18 Processing T5018 for Canada (Release 9.1 Update)

This chapter contains the following topics:

-

Section 18.1, "JD Edwards EnterpriseOne T5018 Processing Overview"

-

Section 18.2, "Understanding the Payroll Processing for T5018"

-

Section 18.4, "Understanding Sources of Information for T5018 Forms"

-

Section 18.10, "Combining Company Information for T5018 Processing"

-

Section 18.14, "Reviewing Records in the T5018 Workfile Table"

18.1 JD Edwards EnterpriseOne T5018 Processing Overview

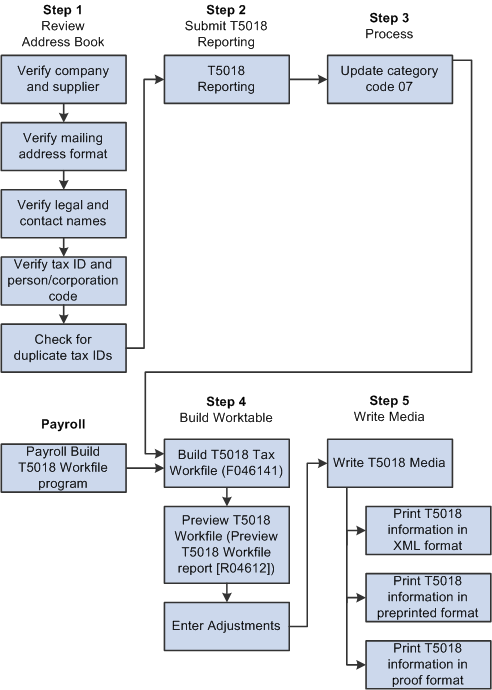

In compliance with the year-end reporting requirements of the Canadian government, companies that provide construction services must prepare and submit the Statement of Contract Payments - T5018 forms. Oracle JD Edwards EnterpriseOne Accounts Payable system includes programs to produce these required T5018 forms and to generate electronic files. If you file more than 50 T5018 slips for a calendar year, you must file the return over the Internet. The Oracle JD Edwards EnterpriseOne software supports the preprinted form and the XML format for T5018 forms.

With the JD Edwards EnterpriseOne Accounts Payable system, you can:

-

Maintain address and tax information for T5018 suppliers.

-

Produce T5018 forms using data from the JD Edwards EnterpriseOne Accounts Payable system, the JD Edwards EnterpriseOne Payroll system, or both.

-

Generate reports to verify T5018 data.

-

Adjust amounts for suppliers if errors are discovered.

-

Print T5018 forms by company.

-

Produce T5018 returns in electronic media format.

The subcontractors should have been set up in the payroll system with a code C in the Contract/Pensioner/Non-Resident Flag field of the Canadian Tax Info by EE program (P771015). If you are paying subcontractors through JD Edwards EnterpriseOne Payroll system, use the Payroll Build T5018 Workfile program (R77603) to build T5018 Payroll subcontractor's history data into the T5018 WorkFile table (F046141). The system then uses this data when you process T5018 from the JD Edwards EnterpriseOne Accounts Payable system. Whether you use payroll or not, to complete the T5018 processing, the system uses the JD Edwards EnterpriseOne Accounts Payable system to generate T5018 returns.

18.2 Understanding the Payroll Processing for T5018

To comply with the regulatory requirement of T5018, the Oracle JD Edwards EnterpriseOne Payroll software has been modified to update value of C for contractors in the Tax History Type field of the history tables Tax History (F0713), Pay Check History Cash Ledger (F0716), Employee Transaction History (F06146), and Pay Check History Summary (F06156) tables for employees who are contractors. The system updates the Tax History Type field in these tables with a value of C and then retrieves only those records for T5018 processing for subcontractors. The payroll system sends data for subcontractors to the tax workfile from where the accounts payable system generates T5018 return.

After you have set up payroll subcontractors by defining a avlue of C in the F060116 table through the Canadian Tax Infor by EE program (P771015), follow these steps to process subcontractors through payroll to build the payroll T5018 data into T5018 Tax Workfile (F046141):

-

Process subcontractors data into Payroll History tables.

-

Clear payroll subcontractors workfile data.

-

Build payroll subcontractors data into T5018 Tax Workfile.

-

Review payroll subcontractors records in T5018 Workfile.

-

Clear payroll subcontractors tax file data.

-

Clear payroll subcontractors tax workfile data.

|

Note: When you are processing T5018 return for subcontractors, the reference of suppliers in the documentation refers to subcontractors. |

18.3 Understanding the A/P Method for T5018

The Accounts Payable (A/P) method generates T5018 returns for all payments that are made to payroll contractors and suppliers entered as individuals, partnerships, or corporations identified by a person/corporation code and those that meet requirements established by Canada Revenue Agency (CRA).

The Government has not set any fixed schedule for filing of T5018 forms. You can file these forms on a calendar year basis or on a fiscal year basis.

Use the A/P method to generate T5018 returns when these conditions exist:

-

Suppliers have been set up with account number allotted by CRA or the Social Insurance Number (SIN) set up in the Tax Id (TAX) field of the Address Book Master table (F0101).

-

Company has been set up with account number allotted by CRA (Canada Revenue Agency). Use the Work With Addresses program (P01012) to set up this account number in the F0101 table. For payor/company, the system retrieves the account number from the TX2 field of the F0101 table.

-

Vouchers have the category code 07 set up as CT in the Accounts Payable Ledger table (F0411). You set up this value while entering vouchers.

-

Vouchers that are to be considered are in paid status.

The A/P method enables you to use the value of CT in category code 07 to limit the vouchers that you select for T5018 processing.

To create the T5018 Tax Workfile (F046141), the T5018 A/P method uses data that is stored in these tables:

-

Accounts Payable Ledger (F0411).

-

Address Book Master table (F0101).

-

Accounts Payable-Matching Document table (F0413).

-

Accounts Payable Matching Document Detail table (F0414).

|

Note: For subcontractors, A/P processing for T5018 is subsequent to completing tasks in the Payroll system. Therefore, while processing T5018 for subcontractors, you must first complete the required tasks in payroll and then run T5018 through A/P. |

18.3.1 Address Book Category Code 01/07

This category code, which is stored in the address book record of the supplier in the F0101 table, is the only category code that is written to the F0411 table.

