Understanding the General Ledger Interface

Understanding the General Ledger Interface

This chapter provides an overview of the interface with Oracle's PeopleSoft Enterprise General Ledger and discusses how to:

Set up business units for general ledger integration.

Group earnings, deduction, and tax expenses.

Map expense groups to ChartField combinations.

Prepare and transfer payroll data to General Ledger.

Note. The General Ledger interface provides flexible integration between Payroll for North America and General Ledger. Make sure you work in conjunction with your general ledger staff to use this interface.

See Also

Getting Started with Manage Commitment Accounting

Understanding the General Ledger Interface

Understanding the General Ledger Interface

Sending payroll data to General Ledger is one of the final steps in the payroll cycle. When you integrate Payroll for North America and General Ledger, you can automatically post earnings and deductions that are associated with a finalized calendar run to your General Ledger system.

This section discusses:

Prerequisites.

Description of the interface with General Ledger.

Integration points.

Prerequisites

Prerequisites

These setup tasks must be completed before you begin the tasks in this chapter:

Update the General Ledger fields on the Installation table – Product Specific page.

See Entering Application- and Industry-Specific Installation Information.

Set up the integration with the Financials database.

See PeopleSoft Enterprise Human Resources PeopleBook: Enterprise Components

Set up the ChartFields and ChartField configuration.

See Setting Up and Working with ChartFields and ChartField Combinations.

Description of the Interface with General Ledger

Description of the Interface with General Ledger

With Payroll for North America you can send payroll accounting transactions to General Ledger. The payroll data that is sent to General Ledger includes the following expense and liability account data:

Earnings.

Deductions.

Federal, state/provincial, and local tax and insurance deductions.

Net pay and direct deposit data.

Integration Points

Integration Points

Integration Points are interfaces between PeopleSoft applications. They enable the transfer of data from one database to another.

The Payroll for North America and General Ledger interface uses two sets of integration points, one to retrieve ChartField and business unit information from General Ledger and one to publish payroll results to General Ledger.

The Payroll for North America interface with PeopleSoft General Ledger uses the following integration points:

|

Service Operation |

Description |

|

BUS_UNIT_GL_FULLSYNC |

Financials database initial full table publish of GL business unit IDs. |

|

BUS_UNIT_GL_SYNC |

Financials database ongoing incremental publish of GL business unit IDs. |

|

BUS_UNIT_FS_FULLSYNC |

Financials database initial full table publish of GL business unit descriptions. |

|

BUS_UNIT_FS_SYNC |

Financials database ongoing incremental publish of GL business unit descriptions. |

|

JOURNAL_GEN_APPL_ID_FULLSYNC |

Financials database initial full table publish of PeopleSoft Journal Generator templates. |

|

JOURNAL_GENERATOR_APPL_ID_SYNC |

Financials database ongoing incremental publish of PeopleSoft Journal Generator templates. |

|

PAYROLL_ACCTG_TRANSACTION |

PeopleSoft HRMS database batch publish of HR (payroll) accounting lines. |

|

One service operation for each GL ChartField |

See Setting Up and Working with ChartFields and ChartField Combinations. |

See Also

Setting Up and Working with ChartFields and ChartField Combinations

Working with Integration Points in Enterprise HRMS

Setting Up Business Units for General Ledger Integration

Setting Up Business Units for General Ledger Integration

To map PeopleSoft HRMS and PeopleSoft General Ledger, use the GL/HR Business Unit Mapping component (BU_GL_HR_LNK).

This section provides an overview and discusses how to:

View general the ledger business unit definition.

View journal generator template defaults.

View the template's summarization options.

Map business units.

See Also

PeopleSoft General Ledger PeopleBook, "Defining Your Operational Structure"

PeopleSoft Application Fundamentals for Financials and Supply Chain Management PeopleBook

Understanding Business Unit Setup

Understanding Business Unit SetupThis section discusses:

General ledger business units.

Journal templates.

Business unit mapping.

