Understanding Encumbrance Processing

Understanding Encumbrance Processing

This chapter provides overviews of encumbrance processing and document IDs and describes how to:

Process encumbrances in batch.

Review error messages for batch encumbrance processing.

Define processing parameters for real-time budget checking

Perform real-time budget checking.

Review budget checking status logs.

Reset budget-checking locks.

Understanding Encumbrance Processing

Understanding Encumbrance Processing

This overview discusses:

Encumbrance processing options.

Encumbrance calculations.

Encumbrance Processing Options

Encumbrance Processing OptionsThere are two options for processing encumbrances:

Batch processing.

You use batch processing to create baseline encumbrances for a fiscal year and to update encumbrances on an ongoing basis.

Note. You should run the batch encumbrance processes regularly to ensure that your encumbrances reflect job data and position data changes that occur during the fiscal year and to liquidate unused pre-encumbrance and encumbrance amounts from the budget.

There are separate batch processes for calculating encumbrance amounts and for posting the encumbrance data to PeopleSoft Enterprise Financials.

Real-time budget checking.

Real-time budget checking processes job data and position data changes as they occur. Depending on how you've configured the system, changes to job data and position data can be processed immediately, with feedback to the user who makes the change, or the budget checking can be deferred, in which case you use a separate budget-checking component to initiate processing.

For both immediate and deferred budget-checking, the system calculates encumbrance amounts and sends the data to PeopleSoft Enterprise Commitment Control, which supplies a return message indicating whether there are sufficient funds for creating the encumbrance.

Note. Encumbrance processing calculates and posts encumbrance data only for departments that are specifically configured to use the Commitment Accounting business process. Configure departments for commitment accounting on the Departments - Comm. Acctg. and EG page (DEPARTMENT_TBL_CA).

See Also

Processing Encumbrances in Batch

Performing Real-Time Budget Checking

Encumbrance Calculations

Encumbrance Calculations

This section describes how the system calculates earnings and fringe encumbrance amounts.

Earnings Encumbrances

The system calculates earnings encumbrances through the funding end date of each earnings funding source.

When a funding source does not have a funding end date, the process calculates earnings encumbrances through the end of the current fiscal year. If the funding end date is prior to the current fiscal year end date, the process calculates earnings encumbrances for the entire fiscal year, and the earnings encumbrance from the funding end date through the fiscal year end date is placed into the suspense account.

The system uses funding information from the Job Earnings Distribution page, Job Data - Payroll page, or Dept Budget Earnings page (DEPT_BUDGET_ERN) to determine funding sources for earnings. Because the Dept Budget Earnings page is the only place to specify earnings funding end dates, calculations based on data from the other pages always calculate earnings encumbrances through the end of the current fiscal year.

Fringe Encumbrances

Use the Encumbrance Definition page (ENCUMB_DEFN) to configure calculations, funding sources, and funding end dates for employer-paid deductions and taxes

The system calculates deduction and tax encumbrances as a percentage of earnings plus a flat amount. When you configure fringe calculations, you can use constant percentages and flat amounts, or you can reference a fringe matrix code that finds the appropriate percentages and amounts based on the employee's company, pay group, employee classification, employee type, full/part-time status, and salary.

For the current fiscal year, the system calculates fringe encumbrances through the end of the fiscal year. If the funding end date is prior to the current fiscal year end date, the fringe encumbrance from the funding end date through the fiscal year end date is placed into the suspense account.

For future fiscal years, the encumbrance process calculates fringe encumbrances through the earlier of the funding end date for the fringe funding source or the funding end date of the earnings on which the fringe calculation is based. If the fringe funding source does not have a funding end date, the process calculates fringe encumbrances through the earlier of the earnings funding end date and the end of the current fiscal year.

Note. When calculating fringe encumbrances, the system doesn't look at a person's actual benefits enrollment and tax situation. Instead, it estimates these based on the information on the Encumbrance Definition page.

Future-Dated Changes

Future dated changes are processed only when the effective is within the current fiscal year.

The encumbrance process calculates encumbrances through the funding end date for your earnings and fringe funding sources or, when no funding end date is specified, through the end of the specified fiscal year.

See Also

Establishing Department Budgets for Employee Earnings

Setting Up Encumbrance Definitions

Entering Payroll Processing Data

Entering Position-Specific Information

Understanding Document IDs

Understanding Document IDsDuring encumbrance calculations, the HR system assigns a document ID to pre-encumbrance and encumbrance data. The document ID is a cross reference identifier between the PeopleSoft HRMS and PeopleSoft Financials systems; it is used as a tracking tag for encumbrance adjustments and liquidating purposes.

For position data transactions, each position has its own document ID, and the combination codes that represent the funding sources for the position each have a different line number. For example, consider a pre-encumbrance for position P0001 with an annual salary of 30,000, and head count of three. The total pre-encumbrance of 90,000 is 60% funded by combination code AAA1 and 40% funded by combination code AAA2:

|

Position Number |

Combination Code |

Amount |

|

P00001 |

AAA1 |

54,000 |

|

P00001 |

AAA2 |

36,000 |

The message that is sent to the Financials system represents this data as follows:

|

Document ID |

Line Number |

Combination Code |

Pre-Encumbrance Amount |

Encumbrance Amount |

|

0000001 |

1 |

AAA1 |

54,000 |

|

|

0000001 |

2 |

AAA2 |

36,000 |

For job data transactions, the document ID represents a more complex key structure: SetID, Department ID, Encumbrance Type, Company, Pay Group, GL Business Unit, Combination Code, and Account.

