Understanding Payroll Data Processing to GLI

Understanding Payroll Data Processing to GLI

This chapter provides overviews of payroll data processing to general ledger interface (GLI), accrued salary and bonus calculation, and leave liability calculation, and discusses how to:

Link journal types to general ledger groupings.

Report leave liability and absence history.

Run the GLI processes.

Remap ChartFields after initial calculation.

Understanding Payroll Data Processing to GLI

Understanding Payroll Data Processing to GLI

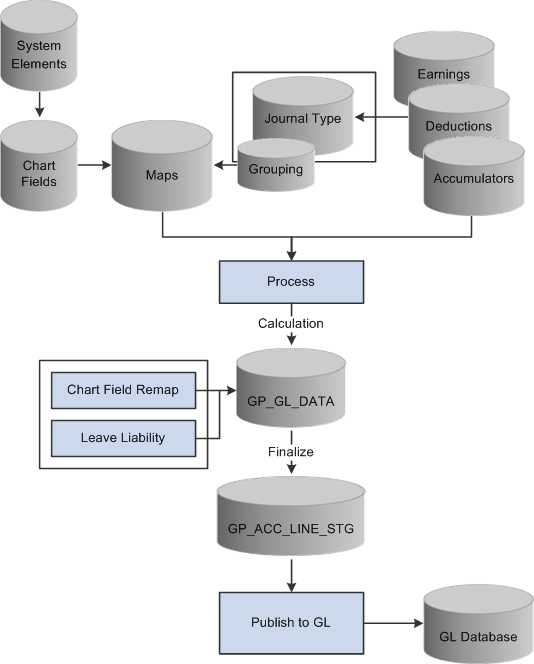

This diagram illustrates the processing of payroll data for the GLI:

Malaysia GLI Processing

The two shaded boxes with borders show the added local functionality. The selected check boxes represent the options that are on the processing page. Note that the Leave Entitlement option updates data in the GP_GL_DATA table for inclusion in the output to the GLI.

See Also

Reporting Leave Liability and Absence History

Linking Journal Types to General Ledger Groupings

Remapping ChartFields After Initial Calculation

Understanding Accrued Salary and Bonus Calculation

Understanding Accrued Salary and Bonus Calculation

The following earnings, which are contained in the EARNINGS GLI section, are provided to calculate the current value of leave entitlements. They are all for use by the general ledger only and should not add to gross or net accumulators. The system calculates GLI earnings in the last period of the month, or on termination. The earnings are not paid but are used for GLI reporting of annual leave liability and the reversal of liabilities on termination:

LIAB ANN DYS

This is the leave liability earning for the standard annual leave entitlement in days.

LIAB TER DYS

This is the leave liability earning that is used for reversing the liability on termination.

SAL ACCRUAL

This is the salary accrual earning that is used to accrue a percentage of earnings. It is used for reporting accrued salary when the pay period end is earlier than the financial period. You decide on the percentage to accrue by using GLI VR PCTSALACR.

CT BON ACCR

In Malaysia, two types of bonuses are paid to employees as incentives: contractual bonuses and noncontractual bonuses. This is the bonus accrual earning that is used to accrue a percentage of a contractual bonus. Bracket GLI BR CTBONPCT determines the percentage of the monthly salary that is accrued. Formula GLI FM BONUSACC determines the accrual entitlement. Both the entitlement bonus (one unit per month) and the amount are accrued.

NCT BON ACCR

This is the bonus that accrual earnings use to accrue a percentage of a noncontractual bonus. Bracket GLI FM NCTBONPCT determines the percentage of the monthly salary that is accrued. Formula GLI FM BONUSACC determines the accrual entitlement. Both the entitlement bonus (one unit per month) and the amount are accrued.

Note. If the end date of the last pay period in a month is before the end of the accounting period, you can send a percentage of total salary as the accrued costing for the gap that is between the two dates. The value that is set to General Ledger is reversed by the Financials system the following month, and it is replaced by actual costings.