General Ledger Business Units

If you're using Enterprise General Ledger, set up General Ledger business units in the Financials database using the General Ledger Definition component. PeopleSoft HRMS subscribes to the General Ledger business unit data and displays it using the Business Unit GL component. The pages are unavailable for entry in HRMS; use them to review the Financials values.

Note. Payroll for North America must post data to at least

one PeopleSoft General Ledger business unit so you need to set up at least

one business unit.

If your organization does not use Enterprise General Ledger, you must

set up a General Ledger business unit directly in PeopleSoft HRMS, using the

Business Unit GL component.

Journal Templates

PeopleSoft Enterprise Journal Generator uses the defaults set up in Journal Generator templates to create journals. Most organizations define templates for each application that distributes to the general ledger. If you're using Enterprise General Ledger, set up and maintain Journal Generator templates in PeopleSoft Financials. Enterprise HRMS subscribes to the Journal Generator template data in Financials and displays it using the Review Journal Generator Templ component in Enterprise HRMS.

If your organization does not use Enterprise General Ledger, you must set up a Journal Generator template directly in HRMS, using the Journal Generator Templates component. The system requires that a template ID be assigned, but it does not use the template.

Business Unit Mapping

To share information successfully with PeopleSoft General Ledger, confirm that you've correctly associated (or mapped) your PeopleSoft HRMS business units to General Ledger business units. The system uses this mapping information to determine which General Ledger business unit to use when generating accounting transactions.

Use the GL/HR Business Unit Mapping page to:

Confirm that a specific Enterprise General Ledger business unit is correctly mapped to the appropriate Enterprise HRMS business unit.

Associate a journal template and calendar ID.

If you use commitment accounting, also identify the associated calendar ID.

See Also

Pages Used to Set Up Business Units for General Ledger Integration

Pages Used to Set Up Business Units for General Ledger Integration|

Page Name |

Definition Name |

Navigation |

Usage |

|

BUS_UNIT_TBL_GL1 |

Set Up HRMS, Product Related, Payroll for North America, GL Interface, Review GL Business Units, Definition |

If you are using PeopleSoft General Ledger, this page is display only. Use it to view the definition of PeopleSoft General Ledger business units. PeopleSoft HRMS processes use the information in the Unit and Base Currency fields only. If you are not using PeopleSoft General Ledger, the fields on this page are editable. Use this page to set up GL business units. |

|

|

BUS_UNIT_TBL_GL2 |

Set Up HRMS, Product Related, Payroll for North America, GL Interface, Review GL Business Units, Currency Options |

View the currency options of PeopleSoft General Ledger business units. PeopleSoft HRMS processes do not use the information on this page. This page is display-only. |

|

|

JRNL_GEN_DEFAULTS |

Set Up HRMS, Product Related, Payroll for North America, GL Interface, Review Journal Generator Templ, Defaults |

View Journal Generator defaults. PeopleSoft HRMS processes use only the SetID and Template fields. |

|

|

JRNL_GEN_SUM |

Set Up HRMS, Product Related, Payroll for North America, GL Interface, Review Journal Generator Templ, Summarization |

View the template's summarization options. PeopleSoft HRMS processes do not use the information on this page. |

|

|

GL/HR Business Unit Mapping |

BU_GL_HR_LNK |

Set Up HRMS, Common Definitions, ChartField Configuration, GL/HR Business Unit Mapping, GL/HR Business Unit Mapping |

Verify that the General Ledger business unit is associated with the correct Human Resources business unit. Associate a journal template with each General Ledger business unit. |

Viewing the General Ledger Business Unit Definition

Viewing the General Ledger Business Unit Definition

Access the Review GL Business Units - Definition page (Set Up HRMS, Product Related, Payroll for North America, GL Interface, Review GL Business Units, Definition).

|

Unit |

The PeopleSoft General Ledger business unit you selected to access the page. |

|

Base Currency |

The base currency for this PeopleSoft General Ledger business unit. A General Ledger business unit supports one base currency per ledger. This is usually the local currency for the organization, but accounting rules or other circumstances might dictate that it be different. |

