Understanding Contract Pay Processing

Understanding Contract Pay Processing

This chapter provides overviews of contract pay processing and contract earnings, and provides examples of contract pay calculations. This chapter then discusses how to:

Set up contract pay.

Enter employee contract pay settings.

Process contract pay.

Administer contract prepay.

Adjust contract employee prepay balances.

Understanding Contract Pay Processing

Understanding Contract Pay Processing

This section discusses:

Employee contract pay setup.

Contract pay calculations

Contract renewals.

Employee Contract Pay Setup

Employee Contract Pay SetupTo set up employee contract pay, you must

Select the C (contract) compensation frequency on the Job Data - Compensation page, and enter the total contract amount as the compensation amount.

Ensure that the employee's pay group has earnings codes for the contract earnings types shown on the Education and Government Additional Earnings Codes page.

Define contract pay settings on the Contract Pay page.

Contract Pay Calculations

Contract Pay CalculationsThis section discusses:

Payment terms.

Calculation processes.

Prepay for benefit deductions.

Back to back contracts.

Contract pay taxation.

Payment Terms

Employers in higher education often process payroll and benefits over a period of time that differs from the employee's contract period. When you define contract pay, you provide start and end dates for the contract work and for the contract payments. These dates define the contract term and the payment term.

PeopleSoft Payroll for North America levels contract pay over the payment term you specify.

For example, consider a contract for 36,000 USD with a contract term of nine months and a monthly payment frequency:

If the payment term is the same as the contract term, you pay 4,000 USD per month for nine months.

If the payment term is twelve months, you pay 3,000 USD per month for twelve months.

There are two exceptions to payment leveling that you can set up for your employees:

You can pay the entire value of the contract in a lump sum that is paid on a day you specify.

You can make a balloon payment by specifying a last payment date.

The system levels payments across the entire payment term, but on the last payment date, it makes a lump sum payment for the remaining value of the contract.

Calculation Processes

There are two processes that you run each pay period:

Run the Contract Projected Payment (CNTPAY01) SQR process to generate contract pay data that can be loaded to paysheets.

This process uses your contract pay settings to calculate contract earnings for all remaining pay periods in the payment term. The calculated values are considered projections until they are paid.

Note. Always run the Contract Projected Payment process before creating paysheets to ensure that the system loads the most current contract pay calculations to paysheets.

Run the Contract Discrepancy Report (CNTPAY05) for a specific pay period to find any discrepancies between the projected payment for the pay period and the actual payment.

If there are discrepancies and the pay run is not confirmed, you can make adjustments on the paysheet. If there are discrepancies and the pay run is confirmed, you can make manual adjustments to the contract pay schedule for future pay periods.

Contract projections can change when there are certain changes to the employee's job data or contract pay settings. When any of these changes occur, the system marks the existing payment schedule for recalculation. (You can also manually mark a payment schedule for recalculation.) The next time you run the Contract Projected Payment process, the system creates a new payment schedule based on the actual payments to date and the future projected payments.

Changes that can trigger recalculation include changing the contract term (for example, if the employee starts work after the original contract term begins or stops work before the original contract term ends), a mid-contract leave of absence, or a change to the employee's contract compensation amount. (Unpaid sick leave affects the amount of the current check, but does not cause the system to recalculate future payments.)

When you make changes to the contract amount on the Job Data - Compensation page, you also choose how to prorate the changes across the payment term and, if the change is an increase, whether to make a retroactive payment for the portion of the increase that is allocated to periods that have already been worked.

See Defining Proration Options for Contract Changes.

Prepay for Benefit Deductions

Employees who are paid only during their contract term can prepay their deductions for benefits that extend past the term of their contract. For example, if benefits coverage is 12 months and an employee has a six-month contract and is paid only during the contract term, the employee can choose to prepay the remaining six months benefits deductions during the contract (and pay) period. This prepayment option is only available to employees who are paid over the contract term.

See Administering Contract Prepay.

Back to Back Contracts

If an employee has back-to-back contracts, and the change over occurs in the middle of a pay period, the system includes pay from both contracts on a single paycheck.

When a single paycheck includes pay from back-to-back contracts, only the newer contract is considered by the prepay process.

To calculate taxes for contract pay, the system annualizes the contract earnings according to the option you select:

Annualize Over 12 Months: the earnings are annualized over 12 months, regardless of the length of the payment term.

Annualize Over Payment Periods: the earnings are annualized over the number of pay periods in the payment term.

User Specified: the system uses an annualization factor that you enter.

Contract Renewals

Contract Renewals

Use the Use the Batch Renewal of Pay Contracts (CNTPAY02) process to renew contracts.

The Contract Renewal process completes the following tasks:

Generates a new contract ID on the Contract Pay (CONTRACT_PAY) component for the next contract term.

The new data row uses the same information from the old contract, but advances the contract and payment dates.

Generates a new effective-dated entry on the Job Data (JOB_DATA) component for the next contract term.

Decreases the number of allowed renewals on the Contract Pay page by one (unless 99 is specified, in which case it is left untouched).

Understanding Contract Earnings

Understanding Contract EarningsThis section discusses:

Worked earnings.

Other earnings for contract pay.

Worked Earnings

Worked EarningsIf an employee completes a contract without interruption, then by the end of the payment term, the employee has performed all of the contract work and thus earned the entire amount paid. However, if the employee does not complete the entire contract, you need to know how much the employee has actually earned so that you can adjust the contract pay accordingly. This amount that the employee has actually earned is considered the worked earnings.

