Understanding Pay Confirmation

Understanding Pay Confirmation

This chapter provides an overview of pay confirmation and discusses how to:

Confirm pay.

Unconfirm pay.

Understanding Pay Confirmation

Understanding Pay Confirmation

This section discusses:

Pay confirmation in the payroll process.

A summary of the Pay Confirmation PSJob process (PAYCONF).

Balance updates and the order of pay calendar confirmation.

Pay Confirmation in the Payroll Process

Pay Confirmation in the Payroll ProcessAfter you verify that the payroll calculation is correct and you run the Pay Calculation COBOL SQL process (PSPPYRUN) in final mode, you can run the Pay Confirmation process. Pay confirmation is the final step in running your payroll. Running the Pay Confirmation process indicates that you've reviewed and approved all payroll information for this pay run, and that you're ready to produce paychecks.

After a payroll has been confirmed, you can generate checks, advices, and any other payroll reports. You can also generate the direct deposit, general ledger, or any other interface. You can review an employee's check totals and payroll balances online.

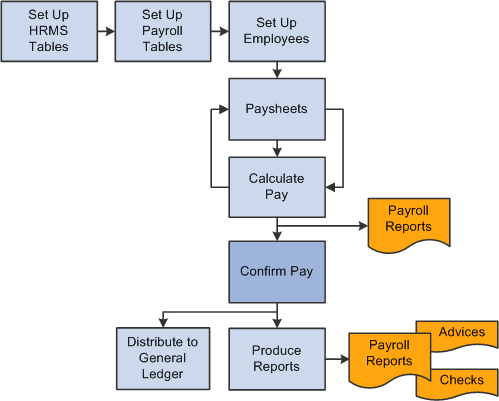

This diagram illustrates where pay confirmation fits into the payroll process, from setting up HRMS tables to producing payroll reports, advices and checks:

Illustration showing how pay confirmation fits into the payroll process from setting up HRMS tables to producing payroll reports, advices and checks

Warning! Do not run the Pay Confirmation process unless you are confident that the amounts have been calculated properly. After the Pay Confirmation process is complete, you cannot update paysheet information unless you first run the Pay Unconfirm COBOL SQL process (PSPUNCNF).

Summary of the Pay Confirmation PSJob Process (PAYCONF)

Summary of the Pay Confirmation PSJob Process (PAYCONF)

Manage the Pay Confirmation process with a pay run ID, just as you do for pay calculation and paysheets. Use the identical pay run ID in the Pay Confirmation process that you used during both the Paysheet Creation COBOL SQL process (PSPPYBLD) and Pay Calculation process.

Note. Do not run the Online Check process while other pay confirmations are running because the processes might not finish in sequential order, causing the Last Form Number Used field to be updated incorrectly. Therefore, running these processes simultaneously might use duplicate check numbers.

The Pay Confirmation PSJob process (PAYCONF) consists of two processing steps:

Pay Confirm COBOL SQL process (PSPCNFRM).

Time and Labor Pay Reversal process (TL_PAY_REVRS).

Pay Confirm COBOL SQL Process (PSPCNFRM)

The PSPCNFRM process:

Processes one company at a time and, within each company, every pay group that is assigned to that pay run ID.

As it processes each pay group, the system indicates how many checks are being confirmed and how many have already been confirmed.

Updates all balances for earnings, deductions, check year-to-date, taxes, garnishments, arrears, and leave accruals.

Assigns check and/or advice numbers.

It checks the value of the Last Form Number Used field in the Form table, increments that by one, and assigns this number to the first person in the check sequence order. The remaining check or advice numbers are assigned sequentially according to the check print sequence options that you've defined in the Pay Group table.

Time and Labor Pay Reversal Process (TL_PAY_REVRS)

The Time and Labor Pay Reversal process (TL_PAY_REVRS) creates the necessary offset rows and new rows of payable time as required by the payable time reversal type specified on the Reverse/Adjust Paychecks run control page.