Options

|

Enable Document Sequencing |

This check box is selected if document sequencing is required for this business unit. |

|

Enable Payables InterUnit VAT (enable Payables interunit value added taxes) |

This check box is selected if payables interunit value added taxes (VAT) is required for transactions between related parties. |

Consolidations

|

For Eliminations Only |

This check box is selected if this business unit is an eliminations entity for consolidations processing. |

Viewing Journal Generator Template Defaults

Viewing Journal Generator Template Defaults

Access the Review Journal Generator Templ - Defaults page (Set Up HRMS, Product Related, Payroll for North America, GL Interface, Review Journal Generator Templ, Defaults).

If you are not interfacing with PeopleSoft Enterprise Financials, this page is editable. To set up a journal generator template enter a:

Template ID.

SetID.

The setID needs to match the setID of the General Ledger business units you created on the Review GL Business Units component (BUS_UNIT_TBL_GL) for the business unit to use a journal generator template.

The remaining fields are not required, so you can enter dummy information or leave them blank.

If you are using PeopleSoft General Ledger, the system displays data in the following fields:

|

Accounting Entry In Sync |

This check box is selected if a PeopleSoft application that supports the multibook feature has generated in-sync accounting entries for this template. |

|

Reversal Code |

The reversal code for this Journal Generator template. |

Journal Header Fields

|

Journal ID Mask |

The journal naming convention. |

|

Journal Date |

The date journals are created; for example, Accounting Date on Transaction or Process Date. |

|

Alt. Journal Date (alternate journal date) |

The journal date used for journals created outside of the open accounting periods range. |

|

Header Descr (header description) |

Descriptive information about the journal. |

|

Source |

Identifies the originating entity responsible for the journal entries. |

|

Document Type |

The default general ledger document type assigned to the journal header. |

|

Reference |

The transaction source of the journal. |

Journal Line Fields

|

Reference |

Refers each journal line back to a document, person, invoice, date, or any other piece of information helpful for tracking the source of the transaction. |

Viewing the Template's Summarization Options

Viewing the Template's Summarization Options

Access the Review Journal Generator Templ - Summarization page (Set Up HRMS, Product Related, Payroll for North America, GL Interface, Review Journal Generator Templ, Summarization).

If you are using PeopleSoft General Ledger, review the primary and alternate summarization options for the template on this page.

Mapping Business Units

Mapping Business Units

Access the GL/HR Business Unit Mapping page (Set Up HRMS, Common Definitions, ChartField Configuration, GL/HR Business Unit Mapping, GL/HR Business Unit Mapping).

|

Business Unit - GL |

The PeopleSoft General Ledger business unit and description. |

|

Journal Template |

Select the journal template to associate with this PeopleSoft General Ledger business unit from the list of available options. Journal templates are used during the Actuals and Encumbrances processes (PAYGL02 and PAYGL03). |

|

Calendar ID |

If you use commitment accounting, select a calendar ID to associate with this PeopleSoft General Ledger business unit. The system uses calendar IDs to distribute actuals over accounting periods. Review calendars on the Detail Calendar page (DETAIL_CALENDAR1). |

HR Business Units

The HR Business Units scroll area displays the Enterprise Human Resources business units and descriptions currently associated with the PeopleSoft General Ledger business unit.

If the PeopleSoft Human Resources and PeopleSoft General Ledger business units aren't correctly mapped, correctly associate them on the Business Unit Reference page. After mapping Human Resources business units to the appropriate General Ledger business units, return to the GL/HR Business Unit Mapping page to associate a journal template and calendar ID with each General Ledger business unit.

See Also

Grouping Earnings, Deduction, and Tax Expenses

Grouping Earnings, Deduction, and Tax Expenses

To group payroll expense activities, use the GL Activity Grouping component (PYGL_ACTIVITY_GRP).

This section provides an overview of expense grouping and discusses how to:

Group earnings expenses.

Group deduction expenses.

Group tax expenses.

