Understanding the Organizational Structure

Understanding the Organizational Structure

This chapter provides an overview of the organizational structure in Global Payroll and discusses how to:

Define element groups.

Define eligibility groups.

Define pay entities.

Define pay groups.

Understanding the Organizational Structure

Understanding the Organizational Structure

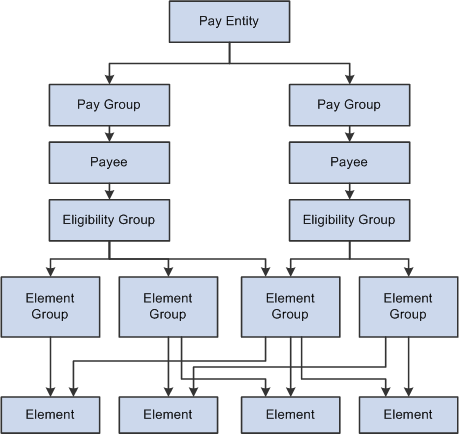

This diagram shows the components of the Global Payroll organizational structure for payroll processing:

Organizational structure of Global Payroll

Elements are the basic building blocks of Global Payroll. Element groups are used to communicate lists of elements to eligibility groups. Eligibility groups are associated with pay groups. Payees who share pay characteristics belong to pay groups. Multiple pay groups are linked to a single pay entity, the business organization that pays payees.

Eligibility groups and element groups are used to control which elements a payee receives. Element Groups contain individual elements such as earnings, deductions, absence entitlements, and absence takes. Eligibility Groups in turn contain Element Groups. This two-level approach allows for a more efficient setup, as illustrated by the following example.

Each payee is assigned to an eligibility group, such as an eligibility group for managers or one for staff employees. You might have some elements, such as management bonuses, for managers only; other elements, such as overtime, for staff employees only; and other elements, such as base pay and taxes, for which all payees are eligible.

Example

Suppose that you have two groups of payees—managers and staff employees—so you create two eligibility groups.

You have 50 earning elements. Of those, 10 earnings (E1-E10) are for managers only, 10 earnings (E11-E20) are for staff employees only, and 30 earnings (E21-E50) are for all payees. You have 20 tax deduction elements (D1-D20) for all payees and 10 voluntary deduction elements (D21-D30) available for managers only.

Without element groups, you'd have to add 70 elements to the management eligibility group and 70 elements to the staff eligibility group.

With the element group concept, you create five element groups:

Management Earnings (earnings that only managers receive).

Staff Earnings (earnings that only staff employees receive).

Common Earnings (earnings that are available to both groups of payees).

Taxes (the 20 deductions).

Voluntary Deductions (the 10 deductions for managers only).

This table lists the element groups that you would add to the eligibility groups:

|

Eligibility Group |

Element Group Members |

|

Management |

Management Earnings (E1-E10) Common Earnings (E21-E50) Taxes (D1-D20) Voluntary Deductions (D21-D30) |

|

Staff |

Staff Earnings (E11-E20) Common Earnings (E21-E50) Taxes (D1-D20) |

Another benefit of element groups becomes apparent if you add elements after initial implementation. Say that you create a new tax (D21) after implementation. Instead of having to add that new element to every eligibility group, you add it to one element group (Taxes).

Defining Element Groups

Defining Element Groups

To define element groups, use the Element Groups (GP_ELEMENT_GROUP) component.

This section provides an overview of element groups and discusses how to:

Name an element group.

Insert elements into element groups.

Understanding Element Groups

Understanding Element GroupsTo identify numerous elements, you can define element groups—groups of earnings, deductions, or absence elements. You can use element groups to:

Assign the same set of elements to a group of payees.

For example, you might group earnings into one element group and deductions into another and use only those two element group names to specify earnings and deductions. Or you might create one element group for hourly employees' earning elements and another for salaried employees' earning elements.

Identify the sets of elements to process during an off-cycle payroll.

