Understanding the Interface with Payables

Understanding the Interface with Payables

This chapter provides an overview of the interface with Payables and discusses how to:

Set up the Payables interface.

Maintain vendor information.

Extract deductions.

Review and send vouchers.

Understanding the Interface with Payables

Understanding the Interface with Payables

This section discusses:

Processing overview.

Voucher records.

Integration points.

Processing Overview

Processing Overview

Payroll for North America enables you to send taxes, benefits, garnishments, and voluntary deductions withheld from employee paychecks directly to Payables for payment. Payables issues payments in the form of checks or electronic funds transfers, as required by the third-party, and makes the appropriate general ledger entries.

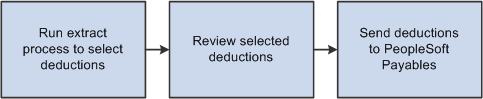

This diagram illustrates the Payables interface processing for sending deductions to PeopleSoft Payables:

Illustration showing the process for selecting and sending deductions to PeopleSoft Payables

Note. The pay run must be confirmed before extracting deductions. In addition, the Non-Commitment Accounting GL Interface process (PAYGL01 or PAYGL01A), the Commitment Accounting Actuals GL interface process (PAYGL02 or PAYGL02A), or the Distribute Payroll Data for AP process (PAYGL01 or PAYGL01A) must be processed successfully before extracting deductions.

To extract and send deduction vouchers to Payables:

Run one or more extract processes to move selected deductions into temporary tables for viewing.

You can extract nontax deductions; U.S. federal, state, or local taxes; or Canadian taxes.

The system updates the AP Status field on the Review Paycheck component (PAY_CHECK) with an X to indicate that the deduction has been extracted for payment through Payables.

Review and validate proposed payments.

The Review AP Extract-Headers - Review AP Extract-Lines page displays summary data by vendor.

The Review AP Extract-Lines - Review AP Extract-Lines page displays details of deductions.

The AP Extract Audit report (PAYXTRCT) lists details of extracted nontax deductions.

Send vouchers to Payables.

Run the Send Vouchers to AP process (PYAP_VCHPOST), which creates and sends the vouchers to Payables.

The system updates the AP Status field on the Review Paycheck component (PAY_CHECK) with an S to indicate that the deduction has been sent and clears deductions from the temporary tables.

Review the PeopleSoft Integration Broker Service Operations Monitor to confirm that the voucher records were successfully sent.

See Also

Reviewing and Sending Vouchers

PeopleSoft Enterprise Human Resources PeopleBook: Enterprise Components

Voucher Records

Voucher Records

The vouchers that are sent to Payables contain three records: VOUCHER, VOUCHER_LINE, and DISTRIB_LINE. Fields of interest in each of these records are listed in the following table. The table lists only a subset of the fields in each record:

|

VOUCHER |

VOUCHER_LINE |

DISTRIB_LINE |

|

BUSINESS_UNIT |

BUSINESS_UNIT |

BUSINESS_UNIT |

|

VOUCHER_ID |

VOUCHER_ID |

VOUCHER_ID |

|

INVOICE_ID |

VOUCHER_LINE_NUM |

VOUCHER_LINE_NUM |

|

INVOICE_DT |

TOTAL_DISTRIBS |

DISTRIB_LINE_NUM |

|

VENDOR_SETID |

MERCHANDISE_AMT |

BUSINESS_UNIT_GL |

|

VENDOR_ID |

|

ACCOUNT |

|

VNDR_LOC |

|

MERCHANDISE_AMT |

|

ADDRESS_SEQ_NUM |

|

|

|

ORIGIN |

|

|

|

VCHR_TTL_LINES |

|

|

|

GROSS_AMT |

|

|

|

DUE_DT |

|

|

|

REMIT_ADDR_SEQ_NUM |

|

|

|

EIN_FEDERAL |

|

|

|

EIN_STATE_LOCAL |

|

|

Integration Points

Integration Points

Before using the integration between Payroll for North America and Enterprise Payables, configure the Integration Broker local node and activate the queues, handlers, and routings for these service operations:

|

Service Operation |

Description |

|

VENDOR_FULLSYNC |

Payables publishes complete data from the VENDOR and related tables and Payroll for North America subscribes. |

|

VENDOR_SYNC |

Payables publishes incremental update data from the VENDOR and related tables and Payroll for North America subscribes. |

|

VOUCHER_BUILD |

Payroll for North America publishes data to the VOUCHER, VOUCHER_LINE, and DISTRIB_LINE tables and Payables subscribes. |