When you take the T5018 ESU, the system automatically adds the value of CT for Canadian T5018 Processing in UDC table 01/07.

18.3.2 Record Identification Type Codes (H00/TA)

The codes in UDC table H00/TA identify the entity for which you are creating an address book record.

When you take the T5018 ESU, the system automatically adds the value of T for US and 6 for Non-US partnership entities in UDC table H00/TA for Canadian T5018 processing.

18.4 Understanding Sources of Information for T5018 Forms

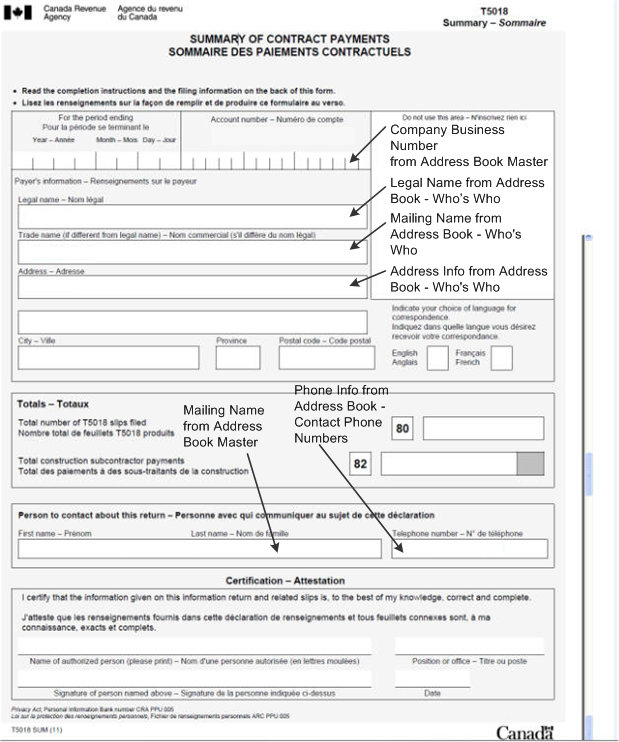

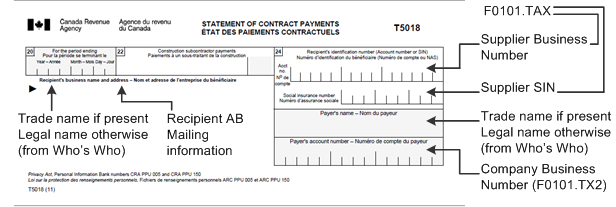

These diagrams show the source of information for various columns on the T5018 Summary and Slip forms:

18.5 Verifying Supplier Setup

This section provides overviews of supplier setup, legal names of T5018 suppliers, mailing names and addresses of T5018 suppliers, and tax IDs for T5018 suppliers.

18.5.1 Understanding Supplier Setup

The information that you set up for suppliers must meet the CRA specifications for T5018 forms. As part of the T5018 process, you must review address book records for suppliers to ensure that you have the necessary information and that the information meets CRA requirements. You should begin preparing for T5018 processing early enough to review address book records, enter corrections, and still meet the T5018 deadline. Ensure that you allow sufficient time to research and update records. If supplier information is incorrect, the CRA might reject the returns and impose fines for each incorrect T5018.

For each supplier that is eligible for T5018 processing, you must specify this Who's Who information in the address book record:

-

Legal name that the system stores in the F0111 table.

-

Mailing name and address that the system stores in the F0116 table.

-

Identification number (Account number or SIN) that the system stores in the F0101 table.

You might also need to provide this information:

-

Default value for Address Book category code (01/07) if you use category code 07 for the A/P Ledger method.

-

Foreign supplier, if the mailing address is outside of Canada.

-

Tax relationships, if you need to combine suppliers with duplicate tax IDs.

Supplier information is stored in these tables:

18.5.2 Understanding Legal Names of T5018 Suppliers

The CRA requires you to use the legal name of the supplier on T5018 returns. This is provided on the W-9 form submitted by the supplier. A supplier's legal name is the name that the CRA associates with the supplier's SIN. A supplier can have only one legal name for tax purposes.

If the mailing name on the supplier master record is not the legal name of the supplier, you must enter the legal name using the Who's Who program (P0111) and designate a type code of T (T5018 legal name). The system prints both the mailing and legal names on the T5018 return.

18.5.2.1 Example of Legal Names

If the mailing name and legal name of a business are different, you must create a Who's Who entry that contains the legal name and a type code of T (T5018 legal name). Most commonly, you use this type code when the mailing name is a business name (such as Johnson Painting Specialists) and the account number is a Social Security Number (SSN) belonging to a person (such as Elmer Johnson).

This example shows two scenarios for T5018s, one in which the Who's Who entry is required and another in which it is not required:

| Scenario | Description |

|---|---|

| Who's Who entry is required. | Johnson Painting Specialists

|

| Who's Who entry is not required. | Elmer Johnson

For this example, a Who's Who entry is not required because the mailing name and legal name are the same (Elmer Johnson). |

18.5.3 Understanding Mailing Names and Addresses for T5018 Suppliers

Review the mailing name and address of each supplier for whom you generate a T5018 return.

The CRA limits addresses on Canadian T5018 returns to three lines (maximum of 40 characters per line), consisting of name (line 1), street address (line 2), and city, state, and ZIP code (line 3). You cannot have a mailing address that contains more than one line for a street address.

|

Note: If an address contains a suite number in addition to a street address, you must enter the street address and suite number on the same line. |

When you must use a legal name in addition to a mailing name, the CRA allows four lines, as follows:

-

Legal name

-

Mailing name

-

Street

-

City, state, ZIP code (postal code)

18.5.4 Understanding Tax IDs for T5018 Suppliers

Suppliers (payees) use W-9 returns to report their identification numbers (account number or SIN) to a payer. A nine-digit identification number is required for each supplier. The JD Edwards EnterpriseOne Accounts Payable system uses this information for the identification number on T5018 returns. The CRA requires that you report the identification number. You set up teh Tax ID using the Tax ID field in the Work With Addresses program.