When processing off-cycle transactions, such as payroll corrections or unscheduled payments, you can use the element group feature to specify which elements to process. You select the element set when you enter off-cycle processing instructions through the Off-Cycle Requests components (GP_OFFCYCLE_SETUP).

When processing off-cycle transactions, such as payroll corrections or unscheduled payments, you can use the element group feature to filter the elements that are processed. You select the element set when you enter off-cycle processing instructions through the Off-Cycle Requests components (GP_OFFCYCLE_SETUP).

Create list sets.

A list set is a collection of elements and parameters that you can use in any process or report that requires a list of elements. For example, you would use an element group to create a list set for use with a payslip generation process.

See Also

Managing Applications and List Sets

Pages Used to Define Element Groups

Pages Used to Define Element Groups|

Page Name |

Definition Name |

Navigation |

Usage |

|

GP_PIN |

Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Elements, Element Groups, Element Group Name |

Name the element group and define its basic parameters. |

|

|

GP_ELEMENT_GROUP |

Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Elements, Element Groups, Element Groups - Element Group Members |

Insert elements into element groups. |

Naming an Element Group

Naming an Element GroupYou name every element and define its basic parameters on an Element Name page. All element components within Global Payroll share the same first Element Name page (GP_PIN).

See Also

Inserting Elements into Element Groups

Inserting Elements into Element Groups

Access the Element Group Members page (Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Elements, Element Groups, Element Group Members).

Use caution when making changes to element groups that are referenced by list sets. Changes to element groups affect related list sets. List sets, their use, and their relationship to element groups are discussed in detail in another chapter in this PeopleBook.

See Managing Applications and List Sets.

|

Element Group Use |

Define the way that this element group will be used. This field limits the entry types available in the Element Group Members group box. Values are:

Note. The system requires that the Element Group Use field value be the same for multiple effective-dated rows. Therefore, if you add a second effective-dated row to this page, the system populates the new effective-dated row's Element Group Use field by default to the value on the original or earliest effective-dated row, and makes the Element Group Use fields unavailable for entry on all effective-dated rows. So, as long as there's only one row, you can edit the Element Group Use field value. When you insert more than one row, all rows will have the same Element Group Use field value (the value of the original or earliest effective-dated row) and all rows will have the Element Group Use field unavailable for entry. |

Applications - Static/Dynamic

Select whether the element group is a static or dynamic list of elements. Static element groups include a list of elements in the Element Group Members group box. Dynamic element groups include only a SQL Where clause - Dynamic Selection Criteria field - that dynamically determines which elements are included in the group every time the element group is called. The Where clause can also contain an Order By clause to sort the selected elements. This option is only available when Element Group Use is Application.

Element Group Members

|

Element Type |

Select the type of element that you're adding to the element group. Values are Absence Entitlement, Absence Take, Deduction, Earnings, and Element Group. Note. When nesting element groups (that is, including element groups within element groups), the member groups must have the same use option as the parent group. |

|

Element Name |

Select the element name that corresponds to the entry type selected. |

|

Description |

Click to open the element's definition component in a separate browser window. |

|

Eligibility Assignment |

Select the method for assigning the selected element to a payee. This field enables you to indicate whether a payee gets the element processed simply by inclusion in the eligibility group or whether you have to assign the element through the payee-level Earnings/Deductions Assignment page or enter positive input. This field is only available when Group Use Type is Eligibility or All-Purpose. Values are: By Eligibility Group: For elements that apply to most or all payees who are associated with this element group through an eligibility group. This option is used infrequently, because most earnings and deductions are payee-specific. By Payee: For payee-level elements. Typically, most earning and deduction elements fall into this category. This field is hidden when you select Process Set for the element group use. It is also hidden when the entry type is Element Group. |

|

Application Default Sort Sequence |

Enter the sequence number used to sort the element. To display multiple elements on the same line, use the same sequence number. For example, you would use the same sequence number to display employer and employee deductions side by side. This field is only available when Group Use Type is Application or All-Purpose. |

Changing the Element Group Use Field

When needed, you can change the Element Group Use value after you have created the element group. When the field value is changed, the system conducts the following checks:

If the field value is Eligibility or Process Set and the element group is being used in that specific area, the system will only allow a change to All-purpose.