Note. To research the technical details of any integration point used by PeopleSoft applications, refer to the Interactive Services Repository on My Oracle Support.

See Also

Interactive Services Repository in the Implementation Guide section of My Oracle Support.

Working with Integration Points in Enterprise HRMS

Enterprise PeopleTools PeopleBook: Integration Broker

PeopleSoft Enterprise Human Resources PeopleBook: Enterprise Components

Setting Up the Payables Interface

Setting Up the Payables Interface

Perform the following setup steps when you implement Payroll for North America and on an ongoing basis, as needed, to maintain the accuracy of your deduction records:

(Optional) Specify the invoice prefix on the Installation Table (INSTALLATION_TBL) - Product Specific page.

The character you put in the AP Inv. Prefix field is used as a prefix on all invoices coming from PeopleSoft HRMS.

Specify payroll tax extraction on the Company (COMPANY_TABLE) - Default Settings page.

Select the Pay Taxes through AP check box if you plan to use the interface with Payables to extract payroll taxes.

Define general and benefit deductions.

For both general and benefit deductions, you must define when each deduction is to be paid. For example, you might want Payables to pay some deductions every time they are calculated and pay other deductions only when the goal balance has been met.

Define vendors in Payables and publish them to the PeopleSoft HRMS database.

Link deduction definitions to vendors and define when deductions are to be paid.

All deductions to be paid by Payables must be linked to a vendor.

To link nontax deductions (benefits, general deductions, garnishments) to vendors, complete the SetID and Vendor ID fields on the Benefit Plan Table page, Garnishment Spec Data 2 page, and General Deduction Table page.

To determine which deductions to retrieve for Payables, use the Pay Mode and AP Payment Date Type fields on the Benefit Plan Table page, Garnishment Spec Data 7 page, and General Deduction Table page.

The Garnishment Spec Data 7 page also includes a Separate AP Payment check box that you use to control whether to generate separate checks when there are multiple garnishments for the same vendor.

To link U.S. tax deductions to vendors:

Use the Tax Type Table page to define the tax types paid to a vendor

Link each tax type to the appropriate vendor and tax classes on the AP State Tax Types/Classes Table page or the AP Local Tax Types/Classes page.

To link Canadian tax deductions to vendors, use the Canadian Tax Type Table page.

Set up ChartFields for the GL (general ledger) interface.

If your organization uses noncommitment accounting, set up the grouping and mapping of expense ChartField for PeopleSoft Enterprise GL (General Ledger) Interface

See Integrating with Enterprise General Ledger.

If your organization uses commitment accounting, set up commitment accounting control tables.

See PeopleSoft Enterprise Human Resources PeopleBook: Manage Commitment Accounting

See Also

Setting Up and Installing PeopleSoft HRMS

Setting Up Organization Foundation Tables

Setting Up Tax Types for PeopleSoft Enterprise Payables Integration

Maintaining Vendor Information

Maintaining Vendor InformationThis section provides an overview of maintaining vendors and discusses how to run the AP Vendor Listing report.

Understanding Vendor Maintenance

Understanding Vendor MaintenanceEach benefit provider, garnishment collector, tax authority, or other entity that receives employee deductions must have a valid Vendor ID. Vendor IDs created in the PeopleSoft Financials database can be viewed on the AP Vendor Listing report and in the Vendor table.