Understanding Expense Grouping

Understanding Expense GroupingIf your organization uses noncommitment accounting, you can track expenses by grouping expense activities into logical definitions that share the same combination of ChartField values. For example, you can group all regular earnings in one group and all overtime earnings in another group.

You can then map the groups to the combination of ChartField values for each group.

Note. Work with your finance office to identify expense activity groups and their members, and to map each group to the correct combination of ChartField values.

The GL Activity Grouping Component

When you add a new value and enter the component, you must select an activity type in the Valid Activity Type(s) group box. The selected activity type determines which page in the component is available for data entry.

You must then access the correct page in the component for the type of expense group that you are creating.

Default Groups

You must create a default group for each activity type. Select Group contains all codes.

During distribution of costs, when the GL Interface process encounters an expense that is not mapped to a valid group, it assigns the expense to the default group for that activity type.

The default group contains all codes so that no expense of this activity type is excluded from this group.

Updating Expense Groups

After you map all expense activities, if you add new earnings, deductions, or taxes, you must add the new codes to an existing group, create a new group, or let the new code be distributed to the existing default group. If you add a group, you must also map it to the correct ChartField combination.

Pages Used to Group Expense Activities

Pages Used to Group Expense Activities|

Page Name |

Definition Name |

Navigation |

Usage |

|

PYGL_ACTIVE_ERNGRP |

Set Up HRMS, Product Related, Payroll for North America, GL Interface, GL Activity Grouping, Earnings Expenses |

Group earnings codes into expense groups. |

|

|

PYGL_ACTIVE_DEDGRP |

Set Up HRMS, Product Related, Payroll for North America, GL Interface, GL Activity Grouping, Deduction Expenses |

Group deduction codes into expense groups. |

|

|

PYGL_ACTIVE_TAXGRP |

Set Up HRMS, Product Related, Payroll for North America, GL Interface, GL Activity Grouping, Tax Expenses |

Group taxes into expense groups. |

Grouping Earnings Expenses

Grouping Earnings Expenses

Access the Earnings Expenses page (Set Up HRMS, Product Related, Payroll for North America, GL Interface, GL Activity Grouping, Earnings Expenses).

|

Valid Activity Type(s) |

Select Earnings Group. |

|

Group contains all codes |

To create the required default earnings group, select Group contains all codes. This group is used for any earnings expenses that are not included in a specific group. When you select this check box, the other fields on the page disappear. |

Codes in Group Definition

|

Earnings Code |

Select earnings codes to include in this group. |

Grouping Deduction Expenses

Grouping Deduction Expenses

Access the Deduction Expenses page (Set Up HRMS, Product Related, Payroll for North America, GL Interface, GL Activity Grouping, Deduction Expenses).

|

Valid Activity Type(s) |

Select Deduction Group. |

|

Group contains all codes |

To create the required default deduction group, select Group contains all codes. This group is used for any deduction expenses that are not included in a specific group. When you select this check box, the other fields on the page disappear. |

Codes in Group Definition

|

Plan Type, Deduction Class, and Deduction Code |

Select the appropriate plan type and deduction class for the deduction code you are adding to the group. For a particular deduction code, all applicable deduction classes must be included in groups. Applicable deduction classes for expenses are: N: Nontaxable benefit. P: Nontaxable before-tax benefit. T: Taxable benefit. L: Taxable benefit (Canada - Quebec). |

|

Sales Tax Type |

Sales tax type applies only to Canada. Available values vary depending upon the deduction code. Note. (USA) U.S. users must select B (none), which is the default. |

Grouping Tax Expenses

Grouping Tax Expenses

Access the Tax Expenses page (Set Up HRMS, Product Related, Payroll for North America, GL Interface, GL Activity Grouping, Tax Expenses).

|

Valid Activity Type(s) |

Select Tax Group. |

|

Group contains all codes |

To create the required default tax group, select Group contains all codes. This group is used for any tax expenses that are not included in a specific group. When you select this check box, the other fields on the page disappear. |

