Understanding Joint Venture Processing

Understanding Joint Venture Processing

This chapter provides an overview of joint venture processing and discusses how to:

Add and maintain joint venture assets.

Change ownership allocations for existing joint ventures.

Understanding Joint Venture Processing

Understanding Joint Venture Processing

The Joint Venture Processing feature of PeopleSoft Asset Management enables you to accurately track finances when two or more business units share in the ownership of an asset or a group of assets. To use this feature, you must set up a Joint Venture Business Unit, identify business units that participate in the joint venture, and associate all of the business units with their respective equities.

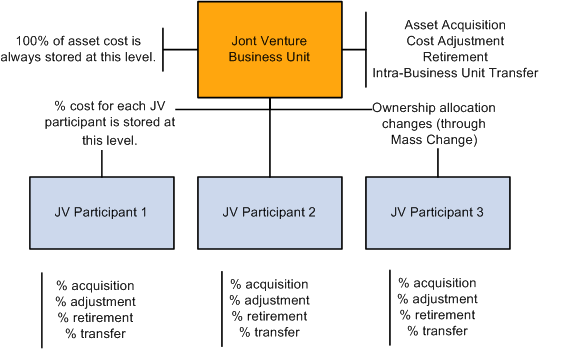

The following graphic illustrates the relationship between a joint venture business unit and its participants. A joint venture business unit owns 100 percent of all joint venture assets. Participating business units are each assigned an equity percentage of the jointly owned assets. When you add, adjust, or retire an asset at the joint venture business unit level, similar transactions take place at the participant level, with cost and depreciation prorated according to each participant's equity percentage.

Joint venture processing

Equity percentages are defined in the Joint Venture Allocation table when you set up the PeopleSoft Asset Management tables. The sum of the participants' percentages must equal 100 percent. Equity percentages are allotted to participating business units according to the values you enter in the joint venture allocation table.

This allocation table sets up joint venture processing for Participants 1, 2, and 3, which own 60 percent, 20 percent, and 20 percent of the joint venture assets, respectively:

|

Business Unit |

Percentage |

|

Joint Venture Business Unit |

100 |

|

Participant 1 |

60 |

|

Participant 2 |

20 |

|

Participant 3 |

20 |

Most transactions on joint venture assets are performed at the Joint Venture Business Unit level. These transactions are automatically performed at the participant level as well, with cost, fair market and depreciation information prorated based on each participant's equity percentage.

For example, asset ID JV00022 was entered for the Joint Venture Business Unit. With USD 10,000 of remaining value and USD 2,000 in accumulated depreciation, these assets are created based on the previous allocation table:

|

Unit |

Asset ID |

Book |

Remaining Value |

Accumulated Depreciation |

|

Joint Venture Business Unit |

JV000022 |

CORP |

10,000 |

2,000 |

|

NA |

NA |

FEDERAL |

10,000 |

2,000 |

|

Participant 1 |

JV000022 |

CORP |

6,000 |

1,200 |

|

|

|

FEDERAL |

6,000 |

1,200 |

|

Participant 2 |

JV000022 |

CORP |

2,000 |

400 |

|

|

|

FEDERAL |

2,000 |

400 |

|

Participant 3 |

JV000022 |

CORP |

2,000 |

400 |

|

|

|

FEDERAL |

2,000 |

400 |

Adds, Adjusts, and Retirements must take place at the Joint Venture Business Unit level. Changes in ownership allocation—such as additions and deletions of participants and reallocations of equity percentages—must be made at the Joint Venture Participant level.

Prerequisites for Joint Venture Processing

Prerequisites for Joint Venture Processing

Joint Venture Processing requires setup steps that you need to follow to use this feature. These steps must be completed in the correct order so that subsequent options are available for selection.

To set up joint venture processing:

Select Set Up Financials/Supply Chain, Install, Installation Options, Asset Management and select the Joint Venture Processing check box on the Installation Options - Asset Management page.

Select Set Up Financials/Supply Chain, Business Unit Related, Assets, Asset Management Definition and define at least one Joint Venture Business Unit on the PeopleSoft AM Business Unit Definition page.

The option to define a Joint Venture Business Unit is active only if you enabled Joint Venture Processing in step 1.

Create one business unit for each participant in the joint venture relationship to establish Joint Venture Processing.

These are standard business units and there are no additional steps to perform. Profiles for joint venture participant business units must have the same Profile ID as the joint venture business unit.

Associate the Joint Venture Participants with a particular Joint Venture Business Unit and define the percentage of asset ownership allocated to each participant to complete the last step in establishing Joint Venture Processing.

Do this by setting up a Joint Venture Allocation table for each Joint Venture Business Unit.

See Also

Establishing PeopleSoft Asset Management Business Units

Adding and Maintaining Joint Venture Assets

Adding and Maintaining Joint Venture Assets

Most transactions on joint venture assets are performed at the Joint Venture Business Unit level. These include asset acquisitions, cost adjustments, retirements, and intrabusiness unit transfers (for example, transfers from one department, product, project, or category to another within the same business unit).

Note. InterUnit transfer of joint venture assets is not available or supported.

Joint venture asset transactions are executed just as they are for any non-joint venture asset with no special steps to take. However, it is recommended that you establish a naming convention to distinguish assets that are shared by a joint venture. For example, you might assign a joint venture asset an asset ID that begins with the letters JV.

Joint venture asset transactions are automatically executed at the participant level as well, with cost and depreciation information prorated based on each participant's equity percentage. Acquisition detail table entries are not prorated. Any change in the ownership allocation of joint venture assets (ownership transfers) must be performed at the joint venture participant level.

