11g Release 1 (11.1.1.5.0)

Part Number E20384-01

Contents

Previous

Next

|

Oracle® Fusion

Applications Project Management Implementation Guide 11g Release 1 (11.1.1.5.0) Part Number E20384-01 |

Contents |

Previous |

Next |

This chapter contains the following:

Manage Expenditure Categories and Types

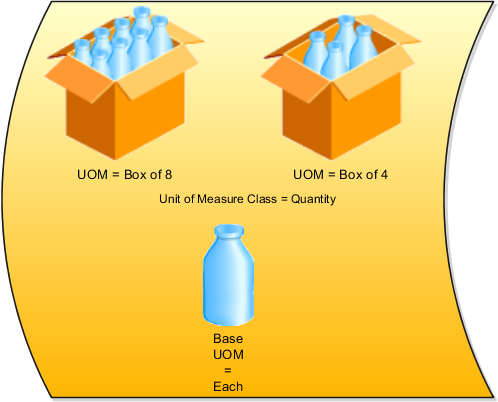

Define units of measure, unit of measure classes, and base units of measure for tracking, moving, storing, and counting items.

The Quantity unit of measure class contains the units of measure Box of 8, Box of 4, and Each. The unit of measure Each is assigned as the base unit of measure.

Unit of measure classes represent groups of units of measure with similar characteristics such as area, weight, or volume.

Units of measure are used by a variety of functions and transactions to express the quantity of items. Each unit of measure you define must belong to a unit of measure class.

Each unit of measure class has a base unit of measure. The base unit of measure is used to perform conversions between units of measure in the class. For this reason, the base unit of measure should be representative of the other units of measure in the class, and should generally be one of the smaller units. For example, you could use CU (cubic feet) as the base unit of measure for a unit of measure class called Volume.

Each unit of measure class must have a base unit of measure.

This table lists examples of unit of measure classes, the units of measure in each unit of measure class, and the unit of measure assigned as the base unit of measure for each unit of measure class. Note that each base unit of measure is the smallest unit of measure in its unit of measure class.

|

Unit of Measure Class |

Units of Measure |

Base Unit of Measure |

|---|---|---|

|

Quantity |

dozen box each |

each |

|

Weight |

pound kilogram gram |

gram |

|

Time |

hour minute second |

second |

|

Volume |

cubic feet cubic centimeters cubic inches |

cubic inches |

A unit of measure standard conversion specifies the conversion factor by which the unit of measure is equivalent to the base unit of measure.

This table lists examples of unit of measure classes, one unit of measure included in each class, the base unit of measure for the unit of measure class, and the conversion factor defined for the unit of measure.

|

Unit of Measure Class |

Unit of Measure |

Base Unit of Measure |

Conversion Factor |

|---|---|---|---|

|

Quantity |

dozen |

each |

12 (1 dozen = 12 each) |

|

Weight |

pound |

gram |

454 (1 pound = 454 grams) |

|

Time |

minute |

second |

60 (1 minute = 60 seconds) |

A unit of measure standard conversion defines the conversion factor by which the unit of measure is equivalent to the base unit of measure that you defined for the unit of measure class. Defining a unit of measure standard conversion allows you to perform transactions in units other than the primary unit of measure of the item being transacted. The standard unit of measure conversion is used for an item if an item-specific unit of measure conversion has not been defined.

Your implementation team creates revenue categories to group expenditure types and event types for revenue recognition. A revenue category describes a source of your organization's revenue.

The following table illustrates possible revenue categories your implementation team can define for labor and other types of revenue.

|

Revenue Category Name |

Description |

|---|---|

|

Fee |

Fee Earned |

|

Labor |

Labor Revenue |

|

Other |

Nonlabor Revenue |

|

Payment |

Payment |

The source of revenue for an organization. Revenue categories group expenditure types and event types for revenue and invoices, and are also used to define accounting rules.

Expenditures are divided into expenditure categories and revenue categories. Within these groups, expenditures are further classified by expenditure type classes, expenditure types, and nonlabor resources.