Worked Earnings Calculation Methods

The system provides two methods for tracking worked earnings:

Actual divides the total contract pay by the number of work days in the contract to produce a daily rate for worked earnings.

In pay periods with no unpaid leave, the worked earnings are the daily rate multiplied by the number of work days in the period. Because pay periods don't always have the same number of work days, the worked earnings vary by pay period.

Prorate divides the total contract pay by the number of pay periods in the contract term to produce a pay period rate for worked earnings.

In pay periods with no unpaid leave, the pay period rate is also the amount of worked earnings.

The Prorate method uses the daily rate (the same daily rate that the Actual method uses) to reduce pay for unpaid leave and to allocate earnings for paid leave.

Determination of Actual Work Days

The system determines the actual work days in the contract term and in the pay period by looking at these three elements:

The employee's work schedule: selected days of the week are work days.

The school schedule: school breaks are not considered work days.

The holiday schedule: holidays are considered work days unless the contract pay settings exclude holidays.

Even though employees don't actually work on holidays, paid holidays are treated like paid work days for purposes of tracking the employee's actual earnings.

Other Earnings for Contract Pay

Other Earnings for Contract PayRegardless of the method for calculating worked earnings, the contract pay calculation process tracks these three types of earnings:

|

Contract Regular (CRG) |

Contract regular earnings are the portion of worked earnings, as calculated by the Prorate method, that are attributed to actual work days rather than paid leave. For example, if a contract for 60,000 CAD has a contract term of ten months and a monthly frequency, and there are no paid holidays, then the projected contract regular earnings for each of the ten months is 6,000 CAD, regardless of the payment term. In a month where the employee takes two days of unpaid leave, the actual contract regular earnings are reduced by two times the daily earnings rate.

Note. When worked earnings are calculated using the Prorate

method, the worked earnings are the sum of contract regular earnings and paid

leave earnings. |

|

Paid Not Earned (PNE) |

If the payment term begins before the contract term, earnings for the periods before the contract starts are paid, but not yet earned and therefore allocated to the Paid Not Earned earnings code. The system then reduces the PNE balance over the course of the contract term by prorating the amount of PNE across the contract term and creating corresponding negative PNE earnings during each pay period. At the end of the contract term, the PNE balance is zero. For example, there is a contract for 60,000 CAD with a payment term from July 1 to June 30 (12 months), and a contract term from September 1 to April 30 (eight months). The level payments are 5,000 CAD per month for twelve months. During July and August, there are no contract regular earnings, so the entire 5,000 CAD per month is allocated to PNE, for a total of 10,000 CAD at the time the contract term starts. To reduce this to zero by the end of the contract, the system divides 10,000 CAD by the eight months of the contract, with the result that -1,250 CAD is then applied to PNE during each of the next eight monthly pay periods. |

|

Earned Not Paid (ENP) |

This is the amount by which the worked earnings exceed the amount paid, adjusted for any Paid Not Earned amounts. If worked earnings are greater than the adjusted actual pay, this is a negative amount. If worked earnings are less than the adjusted actual pay, this is a positive amount. |

For each pay period, the total paid is the sum of the contract regular, PNE, and ENP amounts.

Note. You assign specific earnings codes for contract regular pay, PNE, and ENP in the Pay Group Table component.

Contract Pay Calculation Examples

Contract Pay Calculation ExamplesThis section provides examples showing worked earnings, contract regular earnings, PNE earnings, and ENP earnings in various scenarios. All examples use a monthly pay frequency.

Note. In these examples, the contract regular (CRG) earnings shown have not yet been reduced by the amount of holiday pay.

Example 1: Payment Term Begins Before and Ends After Contract Term

Example 1: Payment Term Begins Before and Ends After Contract TermIn this example, the payment term begins before the contract term, and the payment term ends after the contract term.

Contract Settings

These are the parameters that determine the daily pay rate in this example:

|

Parameter |

Value |

|

Contract Salary |

60,000 |

|

Work Days |

147 |

|

Paid Holidays |

25 |

|

Total Paid Days (work days + paid holidays) |

172 |

|

Daily Pay Rate (contract salary / total paid days) |

348.83721 per day |

These are the parameters that determine the pay period rates in this example:

|

Parameter |

Contract Term |

Payment Term |

|

Dates |

September 1 to April 30 |

July 1 to June 30 |

|

Number of monthly pay periods |

8 |

12 |

|

Pay Period Rates |

Contract regular earnings (not adjusted for holidays) 60,000 over 8 months = 7,500 per month |

Amount paid: 60,000 over 12 months = 5,000 per month |

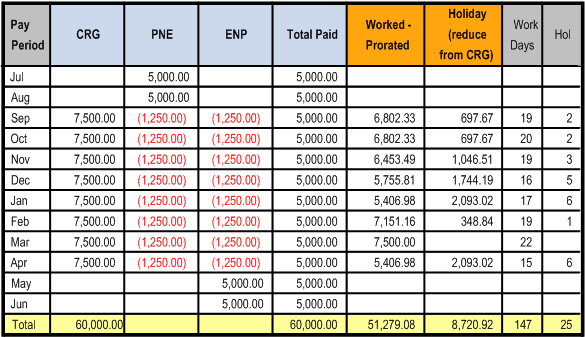

Prorate Method

In the following table, worked earnings are calculated using the Prorate (pay period rate) method.

