Understanding Loans and Advances

Understanding Loans and AdvancesThis chapter provides an overview of loans and advances and discusses how to:

Set up loan and advance repayments.

View delivered loan and advance elements.

Understanding Loans and Advances

Understanding Loans and AdvancesPeopleSoft Enterprise Global Payroll for Spain enables you to process loans and advance payments made to employees through the payroll. You pay the loan or advance with the employee's pay or in cash for one pay period, and then take repayments from the employee's pay over successive pay periods until the amount is repaid in full. (Advances must be repaid over a single period.) Use the Advance/Loan page to enter details of an employee's loan or advance, and the system records the repayments on the Payment Schedule page.

Loan and Advance Repayments in the Pay Process Flow

Loan and Advance Repayments in the Pay Process Flow

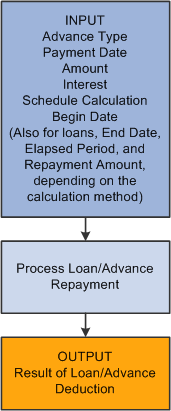

This diagram illustrates how loan and advance repayments fit into the overall pay process flow of PeopleSoft Enterprise Global Payroll for Spain. Loan and advance repayments are voluntary deductions, which are deducted after statutory deductions. They appear in the process list after the statutory deductions.

Loan and advances process flow for PeopleSoft Enterprise Global Payroll for Spain

Setting Up Loan and Advance Repayments

Setting Up Loan and Advance Repayments

This section provides an overview of loan and advance repayments and discusses how to:

Enter loans and advances.

View the payment schedule.

Understanding Loan and Advance Repayments

Understanding Loan and Advance RepaymentsIf an employee receives an advance, the total amount must be repaid in the same month that the advance was granted, or in the following month. Advances are paid over one period only; that is, they cannot be repaid over several months. Employees may also request an advance payment over an extra period—in this case, PeopleSoft Enterprise Global Payroll for Spain deducts the advance repayment from an extra pay period.

If an employee is granted a loan, use PeopleSoft Enterprise Global Payroll for Spain to select one of three calculation types for repayment. Specify the number of periods over which repayment is to be made and let the system determine the end date. Or specify the repayment amount for each period and let the system determine the end date.

You can also enter the type of interest that applies. For example, if the statutory interest rate is 7 percent and you grant an employee a loan at 4 percent, this is 3 percent less expensive than a bank loan. The Spanish government regards the difference between the statutory interest rate and the company interest rate as salary in kind—salario en especie—which is calculated in the following way:

Salary in kind = interest repayment amount at statutory rate – interest repayment amount at company rate.

With Global Payroll, you can instruct the system to take into account the number of extra pay periods to which an employee is entitled. Employees in Spain are usually paid over 12 periods, plus the number of extra pay periods stated in the labor agreement. If you want Global Payroll to consider extra pay periods when calculating loan repayments for employees who are paid additional pay periods, the system checks the employee's labor agreement for the number of additional pay periods and calculates the loan repayment accordingly.

Use the Advance/Loan page to enter details of an employee's loan or advance, and the system displays the employee's repayments on the Payment Schedule page.

Pages Used to Set Up Loans and Advances

Pages Used to Set Up Loans and Advances|

Page Name |

Definition Name |

Navigation |

Usage |

|

GPES_ADV_LOAN |

Global Payroll & Absence Mgmt, Payee Data, Loans, Request Advances/Loans ESP, Advance/Loan |

Record the details of a loan or advance payment made to an employee. |

|

|

GPES_ADVLOAN_SCHED |

Global Payroll & Absence Mgmt, Payee Data, Loans, Request Advances/Loans ESP, Payment Schedule |

View the status of an employee's loan or advance, as well as the repayments that he or she have made. The page displays the original amount of the loan and advance, the remaining amount to be repaid, and the loan amortization schedule. |

Entering Loans and Advances

Entering Loans and Advances

Access the Advance/Loan page (Global Payroll & Absence Mgmt, Payee Data, Loans, Request Advances/Loans ESP, Advance/Loan).