If the field value is Eligibility or Process Set and the element group is not being used in that specific area, the system will allow any change.

If the field value is All-purpose, the system will only allow a change if it is does not alter any current usage (for example, the system will not allow a change to Eligibility if the Element Group is used to define a process set.

See Also

Managing Applications and List Sets

Defining Eligibility Groups

Defining Eligibility Groups

To define eligibility groups, use the Eligibility Groups (GP_ELIG_GROUP) component.

This section provides an overview of eligibility groups and discusses how to insert element groups into eligibility groups.

Understanding Eligibility Groups

Understanding Eligibility GroupsEligibility groups indicate the specific elements for which a certain payee population may be eligible. Eligibility groups contain one or more element groups and are often used to differentiate types or levels of workers. For example, you can create an eligibility group of element groups pertaining to company executives.

You assign a default eligibility group to each pay group. Payees assigned to a pay group inherit the eligibility group from the pay group definition. You can override a pay group definition by payee by stating a different eligibility group at the payee level.

Page Used to Define Eligibility Groups

Page Used to Define Eligibility Groups|

Page Name |

Definition Name |

Navigation |

Usage |

|

GP_ELIG_GROUP |

Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Framework, Organizational, Eligibility Groups, Eligibility Group |

Insert element groups into eligibility groups. |

Inserting Element Groups Into Eligibility Groups

Inserting Element Groups Into Eligibility Groups

Access the Eligibility Group page (Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Framework, Organizational, Eligibility Groups, Eligibility Group).

|

Element Name |

Select the name of the element group to associate with this eligibility group. To select additional element groups, add more rows. |

Defining Pay Entities

Defining Pay Entities

To define pay entities, use the Pay Entities (GP_PYENT) component.

This section provides an overview of pay entities and discusses how to:

Enter address information for a pay entity.

Enter processing details for a pay entity.

Note. This section discusses the first two pages of the Pay Entity component. The other pages in the Pay Entity component, including the Retro Limits page, the Supporting Element Overrides page, and the Source Bank Link page, are discussed elsewhere in this PeopleBook.

See Also

Setting Backward and Forward Retro Limits

Linking Source Banks to Pay Entities

Understanding Pay Entities

Understanding Pay EntitiesA pay entity is the organization that is responsible for paying payees. You can also use a pay entity to define the type of currency for processing calculations. The pay entity is a legal definition of an organization from a payroll perspective. In many cases, an organization and a pay entity are identical. Global Payroll doesn't define a relationship between an organization and a pay entity. If several organizations are held by the same holding organization, the holding organization can be the pay entity, or one organization can have several subsidiaries that are individual pay entities. The system defines most accumulators by pay entity.

Batch Processing

Batch processing uses the data on the Processing Details page to determine which elements to load. Only elements that are defined for All Countries (on the Element Name page) and those defined for Specific Country, where the country equals the pay entity country are loaded.

If any element with a different country has been referenced, the batch program logs an error. Depending on that element's importance, the process might cease. If it cannot continue, it issues the following message:

Element %1 (PIN %2) not loaded into UPINA. (N/A for country: %3).

If the process can continue, it issues one of these messages:

Element %1 (PIN %2) - and data for the element - not loaded into the process. (N/A for country: %3)

Element %1 of parent element %2 on Process List %3 is not found in %4. (PIN number %5)

Note. Reasons other than country assignment can prevent an element from being loaded.

