Element Eligibility

Element Eligibility

This chapter discusses which elements are eligible for resolution and whether to resolve an element that is eligible during a payroll or absence run. It discusses:

Element eligibility.

Element resolution.

Element Eligibility

Element Eligibility

This section discusses how the system determines which elements are eligible for resolution.

The system determines which earning, deduction, absence take, and frequency-based entitlement elements that it encounters on a process list are eligible for resolution, using the eligibility program, which applies eligibility tests.

If the element passes, the system sets the eligibility switch to Yes and a process switch to Yes. The Process List Manager calls the PIN Manager to resolve the element.

If the element is ineligible, the process switch is generally set to No and the element isn't resolved.

Under certain circumstances, the process switch is set to Yes, even if the element isn't eligible, for example, when a retroactive delta for an earning or deduction is forwarded to the calendar or when a deduction has an outstanding arrears balance. In such cases, the system might bring the delta in as an adjustment or resolve the arrears balance but not the earning or deduction element itself.

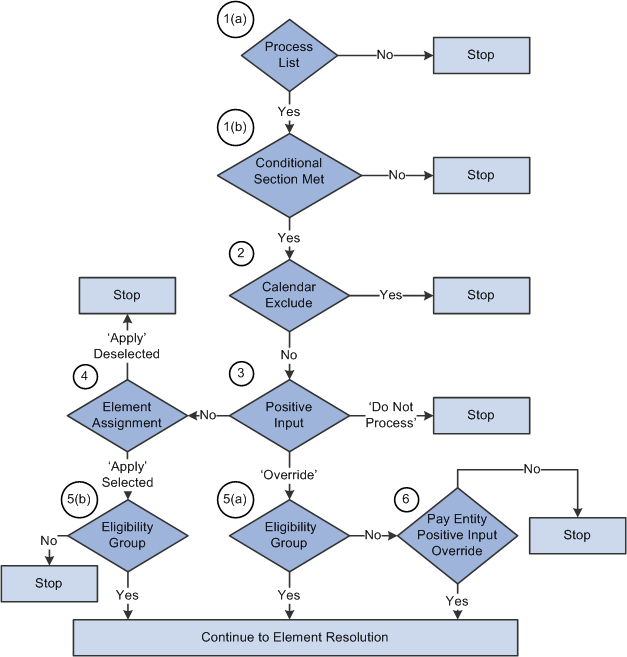

The following diagram illustrates what the system checks to determine element eligibility:

Element eligibility diagram

To determine element eligibility the system checks:

Process list.

The process list provides the first test of eligibility. The element must be in a section of the process to be eligible for resolution.

Process lists can specify conditions under which sections are resolved. If a section isn't resolved because the required conditions are not met, no further processing occurs for that section's elements.

Note. With a generate positive input section, the system checks element eligibility while processing the target calendar, not when processing the source calendar that generates positive input.

Calendar exclude.

The eligibility program checks to see if you've entered instructions to exclude the element from the calendar that's currently being processed. If the element is excluded, the eligibility switch is set to No. The element isn't resolved, no positive input is used, no pay backs from arrears balances occur, and no adjustments are forwarded. (If you exclude an element, you can still assign it a value in a formula.)

Positive input.

If there's no positive input, the system checks for an element assignment (step 4).

If there's a positive input instance with the Override action type (and no Do Not Process instances), the system checks the eligibility group (step 5).

If there's a positive input instance with the Do Not Process action type, the Eligibility program sets the process switch to No, even if there are other instances with an Override or Add action type. It takes only one Do Not Process instance to stop processing the element.

Note. In this context, if the element has user fields, element means element/user field set. For example, assume that STATE is a user field for garnishments, and a payee has garnishments for both Nevada and California. A Do Not Process instance for a garnishment positive input for Nevada would not affect the eligibility of the same garnishment positive input for California. This caveat applies to several of the following bullet points.

See Managing Multiple Resolutions of an Earning or Deduction.

Element Assignment.