Note. If you are using Payables, it is highly recommended that you do not set up data in the HRMS Vendor tables. This information should be set up in the Vendor tables in the PeopleSoft Financials database and sent to HRMS through the VENDOR_FULLSYNC and VENDOR_SYNC service operations in PeopleSoft Integration Broker. If updates occur on the HRMS vendor tables and do not get updated on the vendor tables in the PeopleSoft Financials database, the interface outcome could be unpredictable. Corrections and updates to vendor information should occur only in the PeopleSoft Financials database.

See Also

Page Used to Run the AP Vendor Listing Report

Page Used to Run the AP Vendor Listing Report|

Page Name |

Definition Name |

Navigation |

Usage |

|

RUNCTL_PAYVNDR |

Payroll for North America, Payroll Distribution, Accounts Payable Information, AP Vendor Listing, AP Vendor Listing |

Generate the PAYVNDR report that prints a listing of all vendors, up to a given date. |

Extracting Deductions

Extracting DeductionsThis section lists prerequisites and common elements and discusses how to:

Extract nontax deductions.

(USA) Extract federal tax deductions.

(USA) Extract state tax deductions.

(USA) Extract local tax deductions.

(CAN) Extract Canadian tax deductions.

See Also

Prerequisites

PrerequisitesBefore you can extract deductions, you must:

Confirm the pay run.

Run GL interface processing to prepare the data.

The process you run to prepare the data depends upon your organization's system of accounting and general ledger system.

This table describes the required processing under various conditions:

|

Your Organization Uses |

Required Processing |

Processing Description |

|

Non-commitment accounting with PeopleSoft GL Interface. |

Run the Non Commitment Accounting Information PSJob process (PAYGL01– E&G, or PAYGL01A), after each pay run is confirmed. |

Prepares ChartField information for each deduction transaction and stores it in tables such as PAY_NA_DED_LIAB, PAY_NA_TAX_LIAB, and PAY_NA_CTX_LIAB for the tax and non-tax deduction extraction processes to access. |

|

Commitment accounting with PeopleSoft GL Interface. |

Run the Commitment Accounting Actuals PSJob process (PAYGL02 — E&G, or PAYGL02A) Actuals GL Interface) after each pay run is confirmed. |

Prepares ChartField information for each deduction transaction and stores it in tables such as PAY_DED_LIAB_AP, PAY_TAX_LIAB_AP, and PAY_CTX_LIAB_AP for the tax and non-tax deduction extraction processes to access. |

|

PeopleSoft Enterprise Payables but does not use PeopleSoft GL Interface . |

Run the Distribute Payroll Data for AP SQR process (General Ledger Interface - PAYGL01) after each pay run is confirmed. |

Prepares ChartField information for each deduction transaction and stores it in tables such as PAY_NA_DED_LIAB, PAY_NA_TAX_LIAB, and PAY_NA_CTX_LIAB for the tax and non-tax deduction extraction processes to access. |

See Also

Integrating with Enterprise General Ledger

PeopleSoft Enterprise Human Resources PeopleBook: Manage Commitment Accounting

Common Elements Used in this Section

Common Elements Used in this Section|

Tax Period End Date |

Enter the end date for the tax period. To be selected for payment, the paycheck date for tax deductions must be equal to or before the tax period end date. (The paycheck date populates the Pay Tax records after a pay run is confirmed). |

|

Payment Date |

Enter the date to appear on the voucher in Payables. This is the date when AP actually pays the taxes. |

Pages Used to Extract Deductions

Pages Used to Extract Deductions

Extracting Nontax Deductions for Payables

Extracting Nontax Deductions for Payables

Access the Non-Tax Deductions Extract page (Payroll for North America, Payroll Distribution, Accounts Payable Information, Non-Tax Deductions Extract, Non-Tax Deductions Extract).

Note. The CA Non-Tax Deductions Extract page is identical to the page shown for non-commitment accounting.

Use the parameters to extract nontax deductions for the pay run ID that you specify or extract just those deductions with a pay mode set to the date that you select. You can limit your selection further by specifying particular vendors you want to pay.