Codes in Group Definition

|

Country |

The country that you select determines the fields that are available for data entry: USA: The State, Locality, and Tax Class fields are available. Canada: The Wage Loss Replacement Plan and Tax Class fields are available. |

|

State and Locality |

(USA) Use of the State and Locality fields depends upon the type of tax and the location. For example, FICA OASDI is a federal tax that would not require the State and Locality fields. |

|

Wage Loss Replacement Plan |

(CAN) Set up a separate group for each different wage loss plan for purposes of employment insurance (EI). |

|

Tax Class |

Tax Class is always a required field. The values available for selection depend upon the values selected in preceding fields. |

Mapping Expense Groups to ChartField Combinations

Mapping Expense Groups to ChartField Combinations

To map expense groups, use the ChartField Expense Mapping component (PYGL_CF_MAPPING) or (PYGL_CF_MAPPING_CAN).

This section provides an overview of expense mapping and discusses how to:

Map earnings groups.

Map deduction groups.

Map U.S. tax groups

Map Canadian tax groups.

Understanding Expense Mapping

Understanding Expense MappingThis section discusses:

Mapping levels.

Example of employee-level mapping.

Component Search page.

ChartField configuration.

Mapping Levels

When mapping expense groups to ChartField combinations, you can assign ChartField combinations based on these levels:

Company

Department

Position

Job code

Employee

When resolving the mapping for a payroll record, the GL Interface PSJob process (PAYGL01) starts at the lowest level--employee--and determines whether there is a definition for the employee and activity group being processed. If it is not found, the search goes one level up, to the job code being processed, and continues up until a mapping for the current payroll record is found. The search stops when an entry is found.

This way, you need only define mapping entries at lower levels where desired. For example, earnings could be assigned at the employee level while the employer expenses for taxes remain at the company level.

Example of Employee-Level Mapping

You might want to map earnings expense at the employee level if an employee is on loan to another department and the originating department wants to charge the temporary department for the time. To do this, you would map the earnings at the employee level on a temporary basis. This also reduces any overhead due to initiating transfers, and so forth.

Note. Note. To assign expenses at the employee level, use the Combination Code field on the employee's Job Data – Payroll page.

Component Search Page

On the search page for the component, you must select a company and business unit. If you select a mapping level more specific than Company, you must further select the particular value, such as the department, position, or employee ID.

ChartField Configuration

The fields displayed on the mapping pages are determined by the ChartField configuration.

See Also

Setting Up and Working with ChartFields and ChartField Combinations

Entering Payroll Processing Data

Common Elements Used in This Section

Common Elements Used in This Section|

GL Group Name |

Select the general ledger group. |

|

Edit ChartFields |

Click to search for ChartField combinations by speed type, combination code, or ChartField transaction. |

Pages Used to Map Expense Groups to ChartField Combinations

Pages Used to Map Expense Groups to ChartField Combinations|

Page Name |

Definition Name |

Navigation |

Usage |

|

PYGL_CO_CF_MAPERN |

|

Specify mapping level and map earnings expense groups to ChartField combinations. |

|

|

PYGL_CO_CF_MAPDED |

|

Specify mapping level and map deduction expense groups to ChartField combinations. |

|

|

PYGL_CO_CF_MAPTAX |

Set Up HRMS, Product Related, Payroll for North America, GL Interface, ChartField Expense Mapping USA, U.S. Tax Mapping |

Specify mapping level and map U.S. tax expense groups to ChartField combinations. |

|

|

PYGL_CO_CF_MAPCTX |

Set Up HRMS, Product Related, Payroll for North America, GL Interface, ChartField Expense Mapping CAN, Canadian Tax Mapping |

Specify mapping level and map Canadian tax expense groups to ChartField combinations. |

|

|

RUN_PAY752 |

Payroll for North America, Payroll Distribution, GL Interface Reports, Company ChartField Mapping, Company ChartField Mapping Report |

Generate the PAY752 report that lists all of the HR chart keys and their equivalent general ledger accounts and department IDs. |

|

|

PRCSRUNCNTRL |

Set Up HRMS, Product Related, Payroll for North America, GL Interface, Company GL Data Report, Company Report |

