10 Working With E-Invoice Data Extraction and Response for Hungary

This chapter contains the following topic:

10.1 Understanding E-Invoice Data Extraction and Response

According to an announcement by the Hungarian government, businesses issuing B2B sales invoices by means of invoicing software are required to provide invoice data to the Hungarian Tax Authorities (HTA). This includes all receivables transactions performed with other businesses that have Hungarian tax numbers with a VAT amount equal to or above 100,000 HUF. This thresh-hold can be lower if the taxpayer decides so.

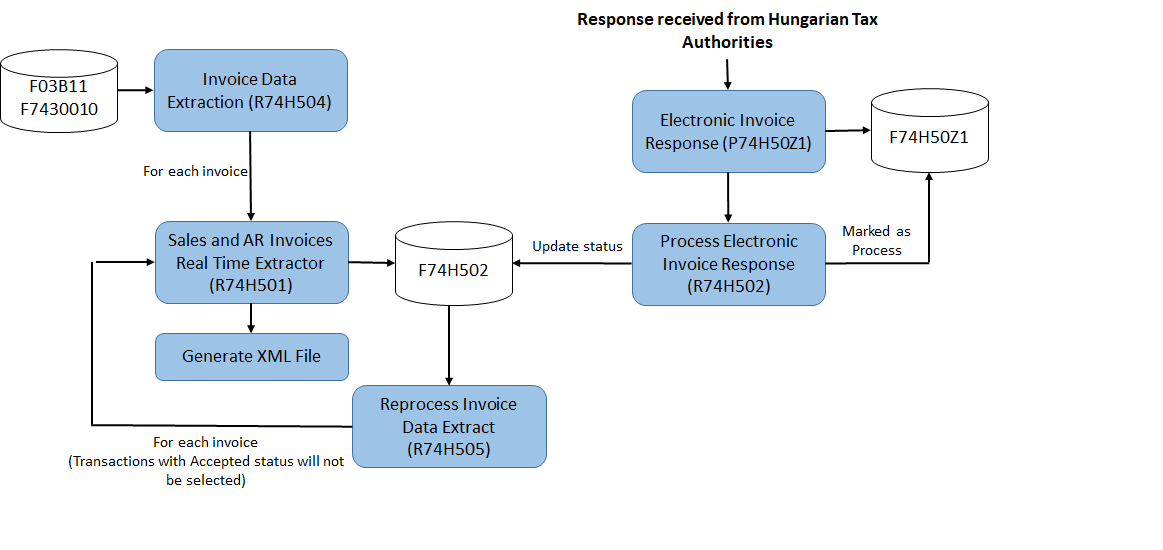

This image shows the business process flow of e-invoice extraction and response processing in the JD Edwards EnterpriseOne solution.

10.1.1 Understanding System Setup for E-Invoice Data Extraction and Response

You use the Product Code Setup program (P74H501) to update product code value and product code category on the Item Master program (P4101) and Item Branch/Plant program (P41026). You can set up the product code value for all branch/ plants of the same item.

You use the Response Result Code Setup program (P74H503) to set up the validation result codes for the invoice entries received from the Hungarian Tax Authorities. The system stores these validation result codes in the Validation Result Code Setup table (F74H503). For example, you set up the Transmitted Status Code as A for Success and R for Failure.

10.1.2 Prerequisites

Before you process the e-invoice data extraction and response:

-

Verify that the existing e-invoice generation process is complete before you run the R74H504 report.

-

Set up the validation result codes for the invoice entries received from the Hungarian Tax Authorities using the Response Result Code Setup program (P74H503).

-

Verify that the sales update process is complete and posted for SOP transactions.

-

Verify that the product code value and the product code category are updated through the Item Master program (P4101) and the Item Branch/Plant program (P41026). To update the product code value and the product code category, use the Product Code Setup program (P74H501).

10.1.3 Extracting Invoice Data

You use the Invoice Data Extract program (R74H504) to extract the invoice data of the domestic and non-void transactions and submit to the Hungarian Tax Authorities. The R74H504 report extracts the invoice data from the Customer Ledger table (F03B11) and the Legal Document Header table (F7430010).

