Understanding Credit Card Processing

Understanding Credit Card Processing

This chapter provides an overview of credit card processing and discusses how to process credit card payments and review transactions.

rr

Note. This chapter is relevant to PeopleSoft Support only; PeopleSoft HelpDesk, HelpDesk for Human Resources, and Service Center for Higher Education do not incorporate credit card functionality.

Understanding Credit Card Processing

Understanding Credit Card Processing

If your organization accepts credit cards in payment for support, you can use the Authorize Credit Card page to manage this process. This page is not available when the case is associated with an agreement where this form of payment (pay for service) is inapplicable.

See PeopleSoft Enterprise Components for CRM 9.1 PeopleBook

This section discusses:

Processing options.

Credit card transactions.

Transaction process flow.

Processing Options

Processing Options

Credit card processing depends on whether you use a third-party credit card authorization and payment vendor.

If you entered a merchant ID on the setup page, these conditions occur:

The Authorize Credit Card page contains a Submit button that agents use to submit transactions.

The Authorize Credit Card page requires you to enter information that your third-party credit card authorization and payment vendor requires.

If you did not enter the merchant ID, there are no required fields on the Authorize Credit Card page. This page does not have a Submit button. Instead, the page captures information for use with your organization's own solution for processing credit card payments.

Credit Card Transactions

Credit Card Transactions

PeopleSoft Support facilitates credit card processing through integration with third-party credit card authorization and payment vendors.

Depending on how your organization has configured your credit card processing, some or all of these transaction options are available:

|

Transaction Option |

Processing |

|

Verifies that the card is valid for the charge (the customer has enough credit to pay for the order, the card is not stolen, and so on). The vendor does not bill the credit card. |

|

|

Bills the card without first verifying that the card is valid for the charge. Select this option if you have preauthorized the transaction and you want to submit the transaction for billing only. |

|

|

Performs both authorization and billing. The vendor charges the customer's credit card upon receiving authorization. |

|

|

Credits the customer's credit card. |

Transaction Process Flow

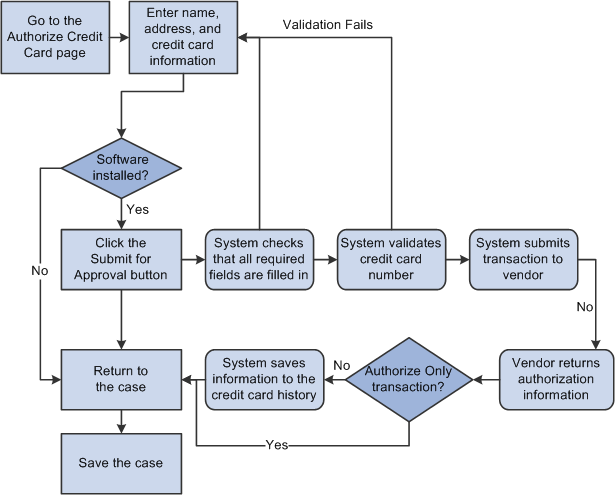

Transaction Process FlowThis diagram illustrates the credit card transaction process flow. The system performs all credit card validation before submitting data to the vendor, which prevents unnecessary transaction charges.

When the system validates a credit card number, it validates that:

The credit card number is the correct length.

The credit card number starts with a valid prefix.

The credit card number is valid (if the Credit Card Setup page specifies the use of a check digit algorithm).

The system saves the authorization information along with the other transaction information in the credit card history once you manually save the case. This ensures that you have records of any real-time billing or credit transactions.

Processing Credit Cards and Reviewing Transactions

Processing Credit Cards and Reviewing Transactions

This section discusses how to:

Submit credit card information for authorization.

Review credit card transactions.

View address details.