Changing Ownership Allocations for Existing Joint Ventures

Changing Ownership Allocations for Existing Joint Ventures

You must define and run a mass change to change the ownership allocation of assets in an existing joint venture. The Joint Venture Allocation table affects only newly added assets, which means that changes made to the allocation table do not affect existing joint venture assets.

Additions and deletions of participants and reallocations of equity percentages are recorded as sales transactions. This results in either a gain or a loss on the part of the selling participant. The value of the sale proceeds for the selling participants is recorded as the capital cost incurred by the buying participants.

PeopleSoft Asset Management processes these changes by retiring some portion of the equity percentage from the selling participant (to calculate gain/loss) and then transferring percentages between business units until the desired ownership ratio is achieved. The mass change transfers an established amount of the asset cost and quantity from one business unit to another (a one-to-one transfer). Because of this, you may need to run the mass change multiple times (up to the number of participating business units minus 1) to effect the desired change. For instance, if you have three original participants and want to add another, you might run the mass change three times: between business units 1 and 4, 2 and 4, and 3 and 4.

Defining a Mass Change for Joint Venture Processing

Defining a Mass Change for Joint Venture Processing

To change the ownership allocation of assets in an existing joint venture, PeopleSoft Asset Management is delivered with these joint venture mass change templates:

|

Mass Change Template |

Description |

|

JVA-Joint Venture BU Addition |

Adds a joint venture participant. |

|

JVP-Joint Vent BU Add (w/Prof) |

Adds a joint venture participant using book values from the new business unit's profile ID. |

|

JVR-Joint Venture BU Removal |

Removes a joint venture participant. |

|

JVT-JV Allocation Change |

Transfers the allocation percentages for a joint venture from one business unit to another. |

Note. After you run these changes, it is a good idea to update the allocation table to reflect the new equity percentages. Joint venture mass changes do not affect Joint Venture Allocation tables, and you must change these tables to reflect the updated joint ventures.

In addition to selecting the appropriate mass change template, make other selections that are specific to joint venture processing. PeopleSoft Asset Management requires a Transaction Date and an Accounting Date.

Depending on the joint venture mass change template you select, you may also need to select a set of default values for some or all of these fields:

|

Joint Venture Business Unit to Add to |

Value is inserted into INTFC_FIN table. |

|

Percentage of Cost |

Enter a decimal value—for example, enter 0.50 for 50 percent. |

|

Disposal Code |

Choose a disposal code from the available options. Disposal codes are fully described in Retiring Assets. |

|

Total Proceeds |

Enter 0 if there are none. |

|

Percentage of Quantity |

Enter a decimal value—for example, enter 0.50 for 50 percent. |

|

Total Removal Cost |

Enter 0 if there is none. |

|

Retirement Type |

Enter either Extraordinary or Ordinary to indicate how the gain or loss that results from a retirement should be reported. This is for information only. |

|

Retirement Convention |

Select a retirement convention. This indicates how depreciation will be calculated through retirement. |

|

Voluntary/Involuntary |

Enter either Voluntary or Involuntary to indicate the reason for a retirement. This is for information only. |

See Processing Asset Mass Changes.

Adding a Joint Venture Participant

The Mass Change application engine program adds a joint venture participant business unit to an existing joint venture and performs these additional functions:

Retires an established percentage of cost and quantity from one business unit and its books by using the defaults you specify for the retirement.

Adds the same percentage of cost and quantity to the new business unit and its books by using the proceeds you specify for the retirement.

When defining the mass change, select JVA-Joint Venture BU Addition as the Mass Change Template used to add a joint venture participant. If you want to use book values from the profile ID of the new participant business unit, select the JVP-Joint Vent BU Add (w/Prof) mass change template.

In Execution Sequence 1, select the book or books from which you want to retire a portion of assets. Specify the Joint Venture Business Unit from which you want to retire assets so that these values can be applied to the new participant business unit.

In Execution Sequence 2, enter default values for the mass change.

Note. Before adding a business unit to an existing joint venture, that business unit must be fully established.

Removing a Joint Venture Participant

When Mass Change removes a joint venture participant business unit from an existing joint venture, it also performs these functions:

Retires the total cost and quantity from one business unit and its books, using the defaults you specify for the retirement.

Adds that cost and quantity to another business unit and its books, using the proceeds you specify for the retirement.

When defining the mass change, select JVA-Joint Venture BU Removal as the Mass Change Template used to remove a joint venture participant.

In Execution Sequence 1, select the book or books that you want to remove. Specify the Joint Venture Participant Business Unit you want to remove.

In Execution Sequence 2, enter default values for the mass change.

Changing Joint Venture Ownership Allocations

When the Mass Change process changes ownership allocations for an existing joint venture, it also performs these functions:

Retires a percentage of the cost and quantity from one business unit and its books, using the defaults specified for the retirement.

Adds that same percentage of cost and quantity to another business unit and its books, using the proceeds specified for the retirement.

When defining the mass change, select JVT-JV Allocation Change as the Mass Change Template used to change joint venture ownership allocations.

In Execution Sequence 1, select the department or departments from which you want to transfer joint venture assets. Specify the Joint Venture Business Unit from which you want to transfer assets.

In Execution Sequence 2, enter default values for the mass change.

Loading Joint Venture Transactions

Loading Joint Venture Transactions

After you run a joint venture mass change, use the Transaction Loader to load results of the mass change into the PeopleSoft Asset Management tables.

See Running the Transaction Loader.