For some foreign suppliers, an identification number might not be required.

18.6 Entering Supplier Information for T5018s

This section discusses how to:

-

Set up the person/corporation code and tax ID number for a supplier.

-

Set up mailing information and the Code 07 field for a supplier.

-

Set up a legal name for a supplier.

Enter T5018 information for a supplier after you complete the steps to enter supplier master information.

18.6.1 Forms Used to Enter Supplier Information for T5018s

| Form Name | FormID | Navigation | Usage |

|---|---|---|---|

| Supplier Master Revision | W04012A | Annual Processing (G0422), Supplier Master Information

Select a supplier and click Select on Work With Supplier Master. |

Set up the person/corporation code and the tax ID number for a supplier. |

| Address Book Revision | W01012A | On the Supplier Master Revision form, select A/B Revision from the Form menu, and then select the Mailing tab. | Set up mailing information and the Code 07 field for a supplier. |

| Who's Who | W0111A | Select Who's Who from the Form menu on Address Book Revision. | Set up a legal name for a supplier. |

18.6.2 Setting Up Mailing Information and the Code 07 Field (AC07) for a Supplier

Access the Address Book Revision form.

Figure 18-4 Address Book Revision form: Mailing tab

Description of "Figure 18-4 Address Book Revision form: Mailing tab"

-

Select the Mailing tab and complete these fields:

-

Address Line 1

Enter the street address of the supplier, including the suite number on this line, and in the Address Line 2 field. Do not enter any street address information in the Address line 3 and Address Line 4 fields.

-

City,State, and Postal Code

Enter the city, state, and postal code of the supplier's address.

-

-

Select the Cat Code 1 - 10 tab.

Figure 18-5 Address Book Revision form: Cat Code 1 - 10 tab

Description of "Figure 18-5 Address Book Revision form: Cat Code 1 - 10 tab"

-

Complete this field:

-

Code 07

Select the value CT from user-defined code (UDC) table 01/07 to specify the type of return as T5018 to be processed for the supplier. The system uses this value as the default value when you enter vouchers for the supplier.

-

18.7 Processing T5018s for Foreign Suppliers

This section provides an overview of T5018 processing for foreign suppliers and discusses how to identify foreign suppliers for T5018s.

18.7.1 Understanding T5018 Processing for Foreign Suppliers

If you make payments to suppliers with mailing addresses outside Canada, you might be required to identify them as foreign suppliers and submit T5018 returns. A foreign supplier is eligible for a T5018 form if the address book record contains 1, 2, or 6 in the Person/Corporation Code field.

If a supplier master record is specified as foreign, but does not include an individual or noncorporate designation, the system issues the error message Invalid Person/Corporation Code when you run the Build T5018 Workfile - A/P program. To correct the error, you must enter P or N in the Person/Corporate Code field in the address book record for the supplier and rerun the program. The values in the Person/Corporation Code and Payables fields are used for tax purposes only; they do not affect any other software process.

18.7.2 Form Used to Process T5018s for Foreign Suppliers

| Form Name | FormID | Navigation | Usage |

|---|---|---|---|

| Address Book Revision | W01012A | Annual Processing (G0422), Supplier Master Information

Select a supplier and then select A/B Revision from the Row menu on Work With Supplier Master. |

Identify foreign suppliers for T5018s. |

18.7.3 Identifying Foreign Suppliers for T5018s

Access the Address Book Revision form.

Figure 18-7 Address Book Revision form: Additional 1 tab

Description of "Figure 18-7 Address Book Revision form: Additional 1 tab"

- Payables Y/N/M

-

Select F to indicate that the supplier is a foreign supplier.

- Person/Corporation Code

-

Select P or N, depending on the type of supplier.

|

Note: You must also enter the country code of the supplier in the Country field on the Mailing tab of the Address Book Revision form. |

18.8 Combining Suppliers with Duplicate Tax IDs

This section provides an overview of suppliers with duplicate tax IDs and discusses how to combine suppliers with duplicate tax IDs.

18.8.1 Understanding Suppliers with Duplicate Tax IDs

You might have several suppliers owned by a single company or legal entity that share the same tax ID. You must prepare a T5018 return for the legal entity, not for the individual suppliers. This means that you must combine the amounts that you paid to the suppliers into one sum and report the combined amount on the legal entity's T5018 return.

For example, Anderson Home Improvements (a supplier) owns Anderson Carpet Cleaning (another supplier). Although you made payments to both suppliers, you must create a T5018 return only for the legal entity, Anderson Home Improvements.

To combine amounts for suppliers, enter the supplier number of the legal entity in one of the Address Number fields on the Related Address tab of the Address Book Revision form. In the preceding example, you would enter the address book number for Anderson Home Improvements in one of the Address Number fields in the address book record for Anderson Carpet Cleaning. Then when you run the Payroll Build T5018 Workfile program (R77603) for Payroll and the Build T5018 Workfile - A/P program (R04614) for AP, you would specify in a processing option the field to use to combine amounts for one legal entity.

|

Important: You must use the same address number field to specify related address consistently on address book records for suppliers and companies for the system to combine supplier payments properly. |

18.8.2 Form Used to Combine Suppliers with Duplicate Tax IDs

| Form Name | FormID | Navigation | Usage |

|---|---|---|---|

| Address Book Revision | W01012A | Annual Processing (G0422), Supplier Master Information

Select a supplier and click Select on Work With Supplier Master. Select A/B Revision from the Form menu on Supplier Master Revision. |

Combine suppliers with duplicate tax IDs. |

18.8.3 Combining Suppliers with Duplicate Tax IDs

Access the Address Book Revision form and select the Related Address tab.

Figure 18-8 Address Book Revision form: Related Address tab

Description of "Figure 18-8 Address Book Revision form: Related Address tab"

- Parent Number

-

Enter the address book number of the parent company. The system uses this number to associate a particular address with a parent company or location. Any value that you enter in the Parent Number field updates the Address Organizational Structure Master table (F0150) for the blank structure type. This address number must exist in the Address Book Master table (F0101) for validation purposes. Examples of address book records that would have a parent number include:

-

Subsidiaries with parent companies.

