval documentation’ is ‘YES’ |

Final Documentation |

Instance is moved to ‘Final Documentation’ stage, if ‘Post Approval documentation’ is ‘YES’ and outcome is “PROCEED”. |

Successful Hand off to Core & ‘Post Approval documentation’ is ‘NO’ |

User Acceptance |

Instance is moved to ‘User Acceptance’ stage, when the user selects the outcome "PROCEED" and saves the task. |

||

For any system exceptions |

Manual Retry |

For any system exception, task will be moved to Manual retry stage |

||

20 |

Manual Retry |

outcome = "PROCEED" |

Hand-off |

Details will be hand off to CI core when the user selects the outcome "PROCEED" and saves the task. |

21 |

Final Documentation |

outcome = "PROCEED" |

User Acceptance |

Instance is moved to ‘User Acceptance’ stage, when the user selects the outcome "PROCEED" and saves the task. |

22 |

User Acceptance |

outcome = "ACCEPT" and Down payment Required and not done before is ‘YES’ |

Down Payment |

Instance is moved to ‘Down Payment’ stage, when the user selects the outcome "ACCEPT" and saves the task. |

outcome = "REJECT" and Disbursed is ‘YES’ |

Manual Liquidation |

Instance is moved to ‘Manual Liquidation’ stage, when the user selects the outcome "REJECT" and saves the task. |

||

outcome = "ACCEPT" and Down payment Required and not done before is ‘NO’ |

END |

Task will be changed to completed status and it will not be available for further movement |

||

outcome = "REJECT" and Disbursed is ‘NO’ |

END |

Task will be changed to completed status and it will not be available for further movement |

||

23 |

Down Payment |

outcome = "PROCEED" |

END |

Task will be changed to completed status and it will not be available for further movement |

24 |

Manual Liquidation |

outcome = "PROCEED" |

END |

Task will be changed to completed status and it will not be available for further movement |

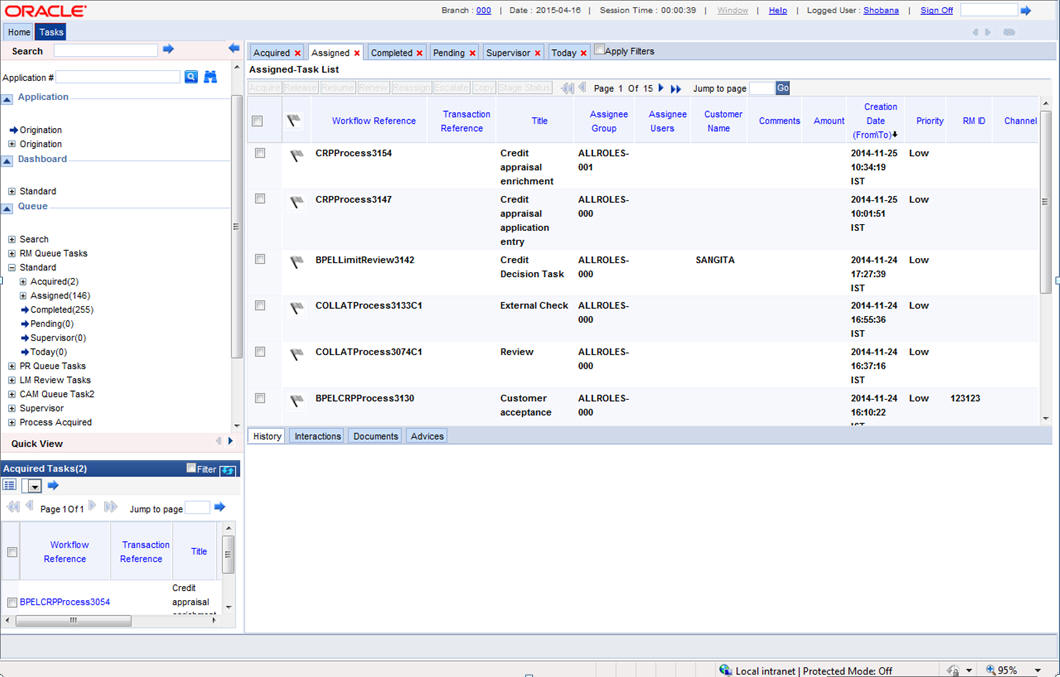

Acquiring a Stage

To acquire a stage, you need to go to the ‘Task’ menu and select ‘Assigned’ under ‘Standard’ option.

You can acquire a task by performing the following tasks:

- Search for the application from the Quick search / Standard search options (or) look for the application in the assigned Queue.

- Select the task and click on Acquire button.

All tasks that have been successfully completed are listed in the right side of the screen. Select the check box against your ‘Workflow Ref No’ and click ‘Acquire’ button at the top ofthe screen to acquire the next stage of the task.

The system displays the message as ‘Acquire Successful’ on successful acquisition of the task.

Click ‘Ok’ to proceed to the next stage. To select the acquired task for the next stage, select ‘Acquired’ under ‘Standard’ option in the ‘Task’ menu. All the tasks that have been successfully acquired are displayed in the right side of the screen. Search for your workflow reference number and click the ‘Workflow Ref No’ to open the required screen.

2.3 Stages in Corporate Islamic Financing Process Flow

Istisna process flow uses Oracle BPEL framework with multiple human tasks for workflow stages. The capture and enrichment of information in multiple steps can be dynamically assigned to different user roles, so that multiple users can take part in the transaction. Oracle Business rules are used for dynamic creation of multiple approval stages.

Following are the stages involved in Istisna Corporate Islamic Financing:

Step 1. Financing Transaction Initiation

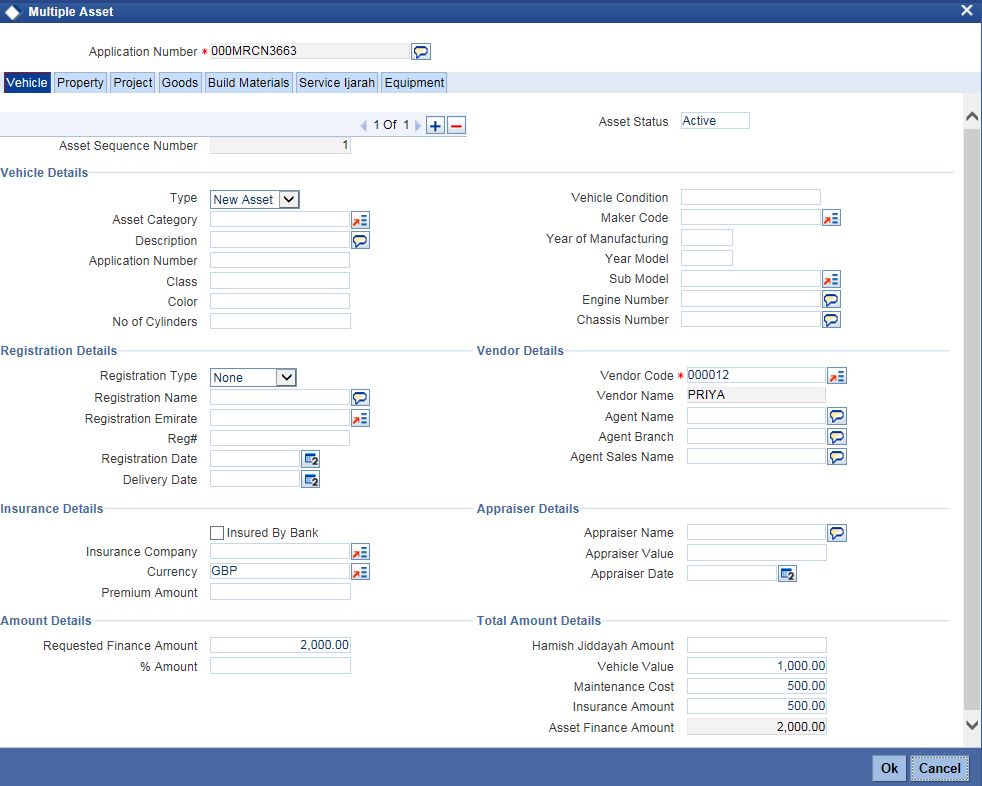

In the application entry stage, you can initiate the Istisna contract and capture the requested details. The system populates the applicants details maintained. You can capture the purchase details of the asset in the Purchase Details tab. The system defaults the Asset type from the product. Click ‘Multiple Asset’ button to enter the details about the asset. You can pull Lead data and simulate application details. You can attach interactions to the application and upload the documents maintained for this stage.

Step 2. Application Follow-up

At this stage, you can upload the documents collected from the applicant and follow up if necessary documents are not submitted by the applicant. The Document Support team verifies and uploads the documents which are provided by the customer. The system does not allow modification of any other data in this stage. The collected documents are scanned and uploaded along with application.

Step 3. Application Enrichment

At this stage, the application is enriched with the details like Director Details, Financial Details, Linkages, and so on. The user can modify the customer details, if required. In this stage, the user can enter the asset details and multiple asset details. Along with other details, the user can provide Hamish Jiddayah details and asset details in this stage. The system validates duplication of applications and applicants for CIF, CASA, Collaterals, Facilities, Cheque Book validation during SAVE operation.

Step 4. Underwriting Pre-Qualification

In this stage, the Credit Admin retrieves the documents and reviews it. Financial statements are put in a standard template and basic analysis is done including bank policy Islamic financing norms compliance checks. Details such as Terms and Conditions, Deviations, Summary, Comments, Documents can be captured in this stage.

You can view the details of the property such as, ‘Property Handover’, ‘Property Handover Date’, ‘Original construction Date’ and ‘End Of Construction Date’. You can also view the nominal disbursal details in ‘Nominal Disbursal’ screen.

Step 5. Underwriting Pre-Qualification Approval

At this stage, underwriter reviews the basic analysis done by the credit along with the application and supporting documents.Underwriter will decide whether to proceed with the deal or not based on the given information. The system allows modification of initial credit analysis done.

The underwriter evaluates the financial documents and project details provided by the customer and prepares the initial credit write up in this stage that includes standard set of terms and conditions. This credit write up is submitted to the credit admin for review and support. The system does not allow modification of customer data and other data provided in the previous stages.

Step 6. Risk Evaluation

At this stage, the user can evaluate the risk associated with the applicant and the application. The user can capture the risk based on credit scores and credit ratios . The user can perform horizontal and vertical analysis. The system does not allow modification of customer data and other data provided in the previous stages.

Step 7. Legal Verification

At this stage, any legal constraints associated with the applicant and the finance application are evaluated. The system does not allow modification of customer data and other data provided in the previous stages.

Step 8. Credit Analysis

In this stage, the Underwriter evaluates the financial documents and project details provided by the customer. The underwriter prepares the initial credit write up in this stage that includes standard set of terms and conditions. This credit write up is submitted to the credit admin for review and support. The system does not allow modification of customer data and other data provided in the previous stages.

Step 9. Collateral Evaluation

At this stage, the collaterals submitted for the finance application are evaluated. After evaluation the details are passed on to the underwriter. In case, if the collateral is new, then Collateral Creation process flow is initiated. The system does not allow modification of customer data and requested details in this stage.

Step 10. Underwriting Proposal Preparation

At this stage, the credit admin evaluates the application based on the inputs from the previous stages. The credit admin will review the initial credit write up and decides to support or reject the application. The credit admin will also have the option to send the application to underwriter for revision. The underwriter arrives at the interest rate, tenor and the charges, based on the evaluation of the application with details and analysis performed so far. The Underwriter prepares the final credit recommendation summary that will include all aspects of the deal like borrower details, finance details, underwriting details, pricing, justification for recommendation and final term sheet.

Step 11. Underwriting Proposal Review

At this stage, the Credit Admin reviews the credit recommendation summary. If there is any error, then the credit admin routes the application back to underwriter for rectification. The system does not allow any modification of details in this stage by the credit admin.

Step 12. Application Modification

At this stage, the user modifies the application details as per the underwriter review comments. The user interacts the customer, in case of additional documents which are required for further processing as mentioned by the reviewer. In case of any additional approval, the modified application is sent back to underwriter for pre-qualification approval. .

Step 13. Sanction Approval

At this stage, the Credit Admin approves or rejects the application based on the credit recommendation summary. The Credit Admin can add comments justifying the sanction. The system does not allow modification of data provided in earlier stages. The system generates the sanction letter for approval or regret letter for rejection as the case may be and send it to the account manager.

Step 14. Sanction Letter Review

At this stage, the account manager reviews the sanction letter or regret letter and sends it to the borrower.

Step 15. Customer Sign-off

At this stage, the customer signs off the sanction letter acknowledging the terms mentioned therein. The document support team receives the signed copy of the sanction letter and uploads the same on to the system. If the borrower rejects the sanction, the application is terminated in this stage. The system does not allow modification of data provided in earlier stages.

Step 16. Documentation and TC Verification

At this stage, the finance documentation team prepares the finance documents for execution by the borrower. Once the documents are ready, it is sent to the borrower for sign off. The details entered in earlier stages cannot be modified.

Step 17. Documentation Follow Up

At this stage, a follow up is done on the mandatory documents, which are yet to be collected from the customer or the borrower. Once the documents are received, it is sent to the borrower for sign off. The details entered in earlier stages cannot be modified.

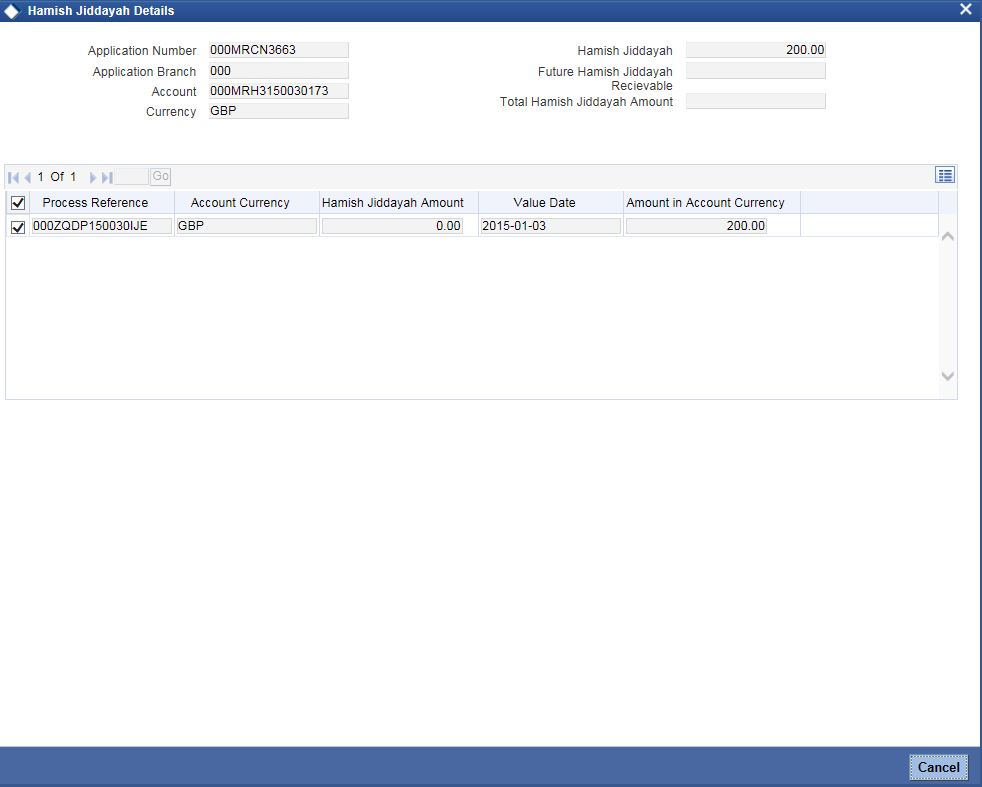

Step 18. Hamish Jiddayah (Down Payment)

At this stage, the user can do Hamish Jiddayah (Down payment) for the contract. This is an optional stage. The task will come to this stage only when Hamish Jiddayah amount is given. Hamish Jiddayah can be done before or after finance account creation. The user can give the details about the payment amount and settlement account and proceed.

