11. Reports

During the day, or at the end of the day, you may want to retrieve information on any of the several operations that were performed during the day in your bank. You can generate this information in the form of reports in Oracle FLEXCUBE.

For every module you can generate reports, which give you data about the various events in the life of a specific contract, or across contracts, at a specific point in time. You can have analysis reports, daily reports, exception reports (reports on events that ought to have taken place on the contract but have not, due to various reasons), history reports and so on. A set of report formats is pre-defined for every module.

This chapter contains the following sections:

- Section 11.1, "Generating Reports"

- Section 11.2, "Accrual Control List Report"

- Section 11.3, "Accrual Control List Summary Report"

- Section 11.4, "Adverse Status Report"

- Section 11.5, "Adverse Status Summary Report"

- Section 11.6, "Amortization Report"

- Section 11.7, "Contract Retrieval Report"

- Section 11.8, "Event Report"

- Section 11.9, "Lending Forward Contract Report"

- Section 11.10, "Forward Amendments Details Changes Report"

- Section 11.11, "Interest Calculation Analysis Report"

- Section 11.12, "Linked Contracts Utilization Report"

- Section 11.13, "Maturity Report"

- Section 11.14, "Overdue Schedules Details"

- Section 11.15, "Overdue Schedules Summary"

- Section 11.16, "Periodic Rate Revision"

- Section 11.17, "Loan Payoff Calculator Report (Account)"

- Section 11.18, "Loan Payoff Calculator Report (Line)"

- Section 11.19, "Loan History Report"

- Section 11.20, "Automatic Loan Payment Exception"

- Section 11.21, "Loan Past Due Notice"

- Section 11.22, "Past Due and Non-performing Loan Month End Projections Report"

- Section 11.23, "Ledger Verification Report "

- Section 11.24, "New Loans Report "

- Section 11.25, "Loan Rollover Monitoring Report "

- Section 11.26, "Loan Register/Trial Balance Report "

- Section 11.27, "Loan Rollover Notice"

- Section 11.28, "Disbursements Made Today Report"

- Section 11.29, "Insurance Policy Expired Today Report"

- Section 11.30, "Loan Settlement Notice Report"

- Section 11.31, "Taken Over Assets Reports"

- Section 11.32, "Loans with CASA Benefit Report"

- Section 11.33, "Customer Loan Agreement"

- Section 11.34, "Loan Rejection Report"

- Section 11.35, "Loan Branch Transfer Report"

- Section 11.36, "Ad-Hoc Combined Statement"

- Section 11.37, "Combined Statement Generation Report"

11.1 Generating Reports

From the Application Browser, select the Reports option. A list of all the modules to which you have access rights are displayed in the screen. When you click on a module, all the reports for which you have access rights under the selected module are displayed. Click on the report you want to generate. You will be given a selection Criteria based on which the report would be generated.

Click ’OK’ button when you have specified your preferences. The ‘Print Options’ screen gets displayed, where you can specify the preferences for printing the report.

In this screen, you can indicate the following preferences for printing the report.

Format

Select the format in which you want the report to be generated from the options provided in the drop-down list. The following options are available:

- HTML

- RTF

- Excel

Output

Select the output for the report from the options provided. The following options are available:

- Print – select this option if you wish to print the report

- View – select this option if you wish to view the contents of the report

- Spool – select this option if you wish to spool the report for further use

Printer

Specify the name of the printer or select it from the option list provided. All the configured printers are displayed in the list.

This is applicable only if you have specified the output as ‘Print’.

Contents of the report

The contents of the report are discussed under the following heads:

Header

The Header section of the report carries the title of the Report, information on the User who generated the report, the branch code, the date and time and the page number of the report.

Body of the report

The actual contents of the report are displayed in this section. It is detailed for each report, in the subsequent sections of this document.

11.2 Accrual Control List Report

This section contains the following topics:

- Section 11.2.1, "Generating Accrual Control List Report"

- Section 11.2.2, "Selection Options"

- Section 11.2.3, "Contents of the Report"

11.2.1 Generating Accrual Control List Report

The accrual control journal gives the details of accruals done on loan contracts, as of a specific date.

This report shows the Events and Component details for each account and will be generated for a specific combination of the Account Number, Event Date and Branch Name.

The Component and Item details will be displayed based on Events and Account Number.

You can invoke this report screen by typing ‘CLRPACCR’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

11.2.2 Selection Options

If you generate the report manually, the report will list the accounts whose Accrual Processing Date is equal to the date that you specify in the screen CL Accrual Control List.

Specify the following details:

Accrual Processing Date

Specify the accrual processing date to be considered for the report.

11.2.3 Contents of the Report

The options that you have specified while generating the report are printed at the beginning of the report. Apart from the header the following information is provided for each contract:

Body of the Report

Field |

Description |

Account Number |

The account number of the contract |

Status |

The status of the loan contract |

Component |

This is the component of the loan against which accrual entries are passed |

Currency |

This is the component currency. If not specified at the Component level, the loan currency is displayed |

Current Accrual |

This is the amount for which accrual entries are passed for the current month |

Value Date |

The Value Date of the contract |

11.3 Accrual Control List Summary Report

This section contains the following topics:

- Section 11.3.1, "Generating Accrual Control List Summary Report"

- Section 11.3.2, "Contents of the Report"

11.3.1 Generating Accrual Control List Summary Report

The Accrual Control List Summary report summarizes the details of accruals product wise.

11.3.2 Contents of the Report

Apart from the header the following information is provided for each contract:

Body of the Report

Field |

Description |

Product Code |

This is the product for which the summary report is being generated |

Status |

The status of the loan contract under the product |

Component |

This is the component of the loan against which accrual entries are passed, for the contract under the product |

Currency |

This is the component currency. If not specified at the Component level, the loan currency is displayed |

Value Date |

The Value Date of the contract under this product |

Current Accrual |

This is the amount for which accrual entries are passed for the current month |

11.4 Adverse Status Report

This section contains the following topics:

- Section 11.4.1, "Generating Adverse Status Report"

- Section 11.4.2, "Selection Options"

- Section 11.4.3, "Contents of the Report"

11.4.1 Generating Adverse Status Report

The Adverse status report gives details of loan contracts that have moved into a status other than active and liquidated.

The amounts outstanding for the various components are reported in this report.

You can invoke this report screen by typing ‘CLRPSTAT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

11.4.2 Selection Options

If you generate the report manually (from the reports Browser) you can specify preferences for the generation of the report. The contents of the report are determined by the preferences that you specify.

You can specify the following preferences for the report:

Product Type

You can generate the Adverse Status report for a specific Product Category or for all categories. Select a Product Category from the option list provided.

Product Code

You can generate a product-wise report. Select the Product Code from the option list which contains all valid products under the category you have selected.

Currency

Under specific Product(s), you can choose to generate reports in a specific currency(s).

Customer

You can generate this report for specific customer(s).

Status

Specify a valid status of the account from the adjoining option list.

From Date (Value Date)

Enter the Value Date of the contract. The system will generate a report for the contracts that have a Value Date greater than the date you enter here.