-

Branches with a home office.

-

Job sites with a general contractor.

-

- 1st Address Number to 5th Address Number

-

If you want to report the payment on T5018 for an address other than the primary address, enter the alternate address number in one of these fields.

If you leave all these fields blank on an entry form, the system supplies the primary address from the Address Number field.

- Factor/Special Payee

-

Enter a number in the Address Book that identifies a special payment address for accounts payable.

This number must exist in the Address Book Master table (F0101) for validation purposes. If you leave this field blank on an entry form, the system supplies the primary address from the Address Number field.

18.9 Managing Company Information

This section provides an overview of company information and discusses how to:

-

Set up a T5018 contact name.

-

Enter a phone number.

18.9.1 Understanding Company Information

The information that you set up for companies must meet the CRA specifications for Form T5018. As part of the T5018 process, you must review address book records for companies within your organization to ensure that you have the necessary information and that the information meets CRA requirements.

Accurate T5018 reporting depends on setting up company records correctly. Begin preparing for T5018 processing early enough to review address book records, enter corrections, and still meet the T5018 deadline. Ensure that you allow sufficient time to research and update records. If company information is incorrect, the CRA might reject the returns and impose fines for each incorrect T5018.

For each company that submits T5018 forms, you must specify this information in the company's address book record:

-

Address number

-

Contact name

-

Mailing name

-

Add'l IndTax ID

-

Phone number

Company information is stored in the Company Constants table (F0010).

18.9.1.1 Company Address Book Numbers

You must verify the address book number that is assigned to a company or payer. The system uses this information to:

-

Print the company name on T5018 returns as the payer.

-

Combine company records for T5018 processing.

Typically, the company number is the same as the company's address book number. The company number has a limit of five characters, whereas the address book number might have as many as eight characters. If the company number is different from the address book number for the company, you must provide a cross-reference between the two numbers using the Company Address Number and Company Number fields in the Company Names & Numbers program (P0010).

If the Company Address Number field on the Company Setup form of the Company Names & Numbers program is blank, the company number and company address book number are the same. If the Company Address Number field contains a value and the value is different from the company number, then the company number and company address book number are different and the system uses the mailing address that is assigned to the company address book number.

Information about company address book numbers is stored in the Company Constants table (F0010).

18.9.1.2 Company Address Book Records

For T5018 forms, both payer and transmitter companies exist. The transmitter company is the company that sends the T5018 data to the CRA. An electronic file often contains several payer companies, but it can have only one transmitter company. You should review the company address book record for each payer company to ensure that it contains the correct mailing name, address, contact name, and so on.

18.9.2 Forms Used to Manage Company Information

| Form Name | FormID | Navigation | Usage |

|---|---|---|---|

| Company Setup | W0010B | Organization & Account Setup (G09411), Company Names & Numbers

Select a company and click Select on Work With Companies. |

Verify company address book numbers. |

| Address Book Revision | W01012A | Daily Processing (G01), Address Book Revisions

Select a record and click Select on Work With Addresses. |

Verify company address book records. |

| Who's Who | W0111A | Select Who's Who from the Form menu on Address Book Revision. | Set up a T5018 contact name. |

| Phone Numbers | W0115A | Select the T5018 contact on the Who's Who form and then select Phones from the Row menu. | Enter a phone number. |

18.9.3 Setting Up a T5018 Contact Name

Access the Who's Who form.

To create a T5018 contact name for the company, create a new record for the contact name and complete the Type Code field.

- Type Code

-

Select T5018 Contact Name.

18.10 Combining Company Information for T5018 Processing

This section provides an overview of company tax relationships and lists the form used to combine companies for T5018 processing.

18.10.1 Understanding Company Tax Relationships

Tax relationships can exist for companies with the same tax ID. The following topics illustrate the setup requirements for address book records to ensure correct T5018 reporting:

18.10.1.1 Companies with the Same Tax ID

Suppose that a company or legal entity owns several companies or business units that share the same tax ID. You must prepare T5018 returns for the legal entity, not for the individual companies. This means that you must combine the amounts that the individual companies (payers) paid to the same supplier.

Because the system enables you to specify up to five alternate addresses for each company, you can use the alternate address number of the legal entity as one of the alternate addresses for each company. You use the Work With Addresses program to specify alternate addresses. Later in the T5018 process, you specify which of the alternate addresses the system uses to combine the payments that the individual companies made to one supplier.

For example, Smith Construction Company (your company) owns Johnson Fabrications Incorporated (another company). Each company made payments to Marshall Electrical Systems, a supplier, but you must create a T5018 return only for the legal entity, Smith Construction Company. You specify Smith Construction Company as one of the alternate addresses for Johnson Fabrications Incorporated, which enables the system to combine and record the payments that both companies made to Marshall Electrical Systems on the T5018 for Smith Construction.

18.10.1.2 Example of Combining Companies for T5018 Processing

This example describes a company in which the address book record and company record are different. The company number is 500 and the address book number is 5005.

Company 500 owns companies 100 and 200 and shares the same tax ID. For T5018 processing, related address book combining must be set up so that company 500 is the payer on all T5018 returns for the three companies.

For this example, assume that:

-

The address book and company records are the same number for company 100 and for company 200.

-

Companies 100, 200, and 500 use the second related address number for address book combining.

For companies 100 and 200, the second related address on the address book record is set to 500.

|

Note: 500 is the company number, not the company address number. |

Company 500 does not have an address book number of 500; therefore, when the company record was set up, 5005 was assigned as the company address number. This information is stored in the Company Constants table (F0010) and can be viewed by means of the Company Names & Numbers program (P0010).

These programs use related address book combining to produce T5018s for company 500:

-

Build A/P Workfile program (R04614). With the Alternate Address Combining processing option set to 2, this program uses company number 500 (from the second Address Number field on the Address Book Revision form) and the tax ID of the address book number (5005) that is associated with company 500 to build the record in the T5018 Tax Workfile (F046141).

-

Write Media program (P04615). This program uses the address book number (5005) that is associated with company 500 to locate the mailing address for the T5018 return.