See Also

Working with Checks and Direct Deposit

Reversing or Adjusting a Paycheck

Balance Updates and the Order of Pay Calendar Confirmation

Balance Updates and the Order of Pay Calendar Confirmation

When a check is processed for an employee, the system updates the various balance records (earnings, deductions, taxes, and so on). Balance records are stored by year, quarter, and balance period or month. For Canada, balance records are stored by year, wage loss plan, province, quarter, and balance period or month.

The system updates balances based on the check date of the pay calendar to which they are associated. The actual check date is not a factor.

This table lists dates used to illustrate balance updating:

|

Period End Date |

On-Cycle Check Date On Pay Calendar |

Off-Cycle Check Date On Paychecks |

|

December 31, 2006 |

December 31, 2006 |

January 2, 2007 |

Based on the dates in the table:

On-cycle pay confirmation updates balances for December 2006.

Off-cycle pay confirmation tied to the December on-cycle calendar updates balances in December 2006, even though the employees' check date is in January 2007.

If you tie the off-cycle to the first payroll calendar in 2005, Pay Confirmation updates the January 2005 balances.

After you have posted to a month, you cannot post to a previous month. For example, after you have posted an April balance, the system does not allow you to update a March balance of the same type. If you try to post to a previous month, the Pay Confirmation process stops with an error. This may occur for semimonthly and monthly pay groups.

Example - Semimonthly Pay Group

An employee is in a semimonthly pay group for the first three weeks of the month. He is then transferred to a monthly pay group. He has a paysheet for the semimonthly pay group for the third week of the month and a monthly paysheet for the fourth week of the month. The semimonthly pay group has a pay end date of March 31 and a check date of April 5, and therefore a balance Period of 4 on the pay calendar. The monthly pay group has a pay end date of March 31 and a check date of March 31, and therefore a balance Period of 3 on the pay calendar.

If the semimonthly pay group is confirmed before the monthly pay group, the April balance record is created before the March balance is updated. As a result, when you try to confirm the monthly pay group, the Pay Confirmation process stops with an error.

To prevent the problem, you need to confirm the monthly pay group first, because the check date is in March.

Example - Monthly Pay Group

An employee is in the monthly pay group for the month of March. This payroll has a pay end date and check date of March 31. Effective April 1, the employee is transferred to the semimonthly pay group. Before you confirm the March 31 monthly payroll, you confirm an off-cycle check that is attached to the April semimonthly payroll for this employee. This off-cycle check creates an April balance record; when you try to confirm the March monthly payroll, the Pay Confirmation process stops with an error.

To avoid this error, Pay Confirmation calendars in order, by month of the check date.

Confirming Pay

Confirming PayThis section provides an overview of pay confirmation results and discusses how to run the Pay Confirmation process.

Understanding Pay Confirmation Results

Understanding Pay Confirmation Results

Review pay confirmation results using hard copy reports or the available online Review Paycheck pages in the Payroll Processing menu.

See Also

Reviewing Pay Calculation Results

Working with Checks and Direct Deposit

Pages Used to Confirm Pay

Pages Used to Confirm Pay|

Page Name |

Definition Name |

Navigation |

Usage |

|

RUNCTL_AUDIT |

|

Generate the PAY036 report which provides a detailed listing (by company, calendar year, pay group, month code, pay end date, and employee ID) of information that might cause problems during the Pay Confirmation process. |

|

|

RUNCTL_PAY_CONF |

|

Enter pay confirmation process parameters and run the Pay Confirmation process. |

Running the Pay Confirmation COBOL SQL Process (PSPCNFRM)

Running the Pay Confirmation COBOL SQL Process (PSPCNFRM)

Access the Confirm Payroll page (Payroll for North America, Payroll Processing USA, Produce Payroll, Confirm Payroll, Confirm Payroll; or Payroll for North America, Payroll Processing CAN, Produce Payroll, Confirm Payroll, Confirm Payroll; or Payroll for North America, Payroll Processing USF, Produce Payroll, Confirm Payroll, Confirm Payroll).