If there is an error in the selection of a transaction due to validation failure, the Invoice Extraction Error report (R74H503) displays the details of the transactions with error. The system validates the transaction based on the minimum invoice VAT amount value specified in the processing option.

After you extract the invoice data, the system runs the Sales and AR Invoices Real Time Extractor program (R74H501) to extract the sales and accounts receivable invoice data for each processed invoice and export it to XML files. The exported transactions are stored in the Extracted Transactions Detail table (F74H502) with Submitted (S) status.

Before you begin, set the processing options for the R74H504 program.

Default

-

Company

Specify a country code that identifies a specific organization, fund, or other reporting entity.

-

Date From

Specify the beginning date for the transaction code.

-

Date Thru

Specify the ending date for the transaction code.

-

Select Date

Specify the date type that the system uses to select records to process.

-

Threshold VAT Amount

Specify the minimum invoice VAT amount that the system uses to select records to process. The value for this processing option must be greater than zero.

-

Fiscal Representative

Specify the address book number of the Company's fiscal representative. If you leave this processing option blank, the system uses the Company's address number as a fiscal representative.

-

Invoice Appearance

Specify the predefined lookup codes that identifies the physical appearance of the invoice document. Use this field to print the value of InvoiceAppearance tag in the Hungary E-Invoice Data Extract XML. If you leave this processing option blank, the system uses the default value as PAPER.

10.1.4 Reprocessing Invoices Data Extraction

You use the Reprocess Invoice Data Extract program (R74H505) to reprocess the electronic invoices data and submit to the Hungarian Tax Authorities. You use this program to reprocess the invoice data of the transactions that are not approved by the Hungarian Tax Authorities. When you run this report, the system excludes the invoices with status value as Approved in the Extracted Transactions Detail table (F74H502). You can use the external data selection on the Transmitted Invoice Status column of the F74H502 table to select the transactions having errors.

Before you begin, set the processing options for the R74H505 program.

Default

-

Company

Specify a country code that identifies a specific organization, fund, or other reporting entity.

-

Date From

Specify the beginning date for the transaction code.

-

Date Thru

Specify the ending date for the transaction code.

-

Select Date

Specify the date type that the system uses to select records to process.

-

Threshold VAT Amount

Specify the minimum invoice VAT amount that the system uses to select records to process.

-

Fiscal Representative

Specify the address book number of the Company's fiscal representative. IIf you leave this processing option blank, the system uses the Company's address number as a fiscal representative.

-

Invoice Appearance

Specify the predefined lookup codes that identifies the physical appearance of the invoice document. Use this field to print the value of InvoiceAppearance tag in the Hungary E-Invoice Data Extract XML. If you leave this processing option blank, the system uses the default value as PAPER.

10.1.5 Processing Electronic Invoice Response

You use the Electronic Invoice Response program (P74H50Z1) to upload the response file received from the Hungarian Tax Authorities in the Electronic Invoice Response File table (F74H50Z1). You use the import data feature from the P74H50Z1 program to upload the response data in Excel format. If the status code is left blank, the P74H50Z1 program retrieves the value from the Message column from the Response Result Code Setup program (P74H503). You can edit the transaction status from the P74H50Z1 program.

You use the Process Electronic Invoice Response program (R74H502) to view the records processed successfully and to update the invoice status in the Extracted Transactions Detail table (F74H502). The R74H502 program updates the invoice status based on the data available in the F74H50Z1 table. The JD Edwards EnterpriseOne system uses Company and Legal Invoice Number fields to identify and retrieve records from the F74H502 table to reprocess the response invoice data.The R74H502 report does not select the transaction if the Processed Flag column value of the transaction is Y in the F74H50Z1 table or the invoice number of the transaction is not available in the F74H502 table.

10.1.6 Extracted Transactions Detail

You use the Extracted Transactions Detail program (P74H502) to view the status codes of all transactions. You can edit the status codes of the transactions from the P74H502 program. You cannot edit the status code of the accepted transactions. Additionally, you can delete the transactions using the R74H502 program. You cannot delete the transactions with A - Approved status using this program.