To Date (Value Date)

Enter the Value Date of the contract. The system will generate a report for the contracts that have a Value Date lesser than the date you enter here.

Report Format

Select the format in which you need to generate the report from the adjoining drop-down list. This list displays the following values:

- HTML – Select to generate report in HTML format.

- RTF – Select to generate report in RTF format.

- PDF – Select to generate report in PDF format.

- EXCEL – Select to generate report in EXCEL format.

Report Output

Select the output in which you need to generate the report from the adjoining drop-down list. This list displays the following values:

- Print – Select to print the report.

- View – Select to print the report.

- Spool – Select to spool the report to a specified folder so that you can print it later.

Printer At

Select location where you wish to print the report from the adjoining drop-down list. This list displays the following values:

- Client – Select if you need to print at the client location.

- Server – Select if you need to print at the server location

Printer

Select printer using which you wish to print the report from the adjoining option list.

11.4.3 Contents of the Report

The report options that you selected while generating this report are printed at the beginning of the report.

Apart from the header the following information is provided for each contract:

Body of the Report

Field |

Description |

Product Code |

This is the product for which the report is generated |

Status |

This is the current status of the component that is in a status other than Active or Liquidated. The status codes are defined for a product and applied to contracts involving the product |

Customer |

This is the CIF ID of the customer involved in the loan. |

Customer Name |

The name of the customer |

Account Number |

This is the account number of the loan account being reported |

Component |

The component whose status details the report reflects |

Currency |

This is the component currency. If not specified at the Component level, the loan currency is displayed |

Maturity |

This is the Maturity Date of the loan |

Maximum Overdue Days |

If more than one account is overdue under the product, this field will reflect the number of overdue days of the account with the highest number of overdue days |

Overdue Amount |

This is the total amount that is overdue for the component as of the date of report generation |

Date of Last Disbursement |

Date of Last Disbursement |

Date of Last Payment |

Date of Last Payment |

11.5 Adverse Status Summary Report

This section contains the following topics:

11.5.1 Generating Adverse Status Summary Report

The Adverse Status Summary report summarizes the details of each contract.

11.5.2 Contents of the Report

Apart from the header the following information is provided for each contract:

Body of the Report

Field |

Description |

Product Code |

This is the product for which the report is generated |

Status |

This is the current status of the contract for which details are being reported |

Component |

This is the component of the loan against which the payment due is being reported. If more than one component falls due on the same day they will be reported one by one |

Currency |

This is the component currency. If not specified at the Component level, the loan currency is displayed |

Earliest Due Date |

For all the loans reported, this is the earliest date on which a repayment is due |

Latest Due Date |

For all the loans reported, this is the latest date on which a repayment is due |

Cumulative Overdue Amount |

This is the total amount that is overdue for the component(s) as of the date of report generation |

11.6 Amortization Report

This section contains the following topics:

- Section 11.6.1, "Generating Amortization Report"

- Section 11.6.2, "Selection Options"

- Section 11.6.3, "Contents of the Report"

11.6.1 Generating Amortization Report

The Amortization Report gives the amortization details of loan contracts.

You can invoke this report screen by typing ‘CLRPAMSC’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

11.6.2 Selection Options

If you generate the report manually (from the reports Browser) you can specify preferences for the generation of the report. The contents of the report are determined by the preferences that you specify.\

You can specify the following preferences for the report:

Loan Account

Enter the Account Number for which amortization details should be displayed in the report. If you do not enter an account number here, the report will be generated for all accounts.

11.6.3 Contents of the Report

The report options that you selected while generating this report are printed at the beginning of the report.

Apart from the header the following information is provided for each contract:

Body of the Report

Field |

Description |

Account Number |

This is the reference number of the loan being reported |

Principal |

The principal amount of the loan being reported |

Product |

This is the product for which the report is generated |

Customer |

This is the CIF ID of the customer involved in the loan |

Tenor |

The tenor of the loan being reported |

Year |

This is the year for which the amortization details are being displayed in the report |

Due date |

The due date of an installment of the loan |

Currency |

The currency of the account |

Installment |

This is the installment amount of the loan |

Interest Due |

The interest amount due |

Principal Due |

The principal amount due |

Total Amount Due |

The total principal amount due on the loan |

11.7 Contract Retrieval Report

This section contains the following topics:

- Section 11.7.1, "Generating Contract Retrieval Report"

- Section 11.7.2, "Selection Options"

- Section 11.7.3, "Contents of the Report"

11.7.1 Generating Contract Retrieval Report

The Contract Retrieval report gives you comprehensive information about a loan contract. Information about loan contracts that are active, liquidated and reversed can be retrieved through this report. You can generate the report for a variety of reasons.

You can invoke this report screen by typing ‘CLRPRETR’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

11.7.2 Selection Options

If you generate the report manually (from the reports Browser) you can specify preferences for the generation of the report. The contents of the report are determined by the preferences that you specify.

You can specify the following preferences for the report:

Product Type

You can generate the Contract Retrieval Report for a specific product type or for all categories. Select a product type from the option list provided.

Product Code

You can generate a product-wise report. Select the Product Code from the option list which contains all valid products under the category you have selected.

Currency

Under specific Product(s), you can choose to generate reports in a specific currency(s).

Customer

You can generate this report for specific customer(s).

Maturity Type

You can generate the report only for a particular Maturity Type. The Maturity type of a loan can be

- Fixed - this type of a loan has a fixed maturity date

- Call - If the maturity date is not fixed the loan can be liquidated any time

You can generate the report either for fixed maturity loans or call loans.

Account Status

You can generate the report based on the status of the loan contract. The report can be generated for loans with the following statuses only:

- Active

- Liquidated

- Reversed

- To be initiated

All the loans with the specified status for the specific period will be reported.

Auth Status

You can generate the report for loan contracts either with an authorized or unauthorized status.

From (Value Date)

Enter the Value Date of the contract. The system will generate a report for the contracts that have a Value Date greater than the date you enter here.

To (Value Date)

Enter the Value Date of the contracts. The system will generate a report for the contracts that have a Value Date lesser than the date you enter here.

From (Maturity Date)

Specify the Maturity Date of the loan. The report will be generated for all contracts whose Maturity Date is equal to, or greater than the date you have specified here.

To (Maturity Date)

Specify the Maturity Date of the loan. The report will be generated for all contracts whose Maturity Date is equal to, or less than the date you have specified here.

11.7.3 Contents of the Report

The report options that you selected while generating this report are printed at the beginning of the report.

