Oracle® Insurance Rules Palette 9.4.0.0 E18894_01

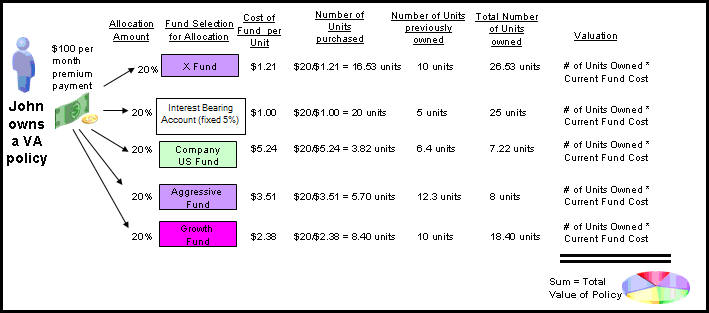

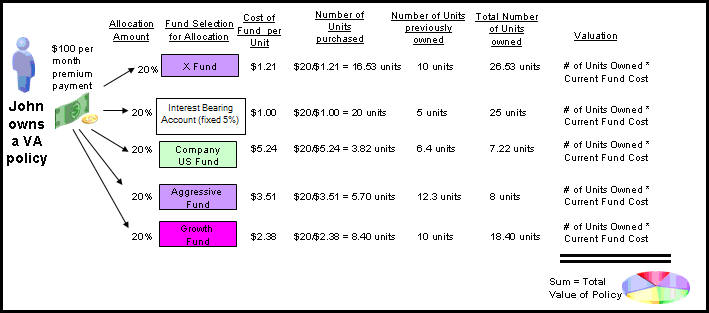

Valuation is the calculation of a policy’s worth. Valuation is a process that calculates the policy’s current fund and deposit values. A policy that performs valuation calculations must be one that accumulates cash value, such as a Variable Annuity. A policy such as Term Insurance does not accumulate cash value, so there is no value to calculate.

The calculation of a policy’s value is determined by the type of funds in the policy. A policy owner invests money in a policy by making deposits into specific fund(s). The value of a policy depends on the amount and type of funds the policy owner has elected to purchase and how they perform in the marketplace. The policy owner may move money out of funds or transfer between funds, which will also affect the policy’s value. The movement of money in and out of a policy requires complex calculations and logic. The OIPA system offers an agile environment that can support the various configuration scenarios needed to manage a wide array of valuation requirements and fund types.

There are two different methods of configuration valuation: traditional and point-in-time. When traditional valuation is used, all policy valuation calculations are made using all data from the inception of the fund. When Point-in-Time valuation is used, policy valuation calculations are made using values from the last processed valuation, rather than from inception. Since traditional valuation must recalculate all valuation data each time valuation is processed, it is much more resource intensive than Point-in-Time valuation.

Simplified Valuation Diagram

Unit linked funds require a special type of valuation. Since an activity

When configuring valuation the following areas should be considered:

Funds

Allocations

Transactions

Assignments

Any additional rules to enhance processing

Copyright © 2009, 2011, Oracle and/or its affiliates. All rights reserved. Legal Notices