Because the system created separate document IDs for each combination code, the line number is not used to represent different combination codes, and it is always 1.

To continue with the example, you now fill position P0001 (represented by document ID 0000001). The employee is funded by the same combination codes in the same proportions:

|

Employee ID |

Company |

Pay Group |

Department ID |

Combination Code |

Amount |

|

KU001 |

GBI |

KU1 |

123 |

AAA1 |

18,000 |

|

KU001 |

GBI |

KU1 |

123 |

AAA2 |

12,000 |

You need to liquidate the pre-encumbrances for the position and create the encumbrances for the employee. The message that is sent to the Financials system looks like this

|

Document ID |

Line Number |

Combination Code |

Pre-Encumbrance Amount |

Encumbrance Amount |

|

0000001 |

1 |

AAA1 |

36,000 |

|

|

0000001 |

2 |

AAA2 |

24,000 |

|

|

0000002 |

1 |

AAA1 |

18,000 |

|

|

0000003 |

1 |

AAA2 |

12,000 |

Note that the pre-encumbrance amount in the message is an amount that replaces the previous amount, not an adjustment to the amount.

Processing Encumbrances in Batch

Processing Encumbrances in Batch

This section provides overviews of encumbrance batch processing and discusses how to:

Run the Fiscal Year End Encumbrance Cleanup process (HP_YEENC_CLN).

Run the Batch Encumbrance Calculation process (ENC_CALC).

View and modify suspense combination code encumbrance transactions.

Run the Encumbrance GL Interface process (PAYGL03).

Understanding Encumbrance Batch Processing

Understanding Encumbrance Batch Processing

This section describes the batch processes that you use to calculate encumbrances and post encumbrance data to PeopleSoft Enterprise Financials.

Batch Encumbrance Processing Overview

To process encumbrances in batch, follow these steps:

Use the Fiscal Year End Encumbrance Cleanup process (HP_YEENC_CLN) to liquidate all unused pre-encumbrance and encumbrance amounts.

Use the Batch Encumbrance Calculation process (ENC_CALC) to:

Calculate baseline encumbrances for a fiscal year.

Update encumbrances that reflect subsequent changes to job data and position data.

Liquidate unused pre-encumbrance and encumbrance amount for the pay cycles that have been confirmed.

Review encumbrance transactions that have been assigned to suspense codes, and take appropriate action.

Run the Encumbrance GL Interface process (PAYGL03) to post the results to the general ledger. and commitment control tables.

Run this process after each run of the Batch Encumbrance Calculation process and after each run of the Fiscal Year End Encumbrance Cleanup process.

The Fiscal Year End Encumbrance Cleanup Process (HP_YEENC_CLN)

Use the Fiscal Year End Encumbrance Cleanup process (HP_YEENC_CLN) to liquidate all unused pre-encumbrance and encumbrance amounts.

Because the system creates encumbrances through the funding end date for a funding source, some of the encumbrances that you create during one fiscal year can extend into subsequent fiscal years. Therefore, before you create baseline encumbrances for the new fiscal year, you need to liquidate all unused pre-encumbrance and encumbrance amounts for the current and future budget years.

Note. You must run the Fiscal Year End Encumbrance Cleanup process before creating baseline encumbrances for a new fiscal year. Creating new baseline encumbrances without first cleaning up existing encumbrances could result in double-booked encumbrances.

The Batch Encumbrance Calculation Process (ENC_CALC): Baseline Encumbrances

The Batch Encumbrance Calculation process creates baseline pre-encumbrance and encumbrance transactions for the current fiscal year. The encumbrances can extend into subsequent budget years depending on the funding end dates for the funding sources.

If baseline encumbrances already exist for a future fiscal year, then the calculation process only calculates encumbrances and pre-encumbrances for the current fiscal year: no future budget years are considered.

Baseline encumbrance calculations are created for all filled and vacant positions based on data from the Job Data page, the Position Data - Specific Information page (for vacant positions), and the Department Budget component.

The Batch Encumbrance Calculation Process (ENC_CALC): Updated Encumbrances

As you change data in your system, your baseline encumbrance calculations may be impacted. Update the encumbrance calculations by periodically running the Batch Encumbrance Calculation process.

If there are setup table changes, you can run the Batch Encumbrance calculation with table change option, which is driven by the Encumbrance Trigger table (ENCUMB_TRIGGER).

To configure the system to create trigger records, you must enable encumbrance triggers on the Product Specific page of the installation table.

See Entering Application- and Industry-Specific Installation Information.

The system creates pre-encumbrance triggers when:

Department budget information is inserted, deleted, or corrected for an entity, and the changes affect the pre-encumbrance calculation for all entities that belong to it and don't have a lower-level budget.