Payment term begins before and ends after contract term: proration method

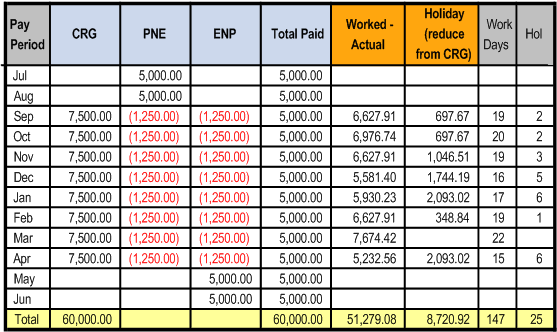

Actual Method

In the following table, worked earnings are calculated using the Actual (daily rate) method:

Payment term begins before and ends after contract term: actual method

Example 2: Employee Starts Work Late and Partial Period is Prorated

Example 2: Employee Starts Work Late and Partial Period is ProratedIn this example, payments begin on September 1 for a contract term that starts on November 1. On October 1, the contract begin date changes to November 13.

Original Contract Settings

These are the parameters that determine the daily pay rate in this example:

|

Parameter |

Value |

|

Original Contract Salary |

60,000 |

|

Work Days |

130 |

|

Paid Holidays |

22 |

|

Total Paid Days (work days + paid holidays) |

152 |

|

Daily Pay Rate (contract salary / total paid days) |

394.73684 |

These are the parameters that determine the pay period rates in this example:

|

Original Settings |

Original Contract Term |

Original Payment Term |

|

Dates |

November 1 – May 31 |

September 1 – August 31 |

|

Number of monthly pay periods |

7 |

12 |

|

Pay Period Rates |

Contract regular earnings (not adjusted for holidays) 60,000 over 7 months = 8,571.42857 per month Note. This will be adjusted before the contract term begins. |

Amount paid: 60,000 over 12 months = 5,000 per month |

Prorate Method for Adjusting Contract and Calculating Worked Earnings

The system performs these recalculations because of the late start.

|

New Value of Contract |

56,883.12 Starting November 13 instead of November 1 means that the employee is working only 14 of the 22 work days in November. (The two holidays are paid holidays and count as work days.) The original monthly value of the contract (60,000 / 7) is multiplied by the new number of months (6 + 14/22) for a new total contract value of 56,883.12. |

|

New Monthly Payments |

4,716.65 The contract change is entered on October 1, at which point there are 11 pay periods left in the contract. The new contract value is 56,883.12, but 5,000 was already paid in September, so 51,883.12 remains to be paid over the 11 remaining pay periods. The new level payment amount is 4,716.65. |

|

New Monthly CRG |

8571.43 The contract is now for 6 + 14/22 months. The new contract value of 56,883.12 is divided by (6 + 12/22), for a new monthly CRG of 8,571.43. Note. This is also the worked earnings per pay period. |

|

November CRG, PNE, and ENP |

|

|

December through May CRG, PNE, and ENP |

|

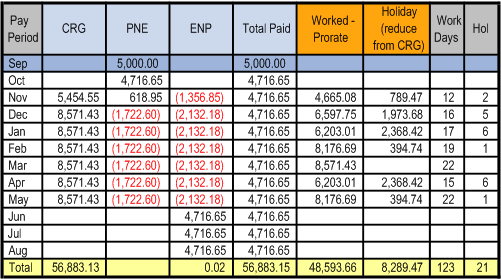

The following table shows the recalculated contract pay projections with worked earnings calculated using the Prorate method. The total worked earnings for each pay period is the sum of the Worked - Prorate earnings and the Holiday earnings. Because CRG shown in this table hasn't been reduced for holiday pay, the CRG also represents the worked earnings.

Employee starts work late and partial period is prorated: proration method

Actual Method for Adjusting Contract and Calculating Worked Earnings

The system performs these recalculations because of the last start.

|

New Value of Contract |

56,842.11 From November 1 – 12, the there were eight work days. Therefore, the value of the contract worth is reduced by eight times the daily rate for the contract: 60,000 – (394.73684 * 8) = 56,842.11. |

|

New Monthly Payments |

4,712.92 The contract change is entered on October 1, at which point there are 11 pay periods left in the contract. The new contract value is 56,842.11, but 5,000 was already paid in September, so 51,842.11 remains to be paid over the 11 remaining pay periods. The new level payment amount is 4,712.92 |

|

New Monthly CRG |

8,565.24 The contract is now for 6 + 14/22 months. The new contract value of 56,842.11 is divided by (6 + 12/22), for a new monthly CRG of 8,565.24 |

|

November CRG, PNE, and ENP |

|

|

December through May CRG, PNE, and ENP |

|

|

Worked Earnings per Pay Period |

The daily rate for the contract is unchanged, so the worked earnings per pay period are reduced for November, when the employee worked fewer days than the original contract called for, but are the same for all other months. |

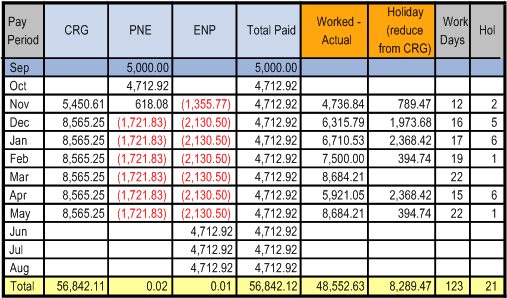

The following table shows the recalculated contract pay projections with worked earnings calculated using the Actual method. The total worked earnings for each pay period is the sum of the Worked - Actual earnings and the Holiday earnings.