If the user has not given the payment details and preceded, then down payment will not happen for the account and will move to the next stage, but system will throw an override.

If the down payment is done before account creation, then once the account is created system will automatically link the down payment reference number to the finance account on creation.

If the down payment amount is not null and if down payment is not done, then account will be created in ‘Uninitiated’ status. Once the user does down payment for the entire down payment amount, the account status will be changed to ‘Initiated’.

Step 19. Manual Retry

For any exception during the hand off/ unavailability of CI service, the instance is moved to Manual retry stage where the user is allowed to manually re-initiate the core hand off after core validation.

Step 20. Final Documentation

This stage is visited only if the 'Final Documentation Required' flag is checked in the 'Documents & TC Verification' stage. At this stage, documentation team will prepare the finance documents for execution.

Step 21. User Acceptance

At this stage, withdrawal from the lease contract due to some reasons after finance account creation is possible.

Step 22. Manual Liquidation

At this stage, if the disbursement has happened and user has rejected the offer, then there will be a provision to liquidate the contract. For liquidation, full disbursed amount should be selected.

2.4 Corporate Islamic Financing Application Details

This section contains the following topics:

- Section 2.4.1, "Processing Corporate Istisna Financing Transaction Initiation"

- Section 2.4.2, "Applicant Tab"

- Section 2.4.3, "Financials Tab"

- Section 2.4.4, "Financing Tab"

- Section 2.4.5, "Components Tab"

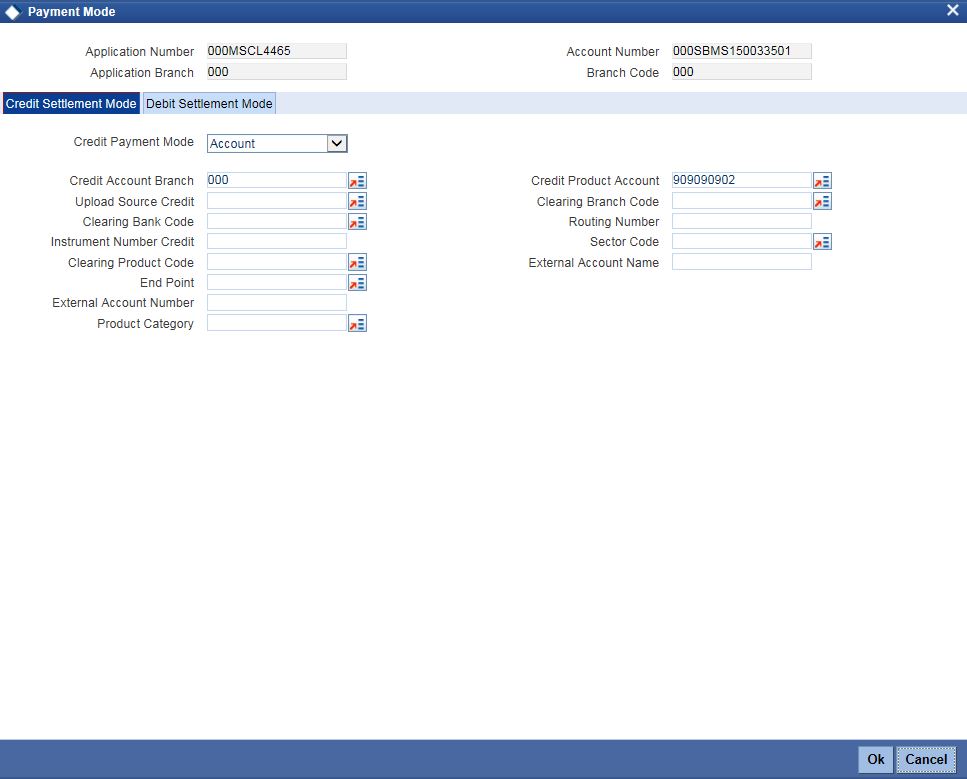

- Section 2.4.6, "Credit Settlement Mode"

- Section 2.4.7, "Charges Tab"

- Section 2.4.8, "Credit Settlement Mode"

- Section 2.4.9, "Limits Tab"

- Section 2.4.10, "Asset Details Tab"

- Section 2.4.11, "Hamish Jiddayah Tab"

- Section 2.4.12, "Terms Tab"

- Section 2.4.13, "Deviations Tab"

- Section 2.4.14, "Summary Tab"

- Section 2.4.15, "Comments Tab"

- Section 2.4.16, "Documents Button"

- Section 2.4.17, "Advices Tab"

- Section 2.4.18, "Checklist Tab"

- Section 2.4.19, "Dedupe Button"

- Section 2.4.20, "Financing Asset Button"

- Section 2.4.21, "Insurance Tab"

- Section 2.4.22, "Preference Button"

- Section 2.4.23, "Covenant Button"

- Section 2.4.24, "Evaluation Button"

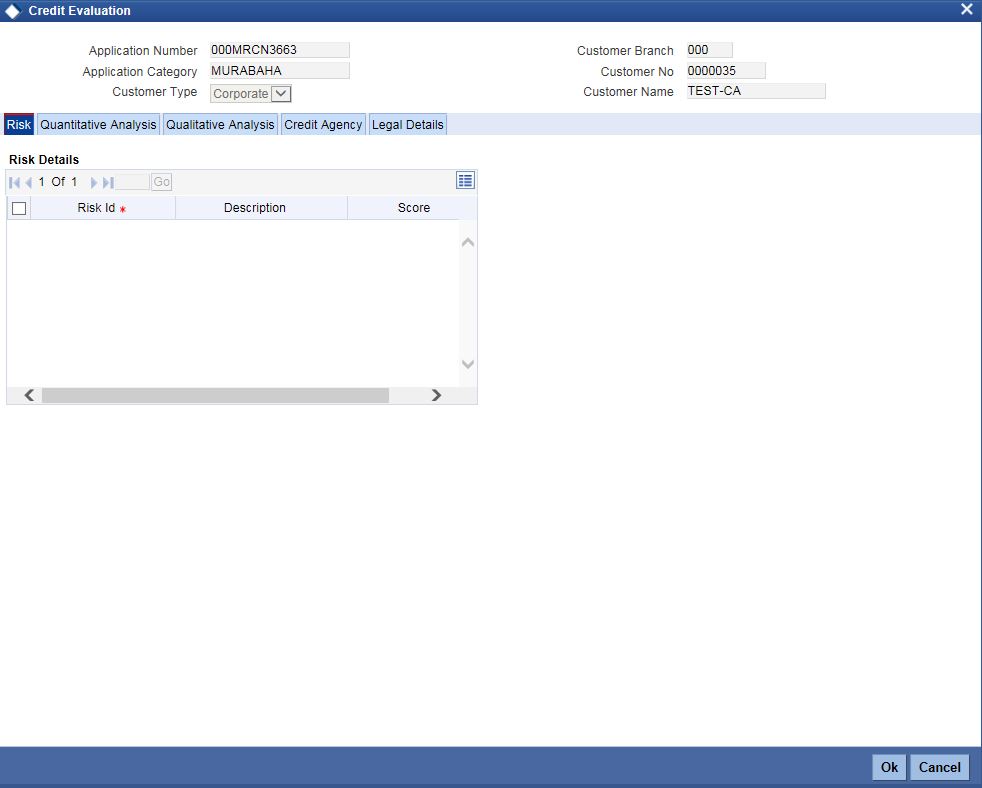

- Section 2.4.25, "Risk Tab"

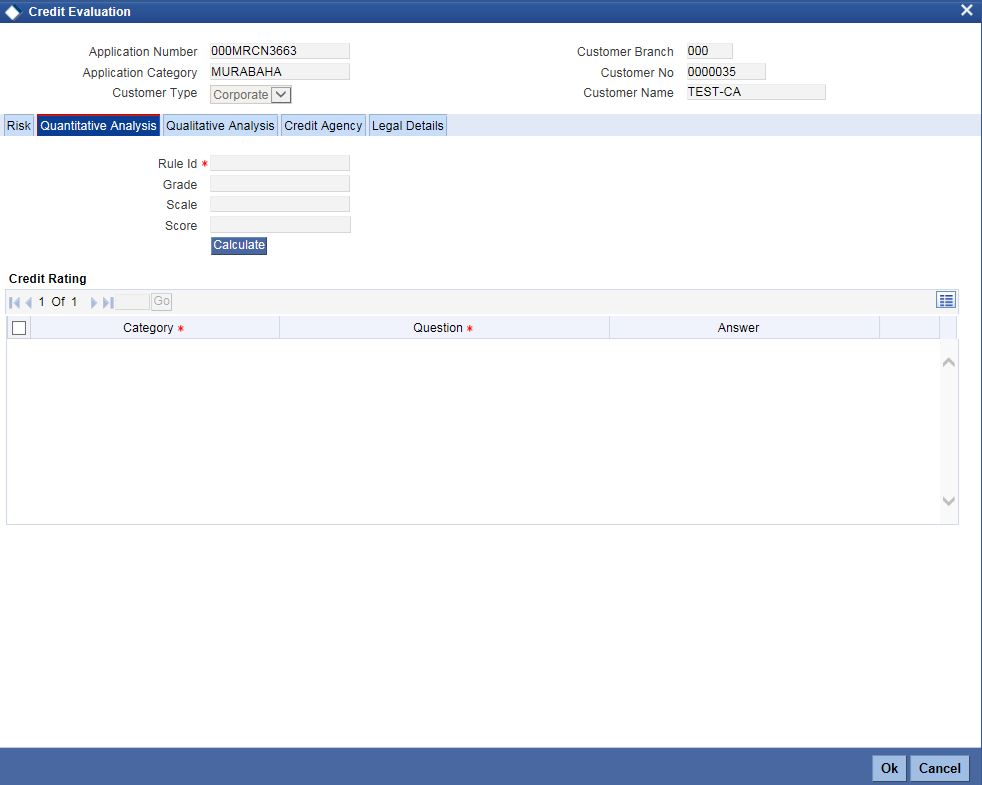

- Section 2.4.26, "Quantitative Analysis Tab"

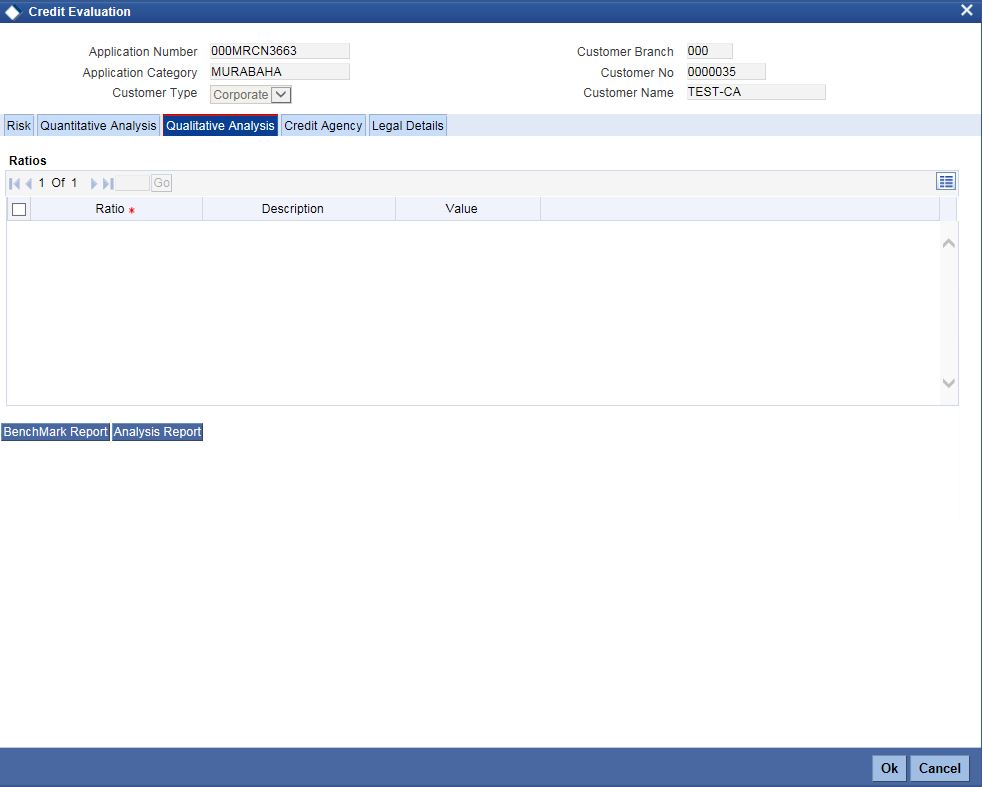

- Section 2.4.27, "Qualitative Analysis Tab"