Encumbrance default information is inserted, deleted, or corrected for an entity on the Encumbrance Definition page and the changes affect the pre-encumbrance calculation for all entities that belong to it and don't have lower-level defaults.

The system creates encumbrance triggers when:

Department budget information is inserted, deleted, or corrected for an entity, and the changes affect the encumbrance calculation.

Encumbrance default information is inserted, deleted, or corrected for an entity on the Encumbrance Definition page, and the changes affect the encumbrance calculation for all entities that belong to it.

Contract pay information is added or modified.

Suspense Code Review

When you use batch processing to create and post encumbrance data, the system allocates transactions without funding sources or adequate funding to the department budget's suspense combination code. View these transactions and specify a new combination code on the Encumbrance Suspense ComboCodes component (HP_ENCUMB_SUSPNSE).

The system processes transactions that exceed their budget cap if the funding source has the Allow Overspend check box selected on the Department Budget component. The process generates a warning for these transactions.

The Encumbrance GL Interface Process (PAYGL03)

Run this process after each run of the Batch Encumbrance Calculation process (after calculating baseline encumbrance data and after calculating updates to baseline data).

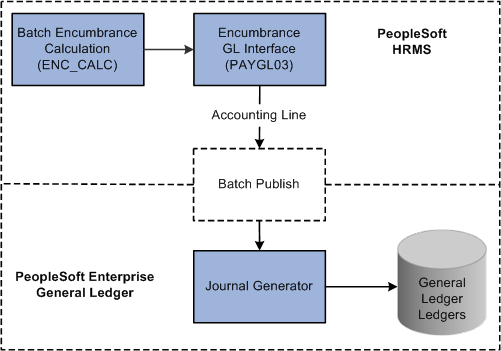

This diagram illustrates how the system transfers encumbrance data to the PeopleSoft Enterprise General Ledger ledgers.

Posting encumbrance data to PeopleSoft Enterprise General Ledger

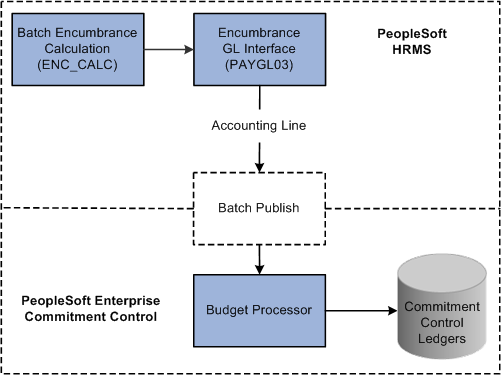

If you are using PeopleSoft Enterprise Commitment Control, the system transfers encumbrance data to the Commitment Control ledgers, as illustrated in this diagram:

Posting encumbrance data to PeopleSoft Enterprise Commitment Control

See Also

Entering Application- and Industry-Specific Installation Information

Setting Up Encumbrance Definitions

Enabling and Controlling Department Information for Specified Customers

Pages Used to Process Encumbrances in Batch

Pages Used to Process Encumbrances in Batch|

Page Name |

Definition Name |

Navigation |

Usage |

|

HP_RCTL_YE_ENC_CLN |

|

Run the Fiscal Year End Encumbrance Cleanup process (HP_YEENC_CLN) process to liquidate any unused pre-encumbrances and encumbrances before creating new baseline encumbrance data. This is necessary to prevent double booking of multiyear encumbrances. |

|

|

HP_RUN_CNTL_ENC |

Set Up HRMS, Product Related, Commitment Accounting, Process Encumbrances, Encumbrance Process |

Run the Batch Encumbrance Calculation process (ENC_CALC) to calculate pre-encumbrances and encumbrances in batch, either to create baseline data for a new fiscal year or to calculate updates to the baseline data. |

|

|

HP_ENCERN_SUSP_DST |

Set Up HRMS, Product Related, Commitment Accounting, Encumbrances Information, Encumbrance Suspense ComboCode |

View and modify encumbrance transactions that are distributed to the combination code of the suspense account. Redistribute from the suspense account to another valid ChartField combination. |

|

|

ChartField Detail |

HMCF_HRZNTL_CFLD |

Click the Edit ChartFields link on the Encumbrance Suspense ComboCode page. |

Select individual ChartField values or search for an existing combination code. |

|

RUNCTL_PRCSDATE |

|

Run the Encumbrance GL Interface process (PAYGL03) after you run the Batch Encumbrance Calculation process or the Fiscal Year End Encumbrance Cleanup process. The Encumbrance GL Interface process prepares the accounting lines for publishing to PeopleSoft Financials and updates the Budget Actuals table in PeopleSoft HRMS. |

Running the Fiscal Year End Encumbrance Cleanup Process (HP_YEENC_CLN)

Running the Fiscal Year End Encumbrance Cleanup Process (HP_YEENC_CLN)

Access the Fiscal Year End Encumbrance Cleanup page (Payroll for North America, Payroll Distribution, Commitment Accounting USA, Fiscal YE Encumbrance Cleanup, Fiscal YE Encumbrance Cleanup).

|

Fiscal Year |

Enter the fiscal year whose baseline encumbrances you wish to liquidate. |

|

Clear Future Fiscal Years |

Select this check box to clear encumbrances for subsequent fiscal years along with the current fiscal year. |

|

Process All Companies |

Select this check box to cleanup multiyear encumbrances for all companies. If you leave this check box deselected, use the Companies grid to enter specific companies to process. |

Running the Batch Encumbrance Calculation Process (ENC_CALC)

Running the Batch Encumbrance Calculation Process (ENC_CALC)

Access the Encumbrance Process page (Set Up HRMS, Product Related, Commitment Accounting, Encumbrance Process, Encumbrance Process).