Advances/Loans

|

Sequence number |

Enter a sequence number for the advance/loan. (This number helps prevent duplicate key conditions; it does not control the processing sequence.) |

Payment Data

|

Advance Type |

Select the advance type that the employee is going to receive: Advance or Loan. |

|

Statutory Interest |

This field appears for loans only. The system displays the statutory interest rate that you defined on the Statutory Rates page. |

|

Payment Date |

Enter the date when the loan or advance is to be paid to the employee. The system generates an earning amount for the corresponding payroll period. Note. If this field is left blank, the assumption is that the payment will be made in cash. The system does not generate the earning and pay it through payroll processing. |

|

Amount |

Enter the amount of the loan or advance. |

|

Company Interest |

This field appears for loans only. Enter the interest rate that applies to the loan from the employer. |

Repayment Schedule

|

Calculation Type |

Select a calculation type to determine the payment schedule. Values are: Elapsed Period: Select if you want the system to calculate the end date and repayment amount for you, according to the number of periods that you specify in the Elapsed Period field. The End Date field becomes unavailable for edit. End Date: Select if you want to specify the end date of the loan repayments. The Elapsed Period field becomes unavailable for edit. Flat Amount: Select if you want to specify the flat amount that the employee is to repay each pay period. The system automatically calculates the number of repayment periods. The system displays the Repayment field instead of the Elapsed Period field. The End Date field becomes unavailable for edit. Note. If you select the advance type Advance, the system automatically sets the calculation type to Elapsed Period. |

|

Consider Extra Period |

Select if you want the calculation to include extra period payments. |

|

Begin Date |

Enter the date when the employee begins making the loan or advance repayments. For extra period advances, the begin date must fall within the extra period in which the repayment will be made. |

|

End Date |

Enter the date when the loan or advance repayments are due to end. (You can enter a value in this field only when you select End Date as the calculation type.) Note. The system generates payments between the begin and end dates and calculates the necessary amount to be deducted. |

|

Elapsed Period |

Enter the number of pay periods over which the employee is to repay the loan. You can enter a value in this field only when you select Elapsed Period as the calculation type. The system automatically calculates the end date for you. For example, if you enter the elapsed period as 13, the system calculates the end date as 13 pay periods after the begin date that you entered and the amount to repay. Note. If you select the advance type Advance, the system automatically sets Elapsed Period to 1. This is because advances must be repaid in full in the next pay period. |

|

Repayment |

Enter the monthly loan repayment amount that the employee has requested to pay. This amount includes the principal amount of the loan and the interest payment. You can enter a value in this field only when you select Flat Amount as the calculation type. |

|

Allow Last Repay Greater |

Select to include any loan remainder less than the monthly repayment amount as part of the last scheduled payment. For example, if you assign a loan amount of 3500 EUR to a payee, with a Repayment value of 1000 EUR, the system would schedule three payments of 1000 EUR and one final payment of 500 EUR to repay the loan if the Allow Last Repay Greater check box were deselected. With the check box selected, the system would schedule two payments of 1000 EUR and one final payment of 1500 EUR. This field is available only if you select Flat Amount as the calculation type. |

|

Calculate Loan |

This button appears for loans only. Click this button to automatically calculate the loan. The system checks the employee's labor agreement and takes into account the number of extra pay periods to which the employee is entitled. |

Viewing the Payment Schedule

Viewing the Payment Schedule

Access the Payment Schedule page (Global Payroll & Absence Mgmt, Payee Data, Loans, Request Advances/Loans ESP, Payment Schedule).