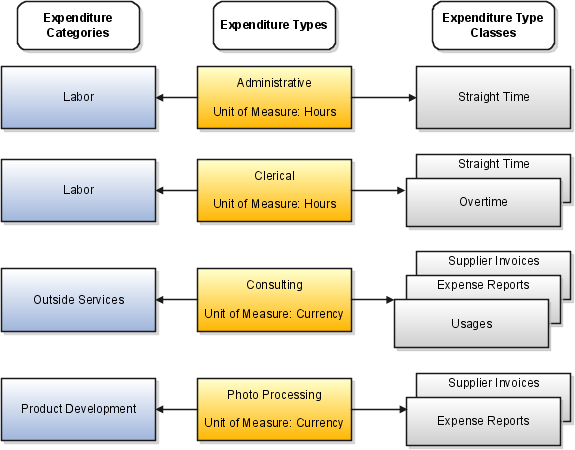

This following graphic shows examples of expenditure classifications. Each expenditure type consists of an expenditure category, a unit of measure and one or more expenditure type classes.

Following are the expenditure categories, units of measure, and expenditure type classes for each expenditure type shown in the diagram.

Administrative

Expenditure Category: Labor

Unit of Measure: Hours

Expenditure Type Class: Straight Time

Clerical

Expenditure Category: Labor

Unit of Measure: Hours

Expenditure Type Classes: Straight Time and Overtime

Consulting

Expenditure Category: Outside Services

Unit of Measure: Currency

Expenditure Type Classes: Supplier Invoices, Expense Reports, and Usages

Photo Processing

Expenditure Category: Product Development

Unit of Measure: Currency

Expenditure Type Classes: Supplier Invoices and Expense Reports

An expenditure type class tells Oracle Fusion Projects how to process an expenditure item.

Oracle Fusion Projects predefines all expenditure type classes, which include the following:

Straight Time

Overtime

Burden Transaction

Expense Reports

Inventory

Miscellaneous Transaction

Supplier Invoices

Usages

Work-in-Process

Oracle Fusion Projects uses the following expenditure type classes to process labor costs.

Straight Time: Labor costs calculated using a base cost rate multiplied by hours.

Overtime: Labor costs calculated using a premium cost rate multiplied by hours.

Oracle Fusion Projects uses the following expenditure type classes to process nonlabor projects.

Burden Transaction: Burden transactions track burden costs that are calculated in an external system or calculated by Oracle Fusion Projects as separate, summarized transactions. These costs are created as a separate expenditure item that has a burdened cost amount, and a quantity and raw cost value of zero.

You can adjust burden transactions that are not system-generated.

Expense Reports: Expense reports imported from Oracle Fusion Payables or an external system.

Expense reports that you import into Oracle Fusion Projects must be fully accounted prior to import.

Inventory: Inventory transactions imported from Oracle Fusion Inventory or an external system.

Miscellaneous Transaction: Used to track miscellaneous project costs. Following are examples of miscellaneous transactions.

Fixed assets depreciation

Allocations

Interest charges

Supplier Invoices: Supplier invoices, discounts, and payments from Oracle Fusion Payables or an external system, and receipt accruals from Oracle Fusion Cost Management.

Usages: You must specify the nonlabor resource for every usage item that you charge to a project.

For each expenditure type classified by a Usages expenditure type class, you also define nonlabor resources and organizations that own each nonlabor resource.

Work-in-Process: Used when you import work-in-process transactions from third-party applications or Oracle Fusion Project Costing using Microsoft Excel or web services, or enter work-in-process transactions directly into Oracle Fusion Projects.

When defining an allocation rule, you must specify the expenditure type class for the allocation transaction attributes. Choosing the expenditure type class determines how the allocated amount is created as costs on the expenditure item.

The miscellaneous transaction expenditure type class is used to allocate the source amount as raw cost on the expenditure item.

The burden transactions expenditure type class is used to allocate the source amount as the burden cost for the expenditure item, while expenditure item quantity and raw cost remain zero.

An expenditure type is a classification of cost that you assign to each expenditure item that you enter in Oracle Fusion Projects. Create expenditure types for processing requirements, such as calculating raw costs, to classify costs, and to plan, budget, forecast, and report on projects.

Following are examples of other ways that you can use expenditure types:

Assign an expenditure type to each burden cost code when capturing burden costs on separate, summarized expenditure items. The assigned expenditure type becomes the expenditure type for that type of burden cost.

Specify default expenditure types for each resource class for different project units. The application uses the default expenditure type for planning purposes. For example, when determining the raw and burdened cost rates for a planning resource, if the resource format does not contain an expenditure type or nonlabor resource, then the application uses the default expenditure type for the resource class of the resource to determine the rates.

Labor cost multipliers are used to calculate costs for overtime expenditure items. Associate a labor cost multiplier to an expenditure type with the Overtime expenditure type class. The costing process multiplies the standard labor cost rate by the multiplier and the hours to calculate the cost for overtime expenditure items.

