Understanding Composite Asset Processing

Understanding Composite Asset ProcessingThis chapter provides an overview of composite asset processing and discusses how to:

Add a composite asset.

Add a composite member asset.

Capitalize composite members into composite assets.

Retire composite members from composite assets.

Load composite asset transactions.

Perform transactions on composite assets.

Understanding Composite Asset Processing

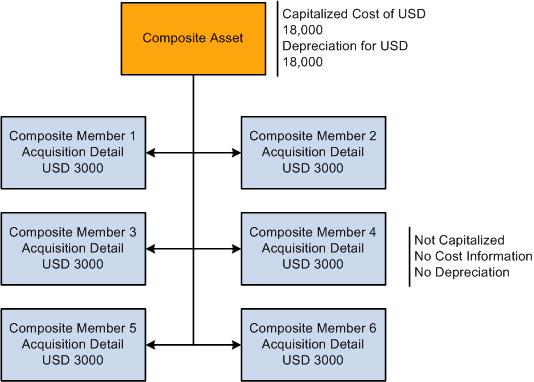

Understanding Composite Asset ProcessingComposite Asset Processing, frequently used by utility companies, is a way of grouping many assets so that their total cost is carried by, and depreciated as, one asset. This single asset is termed a composite asset, and associated assets are known as composite members.

In composite processing, no transaction detail is carried by individual composite members. All transaction detail, including any gain or loss accrued upon retirement, is rolled up to the composite asset level. Once this rollup occurs, no transaction detail is retained by composite members. Because depreciation occurs at the composite asset level, only the composite asset carries any information—such as book, depreciation method, prorate convention, or life—that relates to depreciation.

Composite asset processing

Because the composite asset carries all the cost for its associated composite members, it is a financial, or capitalized, asset. The composite asset can also carry its own cost information or not, as required, although no individual detail is retained once the total cost has been rolled up. Composite member assets, on the other hand, are nonfinancial assets, or not capitalized, and carry no cost information. Instead, they carry acquisition detail, which is summed up and capitalized at the composite asset level.

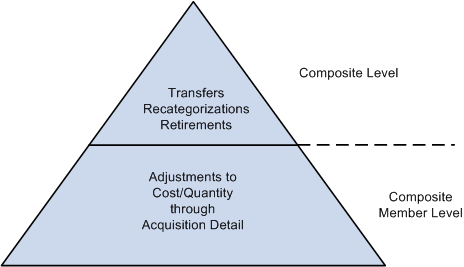

All transactions are performed at the composite asset level except for adjustments to acquisition detail. Adjustments are made at the composite member level and then rolled up to the composite level.

Note. The fair value (FV) of the asset does not roll up from the composite member to the composite level.

Summing up and adjusting cost information for composite assets is accomplished through a mass change that:

Sums the acquisition detail for each ChartField combination contained in the affected Composite Member assets.

Inserts one cost row into the Composite Asset for the total of each ChartField combination.

Note. Composite members are not considered in the Capitalization Threshold evaluation.

Adding a Composite Asset

Adding a Composite Asset

Using Asset Basic Information, you must perform three steps to add a composite asset:

Select the Composite Asset check box on the General Information page.

After you save the asset, make note of its Asset ID.

Enter an asset Profile ID on the General Information page.

Capitalize the asset on the Asset Acquisition Detail page by selecting the Capitalize button.

You can enter cost information or not, as required.

See Adding and Maintaining Asset Information.

Adding Composite Member Assets

Adding Composite Member Assets

Using Asset Basic Information, you must perform these steps to enter composite member assets:

Associate the member with a composite asset.

Select the Composite Asset check box on the General Information page and associate the composite member by selecting a composite asset in the Composite Asset ID field.

On the Asset Acquisition Detail page, assign a Capitalize status of To be Capitalized.

The composite member is uncapitalized with no cost rows. You can use a Profile ID for composite member assets if you want. However, you must use a nonfinancial asset profile. A composite member asset may display an Amount left to Capitalize if it has any acquisition detail. This amount is displayed until the composite member is capitalized into its associated composite asset.

Add appropriate acquisition details to the composite member on the Asset Acquisition Detail page.

Note. A nonfinancial Asset Profile does not contain any book information. On the pages of the Asset Basic Information component, Capitalized Asset should not be selected.

Select an asset type (if no profile has been established).

See Adding and Maintaining Assets.

See Setting Up Asset Profiles.

Capitalizing Composite Members into Composite Assets

Capitalizing Composite Members into Composite Assets

To capitalize composite members into their associated composite asset, you need to create and run a mass change definition using the Mass Change Template CC - Capitalize into Composite.

