Understanding General Ledger VAT Setup and Processing

Understanding General Ledger VAT Setup and Processing

This chapter provides an overview of Oracle's PeopleSoft Enterprise General Ledger VAT setup and processing, lists prerequisites, and discusses how to:

Set up value-added tax (VAT) options and defaults for General Ledger processing.

Create and process journals with VAT.

Import VAT data from third-party systems.

Understanding General Ledger VAT Setup and Processing

Understanding General Ledger VAT Setup and Processing

This section provides an overview of VAT in PeopleSoft General Ledger and discusses:

VAT default and override relationships in General Ledger.

VAT setup and defaults for General Ledger.

VAT transaction entry and processing in General Ledger.

This PeopleSoft application accommodates a number of methods for calculating VAT based on either the countries where your organization is located or the countries with which you conduct business. You can set up all of your VAT defaults and other VAT information in Setup Financials/Supply Chain, Common Definitions, VAT and Intrastat, Value Added Tax for each of your PeopleSoft applications. You must set up VAT for PeopleSoft General Ledger at the business unit, journal source, and account ChartField levels. Each of these levels is represented by a VAT driver, which is provided with the PeopleSoft application. You can set up the VAT defaults for PeopleSoft General Ledger in a central VAT location by selecting the appropriate VAT driver:

Account ChartField

Journal Source

GL Business Unit

When you click the VAT Defaults link on the General Ledger Business Unit Definition - VAT Defaults page, the appropriate page (Journal Source Definition page, Account ChartField page, VAT Defaults Setup page) appears, based on one of the VAT drivers for PeopleSoft General Ledger.

For example, when you click the VAT link on the General Ledger Business Unit - VAT Defaults page, the VAT driver for the VAT Defaults page is BUS_UNIT_TBL. When you click the VAT link on the Account page, the VAT driver for the VAT Defaults page is GL_ACCOUNT_TBL. Finally, if you click the VAT link on the Journal Source Definition page for Online Journal Entries (ONL), the VAT driver is SOURCE_TBL for the VAT Default page. Each VAT driver determines the appearance of the VAT Defaults page.

To process PeopleSoft General Ledger transactions, you must set the defaults and parameter controls that apply to VAT at the business unit, journal source, and account levels. The objective is to calculate and create a variety of VAT accounting entries to record not only the tax on goods and services, but also—simultaneously—record the recoverable, nonrecoverable, and rebate portions of the VAT at the journal line level.

VAT Default and Override Relationships in General Ledger

VAT Default and Override Relationships in General LedgerThe hierarchy for VAT default options for PeopleSoft General Ledger is:

VAT Entity and VAT Country

Business Unit

Journal Source

Account

Therefore, VAT default options set up for the VAT entity or VAT country override the VAT default options set up for a business unit, journal source, or account level.

If there are no VAT default options set at the VAT entity or VAT country levels, then any VAT default options set up at the business unit level override any VAT defaults set up a the journal source or account levels.

If no VAT defaults are set at the VAT entity, VAT country, or VAT business unit level, then the VAT default options set at the journal source level override the VAT default options set at the account level.

When you enter a journal line, however, overriding of VAT default options works in the reverse order:

Account

Journal Source

Business Unit

When entering VAT at the journal line, if you established an option value at the account level, that value overrides a value set at the journal source and business unit levels. Likewise, if you have not established values at the account or journal source level, PeopleSoft General Ledger calculates VAT using the options set for the business unit, VAT entity registration, or VAT country levels.

VAT Setup and Defaults for General Ledger

VAT Setup and Defaults for General LedgerThe VAT defaults are controlled by VAT drivers at various levels of the hierarchy, and they are stored in a common set of tables provided by default. Depending on the driver, you can set certain fields and override them in a lower level of the hierarchy.

Two main components control the VAT defaults: the VAT Defaults Setup component and the Services VAT Treatment Setup component. For PeopleSoft General Ledger, only the VAT Defaults Setup component is applicable. You can access this component from the common VAT menu (Set Up Financials/Supply Chain, Common Definition, VAT and Intrastat, Value Added Tax) or from the applicable general ledger pages. If you access it from the VAT menu, the driver you select determines the fields that appear. If you access it from the application pages, the component from which you are accessing determines the fields that appear. For example, if you access the VAT Defaults Setup page from the VAT and IntraStat Common Definitions menu, and you select the GL Business Units (BUS_UNIT_TBL_GL) driver, then you see the same fields as you do when you click the VAT Default link on the GL Business Unit Definition - VAT page.