Pay Mode Selection

|

Deduct/Collect Comp./Bond Met (deducted/collection completed/bond price met) |

This option is applicable if you selected Pay as Deducted, Pay when Collection Completed, or Pay When Bond Price met as the pay mode on the General Deduction table, Benefit Plan table, or Garnishment Spec (garnishment specification) table and you selected either Check Date or Pay Period End Date as the AP payment date type. |

|

Pay Run ID |

This field works in conjunction with the Deduct/Collect Comp./Bond Met option. It enables you to limit the extract process to a single pay run that is associated with this run control ID. Select the pay run. If the pay mode is Pay When Collection Completed or Pay When Bond Price met, deductions that meet the criteria by the end date of the pay period represented by the pay run ID are extracted. |

|

Specified Date |

Select to send only those nontax deductions with a check date that's before or the same as the date that you enter in the Payment Due Date field. This option is appropriate when deductions for more than one pay period must be extracted (for example, benefit deductions that are withheld every pay period and sent to the vendor at the end of the month). |

|

Payment Due Date |

This field appears only when you select the Specified Date option. Enter the date that you want to appear on the voucher. This is the date on which the Payables system pays the vendor. |

Vendor Selection

|

Pay All Vendors |

By default, the system selects deductions for all vendors. To pay selected vendors only, deselect this check box. The SetID, Vendor ID, and Name fields then become available. |

Vendor Info

This group box appears only if you deselect the Pay All Vendors check box. Select the vendors that you want to pay.

See Also

Specifying the Deduction Priority

Setting up a Garnishment Deduction

(USA) Extracting Federal Tax Deductions for Payables

(USA) Extracting Federal Tax Deductions for Payables

Access the Extract AP Federal Taxes page (Payroll for North America, Payroll Distribution, Accounts Payable Information, Extract U.S. Federal Taxes, Extract AP Federal Taxes).

Specify which tax types to include in the extract. Only those tax deductions with a tax class that belongs to a tax type that you specify are selected for payment through Payables.

Tax Type Information

|

Tax Type |

Select the tax type. The prompt table includes only those tax types that you defined on the Tax Type Table page. You can add as many tax types as you like. |

See Also

Setting Up Tax Types for PeopleSoft Enterprise Payables Integration

(USA) Extracting State Tax Deductions for Payables

(USA) Extracting State Tax Deductions for Payables

Access the Extract AP State Taxes page (Payroll for North America, Payroll Distribution, Accounts Payable Information, Extract U.S. State Taxes, Extract AP State Taxes).

You can extract deductions for all or specific states. If you choose to extract deductions for a particular state, you can also limit the selection to certain tax types.

State Selection

|

All States |

Select to extract state tax deductions for all states. |

|

Specific States |

Select to extract state tax deductions for a particular state. When you select this option, the States group box appears. |

States

This group box appears only when you select the Specific States option.

|

State |

The states for which you defined tax types are available in the prompt. |

|

Tax Type |

Select the tax type. The prompt table includes only those tax types that you entered for the state on the Fed/State Tax Types/Classes table. |

(USA) Extracting Local Tax Deductions for Payables

(USA) Extracting Local Tax Deductions for Payables

Access the Extract U.S. Local Taxes page (Payroll for North America, Payroll Distribution, Accounts Payable Information, Extract U.S. Local Taxes, Extract U.S. Local Taxes).

You can extract tax deductions for all localities or a subset of localities. As with state tax processing, processing a subset requires that you specify one or more states, one or more localities within each state, and the specific tax types to process.

Locality Selection

|

All Localities |

Select to extract local tax deductions for all localities in all states. |

|

Specific Localities |

Select to extract tax deductions for specific localities within the specified state. When you select this option, the State/Localities group box appears. |

State/Localities

This group box appears only when you select the Specific Localities option. Select the localities and tax types for which you want to extract tax deductions.

|

State |

The states for which you defined tax types are available in the prompt. |

|

Locality |

The localities for which you defined tax types are available in the prompt. |

|

Tax Type |

Select the tax type. The prompt table includes only those tax types that you entered for the state on the Local Tax Types/Classes table. |

(CAN) Extracting Canadian Tax Deductions for Payables

(CAN) Extracting Canadian Tax Deductions for Payables

Access the Extract AP Canadian Taxes page (Payroll for North America, Payroll Distribution, Accounts Payable Information, Extract Canadian Taxes, Extract AP Canadian Taxes).