Employee starts work late and partial period is prorated: actual method

Setting Up Contract Pay

Setting Up Contract Pay

To set up contract pay, use the School Schedule Table (HP_SCHOOL_SCHD_TBL), Contract Pay Type (CONTRACT_PAY_TYPE), and Pay Group Table (PAYGROUP_TABLE) components.

This section lists the pages used to set up contract pay and discusses how to:

Define school schedules.

Define contract pay types.

Define contract earnings codes for a pay group.

Pages Used to Set Up Contract Pay

Pages Used to Set Up Contract Pay|

Page Name |

Definition Name |

Navigation |

Usage |

|

HP_SCHOOL_SCHD_TBL |

Set Up HRMS, Product Related, Workforce Administration, Contract Administration, School Schedule, School Schedule |

Define school schedules to use when calculating the number of work days in a contract. Days during the breaks that you define on the School Schedule page are not considered work days. |

|

|

CONTRACT_PAY_TYPE |

Set Up HRMS, Product Related, Workforce Administration, Contract Administration, Contract Pay Type, Contract Pay Type |

Define contract pay types to provide default values for the Contract Pay page, where you set up pay details for a specific employee contract. |

|

|

Education and Government Additional Earnings Codes |

PAYGRP_TBL3_HP_SEC |

Set Up HRMS, Product Related, Payroll for North America, Payroll Processing Controls, Pay Group Table, Calc Parameters Click Addl Educ/Govt Earnings Codes on the Calc Parameters page. |

Define earnings codes for contract regular, earned not paid, and paid not earned earnings. |

Defining School Schedules

Defining School Schedules

Access the School Schedule page (Set Up HRMS, Product Related, Workforce Administration, Contract Administration, School Schedule, School Schedule).

School Break Details

|

Break Start Date and Break End Date |

Enter the first and last date of the school break. For one-day breaks, these values are the same. Breaks cannot overlap. A school schedule can cover multiple school years. As your school's schedule becomes available for each new school year, add the break information to the existing school schedule definition. |

Define Contract Pay Types

Define Contract Pay Types

Access the Contract Pay Type page (Set Up HRMS, Product Related, Workforce Administration, Contract Administration, Contract Pay Type, Contract Pay Type).

The settings on this page determine the default values of the corresponding fields on the Contract Pay page and the Contract Pay Options page, where you configure payment options for a specific employee contract. Users can override any of these values on the Contract Pay page.

When you create a contract pay type, you must select a default payment term and calculation method. Entering additional default values is optional.

See Defining Contract Pay for an Employee.

Defining Contract Earnings Codes for a Pay Group

Defining Contract Earnings Codes for a Pay GroupAccess the Education and Government Additional Earnings Codes page (Set Up HRMS, Product Related, Payroll for North America, Payroll Processing Controls, Pay Group Table, Calc Parameters, then click the Addl Educ/Govt Earnings Codes button on the Calc Parameters page).

Enter the earnings codes for contract regular earnings, earned not paid and paid not earned

Entering Employee Contract Pay Settings

Entering Employee Contract Pay Settings

This section discusses how to:

Define contract pay for an employee.

Define pay annualization and funding options for contract pay.

Define proration options for contract changes.

Pages Used to Set Up Employee Contract Pay

Pages Used to Set Up Employee Contract Pay|

Page Name |

Definition Name |

Navigation |

Usage |

|

CONTRACT |

Workforce Administration, Job Information, Contract Administration, Update Contract Pay NA, Contract Pay |

Define contract pay for an employee. |

|

|

HP_CONTRACT_ACTUAL |

Workforce Administration, Job Information, Contract Administration, Update Contract Pay NA, Contract Pay Options |

Define pay annualization and funding options for contract pay. |

|

|

ChartField Detail |

HMCF_HRZNTL_CFLD |

Click the Edit Chart Fields link on the Contract Pay Options page. |

See Identify the ChartField Combo Codes to use for Paid Not Earned and Earned Not Paid contract pay. |

|

JOB_CNT_CHG_SEC |

Workforce Administration, Job Information, Job Data, Compensation Click the Contract Change Prorate Option link on the Compensation page. |

Choose how to prorate contract pay when there is a change to the contract amount. |

Defining Contract Pay for an Employee

Defining Contract Pay for an Employee

Access the Contract Pay page (Workforce Administration, Job Information, Contract Administration, Update Contract Pay NA, Contract Pay).

|

Contract ID |

Displays an automatically-generated number that is unique for the employee and record number. This contract ID is not connected to a contract number from the Update Contracts component. When you renew a contract for another term, create a new contract ID. The system then creates a new set of projections for the new contract ID. When you change the terms of an existing contract (for example, by adjusting the contract begin date if the employee starts late), use a new effective dated row for the current contract ID. The resulting calculation then supersedes the existing calculation, and rolls up any actuals that are associated with the previous effective-date. |

|

Recalculate Contract |

Click this button to flag the contract for recalculation when you next run the Contract Projected Payment process. This button is unavailable if the system has already flagged the contract for recalculation. The system flags the contract for recalculation when you make certain contract pay changes or job data changes. |