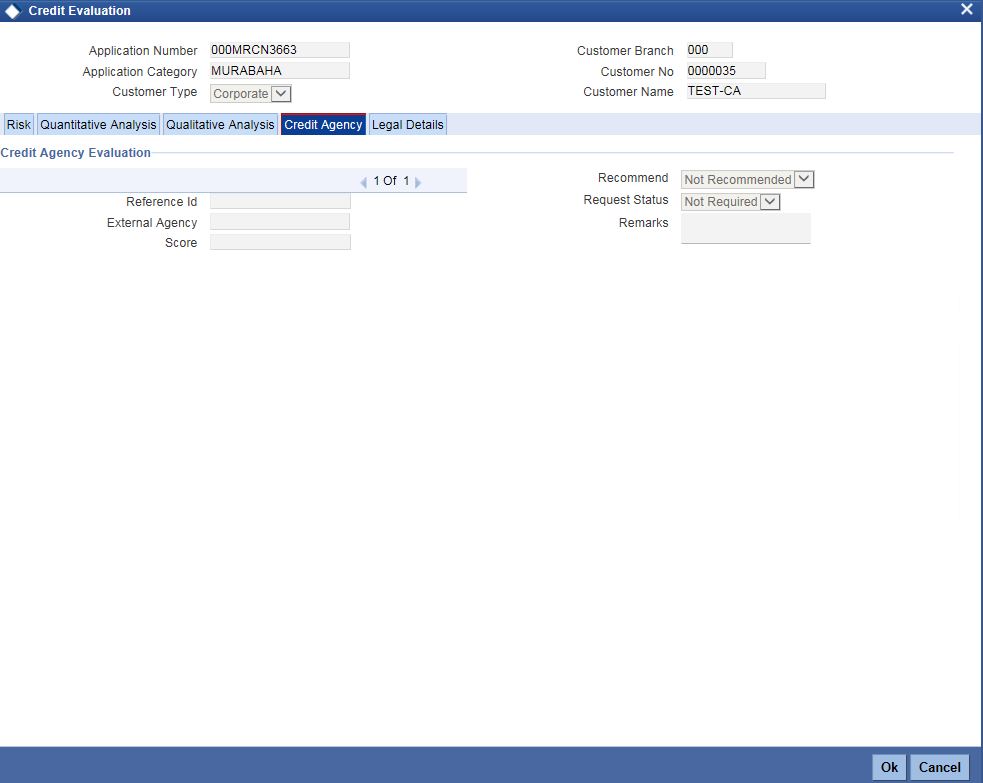

- Section 2.4.28, "Credit Agency Tab"

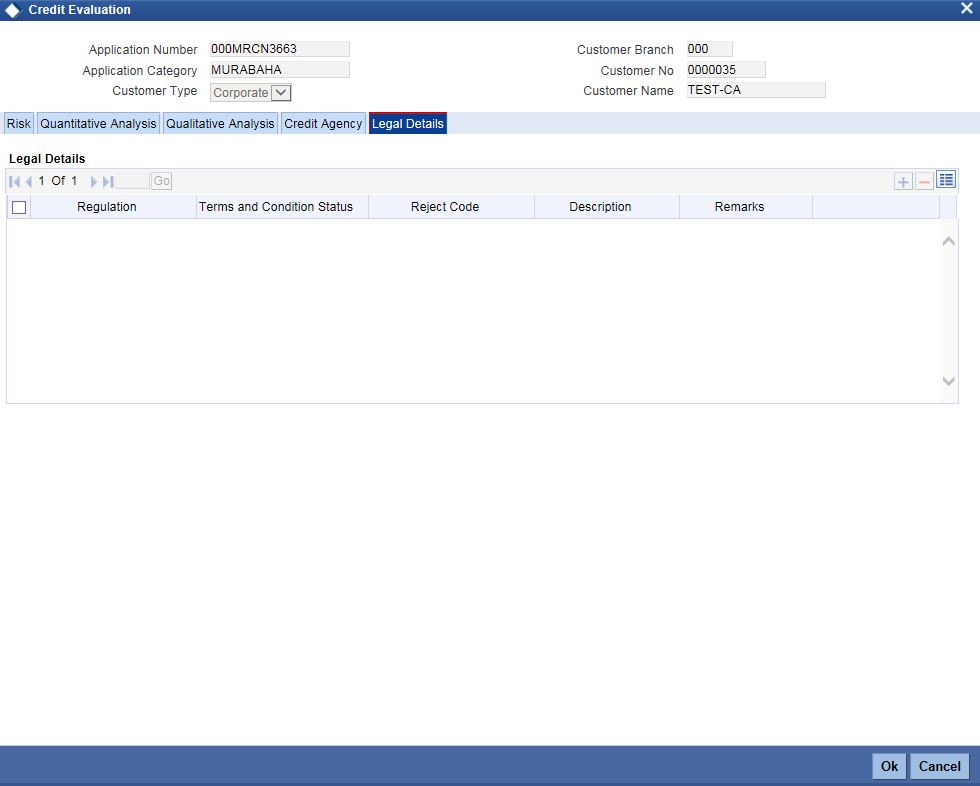

- Section 2.4.29, "Legal Details Tab"

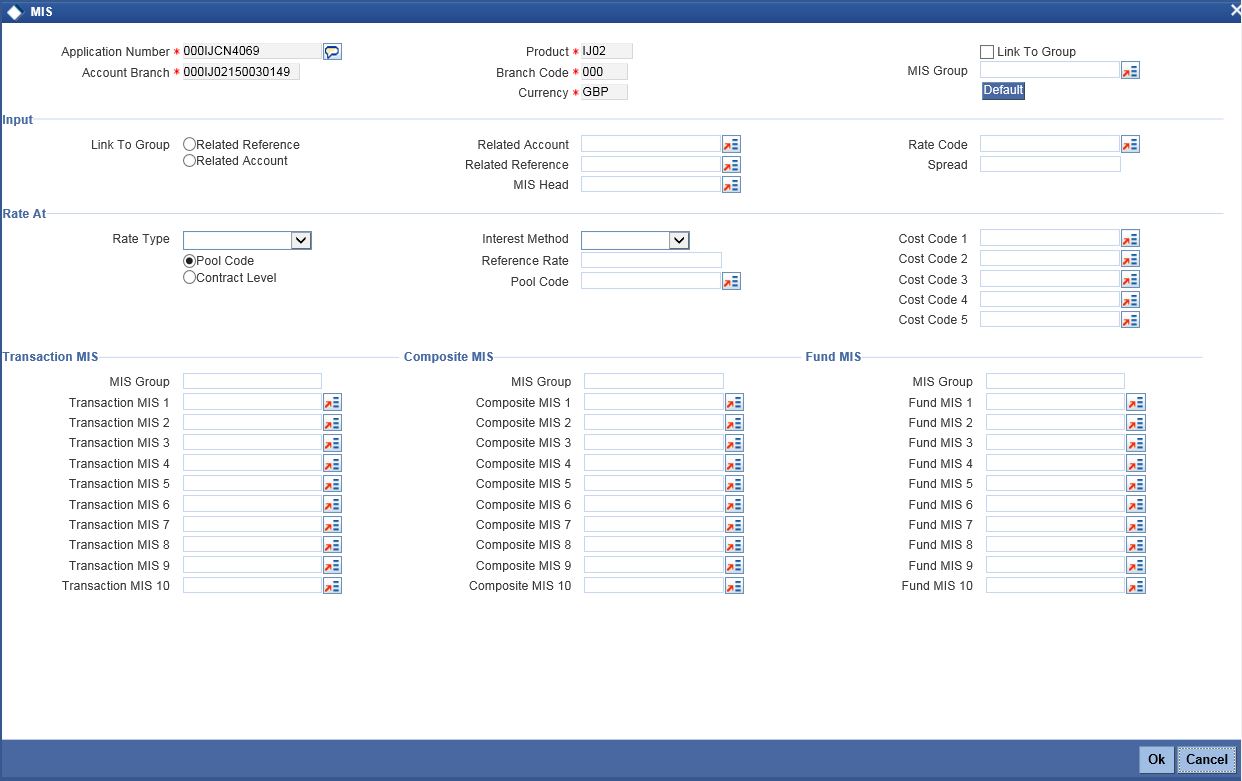

- Section 2.4.30, "MIS Button"

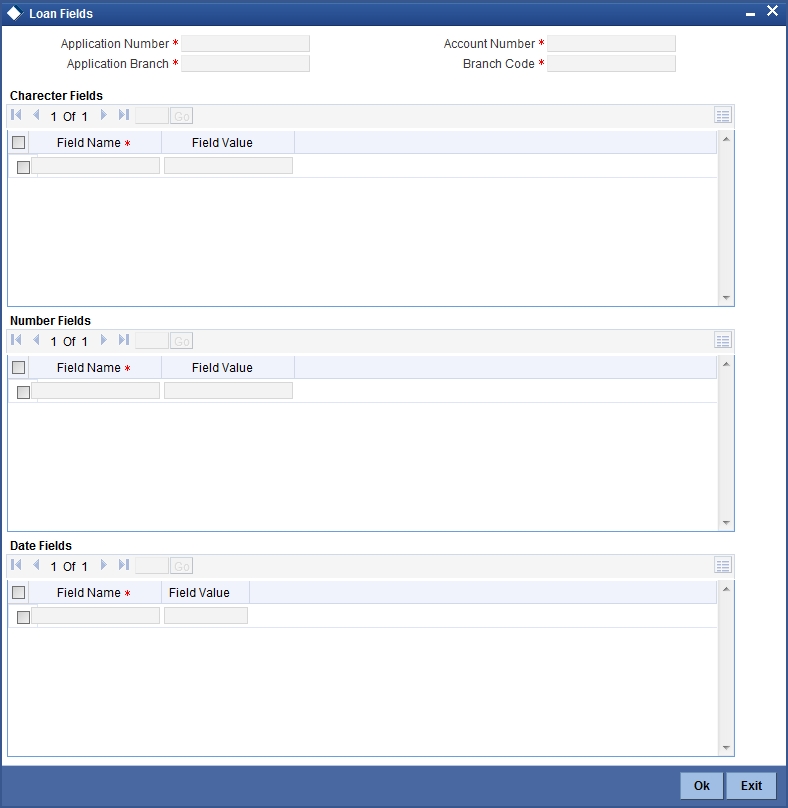

- Section 2.4.31, "Fields Button"

- Section 2.4.32, "SWIFT Message Button"

- Section 2.4.33, "Payment Mode Button"

- Section 2.4.34, "Inventory Tracking Button"

- Section 2.4.35, "Multi Finance Button"

- Section 2.4.36, "Hamish Jiddayah Details Button"

- Section 2.4.37, "Multiple Asset Button"

2.4.1 Processing Corporate Istisna Financing Transaction Initiation

You can initiate the Istisna contract and capture the requested details in the ‘Corporate Islamic Financing’ screen, if you have the required access rights. You can invoke this screen by typing ‘ORDCITIN’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button..

Specify the following in this screen:

Application Number

The system displays the application reference number on initiating a process. This number is unique throughout the process.

Application Branch

The system displays the branch where application is captured.

Application Date

The system defaults the application initiation date.

Application Category

Specify the application category. Alternatively, you can select the application category from the option list. The category is used for populating the documents, advices and checklist mapped in Document sub screen.

Application Type

The system displays the application type.

Interaction ID

The system displays the interaction ID.

Stage

The system displays the stage of the application.

Sub-stage

The system displays the sub-stage of the application.

Status

The system defaults the application status based on the current stage of the process.

Priority

Select application priority from the adjoining drop-down list.The options available are:

- High

- Low

- Medium

Channel

Specify the channel through which the application is initiated. Alternatively, you can select the channel from the option list. The list displays all valid channels.

Channel Reference

Specify the channel reference number.

External Source

Specify the external source.

External Reference

Specify the external reference number.

User Reference

Specify the user reference number.

Additional Approval Required

Check this box if additional approval is required for the finance application.

2.4.2 Applicant Tab

Financial Enquiry

Lead ID

Specify the lead ID. Alternatively, you can select the lead ID from the option list. The list displays the lead IDs maintained in the system.

Enquiry ID

Specify the enquiry ID. Alternatively, you can select the enquiry ID from the option list. The list displays the enquiry IDs maintained in the system.

Preferences

KYC Required

Check this box if KYC review is required for the applicant.

Collateral Valuation Required

Check this box if collateral valuation is required for the collaterals linked to the finance application.

Risk Evaluation Required

Check this box to evaluate the risk in granting the finance.

Legal Verification Required

Check this box to evaluate the legal constraints associated with the finance application.

External Check

Check this box if external check is required.

Buyer Details

Branch

Specify the branch of the customer. Alternatively, you can select the branch from the option list. The list displays all valid branch details.

Type

The system displays the type of applicant.

Customer ID

Specify the customer ID of the applicant. Alternatively, you can select the customer ID from the option list. The list displays all valid customer IDs.

Customer Name

Specify the name of the customer.

Liability ID

Specify the liability ID. Alternatively, you can select the liability ID from the option list. The list displays all valid liability IDs.

360 Degree View

Click this button for 360 degree applicant view.

Industry Details

Industry Category

The system displays the industry category.

Main Industry

The system displays the main industry.

Sub Industry

The system displays the sub industry.

Sector

The system displays the sector details.

Sub Sector

The system displays the sub sector details.

Incorporation Details

Incorp Date

The system displays the date of incorporation.

Incorporation Country

The system displays the country of incorporation.

Currency

The system displays the currency details.

Capital

The system displays the capital details.

Net Worth

The system displays the net worth.

Product Details

Facility

Select the required facility from the drop-down list. The list displays the following values:

- CASA

- Finance

- Cheque Book

- Credit Card

- Debit Card

Product

The system displays the product based on the facility selected.

Description

Give a brief description on the product.

Summary

Click this button to view summary details based on the facility selected.

Branch

Specify the branch of the customer. Alternatively, you can select the branch from the option list. The list displays all valid branch details.

Reference ID

The system displays the reference ID.

Details

The system displays the details of the customer.

Linked to Finance

Check this box to link the facility to the finance.

Purpose

The system displays the finance purpose.

Other Applicant

The system displays the other applicant details.

2.4.3 Financials Tab

Click ‘Financials’ tab to maintain financial details.

Specify the following details:

Equity Capital

Currency

Specify the equity currency. Alternatively, you can select the equity currency from the option list. The list displays all the currencies maintained in the system.

Authorized Share capital

The system displays the authorized share capital.

Issued Share Capital

The system displays the issued share capital.

Subscribed Share Capital

The system displays the subscribed share capital.

Paid up Share Capital

The system displays the paid up share capital.

Debit Capital

Currency

The system displays the debit currency .

Short Term Debt

The system displays the short term debt.\

Long Term Debt

The system displays the long term debt.

Equity Pattern

Currency

Specify the currency code. Alternatively, you can select the currency code from the option list. The list displays all the currencies maintained in the system.

Holder Type

The system displays the holder type.

Amount

The system displays the amount.

Percentage

The system displays the equity percentage.

Debt Pattern

Debt Type

The system displays the debt type

Lending Institution

The system displays the lending institution.

Currency

Specify the currency code. Alternatively, you can select the currency code from the option list. The list displays all the currencies maintained in the system.

Amount

The system displays the debt amount.

Percentage

The system displays the debt percentage.

Balance

The system displays the balance.

Due Date

The system displays the due date.

Corporate Performance

Financial Year

The system displays the financial year.

Currency

Specify the currency code. Alternatively, you can select the currency code from the option list. The list displays all the currencies maintained in the system.

Net Sales

The system displays the net sales.

Net Profit

The system displays the net profit.

Net Worth

The system displays the worth.

Promoters

Promoter Name

The system displays the name of the promoter.

Acquisition Date

The system the acquisition date.

Currency

Specify the currency code. Alternatively, you can select the currency code from the option list. The list displays all the currencies maintained in the system.

Share Count

The system displays the share count.

Face Value

The system displays the face value.