Body of the Report

Field |

Description |

Account Number |

The account number for which the report is being generated |

Account Status |

This is the current status of the account |

Outstanding Amount |

This is the total outstanding amount that the customer has to repay. This amount also includes amounts belonging to earlier schedules that are yet to be paid. In case the customer has made pre-payments the outstanding amount can be less than the due amount |

Product Code |

This is the product for which the report is generated |

Product Category |

This is the product category to which the generated report belongs |

Product Description |

This is the description of the product |

User Reference |

This is the reference number of the loan being reported |

Customer |

This is the CIF ID of the customer involved in the loan |

Customer Name |

The name of the customer |

Related Reference Number |

This is the alternate account number |

Account Currency |

The currency of the account |

Financed Amount |

The loan amount financed |

Original Start Date |

This is the original start date of the loan |

Booking Date |

The Booking Date of the contract |

Value Date |

The Value Date of the contract |

Maturity Type |

This is the Maturity Type of the contract |

Maturity Date |

The Maturity Date of the contract |

Tenor (In days) |

The tenor of the loan |

User Defined Status |

The status of the loan |

Auth Status |

The authorization status of the contract |

Liquidation Mode |

The liquidation mode of the contract |

Rollover Type |

The rollover mode |

Rollover Count |

The rollover count |

Component |

The components of the loan are listed here |

Currency |

This is the currency of the component |

Rate Type |

This is the rate type |

Rate Code |

This is the rate code |

Resolved Value |

This is the effective rate |

Special Amount |

This is the special amount for the component |

EUR Currency |

This is the EUR currency |

11.8 Event Report

This section contains the following topics:

- Section 11.8.1, "Generating Event Report"

- Section 11.8.2, "Selection Options"

- Section 11.8.3, "Contents of the Report"

11.8.1 Generating Event Report

Contract events are events that have taken place during the tenor of a loan contract.

Contract Events report gives a list of all the events that have taken place during the tenor of a loan contract. The events are listed by their Value Date.

You can invoke this report screen by typing ‘CLRPEVNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

11.8.2 Selection Options

If you generate the report manually (from the reports Browser) you can specify preferences for the generation of the report. The contents of the report are determined by the preferences that you specify.

You can specify the following preferences for the report:

From (Account Number)

Select the starting account number. The system will display event details of all accounts from this account number.

To (Account Number)

Select the ending account number. The system will display event details of all accounts upto this account number.

Note

If you do not enter an account number in the above two field, the system will display the event details of all accounts.

From (Event Date)

Enter the date from which event details should be generated in the report for accounts.

To (Event Date)

Enter the date upto which event details should be generated in the report for accounts.

Note

You have the option of not specifying the ‘From’ and ‘To’ dates, but if you specify the ‘From Event Date’, it will be mandatory for you to specify the ‘To Event Date’.

Include Accrual Events also

Check this box to indicate accrual related events should be included.

Single Account Number

Select this option to indicate the report should be generated for a single account number or for a range.

All

Select this option to indicate the report should be generated for all accounts.

11.8.3 Contents of the Report

The report options that you selected while generating this report are printed at the beginning of the report.

Body of the Report

Field |

Description |

Account Number |

The account number of the contract |

Account Currency |

The currency of the account |

Customer ID |

This is the CIF ID of the customer involved in the loan |

Customer Name |

The name of the customer |

Event Description |

This is the code of the event for which details are being reported |

Event Date |

This indicates the date on which the event took place. |

Component Name |

The component for which details are displayed in the report |

Component Amount Tag |

The amount tag |

Component Value |

The value of the amount tag |

Component Currency |

The currency of the component |

11.9 Lending Forward Contract Report

This section contains the following topics:

- Section 11.9.1, "Generating Lending Forward Contract Report"

- Section 11.9.2, "Selection Options"

- Section 11.9.3, "Contents of the Report"

11.9.1 Generating Lending Forward Contract Report

A forward contract is a loan with a future value date. The value date is the date on which the loan takes effect. The tenor of the loan contract will begin on this date. All accounting entries for the loan contract, all calculations for interest and all the other components based on the tenor will be made from this date onwards.

The forward contract report gives details of all the loan contracts with a future value date. Only contracts that take effect on a date later than or same as the specified date are included in the report.

You can invoke this report screen by typing ‘CLRPFRWD’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

11.9.2 Selection Options

If you generate the report manually (from the reports Browser) you can specify preferences for the generation of the report. The contents of the report are determined by the preferences that you specify.

You can specify the following preferences for the report:

From (Value Date)

Enter the Value Date of the contract. The system will generate a report for the contracts that have a Value Date greater than the date you enter here.

To (Value Date)

Enter the Value Date of the contract. The system will generate a report for the contracts that have a Value Date lesser than the date you enter here.

Note

It is not mandatory for you to enter the ‘From’ and ‘To’ dates.

Product Category

You can generate the Forward Contract Report for a specific Product Category or for all categories. Select a Product Category from the option list provided.

11.9.3 Contents of the Report

The report options that you selected while generating this report are printed at the beginning of the report.

Body of the Report

Field |

Description |

Product Category |

This is the product category to which the generated report belongs |

Account Number |

The account number of the contract for which the report is generated |

Customer ID |

This is the CIF ID of the customer involved in the loan |

Customer Name |

The name of the customer |

Amount |

This is the principal amount involved in the loan |

Currency |

This is the currency in which the amount is displayed |

Euro Equivalent |

The Euro equivalent of the loan amount |

Value Date |

This is the date on which the loan takes effect |

Maturity Type |

This is the maturity type of the loan. It could be fixed or call. |

Maturity Date |

This is the date on which the loan matures. The maturity date is generated in the report only in case of fixed maturity loans. |

Field |

Description |

CHARGE DETAILS |

|

Component |

The component on which a charge is being applied |

Amount |

The charge amount |

Currency |

The currency in which the amount is displayed |

Euro Equivalent |

The Euro equivalent of the charge |

Waiver |

Whether or not the charge has been waived |

INTEREST DETAILS |

|

Component |

The interest component |

Amount |

The interest amount |

Currency |

The currency in which the amount is displayed |

Euro Equivalent |

The Euro equivalent |

Rate |

The interest rate being applied |

Effective Rate |

The effective interest rate |

Waiver |

Whether the interest has been waived |

11.10 Forward Amendments Details Changes Report

This section contains the following topics:

- Section 11.10.1, "Generating Forward Amendments Details Changes Report"

- Section 11.10.2, "Selection Options"

- Section 11.10.3, "Contents of the Report"

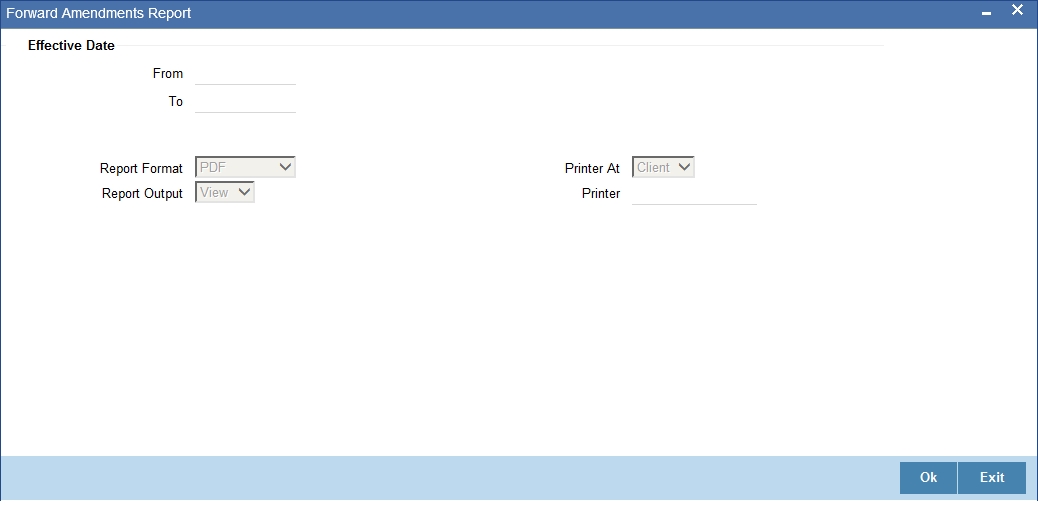

11.10.1 Generating Forward Amendments Details Changes Report

The Forward Amendments Details Changes Report gives a list of all the amendments made to contracts with a future value date.

