Overview of FLSA Calculations

Overview of FLSA Calculations

This appendix discusses:

Overview of FLSA calculations.

Multiplication factors in FLSA calculations.

FLSA rates for hourly and exception hourly employees.

FLSA rates for hospital employees.

FLSA rates for salaried employees.

FLSA rates for monthly and semimonthly exception hourly employees.

FLSA requirements for public safety employees.

FLSA rates with mid-period rate changes.

Single payments over multiple pay periods.

Seven-day FLSA period with biweekly payroll.

FLSA rates and double-time pay.

Alternative overtime calculations.

Overview of FLSA Calculations

Overview of FLSA Calculations

FLSA calculations apply only to the U.S. The Fair Labor Standards Act of 1937 requires that you pay overtime to nonexempt employees who work more than 40 hours in a week.

Note. Normally, Payroll for North America does not calculate

FLSA if the employee does not have at least 40 FLSA hours in the week. For

nonexempt or alternative overtime employees working in California, however,

FLSA will be paid on all overtime hours, without first having to verify that

employees have at least 40 hours of regular earnings. So, if the paysheet

shows 30 REG and 10 OT, FLSA will be paid on the 10 hours of OT (overtime).

How you calculate overtime, prorate bonuses, and handle other earnings (such as shift differentials and tips) depends on whether the employees are subject to FLSA standards or exempt from them.

FLSA calculation is affected by the pay frequency. Supported pay frequencies are weekly, biweekly, monthly and semimonthly. Frequency factors that are defined on the Frequency table may be required in converting the amounts from pay period to FLSA period frequency.

Note. Payroll for North America does not calculate a blended FLSA rate for employees working in multiple companies, because each job would have its own FLSA rate.

Note. Payroll for North America does not calculate an FLSA adjustment on a separate on-cycle check that is processed in the same pay run as the regular check. To calculate FLSA for a separate check in the same pay run, it must be an off-cycle check.

See Also

Setting Up for FLSA Calculation

Terms and Definitions

Terms and Definitions

These definitions aid in the discussion of FLSA calculations:

Multiplication Factors in FLSA Calculations

Multiplication Factors in FLSA Calculations

This section discusses:

Example of contractual overtime with a multiplication factor of 0.5.

Example of contractual overtime with a multiplication factor of 1.5.

Example of contractual overtime with a multiplication factor greater than 1.5.

Note. The information in these tables is summarized on the employee paysheet by earnings codes. The FLSA function does not determine overtime rules. In all of the examples in this section, the Higher of FLSA/Contractual (higher of Fair Labor Standards Act/contractual) option is selected in the FLSA Rule group box on the FICA/Tax Details page that is accessed from the Company - Default Settings page.

Example of Contractual Overtime with a Multiplication Factor of 0.5

Example of Contractual Overtime with a Multiplication Factor of 0.5When using a multiplication factor of 0.5 for overtime, you must either set up a companion earnings with a multiplication factor of 1.0 to record the straight-time hours, or include the straight-time hours with the regular hours.

This example includes the straight-time hours in a companion earnings:

|

Employee |

David |

|

Contractual hourly rate |

12.00 USD |

|

Workday |

8 hours |

|

FLSA period |

7 days |

|

Pay period |

Weekly |

Contractual Calculation

|

Earnings Code |

Hours |

Rate |

Earnings |

|

Regular |

40 |

12.00 USD |

480.00 USD |

|

Overtime at 0.5 |

6.5 |

6.00 USD = 12.00 USD × 0.5 |

39.00 USD |

|

Overtime at 1.0 |

6.5 |

12.00 USD |

78.00 USD |

|

Shift 2 differential |

12 |

3.25 USD |

39.00 USD |

|

Shift 2 overtime at 0.5 |

2 |

7.625 USD = (12.00 USD + 3.25 USD) × 0.5 |

15.25 USD |

|

Shift 2 overtime at 1 |

2 |

15.25 USD = 12.00 USD + 3.25 USD |

30.50 USD |

David's contractual premium pay is 54.25 USD:

12.00 USD × 0.5 × 6.5 overtime hours = 39.00 USD.

15.25 USD × 0.5 × 2.0 shift overtime hours = 15.25 USD.

FLSA Calculation

|

Earnings Code |

Hours |

Straight-Time Rate |

Straight-Time Earnings |

|

Regular |

40 |

12.00 USD |

480.00 USD |

|

Overtime at 1.0 |

6.5 |

12.00 USD |

78.00 USD |

|

Shift 2 differential |

|

3.25 USD |

39.00 USD |

|

Shift 2 overtime at 1.0 |

2 |

15.25 USD |

30.50 USD |

|

Totals |

48.5 |

|

627.50 USD |

Calculations:

FLSA rate:

12.9381 = 627.50 USD / 48.5 total weekly hours.

Premium pay:

54.98 USD = 12.9381 USD × 0.5 × 8.5 overtime hours.

Because the FLSA overtime premium of 54.98 USD is greater than the contractual premium of 54.25 USD, use the FLSA rate to calculate David's overtime for the week.

Example of Contractual Overtime with a Multiplication Factor of 1.5

Example of Contractual Overtime with a Multiplication Factor of 1.5This example shows the calculation and comparison of the contractual and FLSA premiums:

|

Employee |

Laura |

|

Contractual hourly rate |

12.00 USD |

|

Workday |

8 hours |

|

FLSA period |

7 days |

|

Pay period |

Weekly |

Contractual Calculation

|

Earnings Code |

Hours |

Rate |

Earnings |

|

Regular |

40 |

12.00 USD |

480.00 USD |

|

Overtime at 1.5 |

6.5 |

18.00 USD = 12.00 USD × 1.5 |

117.00 USD |

|

Shift 2 differential |

12 |

3.25 USD |

39.00 USD |

|

Shift 2 overtime at 1.5 |

2 |

22.875 USD = (12.00 USD + 3.25 USD) × 1.5 |

45.75 USD |

Laura's contractual premium pay is 54.25 USD:

12.00 USD × 0.5 × 6.5 overtime hours = 39.00 USD.

15.25 USD × 0.5 × 2.0 shift overtime hours = 15.25 USD.

FLSA Calculation

|

Earnings Code |

Hours |

Straight-Time Rate |

Straight-Time Earnings |

|

Regular |

40 |

12.00 USD |

480.00 USD |

|

Overtime at 1.0 |

6.5 |

12.00 USD |

78.00 USD |

|

Shift 2 differential |

|

3.25 USD |

39.00 USD |

|

Shift 2 overtime at 1.0 |

2 |

15.25 USD |

30.50 USD |

|

Totals |

48.5 |

|

627.50 USD |

Calculations:

FLSA rate:

12.9381 USD = 627.50 USD / 48.5 total weekly hours.

Premium pay:

54.98 USD = 12.9381 USD × 0.5 × 8.5 overtime hours.

Because the FLSA overtime premium of 54.98 USD is greater than the contractual premium of 54.25 USD, use the FLSA rate to calculate Laura's overtime for the week.