Pages Used to Define Pay Entities

Pages Used to Define Pay Entities|

Page Name |

Definition Name |

Navigation |

Usage |

|

GP_PYENT_NAME |

Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Framework, Organizational, Pay Entities, Pay Entity Address |

Enter address information for a pay entity. |

|

|

GP_PYENT_PRCS_DTL |

Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Framework, Organizational, Pay Entities, Processing Details |

Enter processing details for a pay entity. |

Entering Address Information for a Pay Entity

Entering Address Information for a Pay Entity

Access the Pay Entity Address page (Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Framework, Organizational, Pay Entities, Pay Entity Address).

|

Country |

Select the country where your pay entity is located. |

|

Address |

Click the Edit Address link to enter the pay entity address. The system displays the appropriate address fields for the selected country. Address information fields aren't required; therefore, you can enter only the information that applies to your organization's pay entity. Leave other fields blank. |

Entering Processing Details for a Pay Entity

Entering Processing Details for a Pay Entity

Access the Pay Entities - Processing Details page (Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Framework, Organizational, Pay Entities, Processing Details).

Warning! Do not modify fields above the effective-dated area of the page after implementation. Doing so can destroy the integrity of retroactive and accumulator calculations.

|

Country |

Select the processing country for this pay entity. |

|

Calendar Yearly Start Month and Calendar Yearly Start Day |

Enter the start date for the pay entity's calendar year. This date becomes the default start date for accumulators that are based on calendar year, unless you specify otherwise in the accumulator definition. |

|

Fiscal Yearly Start Month and Fiscal Yearly Start Day |

If your pay entity operates on a fiscal year that's different from the calendar year, enter the start date of the fiscal year. This date is used as the default start date for accumulators that are based on fiscal year, unless you specify otherwise in the accumulator definition. |

|

Payment Key 1-4 |

If your business rules require the use of payment keys, you can set them up here. A pay entity can have up to four payment keys. Values are: Company, Contract Number, Department, and Establishment ID. Payment keys are used primarily during forwarding retroactive situations. When a payment key exists (for example, company or contract number) for the recalculation period (the period from which the retroactive deltas are being forwarded) and the deltas are being forwarded to the current period, the system keeps the retroactive delta data separate in the current pay period. This enables the system to run a separate gross-to-net calculation in the current pay period for that set of payment keys, creating an additional GP_PYE_SEG_STAT record. |

|

Source Bank ID |

Enter the default source bank that funds payroll activities for this pay entity's payees. You can override this value through the Source Bank Link page. |

The processing currency defined at the pay entity level is the unit to which other currencies are converted before calculations are made.

|

Currency Code |

Select the default processing currency, which the system uses for calculations and reports and as the default for any element without an associated currency. Note. If the effective date changes during a pay period, the system uses the currency that's effective at the end of that pay period. Any change of currency should coincide with the beginning of a pay period. |

|

No Rounding |

Select to prevent rounding in currency conversion. |

|

Use Specified Rounding |

Select to have the system run a rounding rule for currency conversion, regardless of the value's source (for example, positive input, accumulators, or historical rules). |

|

Rounding Rule Element |

If you selected Use Specified Rounding, enter the rounding rule element that you want to use for rounding. |

|

Select to enable positive input to override eligibility group defaults. Enables you to override the effect that eligibility groups have on what elements a payee can receive. For example, suppose that during the batch process the system encounters positive input for an earning element that is not in a payee's eligibility group. By selecting Positive Input, you are telling the system to process the positive input. |

With retroactivity, it's necessary to recalculate prior periods in the same currency as the original calculation for the pay period. When the recalculation and the current period have different processing currencies, the difference between the new and old values is computed in the currency of the original calculation.

The retroactive deltas are converted to the processing currency with the exchange rate as of the effective date defined at the payee level (period begin date, end date, and pay date). Retroactive adjustments are, therefore, computed in the processing currency.

Example

From January to June 2001, the currency is set to FRF (French francs). In July, you switch to EUR. In July there is retroactivity for a payee effective in June 2001. The recalculations are done using FRF. The delta is first calculated in FRF and converted to the EUR, using the exchange rate as of the current pay period. Retro adjustments are brought forward into the current period in EUR.