You can invoke this report screen by typing ‘CLRPFWCH’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

11.10.2 Selection Options

If you generate the report manually, the report will list the accounts whose Effective Date is between the dates that you specify in the screen Forward Amendments Report screen.

You can specify the following preferences for the report:

From (Effective Date)

Enter the date from which the report should include amendment details.

To (Effective Date)

Enter the date upto which the report should include amendment details.

11.10.3 Contents of the Report

The report options that you selected while generating this report are printed at the beginning of the report.

Body of the Report

Field |

Description |

Account Number |

The account number of the contract for which the report is being generated |

Maturity Date |

The Maturity Date of the contract |

Value Date |

The Value Date of the contract |

Loan Amount |

The principal loan amount of the contract |

Currency |

This is the component currency. If not specified at the Component level, the loan currency is displayed |

Customer ID |

This is the CIF ID of the customer involved in the loan |

Customer Name |

The name of the customer |

Transaction Date |

The date of the transaction |

Amendment Date |

The date of amendment |

New Maturity Date |

The Maturity Date after amendment |

Differential Amount |

This is the difference between the original financed amount and the new financed amount. If there is no change in the loan value, this field will be zero. |

Latest ESN |

The latest Event Sequence Number |

Component Name |

The component that has been amended |

New Rate |

The new rate that has been applied to the component |

Old Rate |

The original rate |

New Rate Code |

The new rate code |

Old Rate Code |

The original rate code |

11.11 Interest Calculation Analysis Report

This section contains the following topics:

- Section 11.11.1, "Generating Interest Calculation Analysis Report"

- Section 11.11.2, "Selection Options"

- Section 11.11.3, "Contents of the Report"

11.11.1 Generating Interest Calculation Analysis Report

The Interest Calculation Analysis Report is generated for the accounts required between the given Value Date ranges.

The report will be generated for a specific combination of Branch, Account Number and Value Date range.

You can invoke this report screen by typing ‘CLRPCALC’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

11.11.2 Selection Options

If you generate the report manually (from the reports Browser) you can specify preferences for the generation of the report. The contents of the report are determined by the preferences that you specify.

You can specify the following preferences for the report:

Single/Range (Account Type)

Select this option to indicate you are either specifying a range of account numbers or a specific one whose report is to be generated.

All (Account Type)

Select this option to indicate the report should be generated for all accounts.

From (Account Number)

Select the starting account number. The system will display details of all accounts from this account number.

To (Account Number)

Select the ending account number. The system will display details of all accounts upto this account number.

From (Value Date)

Enter the Value Date of the contract. The system will generate a report for the contracts that have a Value Date greater than the date you enter here.

To (Value Date)

Enter the Value Date of the contract. The system will generate a report for the contracts that have a Value Date lesser than the date you enter here.

11.11.3 Contents of the Report

The report options that you selected while generating this report are printed at the beginning of the report.

Body of the Report

Field |

Description |

Account Number |

The account number of the contract for which the report is being generated |

Value Date |

The Value Date of the contract |

Maturity Date |

The Maturity Date of the loan contract |

Customer Id |

This is the CIF ID of the customer involved in the loan |

Customer Name |

The name of the customer |

Component |

The component for which details are being displayed in the report |

Interest Method |

The method if interest calculation |

Currency |

The account currency |

Start Date |

Reflects the start date of change of interest rate |

End Date |

Reflects the end date of change of interest rate |

Basic Amount |

The basic amount on which the interest is calculated |

Rate |

The interest rate applicable to a certain period |

Number of Days |

The number of days for which the rate is applicable |

Interest Amount |

The is the interest amount |

11.12 Linked Contracts Utilization Report

This section contains the following topics:

- Section 11.12.1, "Generating Linked Contracts Utilization Report"

- Section 11.12.2, "Selection Options"

- Section 11.12.3, "Contents of the Report"

11.12.1 Generating Linked Contracts Utilization Report

This report will include the details of the accounts, lines or collaterals that have been linked to an account, based on the selection criteria. Linkage Account details and the Amount Financed will be shown for each Account in this report.

You can invoke this report screen by typing ‘CLRPLICU’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

11.12.2 Selection Options

If you generate the report manually, the report will list the accounts that you have specified in the Linked Contract Utilization screen.

You can specify the following preferences for the report:

From (Account Number)

Select the starting account number. The system will display event details of all accounts from this account number.

Note

If you enter an account number in this field, you will have to enter an account number in the field ‘To’.

To (Account Number)

Select the ending account number. The system will display event details of all accounts upto this account number.

Note

If you do not enter an account number in the above two fields, the system will display the event details of all accounts.

11.12.3 Contents of the Report

The report options that you selected while generating this report are printed at the beginning of the report.

Body of the Report

Field |

Description |

Account Number |

The account number of the contract |

Amount Financed |

The loan amount |

Currency |

This is the component currency. If not specified at the Component level, the loan currency is displayed |

Value Date |

The Value Date of the contract |

Maturity Date |

The Maturity Date of the loan contract |

Linkage Type |

This is the linkage type |

Linked Reference Number |

The reference number of the linkage type |

Customer ID |

This is the CIF ID of the customer involved in the loan |

Customer Name |

The name of the customer |

Linkage Amount |

The amount linked |

Secured Portion |

This is the secured portion of the loan |

11.13 Maturity Report

This section contains the following topics:

- Section 11.13.1, "Generating Maturity Report"

- Section 11.13.2, "Selection Options"

- Section 11.13.3, "Contents of the Report"

11.13.1 Generating Maturity Report

The maturity report gives information about a contract that is:

- Maturing during the period that you specify

- Have schedules falling due during that period

You can invoke this report screen by typing ‘CLRPMATR’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

11.13.2 Selection Options

If you generate the report manually (from the reports Browser) you can specify preferences for the generation of the report. The contents of the report are determined by the preferences that you specify.

You can specify the following preferences for the report:

Product Category

You can generate the Contract Retrieval Report for a specific Product Category or for all categories. Select a Product Category from the option list provided.

Product Code

You can generate a product-wise report. Select the Product Code from the option list which contains all valid products under the category you have selected.

Contract Currency

Under specific Product(s), you can choose to generate reports in a specific currency(s).

Customer

You can generate this report for specific customer(s).

Maturity Type

You can generate the report only for a particular Maturity Type. The Maturity type of a loan can be

- Fixed - this type of a loan has a fixed maturity date.

- Call - If the maturity date is not fixed the loan can be liquidated any time.