Example of Contractual Overtime with a Multiplication Factor Greater

Than 1.5

Example of Contractual Overtime with a Multiplication Factor Greater

Than 1.5This example shows the calculation and comparison of the contractual and FLSA premiums:

|

Employee |

Jane |

|

Contractual hourly rate |

12.00 USD |

|

Workday |

8 hours |

|

FLSA period |

7 days |

|

Pay period |

Weekly |

Contractual Calculation

|

Earnings Code |

Hours |

Rate |

Earnings |

|

Regular |

40 |

12.00 USD |

480.00 USD |

|

Overtime at 1.5 |

3.5 |

18.00 USD = 12.00 USD × 1.5 |

63.00 USD |

|

Overtime at 2.0 |

4.5 |

24.00 USD (= 12.00 USD × 2) |

108.00 USD |

|

Shift 2 differential |

16 |

3.25 USD |

52.00 USD |

|

Shift 2 overtime at 1.5 |

2 |

22.875 USD = (12.00 USD + 3.25 USD) × 1.5 |

45.75 USD |

Jane's contractual premium pay is 90.25 USD:

12.00 USD × 0.5 × 3.5 overtime hours = 21.00 USD.

12.00 USD × 1 × 4.5 overtime hours = 54.00 USD.

15.25 USD × 0.5 × 2.0 shift overtime hours = 15.25 USD.

FLSA Calculation

|

Earnings Code |

Hours |

Straight-Time Rate |

Straight-Time Earnings |

|

Regular |

40 |

12.00 USD |

480.00 USD |

|

Overtime at 1.0 |

3.5 |

12.00 USD |

42.00 USD |

|

Overtime at 1.0 |

4.5 |

12.00 USD |

54.00 USD |

|

Shift 2 differential |

0 |

3.25 USD |

39.00 USD |

|

Shift 2 overtime at 1.0 |

2 |

15.25 USD |

30.50 USD |

|

Totals |

50 |

|

645.50 USD |

Calculations:

FLSA rate:

12.91 USD = 645.50 USD / 50 total weekly hours.

Premium pay:

12.91 USD × 0.5 × 10 overtime hours = 64.55 USD.

Because the contractual overtime premium of 90.25 USD is greater than the FLSA premium of 64.55 USD, use the contractual rates to calculate Jane's overtime.

FLSA Rates for Hourly and Exception Hourly Employees

FLSA Rates for Hourly and Exception Hourly Employees

This section discusses:

FLSA rates for hourly employees.

Example of Hourly FLSA calculation.

Note. Calculations are different for exception hourly employees paid monthly or semimonthly.

See FLSA Rates for Monthly and Semimonthly Exception Hourly Employees.

FLSA Rates for Hourly Employees

FLSA Rates for Hourly EmployeesThe examples in this section compare premium amounts, rather than rates. The premium is the amount over the regular rate that an employee earns by working overtime. The system adds this to the contractual rate for the overtime hours that an employee works.

If an hourly employee has only regular earnings, the FLSA regular rate is the same as the contractual hourly rate (that is, the rate at which you contracted to pay the employee for a job). If the employee has other included earnings (such as bonuses, shift differentials, multiple pay rates in the same FLSA period, or overtime), the system calculates the FLSA regular rate as shown in the examples in this section, with the exception of overtime pay for workweeks with fewer than 40 hours.

Example of Hourly FLSA Calculation

Example of Hourly FLSA CalculationThe information in these tables is summarized on the employee paysheet by earnings codes. The FLSA function does not determine overtime rules. In this example, the Higher of FLSA/Contractual option is selected in the FLSA Rule group box on the FICA/Tax Details page that is accessed from the Company - Default Settings page.

This is the general FLSA formula that also applies to exception hourly weekly and biweekly employees:

FLSA rate = (regular period pay + overtime pay at contractual + total other FLSA eligible earnings) / total FLSA eligible hours

FLSA overtime premium = overtime hours × .5 × FLSA rate

|

Employee |

Sam |

|

Contractual hourly rate |

6.00 USD |

|

Workday |

8 hours |

|

FLSA period |

7 days |

|

Pay period |

Weekly |

|

Bonus |

12.00 USD |

Contractual Calculation

|

Earnings Code |

Hours |

Rate |

Earnings |

|

Regular |

40 |

6.00 USD |

240.00 USD |

|

Overtime at 1.5 |

6 |

9.00 USD = 6.00 USD × 1.5 |

54.00 USD |

|

Bonus |

|

12.00 USD |

Sam's contractual premium pay:

18.00 USD = 6.00 USD × 0.5 × 6 overtime hours.

If Sam's regular rate is less than the minimum wage, you must calculate his overtime using the higher of the state or federal minimum wage, which is stored in the Federal/State Tax table.

Sam's bonus might cover a work period that exceeds the current pay period.

FLSA Calculation

|

Earnings Code |

Hours |

Straight-Time Rate |

Straight-Time Earnings |

|

Regular |

40 |

6.00 USD |

240.00 USD |

|

Overtime at 1.0 |

6 |

6.00 USD |

36.00 USD |

|

Bonus |

|

|

12.00 USD |

|

Totals |

46 |

|

288.00 USD |

Calculations:

FLSA rate:

6.26 USD = 288.00 USD / 46 total weekly hours.

Premium pay:

18.78 USD = 6.26 USD × 0.5 × 6 overtime hours.

Because the FLSA overtime premium of 18.78 USD is greater than the contractual premium of 18 USD, use the FLSA rate to calculate Sam's overtime.