18.10.2 Form Used to Combine Companies for T5018 Processing

| Form Name | FormID | Navigation | Usage |

|---|---|---|---|

| Address Book Revision | W01012A | Daily Processing (G01), Address Book Revisions

Select a company and click Select on the Work With Addresses form. |

On the Related Address tab, combine companies for T5018 processing. |

18.11 Working with Payroll for T5018

This section provides overviews of account number setup for company and contractors, the changes to the Canadian Tax Info by EE program (P770105), Convert Tax History Type in F0713/F0716/F06146/F06156, and Payroll Build T5018 Workfile programs and discusses how to:

-

Run the Convert Tax History Type in F0713/F0716/F06146/F06156 to C program (R77601).

-

Run the Payroll Build T5018 Workfile program (R77603).

-

Set processing options for the Convert Tax History Type in F0713/F0716/F06146/F06156 to C program (R77601).

-

Set processing options for the Payroll Build T5018 Workfile program (R77603).

18.11.1 Understanding the Account Number Setup for Company and Contractors

You must use the TX2 (Additional Tax Id) field in the Address Book to setup the Company's account number.

You must use the TX2 (Additional Tax Id) field in the Address Book to set up contractor's account number. If the contractor does not provide the account number, leave the TX2 field blank or enter a value of 000000000RT0000, 000000000RP0000, 000000000RZ0000 or 000000000 for default company. In this case, the system uses the SIN value from the TAX field in Address Book. The system does not consider the suppliers with default company for summarization and reports them separately.

18.11.2 Understanding the Changes to the Canadian Tax Info by EE Program

To distinguish contractors from other types of records, you must define the value of C for contractors in the Contract/Pensioner/Non-Resident Flag field on the Federal tab of the Canadian Tax Info by EE program (P771015). You use this program to set up the employee records for contractors with tax history type C. The system stores this value in the TaxCalcMethod (FICM) of the F060116 table. Then, when you run payroll, the system automatically updates this value of C as tax history type in the history tables F0713, F0716, F06146, and F06156.

|

Note: To update the records that existed in the history tables before taking the Canada T5018 ESU with the tax history type field to C, you need to run the Convert Tax History in F0713/F0716/F06146/F06156 program (R77601). Running this program updates the history type field for Canadian Employees with C in the FICM field of the F060116 table. You must run this program before you run the next payroll after taking the T5018 ESU. |

18.11.3 Understanding the Convert Tax History Type in F0713/F0716/F06146/F06156 to C Program

You run the Convert Tax History in F0713/F0716/F06146/F06156 to C program to update the value of contractors in the Tax History Type field (THTY)to C in the history tables F0713, F0716, F06146, and F06156. The Tax History Type is a field in the history tables. When you run this program, the system updates the tax history type to a value of C for all contractor records. The system identifies contractor records by the value of C in the FICM field of the F060116 table.

You need to run this report only once after taking the ESU when you have contractor records.

|

Important: After taking the Canada T5018 ESU and before you run the next payroll, you must run the Convert Tax History in F0713/F0716/F06146/F06156 to C program. If you have contractors and you run the payroll after taking the ESU and without running this program, the system causes incorrect data for T5018 that will have to be corrected manually. The Oracle JD Edwards EnterpriseOne system does not support any application to correct data in this case. |

18.11.4 Understanding the Payroll Build T5018 Workfile Program

You run the Payroll Build T5018 Workfile program to insert records with a tax history type of C for contractors from the F0716 table to the F046141 table. You can run this report for a calendar or a fiscal year. This program inserts only the original records and, for any amended or cancelled records, use the Enter T5018 Workfile Adjustments program.

|

Note: If you run the Payroll Build T5018 Workfile program for a large number of records and then need to revert, you must use the Clear T5018 Workfile program (R04616). Alternately, for reverting a smaller number of records, you can use the Enter T5018 Workfile Adjustments program. |

18.11.5 Running the Convert Tax History Type in F0713/F0716/F06146/F06156 to C Program

Type BV in the Fast Path, enter R77601 in the Batch Application field, and then select the version to run the report.

18.11.6 Running the Payroll Build T5018 Workfile Program

Select Payroll T5018 (G07BTAXCA3), Payroll Build T5018 Workfile.

18.11.7 Setting Processing Options for Convert Tax History Type in F0713/F0716/F06146/F06156 Program (R77601)

Processing options enable you to specify the default processing for programs and reports.

18.11.7.1 Process

These processing options specify how the value of TaxHistoryType (THTY) is updated in F0713, F0716, F06146, and F06156 tables. The system updates the contractor payroll history records based on reporting year and address number.

- Proof and Update Mode

-

Use this processing option to specify whether to run the report in proof or update mode. If you run the report in proof mode, the system does not update records for any table. To update records in the F0713, F0716, F06146, or F06156 table, you must run the report in the update mode.

- Beginning Year

-

Use this processing option to specify the year from when the records have to be modified to value of C for contractors in the Tax History Type field of the history tables. The system runs this report till the current date.

18.11.8 Setting Processing Options for Payroll Build T5018 Workfile Program (R77603)

Processing options enable you to specify the default processing for programs and reports.

18.11.8.1 Process

These processing options specify how the program will build and update the F046141 workfile. The system processes contractor payroll history records based on pay period dates and address number.

- Proof and Final Mode

-

Use this processing option to specify whether to run the report in proof or final mode. If you run the report in proof mode, the system does not insert records into any tables. To insert the records in the F046141 table, you must run the report in final mode.

- Pay Period Begin Date

-

Use this processing option to specify the date from which you want to run the report.

- Pay Period End Date

-

Use this processing option to specify the date through which you want to run the report.

18.12 Clearing the T5018 Tax and Work Files

This section provides overviews of the Clear T5018 Workfile and Clear T5018 Tax file programs and discusses how to:

-

Run the Clear T5018 Workfile program (R04616).

-

Run the Clear T5018 Tax file program (R04617).