Pages Used to Process Credit Cards and Review

Transactions

Pages Used to Process Credit Cards and Review

Transactions|

Page Name |

Definition Name |

Navigation |

Usage |

|

RC_CASE_CARD_SEC |

Support, Add Case, Case Click the Credit Card Information link on the Billing page. Or click Credit Authorization link from Case page [if enabled on display template] |

Submit a customer's credit card information for authorization. |

|

|

Credit Card Information - Transaction Results |

RC_CASE_CARD_SEC |

Click the Submit Transaction button on the Credit Card Information page. |

Review transaction results. |

|

RB_CARD_HISTORY |

Review Electronic Card History, Electronic Card History |

Review credit card transactions that have been submitted for authorization. |

|

|

View Contact Address Detail |

RB_CARD_ADDR |

Click the Contact Address link on the Review Electronic Card History page. |

Review the address information that was used to process the credit card transaction. |

Submitting Credit Card Information for Authorization

Submitting Credit Card Information for AuthorizationAccess the Credit Card Information page (Support, Add Case, Case, click the Credit Card Information link on the Billing page, or click Credit Authorization link from case page [if enabled on display template]).

This page is also used in the Service Order and Agreement components for credit card authorization purposes.

Note. For security purposes, the credit card number and the verification number are encrypted and stored in the database. After save, only the last 4 digits of the credit card number is shown. As for the verification number, it is masked with XXX, and will be removed permanently from the database after the credit card authorization process completes.

Credit Card Information

This group box displays fields that are generally required by third-party credit card software vendors. All fields are required.

|

Credit Card on File and Credit Card |

Select this option if the customer or consumer has a credit card on file. Then select the card that you want to use from the Credit Card drop-down list box. |

|

Phone |

Enter the customer's phone number. |

|

Email Address |

Enter the customer's email address. |

|

New Credit Card |

Select this option if the customer is using a new credit card. |

|

Save on File |

Select the check box if you want to save the person's credit card information. |

|

First Name, Last Name and Name on Card |

Enter this information for the credit card holder. The default name is the name of the consumer or contact who is associated with the case. Change the value if this is not the name on the credit card. Credit card information stored in a person's record (for example, information entered in the Consumer or Contact component) does not appear by default on this page. If, after submitting a credit card charge, you return to this page to authorize additional charges, the information that you previously entered is saved, but the credit card number is masked so that you see only the last four digits. The information is preserved for the current case only. If the same person pays for another case, you must reenter all of the information. |

|

Card Type |

Select a credit card type. Values are based on the credit cards that are designated Active on the Credit Card Setup page and may include AMEX, Diners Club/Carte Blanche, Discover, MasterCard, and Visa. |

|

Card Number |

Enter the number of the credit card that is to be charged for the transaction. |

|

Expires |

Select the credit card expiration date (2-digit month and 4-digit year). Note. The Expires field (CR_CARD_EXPYR) contains translate values for valid expiration years. You must periodically review and update this field with valid expiration year values. PeopleSoft CRM delivers values that range from 2001 to 2014. |

|

Verification Number |

Enter the verification code of the credit card. This field becomes required if the Credit Card Verification Number Required option is selected on the General Options page. After the credit card transaction is submitted and the authorization process is completed (passed or failed), the verification number will be deleted permanently from the system in compliance with the Payment Card Industry (PCI) Security Standards Council recommendations on sensitive data storage. |

|

Email Address and Phone |

Displays the customer's primary email address and telephone number by default. |

|

Address |

Displays the primary address that the system has on file for the person for whom you are executing a credit card transaction. Other addresses that are associated with that person are also available for selection. Confirm that the address is the billing address for the credit card, because address verification is part of the authorization process. The address format is based on the country that you enter. Click the Enter New Address link if you want to add a new address to be used in the transaction. Click the Edit link if you want to update the currently selected address. |

Transaction Details

The options that are available depend on how your organization has configured credit card processing.

