Understanding Hedge Analytics and Hedge Accounting

Understanding Hedge Analytics and Hedge AccountingThis chapter provides an overview of hedge accounting and analytic, and discusses:

FAS 133 Hedge Accounting.

Hedge types.

Embedded derivatives.

Accounting Treatments for complying with IAS 39.

Understanding Hedge Analytics and Hedge Accounting

Understanding Hedge Analytics and Hedge AccountingEvery enterprise's assets and liabilities are exposed to fluctuations in interest rates, exchange rates, or commodity prices. An enterprise will always have natural hedges, but in most cases it is necessary to manage risk proactively by taking a position in a derivatives contract, insurance, and so on. Not entering into such contracts actually increases overall risk.

Derivatives, such as foreign exchange forward and future contracts, options, or currency swaps can reduce deviations from expected earnings, but the enterprise needs to implement risk management systems and procedures to manage those transactions.

Risk Management provides the IAS 39 and FAS 133 Hedge Accounting features to address your organization's economic realities and the regulatory requirements associated with derivative instruments.

FAS 133 provides accounting standards for working with hedge transactions and requires certain compliance elements that provide stakeholders with windows into the workings and financial progress of the enterprise's risk management. Under FAS 133, you use special accounting for hedged transactions, decreasing the income statement volatility otherwise introduced by mark-to-market accounting.

Since PeopleSoft 8.0, Treasury provided a hedge accounting solution based on FAS 133 guidelines, which focuses on accounting for derivatives and hedging activities. IAS 39 takes a broader view on accounting for financial instruments in general, and extends the areas addressed in FAS 133. There are, however, some differences that have a significant impact on reported performance.

IAS 39 imposes strict regulations on the use of hedge accounting, even for hedges that are economically effective. IAS 39 also imposes requirements for a wide range of instruments, including all derivatives, an enterprise's investments in debt and equity securities, financial assets and liabilities held for trading, and a company's own debt. It also covers short-term instruments such as trade receivables and payables.

Whether an organization complies with FAS 133 or IAS 39 regulations, PeopleSoft provides the ability to review investment and hedging strategies, and implement accounting systems to meet the processes and documentation requirements.

See Also

Creating and Maintaining Hedges

FAS 133 documentation, www.FAS133.com

IAS 39 documentation, www.iasc.org.uk

Risk Management and Hedge Accounting

Risk Management and Hedge Accounting

This section discusses:

FAS 133 Documentation requirements.

Periodic effectiveness assessment for FAS 133.

Hedge de-designation.

FAS 133 Documentation Requirements

FAS 133 Documentation Requirements

Risk Management enables you to systemically meet and capture most hedge accounting requirements around documentation for FAS 133 and IAS 39. .

There are, however, certain documentation issues in the FAS 133/IAS 39 standard that fall outside of the scope of database features, and these may or may not apply to your organization and its risk management strategy. PeopleSoft discloses and documents these context-sensitive areas during the course of this PeopleBook.

Periodic Effectiveness Assessment for FAS 133

Periodic Effectiveness Assessment for FAS 133

Effectiveness tests provide a means for an organization, its stakeholders, and external auditors to evaluate whether risk management strategies are on track. The tests also evaluate whether hedges are working or are likely to work as planned, and thus remain within bounds for special accounting.

Note. The paragraphs below are purely from FAS 133 documentation provided at the time of issue. The Financial Accounting Standards Board (FASB), however, regularly updates and appends some of the content through amendments or through feedback from Derivatives Implementation Group (DIG) commentaries. PeopleSoft does not take responsibility for such changes and modifications and expects the users to be familiar with the changes recommended by FASB in regards to FAS 133/138 accounting standards.

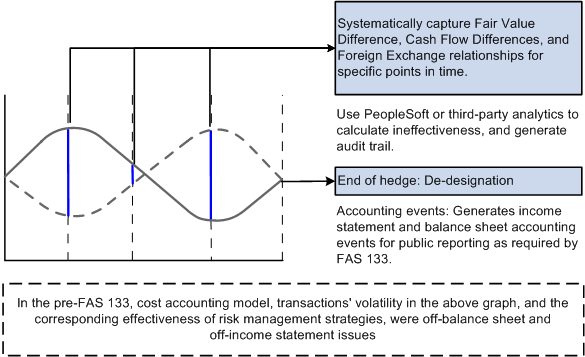

Examining the value of derivative instruments at given points in time, per paragraph 20(b), 28(b), determines whether they have experienced gains and losses on a derivative. When you set up a transaction, its correspondent hedged deal, and the link between the two and document it for FAS 133, you must also define and document tests or methodologies to assess hedge effectiveness.