On-Cycle or Off-Cycle Run

|

Pay Run ID |

For on-cycle confirmation, enter the pay run ID. Use the identical pay run ID in the Pay Confirmation process that you used during both the Paysheet Creation and Pay Calculation processes. |

|

On or Off-Cycle |

To confirm all off-cycle checks that are associated with a particular period, enter a pay run ID and select Off-Cycle. To confirm off-cycle checks by page range, leave the Pay Run ID field blank, select Off-Cycle, and use the Off-Cycle Run group box to specify parameters for the calculation: company, pay group, pay end date, and the page numbers. |

Off-Cycle Run

|

All Reversals/Adjustments |

Select to process all reversals and adjustments. |

Unconfirming Pay

Unconfirming Pay

This section provides an overview and discusses how to:

Run the Pay Unconfirm process.

Correct unconfirmed Time and Labor payable time generated by a check reversal.

Understanding Pay Unconfirm Processing

Understanding Pay Unconfirm ProcessingThe Pay Unconfirm process is provided primarily for testing and implementation purposes. Unconfirming a payroll is not recommended in the production environment.

Warning! In the production environment, this process is appropriate for emergency use only. Normal production procedure should be to use backup and restore procedures to restore the database to the condition prior to confirmation. If you're considering running the Unconfirm process in production, please discuss it with the Global Support Center first.

Pages Used to Unconfirm Pay

Pages Used to Unconfirm Pay|

Page Name |

Definition Name |

Navigation |

Usage |

|

RUNCTL_PAY_UNCONF |

|

Run the Pay Unconfirm process to update paysheet information or to make data or table changes that require recalculation after you've run the Pay Confirmation process. |

|

|

RUNCTL_UNCNF_TL |

|

Reverse Time and Labor payable time generated by a check reversal. Run the Reverse Time and Labor Application Engine process (TL_UNCONFIRM) to correct the corresponding payable time rows in Time and Labor that were created by the Time and Labor Pay Reversal process (TL_PAY_REVRS) during pay confirmation. |

Running the Pay Unconfirm COBOL SQL Process (PSPUNCNF)

Running the Pay Unconfirm COBOL SQL Process (PSPUNCNF)

Access the Unconfirm Payroll page (Payroll for North America, Payroll Processing USA, Produce Payroll, Unconfirm Payroll, Unconfirm Payroll; or Payroll for North America, Payroll Processing CAN, Produce Payroll, Unconfirm Payroll, Unconfirm Payroll; or Payroll for North America, Payroll Processing USF, Produce Payroll, Unconfirm Payroll, Unconfirm Payroll).

The Unconfirm Payroll page is identical to the Confirm Payroll page.

Correcting Unconfirmed Time and Labor Payable Time Generated by a Check

Reversal

Correcting Unconfirmed Time and Labor Payable Time Generated by a Check

ReversalAccess the Reverse Time and Labor page (Payroll for North America, Payroll Processing USA, Produce Payroll, Reverse Time and Labor, Reverse Time and Labor; or Payroll for North America, Payroll Processing CAN, Produce Payroll, Reverse Time and Labor, Reverse Time and Labor; or Payroll for North America, Payroll Processing USF, Produce Payroll, Reverse Time and Labor, Reverse Time and Labor).

If you unconfirm a pay run that includes a reversal of Time and Labor payable time, you must then run the Reverse Time and Labor Application Engine process (TL_UNCONFIRM).

Note. You must know the paycheck number of the reversed paycheck when you run this process.

The Reverse Time and Labor process attempts to delete the payable time rows in Time and Labor that were created by the Time and Labor Pay Reversal process (TL_PAY_REVRS) during confirmation of the reversal.

If a future row of payable time that was created during reversal confirmation has already been loaded to payroll, the system does not delete rows; instead it issues a warning message.

Note. After running the Reverse Time and Labor process, check messages. If the system has issued a warning that payable time rows could not be deleted and must be manually adjusted, you must make manual corrections. Depending upon how much of the payroll process has been completed for that payable time, you might have to coordinate with the Time and Labor administrator to make the corrections.

The fields on this page are identical to the process request parameters and selection criteria fields on the Paycheck Reversal Adjustment page.

You must enter the paycheck number of the original check that you reversed and then unconfirmed.

See Also

Reversing or Adjusting a Paycheck