18.12.1 Understanding the Clear T5018 Workfile Program

You must ensure that you run the Clear T5018 Workfile to delete prior year records from the T5018 Tax Workfile (F046141) before you begin processing T5018 returns for the current year. Thereafter, do not run this program for the current year unless you make a mistake like running the Build T5018 Workfile - A/P program (R04614) twice for the same type of return, and you cannot easily correct errors by adjusting records in the F046141 workfile.

The Clear T5018 Workfile program removes all records in the F046141 table, including any adjustments that you entered using the Enter T5018 Workfile Adjustments program (P04610). The Build T5018 Workfile - A/P program (R04614) adds records to the F046141 table each time you run it.

|

Note: If the data in the F046141 table is important, take a backup of the F046141 table before you clear it. You need this data in case of an audit for that year. |

18.12.2 Understanding the Clear T5018 Tax File Program

When you process T5018, ensure that you run the Clear T5018 Tax file program to delete prior year records from the T5018 Tax File (F04614) before you begin processing T5018 returns for the current year. Thereafter, do not run this program for the current year unless you make a mistake like running the Build T5018 Workfile - A/P program twice.

The Clear T5018 Tax file program removes all records in the F04614 table. The Build T5018 Workfile - A/P program adds records to the F046141 table each time you run it.

|

Note: If the data in the F04614 table is important, take a backup of the F04614 table before you clear it. |

18.13 Building the T5018 Workfile

This section provides overview of the Build T5018 Workfile - A/P program, lists prerequisites, and discusses how to:

-

Run the Build T5018 Workfile - A/P program.

-

Set processing options for the Build T5018 Workfile - A/P program.

18.13.1 Understanding the Build T5018 Workfile - A/P Program

The Build T5018 Workfile - A/P program (R04614) builds the F046141 table, which you use to generate T5018 returns. This program selects all paid vouchers that have the code 7 as CT for the current reporting year for the suppliers who have a value of 1, 2, 6, C, P, T, or blank in the Person/Corporation code in the Address Book system. The system uses these tables to build the T5018 Tax Workfile:

-

Accounts Payable Ledger table (F0411).

-

Accounts Payable-Matching Document table (F0413).

-

Accounts Payable Matching Document Detail table (F0414).

The Build T5018 Workfile - A/P program also uses processing options to define the ending date for the one year period for which to create records in the T5018 Tax Workfile.

The Build T5018 Workfile - A/P program does not generate a report. You must view Work Center messages to ensure that the program finished successfully.

After you build the F046141 workfile, you can use the Enter T5018 Workfile Adjustments program (P04610) to view the records generated and adjust them as needed. When you adjust records in the F046141 workfile, the system does not change any data in the accounts payable tables. The workfile is used only to gather information to be reported to the CRA on T5018 forms, and is not used for any other purpose.

Each time that you run the Build T5018 Workfile - A/P program, the system adds records to the existing records in the workfile.

|

Important: Back up the F046141 table nightly and keep a record of the adjustments that you enter daily using the Enter T5018 Workfile Adjustments program. If you must clear the F046141 table because you erroneously updated existing records, you can restore the F046141 table, rerun the Build T5018 Workfile - A/P program using different data selection, and then re-enter only those adjustment records that were entered since the last backup. |

18.13.2 Prerequisites

Before completing the tasks in this section:

-

(Release 9.1 Update) Add or change the Category Code 07 field value for voucher pay items using the Speed Status Change (P0411S) program, as necessary.

To change the value of the single voucher, enter a value "P" in the Pay Status field on the Work with Speed Status Change form. Access the Update Single Pay Item form to add or change the category code 7 value. The value is updated for the selected voucher(s) in F0411 table.

To change the value of multiple vouchers, enter a value "P" in the Pay Status field on the Work with Speed Status Change form. Access the Global Updates form to add or change the category code 7 value. The value is updated for the selected voucher(s) in F0411 table.

-

Run the Clear T5018 Workfile program (R04616) to delete prior year records in the F046141 table.

-

Run the Clear T5018 Tax file program (R04617) to delete prior year records in the F04614 table.

18.13.3 Running the Build T5018 Workfile - A/P Program

Select Canadian T5018 Processing (G04223), Build T5018 Workfile - A/P.

18.13.4 Setting Processing Options for Build T5018 Workfile - A/P Program (R04614)

Processing options enable you to specify the default processing for programs and reports.

18.13.4.1 Process

These processing options specify how the program will build and update the F046141 workfile. Vouchers are selected based on reporting year and address number.

- T5018 Reporting Date

-

Use this processing option to specify the date for T5018 reporting. The system selects only those vouchers that were paid within one year previous to that date.

- Alternate Address Combining Method

-

Use this processing option to specify which address number the system will use to update the F046141 table. If you leave this processing option blank or if the specified alternate address number is blank, the system uses the original address number (AN8) of the T5018-eligible voucher. Values are:

Blank: The system uses the original address number (AN8).

1: First alternate address (AN81).

2: Second alternate address (AN82).

3: Third alternate address (AN83).

4: Fourth alternate address (AN84).

5: Fifth alternate address (AN86).

6: Factor/special payee (AN85).

7: Parent number (PA8).

The workfile record is written with the tax ID for suppliers and additional tax ID for companies specified in the Address Book Master table (F0101) for the address number that you specify in this processing option. If the workfile already contains a record for that same address number, the existing record is updated with the added amount.

18.14 Reviewing Records in the T5018 Workfile Table

This section provides an overview of T5018 Workfile record review and discusses how to review records in workfile.

18.14.1 Understanding T5018 Workfile Record Review

After you use the Build T5018 Workfile - A/P program to build the F046141 table, you can review the records by supplier in the F046141 workfile using the Enter T5018 Workfile Adjustments program (P04610).

After you review the records in the F046141 table, you can use the Enter T5018 Workfile Adjustments program to add, change, or delete records.

If data is from a source outside of the EnterpriseOne system, you must first manually add the records to the F046141 workfile using the Enter T5018 Workfile Adjustments program. Then, you can review them using the same program. To be able to add a record from an outside source, you must use a supplier that has a valid address book record with a Person/Corporation Code value of 1, 2, 6, C, P, T or blank.