Effectiveness Assessment at Inception

FAS 133 requires that you define tests of effectiveness assessment at the inception of the hedge, not retroactively or during the hedge's life span. Identifying and recording a derivative's value at predetermined points in time creates an audit trail.

Note. Regarding fair value hedges, ¶ 20(b) states: Both at inception of the hedge and on an ongoing basis, the hedging relationship is expected to be highly effective in achieving offsetting changes in fair value attributable to the hedged risk during the period that the hedge is designated. An assessment of effectiveness is required whenever financial statements or earnings are reported and at least every three months [¶ 20(b)]. Regarding cash flow hedges, ¶ 28(b) states: Both at inception of the hedge and on an ongoing basis, the hedging relationship is expected to be highly effective in achieving offsetting cash flows attributable to the hedged risk during the term of the hedge, except as indicated in paragraph 28(d) below. An assessment of effectiveness is required whenever financial statements or earnings are reported, and at least every three months [¶ 28(b)].

Hedge De-Designation

Hedge De-Designation

When your hedge transaction criteria are not met, including failed effectiveness assessment tests, you must de-designate the hedges, unwind their components, and apply mark-to-market accounting back to the last recorded date that the hedge passed effectiveness assessment. If a fundamental change in nature has occurred to the criteria you are hedging, FAS 133 accounting ends. For example, if you sell the recognized asset/liability, it expires, or the once firm commitment is terminated, FAS 133 accounting no longer holds.

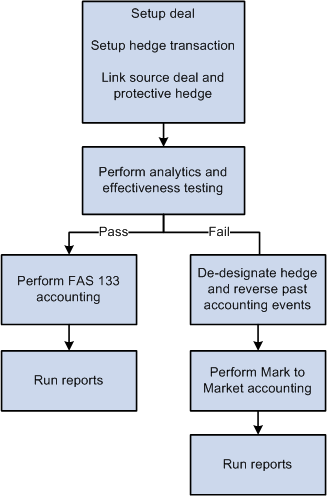

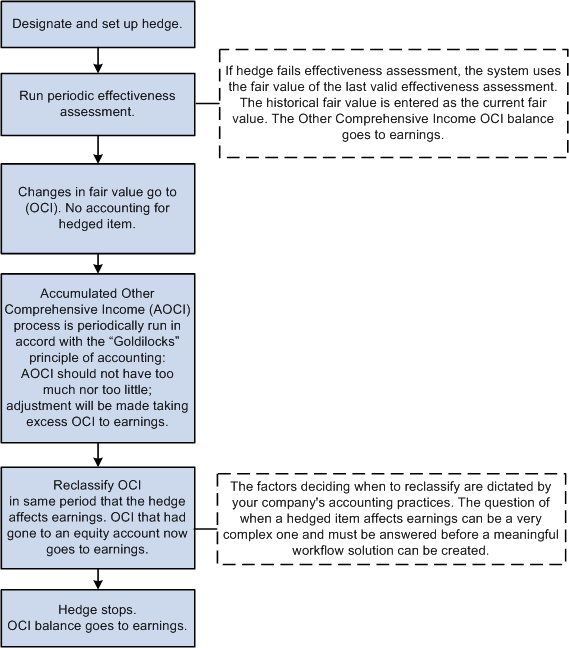

Whenever deals meet documentation and effectiveness assessment testing requirements, you can use FAS 133's special accounting and benefit from decreased income statement volatility. This flowchart provides an overview of FAS 133 hedge accounting:

FAS 133 Hedge Accounting overview

Ineligible and Eligible Hedge Scenarios

These types of hedge scenarios are ineligible under FAS 133:

Liquidity

Theft

Weather

Competition

Seasonality

Political

Operational

These types of hedge changes are eligible under FAS 133:

Fair value of entire financial instrument.

Percentage of entire fair value of the financial instrument.

Fair value attributable to changes in interest (including prepayment as a separate component of interest-rate risk).

Fair value attributable to changes in foreign currency exchange rates.