FLSA Rates for Hospital Employees

FLSA Rates for Hospital Employees

Hospitals and nursing homes can enter into agreements with employees under which they use a 14 consecutive day period, rather than a seven-day period, as the basis for calculating overtime. The FLSA formula is the same as hourly employees.

Note. You must select the FLSA calendar with 14 FLSA period in days on the FLSA Period Definition page. For the FLSA feature to work, you must pay the 8/80 employees biweekly. When you pay some employees 8/80 and some on a seven-day period, you must assign employees to separate pay groups, based on the FLSA method of calculating premium pay.

|

Employee |

Bill |

|

Contractual hourly rate |

12.00 USD |

|

Workday |

8 hours |

|

FLSA period |

14 days |

Contractual Calculation

|

Earnings Code |

Hours |

Rate |

Earnings |

|

Regular |

76 |

12.00 USD |

912.00 USD |

|

Overtime at 1.5 |

6.5 |

18.00 USD = 12.00 USD × 1.5 |

117.00 USD |

|

Shift 2 differential |

40 |

3.25 USD |

130.00 USD |

|

Shift 2 overtime at 1.5 |

4 |

22.875 USD = (12.00 USD + 3.25 USD) × 1.5 |

91.50 USD |

|

Sick pay, shift 2 |

4 |

15.25 |

61.00 USD |

|

Total wages |

|

|

1311.50 USD |

Bill's contractual premium pay is 69.50 USD:

12.00 USD × 0.5 × 6.5 overtime hours = 39.00 USD.

15.25 USD × 0.5 × 4.0 shift overtime hours = 30.50 USD.

FLSA Calculation

|

Earnings Code |

Hours |

Straight-Time Rate |

Straight-Time Earnings |

|

Regular |

76 |

12.00 USD |

912.00 USD |

|

Overtime at 1.0 |

6.5 |

12.00 USD |

78.00 USD |

|

Shift 2 differential |

0 |

3.25 USD |

130.00 USD |

|

Shift 2 overtime at 1.0 |

4 |

15.25 USD |

61.00 USD |

|

Sick pay, shift 2 |

0 |

|

0.00 USD (not used to calculate FLSA regular rate) |

|

Totals |

86.50 |

|

1181.00 USD |

Calculations (Only use total hours of 86.50 worked for FLSA regular rate. Shift hours are already included in regular, and sick hours are not used):

FLSA rate:

13.653 USD = 1181.00 USD / 86.50 total pay period hours.

Premium pay:

71.67 USD = 13.653 USD × 0.5 × 10.5 total pay period overtime hours.

Because the FLSA overtime premium of 71.67 USD is greater than the contractual premium of 69.50 USD, use the FLSA rate to calculate Bill's overtime.

FLSA Rates for Salaried Employees

FLSA Rates for Salaried Employees

This section provides examples of the three ways to calculate FLSA regular rates for salaried, nonexempt employees:

Rates for fixed salaried hours.

Rates for unspecified salaried hours.

Basic Rate Formula for fixed salaried hours.

Note. Do not enter a salaried employee's compensation rate

as an hourly rate (hourly frequency) in the Compensation Rate field

on the Job Data – Compensation page. Under some conditions, doing so

causes the system to pay minimum wage in place of the FLSA rate.

Fixed Salaried Hours

Fixed Salaried HoursFor fixed salaried hours, the FLSA Rate uses Standard Hours from Job Data and uses the Multiplication Factor of 1.5:

FLSA Rate = (Regular Period Pay + Total Other FLSA Eligible Earnings) / Standard Hours.

FLSA Overtime Pay = Overtime Hours × 1.5 × FLSA Rate.

Weekly Wage Equivalent = Regular Period Pay × Pay Period Frequency Factor / Weekly Frequency Factor.

If the employee doesn't work the whole FLSA work week, then the Weekly Wage equivalent will be prorated by the number of days worked divided by total work days in the week.

In this example Mary has Standard Hours of 40-hour workweek and work week of five days. The number of actual working days in the month does not matter, because for FLSA premium purposes, Mary's salary is calculated as a weekly wage. With Mary's Monthly Pay Period Earnings of 1200 USD, her Weekly Wage Equivalent is 276.92 USD (1200 USD × 12 / 52).

|

Employee |

Pay Period Earns |

Weekly Wage Equivalent |

Hours Per Week |

FLSA Regular Rate |

|

Mary |

1200.00 USD |

276.92 USD |

40 |

6.92 USD = 276.92 / 40 |

Mary worked two hours of overtime in week one and four hours of overtime in week three. She is entitled to overtime pay of 62.28 USD (6.92 USD × 1.5 × 6 hours). Her total check for the month is 1262.28 USD.

If Mary receives a bonus of 50 USD for week one, her hourly rate of pay for that week is 8.17 USD (= 276.92 USD + 50 USD / 40). She receives overtime pay of 24.51 USD (8.17 USD × 1.5 × 2) for week one and 41.52 USD (6.92 USD × 1.5 × 4) for week three. Her total check for the month is 1316.03 USD.

Note. The multiplication factor used to calculate the overtime is 1.5, rather than 0.5, because the straight-time portion of the overtime is not used to determine the FLSA rate.

The Additional Information group box of the FLSA Pay Data page displays the standard hours in FLSA Hours and the weekly wage equivalent earnings in FLSA Earns.

Unspecified Salaried Hours

Unspecified Salaried HoursFor salaried unspecified hours, FLSA Rate uses actual hours worked and multiplication factor of .5:

FLSA Rate = (Regular Period Pay + Total Other FLSA Eligible Earnings) / Total Hours Worked.

FLSA Overtime Premium Pay = Overtime Hours × .5 × FLSA Rate.

If the employee is paid Monthly or Semimonthly, the Weekly Wage Equivalent needs to be calculated using the same formula as specified for Fixed Hours.

Note. For salaried employees with unspecified hours, the system always ignores the FLSA Rule selected on the Company table and calculates overtime at the FLSA rate, even if it is lower than the contractual rate.