These VAT user overrides are set:

Service Type, Place of Supply Driver, or both—a change to either protects both.

Reporting Country, Defaulting State, or both—a change to either protects both.

Bank/Customer/Vendor Registration Country.

Calc on Advance Payments.

Place of Supply Country, Place of Supply State, or both—a change to either, where applicable, protects both.

Applicability.

User overrides are reset to blank when the user:

Clicks Change Physical Nature.

Clicks Reset All VAT Defaults.

Leaves the component and comes back in again.

See Accessing the Service VAT Treatment Defaults Setup Page.

VAT Drivers, VAT Driver Keys, and the Defaulting Hierarchy for VAT Defaults

The following table lists the VAT drivers and associated VAT driver keys in the VAT default hierarchy sequence from most specific to least specific for the VAT Defaults component. No general ledger drivers apply to the Services VAT Treatment Defaults.

|

VAT Driver |

VAT Driver Keys |

PeopleSoft Application |

Country |

State |

Applicable to Regular VAT Defaults |

Applicable to Services VAT Treatment Defaults |

|

Account ChartField |

Account SetID Account |

General Ledger |

Optional |

Optional |

Yes |

No |

|

Journal Source |

Source SetID Source |

General Ledger |

Optional |

Optional |

Yes |

No |

|

GL Business Unit |

Business Unit |

General Ledger |

Optional |

Optional |

Yes |

No |

|

VAT Entity Registration |

VAT Entity Country |

All |

Required |

Optional |

Yes |

No |

|

VAT Country |

Country |

All |

Required (key) |

Optional |

Yes |

No |

VAT Transaction Entry and Processing in General Ledger

VAT Transaction Entry and Processing in General LedgerPeopleSoft General Ledger processes VAT transactions originating from the following sources:

PeopleSoft subsystems

PeopleSoft General Ledger

External systems

Note. Commitment control functionality does not support VAT.

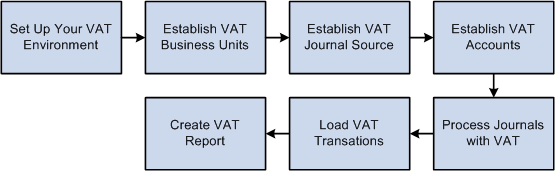

This diagram illustrates VAT processing in PeopleSoft General Ledger:

VAT processing in PeopleSoft General Ledger

When you create a journal entry with VAT, the Journal Edit process calculates VAT, spreads the VAT amounts, if necessary, and, for an inclusive VAT transaction, subtracts the VAT amount from the journal line and then adds it back in for the journal balances.

You can also create a Standard Journal Entry (SJE) Model journal for VAT. However, Journal Edit does not perform any of the processes mentioned on the model journal. Instead, the SJE process copies the VAT lines to retain any user-entered information and Journal Edit processes VAT on standard journals created from the SJE process.

After creating general ledger journal entries, you can edit and post them online or you can process them in batches. You must run the VAT Transaction Loader process to load data into the VAT Transaction Table before you can run the VAT Report Extract process to enable you to print VAT reports. You run the VAT Transaction Loader process based on your organization's volume of VAT data. For example, you may only need to run this process once each week. You can select this process each time you produce reports or schedule it to run automatically. You then can run the VAT Report Extract process based on when you need to produce reports.

PeopleSoft delivers the General Ledger AE program, GL_JRNL_IMP, that you use to import VAT data to Journal tables from third-party systems. Since this program directly modifies and loads data into transaction tables, a database administrator or someone with detailed knowledge of the physical layout of the tables should run them. You must be aware which tables are affected by these programs and run the programs at the appropriate times.

The Effects of Changing VAT Defaults

The system displays VAT defaults in descending order of effect. When you change multiple VAT defaults and click Adjust Affected VAT Defaults, specific fields will or will not be adjusted. Work from the top to the bottom of the list, clicking Adjust Affected VAT Defaults at the appropriate times to avoid adjustments to VAT defaults that you overrode but did not memorize.

For example, if you override Calculate at Gross or Net and click Adjust Affected VAT Defaults, nothing happens because the Calculate at Gross or Net field does not affect any other VAT defaults. If you then override Vendor Registration Country and click Adjust Affected VAT Defaults again, the system adjusts all VAT defaults except Vendor Registration Country. This time, Calculate at Gross or Net was overridden, which means that you must override this VAT default again to undo the adjustment.