Fair value attributable to changes in the obligator's creditworthiness.

Understanding Hedge Types

Understanding Hedge Types

FAS 133 standardizes accounting for derivative instruments. It requires you to recognize derivative instruments as assets and liabilities in their statements of financial position and then to measure them at fair value. If certain conditions are met, your organization can designate a derivative instrument as a fair value hedge, cash flow hedge, or foreign currency hedge.

This section discusses:

Risk Management and hedges.

Fair value hedges.

Cash flow hedges.

Foreign currency hedges.

Risk Management and Hedges

Risk Management and HedgesThis diagram shows how Risk Management handles hedges:

Handling hedges in Risk Management

This table shows the types of hedges that are available with particular kinds of instruments:

|

Instrument |

Interest Rate |

F/X |

Fair Value |

Cash Flow |

Other |

|

Swap |

XXX |

|

XXX |

XXX |

|

|

Forward |

|

XXX |

XXX |

|

XXX |

|

Option |

|

XXX |

|

XXX |

|

Fair Value Hedges

Fair Value Hedges

Fair value hedges are hedges against exposure to changes (that are attributable to a particular risk) in the fair value of either of the following:

Recognized assets or liabilities on your balance sheet.

Unrecognized firm commitment and specific business commitments having significant financial relevance to your organization, but whose quantitative value does not go to your general ledger.

You hedge firm commitments in fair value hedges and in foreign currency cash flow hedges.

See "Fair Value Hedges: Firm Commitments—Statutory Remedies for Default Constituting a Disincentive for Nonperformance" published by Rutgers University.

Note. 540 defines a Firm Commitment as the following: "An agreement with an unrelated party, binding on both parties and usually legally enforceable, with the following characteristics: (a) The agreement specifies all significant terms, including the quantity to be exchanged, the fixed price, and the timing of the transaction. The fixed price may be expressed as a specified amount of an entity's functional currency or of a foreign currency. It may also be expressed as a specified interest rate or specified effective yield. (b) The agreement includes a disincentive for nonperformance that is sufficiently large to make performance probable."

Under FAS 133, gains and losses on qualifying fair value hedges should follow these accounting guidelines:

They must recognize the hedging instrument's gain or loss in current earnings.

The gain or loss (that is, the change in fair value) on the hedged item attributable to the hedged risk must adjust the carrying amount of the hedged item and be recognized in current earnings.

Note. From ¶ 19 of FAS 133: "The change in fair value of an entire financial asset or liability for a period refers to the difference between its fair value at the beginning of the period (or acquisition date) and the end of the period, adjusted to exclude (a) changes in fair value due to the passage of time and changes in fair value related to any payments received or made, such as in partially recovering the asset or partially settling the liability."

Here is an example of how this works:

With regression testing of a fair value hedge, the hedge is considered effective if its period ratio is between 80 and 125 basis points (0.8 to 1.25).

Period ratio equals the difference between the fair value change of hedging instrument (change in swap value) and the fair value change of hedged item (change in debt value).

|

|

Period 1 |

Period 2 |

Net Difference |

|

Change in swap value (hedging instrument) |

10 |

-7 |

17 |

|

Change in debt value (hedged item) |

-9 |

5 |

14 |

|

Difference in fair value |

1 |

-2 |

3 |

|

Period ratio |

-1.11 passes regression test ratio is within 0.8 to 1.25 |

-1.4 fails regression test terminate hedge |

|

Note. DIG's Fair Value Hedges: Basing the Expectation of Highly Effective Offset on a Shorter Period Than the Life of the Derivative states: "In documenting its risk management strategy for a fair value hedge, an entity may specify an intent to consider the possible changes (that is, not limited to the likely or expected changes) in value of the hedging derivative and the hedged item only over a shorter period than the derivative's remaining life in formulating its expectation that the hedging relationship will be highly effective in achieving offsetting changes in fair value for the risk being hedged. The entity does not need to contemplate the offsetting effect for the entire term of the hedging instrument."

The functionality of Risk Management is not intended for formulating the prospective consideration that a hedge will be effective.