18.14.2 Form Used to Review Records in the T5018 Workfile Table

| Form Name | FormID | Navigation | Usage |

|---|---|---|---|

| Adjust T5018 Workfile Records | W04610B | Canadian T5018 Processing (G04223), Enter T5018 Workfile Adjustments

Select a record and click Select. |

Review record information. |

18.14.3 Reviewing Records in Workfile

Access the Adjust T5018 Workfile Records form.

Review the amount, source system, record type, and other tax fields and click the OK button.

- Amount

-

Enter a value that identifies the amount that the system adds to the account balance of the associated account number. Enter credits with a minus sign (-) place before or after the amount.

- Recipient Tax ID

-

Enter the 15-character account number that consists of the nine-digit business number, a two-letter program identifier, and a four-digit reference number assigned by CRA or the SIN of the recipient. This applies to Canadian T5018 processing.

- Co

-

Enter a value that identifies a specific organization, fund, or other reporting entity. This value must exist in the Company Constants table (F0010) and must identify a reporting entity that has a complete balance sheet. At this level, you can have intercompany transactions.

You can use the company 00000 for default values such as dates and automatic accounting instructions. However, you cannot use company 00000 for transaction entries.

- Report Type Code

-

Enter a code that indicates whether T5018 returns are original, amended or cancelled. Valid values are:

-

Original

-

Amended

-

Cancelled

Note:

If you change the record type of a record, then the system changes the record type for all records having same combination of Payor Account Number and Payee Account Number. -

- Source System

-

Select a value to identify the source of the Canadian T5018 tax record. Valid values are:

-

0: Accounts Payable

-

1: Payroll

-

18.15 Previewing T5018 Workfile

This section provides an overview of the Preview T5018 Workfile report, lists common error messages on T5018 Workfile report, and discusses how to:

-

Run the Preview T5018 Workfile report (R04612).

-

Set processing option for the Preview T5018 Workfile report (R04612).

18.15.1 Understanding the Preview T5018 Workfile Program

You use the Preview T5018 Workfile program to generate the T5018 Workfile report. This report displays information in the workfile in a simplified way for the user to be able to comprehend. It also marks invalid, blank, and duplicate tax IDs and displays the appropriate error messages. You can use this report to verify whether the Tax ID setup is correct.

18.15.2 Common Error Messages on T5018 Workfile Report

Running the T5018 Workfile report can alert you to potential problems with your T5018 information. The T5018 workfile reports print error messages that you can use to review and correct your T5018 information before running the Write T5018 Media program. This table lists common error messages and causes that appear on T5018 workfile report:

| Error | Cause |

|---|---|

| Alternate Company Address | Company's alternate address number is the same as the address book number of a different company. |

| Blank Company Number | The company number in the GL Worktable is blank. |

| Blank Payor BN | The address book record for the company does not have a payor business number. |

| Blank Recipient BN | The supplier master record for the supplier does not have a recipient business number. |

| Blank Recipient/Payor BN | The address book record for the company and supplier do not have a business number. |

| Duplicate Payor BN | A record has already been processed with the same recipient business number, but with a different company number.

When you run the Write T5018 Media program, the system reports the combined T5018 information of the companies and uses the mailing address and other company information of the last company that it processes (first one processed in descending order). You must research this error to determine whether the companies should be combined. |

| Duplicate Recipient BN | A record has already been processed with the same recipient business number but with a different supplier number.

When you run the Write T5018 Media program, the system reports the combined T5018 information of the suppliers and uses the address number and mailing address of the last supplier (first one processed in descending order). You must research this error to determine whether the suppliers should be combined. |

| Duplicate Recipient/Payor BN | A record has already been processed with the same recipient business number, but with a different supplier number and with the same payor business number and different company number. |

| Invalid Payor BN | A record has already been processed with the same company number, but with a different payor business number. |

| Invalid Recipient BN | A record has already been processed with the same supplier, but with a different recipient business number. |

| Invalid Recipient/Payor BN | A record has already been processed with the same supplier and company number, but with a different payor and recipient business number. |

| Missing Company Address # | An address book record does not exist for the company. |

You must investigate these error messages and make any necessary corrections before you process T5018 returns.

18.15.3 Running the Preview T5018 Workfile Report

Select Canadian T5018 Processing (G04223), Preview T5018 Workfile.

18.16 Working With the Write T5018 Media Program

This section provides an overview of the Write T5018 media program, lists prerequisite, and discusses how to:

-

Run the Write T5018 Media program (P04615).

-

Run the Write T5018 Media report (R04615).

18.16.1 Understanding the Write T5018 Media Program

You print T5018 returns and distribute them to suppliers so that the suppliers have legal documents to support the information they provide to CRA on their tax returns. To print the T5018 returns, use the Write T5018 Media program (P04615).

The Write T5018 Media program summarizes data from the F046141 table and stores it in the F04614 table. The program then transfers the data from the F04614 table to the T5018 form and reporting medium that you will send to the supplier and the CRA, respectively.

The Write T5018 Media program consists of this program and report:

-

The Write T5018 Media program (P04615). You use the Write T5018 Media form to select the report type (proof report, preprinted forms, and XML) in which to generate T5018 information and the generation method.

-

The Write T5018 Media report (R04615). After you select the report type and click OK on the Write T5018 Media form, the system prints a report if run in final mode. This report when run in any other medium than proof, contains summary information for the type of return you select and is followed by one of these reports based on the medium you selected:

-

T5018 XML Generation (R046151)

-

T5018 Pre-Printed (R046152)

-

T5018 Proof (R046153)

Each of these reports generates and prints T5018 information. The Write T5018 Media report does not include processing options. It prints information based on the processing options in the Write T5018 Media program (P04615)

Note:

Oracle recommends that you perform validation against the CRA Schema available at the linkhttp://www.cra-arc.gc.ca/esrvc-srvce/rf/mgmd/dnwldschm-eng.htmlusing a validating parser to ensure that the XML does not have any errors.Form or Report Description T5018 XML Generation Prints the T5018 information in XML format. You use this report to submit to CRA. T5018 Pre-Printed Prints information on preprinted T5018 forms. For each supplier that receives a T5018 form, the T5018 return information prints in the appropriate information. Each return includes the supplier's legal name, along with the mailing address and the Canadian account number for the supplier, as well as the company that is responsible for the payments to the supplier.