You can generate the report either for fixed maturity loan or call loans.

Liquidation Mode

Components of a loan can be liquidated automatically or manually. In auto liquidation a schedule will be automatically liquidated on the day it falls due. In manual liquidation a schedule amount has to be liquidated manually.

You can generate the report based on the liquidation mode that you have specified. The report can be generated only for loans with auto liquidation or you can generate the report for loans that have to be manually liquidated.

From Date (Value Date)

Enter the Value Date of the contract. The system will generate a report for the contracts that have a Value Date greater than the date you enter here.

To Date (Value Date)

Enter the Value Date of the contract. The system will generate a report for the contracts that have a Value Date lesser than the date you enter here.

From Date (Schedule Date)

Specify the Starting Date of the schedule.

To Date (Schedule Date)

Specify the Ending Date of the schedule.

11.13.3 Contents of the Report

The report options that you selected while generating this report are printed at the beginning of the report.

Body of the Report

Field |

Description |

Call Contracts |

|

Customer ID |

This is the CIF ID of the customer involved in the loan |

Customer Name |

The name of the customer |

Account Number |

The account number for which the report is being generated |

Currency |

This is the component currency. If not specified at the Component level, the loan currency is displayed |

Financed Amount |

The loan amount |

Outstanding Amount |

This is the total outstanding amount that the customer has to repay. This amount also includes amounts belonging to earlier schedules that are yet to be paid. In case the customer has made pre-payments the outstanding amount can be less than the due amount. |

Fixed Contracts |

|

Due Date |

This is the due date for the due amount |

Customer ID |

This is the CIF ID of the customer involved in the loan |

Customer Name |

The name of the customer |

Account Number |

The account number for which the report is being generated |

Maturity Date |

Maturity Date of the loan |

Component |

Component which is due |

Currency |

Currency of the component |

Due Amount |

The amount which is due |

Outstanding Amount |

This is the due amount minus the amount paid |

11.14 Overdue Schedules Details

This section contains the following topics:

- Section 11.14.1, "Generating Overdue Schedules Details"

- Section 11.14.2, "Selection Options"

- Section 11.14.3, "Contents of the Report"

11.14.1 Generating Overdue Schedules Details

Repayment schedules can be defined for various components of a product like principal, interest, commission and fees. These schedules will apply to all the loans involving the product unless you redefine them at the time of processing the loan.

The Overdue Schedules report gives details of all repayment schedules of a loan that are overdue (i.e., are not paid even when they are beyond their scheduled repayment dates.

You can invoke this report screen by typing ‘CLRPOSCH’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

11.14.2 Selection Options

If you generate the report manually (from the reports Browser) you can specify preferences for the generation of the report. The contents of the report are determined by the preferences that you specify.

Product Type

You can generate the Overdue Schedules Report for a specific product type or for all categories. Select a product type from the option list provided.

Product Code

You can generate a product-wise report. Select the Product Code from the option list which contains all valid products under the category you have selected.

Currency

Under specific Product(s), you can choose to generate reports in a specific currency(s).

Customer

You can generate this report for specific customer(s).

From Date (Value Date)

Enter the Value Date of the contract. The system will generate a report for the contracts that have a Value Date greater than the date you enter here.

To Date (Value Date)

Enter the Value Date of the contract. The system will generate a report for the contracts that have a Value Date lesser than the date you enter here.

From Date (Schedule Date)

Specify the Starting Date of the schedule.

To Date (Schedule Date)

Specify the Ending Date of the schedule.

11.14.3 Contents of the Report

The report options that you selected while generating this report are printed at the beginning of the report.

Body of the Report

Field |

Description |

Due Date |

The due date of the component which is overdue |

Overdue Days |

The number of days by which the component is overdue |

Customer |

This is the CIF ID of the customer involved in the loan |

Customer Name |

The name of the customer |

Account Number |

The account number of the customer for whom the report is being generated |

Status |

The status of the component which is overdue |

Component |

The component which is overdue |

Currency |

This is the component currency. If not specified at the Component level, the loan currency is displayed |

Overdue Amount |

This is the component amount that is overdue |

11.15 Overdue Schedules Summary

This section contains the following topics:

11.15.1 Generating Overdue Schedules Summary

The Overdue Schedules Summary report summarizes the details of overdue schedules.

11.15.2 Contents of the Report

Apart from the header the following information is provided:

Body of the Report

Field |

Description |

Product Code |

This is the product for which the report is generated |

Status |

This is the current status of the contract for which details are being reported |

Due Date |

This is the due date |

Component |

This is the component of the loan against which the payment due is being reported. If more than one component falls due on the same day they will be reported one by one |

Component Currency |

This is the component currency. If not specified at the Component level, the loan currency is displayed |

Cumulative Overdue Amount |

This is the total amount that is overdue for the component(s) as of the date of report generation |

11.16 Periodic Rate Revision

This section contains the following topics:

- Section 11.16.1, "Generating Periodic Rate Revision"

- Section 11.16.2, "Selection Options"

- Section 11.16.3, "Contents of the Report"

11.16.1 Generating Periodic Rate Revision

The Periodic Rate Revision Report lists the details of a customer, the rate revision date and the effective rate.

The report will be generated for a specific combination of Revision Date, Customer, Account Number and Rate Code.

You can invoke this report screen by typing ‘CLRPREVN’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

11.16.2 Selection Options

If you generate the report manually (from the reports Browser) you can specify preferences for the generation of the report. The contents of the report are determined by the preferences that you specify.

You can specify the following preferences for the report:

Product Category

You can generate a product-wise report. Select the Product Code from the option list which contains all valid products under the category you have selected.

Product Code

Select the Product Code from the option list which contains all valid products under the category you have selected.

Currency

Under specific Product(s), you can choose to generate reports in a specific currency(s).

Customer

You can generate this report for specific customer(s).

Maturity Type

You can generate the report only for a particular Maturity Type. The Maturity type of a loan can be

- Fixed - this type of a loan has a fixed maturity date.

- Call - If the maturity date is not fixed the loan can be liquidated any time.

You can generate the report either for fixed maturity loan or call loans.

From Date (Value Date)

Enter the Value Date of the contract. The system will generate a report for the contracts that have a Value Date greater than the date you enter here.

To Date (Value Date)

Enter the Value Date of the contract. The system will generate a report for the contracts that have a Value Date lesser than the date you enter here.

From Date (Revision Date)

Enter the Revision Date from which the report has to be generated.

To Date (Revision Date)

Enter the Revision Date upto which the report has to be generated.

11.16.3 Contents of the Report

The report options that you selected while generating this report are printed at the beginning of the report.

Body of the Report

Field |

Description |

Revision Date |

The rate revision date |

Rate Code |

The rate code |

Customer |

This is the CIF ID of the customer involved in the loan |

Customer Name |

The name of the customer |

Account Number |

This is the account number of the loan account being reported |

Currency |

This is the component currency. If not specified at the Component level, the loan currency is displayed |

Amount Financed |

The total amount financed |

Component |

The component that has undergone a rate revision |

Formula Name |

The name of the formula |

Component Currency |

The currency of the component |

User Defined Element ID |

The User Defined Element |

Resolved Rate |

The rate applicable |

11.17 Loan Payoff Calculator Report (Account)

This section contains the following topics:

- Section 11.17.1, "Generating Loan Payoff Calculator Report (Account)"

- Section 11.17.2, "Selection Options"

- Section 11.17.3, "Contents of the Report"

11.17.1 Generating Loan Payoff Calculator Report (Account)

The Loan Payoff Calculator Report lists the payoff values for the loan account and component-wise charges and fees details for the loan.