Note. After running fiscal year encumbrances, run the Encumbrance GL Interface process (PAYGL03) to post the encumbrances.

Run With Errors Options

|

Run Previous Encumbrances in Error |

Select to restart a previous process that contained errors. The system reprocesses only those records containing errors. Use this option after you have addressed the errors from the previous run. When you select this option, the system populates the rest of the fields on the page with the settings from the instance that you are reprocessing, and all fields become read-only. |

|

Complete Restart/Ignore Previous Errors |

Select this option if you want to restart the Batch Encumbrance Calculation process and ignore errors from previous runs. When you select this option, you select processing settings using the rest of the fields on this page. |

Additional Encumbrance Process Parameters

|

Fiscal Year |

Enter the fiscal year for which you want to create pre-encumbrance and encumbrance transactions. Encumbrances and pre-encumbrances can extend into subsequent fiscal years when they are associated with a funding end date that is after the end of the specified fiscal year. However, if the Batch Encumbrance Calculation process finds existing encumbrances for subsequent fiscal years, it will not create encumbrances for these subsequent fiscal years. |

|

Encumbrance Begin Date |

Enter the date that you want the system to start calculating encumbrances. For example, if your fiscal year runs from April 1 to March 31, and you specify May 1 as the Encumbrance Begin Date, the encumbrance calculations are prorated to 335 days (rather than 365). When you create baseline encumbrances, the Encumbrance Begin Date is generally the same as the Fiscal Year Begin Date. However, if you need to recalculate the encumbrance after you have confirmed one or more pay cycles for the fiscal year, the system will determine the encumbrance begin date. This date is the greater of either the last pay confirm date plus one day or the encumbrance begin date entered in the run control. |

|

Encumbrance Prorate Option |

If you are prorating encumbrances across accounting periods, you can prorate using calendar or work days. Indicate if the encumbrance prorate option is Calendar Days or Work Days. |

|

Processing Option |

Select from the following options:

|

Pay Run ID

|

Pay Run ID |

If your processing option is Pay Run, enter a specific pay run ID here. |

Company

|

Company and Pay Group |

If your processing option is Company, enter a specific company here. To further limit processing to a specific pay group, select a pay group as well. Note. When processing pre-encumbrances, the entire company is processed regardless of the specified pay group. |

Budget Status

|

Budget Status |

If your processing option is Budget, the system processes the employees or positions with the budget check status you select. The options are Invalid or Pending. |

Viewing and Modifying Suspense Combination Code Encumbrance Transactions

Viewing and Modifying Suspense Combination Code Encumbrance Transactions

Access the Encumbrance Suspense ComboCode page (Set Up HRMS, Product Related, Commitment Accounting, Encumbrances Information, Encumbrance Suspense ComboCode).

When the Batch Encumbrance Calculation process encounters transactions without sufficient funding for the current fiscal year, it posts the transactions to the department budget suspense combination code. Use the Encumbrance Suspense ComboCode page to view the transactions and to redistribute to another valid ChartField combination before you run the Encumbrance GL Interface process (PAYGL03).

To view and modify suspense combination code encumbrance transactions:

Review the transaction.

The Encumbrance Suspense ComboCode page displays all the information about the transaction, including the person name and ID, the fiscal year, the original combination code (the combination code that did not have enough to fund this transaction), and the encumbered amount.

Enter a new combination code to fund the transaction.

Enter a new combination code in the ChartField Detail page to fund the encumbrance transaction. You can redistribute the amount to multiple ChartField combinations.

Note. Click the Edit ChartFields link to search for an existing combination code or select a unique combination of ChartFields on the ChartField Detail page.

See Also

Editing ChartField Combinations in HRMS Transactions

Running the Encumbrance GL Interface Process (PAYGL03)

Running the Encumbrance GL Interface Process (PAYGL03)

Access the GL Interface - Encumbrances page (Set Up HRMS, Product Related, Commitment Accounting, Process Encumbrances, Encumbrance GL Interface, GL Interface - Encumbrances).

Run the Encumbrance GL Interface process (PAYGL03) whenever you run the Batch Encumbrance Calculation process, run the Fiscal Year End Encumbrance Cleanup process, or make changes to the suspense combination code transactions. The Encumbrance GL Interface process creates accounting lines for publishing to PeopleSoft Financials, and it updates the Budget Actuals table in PeopleSoft HRMS.