In the following example, Mary receives 1200 USD per month for however many hours her job requires, but she is entitled to overtime if she works more than 40 hours in a week. Her weekly wage equivalent is 276.92 USD (1200 USD × 12 / 52). She works three hours of overtime in week one and five hours of overtime in week three.

FLSA Calculation

|

Earnings |

Week 1 |

Week 2 |

Week 3 |

Week 4 |

|

Weekly Wage Equivalent |

276.92 USD |

276.92 USD |

276.92 USD |

276.92 USD |

|

Total Hours worked |

43 (40 Regular + 3 Overtime Hours) |

40 Regular Hours |

45 (40 Regular + 5 Overtime Hours) |

40 Regular Hours |

|

FLSA rate |

6.44 USD = 276.92 USD / 43 hours |

6.92 USD = 276.92 USD / 40 hours |

6.15 USD = 276.92 USD / 45 hours |

6.92 USD = 276.92 USD / 40 hours |

|

FLSA overtime premium |

9.66 USD = 6.44 USD × 0.5 × 3 overtime hours |

0 |

15.38 USD = 6.15 USD × 0.5 × 5 overtime hours |

0 |

|

Overtime pay |

30.42 USD = (6.92 USD × 3) + 9.66 USD |

0 |

50.00 USD = (6.92 USD × 5) + 15.38 USD |

0 |

|

Total Pay Earnings |

307.35 USD = 276.92 USD + 30.43 USD |

276.92 USD |

326.92 USD = 276.92 USD + 50.00 USD |

276.92 USD |

If Mary receives a bonus of 50 USD for week one, her FLSA hourly rate of pay for that week is 7.60 USD ((276.92 USD + 50 USD) / 43). The FLSA overtime premium is 11.40 USD (7.60 USD × 0.5 × 3). She receives overtime pay of 32.16 USD ((6.92 USD × 3) + 11.40).

The Additional Information group box of the FLSA Pay Data page displays the weekly wage equivalent earnings in FLSA Earns.

Basic Rate Formula for Fixed Salaried Hours

Basic Rate Formula for Fixed Salaried HoursThe Department of Labor allows the use of a Basic Rate Formula to calculate the regular rate of pay for semimonthly or monthly salaried employees, if the employee agrees. With the Basic Rate Formula, you calculate a salaried employee's FLSA rate using the following formula:

FLSA rate = pay period salary / number of days in the pay period / number of hours in a normal workday.

FLSA overtime pay = overtime hours × 1.5 × FLSA rate.

The workday hours come from the employee's Job Data record:

|

Employee |

Pay Period Earnings |

Days in Period |

Workday Hours |

FLSA Regular Rate |

|

Mary |

1200.00 USD |

23 |

8 hours |

6.52 USD = 1200 USD / 23 / 8 |

Mary works two hours of overtime in week one and four hours of overtime in week three. She is entitled to overtime pay of 58.68 USD (6.52 USD × 1.5 × 6 hours). Her total check for the month is 1258.68 USD. In a month with only 20 workdays, Mary's FLSA rate is 7.50 USD (1200 USD / 20 / 8). If she works six hours of overtime, her overtime pay is 67.50 USD (7.50 USD × 1.5 × 6 hours) and her total check for the 20-day month is 1267.50 USD.

If Mary receives a bonus of 50 USD in a month with 20 workdays, her FLSA rate is 7.81 USD ((1200 USD + 50 USD) / 20 / 8). If she works six hours of overtime, her overtime pay is 70.29 USD (7.81 USD × 1.5 × 6 hours) and her total check for the month is 1320.29 USD.

The Additional Information group box of the FLSA Pay Data page displays the days in period, work day hours, and pay period earnings.

FLSA Rates for Monthly and Semimonthly Exception Hourly Employees

FLSA Rates for Monthly and Semimonthly Exception Hourly Employees

This section discusses:

Monthly exception hourly FLSA calculation.

Example of monthly exception hourly FLSA calculation.

Monthly Exception Hourly FLSA Calculation

Monthly Exception Hourly FLSA CalculationFor a monthly or semimonthly pay period, the annualized allocation of standard hours and rate for regular earnings on the paysheet doesn't reflect the actual hours and rate worked. The system therefore calculates:

Total hours worked in pay period = work days in pay period × work day hours from Job Data.

Pay period average rate = pay period earnings / total hours worked.

The FLSA regular earnings = pay period average rate × actual hours worked.

The calculated FLSA regular earnings is the one used in FLSA rate calculation instead of the regular earnings from paycheck.

This section provides an example of monthly exception hourly FLSA calculation.

Note. For weekly and biweekly pay periods the calculation is the same as the example for hourly employees.

Example of Monthly Exception Hourly FLSA Calculation

Example of Monthly Exception Hourly FLSA CalculationThis example shows the calculation method when the FLSA period crosses two months.

Period Definitions

This example relates to the following periods:

|

Period |

Begin – End Dates |

|

Pay period (June) |

June 1 to June 30 |

|

Pay period (July) |

July 1 to July 31 |

|

Earnings period (June end) |

June 28 to June 30 |

|

Earnings period (July begin) |

July 1 to July 4 |

|

FLSA period |

June 28 to July 4 |

Annualized Contractual Allocation

This table shows Mark's annualized allocation of standard hours and rate for regular earnings:

|

Description |

Value |

Calculation Formula |

|

Hours per month |

173.33 |

((40 standard hours per week × 52 weeks per year) / 12 months) |

|

Regular earnings per month |

2,291.67 USD |

|

|

Hourly rate |

13.221154 USD |

(2,291.67 USD earnings per month / 173.33 hours per month) |

Regular Paycheck Earnings by Earnings Period

|

Earnings Period |

Rate Code |

Hours |

Rate |

Earnings |

Overtime Hours |

|

June 28 to June 30 |

TRG (regular) |

16.00 |

13.221154 |

211.54 |

5 |

|

July 1 to July 4 |

TRG (regular) |

13.33 |

13.221154 |

176.24 |

4 |

Additional Information on FLSA Pay Data

On Mark's FLSA Pay Data page the following information appears in the Additional Information group box for the Pay Period Average Reg Earns calculation:

|

Earnings Period |

FLSA Hours |

Rate |

FLSA Earns |

Days in Period |

Work Day Hours |

Pay Period Earn |

|

June 28 to June 30 |

16.00 |

13.020852 |

208.33 |

22 |

8.00 |

2291.67 |

|

July 1 to July 4 |

24.00 |

12.454728 |

298.91 |

23 |

8.00 |

2291.67 |

In the earnings period July 1 to July 4, 13.33 hours are posted for regular earnings. However, from July 1 to July 4, Mark actually worked three eight-hour days, bringing the total FLSA hours worked to 24, instead of the 13.33 hours posted for regular. This illustrates how the annualized allocation of hours doesn't match the actual hours worked.