In another example, if you override Vendor Registration Country and click Adjust Affected VAT Defaults, the system adjusts all VAT defaults except Vendor Registration Country and Vendor Registration ID. If you then override Place of Supply Driver and click Adjust Affected VAT Defaults again, the system adjusts all VAT defaults except Service Type, Place of Supply Driver, Vendor Registration Country, and Vendor Registration ID.

See Also

Creating Standard Journal Entries (SJEs)

Prerequisites

Prerequisites

Before you process VAT transactions in PeopleSoft General Ledger:

Read Setting Up Global Options and Reports, "Understanding Value Added Taxes."

Set up your VAT environment.

If you intend to create an allocation journal that includes VAT processing in the journal edit, deselect the ByPass Vat Processing check box on the Output Options page. The system then recognizes the VAT Account flag, calculates VAT, and generates additional VAT accounting lines where appropriate. Be careful when using this feature in a multilevel allocation because the system may generate accounting entries more than once for the same expense to recover VAT. To avoid this situation, deselect the Bypass VAT check box for only one step in a multilevel allocation.

Note. Refer to the individual PeopleBooks for the subsystems

that feed VAT transactions to the PeopleSoft General Ledger, for VAT information

applicable to that application, and to access the setup information for the

various applications.

PeopleSoft Commitment Control does not support VAT.

See Also

Setting Up VAT Options and Defaults for General Ledger Processing

Setting Up VAT Options and Defaults for General Ledger Processing

To set up VAT options and defaults, use the following components:

VAT Defaults (VAT_DEFAULT_SEARCH)

General Ledger Definition (BUS_UNIT_TBL_GL)

Journal Source (SOURCE)

Account (GL_ACCOUNT)

Use the ACCOUNT_CF component interface to load data into the tables for the Account component.

This section discusses how to:

Set up VAT defaults for the General Ledger VAT drivers.

Set up General Ledger Business Unit VAT Default options.

Set up VAT default options for Journal Source.

Set up VAT defaults for an account.

Pages Used to Set Up VAT Options and Defaults for General Ledger Processing

Pages Used to Set Up VAT Options and Defaults for General Ledger Processing

|

Page Name |

Definition Name |

Navigation |

Usage |

|

VAT Defaults Setup |

VAT_DEFAULTS_DTL |

|

Access VAT defaults to the journal line for the general ledger business units, source, and account. The default fields are available on the VAT Defaults Setup page for the business unit, the source, and the account based on the page where you select the VAT Default link. |

|

General Ledger Definition - VAT Defaults |

BUS_UNIT_TBL_GL5 |

Set up Financials/Supply Chain, Business Unit Related, General Ledger, General Ledger Definition, VAT Defaults |

Define VAT options that are provided by default to the journal line from your general ledger business units and select the VAT Default link to define additional central VAT defaults. Note. This page only appears if the business unit is associated with a VAT entity. |

|

Journal Source - Definition |

SOURCE1 |

Set Up Financials/Supply Chain, Common Definitions, Journals, Source, Definition |

Specify whether the source is for goods or services and select the VAT Default link to define additional central VAT defaults. |

|

Account |

GL_ACCOUNT |

Set up Financials/Supply Chain, Common Definitions, Design ChartFields, Define Values, ChartField Values, Account |

Specify whether the account is for goods or services and select the VAT Default link to define additional central VAT defaults. |

Setting Up VAT Defaults for the General Ledger VAT Drivers

Setting Up VAT Defaults for the General Ledger VAT Drivers

Access the VAT Defaults Setup page (Click the VAT Default link on either the General Ledger Definition - VAT Defaults page, the Journal Source - Definition page, or the Define ChartField - Account page).

Note. The default values on this page are dependent on the VAT driver that you select. This example uses the BUS_UNIT_TBL_GL VAT driver.

|

VAT Driver |

The VAT Defaults Setup page is a common page used to set up VAT defaults for all PeopleSoft applications that process VAT transactions. You can define general ledger defaults as applicable for each PeopleSoft-defined General Ledger VAT driver. The PeopleSoft General Ledger VAT drivers are:

Note. If you select the VAT Defaults link on the General Ledger Business Unit Definition - VAT Defaults page, the Journal Source - Definition page, or the Account page, then you access the VAT Defaults Setup page for the selected driver. All VAT defaults are set up on these central VAT pages. |

Note. The VAT Defaults Setup pages are described in detail in the PeopleSoft Enterprise Global Options and Reports 9.1 PeopleBook, "Working with VAT."

See Establishing VAT Defaults.