There are two functions of an element assignment. The first is to assign an element to a payee. The second allows you to override the element definition for a payee.

If there is no positive input, the system checks for instructions that assign or override the element at the payee level; entered through the Payee Assignment by Element page, Element Assignment by Payee page, or Entitlement/Take Assignment page.

If there is no element assignment the system checks the eligibility group for the element (see step 5).

If there is an element assignment with the Apply check box selected the system checks the eligibility group (see step 5).

If there is an element assignment with the Apply check box not selected for an element, the eligibility program sets the process switch to No. The element will fail eligibility even if the element is in the payee's eligibility group. In this way, the user may override the element's eligibility definition.

Note. When adding an element to an eligibility group, you can specify that the element will only pass eligibility if there is input at the payee level for that element. This applies to both positive input and element assignments. The lack of positive input or an element assignment in this case causes the element to fail eligibility (see step 5).

Eligibility group.

Elements are added to an eligibility group and designated as payee level or by eligibility group. Elements designated at the payee level require input at the payee level for that element. This is accomplished through the use of positive input or element assignments (noted in steps 3 and 4 above).

If there is positive input with the Action Type of Override (and no Do Not Process instances) and the element is in the payee's eligibility group, the system sets the process and eligibility switches to Yes. Otherwise, it checks setup for a pay entity override (step 6).

If there is an element assignment and the Apply check box is selected, and the element is in the payee's eligibility group, the system sets the process and eligibility switches to Yes.

If there is no positive input or element assignment, the system checks if the element is in the payee's eligibility group designated By Eligibility Group and sets the process and eligibility switch to Yes. If the element is not in the eligibility group, processing of the element stops.

Pay Entity override.

If you've enabled positive input overrides for the pay entity (on the Pay Entity - Processing Details page), the element is eligible for resolution even though it is not in the payee's eligibility group.

Note. If a deduction element with an arrears balance doesn't pass the eligibility criteria, the system still performs payback processing when the Arrears Payback Controlled By option on the Deduction - Arrears page specifies All Pay Runs.

See Also

Excluding Elements From a Calendar

Assigning and Disabling Earnings and Deductions by Payee

Managing Multiple Resolutions of an Earning or Deduction

Element Resolution

Element Resolution

This section provides an overview of element resolution and discusses:

Definition as of date.

Begin and end dates.

Generation control.

Arrears.

Earnings and deductions.

Overrides.

Recalculate options.

Understanding Element Resolution

Understanding Element ResolutionThere are many factors that affect the resolution of an element that meets the eligibility criteria. In general, there's an element resolution program for each element type. Earning and deduction elements are handled by the same program.

Definition as of Date

Definition as of Date

All effective-dated elements contain a Definition As Of Date field, which tells the system which effective-dated row to use when retrieving an element definition. You provide the Definition As Of Date information on the Element Name page. If, for example, you select Calendar Period Begin Date, the system retrieves the element definition that was in effect as of the calendar period's first day.

See Also

Understanding the Process of Selecting Definition As Of Dates

Begin and End Dates

Begin and End Dates

Begin and end dates are used with override instructions, specifying the period during which an override applies. Processing rules for begin and end dates vary, depending on the type of override that's being processed.

See Also

Begin and End Date Logic for Overrides

Generation Control

Generation Control

Generation control enables you to further control whether an earning, deduction, absence entitlement, or entitlement adjustment is processed for a payee. You define the criteria under which elements should be resolved. Criteria can be based on HR status, run type, segment status, and other parameters.

For each parameter, you select whether the entries exclude or include the element during batch processing. Each payee must pass all generation control conditions for the element to be processed.

If a payee fails generation control for a deduction, payback processing might still occur and retroactive adjustments can still resolve. If a payee fails generation control for an earning, retroactive adjustments still resolve.

See Also

Defining Generation Control Elements

Arrears

Arrears

When a deduction fails generation control processing, payback processing can still occur, depending on the Arrears Payback Controlled By field on the Arrears page. The two values are All Pay Runs and Deduction Schedule. Deduction Schedule means the deduction must have passed generation control to do arrears payback processing. All Pay Runs means that even if the deduction doesn't pass generation control, payback processing occurs.