Assign an expenditure type with the Usages expenditure type class to each nonlabor resource to define nonlabor resources that are used to record usage transactions.

Expenditure types contain the following attributes.

Expenditure and revenue categories

Unit of measure

Rate required

Proceeds of sale

Expenditure type classes

Assigned sets

Tax classification codes

Important

If you create and save an expenditure type, you cannot subsequently update the following attributes for the expenditure type.

Expenditure and revenue categories

Unit of measure

Rate required option

Instead, you must enter an end date for the expenditure type and create a new one. The end date for an expenditure type has no effect on existing transactions. Oracle Fusion Projects uses the old expenditure type to report on and process existing transactions.

Expenditure categories group expenditure types for costing. Revenue categories group expenditure types for revenue and billing.

The expenditure type unit of measure is used as the default value on costing or planning transactions.

For inventory transactions, the primary unit of measure is from the inventory item, and not from the expenditure type on the transaction.

You must use Hours as the unit of measure for labor expenditure types.

Enable the Rate Required option for an expenditure type that requires a cost rate.

Note

For supplier invoice expenditure types, if you specify that a rate is required, Oracle Fusion Projects requires you to enter a quantity in Oracle Fusion Payables for invoice distributions using that expenditure type. When you interface the invoice distribution to Oracle Fusion Projects, the application copies the quantity and amount to the expenditure item and calculates the rate. If you define a supplier invoice expenditure type with the Rate Required option disabled, then the quantity of the expenditure item is set to the amount you enter in Oracle Fusion Payables.

Enable the Proceeds of Sale option for expenditure types that are used to track the proceeds of sale for a capital project.

Expenditure type classes specify how an expenditure item is processed. For example, if you assign the Straight Time expenditure type class to an expenditure type, Oracle Fusion Projects uses labor cost schedules to calculate the cost of an expenditure item with that expenditure type and expenditure type class.

You can assign multiple expenditure type classes to an expenditure type. For example, an expenditure with the expenditure type Materials can have the expenditure type class Supplier Invoice if it originated in Oracle Fusion Payables, and the expenditure type class Inventory if it originated in Oracle Fusion Inventory. This allows you to use a single expenditure type to classify as many costs as you need. You can use the same expenditure type for expenditures with different origins, and therefore different accounting, that should otherwise be grouped together for costing, budgeting, or summarization purposes.

You must assign at least one project transaction type set to each expenditure type. You can add and delete set assignments for an expenditure type at any time, except that you cannot delete the last set assignment for an expenditure type.

You can optionally select a default tax classification code to use for customer invoice lines for an expenditure type and business unit.

You can update expenditure category names and descriptions at any time. You cannot delete an expenditure category if it is used in transaction controls, expenditure types, resource transaction attributes, or cost distribution organization overrides. You can, however, stop usage of an expenditure category by setting an end date for it.

Yes. For example, an expenditure with the expenditure type Materials can have the expenditure type class Supplier Invoice if it originated in Oracle Fusion Payables, and the expenditure type class Inventory if it originated in Oracle Fusion Inventory. This allows you to use a single expenditure type to classify as many costs as you need. You can use the same expenditure type for expenditures with different origins, and therefore different accounting, that should otherwise be grouped together for costing, budgeting, or summarization purposes.

Yes. When capturing retirement costs in a capital project, enter proceeds of sale amounts using expenditure types specifically created for that purpose. Oracle Fusion Projects automatically classifies amounts for all other expenditure types associated with the retirement cost task as cost of removal.

You can update expenditure type names, descriptions, and dates at any time. However, you cannot update the following attributes for the expenditure type: expenditure category, revenue category, unit of measure, rate required, and expenditure type class. To update these attributes, you must set an end date for the expenditure type and create a new expenditure type with a unique name.

You cannot delete an expenditure type and the associated expenditure type class. To stop usage of an expenditure type you can set an end date for it.

Describes and groups organization costs. For example, an expenditure category named Labor refers to the cost of labor. An expenditure category named Supplier refers to the cost incurred on supplier invoices. You use expenditure categories for budgeting, transaction controls, when you define organization overrides, and in accounting rules and reporting.

You define project classifications to group projects. Project classifications include a class category and a class code. The category is a broad subject within which you can classify projects, such as Industry Sector. The code is a specific value of the category, such as Construction, Banking, or Health Care.

You specify the following options when setting up project classifications.

Assign to all projects

Assign to all project types

Available as accounting source

One class code per project

Enter class codes percent

Class codes

Project types

Enable this option if all projects must have a code assigned to this class category. Do not enable if this class category is optional.