Note. Changes to Suspense ChartField Combinations must be made before you run the Encumbrance GL Interface process.

|

Accounting Posting Date |

The date you enter is used to determine the applicable effective-dated row in some setup tables like the journal ID, conversion rate, and offset account tables in PeopleSoft Human Resource system. If you are not using commitment control, the accounting posting date is used as the budget date in the accounting lines for both current and future fiscal year entries |

See Also

Setting Up Encumbrance Definitions

Reviewing Actuals Distribution After GL Posting

Reviewing Error Messages for Batch Encumbrance Processing

Reviewing Error Messages for Batch Encumbrance Processing

This section lists the pages used to review error messages for batch encumbrance processing and discusses how to run the Encumbrance Message error report

Pages Used to Review Encumbrance Processing Error Messages and Logs

Pages Used to Review Encumbrance Processing Error Messages and Logs|

Page Name |

Definition Name |

Navigation |

Usage |

|

ENC_MESSAGES |

|

Review encumbrance error messages online. |

|

|

RUNCTL_BUD009 |

Set Up HRMS, Product Related, Commitment Accounting, Reports, Encumbrance Messages |

Run an Encumbrance Message report (BUD009), which provides information on encumbrance processing error messages. Before using this page, you must have run the encumbrance processes |

Reviewing Encumbrance Error Messages Online

Reviewing Encumbrance Error Messages Online

Access the Review Encumbrance Error Messages page (Set Up HRMS, Product Related, Commitment Accounting, Process Encumbrances, Review Encumbrance Error Messages, Review Encumbrance Error Messages).

Running the Encumbrance Messages Report

Running the Encumbrance Messages ReportAccess the Encumbrance Message Report page (Set Up HRMS, Product Related, Commitment Accounting, Reports, Encumbrance Messages).

|

Department ID (or "ALL") |

Enter the department ID whose encumbrance messages you are reporting. Enter ALL to report on all departments in the selected SetID. |

Defining Processing Parameters for Real-Time Budget Checking

Defining Processing Parameters for Real-Time Budget CheckingTo define processing parameters for real-time budget checking, use the Encumbrance Process Control (HP_ENCUMBER_CTL) component.

This section provides an overview of processing parameters for real-time budget checking and discusses how to define those parameters.

Understanding Fiscal Years for Real-Time Budget Checking

Understanding Fiscal Years for Real-Time Budget CheckingThe Batch Encumbrance process uses the Encumbrance Process run control page (HP_RUN_CNTL_ENC) to specify crucial information such as the fiscal year for the encumbrances, the encumbrance begin date within the fiscal year and the processing option. Real-time budget checking uses the Encumbrance Process Control page (HP_ENCUMBER_CTL) to specify the fiscal year, calendar ID and prorate option. You can configure the Encumbrance Process Control page to use different settings for different companies.

See Also

Performing Real-Time Budget Checking

Page Used to Define Processing Parameters for Real-Time Budget Checking

Page Used to Define Processing Parameters for Real-Time Budget Checking|

Page Name |

Definition Name |

Navigation |

Usage |

|

HP_ENCUMBER_CTL |

Set Up HRMS, Product Related, Commitment Accounting, Encumbrance Information, Encumbrance Process Control, Encumbrance Process Control |

Define processing parameters for real-time budget checking. |

Defining Processing Parameters for Real-Time Budget Checking

Defining Processing Parameters for Real-Time Budget CheckingAccess the Encumbrance Process Control page (Set Up HRMS, Product Related, Commitment Accounting, Encumbrance Information, Encumbrance Process Control, Encumbrance Process Control).

|

Set ID |

This is the default SetID that the system uses to look up the journal template. This SetID is for the General Ledger business unit. |

|

Calendar ID |

Enter the default detail calendar to use for companies other than the ones that you specifically list in the Companies grid. The available calendar IDs are governed by the SetID that you select. Detail calendars define the number of accounting periods in a fiscal year and the starting and end dates for each period. See Understanding Detail Calendars, Reviewing Detail Calendars and Budget Periods. |

|

Fiscal Year |

Enter the fiscal year to use for encumbrance calculations during real-time budget checking. The available choices are governed by the SetID and Calendar ID that you select. Also, when determining whether to enter a default funding end date in an encumbrance definition, the system looks at the department budget settings (specifically, the Funding End Date Defaults from Funding Source check box) for the fiscal year that you enter here. This use of the Fiscal Year field applies regardless of whether real-time budget checking is used. Note. To activate funding end date defaulting for encumbrance definitions, you must define a fiscal year on the Encumbrance Process Control page. |

|

Prorate Option |

If you are prorating encumbrances across accounting periods, you can prorate using calendar or work days. Indicate if the encumbrance prorate option is Calendar Days or Work Days. |

Companies

Use this grid to enter company-specific process control options.

Performing Real-Time Budget Checking

Performing Real-Time Budget CheckingThis section provides an overview of real-time budget checking and discusses how to:

Check the budget for a job data change.

Check the budget for a position data change.