You can invoke this report screen by typing ‘CLRPAYAC’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

11.17.2 Selection Options

If you generate the report manually (from the reports Browser) you can specify preferences for the generation of the report. The contents of the report are determined by the preferences that you specify.

You can specify the following preferences for the report:

Account No

Select the loan account number for which you need to generate the report.

Payoff Date

Enter the Payoff date up to which the report has to be generated.

11.17.3 Contents of the Report

The report options that you selected while generating this report are printed at the beginning of the report.

Body of the Report

Field |

Description |

Principal (Amount Due) |

The principal amount that is due |

Interest (Amount Due) |

The interest amount that is due |

Net Payoff |

The net payoff amount for the loan |

Prepayment Fees |

The prepayment fee associated with the loan |

Component-wise Fees/Charges Details |

|

Component Name |

Name of the component |

Accessed & Unpaid(Fees/Charges) |

The fee or charge that is accessed and unpaid |

Scheduled(Fees/Charges) |

The fee or charge that is scheduled |

Total |

The total fees/charges |

Component-wise Per Diem /Projected Interest Due |

|

Component Name |

The name of the component |

Per-diem |

Per-diem |

Projected Due |

The projected interest due |

Total |

The total fees/charges |

11.18 Loan Payoff Calculator Report (Line)

This section contains the following topics:

- Section 11.18.1, "Generating Loan Payoff Calculator Report (Line)"

- Section 11.18.2, "Selection Options"

- Section 11.18.3, "Contents of the Report"

11.18.1 Generating Loan Payoff Calculator Report (Line)

The Loan Payoff Calculator Report lists the payoff values for the line Id and component-wise charges and fees details for the loan.

You can invoke this report screen by typing ‘CLRPAYLM’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

11.18.2 Selection Options

If you generate the report manually (from the reports Browser) you can specify preferences for the generation of the report. The contents of the report are determined by the preferences that you specify.

You can specify the following preferences for the report:

Line Code

Select the line Id for which you need to generate report.

Payoff Date

Enter the Payoff date up to which the report has to be generated.

11.18.3 Contents of the Report

The report options that you selected while generating this report are printed at the beginning of the report.

Body of the Report

Field |

Description |

Principal (Amount Due) |

The principal amount that is due |

Interest (Amount Due) |

The interest amount that is due |

Net Payoff |

The net payoff amount for the loan |

Prepayment Fees |

The prepayment fee associated with the loan |

Unused Line Fee |

This is the unused line fee |

Currency |

The currency in which the amount is displayed |

Component-wise Fees/Charges Details |

|

Component Name |

Name of the component |

Currency(Fees/Charges) |

The currency in which the fee and charge amounts are displayed |

Accessed & Unpaid(Fees/Charges) |

The fee or charge that is accessed and unpaid |

Scheduled(Fees/Charges) |

The fee or charge that is scheduled |

Total |

The total fees/charges |

Component-wise Per Diem /Projected Interest Due |

|

Component Name |

The name of the component |

Per-diem |

Per-diem |

Projected Due |

The projected interest due |

Currency |

The currency in which the amount is displayed |

Total |

The total fees/charges |

11.19 Loan History Report

This section contains the following topics:

- Section 11.19.1, "Generating Loan History Report"

- Section 11.19.2, "Selection Options"

- Section 11.19.3, "Contents of the Report"

11.19.1 Generating Loan History Report

The Loan History Report lists the event-wise history details for a loan account. It shows all event details for different operations on account.

You can invoke this report screen by typing ‘CLRPLNHT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

11.19.2 Selection Options

If you generate the report manually (from the reports Browser) you can specify preferences for the generation of the report. The contents of the report are determined by the preferences that you specify.

You can specify the following preferences for the report:

Account Number

Select the loan account number for which you need to generate the history report.

11.19.3 Contents of the Report

The report options that you selected while generating this report are printed at the beginning of the report.

Body of the Report

Field |

Description |

Account Number |

The loan account number |

Account Currency |

The currency of the loan account |

Customer Id |

The customer Id of the borrower |

Customer Name |

The name of the borrowing customer |

Component Name |

The name of the component associated with the loan |

Item Value |

The value associated with the component |

Event |

The name of the event during the loan cycle |

Event Description |

Description for the event |

Event Date |

The date on which the event occurred |

Event Sequence Number |

The sequence number of the event |

11.20 Automatic Loan Payment Exception

This section contains the following topics:

- Section 11.20.1, "Generating Automatic Loan Payment Exception"

- Section 11.20.2, "Contents of the Report"

11.20.1 Generating Automatic Loan Payment Exception

The Automatic Loan Payment Exception report lists the details of the loan payment exceptions.

You can invoke this report screen by typing ‘CLRPALPE’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

11.20.2 Contents of the Report

The details of the loan payment exceptions like the customer number, amount due, settlement account etc. are displayed in the report.

Body of the Report

Field |

Description |

Customer Loan Number |

The CIF ID of the customer involved in the loan |

Customer Name |

The name of the customer |

Dept Code |

The code of the department involved in the loan |

Due Date |

The date on which the loan payment was due |

Amount Due |

The repayment amount that is due |

Settlement Account |

The settlement account associated with the loan |

Account Type |

The type of the settlement account |

Auto Liquidation Retries |

The number of retries for auto liquidation |

Reason |

The reason for loan payment exception |

11.21 Loan Past Due Notice

This section contains the following topics:

11.21.1 Generating Loan Past Due Notice

The Loan Past Due Notice report displays all notices for Past Due loans.

You can invoke this report screen by typing ‘CLRPLNPD’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

11.21.2 Contents of the Report

The details of all notices for ‘Past Due’ loans are displayed in the report.

Body of the Report

Field |

Description |

Account Number |

The loan account number |

Payment Due Date |

The due date for payment |

Amount of Payment |

The amount that is due for payment |

Currency |

The currency in which the amount is displayed |

Notice Message |

The message text that is sent to the customer |

Customer Address |

The address of the borrowing customer |

Principal |

The principal amount |

Interest |

The interest amount |

Total Past Due |

Total amount that is past due for payment |

11.22 Past Due and Non-performing Loan Month End Projections Report

This section contains the following topics:

- Section 11.22.1, "Generating Past Due and Non-performing Loan Month End Projections Report"

- Section 11.22.2, "Contents of the Report"

11.22.1 Generating Past Due and Non-performing Loan Month End Projections Report

The Past Due and Nonperforming Loan Month End Projections report lists the monthly projection details of past due and non-performing loans.

You can invoke this report screen by typing ‘CLRPDLIN’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

11.22.2 Contents of the Report

The details of the past due and non-performing loans are displayed in the report.