Enable this option if you want this class category to be required for projects of all project types.

This option indicates if the class category is available as an accounting source so that Oracle Fusion Subledger Accounting can use the category to create mapping sets, account rules, journal line rules, and description rules.

Note

Only one class category at a time is available as an accounting source in Oracle Fusion Subledger Accounting. To change the class category that Oracle Fusion Subledger Accounting uses, inactivate the old class category and create a new one with a different date range.

Specify whether you want to allow entry of only one class code with this class category for a project.

Note

Defining multiple class codes for one category for a project may affect reporting by class category. For example, defining multiple class codes may cause a code to be reported more than once.

Enable this option if you want to associate percentages with the class codes associated with this category. When you have multiple classification codes associated with a single class category, you can report the relative values of your projects in terms of sales or a similar metric. When you enable this option, the application requires class code percentages for the category regardless of the project type.

Enable the Total Percent Must Equal 100 option if you want the application to require that the sum of all class code percentages to be 100% for the selected class category. You can clear this option at any time.

You can define class codes for the category to create more specific groups of projects for reporting. Assign each class code to a reference data set so that only codes that are relevant to the project unit are available for the project.

Associate project classifications with project types for the classification to be available for selection on projects with that project type. You can add classifications to a project type definition, and add project types to a class category definition.

Select the Assign to all projects option for a project type if you require all projects of the project type to be associated with the class category.

Class categories and class codes enable you to classify projects. The following example illustrates how you can use project classifications.

InFusion Corporation designs and implements heavy engineering projects for government and private customers. Because InFusion Corporation maintains a diverse portfolio of contracts, the ability to track sector and funding is very important to corporate management.

Therefore, the organization classifies projects by market sector and funding source. The following table describes the two class categories used.

|

Class Category |

Assign to All Projects |

One Class Code per Project |

Enter Percentage for Class Codes |

Description |

|---|---|---|---|---|

|

Market Sector |

Yes |

Yes |

No |

Market sector in which project work takes place. A single class code must be provided on the project for the class category. |

|

Funding Source |

Yes |

No |

Yes |

Source of funding for project. At least one class code must be provided on the project for the class category. Percentages must be provided to indicate contribution for each source. |

The following table describes the class codes available for the categories specified above.

|

Class Category |

Class Code |

Description |

|---|---|---|

|

Funding Source |

Private |

Project funded by private organizations |

|

Funding Source |

Federal |

Project funded by the federal government |

|

Funding Source |

State or Local |

Project funded by a state or local government |

|

Funding Source |

Foreign |

Project funded by a foreign government |

|

Market Sector |

Utilities |

Project involves utility or power plant construction |

|

Market Sector |

Waste |

Project involves waste disposal or recycling facility constructions |

|

Market Sector |

Mechanical |

Project involves mechanical design and engineering work |

|

Market Sector |

Structural |

Project involves structural design and engineering work |

InFusion management can easily assess projects based on the above class categories and codes.

For example, assume you specify a class category Funding Source on your project. With this category, you select two class codes: Private and Federal. If you assign 30 percent to Private and 70 percent to Federal, then you indicate the proportion of funding received for your project from the two sources.

On the other hand, because you must select a single market sector, you indicate whether project work involves utilities, waste, mechanical, or structural activities.

A work type represents a classification of work. You use work types to classify both actual and scheduled work. The billable status of a work type assigned to a scheduled assignment determines the default billable status of scheduled work.

In billing, you can use work types to classify work for the following purposes:

To determine the default billable status of expenditure items.

To classify cross-charge amounts into cost and revenue for cross-charge transactions.

The default billable status of scheduled work is determined by the billable status of the work type assigned to the scheduled assignments. You can also control the billable status of actual work by the work type assigned to actual transactions. If you choose to do this, then you must change the work type on an actual transaction to change the billable status of the transaction. It is recommended that you do this in order to maintain consistency between processing of actual transactions for customer billing and reporting for billable utilization.

Tip

To use work types to determine whether an expenditure item is billable you must set the profile option Work Type Derived for Expenditure Item to Yes.

Cross-charge work is project work performed by resources from one organization on a project belonging to another organization.

Typically the project-owning organization provides some compensation to the resource organization for this cross-charge work. The compensation can be in the form of sharing revenue with the resource organization or taking on the cost from the resource organization. This allows each organization to be measured on its performance independent of one another. You can classify the transfer price amount type of cross-charge work into cost or revenue based on the work type assigned to project work: scheduled or actual.