FLSA Regular Earnings Calculation

Using the FLSA data as shown in the Additional Information group box, the system computes the FLSA regular earnings using pay period average rate as follows:

|

Calculation |

Formula |

June |

July |

|

Total hours worked in the pay period |

work days in pay period × work day hours |

22 × 8 = 176 |

23 × 8 = 184 |

|

Pay period average rate |

pay period earnings / total hours worked |

2291.67 / 176 = 13.020852 |

2291.67 / 184 = 12.454728 |

|

FLSA regular earnings |

FLSA hours worked × pay period average rate |

16 × 13.020852 = 208.33 USD |

24 × 12.454728 = 298.91 USD |

FLSA Rate Calculation

After calculating the pay period average regular earnings, the rest of the FLSA processing remains the same. The system uses the FLSA regular earnings amounts to calculate the FLSA rate as follows:

|

Earnings Code |

Hours |

Straight-Time Rate |

Straight-Time Earnings |

|

TRG June 28 to June 30 |

16.00 |

13.020739 (pay period average rate) |

208.33 USD |

|

TRG July 1 to July 4 |

24.00 |

12.454565 (pay period average rate) |

298.91 USD |

|

TOV |

9.00 |

13.221154 (annualized contractual hourly rate) |

118.99 USD |

|

TPB |

|

100.00 USD |

|

|

Totals |

49 |

726.23 USD |

In this case, on the earnings end date of July 4, the total FLSA hours are over 40, so the system processes as follows:

Divides the total earnings by the total hours to compute the new FLSA rate.

726.23 USD / 49 = 14.821020.

Applies the new FLSA rate to the current overtime of four hours, giving overtime premium of 29.64 USD (14.821020 USD × .5 × 4 hours).

Total overtime pay is 82.52 USD ((4 hours × 13.221154 USD contractual rate) + 29.64 USD FLSA overtime premium).

Creates a new pay line for the previous period overtime of five hours and applies the new FLSA rate.

5 × 14.821020 = 103.16.

FLSA overtime premium is 37.05 USD (14.821020 USD × .5 × 5 hours) and total overtime pay is 103.16 USD ((5 hours × 13.221154 USD contractual rate) + 37.05 USD FLSA overtime premium).

Reverses the original overtime paid in the previous period at the contractual rate of 13.221154.

The reversal amount is 99.16 USD (13.221154 USD × 1.5 × 5 hours).

FLSA Requirements for Public Safety Employees

FLSA Requirements for Public Safety Employees

This section provides an overview of FLSA requirements for public safety employees and discusses:

Maximum nonovertime hours under 7K exemption (public safety).

28 day, 212–hour FLSA period example.

14 day, 86–hour FLSA period example.

Understanding FLSA Requirements for Public Safety Employees

Understanding FLSA Requirements for Public Safety EmployeesThe FLSA overtime requirements for public safety employees are different from those of other employees, because a specified number of work hours is needed within the FLSA work period before the FLSA rate can be applied to overtime pay. Their work periods vary from seven to 28 days, depending on the work period. Some police officers and fire protection employees have 28-day work periods; some have 14-day work periods. These employees usually receive pay biweekly and have 28-day FLSA pay periods. They can report overtime hours throughout the FLSA period, but FLSA overtime regulations are not invoked until the employee works more than the maximum FLSA hours for the period. After the employee works the maximum FLSA hours for the period, you must pay all overtime over the maximum using the FLSA regular rate.

You must pay overtime to fire protection employees for hours that exceed 212 in a 28-day period. You must pay overtime to law enforcement employees for hours that exceed 171 in a 28-day period. If the work period is fewer than 28 days, the hours are prorated. This enables you to balance work hours over an entire FLSA work period.

Maximum Nonovertime Hours Under 7K Exemption (Public Safety)

Maximum Nonovertime Hours Under 7K Exemption (Public Safety)For those with work periods of seven to 28 days, the system calculates overtime hours that are reported after an employee's FLSA hours equal the number shown in the following table, published by the Wage and Hour Division, U.S. Department of Labor:

|

Days in Work Period |

Fire Protection |

Law Enforcement |

|

28 |

212 |

171 |

|

27 |

204 |

165 |

|

26 |

197 |

159 |

|

25 |

189 |

153 |

|

24 |

182 |

147 |

|

23 |

174 |

141 |

|

22 |

167 |

134 |

|

21 |

159 |

128 |

|

20 |

151 |

122 |

|

19 |

144 |

116 |

|

18 |

136 |

110 |

|

17 |

129 |

104 |

|

16 |

121 |

98 |

|

15 |

114 |

92 |

|

14 |

106 |

86 |

|

13 |

98 |

79 |

|

12 |

91 |

73 |

|

11 |

83 |

67 |

|

10 |

76 |

61 |

|

9 |

68 |

55 |

|

8 |

61 |

49 |

|

7 |

53 |

43 |

Example

A firefighter's work period is 28 consecutive days, and she works 80 hours in each of the first two weeks, 52 hours in week three, and none in week four. Her total work hours of 212 (80 + 80 + 52 + 0) which does not exceed 212 for the 28-day work period.

Therefore, no overtime pay is due.

If the same firefighter has a work period of 14 days, overtime pay is due for 54 hours (160 minus 106 hours, the amount in the table) for the weeks in which she works two consecutive 80 hour weeks.

Days in work period = 14. Overtime pay is due after 106 hours. Therefore, 54 hours of overtime pay is due.

Example: 28-Day, 212-Hour FLSA Period

Example: 28-Day, 212-Hour FLSA PeriodFirefighter Jane has a 28-day work period and earns an annual salary of 24,000 USD for all hours worked. For each FLSA period, Jane receives 1,846.15 USD (= 24,000.00 USD / 13).