|

Amount |

Enter the amount that is to be authorized. |

|

Currency Code |

Select the currency in which the credit card transaction should be calculated. |

|

Transaction Type |

Select one of these values: Authorize Only: Select to submit the transaction for authorization only. The vendor verifies that the card is valid for the charge and does not bill the credit card. Authorize and Bill: Select to submit the transaction for authorization and billing. The vendor performs both authorization, and if the charge is authorized, the vendor charges the customer's credit card. Bill Only: Select if you have preauthorized the transaction and you want to submit the transaction for billing only. The vendor bills the card without verifying that the card is valid for the charge. Credit Only: Select to submit a credit transaction. The vendor credits the customer's credit card. |

|

Submit Transaction |

Click to validate all of the data on the page. If the system finds missing or invalid data, the system displays an error message explaining the problem. You must correct all of the errors before the approval process can be initiated. If all validation criteria are met, clicking this button calls the business interlink. The vendor then performs the authorization, billing, and credit processing that you requested. Warning! When you submit an authorize and bill, bill only, or credit only transaction, the system saves the transaction information after the vendor returns the information. When you submit an authorize only transaction, you must save your work manually by saving the Case page. If you fail to save, the case results in an incomplete credit card transaction and you will have no record of the completed transaction in your system. |

Credit Card Information - Transaction Results

Access the Credit Card Information - Transaction Results page (click the Submit Transaction button on the Credit Card Information page).

This page displays authorization information for the credit card transaction.

|

These statuses are examples and may not be suitable for all vendors: Unprocessed/Retry: Transaction has not been processed or is a failed credit card process and is being resubmitted. Authorized: Transaction is approved. The funds are reserved for the transaction. Credited: A credit has been authorized and processed for the transaction. The funds are credited back to the specified credit card. Denied: Transaction has failed credit card processing and has been declined or disallowed by the company issuing the credit card. Billed: Transaction is complete. Funds are charged to the credit card. Billed transactions must be preceded by an authorization. Authorized and Billed: Signifies successful output from the background settlement process. Manually Approved/Settled: Transaction is approved. Someone contacted the credit card service to obtain verbal approval. Change to Terms: Payment type has been changed from credit card to payment terms. Cancel Order: Transaction is cancelled and is not subject to further processing. Processing: Transaction has been submitted for approval and is awaiting results. |

|

|

Code (credit card authorization code) |

Displays the reference number for an authorized transaction. |

|

Date |

Displays the date that the transaction was authorized. |

|

Reference |

Displays a message regarding the authorization. For example, if a link is not working, you might see Interlink Error. |

|

Click to return to the Credit Card Information page. If you return to the case without submitting the transaction, the information still appears on the Credit Card Information page and is saved to the credit card history when you save the case, even though the transaction results fields are blank. To prevent this from happening, you can either clear all data from the Authorize Credit Card page before returning to the case or close the case without saving. |

See Also

Understanding Credit Card Encryption

Reviewing Credit Card Transactions

Reviewing Credit Card Transactions

Access the Review Electronic Card History page (Review Electronic Card History, Electronic Card History).

Many fields on this page are the same as for the Authorize Credit Card page. Only definitions for fields that do not correspond to similarly named fields on the Authorize Credit Card page are described here.

Card Information

|

Card Owner ID |

Displays the name of the application through which the credit card transaction was processed. PeopleSoft CRM groups credit card transactions by the application from which they originated. Use the Show previous row and Show next row buttons to scroll through the transactions for a specific PeopleSoft CRM application. |

Card History

|

Sequence Number |

If multiple credit card transactions are associated with a case, the sequence number differentiates the transactions. |

|

Verification Number Sent |

Indicates if a credit card verification number was sent for this credit card transaction. The number is not displayed on this page. |

|

Return Message Status, Message 1, Message 2, and Message 3 |

Displays information regarding your authorization, billing, or credit request. |

|

Address Verification Service |

Displays address verification results. An example is Exact Address Match. |

|

Contact Address |

Click to access the Address Secondary page, where you can review the address information used to process the credit card transaction. |

Viewing Address Information

Viewing Address InformationAccess the View Contact Address Detail page (click the Contact Address link on the Review Electronic Card History page).

Use this page to review the address information used to process the credit card transaction. Click Return to go back to the Review Electronic Card History page.