Body of the Report

Field |

Description |

Past Due Category |

The past due category of the loan |

Product Code |

The name of the loan product |

Account Number |

The account number associated with the loan |

Borrower |

The borrower of the loan |

Credit Risk Rating |

The credit risk rating associated with the loan |

Collateral Code |

The collateral code associated with the loan |

Net Balance |

The principal outstanding |

Interest Past Due |

The interest amount that is past due |

No of Days Currently |

The number of days the loan is currently past due |

No of Days Projected |

The projected number of days the loan remains past due |

Last Interest Payment |

The date when the last interest payment was done |

Maturity Date |

The maturity date of the loan |

Maturity Status |

The maturity status of the loan |

Department Name |

The name of the department which initiated the loan |

Niche Code |

The niche code associated with the loan |

11.23 Ledger Verification Report

This section contains the following topics:

11.23.1 Generating Ledger Verification Report

The Ledger Verification Report lists the details of the ledger balances.

You can invoke this report screen by typing ‘CLRPLGBL’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Specify the report print options and click ‘OK’ button to generate the report.

11.23.2 Contents of the Report

The details of the ledger balances like the GL account title, transaction amount, ledger balance etc. are displayed in this report.

Body of the Report

Field |

Description |

Account |

The customer account number |

Branch |

The branch where the account is located |

Product Type |

The type of product |

Product |

The product code |

Description |

The description of the product |

Amount |

The transaction amount |

GL Account Title |

The title of the GL account |

Balance |

The current GL balance |

Difference |

The difference in GL balance |

11.24 New Loans Report

This section contains the following topics:

11.24.1 Generating New Loans Report

The New Loans Report lists the details of all the new loans that have been booked.

You can invoke this report screen by typing ‘CLRPNWLN’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

11.24.2 Contents of the Report

The details of the new loans are displayed in this report.

Body of the Report

Field |

Description |

Account Number |

The customer account number |

Account Status |

The branch where the account is located |

Product Code |

The code of the retail lending product |

Product Category |

The product category of the retail lending product |

Customer |

The identification of the borrowing customer |

Customer Name |

The name of the borrowing customer |

Account Currency |

The currency associated with the loan account |

Financed Amount |

The total amount that has been financed |

Original Start Date |

The original start date of the loan |

Booking Date |

The booking date of the loan |

Value Date |

The value date of the loan |

Maturity Type |

The type of maturity |

Maturity Date |

The date of loan maturity |

Tenor |

The tenor of the loan |

Auth Status |

The authorization status of the loan |

User Defined Status |

The user defined status of the loan account |

Liquidation Mode |

The mode of liquidating the loan |

Rollover Mode |

The rollover mode of the loan |

Rate Type |

The type of rate |

Rate % |

The percentage of rate |

11.25 Loan Rollover Monitoring Report

This section contains the following topics:

- Section 11.25.1, "Generating Loan Rollover Monitoring Report "

- Section 11.25.2, "Contents of the Report"

11.25.1 Generating Loan Rollover Monitoring Report

The Loan Rollover Monitoring Report lists the rollover details of all the loans.

You can invoke this report screen by typing ‘CLRPRLVR’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

11.25.2 Contents of the Report

The details of the loans including the type of rollover and date are displayed in this report.

Body of the Report

Field |

Description |

Branch |

The customer account number |

Customer |

The branch where the account is located |

Loan Number |

The number of the loan |

Currency |

The currency associated with the loan |

Principal Amount |

The principal amount associated with the loan |

Interest at Maturity |

The interest amount at loan maturity |

Total Due |

Total amount that is due |

Product |

The product code of the retail lending product |

Product Description |

The product description |

Rollover Type |

The type of rollover, whether manual or automatic |

Value Date |

The value date of the loan |

Maturity Date |

The maturity date of the loan |

11.26 Loan Register/Trial Balance Report

This section contains the following topics:

- Section 11.26.1, "Generating Loan Register/Trial Balance Report "

- Section 11.26.2, "Contents of the Report"

11.26.1 Generating Loan Register/Trial Balance Report

The Loan Register/Trial Balance Report lists the loan register / trial balance details.

You can invoke this report screen by typing ‘CLRPTRBL’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

11.26.2 Contents of the Report

The loan register / trial balance details are displayed in this report.

Body of the Report

Field |

Description |

Account Number |

The unique identification number of the account |

Short Name |

The short name of the customer |

Codes |

The product code and the type of the product |

Product Category |

The category to which the product belongs |

Interest Rate |

The interest rate associated with the loan |

Face Amount |

The face amount associated with the loan |

Net Payoff |

The net payoff amount for the loan |

Perdiem |

The amount financed |

Available Amount |

The amount available |

Revolving Amount |

The revolving amount |

Payment Amount |

Total amount (principal + interest) that has been repaid |

Interest Balance |

The balance interest payment amount |

Interest Payment |

The interest amount that has been repaid |

Late Fee Due |

The total outstanding penalty |

Principal Balance |

The balance principal amount associated with the loan |

Principal Payment |

The principal amount that has been repaid |

Maturity Balance |

The maturity balance |

Note Date |

The date of the note |

Payment Due Date |

The due date for loan repayment |

Maturity |

The maturity date of the loan |

11.27 Loan Rollover Notice

This section contains the following topics:

11.27.1 Generating Loan Rollover Notice

The Loan Past Due Notice report displays the notice details that are sent to customers in case of loan rollovers.

You can invoke this report screen by typing ‘CLRPRLNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

11.27.2 Contents of the Report

The details of all notices related to loan rollovers are displayed in the report.

Body of the Report

Field |

Description |

Date of Notice |

The date on which the notice was generated |

Facility |

The facility details of the loan |

Loan Reference |

The loan reference number |

Principal Amount |

The principal amount associated with the loan |

Interest at Maturity |

The interest amount due at maturity |

Maturity Date |

The date of maturity of the loan |

Notice Message |

The message text that is sent to the customer |

11.28 Disbursements Made Today Report

This section contains the following topics:

- Section 11.28.1, "Generating Disbursements Made Today Report"

- Section 11.28.2, "Contents of the Report"

11.28.1 Generating Disbursements Made Today Report

The life of the loan account starts when the loan is disbursed into an account. The loan is disbursed after the account is created. The first disbursement for an account is disbursed before the number of days maintained at the product level. You can generate ‘Disbursements made Today Report’ at EOD with details of the disbursements made for the current day which includes first, progressive, and final disbursements. This report also provides the total number of disbursements for the day.

You can invoke ‘Disbursements made Today Report’ screen by typing ‘CLRDISTD’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following parameters here:

Branch Code

Specify a valid code of the Branch in which report is being generated from the adjoining option list.

Disbursement

Select type of disbursement for which you need to generate the report, from the adjoining drop-down list. This list displays the following values:

- First Disbursement – Select if you need to generate a report for first disbursement disbursed on the current date.

- Progressive Disbursement – Select if you need to generate a report for progressive disbursement disbursed on the current date.

- Final Disbursement – Select if you need to generate a report for final disbursement disbursed on the current date.