During the last FLSA period, Jane worked 224 hours (12 more than the maximum of 212). Her regular rate is 8.24 USD (= 1,846.15 USD / 224). Jane's overtime premium is 49.44 USD (= 12 × 8.24 USD × 0.5).

Example: 14-Day, 86-Hour FLSA Period

Example: 14-Day, 86-Hour FLSA PeriodThis police department uses an 86-hour, 14-day work period. Under present city regulations, police officers can receive pay in several earnings codes for hours that exceed 81 in a 14-day period. They can receive:

Mandatory overtime (MOT)

Special event overtime (SOT)

Comp time (CTO)

If the city pays MOT or SOT in the present payment system, this overtime premium for hours up to the FLSA limit of 86 hours can apply as a credit against FLSA liability. For example:

Crediting Overtime Premium Against FLSA Liability

|

Employee |

Joe |

|

Monthly salary |

2,631.00 USD |

|

Contractual hourly rate |

15.179 USD |

|

Scholastic bonus (biweekly) |

18.47 USD |

|

Special assignment pay |

30.36 USD |

|

FLSA period |

14 day, 86 hours |

For a two-week (14-day) pay period, Joe records the following information:

|

Earnings Code |

Description |

Hours |

Effect on FLSA |

|

REG |

Regular |

78 |

Hours and amount |

|

MUP |

Move-up |

3 |

Hours and amount |

|

MOT |

Mandatory overtime |

2 |

Hours and amount |

|

SOT |

Special event overtime |

4 |

Hours and amount |

|

CTO |

Comp time |

2 |

None |

|

SCK |

Sick leave |

2 |

None |

|

Total |

|

91 |

|

Because all of the earnings except SCK and CTO are eligible, the total eligible FLSA hours is 87. Because this is one hour more than the police officer's limit of 86 hours for a 14-day period, Joe has one hour of FLSA liability.

Determining the FLSA Regular Rate

To determine the FLSA regular rate, the system calculates: FLSA eligible earnings / FLSA eligible hours.

|

Earnings Code |

Hours |

Rate |

Earnings |

|

REG |

78 |

15.179 USD |

1,183.96 USD |

|

MUP |

3 |

15.938 USD (= 15.179 USD × 1.05) |

47.81 USD |

|

MOT |

2 |

15.179 USD (straight-time only) |

30.36 USD |

|

SOT |

4 |

15.179 USD (straight-time only) |

60.72 USD |

|

Scholastic bonus |

|

|

18.47 USD |

|

Special assignment pay |

|

|

30.36 USD |

|

Total |

87 |

|

1,371.68 USD |

FLSA regular rate = 1371.68 USD / 87 = 15.766436 USD.

Calculate the Overtime Premium

Calculate the overtime premium under FLSA and under the city's method as follows:

FLSA overtime premium: 1 × 15.766436 USD × 0.5 = 7.88 USD.

City overtime premium: 1 × 15.179 USD × 0.5 = 7.59 USD.

The FLSA premium is greater than the city's premium, so the employee should receive the FLSA rate for the one hour over the 86-hour limit, if the city pays the higher of FLSA or contractual overtime.

Reversing Overtime

If MOT is the main pay group's overtime earnings code (defined in the Pay Group table), then the system reverses the one hour of MOT paid at the contractual rate and pays it at the FLSA rate instead:

|

Earnings Code |

Hours |

Rate |

Earnings |

|

SCK |

2 |

15.179 USD |

30.36 USD |

|

REG |

78 |

15.179 USD |

1,183.96 USD |

|

MUP |

3 |

15.938 USD (= 15.179 USD × 1.05) |

47.81 USD |

|

MOT at contractual |

2 |

22.7685 USD (= 15.179 USD × 1.5) |

45.54 USD |

|

MOT contractual reversal |

−1 |

7.59 USD (= 15.179 USD × 0.5) |

−22.77 USD (= 15.179 + 7.59) |

|

MOT at FLSA rate |

1 |

7.88 USD (= 15.766 USD × 0.5) |

23.06 USD (= 15.179 + 7.88) |

|

SOT |

4 |

22.7685 USD (= 15.179 USD × 1.5) |

91.07 USD |

|

Scholastic bonus |

|

|

18.47 USD |

|

Special assignment pay |

|

|

30.36 USD |

|

Total wages |

|

|

1,447.86 USD |

Note. The original overtime that you enter on the paysheet does not change during pay calculation. If you must pay part of the overtime at a different rate, then instead of reducing the original overtime hours, the pay calculation generates two new paysheet entries: a reversal for those hours at the original rate, and an adjustment entry for the same number of hours at the new rate. These new entries generated are unavailable for selection, and you cannot modify them. Only you (not the pay calculation) can update the original overtime hours. Therefore, multiple recalculation is possible and the original overtime hours is preserved; adjustments and reversals are generated instead to update overtime at different rates if needed.

If there are multiple overtime earnings (for example, MUP, MOT and SOT), the system reverses the overtime hours in sequence, as follows, until the overtime hours that are eligible at the new FLSA rate are zero:

Process the main overtime earnings code defined in the pay group's table for overtime hours.

If you process multiple jobs from multiple pay groups on a single check, use the primary pay group's table overtime earnings code first. If there is a rate change, process the one with the lowest contractual rate first.

For processing multiple jobs from multiple pay groups on a single check, process overtime defined in the nonprimary pay group's table for overtime hours.

If there are multiple overtime earnings codes, process the one with the lowest contractual rate first in this group.

Process all other overtime hours.

Process the one with the lowest contractual rate first in this group.

FLSA Rates with Mid-Period Rate Changes

FLSA Rates with Mid-Period Rate Changes

This example illustrates how the system calculates the FLSA rate when a rate change occurs mid-period.