See Also

Understanding Net Pay Validation and Arrears Processing

Earnings and Deductions

Earnings and Deductions

The following explains the element resolution code in the earnings/deduction program.

After passing eligibility, the element rule is overlaid with entries from the Payee Assignment By Element page, the Element Assignment By Payee page, or the Positive Input page.

If required payee level components are missing, the element isn't resolved. Retroactive adjustment processing and payback processing can still occur.

Note. In this context, element means element/user field set.

See Managing Multiple Resolutions of an Earning or Deduction.

The last step is checking generation control.

If generation control fails, the earning or deduction element doesn't resolve but the arrears payback and retroactive adjustment processing can occur.

See Also

Defining Earning and Deduction Elements

Overrides

Overrides

You can override a value or an element definition at various levels. For example, you can override primary elements, such as earnings, deductions, and absences, at the payee level and exclude an element from the process list for all payees, by using the calendar exclude feature.

You can not allow payee level overrides for an element by deselecting the Payee check box on the Element Name page, Override Levels group box.

If there are several levels of overrides for an element, the system follows a hierarchy during processing.

See Also

Recalculate Options

Recalculate Options

The Always Recalculate option on the Element Name page, the Retro Recalculation Option on the Earnings/Deductions - Calculation page, and the Recalculate option on the section component determine the recalculation options.

If you select Always Recalculate on the Element Name page, the system recalculates the element whenever it encounters it in the calculation process. So when you're updating a formula and recalculating or resolving it, the system uses the previously resolved value of the element if this check box is deselected. Always Recalculate applies only to the period that's being resolved.

On the Earnings/Deductions Calculation page, the Retro Recalculation Option enables you to select Always Recalculate or Do Not Recalculate. If Do Not Recalculate is selected, the earning/deduction program doesn't resolve the element in a retroactive period, but returns the value from the previous calculation. This applies to earnings and deductions, their components, arrears processing, and retroactive adjustments.

Note. The Recalculate setting on a section applies only to the element on that section, not to the entire element resolution chain. In other words, it does not apply to the elements used by the parent element.

When the PIN Manager is called to resolve an element, it:

Checks to see whether the element has already been resolved for the current time frame (segment or slice).

If the element isn't resolved, it calls the appropriate element resolution program to resolve it.

If the element is resolved, the system checks the recalculation logic.

The recalculation logic is as follows:

The system reads the Always Recalculate check box on the Element Name page.

If the check box is selected, the appropriate element resolution program is called; if it isn't, the system takes the next step.

If the PIN Manager was called from the process list, the PIN Manager reads the Recalculate check box from the section of the current element.

If the check box is selected, the appropriate element resolution program is called. If the check box isn't selected, the PIN Manager returns the previously resolved value for the element. The element isn't recalculated.

Example 1

You assign a value of 10 to variable V1 in formula F1 and use V1 in a different formula, F2. If V1 has Always Recalculate selected, the following occurs:

When the formula program calls the PIN Manager to get the V1 value, it determines that V1 is resolved. Because Always Recalculate is selected, the PIN Manager calls the variable element resolution program to resolve the element. V1 is resolved to whatever the definition contains. The value assigned to V1 from F1 is lost.

If you deselect the Always Recalculate check box for V1, the value assigned to V1 from the formula isn't lost. The PIN Manager, called from F2 to resolve V1, determines that V1 is resolved. Additionally, it determines that Always Recalculate isn't selected and returns the previously resolved value to the formula program.

Dates, arrays, and brackets can assign values to variables. For proper calculation, you must consider recalculation logic.

Example 2

In this example, the Always Recalculate check box must be selected. During resolution of a count element, daily processing occurs. The PIN Manager is called to resolve the formula, which isn't used elsewhere, once each day. The formula is resolved for the first day. On the second day, the first-day value is used, unless Always Recalculate is selected for the formula.

See Also

Defining Retroactive Processing