Paid-up Capital %

The system displays the paid-up capital percentage.

Associate Groups

Entity

The system displays the entity.

Business Type

The system displays the business type.

Banking With

The system displays the banking width.

Association Nature

The system displays the nature of association.

Interest Extent

The system displays the interest extent.

Group Performance

Financial Year

The system displays the financial year.

Currency

Specify the currency code. Alternatively, you can select the currency code from the option list. The list displays all the currencies maintained in the system.

Net Sales

The system displays the net sales.

Net Profit

The system displays the net profit.

Net Worth

The system displays the net worth.

2.4.4 Financing Tab

Click ‘Financing’ tab to maintain finance details.

Specify the following details:

Pricing ID

Specify the pricing ID. Alternatively, you can select the pricing ID from the option list. The list displays all valid pricing IDs.

Promotion Code

Specify the promotion code. Alternatively, you can select the promotion code from the option list. The list displays all valid promotion codes.

Financing Offers

Offer ID

Specify the finance offer ID.

No. of Instalments

Specify the number of installments applicable for the selected finance offer.

Frequency

Specify the frequency of the finance offer.

Unit

Select the unit from the drop-down list.

Profit Rate

Specify the profit rate of the finance offer.

Rate Code

Specify the rate code. Alternatively, you can select the rate code from the option list. The list displays all valid rate codes.

Check

Check this box to apply an offer. You can only check one offer at a time.

Cost Details

Financing Product

The system displays the financing product.

Financing Account

Specify the financing account number.

Financing Branch

Specify the financing branch. Alternatively, you can select the financing branch from the option list. The list displays all valid branch codes.

Financing Currency

Specify the financing currency. Alternatively, you can select the currency from the option list. The list displays all valid currency codes.

Amount Financed

Specify the financed amount.

Wakala Reference

Specify the Wakala reference number. Alternatively, you can select wakala reference number from the option list. The list displays all valid Wakala reference number maintained in the system.

Payment Terms

No of Installments

Specify the number of installments required to pay the financed amount.

Installment Frequency

Specify the installment frequency.

Installment Unit

Select the unit of installment from the drop-down list. The list displays the following values:

- Bullet - Select this option for single repayment on maturity date.

- Daily

- Monthly

- Weekly

- Half Yearly

- Quarterly

- Yearly

Installment Start Date

Select the installment start date from the adjoining calendar.

Due Date On

Select the due date from the adjoining calendar.

Maturity Type

Select the maturity type from the drop-down list. The list displays the following values:

- Fixed - this type of a finance has a fixed maturity date

- Call - If the maturity date is not fixed the finance can be liquidated any time

Maturity Date

Select the maturity date from the adjoining calendar.

Tenor (in Days)

Specify the finance tenor in days.

URBOUN

Hamish Jiddayah %

The system displays the Hamish Jiddayah percentage.

Hamish Jiddayah Amount

The system displays the Hamish Jiddayah amount.

Book Date

The system displays the book date.

Value Date

The system displays the value date.

Balloon Amount

Specify the amount that is being paid as balloon payment. This value cannot exceed the principal amount of the finance. You will be allowed to specify this value only if the following conditions are met:

- Contract is linked to a Istisna product

- The box ‘Balloon Required’ is checked in the ‘Product Maintenance’ screen for the linked product.

- The box ‘Recompute schedule on IRR’ is checked in the ‘Product Maintenance’ screen for the linked product.

Fund ID

Select the fund id from the adjoining option list. The system defaults the value of ‘Default Mudarabah Fund’ as fund ID.

The system populates the fund MIS details for a contract which is linked to the Fund ID.

Future D/P Receivable

Specify the future D/P receivable. Your customer need not pay the entire down payment amount in a single installment. The customer can pay it in parts. In such cases, you can specify the amount to be received in the future from the customer. The aggregate of down payments received and ‘Future D/P Receivable’ should be equal to the ‘Down Payment’ amount.

For instance, suppose the down payment is 10000 BHD, down payment received is 8000 BHD and future down payment is 2000 BHD, then Disbursement event will be triggered.

Note

Amount specified in this field cannot exceed the total down payment amount for the contract. This field should be operationally controlled, because the system does not track the ‘Future D/P Receivable’ amount which is received from the customer.

Staff Finance

Specify the staff finance details.

Total Amount

Specify the sum of amount financed and down payment.

Balloon + Principal

Specify the total of balloon and principal amount.

Rab AI MAL

Book Date

The system displays the booking date.

Value Date

Specify the value date.

Profit Sharing Ratio

Specify the profit sharing ratio of the bank.

Customer Share%

Profit Sharing Ratio

Specify the profit sharing ratio of the customer.

Taken Over Asset Details

Collateral Taken over

Check this box to indicate that the collateral is taken over.

Sale Value

Total Sale Value

Specify the total sale value.The system displays the total of principal and profit amount as of initiation date. If the ‘Recompute schedule on IRR’ field is checked in the ‘Product Maintenance’ screen for the linked product and if you specify the balloon amount, the system will compute this value as the sum of principal, normal profit, balloon principal and balloon profit.

Asset Details

Asset Type

Select the type of asset from the drop-down list. The options available are:

- New - To indicate the asset is a new asset

- Used - To indicate the asset is an old asset

Effective Date

Effective Date

Select the effective date from the adjoining calendar.

User Defined Elements

User Data Elements Id

Specify the user data elements ID. Alternatively, you can select the UDE ID from the option list. The list displays all valid user defined elements ID.

Value

Specify the UDE value.

Rate Code

Specify the rate code of the UDE. Alternatively, you can select the rate code from the option list. The list displays all valid rate codes.

Code Usage

Select the code usage. It can be periodic or automatic.

Rate Basis

Select the rate basis from the drop-down list. The list displays the following values:

- Not Applicable

- Per Annum

- Per Month

- Quote Basis

Resolved Value

Specify the resolved value.

Account EMI Change

Effective Date

Select the effective date from the adjoining calendar.

Percentage Change in EMI

Specify the percentage change in EMI.

Amount Change in EMI

Specify the amount change in EMI.

2.4.5 Components Tab

Click ‘Components’ tab to maintain component details.

Component Name

The system displays the component name.

Component Type

Select the component type from the adjoining drop-down list. The list displays the following values:

- Formula with schedule (Component Type - Interest)

- Formula without schedule (Charge)

- Penal Interest

- Prepayment Penalty

- Discount

- Schedule without formula (Principal)

- No schedule No formula (Ad Hoc Charges)

- Penalty Charges

Currency

The system displays the currency code.

Special Interest Amount

The system displays the special interest amount.

Liquidation Mode

The system defaults the mode of liquidation from the product level. However you can modify the same to indicate the mode of liquidation of the component from the drop-down list. The following options are available for selection:

- Auto

- Manual

Waive

Select this option to waive the component for the account.

Main Component

Check this box to indicate that the specified component should be main component.

Verify Funds

Check this box to verify funds.

Penal Basis

The system displays the penal basis.

Service Branch

The system displays the service branch.

Service Account

The system displays the service account.

Settlement Currency

The system displays the settlement currency.

Internal Rate of Return Applicable

Check this box if internal rate of return is applicable.

Special Component

Check this box if the component is a special Interest type. This implies that the computed value of the component can be overridden with the entered value.

Funded During Rollover

Check this box if the component can be funded during the rollover process.

Funded During Initiation

Check this box if the component can be funded during the INIT event.

Exponential Interest Method

Check this box to provide restrictions for exponential finances.If you check this, the system validates the following for exponential interest method calculation:

- COMPOUND_VALUE SDE is maintained in book formula

- Compound days is maintained as one.

Schedule Definition

Schedule Type

Select the type of schedule from the drop-down list. Schedule can be a payment, a disbursement or a rate revision schedule.

Schedule Flag

Select the option for the Schedule flag from the option list. The options are Normal or Moratorium.

You can select the option Moratorium if there are no scheduled repayments for the component for the Moratorium period. However the component is accrued for a certain Moratorium period.

Formula Name

Specify the formula name. Alternatively, you can select the formula name from the option list. The list displays all valid formula names.

First Due Date

Select the first due date from the adjoining calendar.

Start Date

Select the start date from the adjoining calendar.

End Date

Select the end date from the adjoining calendar.

No of Schedules

Specify the number of schedules.

Frequency

Specify the frequency.

Units

Select the units from the drop-down list.

Due Date On

Select the due date from the adjoining calendar.

Amount

Specify the amount.

EMI Amount

Specify the EMI amount.

Compound Days

Specify the compound days.

Compound Months

Specify the compound months.

Compound Years

Specify the compound years.

Days in Month

Select the number of days that would constitute a month for calculation from the drop-down list. The list displays the following values:

- Actual: The actual number of days in a month is taken

- 30(Euro): Thirty days is considered for all months including February irrespective of leap year or not

- 30(US): Thirty days is considered for all months except February where the actual number of days is considered

- Working Days: Working days in a month is considered

Days in Years

Select the number of days that would constitute a year for calculation from the drop-down list. The list displays the following values:

- 252: Number of days in a year is taken as 252, which is the number of working days

- 360: Number of days in a year is taken as 360 irrespective of actual number of calender days

- 365: Number of days in a year is taken as 365 for leap as well as non leap year

- Actual: Actual number of days in a year is taken for interest calculation which is 366 for leap year and 365 for non leap year

Waive

Select this option to specify if you need to allow a waiver of the component payments for the schedule.

Capitalize

Select this option if the schedule amounts are to be capitalized.

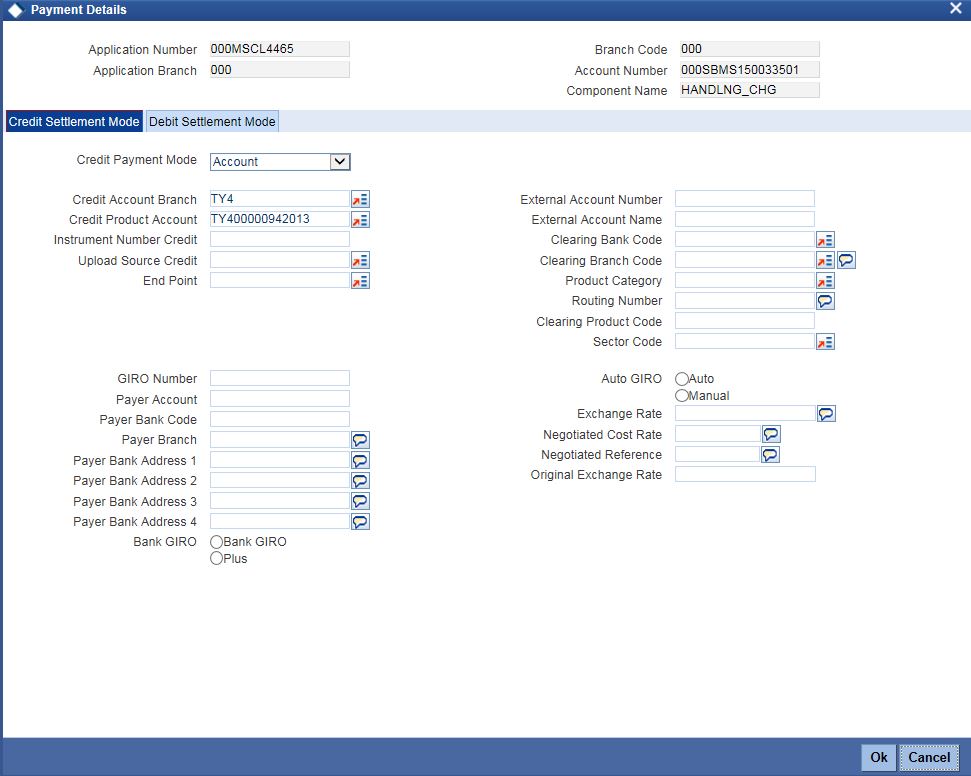

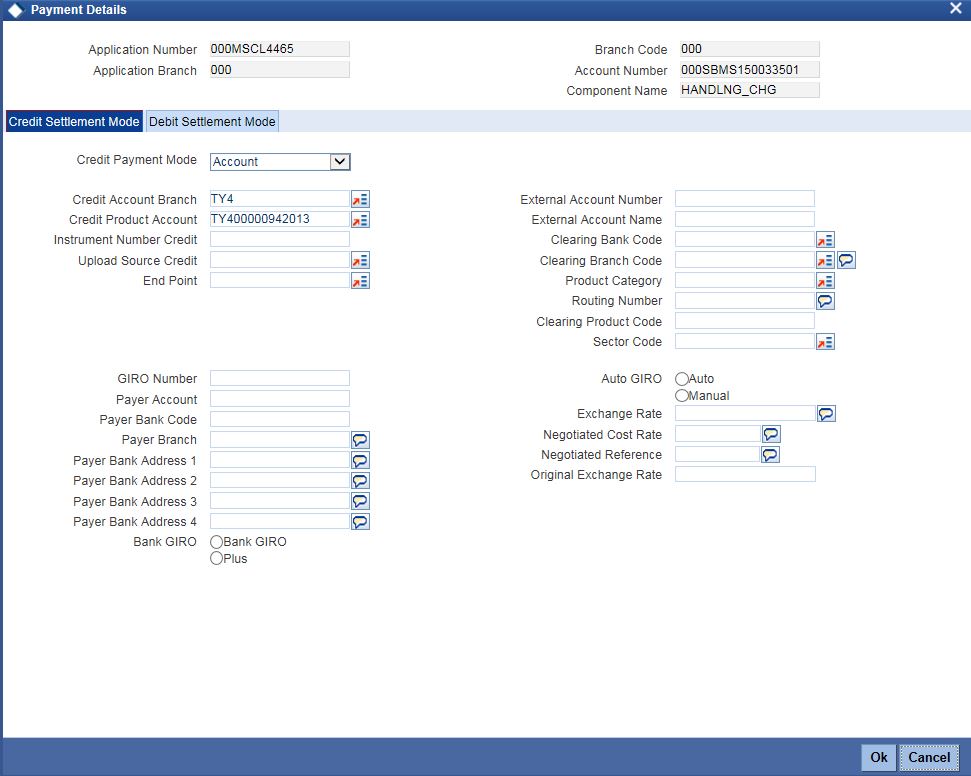

Click ‘Payment Details’ button to specify the payment details.