- All – Select if you need to generate a report for all disbursements disbursed on the current date.

Report Format

Select the format in which you need to generate the report from the adjoining drop-down list. This list displays the following values:

- HTML – Select to generate report in HTML format.

- RTF – Select to generate report in RTF format.

- PDF – Select to generate report in PDF format.

- EXCEL – Select to generate report in EXCEL format.

Report Output

Select the output in which you need to generate the report from the adjoining drop-down list. This list displays the following values:

- Print – Select to print the report.

- View – Select to print the report.

- Spool – Select to spool the report to a specified folder so that you can print it later.

Printer At

Select location where you wish to print the report from the adjoining drop-down list. This list displays the following values:

- Client – Select if you need to print at the client location.

- Server – Select if you need to print at the server location

Printer

Select printer using which you wish to print the report from the adjoining option list.

11.28.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other content displayed in the Disbursements made Today Report is as follows:

Header

The Header carries the title of the report, information on the branch code, the date and time, the branch date, the user id, the module name and the page number of the report.

Body of the Report

The following details are displayed as body of the generated report:

Sr. No. |

Field Name |

Field Description |

1 |

Disbursement Type |

The type of disbursement |

2 |

Acc No |

Indicates Loan Account Number |

3 |

Amt Disbursed |

Indicates Actual amount disbursed today |

4 |

Gross Loan Amount Disbursed |

Indicates Total loan amount sanctioned |

5 |

Transaction Currency |

Indicates Currency |

6 |

Net Amount Disbursed |

Indicates Amount Disbursed till date |

7 |

Amount Debited |

Indicates Debited from other account which also increases the Principle of Loan |

8 |

Amount Deducted |

Indicates The amount deducted from Disbursed amount (any charge) |

9 |

Amount Billed |

This indicates the amount billed |

10 |

Pay Mode |

Indicates Settlement mode |

11 |

Cheque Number |

Indicates If the settlement mode is cheque |

12 |

Formula Type |

This indicates the schedule type |

13 |

Branch |

Indicates Branch code |

14 |

Name |

Indicates Customer name |

15 |

Term (Months) |

Indicates loan term |

16 |

Interest Rate |

Indicates Loan interest rate |

17 |

User Id |

Indicates Maker id |

18 |

Supervisor Id |

Indicates Checker id |

19 |

Product code |

Indicates Product code |

20 |

Product Description |

Indicates Product description |

21 |

Total number of disbursements for the day |

Indicates count |

11.29 Insurance Policy Expired Today Report

This section contains the following topics:

- Section 11.29.1, "Generating Insurance Policy Expired Today Report"

- Section 11.29.2, "Contents of the Report"

11.29.1 Generating Insurance Policy Expired Today Report

Loan limits are sanctioned based on the collateral values offered, subject to the margins. Various collaterals like insurance policies are offered by the customers and the details are maintained in the system. You can generate ‘Insurance Policy Expired Today Report’ at EOD with the details of the matured insurance policies expired on the current day.

You can invoke ‘Insurance Policy Expired Today Report’ screen by typing ‘STRINEXP’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following parameters here:

Branch Code

Specify a valid code of the Branch in which report is being generated from the adjoining option list.

No of Days

Specify a valid number of days within which the Insurance policy expires.

Report Type

You can generate online report or EOD report using the following options:

- Online Report – If you choose this, the system will generate the online report.

- EOD Report – If you choose this, the system will generate EOD report.

Report Format

Select the format in which you need to generate the report from the adjoining drop-down list. This list displays the following values:

- HTML – Select to generate report in HTML format.

- RTF – Select to generate report in RTF format.

- PDF – Select to generate report in PDF format.

- EXCEL – Select to generate report in EXCEL format.

Report Output

Select the output in which you need to generate the report from the adjoining drop-down list. This list displays the following values:

- Print – Select to print the report.

- View – Select to print the report.

- Spool – Select to spool the report to a specified folder so that you can print it later.

Printer At

Select location where you wish to print the report from the adjoining drop-down list. This list displays the following values:

- Client – Select if you need to print at the client location.

- Server – Select if you need to print at the server location

Printer

Select printer using which you wish to print the report from the adjoining option list.

11.29.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other content displayed in the Insurance Policy Expired Today Report is as follows:

Header

The following details are displayed in the header section:

Field Name |

Field Description |

Branch |

Indicates Branch Code and Branch Name |

Module |

The module from which the report was generated |

Run Date |

Indicates Date on which report is generated |

Run Time |

The time at which the report was generated |

User ID |

Indicates User ID |

Page No |

The page number of the report |

Body of the Report

The following details are displayed as body of the generated report:

Field Name |

Field Description |

Insurance Code |

Indicates Insurance Code |

Insurance Name |

Indicates Insurance Name |

Insurance Plan |

Indicates Insurance Plan/remarks |

Date Maturity |

Indicates End date of the Insurance |

Days to Expire |

Indicates No of days to expire |

Collateral Id |

Indicates Collateral id of the Insurance |

Collateral Name |

Indicates Collateral Description |

Insurance Premium |

Indicates Insurance Premium Amount |

Hair Cut Percentage |

Indicates Hair Cut Percentage |

Margin |

Indicates Unutilised amount |

Amount Covering Billing Account |

Indicates Insurance Amount |

Note

- When a report is generated online, it displays a list of insurance policies which would expire for the given no of days.

- PRM_TYPE_OF_REPORT is maintained as ‘E’ at ‘Batch EOD Input’ level.

11.30 Loan Settlement Notice Report

This section contains the following topics:

- Section 11.30.1, "Generating Loan Settlement Notice Report"

- Section 11.30.2, "Contents of the Report"

11.30.1 Generating Loan Settlement Notice Report

You can generate a report, which contains the details of loans that have received a notice for settlement, using ‘Loan Settlement Notice’ screen. To invoke this screen, type ‘CLRPSLNT’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

Specify the following details:

Branch Code

You can generate this report for all the branches or a single branch alone. You can indicate the branch for which the report is being generated using the following options:

- All – If you choose this, the system will generate the report for all the branches.

- Specific – If you choose this, you need to specify the branch code for which the report should be generated. The option list displays all valid branch codes maintained in the system. Choose the appropriate one.

Account Number

You can generate this report for all the accounts or a single account alone. You can indicate the account number for which the report is being generated using the following options:

- All – If you choose this, the system will generate the report for all the accounts.

- Specific – If you choose this, you need to specify the number for which the report should be generated. The option list displays all valid account numbers maintained in the system. Choose the appropriate one.

From Date

Specify the From Date. The report will contain the details of loan settlement notices processed from this date.

To Date

Specify the To Date. The report will contain the details of loan settlement notices processed till this date.

Report Format

Specify the format in which the report should be generated. The drop-down list displays the following options:

- HTML

- RTF

- EXCEL

Choose the appropriate one.

Report Output

Specify the report output form required. The drop-down list displays the following options:

- Print – prints the report

- View – lets you view the report

- Spool – spools the report to a specific location

Choose the appropriate one.

PrinterAt

Specify the location at which the printer is available. The printer can be attached to one of the following:

- Client

- Server

Choose the appropriate one.

Printer