A classification of actual work. For example, a professional services enterprise may define work types such as Analysis, Design, and External Training. Use work types to determine the billability of expenditure items and to classify cross-charge amounts into cost and revenue.

When you create or import expenditure items, the default work type is inherited from the associated task. Tasks, in turn, inherit work type values from parent tasks and ultimately from the project. Project types determine the default work type value for projects and project templates.

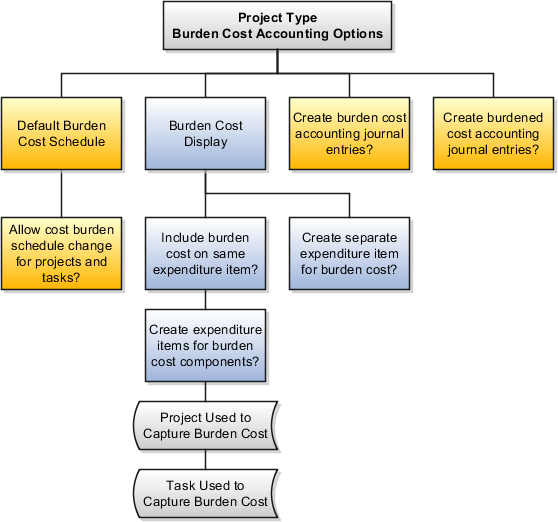

Burdening is a method of applying one or more burden cost components to the raw cost amount of each individual transaction to calculate burden cost amounts. Use project types to control how burden transactions are created and accounted. If you enable burdening for a project type, you can choose to account for the individual burden cost components or the total burdened cost amount.

The following diagram illustrates the burden cost accounting options for project types.

You specify the following options when setting up burdening options for project types.

Default Cost Burden Schedule

Allow Cost Burden Schedule Change for Projects and Tasks

Include Burden Cost on Same Expenditure Item

Create Expenditure Items for Burden Cost Components

Create Separate Expenditure Item for Burden Cost

Create Burden Cost Accounting Journal Entries

Create Burdened Cost Accounting Journal Entries

If you enable burdening for the project type, you must select the burden schedule to use as the default cost burden schedule for projects that are defined with this project type.

Enable this option to allow a change of the default cost burden schedule when entering and maintaining projects and tasks. Do not enable this option if you want all projects of a project type to use the same schedule for internal costing.

Enable this option to include the burden cost amount in the same expenditure item. You can store the total burdened cost amount as a value with the raw cost on each expenditure item. Oracle Fusion Projects displays the raw and burdened costs of the expenditure items on windows and reports.

If you include burden cost amounts on the same expenditure item, but wish to see the burden cost details, enable the option to create expenditure items for each burden cost amount on an indirect project and task.

Enable this option to account for burden cost amounts as separate expenditure items on the same project and task as the raw expenditures. The expenditure items storing the burden cost components are identified with a different expenditure type that is classified by the expenditure type class Burden Transaction. Oracle Fusion Projects summarizes the cost distributions to create burden transactions for each applicable burden cost code. The most important summarization attributes are project, lowest task, expenditure organization, expenditure classification, supplier, project accounting period, and burden cost code. You can use the Burden Summarization Grouping Extension to further refine the grouping.

Indicate whether to create an entry for the burden cost amount.

If burdened costs are calculated for reporting purposes only, and you do not want to interface burdened costs to the general ledger, you can disable the creation of accounting journal entries. If you select this option, only the burden cost, which is the difference between the burdened cost and raw cost, is interfaced to general ledger.

Indicate whether to account for the total burdened cost amount of the items. You typically use this option to track the total burdened cost amount in a cost asset or cost work-in-progress account.

The burdened cost is the sum of raw and burden costs. Therefore, selecting this option may result in accounting for raw cost twice. For example, assume that the raw cost of an item is 100 USD, the burden cost is 50 USD, and the burdened cost is 150 USD. When the application creates a journal entry for 150 USD, it accounts for the 100 USD that was already accounted for as raw cost, plus the 50 USD burden cost.