You can extract tax deductions for a single company or all tax deductions for all companies. Indicate the tax types to extract and enter a tax period end date and a period end date for each tax type specified.

Process Request Parameter(s)

|

Company |

Select a company to extract taxes for a single company. To extract tax deductions for all companies, leave this field blank. |

Tax Type Information

In this group box, select the tax types for which you want to extract tax deductions and the associated dates. For example, if you select CTAX as the tax type and enter a tax period end date of January 1, 2000, the system extracts all tax deductions with a tax class or sales tax class belonging to the CTAX tax type and with a pay check date of January 1, 2000 or earlier.

|

Tax Type |

Select the tax type. The prompt table includes only those tax types that you defined on the Tax Type Table page. You can add as many tax types as you like. |

Reviewing and Sending Vouchers

Reviewing and Sending VouchersThis section discusses how to:

View the payroll deduction summary record for a vendor.

View the detailed payroll deduction records for a vendor.

Send vouchers to Payables.

See Also

Pages Used to Review and Send Vouchers

Pages Used to Review and Send Vouchers

Viewing the Payroll Deduction Summary for a Vendor

Viewing the Payroll Deduction Summary for a Vendor

Access the Review AP Extract-Headers - Review AP Extract-Lines page (Payroll for North America, Payroll Distribution, Accounts Payable Information, Review AP Extract-Headers, Review AP Extract-Headers).

Note. Not all page elements are visible on this page. Depending on the page arrangement, you see additional elements by scrolling either vertically or horizontally.

With the exception of the Description field, all information on this page comes from the Accounts Payable Extract Header table. The Description field displays information that is entered in the More Information field on the Review AP Extract-Lines - Review AP Extract-Lines page.

|

Send |

The system automatically selects this option to indicate that the deduction will be sent to Payables when you start the Post Dedn Payments to AP process. To prevent the transaction from being sent, deselect this check box. |

Viewing the Detailed Payroll Deduction Records for a Vendor

Viewing the Detailed Payroll Deduction Records for a Vendor

Access the Review AP Extract-Lines page (Payroll for North America, Payroll Distribution, Accounts Payable Information, Review AP Extract Headers, Review AP Extract-Lines).

|

Review AP Extract - Headers |

Click the Review AP Extract - Headers link to access the Review AP Extract-Lines – Header page. |

|

More Information |

Use this field to enter comments that you want to appear on the voucher. |

Search Criteria

Use the fields in this group box to search for AP extract lines by company, pay group, extract type, employee ID, or name. You can enter more than one search criteria. You can also sort the results by name or ID.

|

Refresh |

Click the Refresh button to clear the search criteria and make the search criteria fields available for data entry. Then select the criteria that you want to use to limit the data displayed. |

|

Extract Type |

You can search on the following extract types: Benefit, Deduction, Garnishment, and Tax. |

|

Sort By |

Select the order in which you want the data displayed. |

|

Search |

After selecting search and sort criteria, click the Search button to update the display. |

Line Records

Use the tabs in this section to view details of extracted information.

|

Send to AP (send to accounts payable) |

The system automatically selects this option to indicate the transaction is sent to Payables when you start the Post Dedn Payments to AP process. To stop a transaction from being sent, deselect the check box. Any records that you remove will be captured the next time the extract process runs. |

Sending Vouchers to Payables

Sending Vouchers to Payables

Access the Send Vouchers to AP page (Payroll for North America, Payroll Distribution, Accounts Payable Information, Send Vouchers to AP, Send Vouchers to AP).

Note. Tax deductions and nontax deductions must be sent separately.

Transaction Type Selection

|

Non-Tax Deduction Payments |

Select this option to send nontax deductions to Payables. |

|

Tax Deduction Payments |

Select this option to send tax deductions to Payables. |

|

Payment Date |

Enter the date to appear on the voucher in Payables. The system will send only those deductions where the payment date on the extract page matches the date that you enter in this field. |