This illustration shows the fair value hedge in time:

Fair value hedges in time

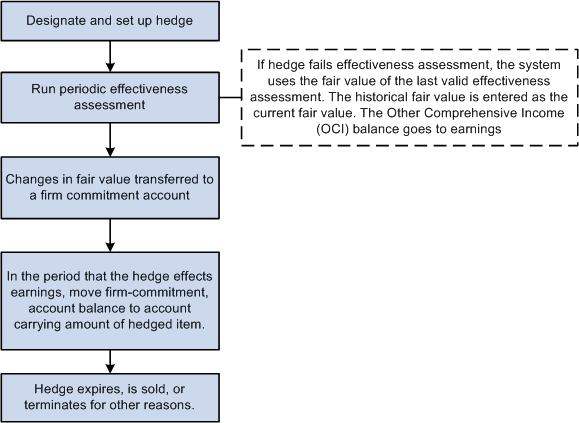

This next illustration shows the life of an unrecognized firm commitment set up as a fair value hedge:

Fair value hedges in time of unrecognized firm commitments

Cash Flow Hedges

Cash Flow Hedges

Cash flow hedges are hedges against exposure to volatility (that are attributable to particular risks) in the cash flows of either:

Recognized assets or liabilities.

Forecasted transactions.

The main purpose of a cash flow hedge is to link a hedging instrument and a hedged item in situations where you expect changes in cash flows to offset one another. Under FAS 133, to achieve this offsetting of cash flows, changes in the fair value of a derivative instrument that is designated and effective as a cash flow hedge must be:

Initially reported as a component of Other Comprehensive Income (OCI) outside earnings.

Later reclassified as earnings in the same periods during which the hedged transaction affects earnings (for example, when a forecasted sale actually happens).

Capture changes in the derivative instrument's fair value using effectiveness testing, which creates OCI accounting events. These events, in turn, generate an audit trail and become available for public reporting. Report OCI in the equity section of the balance sheet.

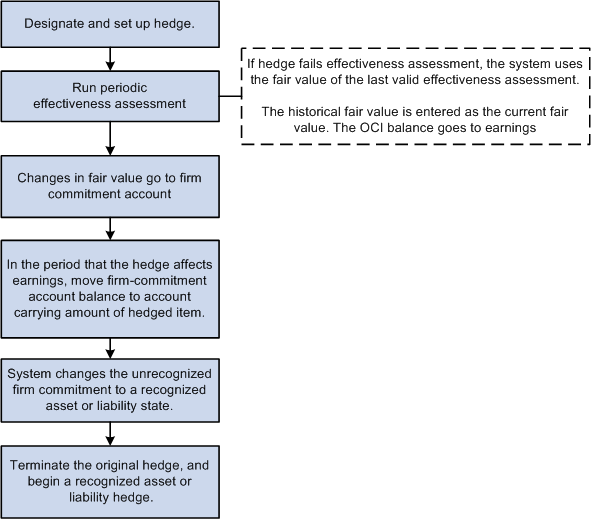

This flowchart shows the cash flow hedge occurring in time:

Cash flow hedges in time

Derivatives Implementation Group Issues

When calculating the amount of ineffectiveness of a cash flow hedge according to ¶ 30(b), the guidance in Derivatives Implementation Group (DIG) Issue G7 applies.

See "G7 - Cash Flow Hedges: Measuring the Ineffectiveness of a Cash Flow Hedge of Interest Rate Risk, When the Shortcut Method Is Not Applied," published by Rutgers University.

The issue lists three methods. Risk Management supports only the calculations of Methods 2 and 3.

Method 1: The Change in Variable Cash Flows method involves the following amounts that need to be calculated using an analytic:

Cumulative change in fair value of the swap.

Present value of the cumulative change in the cash flow on the floating leg of the swap.

Present value of the cumulative change in the expected future interest cash flows on the floating rate debt.

Method 2: The Hypothetical Derivative method involves the following amounts that must be calculated using an analytic:

Cumulative change in fair value of the actual swap.

Cumulative change in fair value "hypothetical" swap that mirrors the floating rate debt.

The change in the fair value of the "perfect" hypothetical swap can be regarded as a proxy for the present value of the cumulative change in expected future cash flows on the hedged transaction, as described in ¶ 30(b)(2).

With the analytic used to value the forecasted transaction, you calculate the second amount in the previous list: the cumulative change in fair value "hypothetical" swap that mirrors the floating rate debt.

Method 3: Change in Fair Value method involves the following amounts that must be calculated using an analytic:

Cumulative change in fair value of the actual swap.