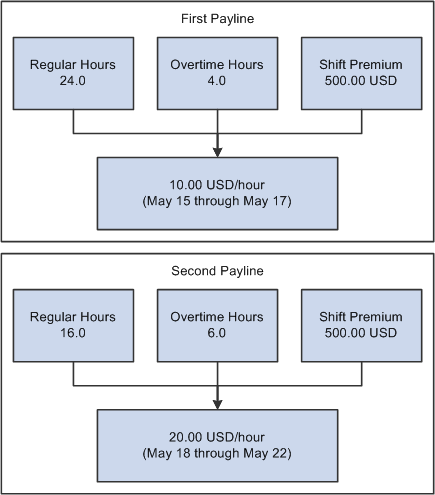

An employee is paid weekly. The pay period begin date is May 15, 2000 (Monday) and the end date is May 21, 2000 (Sunday). The employee works a Monday-through-Friday schedule. Her rate is 10 USD per hour, but she gets a pay rate increase, effective May 18, 2000, to 20 USD per hour.

This diagram shows an example of two-payline paysheet with a mid-period rate change:

Illustration of a two-payline paysheet for a mid-period rate change

Note. The system's FLSA rate calculation incorporates the entire period. This means that only one FLSA rate exists for the entire period.

FLSA Calculation

The following table displays the FLSA calculation:

|

Regular hours |

24 at 10.00 USD per hour |

240.00 USD |

|

Overtime hours |

4 at 10.00 USD per hour |

40.00 USD |

|

Shift premium |

|

500.00 USD |

|

Regular hours |

16 at 20.00 USD per hour |

320.00 USD |

|

Overtime hours |

6 at 20.00 USD per hour |

120.00 USD |

|

Shift premium |

|

500.00 USD |

|

Total |

50 hours |

1700.00 USD |

The FLSA rate equals 34.00 USD per hour, or 1,700 USD for 50 hours.

Paycheck Results

The following table displays the paycheck results:

|

Regular hours |

24.0 |

240.00 USD (24 hrs× 10 USD per hour) |

|

Overtime hours |

6.0 |

162.00 USD (6 hrs × 10 USD per hour + 6 hrs × 0.5 × 34 USD per hour) |

|

Shift |

500.00 USD |

|

|

Regular hours |

16.0 |

320.00 USD (16 hrs × 20 USD per hour) |

|

Overtime hours |

4.0 |

148.00 USD (4 hrs × 20 USD per hour + 4 hrs × 0.5 × 34 USD per hour) |

|

Shift |

500.00 USD |

Note. The system calculates the FLSA rate for the entire period, and the overtime premium (the 0.5 part of the overtime) uses the FLSA rate for both.

Single Payments Over Multiple Pay Periods

Single Payments Over Multiple Pay Periods

For a special payment (such as a bonus or commission) that applies to more than one FLSA period, the FLSA requires that you prorate it across all the affected FLSA periods. If the bonus is FLSA-eligible, you must use the portion of it that is attributable to an FLSA period when calculating the FLSA rate for that period. To have the system prorate a bonus over multiple FLSA periods, add a new entry on the paysheet with earnings begin and end dates for the period covered by the special payment. (You must create pay calendars and FLSA calendars for the period covered). The system prorates the amount for every FLSA period and recalculates overtime affected by the special payment. This can include future payments.

When you enter an FLSA eligible payment amount for a period that covers multiple FLSA periods in a paysheet, the system assigns a prorated payment amount to each FLSA period that is affected. The system reverses the original payment on the paysheet and replaces it with multiple FLSA periods that cover the payment periods. Each prorated payment equals: payment amount × percent of the number of workdays in the FLSA period over the total number of workdays in the payment period. Thus, the system calculates proration by workday, as defined in the employee's Job record.

Example

Jackie earns a bonus of 2640 USD for a six-month period (July 1 to December 31). The seven-day FLSA period runs Sunday to Saturday, and the number of workdays in each FLSA period is five days, from Monday to Friday. The total number of workdays for the six-month bonus period is 132. July 1 falls on a Thursday, which gives the first FLSA period 2 workdays. For the first FLSA period (June 27 to July 3), the prorated bonus is 40 USD (= 2640 USD × 2 / 132). The prorated bonus for the rest of the 26 FLSA-workweek period is 100 USD (= 2640 USD × 5 / 132). The system adds the 40 USD or 100 USD to each workweek accordingly, and recalculates overtime pay by including the prorated bonus in the FLSA earnings that it uses to determine the FLSA rate in the workweeks in which Jackie works overtime.

Seven-Day FLSA Period with Biweekly Payroll

Seven-Day FLSA Period with Biweekly Payroll

When you create a seven-day FLSA period definition and assign it to a pay group with biweekly pay frequency, the system:

Creates two paylines based on the 7-day FLSA period definition:

One payline for the first week.

One payline for the second week.

Divides the total amount of any additional pay between the two paylines.

Calculates the check as it would for an employee paid weekly.

Note. With the seven-day FLSA period definition and biweekly pay frequency setup, do not enter a salaried employee's compensation rate as an hourly rate (hourly frequency) in the Compensation Rate field on the Job Data – Compensation page. Doing so causes the system to pay minimum wage in place of the FLSA rate.

FLSA Rates and Double-Time Pay

FLSA Rates and Double-Time Pay

The FLSA process compares the premium overtime amount (the 0.5 in 1.5), as calculated under the FLSA regulations, and the premium overtime amount calculated with the contractual hourly rate. The system then uses whichever rate pays the greater premium amount or always pays at the FLSA rate, according to the specification on the Company table.

In the case of double-time, the FLSA premium amount for overtime is: overtime hours × FLSA regular rate × 0.5.

The contractual premium amount is: overtime hours × contractual rate × 1.0.

In most cases, the contractual premium is more than the FLSA premium.

Example: 10 Overtime Hours, 15.00 USD Per Hour

Contractual premium: 15.00 USD × 1 × 10 = 150.00 USD.

FLSA premium:

795.00 USD / 50 hours = 15.90 USD FLSA regular rate.

15.90 USD × 0.5 × 10 = 79.50 USD overtime premium.

The contractual premium of 150 USD is greater than the FLSA premium of 79.50 USD.

Alternative Overtime Calculations

Alternative Overtime Calculations

This section discusses:

Important terms and definitions.

Alternative overtime processing.

Calculations for hourly employees, exception-hourly employees, and salaried employees with unspecified salary hours.

Calculations for salaried employees with fixed salary hours.

Alternative overtime calculation example.

Exceptions to calculation methods.