Understanding Real-Time Budget Checking

Understanding Real-Time Budget CheckingYou can optionally configure some or all departments for real-time budget checking. Use real-time budget checking to do online budget checks with PeopleSoft Financials Commitment Control and reserve the funding immediately. You still need to use batch processing to create and post your baseline encumbrance and pre-encumbrance data for the fiscal year.

Real-Time Budget Checking Process Options

There are two ways that the system performs real-time budget checking:

Immediate budget checking from the Job Data and Position Data components.

Immediate budget checking enables the system to inform users if there are insufficient funds (prior to saving their changes). This capability can prevent account overdrafts and helps you avoid the hassles and effort of making adjustments to handle those overdrafts.

Deferred budget checking using separate real-time budget checking components.

There are separate components for checking budgets for job data and for position data.

These components are used to perform on-demand individual budget checks outside of the job and position data components. This allows the system to reassess the individual encumbrances and budget impacts.

A combination of system-level and department-level settings determine where the real-time budget check occurs for critical and non-critical changes that you make to job data and position data. Critical changes in the Job Data component include hiring, rehiring, and adding a concurrent job. Critical changes in the Position Data component include creating a position, increasing the head count for a position, changing a position from inactive to active, and changing the Pre-Encumbrance Indicator for a position from None or Requisition to Immediate,

The following table shows the department-level processing options that you use to determine whether real-time budget checks take place in context or in the separate real-time budget checking components:

|

Process Option |

Critical Changes |

Non-Critical Changes |

|

All |

Allows immediate budget checking from the Job Data and Position Data components. |

Allows immediate budget checking from the Job Data and Position Data components. |

|

Batch Process Only |

Do not allow real-time budget checking. All encumbrance calculations are performed by the batch process. The individual budget check status is set to Pending. |

Do not allow real-time budget checking. All encumbrance calculations are performed by the batch process. The individual budget check status is set to Pending. |

|

Critical |

Allows immediate budget checking from the Job Data and Position Data components. |

Do not allow immediate budget checking from the Job Data and Position Data components. Encumbrance calculations are performed by the batch process or individual budget checks from the Real-time Budget Checking components. The individual budget check status is set to Pending. |

|

Deferred |

Do not allow immediate budget checking from the Job Data and Position Data components. Encumbrance calculations are performed by the batch process or individual budget checks from the Real-time Budget Checking components. The individual budget check status is set to Pending. |

Do not allow immediate budget checking from the Job Data and Position Data components. Encumbrance calculations are performed by the batch process or individual budget checks from the Real-time Budget Checking components. The individual budget check status is set to Pending. |

Immediate Budget Checking: Sufficient Funds

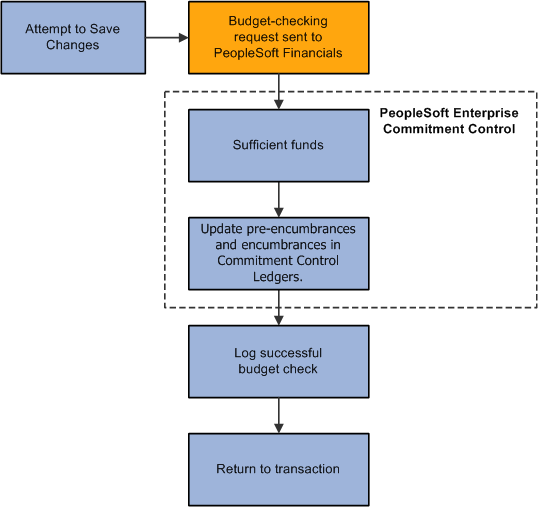

When your settings result in immediate budget checking, the system immediately recalculates encumbrances when a user attempts to save a job data change or position data change that affects the encumbrance amount. The system then sends the encumbrance data to the Commitment Control Budget Processor in PeopleSoft Financials, which in turn verifies that there are sufficient funds available for the recalculated encumbrance amounts.

If there are sufficient funds, the PeopleSoft Financials system updates the Commitment Control ledger encumbrance amounts immediately, as shown in this process flow:

Budget check shows that there are sufficient funds

The specific encumbrance and pre-encumbrance calculations depend on the changes that are made. Note, however, that when you fill a position, the system liquidates the pre-encumbrance as well as creating an encumbrance for the new job record.

Immediate Budget Checking: Insufficient Funds

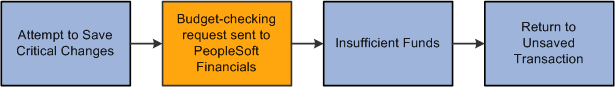

If the system initiates immediate budget checking and there are insufficient funds, the Financials system provides an error message to assist the user in addressing the budget error. The user's options depend on whether the transaction is critical and, if so, whether you enforce real-time budget checking for critical transactions. Enforcing real-time budget checking means that not only does the system immediately check for funds, the system won't let you save critical changes unless sufficient funds are available. You configure this option on the Installation Table - Product Specific page.