Setting Up General Ledger Business Unit VAT Default Options

Setting Up General Ledger Business Unit VAT Default Options

Access the General Ledger Definition - VAT Defaults page (Set Up Financials/Supply Chain, Business Unit Related, General Ledger, General Ledger Definition, VAT Defaults).

|

VAT Reporting Entity |

Create a VAT entity for the levels in your organization that require reporting. You can associate more than one business unit with a VAT entity; however, you can only associate one VAT entity with a specific business unit. To associate a general ledger business unit to a VAT entity, navigate to Setup Financials/Supply Chain, Common Definitions, VAT and Intrastat, Value Added Tax, VAT Entity, Identification. |

|

Physical Nature |

Specify the default nature of transactions for the business unit as either Good or Service. The default can be overridden at the source and account levels. |

|

Prorate Non-Recoverable VAT |

Select to post the non-recoverable VAT to the same ChartFields (including account, alternate account, and other ChartFields) that are specified on the associated expense journal line rather than to a separate VAT account. Selection of this option sets the default for the GL Journal Entry - VAT page, VAT Control group box. |

|

Allocate Non-Recoverable VAT |

If non-recoverable VAT is not prorated (that is, the Prorate Non-Recoverable VAT option is not selected), then non-recoverable VAT amounts are posted to a separate VAT account and alternate account. Select this option to allow the ChartField to which non-recoverable VAT is posted to be determined by your ChartField Inheritance options. For each ChartField, you may specify that the value always be inherited from the associated expense journal line, that the value only be inherited when the VAT is being posted to the same general ledger business unit, that the value be obtained from the set of business unit default ChartFields, or that the VAT be posted to a specific VAT ChartField. Selection of this option sets the default for the GL Journal Entry - VAT page, VAT Control group box. |

|

VAT Default |

Click this link to access the general ledger business unit driver's VAT Defaults page and define additional defaults for the business unit. |

Note. Although the VAT amount may be zero or the VAT may be 100 percent non-recoverable, the system generates a 0 (zero) Recoverable VAT entry. This action is necessary because the VAT Transaction Loader always uses the Recoverable VAT entry as the basis for generating the VAT_TXN_TBL entries.

See Also

Defining General Ledger Business Units

Setting Up VAT Default Options for Journal Source

Setting Up VAT Default Options for Journal Source

Access the Journal Source - Definition page (Set Up Financials/Supply Chain, Common Definitions, Journals, Source, Definition).

|

Physical Nature |

Specify the default nature of transactions for the journal source as either Good or Service. The default can be overridden at the account level. Note. Indicate the default option used most often for VAT transactions that use this source. For options that you use less frequently, override these defaults at the Account Definition level. |

|

VAT Default |

Click this link to access the central VAT Defaults Setup page of the source for the Journal Source VAT driver. Note. The VAT Defaults Setup page appears based on the specific Journal Source you select, such as ONL, AP, and AR. |

See Also

Defining Common Journal Definitions

Setting Up VAT Defaults for an Account

Setting Up VAT Defaults for an Account

Access the Account page (Set Up Financials/Supply Chain, Common Definitions, Design ChartFields, Define Values, ChartField Values, Account, Account).

|

VAT Account Flag |

|

|

Physical Nature |

Specify the default nature of transactions for the account as either Good or Service. The defaults override source and business unit defaults. |

|

VAT Default |

Click this link to access the central VAT Defaults Setup page for account and define the VAT defaults for an account. |

See Also

Creating and Processing Journals with VAT

Creating and Processing Journals with VAT

This section discusses how to:

Enter VAT in the General Ledger journal lines.

Update VAT data in the General Ledger journal VAT lines.

You normally enter VAT data as part of a PeopleSoft subsystem transaction. VAT is calculated within the transaction, the transaction is edited, the VAT Transaction Loader is run, and the transaction is posted. Use general ledger to enter adjustments, corrections, or miscellaneous transactions that either include VAT or affect only the VAT portion of a transaction.

See Also

Pages Used to Create and Process Journals with VAT

Pages Used to Create and Process Journals with VAT

|

Page Name |

Definition Name |

Navigation |

Usage |

|

Journal Entry - Lines |

JOURNAL_ENTRY2_IE |

General Ledger, Journals, Journal Entry, Create/Update Journal Entries, Lines |

Include business unit, any VAT accounts that are entered or generated, and the ability to override the currency, rate, and basis amount. VAT default data from the business unit, journal source, and VAT accounts affects defaults on the GL Journal Entry - VAT page. |

|

GL Journal Entry - VAT |

JOURNAL_ENTRY_VAT |

Click the VAT link on the journal line. |

Override VAT default information generated from the business unit, source, and account that are entered on the header and lines pages, if necessary. |

Entering VAT in the General Ledger Journal Lines

Entering VAT in the General Ledger Journal Lines

Access the Journal Entry - Lines page (General Ledger, Journals, Journal Entry, Create/Update Journal Entries, Lines).