Present value of the cumulative change in the expected future interest cash flows on the floating rate debt.

Foreign Currency Hedges

Foreign Currency Hedges

Foreign currency hedges are hedges against foreign currency exposure to any of the following:

Unrecognized firm commitments (fair value).

Available-for-sale securities (fair value).

Forecasted transactions (cash flow).

Net investments in a foreign operation.

See Firm Commitments.

You can hedge the change in fair value of an available-for-sale debt security (or a specific portion) from changes in foreign currency exchange rates.

You can also hedge available-for-sale equity securities if changes in fair value come from changes in foreign currency under certain conditions. First, the security cannot be traded on an exchange (or another established marketplace) where trades are denominated in your functional currency. Second, dividends, or other cash flows, to the security's holders' must be denominated in the same foreign currency that you expect to receive when the security is sold.

Forecasted Transactions/Recognized Firm Commitments

You can hedge foreign currency exposure to variability in the functional-currency-equivalent cash flows from foreign-currency-denominated forecasted transactions and foreign-currency-denominated intercompany transactions.

Net Investment in a Foreign Operation

The complexity of a foreign operation extends beyond the scope of cash flow and fair value hedges, which address the risks of specific financial components. Net investment in foreign operation hedges are not supported in Risk Management.

Understanding Embedded Derivatives

Understanding Embedded Derivatives

The FAS 133 Hedge Accounting feature in Risk Management enables you to record and account for embedded derivatives in the following two ways:

You enter two separate Risk Management deals: one for the host contract and one for the embedded derivative.

You enter the hybrid deal as a single deal using multiple detail lines/instrument base types if needed, and select the Embedded option on the Instrument Information component.

Note. The latter method is allowable only when the hybrid deal is not remeasured at fair value with changes in fair value reported in any account (such as earnings or OCI or any other account). If the hybrid deal is remeasured at fair value with changes in fair value reported in earnings as they occur, then the embedded derivative is not separated from the host contract (according to the guidance in ¶ 12(b). If the hybrid deal is remeasured at fair value with changes in fair value reported in any other account, then method (1) (separate deals) must be used to enter the hybrid instrument. This is because the system does not allow separate calculations to be made for the fair value of the host contract and the fair value of the embedded derivative.

You must examine specific contracts and ask if they contain an embedded derivative, determine how to split the embedded derivative from the host contract, and determine how best to use the Instrument Base Type architecture in PeopleSoft to split the hybrid contract into a host contract and a separated derivative.

Accounting Treatments for Complying with IAS 39

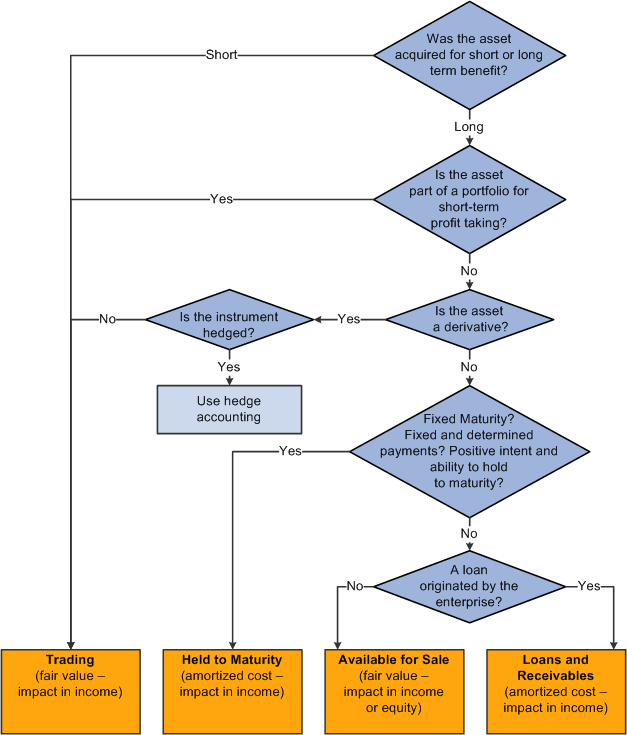

Accounting Treatments for Complying with IAS 39Use this diagram as an aid to determining the accounting treatment for complying with IAS 39 standards. Once determined, the accounting treatment is entered on the Instrument Detail page.

Decision tree for determining accounting treatment for IAS 39 compliance