See Also

Reporting Leave Liability and Absence History

Understanding Leave Liability Calculation

Understanding Leave Liability Calculation

This section discusses:

Leave liability.

Reversal of leave liability on termination.

Leave Liability

Leave LiabilityThe amount of leave that an employee is owed needs to be considered as a liability in the general ledger. For leave liability reporting, Global Payroll for Malaysia uses earnings that store the monetary value of each employee's leave entitlement. The earnings are not paid as earnings because they do not contribute to MYS GROSS SALARY. Consequently, they appear in a section of their own, following the other earnings sections.

Because the GLI flat file requires only the difference between the liability for the last pay period and the current pay period, that difference is calculated by the Application Engine Leave Liability process and passed to GP_GL_DATA.

If an employee is terminated, the stored value of the processed liability must be reversed in the general ledger, because it is no longer a liability.

Reversal of Leave Liability on Termination

Reversal of Leave Liability on Termination

The earning element LIAB TER DYS is the leave liability earning that is used for reversing the liability on termination.

This earning element uses an amount calculation rule if the amount is derived from earning element LIAB ANN DYS. The generation control element CMN GC TERM STAT checks only for terminated employees by using the formula CMN FM TERM STAT. This formula determines whether the employee is currently terminated (that is, the termination date is in the current segment) or the employee was terminated in the past but the termination is entered in the current period. The termination leave liabilities are calculated only when an employee is terminated so that they reverse any remaining liabilities that are in the general ledger.

The earning element LIAB TER DYS contributes to the accumulator LIAB TER DYS_FPTDA.

If an employee is terminated, the leave balance liability earning value becomes the termination liability earning for reversal.

See Also

Reporting Leave Liability and Absence History

Linking Journal Types to General Ledger Groupings

Linking Journal Types to General Ledger Groupings

To set up journal type links to GL groupings, use the Journal Type MYS (GPMY_GL_GROUP) component.

This section provides an overview of linking journal types to general ledger groupings and lists the page used to link journal types to general ledger groupings.

Understanding Linking Journal Types to General Ledger Groupings

Understanding Linking Journal Types to General Ledger GroupingsYou report payroll data to the general ledger by journal type by linking a journal type to a general ledger grouping.

Link journal types to groupings on the Journal Type page. A grouping comprises entry types of earnings, deductions, or segment accumulators. The five delivered journal types are salary, accrual, employee entitlements, statistical, and terminated EE's entitlement (terminated employee's entitlement).

Note. The Leave Entitlements Application Engine process selects data for inclusion in the GPMY_LEAVE_LIAB record (from GP_GL_DATA) by the flags for the journal types employee entitlement and terminated EE's entitlement. Therefore, any organization that needs to resolve leave entitlement calculations that are within the leave entitlement phase of the GLI process needs to select a journal type for each general ledger grouping code that is associated with general ledger liability earning codes.

This table illustrates setup:

|

Grouping Code |

Element |

Journal Type |

|

Accrual |

CT BON ACCR and NCT BON ACCR. |

Accrual. |

|

Earnings |

MYS GROSS (segment accumulator). |

Salary. |

|

Deductions |

MYS DEDUCTIONS. |

Salary. |

|

Entitlements |

LIAB ANN DYS (earning). |

Employee Entitlement. |

|

Termination |

LIAB TER DYS (earning). |

Terminated Annual Liab Days (terminated annual liability days). |

Page Used to Link Journal Types to General Ledger Groupings

Page Used to Link Journal Types to General Ledger Groupings|

Page Name |

Definition Name |

Navigation |

Usage |

|

GPMY_JOURNAL_TYPE |

Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Integration, Journal Type MYS, Journal Type MYS |

Attach one journal type to each general ledger group. |

See Also

Reporting Leave Liability and Absence History

Remapping ChartFields After Initial Calculation

Reporting Leave Liability and Absence History

Reporting Leave Liability and Absence History

This section provides an overview of leave liability reporting and discusses how to:

Calculate annual leave for accrual in days.