Generate the PAY702 report that lists general ledger data from the Company table. This report is a companion to PER707 (the Company Table - General Data report), which lists the payroll-related general ledger information in the Company table. |

Mapping Earnings Groups to ChartField Combinations

Mapping Earnings Groups to ChartField Combinations

Access the Earnings Mapping page (Set Up HRMS, Product Related, Payroll for North America, GL Interface, ChartField Expense Mapping USA, Earnings Mapping; or Set Up HRMS, Product Related, Payroll for North America, GL Interface, ChartField Expense Mapping CAN, Earnings Mapping).

Note. The whole page is not visible above. The fields displayed on the page are determined by the ChartField configuration.

Mapping Deduction Groups

Mapping Deduction Groups

Access the Deductions Mapping page (Set Up HRMS, Product Related, Payroll for North America, GL Interface, ChartField Expense Mapping USA, Deductions Mapping; Set Up HRMS, Product Related, Payroll for North America, GL Interface, ChartField Expense Mapping CAN, Deductions Mapping).

Note. The whole page is not visible above. The fields displayed on the page are determined by the ChartField configuration.

(USA) Mapping U.S. Tax Groups

(USA) Mapping U.S. Tax Groups

Access the U.S. Tax Mapping page (Set Up HRMS, Product Related, Payroll for North America, GL Interface, ChartField Expense Mapping USA, U.S. Tax Mapping).

Note. The whole page is not visible above. The fields displayed on the page are determined by the ChartField configuration.

(CAN) Mapping Canadian Tax Groups

(CAN) Mapping Canadian Tax Groups

Access the Canadian Tax Mapping page (Set Up HRMS, Product Related, Payroll for North America, GL Interface, ChartField Expense Mapping CAN, Canadian Tax Mapping).

Note. The whole page is not visible above. The fields displayed on the page are determined by the ChartField configuration.

Preparing and Transferring Payroll Data to General Ledger

Preparing and Transferring Payroll Data to General Ledger

This section provides overviews of the preparation and transfer of data and the GL reset process, and discusses how to:

Generate payroll accounting lines.

Generate The HR Accounting Line report.

Transfer payroll accounting lines to PeopleSoft General Ledger.

Note. This section applies only to noncommitment accounting.

See Also

PeopleSoft Enterprise Human Resources PeopleBook: Manage Commitment Accounting

Understanding the Preparation and Transfer of Data

Understanding the Preparation and Transfer of DataThis section discusses:

Processing steps.

The GL Reset Run Flag (general ledger reset run flag) SQR Report process (GLXRESET).

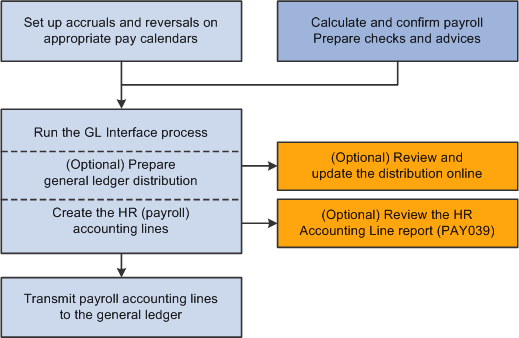

This diagram illustrates the general ledger processing steps to transmit payroll accounting lines to the general ledger:

General ledger processing steps showing how to transmit payroll accounting lines to the general ledger

After the GL interface setup is complete, these are the ongoing steps for each payroll cycle:

Verify that the payroll is confirmed.

Run the GL Interface process.

You can run the GL Interface Application Engine process (PAYGL01) in one step or two separate steps:

(Optional) Prepare the distribution without generating the HR accounting lines, then review and update the distribution in online pages.

(Required) Generate the HR accounting lines.

Publish the contents of the HR Accounting Line table to PeopleSoft Enterprise General Ledger.

Note. Payroll for North America does not subscribe to any post-processing messages that are published by Enterprise General Ledger.