If the transaction is critical, and the system is configured to enforce budget-checking for critical transactions, the user cannot save the transaction without resolving the error condition. The following diagram illustrates enforced immediate real-time budget checking:

Enforced compliance with real-time budget checking

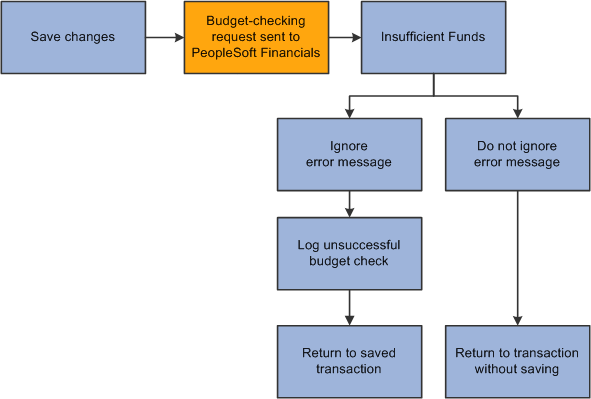

If the transaction is not critical, or if it is critical but the system does not enforce budget compliance for critical changes, then when the budget check shows that there are insufficient funds, the user can choose whether to address the error message or ignore it and save anyway.

When the user does not ignore the budget check error, the system does not save the original transaction and the user can either cancel the changes or modify the changes and attempt another budget check.

The following diagram illustrates the results of ignoring and not ignoring the insufficient funds notification from PeopleSoft Financial:

User chooses whether to ignore insufficient funds

Deferred Budget Checking

Deferred budget checking takes place on the Budget Check by Job and Budget Check by Position pages. These pages display read-only information about the transaction to be checked. Click the Check Budget button to initiate the real-time budget check.

When there are sufficient funds, deferred budget checking reserves the funds in PeopleSoft Financials Commitment Control and updates the PeopleSoft HRMS budget check status for the job or position.

When there are insufficient funds, deferred budget checking updates the PeopleSoft HRMS budget check status to invalid. This has no effect on the job or position data, which has already been saved.

Pages Used to Perform Real-Time Budget Checking and Encumbrance Processing

Pages Used to Perform Real-Time Budget Checking and Encumbrance Processing|

Page Name |

Definition Name |

Navigation |

Usage |

|

HP_BDCK_JOB |

Workforce Administration, Job Information, Budget Check By Job, Budget Check By Job |

Perform budget checking for job data. |

|

|

HP_BDCK_POS |

Organizational Development, Position Management, Budget Check By Position, Budget Check By Position |

Perform budget checking for position data. |

Checking the Budget for a Job Data Change

Checking the Budget for a Job Data Change

Access the Budget Check by Job page Workforce Administration, Job Information. Budget Check By Job, Budget Check by Job)

Review the transaction data, and click the Check Budget button to initiate the budget check.

Budget Check Information

|

RTBC Trigger (real-time budget checking trigger) |

Displays the source component of the budget check transaction. |

|

Critical Transaction |

Displays Y (yes) if the last job data change was a critical transaction, or N (no) if it change was not critical. |

|

Budget Status |

Displays the current budget check status for the job: Valid or Invalid. |

|

RTBC Performed |

Displays Y (yes) if a real-time budget check has been performed, or N (no) if not. |

|

Update in Progress |

Displays Y (yes) if there is another real-time budget check transaction taking place for this job, or N (no) if not. |

|

Encumbrance Update Time Stamp |

Displays the date and time of the last encumbrance transaction. |

Checking the Budget for a Position Data Change

Checking the Budget for a Position Data Change

Access the Budget Check by Position page (Organizational Development, Position Management, Budget Check By Position, Budget Check By Position).

Review the transaction data, and click the Check Budget button to initiate the budget check.

Budget Check Information

|

RTBC Trigger (real-time budget checking trigger) |

Displays the source component of the budget check transaction. |

|

Critical Transaction |

Displays Y (yes) if the last position data change was a critical transaction, or N (no) if it change was not critical. |

|

Budget Status |

Displays the current budget check status for the position: Valid or Invalid. |

|

RTBC Performed |

Displays Y (yes) if a real-time budget check has been performed, or N (no) if not. |

|

Update in Progress |

Displays Y (yes) if there is another real-time budget check transaction taking place for this position, or N (no) if not. |

|

Encumbrance Update Time Stamp |

Displays the date and time of the last encumbrance transaction. |

Reviewing Budget Checking Status Logs

Reviewing Budget Checking Status LogsThis section lists the pages used to review budget checking status logs.

Pages Used to Review Budget Checking Status Logs

Pages Used to Review Budget Checking Status Logs|

Page Name |

Definition Name |

Navigation |

Usage |

|

Budget Status by Job |

HP_RTBC_JOB1_INQ |

Workforce Administration, Job Information, Budget Status by Job, Budget Status by Job |

Review budget status and encumbrance data for an individual job. |

|

Budget Status by Position |

HP_RTBC_POS1_INQ |

Organizational Development, Position Management, Budget Status by Position, Budget Status by Position |

Review budget status and encumbrance data for an individual position. |

|

Budget Status by Document ID |

HP_RTBC_DOC1_INQ |

|

Review budget status for an individual document. |

|

Budget Check Results |

HP_RTBC_JOB2_INQ HP_RTBC_POS2_INQ HP_RTBC_DOC2_INQ |

|

Review budget check results for an individual document. |

Reviewing Budget Check Results By Job

Reviewing Budget Check Results By Job

Access the Budget Status by Job page (Workforce Administration, Job Information, Budget Status by Job, Budget Status by Job).