The delta is calculated and stored in FRF. When the July calendar is processed, deltas that are designated or qualified to be pulled into the July calendar are pulled in and converted to EUR before they are used in the July calculations.

See Also

Defining Retroactive Processing

Understanding Multiple Currencies

Defining Pay Groups

Defining Pay Groups

To define pay groups, use the Pay Groups (GP_PYGRP) component.

This section provides an overview of pay groups and overrides of pay group defaults and discusses how to:

Define pay group parameters.

Define default rounding, proration, and frequency conditions for a pay group.

Note. This section discusses the first two pages of the Pay Group component. The other page in the Pay Group component is the Supporting Element Overrides page which is discussed elsewhere in this PeopleBook.

See Also

Understanding Pay Groups

Understanding Pay GroupsA pay group is a logical grouping of qualifying individuals for payment and contains payees who share pay characteristics. All payees in a pay group must have the same pay frequency (begin, end, and payment dates) and payroll calculation process and belong to the same pay entity.

Understanding Overrides of Pay Group Defaults

Understanding Overrides of Pay Group Defaults

When you set up a pay group, you define a number of default settings, such as eligibility group and work schedules, that apply to payees associated with the pay group.

However, you can set up pay group rule overrides for earnings and deductions, which is useful when certain rules don't apply to specific groups of payees.

Group together payees who typically receive the same type of earnings and deductions. This enables you to define elements that apply to most members of a pay group. You can create any exceptions through payee-level overrides or override the default pay group.

Pages Used to Define Pay Groups

Pages Used to Define Pay Groups|

Page Name |

Definition Name |

Navigation |

Usage |

|

GP_PYGRP_NAME |

Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Framework, Organizational, Pay Groups, Pay Group Name |

Define pay group parameters. |

|

|

GP_PYGRP_DFLT |

Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Framework, Organizational, Pay Groups, Defaults |

Define default rounding, proration, and frequency conditions for a pay group. |

Defining Pay Group Parameters

Defining Pay Group Parameters

Access the Pay Group Name page (Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Framework, Organizational, Pay Groups, Pay Group Name).

|

Pay Entity |

Select the pay entity to associate with this pay group. You can link each pay group with only one pay entity. |

Warning! Once you've processed a payroll, never change the pay entity. Doing so can corrupt your data.

Payee Job Data Defaults

In this group box, you can define numerous default settings for a pay group. The effective date applies to the entire group box; therefore, you can change these options simultaneously if you have schedule, business process, or rule changes.

Note. Not every payee in a pay group has the same eligibility group, exchange rate type, or holiday schedule. You can override any default for an individual on the Job Data - Payroll page. Defaults can be overridden for certain periods of time through effective-dating. On the Job Data - Payroll page, the Global Payroll group box that includes eligibility group, exchange rate type, and holiday schedule information appears only if you set the Payroll System field to Global Payroll.

|

Eligibility Group |

Select the default eligibility group to associate with this pay group. Apply elements to payees in pay groups through eligibility groups. An eligibility group must be associated with a pay group. A payee is assigned to an eligibility group through the default defined at the pay group level. This default value can be overridden at the payee level. Note. Payees in an eligibility group are eligible for elements at the payee level, but if a payee isn't in an eligibility group for which an element is valid, that payee cannot be eligible for that element. |

|

Exchange Rate Type |

Select the default exchange rate type that's used for currency conversions for this pay group during processing. You can specify an element in a currency other than the processing currency. During processing, it is converted to the processing currency, using this exchange rate information. Define exchange rate types on the Market Rate Type page. See PeopleSoft Enterprise Components for PeopleSoft Enterprise HRMS and Campus Solutions PeopleBook. |

|

Use Exchange Rate As Of |

Select the effective date for use in retrieving the exchange rate. The options correspond to the dates that you associate with this pay group. Values are Pay Period Begin Date, Pay Period End Date, and Payment Date. |