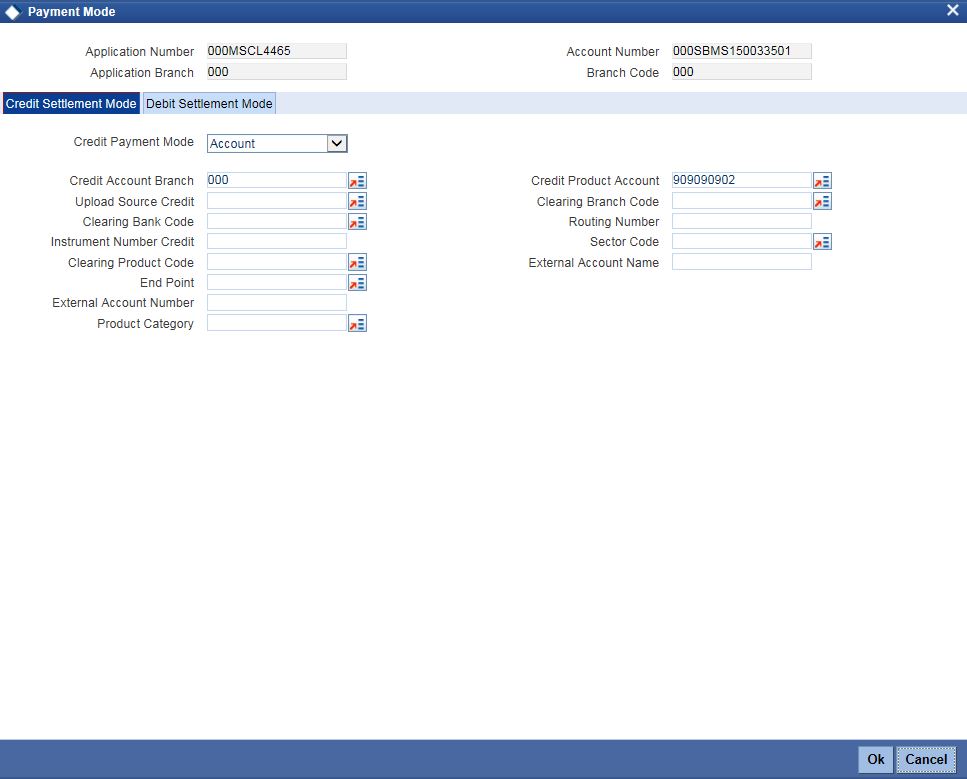

Click ‘Credit Settlement Mode’ tab to specify the credit settlement mode details.

Application Number

The system displays the application number.

Application Branch

The system displays the application branch.

Branch Code

The system displays the branch code.

Account Number

The system displays the account number.

Component Name

The system displays the component name.

2.4.6 Credit Settlement Mode

Credit Payment Mode

Select the credit settlement mode from the drop-down list. The options are as follows:

- Account

- Credit Card

- Clearing

- Debit Card

- External Account

- Electronic Pay Order

- GIRO

- Internal Cheque Instrument

- Cash/Teller

Credit Account Branch

Specify the credit account branch. Alternatively, select the credit account branch from the option list. The displays the valid branch codes maintained in the system.

Credit Product Account

Specify the credit product account. Alternatively, select the credit product account from the option list. The displays the valid product accounts maintained in the system.

Instrument Number

Specify the instrument number.

Upload Source Credit

Specify the upload source credit details. Alternatively, select the source credit details from the option list. The displays the valid credit details maintained in the system.

End Point

Specify the end point. Alternatively, select the end point from the option list. The displays the valid end points maintained in the system.

GIRO Number

Specify the GIRO number.

Payer Account

Specify the payer account.

Payer Bank Code

Specify the payer bank code.

Payer Branch

Specify the payer branch.

Payer Bank Address 1

Specify the payer bank address 1.

Payer Bank Address 2

Specify the payer bank address 2.

Payer Bank Address 3

Specify the payer bank address 3.

Payer Bank Address 4

Specify the payer bank address 4.

Bank GIRO

Select the bank GIRO to be maintained. The options are as follows:

- Bank GIRO

- Plus

External Account Number

Specify the external account number.

External Account Name

The system displays the external account name.

Clearing Bank Code

Specify the clearing bank code. Alternatively, select the clearing bank code from the option list. The displays the valid clearing bank code maintained in the system.

Clearing Branch Code

Specify the clearing branch code. Alternatively, select the clearing branch code from the option list. The displays the valid branch codes maintained in the system.

Product Category

Specify the product category. Alternatively, select the product category from the option list. The displays the valid product categories maintained in the system.

Routing Number

Specify the routing number.

Clearing Product Code

Specify the clearing product code.

Sector Code

Specify the sector code. Alternatively, select the sector code from the option list. The displays the valid sector codes maintained in the system.

Auto GIRO

Select the auto GIRO details. The options are as follows:

- Auto

- Manual

Exchange Rate

Specify the exchange rate prevailing.

Negotiated Cost Rate

Specify the negotiated cost rate.

Negotiated Reference

Specify the negotiated reference number.

Original Exchange Rate

Specify the original exchange rate.

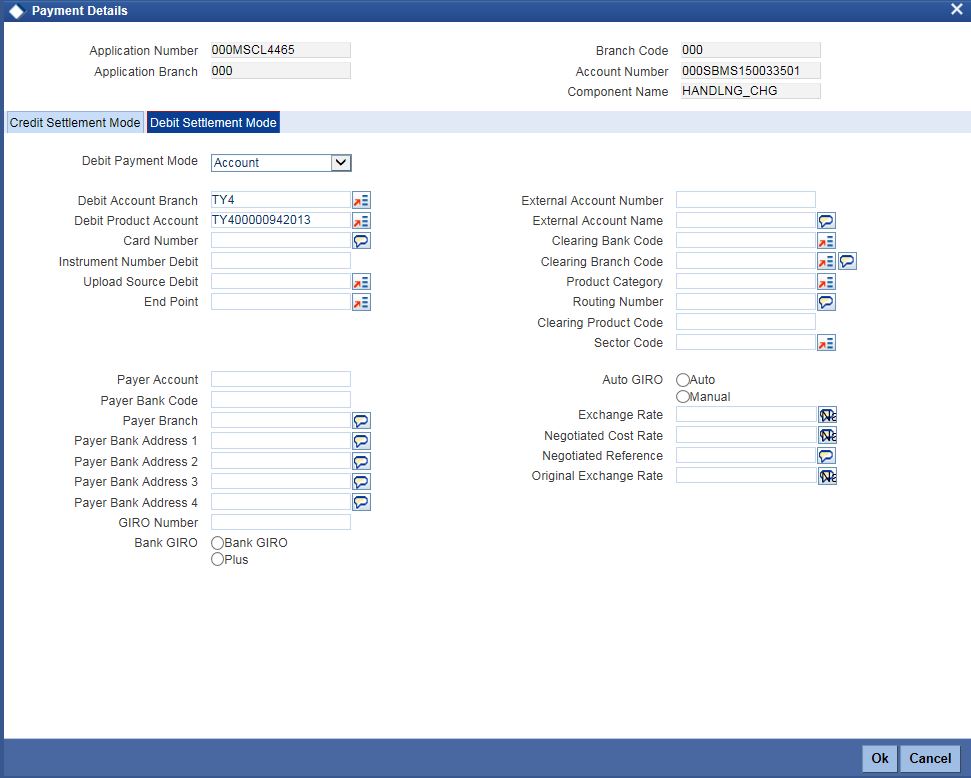

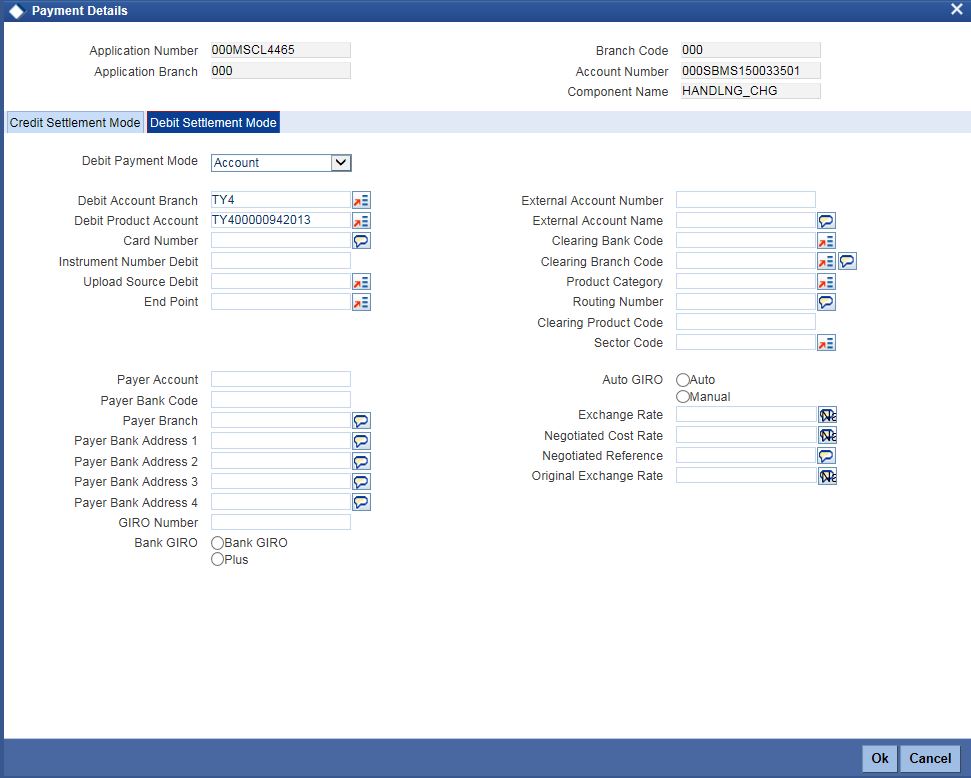

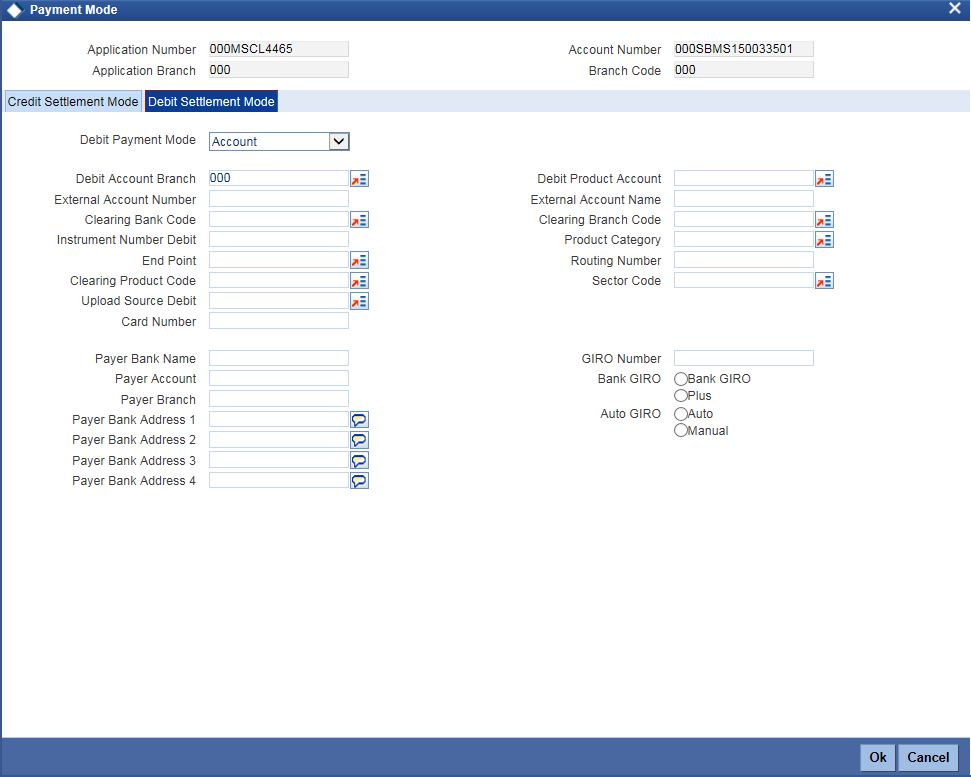

2.4.6.1 Debit Settlement Mode Tab

Click ‘Debit Settlement Mode’ tab to specify the credit settlement mode details.

Specify the following details:

Debit Payment Mode

Select the debit settlement mode from the drop-down list. The options are as follows:

- Account

- Credit Card

- Clearing

- Debit Card

- External Account

- Electronic Pay Order

- GIRO

- Internal Cheque Instrument

- Cash/Teller

- PDC

Debit Account Branch

Specify the debit account branch. Alternatively, select the debit account branch from the option list. The displays the valid branch codes maintained in the system.

Debit Product Account

Specify the debit product account. Alternatively, select the debit product account from the option list. The displays the valid product accounts maintained in the system.

Card Number

Specify the card number.

Instrument Number Debit

Specify the instrument number debit.

Upload Source Debit

Specify the upload source debit details. Alternatively, select the source debit details from the option list. The displays the valid debit details maintained in the system.

End Point

Specify the end point. Alternatively, select the end point from the option list. The displays the valid end points maintained in the system.

Payer Account

Specify the payer account.

Payer Bank Code

Specify the payer bank code.

Payer Branch

Specify the payer branch.

Payer Bank Address 1

Specify the payer bank address 1.

Payer Bank Address 2

Specify the payer bank address 2.

Payer Bank Address 3

Specify the payer bank address 3.

Payer Bank Address 4

Specify the payer bank address 4.

GIRO Number

Specify the GIRO number.

Bank GIRO

Select the bank GIRO to be maintained. The options are as follows:

- Bank GIRO

- Plus

External Account Number

Specify the external account number.

External Account Name

The system displays the external account name.

Clearing Bank Code

Specify the clearing bank code. Alternatively, select the clearing bank code from the option list. The displays the valid clearing bank code maintained in the system.

Clearing Branch Code

Specify the clearing branch code. Alternatively, select the clearing branch code from the option list. The displays the valid branch codes maintained in the system.

Product Category

Specify the product category. Alternatively, select the product category from the option list. The displays the valid product categories maintained in the system.

Routing Number

Specify the routing number.

Clearing Product Code

Specify the clearing product code.

Sector Code

Specify the sector code. Alternatively, select the sector code from the option list. The displays the valid sector codes maintained in the system.

Auto GIRO

Select the auto GIRO details. The options are as follows:

- Auto

- Manual

Exchange Rate

Specify the exchange rate prevailing.

Negotiated Cost Rate

Specify the negotiated cost rate.

Negotiated Reference

Specify the negotiated reference number.

Original Exchange Rate

Specify the original exchange rate.

Click ‘Schedule Details’ button to view the schedule details.

2.4.6.2 Payments Schedules Tab

The system displays the following details.

- Application Number

- Application Branch

- Component Name

- Account

- Account Branch

- Component Currency

Schedule Details

The system displays the Payment schedule details.