Calculate annual leave liability for reversal on termination.

Calculate salary accrual earnings.

Calculate bonus accrual earnings.

Calculate noncontractual bonus earnings.

Reverse leave liability when the cost center changes.

Understanding Leave Liability Reporting

Understanding Leave Liability ReportingThe data that the report process extracts for leave liability reporting can be transferred to the general ledger through the GLI.

The reports and the interface depend on data that is created by using Global Payroll rules.

Note. In this section, the word reported means printed on a report and available for transfer to GLI.

Liability and absence history are calculated and reported for the administration of employee absences and leave. They are used to identify trends in absences and for costing purposes.

Liability is reported for annual leave that is accrued in days. The values are calculated as the earning LIAB ANN DYS. This earning does not contribute to the accumulator MYS GROSS.

When you run the liability report, the parameters include the element category. The earning LIAB ANN DYS is category ANN. The category value is assigned as a variable that is entered as a supporting element override for each earning.

Pages Used to Report Leave Liability and Absence History

Pages Used to Report Leave Liability and Absence History|

Page Name |

Definition Name |

Navigation |

Usage |

|

GPMY_RC_LVELIAB |

Global Payroll & Absence Mgmt, Absence and Payroll Processing, Reports, Leave Liability MYS, Leave Liability MYS |

Specify the population of employees for whom to report leave liability. You can specify an as of date, and you can report by element category. |

|

|

GPMY_RC_ABS_HIST |

Global Payroll & Absence Mgmt, Absence and Payroll Processing, Reports, Leave History MYS, Leave History MYS |

Specify the population of employees about whom to report the history. You can specify an absence type and the period that is to be reported. You can set up to three sort orders. |

Calculating Annual Leave for Accrual in Days

Calculating Annual Leave for Accrual in Days

The calculating rule for LIAB ANN DYS is unit rate, where unit is the formula GLI FM LIAB DAYS and rate is the formula LVE FM PAYRATE.

Leave liabilities are calculated at the end of each month for active employees, or when an employee is terminated. The generation control element GLI GC GENGLI verifies this by using the following formulas:

CMN FM LSTSEGMTH

This formula verifies that it is the last segment of the last pay for the month, and the employee is active.

CMN FM TERMIN

This formula determines whether the employee is terminated in this pay.

The element LIAB ANN DYS contributes to the accumulator LIAB ANN DYS_YTDA.

Calculating Annual Leave Liability for Reversal on Termination

Calculating Annual Leave Liability for Reversal on Termination

The calculation rule for LIAB TER DYS is amount, where amount equals the earning element LIAB ANN DYS.

The generation control element CMN GC TERMIN checks only for terminated employees by using formula CMN FM TERMIN. The formula CMN FM TERMIN determines whether the employee is currently terminated (that is, the termination date is in the current segment) or the employee was terminated in the past and the termination is entered in the current period. The termination leave liabilities are calculated only when an employee is terminated so that they reverse any remaining liabilities that are in the general ledger. No proration applies.

The element LIAB TER DYS contributes to the accumulator LIAB TER DYS_YTDA.

Calculating Salary Accrual Earnings

Calculating Salary Accrual Earnings

The calculation rule for SAL ACCRUAL is Base × Percentage, where base is the accumulator GLI AC RECPYMTS and percentage is the variable GLI VR PCTSALACR.

The variable GLI VR PCTSALACR enables you to enter the percentage that is to be accrued. You add the variable as a calendar-supporting element override on the last calendar of the month, so the variable's override levels should be set to pay calendar. The value of the variable varies according to the gap between the end of the pay period and the end of the financial period. You enter the value on the Pay Calendar SOVR's page because it depends on the number of days between the end of the pay period and the end of the month. Consequently, the override level for the pay calendar should be selected.