Contract Information

|

Effective Date |

The contract effective date must be within the contract payment term (between the Payment Begin Date and the Payment End Date). |

|

Contract Pay Type |

Select a contract type to populate the contract with default settings from the selected contract type. Using a contract type helps you enter data quickly and consistently, but it does not force you to accept any of the associated settings; you can override values that come from the contract type. Selecting a contract type overrides existing data on the Contract Pay page. |

|

Payment Term |

Choose the payment term for the contract. Contract pay is always levelled over the payment term you select. For example, consider a contract for 36,000 USD with a contract term of 9 months. If the payment frequency is monthly and the payment term is the same as the contract, you pay 4,000 USD per month for nine months. If you choose a 12 month payment term, you pay 3,000 USD per month for 12 months. Select from the these payment term options:

|

|

Monthly Frequency |

Select a monthly payment frequency to be used when calculating the monthly pay rate for the contract. Typically, you select the delivered frequency M (monthly), but you can choose any frequency definition with whose frequency type is Monthly. Note. This is not the employee's pay frequency. Pay frequency is established in the employee's pay group. |

|

Calculation Method |

Select a method for calculating worked earnings. This information is necessary so that you can properly calculate final pay if the person does not complete the contract. These are the available calculation methods:

See Understanding Contract Earnings, Contract Pay Calculation Examples. |

|

Pay Period Hours |

If you require hours data for other processes such as leave accruals, enter the number of hours per pay period. When the system loads contract pay to the paysheet, it loads the hours into the payline. |

|

Daily Hours |

Enter the number of hours worked per day. The system uses this to calculate an hourly pay rate for the contract. |

|

Assign Hours To |

If you enter pay period hours, use the Assign Hours To field to indicate how to assign hours to contract earnings codes:

|

|

Contract Begin Date and Contract End Date, |

The maximum length for a contract is 12 months. |

|

Payment Begin Date and Payment End Date |

The payment term must begin on or before the contract begin date and must end on or after the contract end date. Follow these guidelines for defining the begin and end dates for the different types of payment terms:

Note. If an employee has more than one contract, the payment terms can not overlap. |

|

Actual Start Date |

Enter the date the employee actually starts work. The default is the contract begin date. The usual reason for changing this default is if the employee starts working later than originally contracted. |

|

Termination Date |

Enter the date the employee terminates the contract, if different from the contract end date. The usual reason for entering a date here is if the employee stops working earlier than originally contracted. |

|

Last Payment Date |

To set up a balloon payment, enter the date of the payment here. All payments after the last payment date are rolled up and paid on the last payment date. A common use of this option is if you pay contract employees as though they were paid over 12 months, except that the summer pay is paid as a balloon payment at the end of the school year. |

|

School Schedule |

Select the school schedule to use when calculating actual work days. The schedule lists the school break periods; break days are not counted as work days. |

|

Exclude Holiday Schedule |

Select this check box to exclude holidays from the count of actual work days in the contract term (that is, if holidays are considered unpaid leave rather than paid leave). |

|

Work Days in Contract |

Displays the number of work days in the contract term. The system calculates work days based on the employee's work schedule, the school schedule, and the holiday schedule. Holidays counts as work days unless the Exclude Holiday Schedule check box is selected. |

|

Prorate Hrs in Partial Period (prorate hours in partial period) |

If you enter pay period hours so that hours can be loaded to paysheets, you can select this check box to prorate the pay period hours during partial periods. If you allocate hours to contract earnings, partial periods occur when the contract term begins or ends in the middle of the pay period. If you allocate hours to all earnings (contract regular, paid not earned, and earned no paid), partial periods occur when the payment term begins or ends in the middle of the pay period. The proration calculation depends on the calculation method you are using:

|

|

Renew Contract Automatically |

Select to allow the Contracts Renewal process to renew this contract. |

|

Nbr of Renewals (number of renewals) |

Enter the maximum number of automatic renewals for the contract. If the contract can be renewed indefinitely, enter 99. |

See Also

Setting Up and Working with Frequencies

Adding Basic Contract Information

Defining Pay Annualization and Funding Options for Contract Pay

Defining Pay Annualization and Funding Options for Contract Pay

Access the Contract Pay Options page (Workforce Administration, Job Information, Contract Administration, Update Contract Pay NA, Contract Pay Options).

Annualization Options

Select an annualization option for taxable gross and for imputed income calculations for contract pay employees who are paid over less than a full year.

|

Annualize Over 12 Months, |

The earnings are annualized over 12 months, regardless of the length of the payment term. |

|

Annualize Over Payment Periods |

The earnings are annualized over the number of pay periods in the payment term. |

|

User Specified and Annualization Factor |

The system uses the annualization factor that you enter. |

Funding Options

|

Same as Contract Regular |

Select this check box to use the contract regular earnings funding source for the Paid Not Earned and Earned Not Paid earnings as well. When you select this check box, the system hides the other page elements in this group box. |

|

Combo Code for Paid Not Earned and Combo Code for Earned Not Paid, |

If the Same as Contract Regular check box is not selected, these fields show the Combo Codes that you use for Paid Not Earned and Earned Not Paid earnings. |

|

Edit ChartFields |

Click to access the ChartField Detail page, where you select Combo Codes for Paid Not Earned and Earned Not Paid earnings. |

Defining Proration Options for Contract Changes

Defining Proration Options for Contract Changes

Access the Contract Change Proration Options (click the Contract Change Prorate Option link on the Compensation page).

Access this page for the row of job data where you are entering the compensation change.