T5018 Proof Prints a preliminary review of the information that you will send to the CRA. Oracle strongly recommends that you print this report and scrutinize its results.

You can make adjustments to the F046141 and F04614 tables and rerun this program as many times as necessary to ensure that the returns are correct before you do the final T5018 processing.

To determine the company address to print on the T5018 returns, the Write T5018 Media program compares the company number in the F04614 workfile with the address in the Company Constants table (F0010). If the values are different, the program uses the mailing address from the address book number in the F0010 table on the T5018 forms and electronic media.

-

18.16.1.1 Testing T5018 Form Alignment on the Printer

Because different printers print the same PDF report slight differently, you might encounter issues if you test the alignment of the T5018 forms on one printer, and then print the final forms on another printer. You should test the layout of the T5018 forms and print the final T5018 forms on the same printer.

18.16.1.2 Using Multiple Versions of the Write T5018 Media Program

Clients with multiple companies can print T5018 forms separately for each company in their organization. You must set up print versions of the Write T5018 Media programs, such as R04615 and R046152, to print specific T5018 forms by company or to print corrected returns by supplier. You must make a data selection on the R04615 version for all combinations of reporting medium and generation type, but for the combination of Refresh and Proof, you must make data selection on the R046153 version instead of R04615.

|

Note: Use the Write T5018 Media program (P04615) to create files for electronic filing and print T5018 forms. Because the program is used for different purposes, make sure that you do not inadvertently use a print version of the Write T5018 Media program (R04615 and R04615x) with data selection to create an electronic file. The electronic file that you submit to the CRA must include all T5018 information. |

18.16.2 Prerequisite

Before printing T5018 return, ensure that you have built the T5018 Workfile table (F046141).

From a fat-client, you must complete these steps before using the T5018 XML Generation (R046151) for the first time:

-

Set the Start Date from XML Publisher Object Repository (P95600) from the Effective Dates option on the Row menu for the template TP046151.

-

Create a F983052 Version List Tag record and connect the batch version to the report definition from the Batch Versions program (P983051):

-

Find the XJDE0001 version of T5018 XML Generation.

-

Check out (Advanced row exit).

-

Select a report definition (Version Detail row exit, form exit Report Definition, enter Report Definition).

-

Check in (Advanced row exit)

-

From a web client, you must complete these steps before using the T5018 XML Generation for the first time:

-

Complete the A/P Build T5018 Workfile (R04614).

-

Once this workfile is built, launch the Write T5018 Media program (P04615) and select report medium as XML. This will launch the T5018 XML Generation report (R046151).

-

From the Work With Submitted Jobs form, verify that the R046151 Submit Type is RD (Report Definition Submission).

-

Select View RD Output from the Row menu and then select View Output from the Row menu.

18.16.3 Form Used to Print T5018 Return with the Write T5018 Media Program

| Form Name | FormID | Navigation | Usage |

|---|---|---|---|

| Write T5018 Media | W04615B | Canadian T5018 Processing (G04223), Write T5018 Media | Print T5018 returns. |

18.16.4 Printing T5018 Returns

Access the Write T5018 Media form.

- Period Ending Date

-

Enter the date through which you want to print T5018 returns. This is the last day of the reporting period for the supplier that is included in this return.

- Generation Method

-

Select the generation method used to generate T5018 data to submit to the CRA. Options are:

-

Refresh: Select this option to refresh the data from the workfile and then inserting it in the tax file before displaying it.

-

Re-Print: Select to display the records from the existing ones in the tax file.

-

- Report Medium

-

Select the reporting medium used to submit T5018 data to the CRA. Options are:

-

XML: Select to create an XML file.

-

Pre-Print: Select to choose preprinted T5018 laser forms. The system prints information on these forms.

-

Proof: Select to print a proof report.

-

- Return Status

-

Select the status of the T5018 returns. Options are:

-

Original: Indicates that the T5018 return is the original return.

-

Cancelled: Indicates that the T5018 return is the cancelled return. The system prints Cancelled at the top of the T5018 form.

-

Amended: Indicates that the T5018 return is a corrected return. For preprinted forms, the system prints Amended at the top of the T5018 form.

-

- Submission Reference Number

-

Specify the reference number of the document during submission. You use this field when reporting T5018 data electronically, but you can also use this field when running printed forms if you want this information to print on the summary report for review purposes. The system allows you to enter a value in this field only for the XML reporting medium.

- Transmitter Number

-

Specify the company number. You use this field when reporting T5018 data electronically, but you can also use this field when running printed forms if you want this information to print on the summary report for review purposes. The system allows you to enter a value in this field only for the XML reporting medium.

- Company

-

Enter a value that identifies the transmitter company. The system retrieves the values in other transmitter fields on the XML based on this value.

- Contact E-Mail Address

-

Specify the email address of the person submitting the return for any future references. The system allows you to enter a value in this field only for the XML reporting medium. This is an optional field.

- Transmitter Type Indicator

-

Specify a value to indicate the transmitter type for the Canadian T5018 return filing. The system allows you to enter a value in this field only for the XML reporting medium. This is an optional field. Valid values are:

-

1: If you are submitting your returns.

-

2: If you are submitting returns for others, for example, service providers.

-

3: If you are submitting your returns using a purchased software package.

-

4: If you are a software vendor.

-

18.16.5 Setting Processing Options for the Write T5018 Media Program (P04615)

Processing options enable you to specify the default processing for programs and reports.

18.16.5.1 T5018

- 1. T5018 Minimum Amount

- Minimum Amount

-

Use this processing option to specify the minimum amount for reporting T5018. The system does not generate T5018 if the payee's amount is less than the specified minimum amount. If you leave this field blank, the system considers the default value of 0 for T5018 reporting amount.

- 2. Pre-Printed Report Output Format

-

Use this processing option to specify the number of copies of each slip to be printed. Valid values are:

0: Print 1 copy of each slip.

1: Print 3 copies of each slip.

Note (Release 9.1 Update):

If you specify the option to print three copies of T5018 slip, the system prints only two copies of the slip on one page and the third copy on the other page.