Accruals need to be calculated only in the last segment of each month and only for active employees. The generation control GLI GC SALACCR therefore includes the formula GLI FM GENSALACR, which returns a value that determines whether to pay the earning SAL ACCRUAL.

The earning SAL ACCRUAL contributes to the accumulator SAL ACCRUAL_YTDA.

Calculating Bonus Accrual Earnings

Calculating Bonus Accrual Earnings

The calculating rule for CT BON ACCR is amount, where amount equals the formula GLI FM CTBONACC.

You use formula GLI FM CTBONACC to determine the amount that each period accrues for contractual bonuses. The formula GLI FM BONUSACC determines whether a bonus is accrued. The bracket GLI BR CTBONPCT determines the percentage of salary to accrue.

Calculating Noncontractual Bonus Earnings

Calculating Noncontractual Bonus Earnings

The calculation rule for NCT BON ACCR is amount, where amount equals the formula GLI FM NCTBONACC.

You use the formula GLI FM NCTBONACC to determine the amount that each period should accrue for noncontractual bonuses. The formula GLI FM BONUSACC determines whether a bonus is accrued. The bracket GLI BR NCTBONPCT determines the percentage of salary to accrue.

Reversing Leave Liability When the Cost Center Changes

Reversing Leave Liability When the Cost Center Changes

The Leave Entitlements Application Engine process determines whether a change of ChartField exists for each employee. The ChartFields represent cost centers such as departments and pay groups. When the process detects a change, it reverses the liability from the center that stores the processed liability, and it sends the full amount of the new, unprocessed liability (not the difference) to the new cost center.

See Also

Linking Journal Types to General Ledger Groupings

Remapping ChartFields After Initial Calculation

Running the GLI Processes

Running the GLI Processes

This section provides an overview of the GLI process and discusses how to run the GLI process.

Understanding the GLI Process

Understanding the GLI ProcessThe calculation phase of GLI processing populates the GP_GL_DATA table. The Leave Entitlement process compares previous entitlement liability to current entitlement liability and loads the difference into GP_GL_DATA. After you update the GP_GL_DATA table, you can complete the standard core GLI process by running the Finalize process.

You can also run the GPMYS_GL_MAP Application Engine process that updates the ChartFields that are in GP_GL_DATA. The process selects and updates the necessary GP_GL_DATA records with specified ChartField overrides. When you run the GLI Finalize process, the data is summarized by using the chosen, remapped ChartFields for correct account mapping.

Note. You must finalize the payroll before obtaining up-to-date entitlement balances, upon which the liability calculation is based, for annual leave.

Pages Used to Run the GLI Processes

Pages Used to Run the GLI Processes|

Page Name |

Definition Name |

Navigation |

Usage |

|

GPMY_GL_PREPARE |

Global Payroll & Absence Mgmt, Time and Labor / GL Costs, Send Costs to GL MYS, Send Costs to GL MYS |

Initiate the processes for calculation of general ledger data, leave liability, ChartField remapping, finalization of the GLI, and statistical data updates. |

|

|

GPMY_GL_INQUIRY |

Global Payroll & Absence Mgmt, Time and Labor / GL Costs, Review GL Costing Info MYS, Review GL Costing Info MYS |

Review ledger data for an employee. |

Running the GLI Process

Running the GLI Process

Access the Send Costs to GL MYS page (Global Payroll & Absence Mgmt, Time and Labor / GL Costs, Send Costs to GL MYS, Send Costs to GL MYS).

|

ChartField Remap |

Select this option to enable the ChartField Remapping process (GPMYS_GL_MAP) when running the General Ledger process. The ChartField Remapping process updates ChartFields in GP_GL_DATA. The GLI finalize process summarizes the data by using the remapped Chartfields. |

Note. This page provides the additional processing phase options Leave Liability and ChartField Remap. These options are not available on the page that you access when you select Compensate Employees, Manage Payroll Process, Process (GP_GL_PREPARE).