When an employee's contract pay changes, the settings on this page control how the new pay rate is to be applied.

|

No Proration of Change Amt. (no proration of change amount) |

Select if you do not want to prorate the change; the person receives the entire amount of the increase. For example, if a contract amount increases by 4,000 USD, the employee receives all 4,000 USD, regardless of the effective date of the increase. |

|

Prorate Over Contract Period |

Select to prorate the change over the number of pay periods in the contract term (determined by the contract start and end dates). For example, if the contract term is ten months, and the contract amount increases by 4,000 USD after five months (with five months remaining in the contract term), the employee receives half of the increase, or 2,000 USD more than the original contract amount. |

|

Prorate Over Payment Period |

Select to prorate the change over the payment term (determined by the payment start and end dates). For example, if the contract term is ten months, the payment term is twelve months, and the contract and payment terms start at the same time, and the contract amount increases by 4,000 USD after five months (with seven months remaining in the payment term), the employee receives 7/12 of the increase, or 2,333.33 USD more than the original contract amount. |

|

Prorate Using Effective Date |

Note. This option is only applicable if the calculation method is Actual. Select to prorate the compensation change over the number of work days in the contract term. For example, if the contract term includes 150 work days, and the contract amount increases by 3,000 USD effective the 51st day (so the change is effective for 100 days), the employee receives two thirds of the increase, or 1,000 USD more than the original contract amount. |

|

Select Lump Sum Retro Payment (lump sum retroactive payment) |

Choose whether to issue a lump sum retro payment for salary increases. The amount of the increase is determined by the proration option that you choose; this check box controls only whether the increase is paid over the remainder of the payment term or whether it is allocated across all months in the payment term, with retro pay for completed months.

Regardless of whether the increase is allocated to the entire payment term or only the remaining pay periods, the exact amount allocated to each pay period depends whether your contract pay calculation method is Prorate, which in our example would mean that 1/12 of the increase is paid each month, or Actual, which allocates the amount based on the number of work days in each month. Note. This setting is relevant only for salary increases, not for reductions in salary. |

Processing Contract Pay

Processing Contract Pay This section discusses how to:

Calculate contract pay.

Review contract payment details.

Run the contract discrepancy report

Recalculate contract work days

Run the contract renewal process.

Pages Used to Process Contract Pay

Pages Used to Process Contract Pay|

Page Name |

Definition Name |

Navigation |

Usage |

|

RUNCTL_PAYINIT3 |

|

Run the Contract Additional Pay process to generate Contract Pay records. Run this process before creating paysheets. |

|

|

HP_CONTRACT_PYMT |

|

Review projected and actual earnings over the entire payment term of a contract. |

|

|

HP_WRK_SCHDLE_SEC |

Click the Work Schedule link on the Contract Payment Details page. |

Review which days of the week are included in the employee's work schedule. |

|

|

HP_RUNCTL_CNTDISP |

|

Run the Contract Discrepancy Report (CNTPAY05) to identify discrepancies between actual payments and projected payments. |

|

|

RUNCTL_CNTPAY04 |

Workforce Administration, Job Information, Contract Administration, ReCalc Contract Work Days NA, Recalc Contract Work Days |

Run the Update Work Days/Daily Rt process to recalculate the number of work days in contracts. |

|

|

RUNCTL_CNTPAY02 |

Workforce Administration, Job Information, Contract Administration, Renew Pay Contracts NA, Contract Renewals |

Run the Contracts Renewal process. This process enables you to automatically renew contracts that meet the criteria that you specify. |

Calculate Contract Pay

Calculate Contract Pay

Access the Create Contract Projected Pay page (Payroll for North America, Payroll Processing CAN, Create and Load Paysheets, Create Contract Projected Pay, Create Contract Projected Pay; or Payroll for North America, Payroll Processing USA, Create and Load Paysheets, Create Contract Projected Pay, Create Contract Projected Pay).

Pay Run

|

Pay Run ID |

If you are running the process by on-cycle run, enter the pay run ID that you are processing. |

Pay Calendar

|

Company, Pay Group, and Pay End Date |

If you are running the process by off-cycle pay calendar, enter the company, pay group, and pay end date of that you are processing. |

Select All Employees

|

Select All Employees |

Select this check box to force a recalculation of the contract projected payment for all employees in the pay run. |

Lump Sum Retro Payments

|

Separate Check |

Indicate if you are running this process for a lump sum payment to be paid using a separate check. |

Reviewing Contract Payment Details

Reviewing Contract Payment Details

Access the Contract Payment Details page (Payroll for North America, Employee Pay Data CAN, Contract Payment Details, Contract Payment Details; or Payroll for North America, Employee Pay Data USA, Contract Payment Details, Contract Payment Details).

This page displays information about various types of contract pay earnings, including contract regular, paid not earned, earned not paid, and worked earnings. Earlier sections of this chapter explain these earnings types.

See Understanding Contract Earnings.

|

Recalculate Contract |

Displays Yes if:

When the contract is marked for recalculation, the Contract Projected Payment Process recalculates the contract pay the next time it processes this contract. |

Contract Payment Sequence

The Contract Projected Payment process adds a new contract sequence number and effective date if contract data changes affect previously calculated pay rates.

Contract Information

This group box displays key information about the contract, including the value of the contract as of the last recalculation, the contract term, and the payment term.

Contract Calendar

This group box displays information about the data that is used to determine work days during the contract term.

The holiday schedule and school schedule appear on this page. Click the Work Schedule link to view the employee's individual work schedule.

Pay Rates

This group box displays the annual, monthly, daily, and hourly pay rates that correspond to the contract pay. To calculate this information, the system uses the Monthly Frequency and the Daily Hours settings from the Contract Pay page.

See Defining Contract Pay for an Employee.