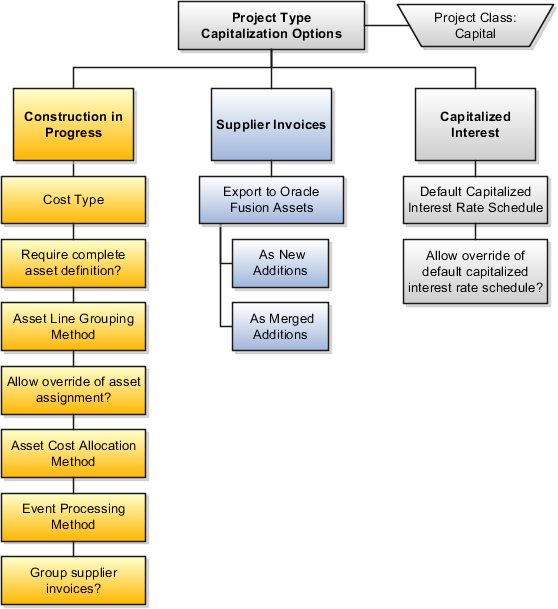

You can assign assets to a project if capitalization is enabled for the project type. Use project types to configure capitalization options that are inherited by each project associated with that project type.

The following diagram illustrates the capitalization options for project types.

You specify the following information when setting up capitalization options for project types.

Construction in Progress (CIP) Options

Supplier Invoices Export Options

Capitalized Interest Options

You specify the following Construction in Progress options when setting up capitalization options for project types.

Indicate whether to capitalize costs at the burdened or raw cost amount for projects with this project type.

Enable this option to require a complete asset definition in Oracle Fusion Projects before sending costs to Oracle Fusion Assets. If you select this option, you do not need to enter information for the imported asset line in Oracle Fusion Assets. The Transfer Assets to Oracle Fusion Assets process places asset lines with complete definitions directly into the Post queue in Oracle Fusion Assets.

Specify one of the following methods to summarize asset lines.

All, which is the highest level of summarization

CIP Grouped by Client Extension

Expenditure Category

Expenditure Category Nonlabor Resource

Expenditure Type

Expenditure Type Nonlabor Resource

This option interacts with the assignment status of the asset to either use or disregard the Asset Assignment extension, as shown in the following table:

|

Override Asset Assignment |

Asset Lines Assigned to Assets |

System Uses Asset Assignment Extension |

|---|---|---|

|

Do Not Override (option not selected) |

Not Assigned |

Yes |

|

Do Not Override |

Assigned |

No |

|

Override |

Not Assigned |

Yes |

|

Override |

Assigned |

Yes |

You can set up the Asset Assignment extension to assign any unassigned asset lines that result from the Generate Asset Lines process, or to override the current asset assignment for specified lines.

Select one of the following predefined allocation methods to automatically distribute indirect and common costs across multiple assets, or select no allocation method.

Actual Units

Current Cost

Client Extension

Estimated Cost

Standard Unit Cost

Spread Evenly

You can specify a capital event processing method to control how assets and costs are grouped over time. You can choose to use either periodic or manual events, or no events.

Enable this option to consolidate the expenditure items on a supplier invoice into one asset line according to the asset line grouping method. Deselect this option to send the lines to Oracle Fusion Assets based on the supplier invoice export option.

If you choose not to group supplier invoices, then select one of the following supplier invoice export options.

As New Additions: Sends each expenditure item on a supplier invoice line to Oracle Fusion Assets as a separate addition line with a status of New.

As Merged Additions: Sends each supplier invoice line to Oracle Fusion Assets as a separate addition line with the status of Merged.

Note

After the addition lines are sent to Oracle Fusion Assets, you can split, merge, or unmerge the lines manually in Oracle Fusion Assets.

Use this field to specify a default interest rate schedule for capitalized interest.

You can select the Allow Override option to allow an override of the default capitalized interest rate schedule for individual projects.

Project classifications group your projects according to categories and codes that you define. When you associate project classifications with project types, the classification is available for selection on projects with that project type.

Use any of the following methods to associate class categories with project types:

Add a classification to the project type definition

Add a project type to the class category definition

Enable the Assign to all Project Types option on the class category definition

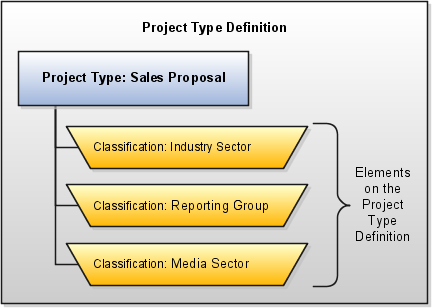

The following diagram shows an example of three classifications that are associated with a project type definition. In this example, the Industry Sector, Reporting Group, and Media Sector classifications are available for selection on projects with the Sales Proposal project type.

For each classification that you associate with the project type, you can enable the Assign to All Projects option for the application to automatically add the classification to the project definition for all new projects with the project type. When this option is enabled, all projects with this project type must be assigned a class code for the class category.