- Schedules

- Schedule Date

- Pay By Date

- Amount Settled

- Amount Due

- EMI Amount

- Amortize Principal

- Accrued Amount

- Capitalized

- Waive

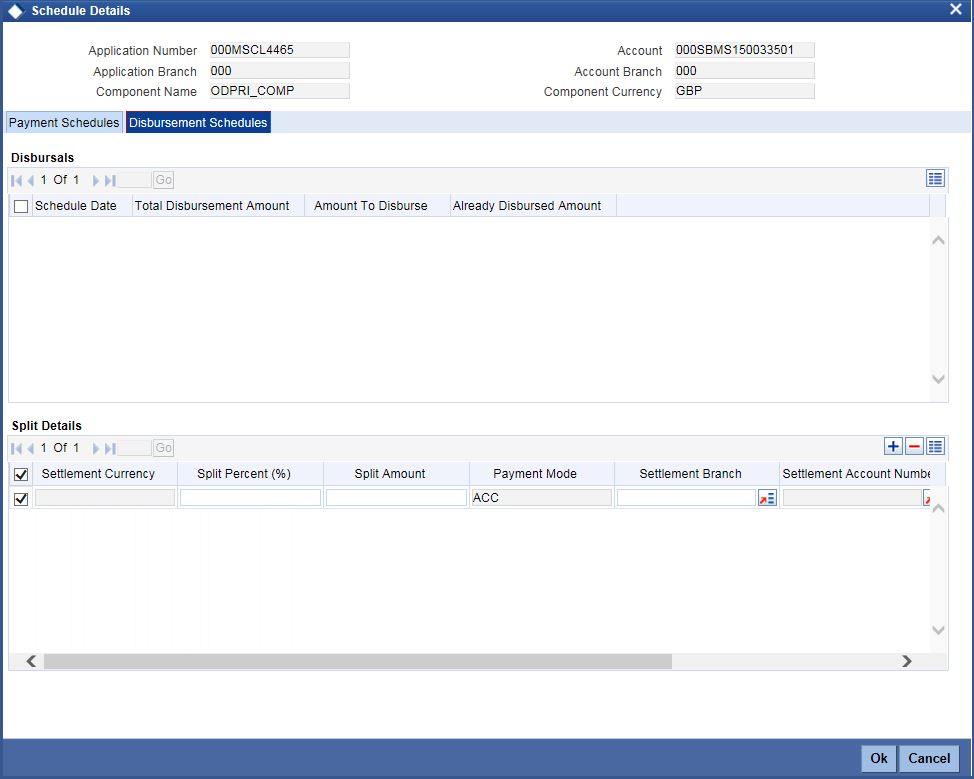

2.4.6.3 Disbursement Schedules Tab

Disbursals

The system displays the Disbursement schedule details.

- Schedule Date

- Total Disbursement Amount

- Amount to Disburse

- Already Disbursed Amount

- Split Details

- Settlement Currency

- Split Percent (%)

- Split Amount

- Payment Mode

- Settlement Branch

- Settlement Account Number

- Account Description

- Customer

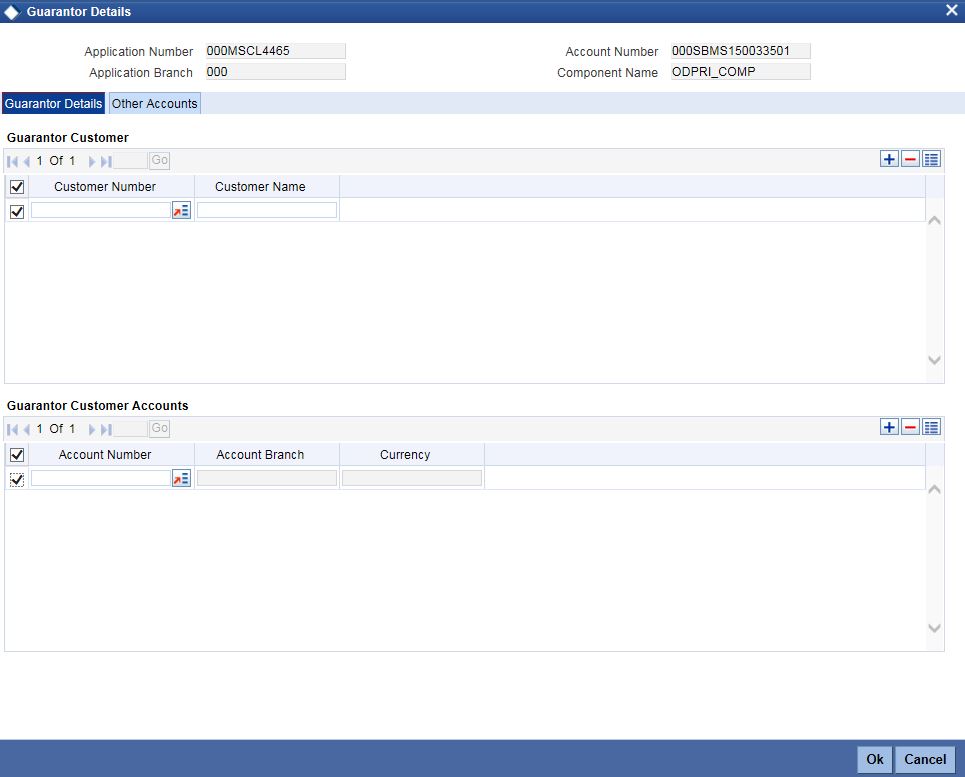

2.4.6.4 Guarantor Button

Click ‘Guarantor’ button to specify the guarantor details.

Specify the following details.

Application Number

The system displays the application number.

Application Branch

The system displays the application branch.

Account Number

The system displays the account number.

Component Name

The system displays the component name.

Guarantor Details

Guarantor Customer

Customer Number

Specify the customer number of the guarantor customer. Alternatively, you can select the customer number from the option list. The list displays the valid customer number maintained in the system.

Customer Name

The system displays the name of the guarantor customer.

Guarantor Customer Accounts

Account Number

Specify the account number of the guarantor customer. Alternatively, you can select the account number from the option list. The list displays the valid account number maintained in the system.

Account Branch

The system displays the account branch of the guarantor customer.

Currency

The system displays the currency of the guarantor customer.

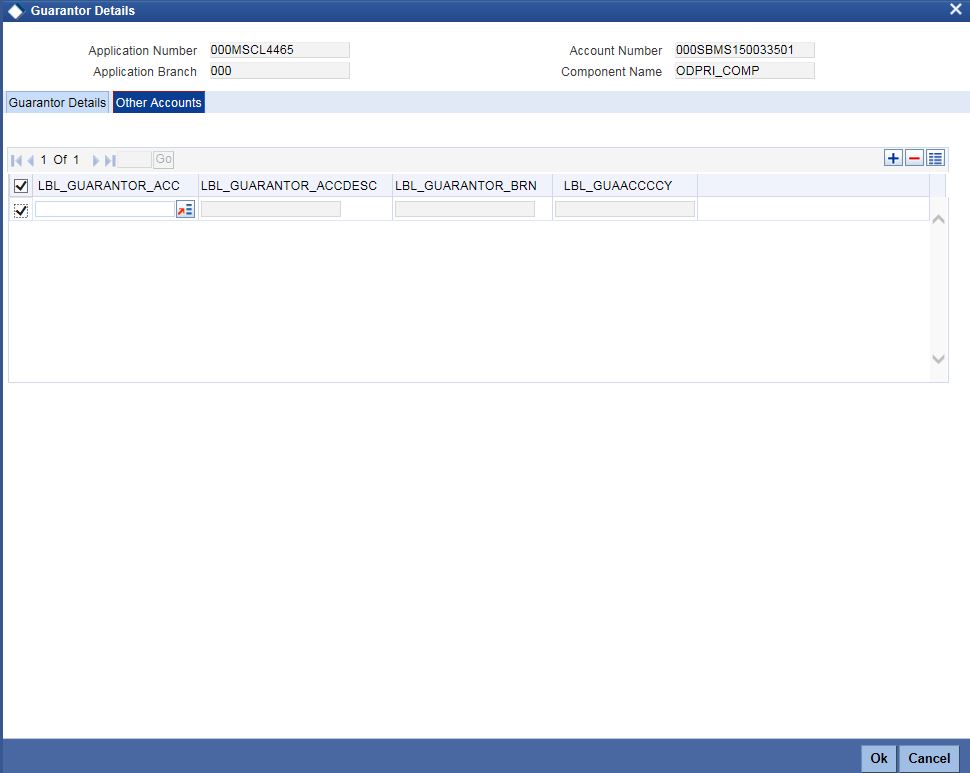

Other Accounts

Click ‘Other Accounts’ tab to specify other details of the account.

Specify the following details:

Guarantor Account

Specify the guarantor account. Alternatively, you can select the guarantor account number from the option list. The list displays the valid guarantor account numbers maintained in the system.

Guarantor Account Description

The system displays the description of the guarantor account.

Guarantor Branch

The system displays the branch code of the guarantor.

Guarantor Account Currency

The system displays the account currency of the guarantor.

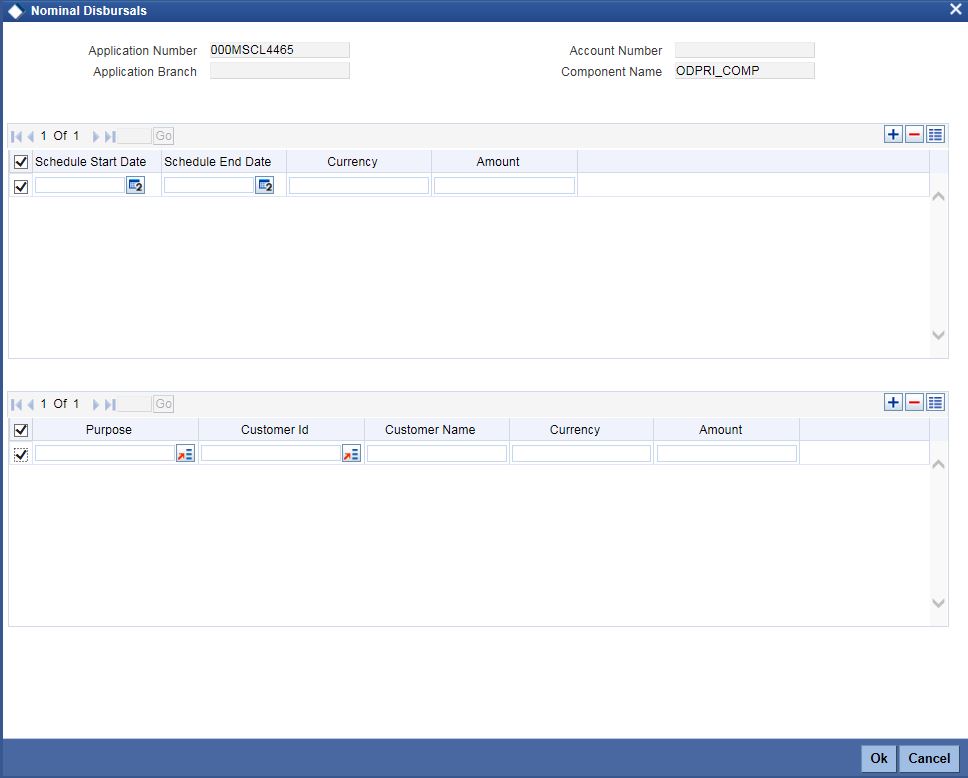

2.4.6.5 Nominal Disbursals button

Click ‘Nominal Disbursal’ button to specify the nominal disbursal details.

Specify the following details:

Application Number

The system displays the application

Application Branch

The system displays the application branch.

Account Number

The system displays the account number.

Component Name

The system displays the components name.

Schedule Start Date

Specify the start date of the Disbursement Schedule from the adjoining calendar.

Schedule End Date

Specify the end date of the Disbursement Schedule from the adjoining calendar.

Currency

Specify the currency code for the disbursement.

Amount

Specify the amount to be financed for disbursal schedules

Purpose

Specify the purpose of disbursement from the option list. Alternatively, you can select the purpose from the option list. The list displays the different types of purpose maintained in the system.

Customer ID

Specify the customer ID for each contractor. Alternatively, you can select the customer ID from the option list. The list displays the valid customer IDs maintained in the system.

Customer Name

The system displays the customer name.

Currency

Specify the currency code for the customer ID selected.

Amount

Specify the amount to be disbursed against the customer ID for the purpose mentioned.

2.4.7 Charges Tab

Click ‘Charges’ tab to maintain charge details.

Charges

Component Name

The system displays the component name.

Currency

The system displays the currency.

Effective Date

Select the effective date from the adjoining calendar.

Due Date

The system displays the due date.

Amount Due

The system displays the amount due.

Amount Waived

The system displayed the amount waived.

Click ‘Payment Details’ button to specify the payment details.

Click ‘Credit Settlement Mode’ tab to specify the credit settlement mode details.

Application Number

The system displays the application number.

Application Branch

The system displays the application branch.

Branch Code

The system displays the branch code.

Account Number

The system displays the account number.

Component Name

The system displays the component name.

2.4.8 Credit Settlement Mode

Credit Payment Mode

Select the credit settlement mode from the drop-down list. The options are as follows:

- Account

- Credit Card

- Clearing

- Debit Card

- External Account

- Electronic Pay Order

- GIRO

- Internal Cheque Instrument

- Cash/Teller

Credit Account Branch

Specify the credit account branch. Alternatively, select the credit account branch from the option list. The displays the valid branch codes maintained in the system.

Credit Product Account

Specify the credit product account. Alternatively, select the credit product account from the option list. The displays the valid product accounts maintained in the system.

Instrument Number

Specify the instrument number.

Upload Source Credit

Specify the upload source credit details. Alternatively, select the source credit details from the option list. The displays the valid credit details maintained in the system.

End Point

Specify the end point. Alternatively, select the end point from the option list. The displays the valid end points maintained in the system.

GIRO Number

Specify the GIRO number.

Payer Account

Specify the payer account.

Payer Bank Code

Specify the payer bank code.

Payer Branch

Specify the payer branch.

Payer Bank Address 1

Specify the payer bank address 1.

Payer Bank Address 2

Specify the payer bank address 2.

Payer Bank Address 3

Specify the payer bank address 3.

Payer Bank Address 4

Specify the payer bank address 4.

Bank GIRO

Select the bank GIRO to be maintained. The options are as follows:

- Bank GIRO

- Plus

External Account Number

Specify the external account number.

External Account Name

The system displays the external account name.

Clearing Bank Code

Specify the clearing bank code. Alternatively, select the clearing bank code from the option list. The displays the valid clearing bank code maintained in the system.

Clearing Branch Code

Specify the clearing branch code. Alternatively, select the clearing branch code from the option list. The displays the valid branch codes maintained in the system.

Product Category

Specify the product category. Alternatively, select the product category from the option list. The displays the valid product categories maintained in the system.

Routing Number

Specify the routing number.

Clearing Product Code

Specify the clearing product code.

Sector Code

Specify the sector code. Alternatively, select the sector code from the option list. The displays the valid sector codes maintained in the system.

Auto GIRO

Select the auto GIRO details. The options are as follows:

- Auto

- Manual

Exchange Rate

Specify the exchange rate prevailing.

Negotiated Cost Rate

Specify the negotiated cost rate.

Negotiated Reference

Specify the negotiated reference number.

Original Exchange Rate

Specify the original exchange rate.