Reviewing Budget Check Results By Position

Reviewing Budget Check Results By PositionAccess the Budget Status by Position page (Organizational Development, Position Management, Budget Status by Position, Budget Status by Position).

Reviewing Budget Check Results By Document ID

Reviewing Budget Check Results By Document ID

Access the Budget Status by Document ID page (Workforce Administration, Job Information, Budget Status by Document ID, Budget Status by Document ID or Organizational Development, Position Management, Budget Status by Document ID, Budget Status by Document ID).

Reviewing Detailed Budget Check Results

Reviewing Detailed Budget Check Results

Access the Budget Check Results page (click the Budget Check Results button on the Budget Status by Job page, the Budget Status by Position page, or the Budget Status by Document ID page).

|

Message Detail |

When there is a link in this column, click the link to review detailed message logs from the budget check. |

Resetting Budget-Checking Locks

Resetting Budget-Checking LocksThis section provides an overview of locked transactions, lists common elements for resetting locks, and shows the pages used to:

Reset locks by employee.

Reset locks by position.

Reset locks by document line.

Reset batch process locks.

Understanding Locked Transactions

Understanding Locked TransactionsThe system employs locking at various levels to prevent simultaneous budget checking for the same transaction. When a user attempts to perform real-time budget checking for a locked transaction, the system displays a concurrent processing error.

For whatever reason, there may be outstanding locks in the system that require manual intervention. The pages under the Reset Encumbrance Locks menu enable you to review and reset these outstanding locks at various levels.

Warning! Incorrect usage can corrupt budget actuals and document summary tables, cause potential deadlock, and cause other system issues. Access to the pages for resetting encumbrance locks should be restricted to knowledgeable application support personnel.

You can reset locks at these levels:

By Encumbrance Control: An encumbrance control lock is set when the Batch Encumbrance Calculation process is running. This lock prevents the system from performing any real-time budget checking or other batch process.

By Position: When real-time budget checking is being performed on a specific position, no other users can perform budget checks on that position until the first check is completed.

By Employee: When real-time budget checking is being performed on a specific Employee ID and record number, no other users can perform budget checks on the job data and related documents until the first check is completed.

By Document Line: When real-time budget checking is being performed on a job or position and its related documents, no other budget check is allow for the same document until the first check is completed.

If job data changes occur for two employees in the same department that refers to the same document, the system performs real-time budget checking on only one employee at a time. The changes that are saved first are processed first; the user who makes the second job data change must wait for the first budget check process to be finished.

Common Elements for Resetting Locks

Common Elements for Resetting Locks|

Reset Lock |

Click this button to remove the lock. |

Pages Used to Reset Budget-Checking Locks

Pages Used to Reset Budget-Checking Locks|

Page Name |

Definition Name |

Navigation |

Usage |

|

HP_RESET_LOCK_JOB |

Set Up HRMS, Product Related, Commitment Accounting, Reset Encumbrance Locks , Reset by Employee, Reset by Employee |

Review locks placed by real-time budget checking for job data changes, and reset the locks if necessary. |

|

|

HP_RESET_LOCK_POS |

Set Up HRMS, Product Related, Commitment Accounting, Reset Encumbrance Locks , Reset by Position, Reset by Position |

Review locks placed by real-time budget checking for position data changes, and reset the locks if necessary. |

|

|

HP_RESET_LOCK_DOC |

Set Up HRMS, Product Related, Commitment Accounting, Reset Encumbrance Locks , Reset by Document Line, Reset by Document Line |

Review locks placed by real-time budget checking and reset the locks if necessary. |

|

|

HP_RESET_LOCK_BCH |

Set Up HRMS, Product Related, Commitment Accounting, Reset Encumbrance Locks , Reset Encumbrance Control Lock, Reset Encumbrance Control Lock |

Review locks placed by the Batch Encumbrance Calculation Process, and reset the locks if necessary. |

Resetting Locks By Employee

Resetting Locks By Employee

Access the Reset By Employee page (Set Up HRMS, Product Related, Commitment Accounting, Reset Encumbrance Locks , Reset by Employee, Reset by Employee).

Resetting Locks By Position

Resetting Locks By Position

Access the Reset By Position page (Set Up HRMS, Product Related, Commitment Accounting, Reset Encumbrance Locks , Reset by Position, Reset by Position).

Resetting Locks by Document Line

Resetting Locks by Document Line

Access the Reset By Document Line page (Set Up HRMS, Product Related, Commitment Accounting, Reset Encumbrance Locks , Reset by Document Line, Reset by Document Line).

Resetting Batch Process Locks

Resetting Batch Process Locks

Access the Reset Encumbrance Control Lock page (Set Up HRMS, Product Related, Commitment Accounting, Reset Encumbrance Locks , Reset Encumbrance Control Lock, Reset Encumbrance Control Lock).