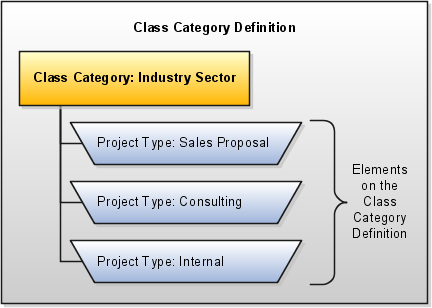

The following diagram shows an example of three project types that are associated with a class category definition. In this example, the Industry Sector classification is available for selection when you create projects with the Sales Proposal, Consulting, or Internal project types.

For each project type that you associate with the class category, you can enable the Assign to All Projects option for the application to automatically add the class category to the project definition for all new projects with any of these project types. When this option is enabled, all projects with this project type must be assigned a class code for the class category.

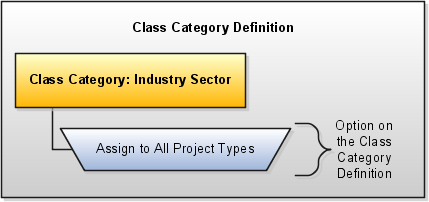

The following diagram shows an example of a class category definition with the Assign to All Project Types option enabled. In this example, a code for the Industry Sector class category is required for all projects, regardless of the project type.

The asset cost allocation method determines how indirect or common costs incurred on a project are allocated to multiple assets.

You can specify an asset cost allocation method to enable Oracle Fusion Projects to automatically allocate unassigned asset lines and common costs across multiple assets. Unassigned asset lines typically occur when more than one asset is assigned to an asset grouping level.

Project templates and projects inherit a default asset cost allocation method from the associated project type. You can override the default at the project level. If you use capital events to allocate costs, then you can also override the asset cost allocation method at the event level.

The following table describes the available asset cost allocation methods.

|

Method |

Basis of Cost Allocation |

|---|---|

|

Actual Units |

Number of units defined for each asset |

|

Client Extension |

Rules defined specifically for your organization |

|

Current Cost |

Construction-in-process (CIP) cost of each asset |

|

Estimated Cost |

Estimated cost of each asset |

|

Standard Unit Cost |

Combination of the standard unit cost and the number of units defined for each asset |

|

Spread Evenly |

Equal allocation of cost to each asset |

Oracle Fusion Projects uses statuses for projects and progress.

The Project status type controls which processes are allowed during each stage of a project.

Oracle Fusion Projects provides the following predefined project statuses.

Unapproved

Submitted

Approved

Rejected

Pending close

Closed

The Progress status type specifies overall progress of a project, task, or resource. Progress statuses are used for reporting and do not control what you can do with a project.

Following are the predefined progress statuses:

On track

At risk

In trouble

You can define additional project and progress statuses based on the available system statuses to meet your business needs.

Each status is associated with a status type and a system status. Optionally you can specify status attributes for initial project status and workflow.

Status Type: Types are Project or Progress.

System Status: Determines which actions are allowed for the project or progress status. Every status must map to a predefined system status.

Initial Project Status: If this option is enabled for a project status, and if the project status belongs to a reference set that is associated with the project unit of the project, then the status is eligible for use as the starting status for the project.

Initial starting status does not apply to progress statuses.

Workflow Attributes: Oracle Fusion Projects provides an approval workflow that allows you to separate project creation from project approval. If you enable workflow for a status, the approval workflow begins when a project changes to that status.

Project status approval workflow includes these attributes:

Status After Change Accepted: The status that the application assigns to the project when a project status change is approved.

Status After Change Rejected: The status that the application assigns to the project when a project status change is rejected.

The project status after workflow is rejected can be the same as the current status.

Workflow attributes do not apply to progress statuses.

You assign project statuses to reference data sets so that only statuses that are relevant to the project unit are available for the project.

Important

Before you can select a status for a project, the status must belong to a reference data set that is associated with the project unit of the project.

Status controls for a system status determine which actions are allowed for projects in a project status that is associated with the system status.

The following actions are controlled with status controls:

Adjust transactions

Capitalize assets

Capitalized interest

Create burden transactions

Create new transactions

Summarize project data

By default, all actions are allowed for projects in an Approved system status.

Not all of the default status controls are editable. For example, if a project status is associated with the Closed system status, you cannot change the status controls to allow the creation of new transactions.

Status controls do not apply to progress statuses.

Next allowable statuses specify which statuses are permitted as the new status when a status is changed manually. You must define next allowable statuses for each project status.