2.4.8.1 Debit Settlement Mode Tab

Click ‘Debit Settlement Mode’ tab to specify the credit settlement mode details.

Specify the following details:

Debit Payment Mode

Select the debit settlement mode from the drop-down list. The options are as follows:

- Account

- Credit Card

- Clearing

- Debit Card

- External Account

- Electronic Pay Order

- GIRO

- Internal Cheque Instrument

- Cash/Teller

- PDC

Debit Account Branch

Specify the debit account branch. Alternatively, select the debit account branch from the option list. The displays the valid branch codes maintained in the system.

Debit Product Account

Specify the debit product account. Alternatively, select the debit product account from the option list. The displays the valid product accounts maintained in the system.

Card Number

Specify the card number.

Instrument Number Debit

Specify the instrument number debit.

Upload Source Debit

Specify the upload source debit details. Alternatively, select the source debit details from the option list. The displays the valid debit details maintained in the system.

End Point

Specify the end point. Alternatively, select the end point from the option list. The displays the valid end points maintained in the system.

Payer Account

Specify the payer account.

Payer Bank Code

Specify the payer bank code.

Payer Branch

Specify the payer branch.

Payer Bank Address 1

Specify the payer bank address 1.

Payer Bank Address 2

Specify the payer bank address 2.

Payer Bank Address 3

Specify the payer bank address 3.

Payer Bank Address 4

Specify the payer bank address 4.

GIRO Number

Specify the GIRO number.

Bank GIRO

Select the bank GIRO to be maintained. The options are as follows:

- Bank GIRO

- Plus

External Account Number

Specify the external account number.

External Account Name

The system displays the external account name.

Clearing Bank Code

Specify the clearing bank code. Alternatively, select the clearing bank code from the option list. The displays the valid clearing bank code maintained in the system.

Clearing Branch Code

Specify the clearing branch code. Alternatively, select the clearing branch code from the option list. The displays the valid branch codes maintained in the system.

Product Category

Specify the product category. Alternatively, select the product category from the option list. The displays the valid product categories maintained in the system.

Routing Number

Specify the routing number.

Clearing Product Code

Specify the clearing product code.

Sector Code

Specify the sector code. Alternatively, select the sector code from the option list. The displays the valid sector codes maintained in the system.

Auto GIRO

Select the auto GIRO details. The options are as follows:

- Auto

- Manual

Exchange Rate

Specify the exchange rate prevailing.

Negotiated Cost Rate

Specify the negotiated cost rate.

Negotiated Reference

Specify the negotiated reference number.

Original Exchange Rate

Specify the original exchange rate.

2.4.9 Limits Tab

Click ‘Limits’ tab to maintain limit details.

Credit Line Details

Type

Select the credit line type from the drop-down list. The list displays the following values:

- Existing - Select this option if the customer is an existing customer.

- New - Select this option if the customer is a new customer.

Line Branch

Specify the line branch. Alternatively, you can select the line branch from the option list. The list displays all valid line branches.

Line Code

Specify the line code. Alternatively, you can select the line code from the option list. The list displays all valid line codes.

Serial

Specify the line serial number.

Description

Give a brief description on the credit line.

Click details button to launch ‘Facility Details’ screen.

Currency

Specify the currency of the credit line. Alternatively, you can select the currency from the option list. The list displays all valid currency codes.

Sanctioned

Specify the sanctioned credit line.

Utilized Amount

Specify the utilized amount.

Available Amount

Specify the available amount.

Proposed Amount

Specify the proposed amount.

Handoff

Check this box to hand-off the modified details to the ELCM system. You should check this box for new facilities created.

Collateral Details

Type

Select the collateral type from the drop-down list. The list displays the following values:

- Existing - Select this option if the customer is an existing customer.

- New - Select this option if the customer is a new customer.

Branch

Specify the line branch. Alternatively, you can select the line branch from the option list. The list displays all valid line branches.

Collateral Code

Specify the collateral code. Alternatively, you can select the collateral code from the option list. The list displays all valid collateral codes.

Currency

Specify the currency of the credit line. Alternatively, you can select the currency from the option list. The list displays all valid currency codes.

Collateral Value

Specify the value of the collateral.

Collateral Type

Specify the collateral type.

Collateral Reference

Specify the collateral reference.

Click ‘Details’ button to launch ‘Collateral Details’ screen.

Handoff

Check this box to hand-off the modified details to the ELCM system. You should check this box for new collateral created.

Financial Linkage

Utilization Order

Specify the utilization order.

Linkage Type

Select a type of linkage to which you need to link the specified account from the adjoining drop-down list. This list displays the following values:

- Collateral – Select if you need to link the account to existing collateral.

- Pool – Select if you need to link the account to collateral pool.

- Facility – Select if you need to link the account to a facility.

- Commitment - Select if you need to link the account to a commitment.

Branch

Specify the branch code of the customer. Alternatively, you can select the branch code from the option list. The list displays all valid branch codes.

Linked Reference ID

Specify the linked reference ID. Alternatively, you can select the linked reference ID from the option list. The list displays all valid reference IDs.

Currency

Specify the currency of the credit line. Alternatively, you can select the currency from the option list. The list displays all valid currency codes.

Limit Amount

Specify the limit amount.

Linkage Amount

Specify the linkage amount.

Linkage (%)

Specify the linkage percentage.

For details on Collaterals, refer to the section ‘Collateral Maintenance’ in the chapter 'Limits and Collaterals' in Limits and Collateral Management User Manual.

2.4.10 Asset Details Tab

Click Asset Details tab to view the details of the asset.

Specify the following details:

Finance Currency

The system displays the finance currency.

Fixed Asset Product

The system displays the fixed asset product.

Status

Specify the status of the asset.

Asset Category

Specify the asset category. Alternatively, you can select the asset category from the option list. The list displays the asset categories maintained in the system

Category Description

The system displays the asset category description.

Location

Specify the location of the asset.

Location Description

The system displays the description of the location of the asset.

Booking Date

Specify the date of booking from the adjoining calendar.

Capitalization Date

Specify the capitalization date from the adjoining calendar.

Fixed Asset Contract Reference

Specify the fixed asset contract reference.

Fixed Asset User Reference

Specify the fixed asset user reference.

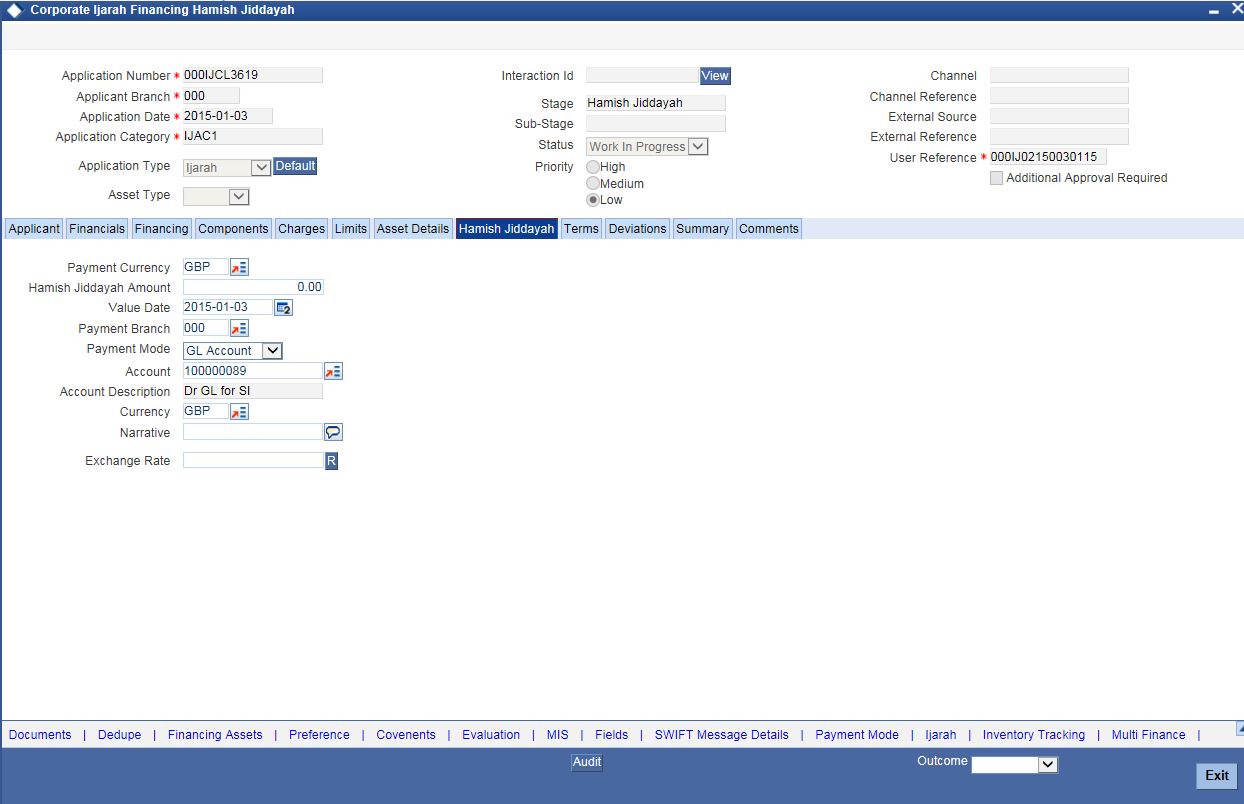

2.4.11 Hamish Jiddayah Tab

Click ‘Hamish Jiddayah’ tab to specify the Hamish Jiddayah details.

Specify the following details:

Payment Currency

Specify the payment currency. Alternatively, you can select the payment currency from the option list. The list displays the valid currency codes maintained in the system.

Hamish Jiddayah Amount

Specify the Hamish Jiddayah amount.

Value Date

Specify the value date from the adjoining calendar.

Payment Branch

Specify the payment branch. Alternatively, you can select the payment branch from the option list. The list displays the valid payment branch maintained in the system.

Payment Mode

Select the payment mode from the drop-down list. The options are as follows:

- GL Account

- Account

- Own Account

Account

Specify the account number from the drop-down list. Alternatively, you can select the account number from the option list. The list displays the valid account number maintained in the system.

Account Description

The system displays the account description.

Currency

Specify the currency code. Alternatively, you can select the currency from the option list. The list displays the valid currency codes maintained in the system.

Narrative

Specify remarks if any.

Exchange Rate

Specify the exchange rate.

2.4.12 Terms Tab

Click ‘Terms’ tab to maintain terms details. You can also maintain ‘Terms’ for the category in ORDCTERM. The system defaults these terms on click of ‘Default’ button.

Terms and Conditions

Terms

Specify the terms and conditions of the finance creation.

Apply

Check this box to apply the terms to finance application.

Due Date

Select the date when the terms will be expired from the adjoining calendar.

Complied

Check this box if you comply with the terms.

2.4.13 Deviations Tab

Click ‘Deviations’ tab to view deviation details.

Deviations

Specify the deviations.

Approved

Check this box if the deviations are approved.

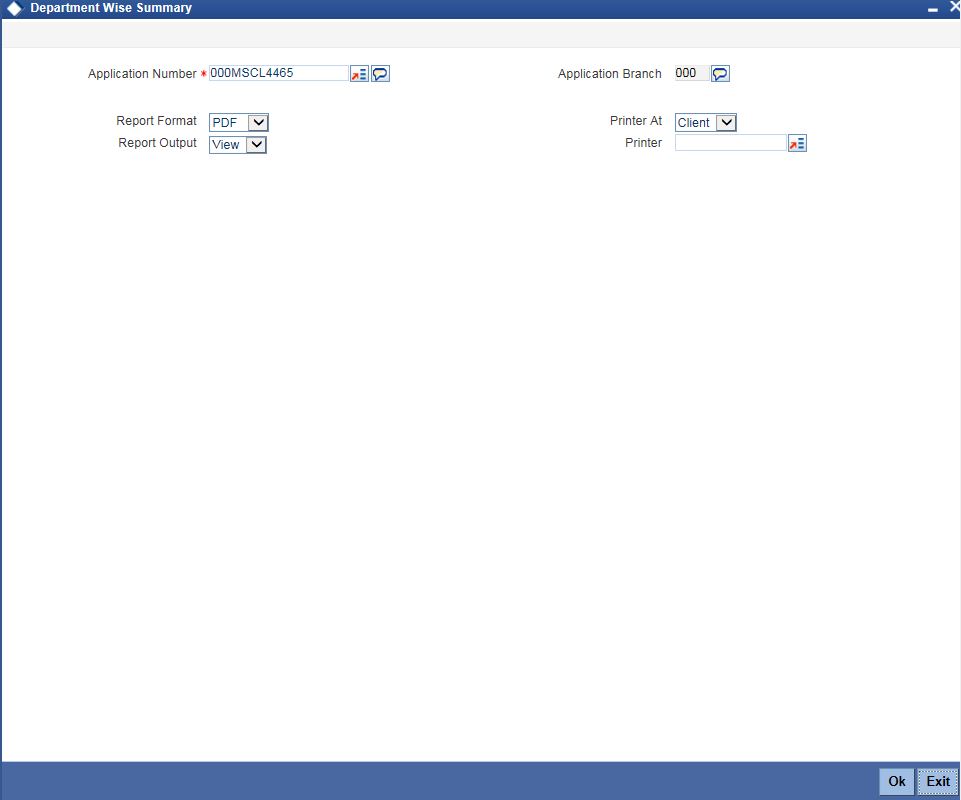

2.4.14 Summary Tab

Click ‘Summary’ tab to view summary details.

Department Summary

Department

Specify the name of the department.

Previous Notes

The system defaults the previous department notes. The system displays any comments given in any of the previous stages by the same department.

For example, when RM initiates the application, the comments may be provided in the Additional notes section. When the application moves to ‘Follow up’ stage or any stage that has to be proceeded by the RM users, the system displays the comments given in the first stage.

Additional Notes

Specify additional department notes.

Click ‘History’ button, to invoke the ‘Department Wise Summary’ screen. The system generates a report of the comments given in all previous stages regardless of the department.

Specify the following details.

Application Number

Specify the application number of the transaction. Alternatively, you can select the application number from the option list. The list displays all the valid application numbers maintained in the system.

Application Branch

The system displays the application branch code.

Report Format

Select the format in which you need to generate the report from the drop-down list. The options are as follows:

- HTML – Select to generate report in HTML format.

- RTF – Select to generate report in RTF format.

- PDF – Select to generate report in PDF format.

- EXCEL – Select to generate report in EXCEL format.

Report Output

Select the report output in which you need to generate the report from the drop-down list. The options are as follows:

- Print – Select to print the report.

- View – Select to print the report.

- Spool – Select to spool the report to a specified folder so that you can print it later.

Printer At

Select location where you wish to print the report from the drop-down list. The options are as follows:

- Client – Select if you need to print at the client location.