See Also

Setting Up for Alternative Overtime Calculation

Important Terms and Definitions

Important Terms and Definitions

The following definitions are provided to aid in the discussion of alternative overtime:

|

The calculated rate used as the basis for determining the overtime payment. The alternative rate is calculated as (regular period pay + overtime pay at contractual + total other FLSA eligible earnings) / total FLSA eligible hours. Note. If the employee is eligible for alternative overtime, the alternative rate replaces the FLSA rate subject to the FLSA rule setting on the Company table. |

|

Equivalent to the hourly rate or compensation rate. |

|

|

The extra amount of the contractual rate paid for overtime, stated as a percentage. For example, if overtime is 1.5 times the contractual rate, the premium rate is 50 percent. |

|

|

The premium amount paid for alternative overtime is paid at the higher of the contractual rate or the alternative rate. |

Alternative Overtime Processing

Alternative Overtime Processing

Here are some general principles of alternative overtime calculations and processing:

For those employees identified as subject to alternative overtime calculation, the system calculates overtime on the alternative basis rather than the usual FLSA method.

To calculate alternative overtime, the system uses the multiplication factor specified for the overtime earnings code on the Earnings table instead of the fixed 0.5 used in federal FLSA calculation.

The alternative overtime method follows the FLSA rule setting on the Company table, either always paying the alternative overtime rate or paying the higher of the alternative overtime rate or the contractual rate.

Note. Salaried employees with unspecified hours are always calculated at the Alternative Overtime rate, even if it is lower than the contractual rate.

FLSA eligible hours for salaried employees differs depending upon the option selected for FLSA Salaried Hours Used:

Unspecified Salaried Hours: The alternative rate is calculated using the total FLSA-eligible hours worked in the week.

Fixed Salaried Hours. The alternative rate is calculated using the weekly standard hours in job data.

Note. Select the FLSA salaried hours used option on the FLSA Period Definition page, accessed from the Pay Group Table - Calc Parameters page.

Calculations for Hourly and Exception-Hourly Employees

Calculations for Hourly and Exception-Hourly Employees

The system calculates alternative overtime as follows for hourly or exception-hourly employees:

Calculates the alternative rate as (regular period pay + overtime pay at contractual + total other FLSA eligible earnings) / total FLSA eligible hours.

Continues processing based on the FLSA Rule setting on the Company table:

If the FLSA rule is Always Use FLSA Premium, the system uses the calculated alternative rate to calculate the overtime premium by multiplying the alternative rate by the multiplication factor on the Earnings table minus the straight time factor. (For example, for multiplication factor 1.5 it uses .5, for 2.0 it uses 1.0.).

If the FLSA rule is Higher of FLSA /Contractual, the system compares the calculated alternative rate to the contractual hourly rate in job data.

If the alternative rate is equal to or less than the contractual hourly rate, it uses the contractual hourly rate to calculate the overtime premium by multiplying the rate by the multiplication factor on the Earnings table.

If the alternative rate is greater than the contractual hourly rate, it uses the alternative rate to calculate the overtime premium by multiplying the alternative rate by the multiplication factor on the Earnings table minus the straight time factor. (For example, for multiplication factor 1.5 it uses .5, for 2.0 it uses 1.0.)

Adds the calculated overtime premium to the overtime straight time amount to derive the total overtime amount.

Calculations for Salaried Employees with Unspecified Salaried Hours

Calculations for Salaried Employees with Unspecified Salaried Hours

For salaried employees for whom the salaried hours option is Unspecified Salaried Hours, the system calculates alternative overtime as follows:

Calculates the alternative rate as (regular period pay + overtime pay at contractual + total other FLSA eligible earnings) / total FLSA eligible hours.

Calculates the overtime premium by multiplying the job hourly rate by the multiplication factor on the Earnings table.

Adds the calculated overtime premium to the overtime straight time amount to derive the total overtime amount.

Calculations for Salaried Employees with Fixed Salaried Hours

Calculations for Salaried Employees with Fixed Salaried Hours

For salaried employees for whom the salaried hours option is Fixed Salaried Hours, the system calculates alternative overtime as follows:

Calculates the alternative rate as (regular period pay + total other FLSA eligible earnings) / weekly standard hours.

Compares this alternative rate to the hourly rate on job.

If the alternative rate is equal to or less than the hourly rate, uses job hourly rate to calculate the overtime premium.

If the alternative rate is greater than the hourly rate, uses the alternative rate to calculate the overtime premium.

Alternative Overtime Calculation Example

Alternative Overtime Calculation ExampleThis table displays the pay data for an hourly employee:

|

Earnings Code |

Hours |

Straight-Time Rate |

Straight-Time Earnings |

|

Regular |

40 |

6.00 USD |

240.00 USD |

|

Overtime at 1.5 |

6 |

6.00 USD |

36.00 USD |

|

Overtime at 2.0 |

2 |

6.00 USD |

12.00 USD |

|

Bonus |

|

|

12.00 USD |

|

Totals |

48 |

|

300.00 USD |

Calculations for the Higher of FLSA /Contractual Rule

This is how the system calculates the overtime when the FLSA rule is Higher of FLSA/Contractual:

Alternative rate:

6.25 USD = 300.00 USD / 48 total weekly hours.

Contractual Premium:

Overtime at 1.5: 18.00 USD = 6.00 USD × 0.5 × 6 overtime hours.

Overtime at 2.0: 12.00 USD = 6.00 USD × 1.0 × 2 overtime hours.

Alternative Premium:

Overtime at 1.5: 18.75 USD = 6.25 USD × 0.5 × 6 overtime hours. This is higher than contractual premium of $18.00 USD, so the alternative rate is used for overtime premium calculation.

Overtime at 2.0: 12.50 USD = 6.25 USD × 1.0 × 2 overtime hours. This is higher than contractual premium of $12.00 USD, so the alternative rate is used for overtime premium calculation.

Calculations for Always Use FLSA Premium Rule

This is how the system calculates the overtime when the FLSA rule is Always Use FLSA Premium:

Alternative rate:

6.25 USD = 300.00 USD / 48 total weekly hours.

Alternative Premium:

Overtime at 1.5: 18.75 USD = 6.25 USD × 0.5 × 6 overtime hours.

Overtime at 2.0: 12.50 USD = 6.25 USD × 1.0 × 2 overtime hours.