Defining the next allowable statuses determines the project process flow. For example, you can specify that a project with a Requested status can have the status changed to either Approved or Rejected. This example shows two possible process flows for the project: Requested to Approved status, or Requested to Rejected status.

The following four options are available when you specify the next allowable statuses:

All: The current status can change to any status. This is the default value.

None: The current status cannot change.

System Status: The next allowable statuses are based on system statuses. Specify which system statuses are next allowable statuses.

Status Name: The next allowable statuses are based on project statuses. Specify which project statuses are next allowable statuses.

Next allowable statuses do not apply to progress statuses.

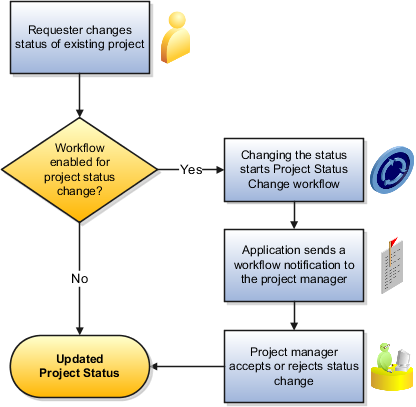

Oracle Fusion Projects provides a default Project Status Change workflow process. If you enable workflow for a project status, the approval workflow begins when a project changes to that status. The default workflow process routes a request for approval of the project status change to the project manager. You can use client extensions to modify the default workflow process to accommodate the needs of your business.

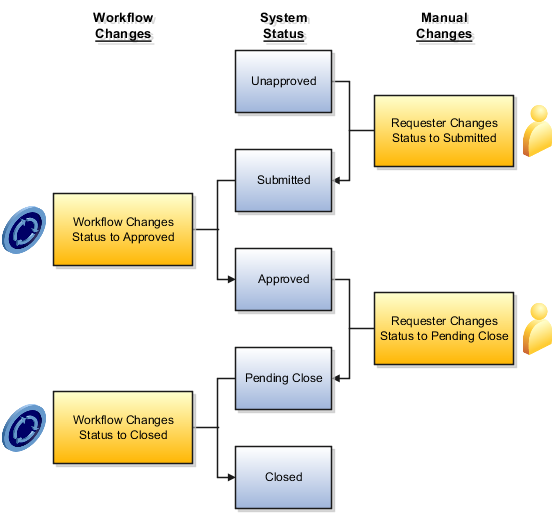

The following diagram shows the process of changing a project status.

During implementation, you specify the project statuses that require approval before a project changes to that status.

For each project status with workflow enabled, you can also specify the following parameters:

The status that the application assigns to the project when a project status change is accepted.

The status that the application assigns to the project when a project status change is rejected.

For example, assume that during implementation, you enable workflow for the Submitted status, and configure the following workflow attributes:

In the Status After Change Accepted field for the Submitted project status, you specify the Approved status as the status that the application assigns to the project when the status change is accepted.

In the Status After Change Rejected field for the Submitted project status, you specify the Rejected status as the status that the application assigns to the project when the status change is rejected.

In this example, when a requester changes the project status to Submitted, the workflow process routes the status change request to the project manager's worklist. If the project manager accepts the status change, the workflow process assigns the Approved status to the project. If the project manager rejects the status change, the workflow process assigns the Rejected status to the project.

Workflow attributes do not apply to progress statuses.

The following diagram shows an example project status flow when Project Status Change workflow is used for status changes during the lifecycle of a project. In this example, a requester changes the project status to Submitted. A workflow notification is sent to the project manager, who accepts the status change. Workflow is configured to change the project status to Approved after a request to change the status to Submitted is accepted. After project completion, the requester changes the project status to Pending Close. A workflow notification is sent to the project manager, who accepts the status change. Workflow is configured to change the project status to Close after a request to change the status to Pending Close is accepted.

You can extend the functionality of Project Status Change workflow by using the following client extensions:

Project Status Change Approver Extension: Overrides the project status change approver.

Use this client extension to specifying a status change approver other than the project manager. By default, the project status change approver is the active project manager.

Project Status Change Workflow Enabled Extension: Determines whether to call the workflow process when the project status changes.

Use this extension to add and modify the conditions that enable workflow for project status changes.

Project Status Change Rules Extension: Specifies the conditions that must be satisfied before a project status can change.

Use this extension to build additional rules for changing a project status. For example, you can enforce a rule that certain class categories and class codes must be assigned to a project before you can change the project to an Approved status.