Advance/Loan Totals

|

Sequence Number |

Displays the sequence number that you entered on the Advance/Loan page. |

|

Total Amount |

Displays the total amount of the loan or advance that was made to the employee. If an employee has several loans, the system displays the details of each loan and the total loan amount, and automatically calculates the remaining loan amount to be repaid. |

|

Remaining Amount |

Displays he amount of the loan or advance that has not been repaid. This amount is automatically reduced per pay period, when the repayments are taken from the employee's salary. |

Loan Amortization Table

|

Month |

Displays the month in which repayments must be made and wether they have been paid. If you selected 1/4/2004 as the begin date on the Advance/Loan page, for example, the system displays 4 as the first repayment. In other words, the first repayment is due in April, the fourth month of the year. |

|

Extra Period |

The system selects this check box automatically if a repayment is to be made in an extra pay period. |

|

Year |

The system automatically enters the year in which the repayment was paid. |

|

Capital |

Displays the capital amount of the loan repayment that the employee has to pay. This amount does not include the interest payment for the loan. |

|

Interest |

The system automatically calculates the interest payment that applies to the loan. |

|

Repayment |

The system automatically calculates the total loan or advance repayment for that month. This amount comprises the capital and the interest payments. |

|

Salary in Kind |

The system automatically calculates the difference between the cost of the loan at the statutory interest rate, and the interest rate that you defined on the Advance/Loan page. This information is used for tax purposes. |

|

Paid |

The system selects this check box automatically when a loan or advance amount has been repaid. |

Viewing Delivered Loan and Advance Elements

Viewing Delivered Loan and Advance Elements

This section discusses:

Delivered loan and advance earnings.

Delivered loan and advance deductions.

Delivered Loan and Advance Earnings

Delivered Loan and Advance EarningsPeopleSoft Enterprise Global Payroll for Spain uses these earnings to calculate payments for loans and advances:

|

Earnings |

Description |

|

DEV ADELANTO |

Salary advance. Contains the amount to be paid to the employee as advance payment, which the employee must pay back through later payrolls. Custom field 5 contains the label DEV ADLNTO. Only processed for the last segment in the period. No retro calculation. |

|

DEV PRESTAMO |

Loan. Used for loan payments. Custom field 5 contains the label DEV PRSTMO. Only processed for the last segment in the period. No retro calculation. |

|

PRSTMO EX |

In kind loan taxable excess. Shows the excess interest amount that results when the interest rate is lower than the statutory rate. Calculated by subtracting the loan interest amount from the statutory interest amount on a month-by-month basis. |

Delivered Loan and Advance Deductions

Delivered Loan and Advance DeductionsPeopleSoft Enterprise Global Payroll for Spain uses these deductions to calculate repayments for loans and advances:

|

Deduction |

Description |

|

DD ADELANTO |

Advance deduction. Used for repayment of advances. Custom field 5 contains the label DD ADELANTO. Only processed for the last segment in the period. No retro calculation. |

|

DD PRST CAP |

Loan capital deduction. Used for repayment of the capital portion of a loan. Custom field 5 contains the label DD PRST CAP. Only processed for the last segment in the period. No retro calculation. |

|

DD PRST INT |

Loan interest deduction. Used for repayment of the interest portion of a loan. This deduction takes its value from the variable AYP VR IMPTOT INT previously calculated in AYP FM IMPORTE called from DDPRST CAP. Only processed for the last segment in the period. No retro calculation. |

|

LIQ ADLNTO |

Deduction for terminated employees. Settles the outstanding advance amount. |

|

LIQ PRSTMO |

Deduction for terminated employees. Settles the outstanding loan amount. |

|

PRSTMO EXX |

In kind loan taxable excess. Shows the excess interest amount that results when the interest rate is lower than the statutory rate. This deduction is linked to PRSTMO EX and offsets it. |

Note. The PeopleSoft system delivers a query that you can run to view the names of all delivered elements designed for Spain. Instructions for running the query are provided in thePeopleSoft Enterprise Global Payroll 9.1 PeopleBook.

See Also

Understanding How to View Delivered Elements