Payee Schedule Defaults

Define scheduling defaults for a pay group. Payees can be assigned a work schedule and an alternate work schedule based on the scheduling defaults defined for the payee's pay group.

|

Schedule Group |

Select the schedule group for the pay group. Schedule groups enable you to categorize schedules into specific groups. |

|

Schedule ID |

Select the schedule ID for the pay group. |

|

Rotation ID |

Select the rotation ID for the selected the schedule ID. Rotation IDs are used with rotating schedules. Rotating schedules can be assigned to several payees with different schedule begin days. Note. The Rotation ID field only appears if you select a rotating schedule. |

|

Alternate Schedule Group |

(Optional) Select an alternate schedule group for the pay group. |

|

Alternate Work Schedule |

(Optional) Select an alternate work schedule. A payee can be associated with an alternate work schedule for some absences. |

|

Alternate Rotation ID |

(Optional) Select an alternate rotation ID for the pay group. Note. The Alternate Rotation ID field only appears if you select a rotating schedule. |

|

Holiday Schedule |

Select the holiday schedule for the pay group. The pay group's holiday schedule is used in processing if you do not select a different holiday schedule for the payee on the Job Data - Payroll page. However, the pay group holiday schedule is not entered as a default on the payee's Job record. |

See Also

Setting Up and Working with Currencies

Defining Default Rounding, Proration, and Frequency Conditions for

a Pay Group

Defining Default Rounding, Proration, and Frequency Conditions for

a Pay Group

Access the Defaults page (Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Framework, Organizational, Pay Groups, Defaults).

Period Information

Define dates for your pay group's fiscal year.

|

Fiscal Year Start |

Define the start date of your organization's fiscal year for this pay group. Values are: Use Paying Entity Defaults: The next two fields become unavailable. Use Specified Start Date: Complete the next two fields. |

|

Start Month and Start Day |

Enter the first month and the first day of the start month in your organization's fiscal year. |

Component Rounding Defaults

Specify default rounding rules for earnings and deductions at the pay group level. You can specify rounding for individual earnings and deductions when those elements are defined or direct the system to follow the pay group default settings.

|

Rounding Option - Base, Rounding Option - Unit, Rounding Option - Rate, Rounding Option - Percent and Rounding Option - Amount |

Select an option to determine whether these components of an earning, deduction, or entitlement element can be rounded before calculation. Values are: No Rounding: Prevents rounding of the component. Use Specified Rounding: Enter a rounding rule in the corresponding field on the right. |

|

Resolved Amount |

Select the rounding rule to apply to the resolved amount for earnings and deductions. Rounding occurs after the system resolves the element's calculation rule. Also applies to an earning or deduction element for which the calculation rule is defined as Amount. Values are: No Rounding: Prevents rounding of the amount. Use Specified Rounding: Enter a rounding rule in the field on the right. |

|

Proration Option |

Select either No Proration or Use Specific Proration. |

|

Proration Rule |

If you selected Use Specific Proration in the Proration Option field, enter the proration rule that is to be used as the default proration rule for elements being used to process this pay group. In defining an earning or deduction element, you can have the system use the pay group default value or have it specify a unique rule for a certain earning or deduction element. |

Frequency Defaults

Use this group box to define the frequency defaults used in multiple pay calculation components.

Note. The system calculates the daily and monthly pay rates that appear on the Job Data - Compensation page based on the frequency factors associated with the pay group assigned to each payee (on the Job Data - Payroll page). As a result, if you use these corresponding daily and monthly rate system elements directly within your Global Payroll rules, you will need to ensure that the frequency factors associated with the pay group coincide with the values to which you expect these values to resolve. Otherwise, rates may not be in sync (because the system retrieves daily and monthly rates directly from Job Data.)

See Also

Defining a Frequency ID and Country-Specific Defaults

Defining Rounding Rule Elements

Setting Up and Working with Frequencies