The Review Distribution Option

You can view and update the distribution data in the Review Payroll Distribution component after running the GL Interface process with the Review Distribution before GL option selected.

This table summarizes the review pages on which you can update combination codes:

|

Page Name |

Linked Pages |

Description |

|

Earnings |

Net Pat Liability |

View and update the distribution of net pay liability and expense. |

|

Deductions |

Deduction Liability Net Pat Liability |

View and update the distribution of deduction liability and expense. |

|

Taxes |

Tax Liability Net Pat Liability |

Net Pat Liability View and update the distribution of tax liability and expense. |

Understanding the GL Reset Run Flag SQR Report Process (GLXRESET)

Understanding the GL Reset Run Flag SQR Report Process (GLXRESET)

The system allows you to process only confirmed payrolls that have not yet had the GL Interface process run on them. When you run the GL Interface process, the system selects the GL Interface Run check box on the Pay Calendar table. If you need to rerun the GL Interface process, you must first run the GL Reset Run Flag process. You can run the process only for payrolls that you haven't published to PeopleSoft General Ledger.

This process:

Deletes all rows on the HR Accounting Line table for the pay run ID that is specified on the reset process run control.

Deselects the GL Interface Run and GL Distribution Runcheck boxes on the Pay Calendar table for the pay run ID that you specified on the reset process run control page.

Note. Running this process is necessary only if you have made a change that requires rerunning the GL Interface process. If you do not have to rerun the GL Interface process for the pay run ID, then you do not run this reset process.

Pages Used to Prepare and Transfer Payroll Data to General Ledger

Pages Used to Prepare and Transfer Payroll Data to General Ledger

Generating Payroll for North America Accounting Lines

Generating Payroll for North America Accounting Lines

Access the Non Commitment Accounting Information page (Payroll for North America, Payroll Distribution, Prepare GL Information, Non-Commit Accounting Info, Non Commitment Accounting Information).

To run the process:

Enter the pay run ID that you want to process. Alternatively, if you have more than one pay calendar for a pay run ID and want to process an individual pay calendar, enter the company, pay group, and pay end date for that pay calendar. The system processes both on-cycle and off-cycle information.

Click the Run button to display the Process Scheduler page.

Select the GL Interface (general ledger interface) check box and click the OK button to complete the process.

(E&G) If you want to interface E&G 7.5 to PeopleSoft General Ledger 8, then select the GL Interface - EG 7.5 (general ledger interface - education and government 7.5) check box.

|

Review Distribution before GL |

Select the Review distribution before GL (review distribution before general ledger) check box to review the data before creating the lines for General Ledger. This check box is deselected by default. If you want to stop and review the distribution before creating the accounting lines, you must select this check box. If you don't select it, the process automatically creates the accounting lines. |

See Also

Understanding the Preparation and Transfer of Data

Creating Pay Calendars and FLSA Calendars

Understanding the GL Reset Run Flag SQR Report Process (GLXRESET)

Generating The HR Accounting Line Report

Generating The HR Accounting Line Report

Access the HR Accounting Line Report page (Payroll for North America, Payroll Distribution, GL Interface Reports, HR Accounting Line, HR Accounting Line Report).

Optional Report Filters

You can limit the report results for a specified date range and GL business unit.

|

Run Date Between and GL Business Unit |

You can run the report with these fields blank. If you specify a beginning date but no ending date, the system enters the beginning date as the default ending date value. |

Transferring Payroll Accounting Lines to PeopleSoft General Ledger

Transferring Payroll Accounting Lines to PeopleSoft General Ledger

Access the Batch Publish page (Enterprise Components, Integration Definitions, Initiate Processes, Batch Publish, Batch Publish).

|

Process Frequency |

Typically, you select Always. |

|

Process Name |

Select PAYGL01. |

Note. Before trying to send any transactions to PeopleSoft General Ledger, verify with your IT staff that PeopleSoft Integration Broker nodes, queues, and service operations (routings and handlers) on have been activated .