- Server – Select if you need to print at the server location

Printer

Specify the printer from which the report has to be printed. Alternatively, you can select the printer from the option list. The list displays all the valid printers maintained in the system.

2.4.15 Comments Tab

Click ‘Comments’ tab to view comment details.

Previous Comments

The system displays the previous stage comments.

Additional Comments

Specify the additional comments in the current stage, if any.

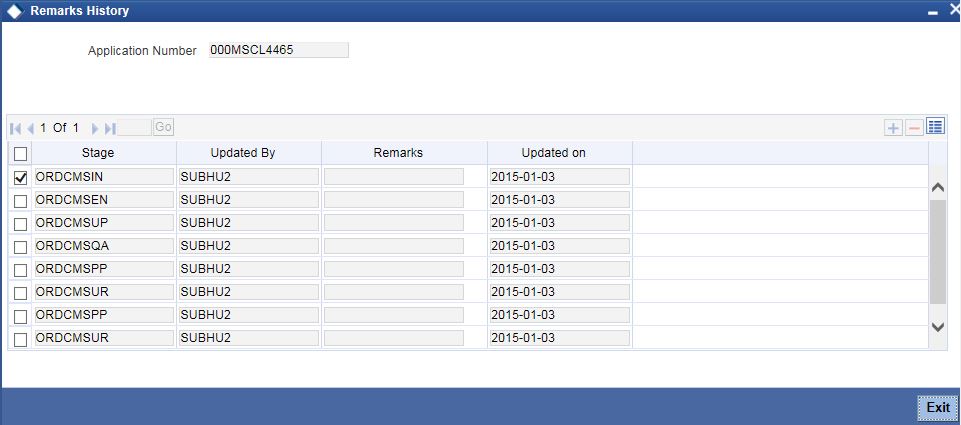

To view history of remarks updated during a transaction. Click ‘Remarks’ button to view the remarks..

The system displays the following details:

- Application Number

- Stage

- Updated By

- Remarks

- Updated on

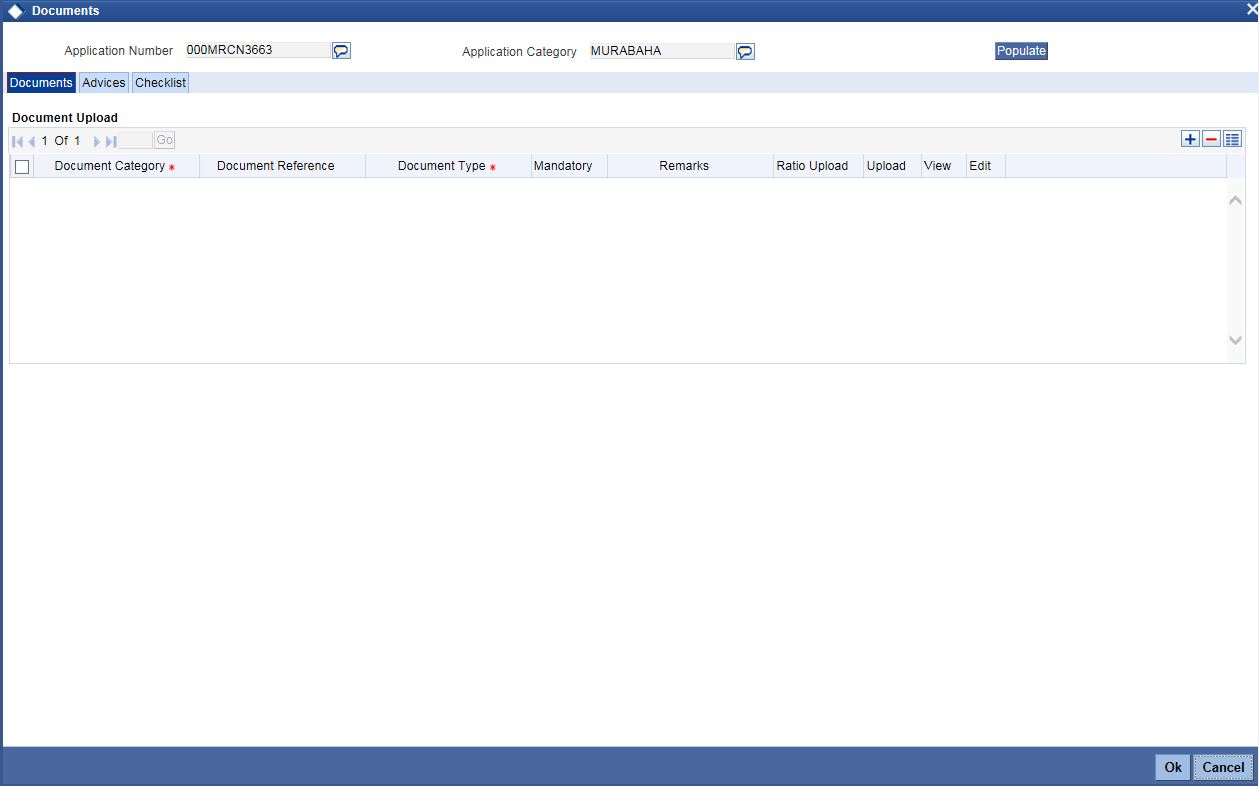

2.4.16 Documents Button

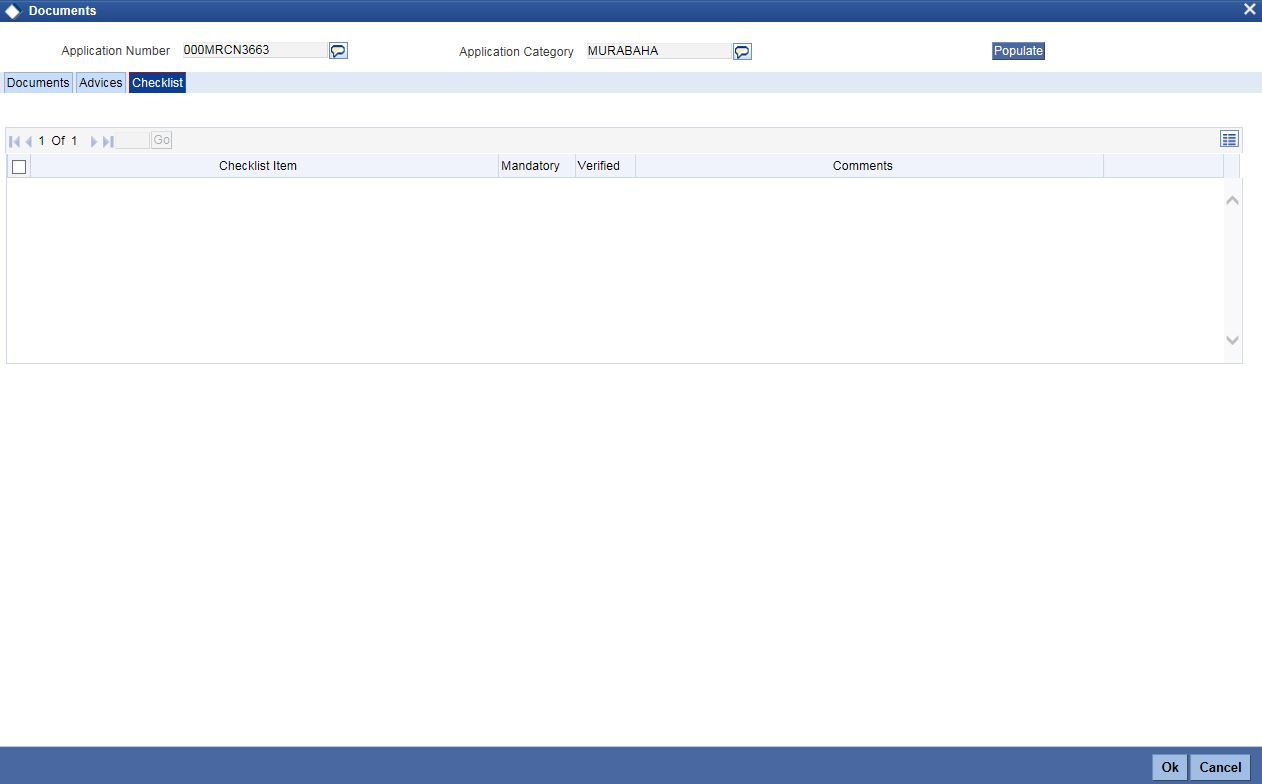

You can capture the finance related documents details through the ‘Documents Upload’ screen. Click ‘Documents’ button to invoke this screen.

Application Number

The system displays the application number.

Application Category

The system displays the application category.

Documents

Document Category

Select the document category from the adjoining option list.

Document Reference

Specify the document reference number.

Document Type

Select the type of document.The adjoining option list displays all the document types maintained in the system. Select the appropriate one.

Mandatory

Check this box to indicate whether the document is mandatory.

Remarks

Specify remarks, if any.

Ratio Upload

Check this box if you require ratio upload.

Upload

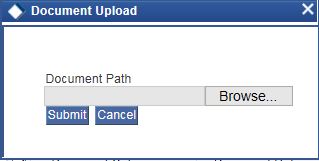

Click ‘Upload’ button to open the ‘Document Upload’ sub-screen. The ‘Document Upload’ sub-screen is displayed below:

In the ‘Document Upload’ sub-screen, specify the corresponding document path and click the ‘Submit’ button. Once the document is uploaded through the upload button, the system displays the document reference number.

View

Click ‘View’ to view the document uploaded.

Edit

Click ‘Edit’ to edit the uploaded documents.

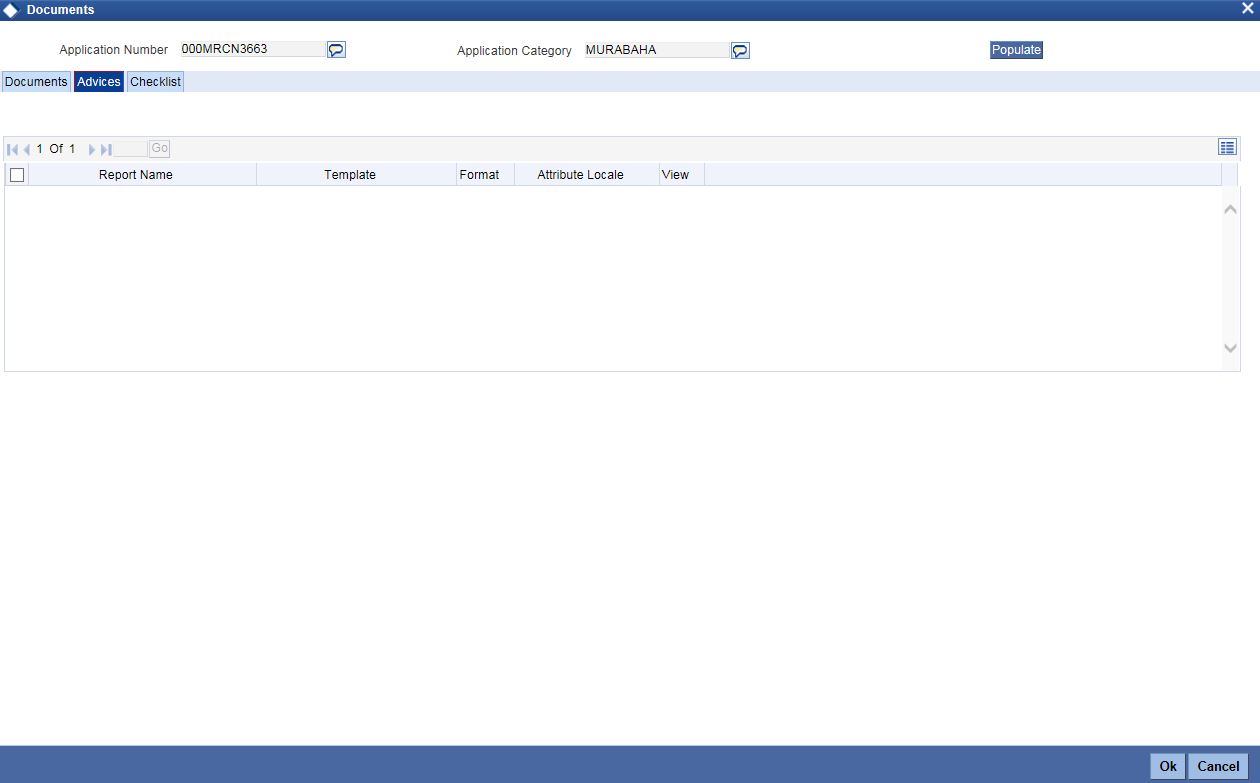

2.4.17 Advices Tab

Click ‘Advices’ tab in Documents screen to view advice details.

Report Name

The system displays the report name.

Template

The system displays the template.

View

Click ‘View’ to view the uploaded document.

2.4.18 Checklist Tab

Click ‘Checklist’ tab in Documents screen to view checklist details.

Checklist Item

The system displays the checklist details.

Mandatory

This field is updated based on the maintenances in Documents sub screen.

Verified

Check this box to confirm that the corresponding checklist is verified.

Comments

Specify comments, if any.

2.4.19 Dedupe Button

You can query the duplicate details in the Dedupe screen.

When a customer or prospect applies for a finance, the bank verifies if there are any duplicate applications initiated by customer or prospect in the system. If there are any pipeline applications that are suspected to be duplicate of an already initiated application or an existing finance contract, the system identifies and displays the existing transactions details in the Dedupe screen.

Click ‘Dedupe’ button to invoke Dedupe details screen.

2.4.19.1 Customers

Applications

In the Application section, the system checks for any duplicates in the applications that are already initiated from Origination.

Existing Customers

In the Existing Customers section, the system checks for any duplicate entry in the existing customer details based on First Name, Middle Name, Last Name, Short Name and National ID.

2.4.19.2 Contracts

Applications

In the Application section, the system checks for any duplicates in the finance applications that are already initiated from Origination.

Existing Customers

In the Existing Customers section, the system checks for any duplicate entry in the existing finance details based on Number of Instalments, Frequency, Frequency Unit, Requested Amount.

2.4.20 Financing Asset Button

You can capture the finance asset details based on the finance type. You can capture the finance type details from this Asset Details screen. You can invoke this screen by clicking ‘Financing Assets’ button

Application Category

The system displays the application category.

Application Number

The system displays the application number.

Application Type

Select the type of application from the drop-down list. The list displays the following values:

- Home

- Vehicle

- Personal

- Mortgage

- Others

Finance Branch

The system displays the finance branch.

Finance Reference

The system displays the finance reference number.

Finance Currency

The system displays the finance currency.

Customer Branch

The system displays the customer branch.

Customer ID

The system displays the customer ID.

Customer Name

The system displays the customer name.

For information on Home, Vehicle, Others, Mortgage and Valuation Tabs, refer to the section ‘Assets Button’ in the chapter 'Account Creation' in Retail Lending User Manual.

2.4.21 Insurance Tab

Click ‘Insurance’ tab to view the insurance details.

Policy Type