Payment Summary

|

Carry Over Amounts and Adjustments to Carry Over Amounts |

Use these group boxes when the contract has been recalculated. The Carry Over Amounts group box displays the contract regular, paid not earned, earned not paid, and actual worked amounts from the previous contract sequence. The Adjustments to Carry Over Amts group box enables you to enter positive or negative adjustments (not overrides) for any of these amounts. The Carry Over Amounts group box also shows the amount of leave from the previous contract sequence, but you cannot adjust this. |

|

Projected Payment Totals and Actual Earnings Totals |

The Projected Payment Totals group box displays projected totals for the entire payment term. It displays totals for contract regular, paid not earned, earned not paid, total paid, leave of absence, and worked earnings. The Actual Earnings Totals group box shows the same earnings types, but shows only the actual amounts to date. |

Projected Payments and Actual Earnings: Projected Earnings Tab

This grid provides pay period details for projected and actual contract pay.

|

Status |

Displays the status of the contract earnings for the given pay period:

|

Projected Payments and Actual Earnings: Actual Earnings Tab

The Actual Earnings tab displays the actual contract pay amounts for confirmed payments. Active rows (rows for payments that haven't been confirmed) show zero earnings in all columns.

The Actual Earnings tab includes all of the same columns as the Projected Earnings tab, along with two more columns related to actual leave taken:

|

Paid Leave |

Displays the actual amount of paid leave earnings for the pay period. |

|

Unpaid Leave |

Displays the earnings that were lost due to unpaid leave during the pay period. |

Running the Contract Discrepancy Report

Running the Contract Discrepancy ReportAccess the Contract Discrepancy Report page (Payroll for North America, Payroll Processing CAN, Pay Period Reports, Contract Discrepancy Report, Contract Discrepancy Report; or Payroll for North America, Payroll Processing USA, Pay Period Reports, Contract Discrepancy Report, Contract Discrepancy Report).

Run the Contract Discrepancy Report for a specific pay period to find any discrepancies between the projected payment for the pay period and the actual payment. If there are discrepancies and the pay run is not confirmed, you can make adjustments on the paysheet. If there are discrepancies and the pay run is confirmed, use the Contract Payment Details page to make manual adjustments to the contract pay schedule for future pay periods.

Recalculating Contract Work Days

Recalculating Contract Work Days

Access the Recalc Contract Work Days page (Workforce Administration, Job Information, Contract Administration, ReCalc Contract Work Days NA, Recalc Contract Work Days).

When you modify a holiday schedule, a school schedule, or employee work days, run the Update Work Days/Daily Rt process to recalculate the actual number of work days for contracts and for contract pay periods.

Running the Contract Renewal Process

Running the Contract Renewal Process

Access the Contract Renewals page (Workforce Administration, Job Information, Contract Administration, Renew Pay Contracts NA, Contract Renewals).

Run the Batch Renewal of Pay Contracts (CNTPAY02) process to renew contracts that are configured for automatic renewal and that expire in the specified number of days.

See Contract Renewals.

Administering Contract Prepay

Administering Contract PrepayThis section provides an overview of contract prepay and discusses how to use the prepay option.

Understanding Contract Prepay

Understanding Contract Prepay

The Contract Prepay Options page enables employees who are paid only during their contract term to prepay their deductions for benefits that extend past the term of their contract. For example, if benefits coverage is 12 months and an employee has a six-month contract and is paid only during the contract term, the employee can choose to prepay the remaining six months benefits deductions during the contract (and pay) period. This prepayment option is only available to employees who are paid over the contract term and who have Pay Over Contract selected as the payment term on the Contract Pay page.

The contract prepay option functionality does not allow for gross-up checks.

Note. The contract prepay option is not recommended for employees that have multiple contracts that, taken together, span the benefits period.

The balance that is accrued with the prepayment deductions covers benefits deductions after the contract term ends. The system doesn't take the prepay deductions to cover them if there are insufficient funds in the paycheck. The system takes all current deductions first. The following situations outline when the system takes deductions and when it uses the prepay balance to cover deductions:

If there are sufficient funds in the paycheck to take the prepay deductions, the system takes the prepay deductions, but only up to the prepay limit (a percentage of the net pay).

If there are funds in the paycheck for the prepay limit to cover some of the prepaid deduction, the system takes a partial deduction, if the prepay deduction is set up for partial deductions.

If there are insufficient funds in the paycheck to cover the prepaid deduction, the system does not take the deduction.

If there are insufficient funds to cover all of the current deduction, the system takes as much as possible of the deduction from the prepaid balance.

When the employee no longer receives a paycheck (the contract and payment term have ended), the system takes current deductions from the prepaid balance.

It is possible to prepay too much or too little in some circumstances, such as:

The deduction rates are based on age.

The deductions are based on current pay earnings, and there is a pay change.

The deduction rate changes after the contract is over.

The prepayment factor causes over payment.

If an employee prepays too much for benefits, use paysheets to make a one-time deduction refund. If an employee prepays too little, make a one-time benefits payment.

Prerequisite

PrerequisiteYou must set up the Company General Deductions page to use PREPAY as a deduction code.