You can override the business Unit on the journal line; however, the selected business unit must have VAT functionality enabled.

If you enter a transaction with its associated ChartFields for a VAT-applicable account, the system generates the VAT journal lines.

You can also enter a journal line directly against a VAT account as an adjustment to a VAT transaction, along with the appropriate ChartFields.

You can override the default Currency and Rate Type.

The exchange rate that appears is based on these two values.

Enter the amount.

Click the VAT link to access the GL Journal Entry - VAT page.

Note. The Lines page operates in deferred processing mode. Most fields are not updated or validated until you save the page or refresh it by clicking a button, link, or tab. This delayed processing has various implications for the field values on the page. For example, if a field contains a default value, then any value you enter before the system updates the page overrides the default. Also, the system updates quantity balances or totals only when you save or click the Calculate Amounts button.

See Also

Entering Journal Line Information

Updating VAT Data in the General Ledger Journal VAT Lines

Updating VAT Data in the General Ledger Journal VAT Lines

Access the GL Journal Entry - VAT page (click the VAT link on the Journal Entry - Lines page).

The VAT link appears on a journal line for which the ChartField is a VAT ChartField and the business unit is VAT-enabled.

Expanding and Collapsing Sections

To manage your VAT data more efficiently, you can expand and collapse sections of this VAT page.

|

Expand All Sections |

Click this button to scroll to and access every section on the page. You can also expand one or more sections by clicking the arrow next to the section name. |

|

Collapse All Sections |

Click to collapse all sections; you will see only the header information. If you expand one or more sections, you can click the arrow next to the section name to collapse the section. |

Updating VAT Values

You can modify any of the accessible fields on this page. These are the VAT default values that you defined in the VAT Default Setup page for Account ChartField , Journal Source, GL Business Unit, VAT Entity Registration, and VAT Country VAT Driver.

See Establishing VAT Defaults.

Note. If you modify any of the VAT values on this page, be sure and use the options in the Adjust/Reset VAT Defaults group box.

VAT Defaults

Adjusting or resetting VAT defaults only affects the fields within this VAT Defaults group box:

|

Adjust/Reset VAT Defaults |

|

Importing VAT Data from Third-Party Systems

Importing VAT Data from Third-Party Systems

This section discusses how to import VAT journals using GL_JRNL_IMP.

Page Used to Import VAT Data from Third-Party Systems

Page Used to Import VAT Data from Third-Party Systems

|

Page Name |

Definition Name |

Navigation |

Usage |

|

External Flat Files - Flat File Journal Import Request |

LOAD_JRNL_PNL |

General Ledger, Journals, Import Journals, External Flat Files, Flat File Journal Import Request |

Import journal data contained in a flat file and insert it into PeopleSoft journal tables. |

See Also

Importing Journals from Flat Files Using GL_JRNL_IMP

Importing VAT Journals Using GL_JRNL_IMP

Importing VAT Journals Using GL_JRNL_IMP

Access the Flat File Journal Import Request page.

|

GL_JRNL_IMP |

Use this utility to insert rows into the PS_JRNL_HEADER, PS_JRNL_LN, PS_JRNL_VAT, PS_OPEN_ITEM_GL, and PS_JRNL_CF_BAL_TBL tables from data contained in a flat file. A commit is performed after all data in the file loads successfully. If the commit process fails, the entire load process is rolled back. You can run multiple instances of this Application Engine process with smaller flat files in a logical unit of work. Group the flat file rows in hierarchical order with the header first, followed by the associated journal lines and control lines. The system uses two system sources, EXT and EXV, to import data. System Source EXT enables the system to recognize that VAT Applicable/VAT Account selection is associated with an account and proceeds to calculate VAT and generates the additional accounting lines to be posted to the VAT accounts. System source EXV prevents the system from processing the journal for VAT so you can load all VAT information from a flat file. Therefore, use EXV to import VAT information and populate the JRNL_VAT table with transactions exactly as they are in the flat file, and use EXT to load journals to populate any missing values with default values and VAT lines when necessary. Once the system populates JRNL_VAT, the imported VAT information is picked up by the VAT Transaction Loader. |

See Also

Using the Flat File Journal Import Process