In Execution Sequence 1, enter the composite asset ID into which you want to capitalize your composite members, the Business Unit to which the composite asset belongs, and the Composite Member Asset IDsyou want to capitalize. You need not capitalize all composite member assets at one time.

In Execution Sequence 2, enter the Composite Member Asset ID and the Profile TableSet ID associated with that Business Unit. This information is required to improve system performance. There are no defaults to enter for this Mass Change Type.

Be sure to enter the Transaction Date and Accounting Date that are required by PeopleSoft Asset Management. You can also select the transaction currency as necessary.

See Also

Retiring Composite Members from Composite Assets

Retiring Composite Members from Composite Assets

To retire composite members from their associated composite asset, you need to create and run a mass change definition using the Mass Change Template CR - Composite Retirement.

In Execution Sequence 1, enter the Composite Asset ID from which you want to retire your composite members, the business unit to which the composite asset belongs, and the Composite Member Asset IDs you want to retire. You need not retire all composite member assets at one time.

In Execution Sequence 2, enter the business unit associated with your composite asset and the Profile TableSet ID associated with that Business Unit. This information is required to improve system performance.

Enter the defaults for the retirement, including a Disposal Code, Retirement Type, and Retirement Convention, and indicate whether this is a Voluntary or Involuntary Retirement.

Be sure to enter the Transaction Date and Accounting Date that are required by PeopleSoft Asset Management.

See Also

Loading Composite Asset Transactions

Loading Composite Asset Transactions

After you have run a Composite Asset mass change, use the Transaction Loader to load results of the mass change into the PeopleSoft Asset Management tables.

The Load Type for capitalize into composite transactions is CIC. The Load Type for retire from composite transactions is either PRT or RET, depending on whether you are doing a partial or a full retirement.

See Running the Transaction Loader.

Understanding the Effect of Capitalization into Composite

Understanding the Effect of Capitalization into Composite

After your composite member assets are capitalized, they are designated Already Capitalized on the Asset Acquisition Detail page. The Capitalization Information group box is inactive. The Asset Acquisition Detail page no longer displays an amount or quantity that is left to capitalize.

The Composite Asset into which you capitalized will now contain one cost row for each ChartField combination represented in the acquisition detail of the composite members you just rolled up. To view this, select Asset Management, Asset Transactions, Financial Transactions, Cost Adjust/Transfer Asset, Cost Information.

Note. The Cost Information page appears after clicking the Search button.

Understanding the Effect of Retirement from Composite

Understanding the Effect of Retirement from Composite

After you retire a Composite Member from a Composite Asset, the cost row for the ChartField combination you retired will be decreased by the amount you retired. To view this, select Asset Management, Asset Transactions, Asset Disposal, Retire/Reinstate Asset, Retire Assets. You can also view this information on the Cost Information page.

Because Composite Member Assets carry no cost information, you will not see any change in them after retirement.

Performing Transactions on Composite Assets

Performing Transactions on Composite Assets

All transactions on composite assets are performed at the composite asset level except adjustments to cost. Adjustments to cost/quantity are made at the composite member level as adjustments to acquisition detail, and then rolled up to the composite level and capitalized, where they are recognized as adjustments to total cost/quantity.

Transaction on composite Elements

Adjustments to Cost/Quantity

Adjustments to Cost/Quantity

Using Asset Basic Information, you must perform three steps to adjust the cost/quantity of a composite asset:

Add a row of acquisition detail to one of the associated Composite Members.

This row should equal the amount of the desired cost/quantity adjustment and contain the appropriate ChartField combination. The additional row is reflected in the Amount Left to Capitalize on the Asset Acquisition Detail page. If you want to add cost/quantity for more than one ChartField combination, enter additional rows.

Use Mass Change to capitalize the adjusted Composite Member into the Composite Asset.

Run the Transaction Loader.

Recategorizations and Transfers

Recategorizations and Transfers

Recategorizations and transfers on composite assets are performed at the composite level. Perform these transactions on composite assets as you would for any other asset by using the Asset Cost Adjust/Transfers component.

To transfer a composite asset:

Select Asset Management, Asset Transactions, Financial Transactions, Cost Adjust/Transfer Asset to access the Main Transaction page.

Select the Transaction Date, Accounting Date, Transaction Code, and Rate Type. Select Transfer in the Action drop-down list box. The Transaction Type for transfers is TRF.

Enter new ChartField information into the appropriate fields on the Cost Information page.

We recommend that you change information one field at a time to establish an audit trail. For example, if you need to change the department and project, first enter the new department and save the change. Then go back and change the project.

The Composite Asset may have several cost rows, each for a separate ChartField combination. These rows are the totals, by ChartField combination, of all the acquisition detail for the associated Composite Member Assets that have been capitalized into the Composite Asset.

Save your changes.

See Adjusting, Transferring, and Evaluating Assets.