See Also

Assigning General Deductions to a Company

Page Used to Prepay Deductions

Page Used to Prepay Deductions|

Page Name |

Definition Name |

Navigation |

Usage |

|

CONTRACT_PREPAY |

Workforce Administration, Job Information, Contract Administration, Contract Prepay Options NA, Contract Prepay Options |

Enable a contract employee to prepay benefits over the course of the contract and pay period when the employee's benefits coverage extends past the term of the contract. |

Using the Prepay Option

Using the Prepay Option

Access the Contract Prepay Options page (Workforce Administration, Job Information, Contract Administration, Contract Prepay Options NA, Contract Prepay Options).

|

Contract Number of Days |

The default value is the length of the contract term for the contract that is effective on the prepay options effective date. You can override this field. |

|

Prepay Limit % (prepay limit percent) |

Enter the percentage of the net pay amount that you can use to prepay benefits. For example, if this value is 15, then you can use a maximum of 15 percent of the net pay amount to prepay benefits. If the prepay benefits amount exceeds 15 percent of the net pay amount, the system takes up to the 15 percent limit. |

Employee Deduction Pre-Payment Options

|

PrePay Option |

Indicate how to calculate the prepaid deductions for this benefit: Contract: The system prorates the deductions that extend past the term of the contract across the contract pay period. Factor: The system adds a factor of the regular deduction to each pay period that falls in the time period in the Begin Date and End Date fields. The following are three possible prepay scenarios in the case of a 9-month contract with monthly payroll and 12-month benefits coverage. Assume the monthly benefits deductions are 60 USD:

|

|

PrePay Factor |

Enter the prepay factor of the deductions that you are prepaying. For example, if you enter 2, the system deducts twice the pay-period deduction amount, in addition to the regular pay-period deduction, for each pay period between the begin and end dates. Use this field only when you select Factor in the PrePay Option field. Note. Using the PrePay Factor option might cause an overpayment of deductions. |

Adjusting Contract Employee Prepay Balances

Adjusting Contract Employee Prepay Balances

This section provides an overview of contract employee prepay balance adjustments and discusses how to:

Review contract prepay balances.

Review contract prepay balance adjustments.

Enter a reason for prepay balance adjustments.

Change prepay balances.

Understanding Contract Employee Prepay Balance Adjustments

Understanding Contract Employee Prepay Balance AdjustmentsThe system creates a prepay balance record when the Pay Confirmation process is run, and it shows a benefits deduction prepayment. The Pay Confirmation process continues to update the prepay balance record with each run. When the prepay balance reaches zero, the system deletes the record.

You cannot make an adjustment to issue a refund for overpayment using the PrePays component (ADJ_PREPAY_BAL). Use paysheets to make a one-time deduction refund.

Note. You must set up a PREPAY deduction code on the Company General Deductions Table to use PREPAY as a deduction code.

Pages Used to Adjust Contract Prepay Balances

Pages Used to Adjust Contract Prepay Balances|

Page Name |

Definition Name |

Navigation |

Usage |

|

BALANCES_PREPAY1 |

|

Review a contract employee's benefits deduction prepay balances if you use the Contract Prepay feature. Before using this page, you must set up the Contract Prepay Options page. |

|

|

BALANCES_PREPAY2 |

|

Review a contract employee's benefits deduction prepay balance and balance history if you use the Contract Prepay feature. Before using this page, you must set up the Contract Prepay Options page. |

|

|

ADJ_PREPAY_BAL1 |

|

Enter a reason for adjustments to an employee's benefits prepayment balance. |

|

|

ADJ_PREPAY_BAL2 |

|

Adjust an employee's benefits prepayment balance. |

Reviewing Contract Prepay Balances

Reviewing Contract Prepay Balances

Access the Prepay Balances page (Payroll for North America, Periodic Payroll Events USA, Balance Reviews, PrePays, Prepay Balances; or Payroll for North America, Periodic Payroll Events CAN, Balance Reviews, PrePays, Prepay Balances).

|

Company |

The company that issued the contract. |

|

PrePay Balance |

The employee's benefits deduction prepay balance (how much the employee has overpaid in anticipation of benefits coverage that extends past the pay period). |

Reviewing Contract Prepay Balance Adjustments

Reviewing Contract Prepay Balance Adjustments

Access the Prepay Balance Adjustments page (Payroll for North America, Periodic Payroll Events USA, Balance Reviews, PrePays, Prepay Balance Adjustments; or Payroll for North America, Periodic Payroll Events CAN, Balance Reviews, PrePays, Prepay Balance Adjustments).

|

Sequence Number |

The sequence number of the adjustment reason. If more than one adjustment occurs in a day, the number in this field indicates which adjustment took place first. |

Prepay Balance Adjustment

|

Adjustment |

The amount of the prepay balance adjustment. For example, if you increase prepayments by 20 USD per month for the remaining six months of the contract term, this field displays 120.00 USD (20 USD * 6 months = 120 USD). |

|

PrePay Balance, Before and After |

Displays the prepay balance before and after the adjustment. |

Entering a Reason for Prepay Balance Adjustments

Entering a Reason for Prepay Balance Adjustments

Access the Adjust Prepay Balance1 page (Payroll for North America, Periodic Payroll Events USA, Balance Adjustments, PrePays, Adjust Prepay Balance1; or Payroll for North America, Periodic Payroll Events CAN, Balance Adjustments, PrePays, Adjust Prepay Balance1).

|

Adjustment Reason |

Enter the reason for the adjustment to the benefits deduction prepayments. |

Changing Prepay Balances

Changing Prepay Balances

Access the Adjust Prepay Balance2 page (Payroll for North America, Periodic Payroll Events USA, Balance Adjustments, PrePays, Adjust Prepay Balance2; or Payroll for North America, Periodic Payroll Events CAN, Balance Adjustments, PrePays, Adjust Prepay Balance2).

|

PrePay |

Enter the amount of the prepay adjustment in either positive or negative amounts. |

|

Balance |

Displays the balance of the prepaid deduction amount after taking into consideration the prepay adjustment amount. |