Running the ChartFields Remapping Process

The ChartFields Remapping process:

Uses specified ChartField overrides and updates the GP_GL_DATA records.

Enables the GLI Finalize process to correctly summarize transactions by using the selected combination of ChartFields, grouping codes, and account values.

You run the new Application Engine program as part of the standard GLI process in the following sequence:

Ensure that the general ledger calculation phase is complete.

Run the new Application Engine process to perform department remapping.

You run the remapping process before the leave entitlement process. If you alter the remapping, you must rerun the calculate process. You can't rerun the remapping process until you run the calculation process.

Ensure that the general ledger leave entitlement phase is complete.

Run the GLI Finalize process.

Note. This process runs as a separate process and is not integrated into existing application engine processes. Thus, it does not affect the existing GLI.

See Also

Reporting Leave Liability and Absence History

Linking Journal Types to General Ledger Groupings

Remapping ChartFields After Initial Calculation

Remapping ChartFields After Initial Calculation

Remapping ChartFields After Initial Calculation

To remap ChartFields, use the GL Chartfield Remapping MYS (GPMY_GL_MAP) component.

This section provides an overview of ChartField remapping and discusses how to remap ChartFields after initial calculation.

Understanding ChartField Remapping

Understanding ChartField RemappingGlobal Payroll for Malaysia enables you to define ChartField remapping data that is used during the GLI process and to post payroll costs to differing levels of ChartFields based on General Ledger groupings codes or accounts. You can use the GL ChartField Remap page to set up general ledger ChartField parameters that enable you to remap default ChartFields after you run the initial Calculate process. For example, you might have a requirement that a higher level of ChartFields is attached to each of the account codes. Instead of using multiple departments for each account code, you might require one global ChartField level that covers all departments.

Page Used to Remap ChartFields After Initial Calculation

Page Used to Remap ChartFields After Initial Calculation|

Page Name |

Definition Name |

Navigation |

Usage |

|

GPMY_GL_MAP |

Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Integration, GL Chartfield Remapping MYS, GL Chartfield Remap |

Set up general ledger ChartField parameters that enable you to remap ChartFields after you run the initial Calculate process. You can configure and maintain general ledger remapping data, and you can set up different levels of ChartFields based on General Ledger groupings codes or accounts. |

Remapping ChartFields After Initial Calculation

Remapping ChartFields After Initial Calculation

Access the GL Chartfield Remap page (Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Integration, GL Chartfield Remapping MYS, GL Chartfield Remap).

ChartFields

ChartFields represent attributes of a payee, such as a department, company, or employee ID. When you send a payee's earnings, deductions, or accumulator amounts to General Ledger, you can also transmit the values that are associated with a specific combination of ChartFields for the payee.

|

Chartfields to be passed to GL (ChartFields to be passed to general ledger) |

A field appears for each ChartField that you set up on the ChartField page in Global Payroll. Select the ChartFields check boxes to specify whether to send specific ChartFields to the general ledger. During mapping, ChartFields can be used to cost to different account codes. You can then specify not to send the ChartFields to the general ledger and only send the values to the accounts. When integrating Global Payroll with General Ledger, you can remap ChartField values to a business unit's general ledger account numbers. To enter the new, remapped ChartField value, use the Transformed Values tab. |

Transformed Values

The default ChartFields values appear in the fields on the ChartFields tab. To remap the default settings, select the new values on the Transformed Values tab.

|

Account |

Select the General Ledger account number to which the ChartFields and grouping codes map. |

|

Grouping Code |

Select the code to map to the General Ledger account. This is the grouping code for the elements that are included in the General Ledger transfer. A grouping consists of entry types of earnings, deductions, or segment accumulators. Elements must exist in groups before they can be processed by General Ledger. Instead of entering earnings individually, you bundle them into one accumulator and create a grouping code for that accumulator. |

See Also

Reporting Leave Liability and Absence History

Linking Journal Types to General Ledger Groupings