11g Release 1 (11.1.3)

Part Number E20379-03

Contents

Previous

Next

|

Oracle® Fusion

Applications Workforce Deployment Implementation Guide 11g Release 1 (11.1.3) Part Number E20379-03 |

Contents |

Previous |

Next |

This chapter contains the following:

Deduction rates and amounts may vary depending on the range in which the earnings balance falls. A deduction range is a table that holds the range of values and associated rates or amounts to use in deduction and exemption calculations. For example, a deduction range for a graduated tax might contain two range value rows: one that defines the tax rate for earnings under $50,000 and another for earnings above $50,000.

Each legislation has a set of predefined deduction ranges used to calculate statutory deductions. You cannot edit predefined deduction ranges. Depending on your configuration, you may be able to add new deduction ranges.

Each deduction range belongs to a deduction range group used to categorize related deduction ranges. Examples of deduction range groups include city tax information and social insurance information. A set of standard deduction range groups is delivered with the application and available to all legislations. When you create a deduction range, you can select an existing range group or create a new one.

Deduction ranges are building blocks used in the calculation of deductions and exemptions. You associate a deduction range with a calculation factor, which defines the complete set of rules for calculating the deduction element for balances in the range table. The deduction range provides the values, but the calculation factor specifies when and how to apply them.

For example, a calculation factor might direct the payroll process to do the following: Calculate the deduction using this deduction range only if the person lives in Region B, and then annualize the calculated result to produce the final deduction amount.

Use the Manage Payroll Deductions task in the Payroll Calculation work area to view and manage calculation factors.

The examples that follow illustrate how to use both static and dynamic deduction range values, and how to override the default calculation type for individual range value rows.

The deduction range for a regional income tax uses a default calculation type of Flat Rate. However, for the lowest and highest incomes, a flat amount applies. For these two ranges, the Flat Amount calculation type overrides the default type, and uses a monetary value rather than a percentage. No database item is specified in the Basis of Range of Values for the deduction range, so the range values are static.

|

From Value |

To Value |

Calculation Type Override |

Rate or Amount |

|---|---|---|---|

|

0 |

199 |

Flat Amount |

$0 |

|

200 |

999 |

|

4% |

|

1000 |

1999 |

|

6% |

|

2000 |

999,999,999 |

Flat Amount |

$300 |

The deduction range for a tax exemption uses a default calculation type of Incremental Rate. The first and last range value rows specify the Flat Amount calculation type, which overrides the default type. The Gross Earnings YTD database item is specified in the Basis of Range Values field, which means that the range values represent a percentage of year-to-date gross earnings. The following sample values define a set of dynamic range values for this deduction range:

|

From Value |

To Value |

Calculation Type Override |

Rate or Amount |

|---|---|---|---|

|

0 |

.1 |

Flat Amount |

$300 |

|

.1 |

.2 |

|

10% |

|

.2 |

.9 |

|

30% |

|

.9 |

1 |

Flat Amount |

$0 |

The first range value row defines a flat amount of $300 that applies to the first 10% of gross earnings. The second row defines a 10% rate that applies to the next 10%. The third row defines a 30% rate that applies between 20% and 90%. The final row defines a flat amount of zero between 90% and 100%.

A deduction override refers to a value entered on a deduction card that replaces a value defined in a deduction range. For example, an organization might set a default tax rate at the legislative level, and allow the rate to be overridden by a flat amount entered on a personal deduction card at the payroll relationship level.

When the payroll process runs, it checks for deduction card overrides in the following order:

Payroll relationship

Tax reporting unit

Payroll statutory unit

When the process finds an override record, it stops checking and uses the values defined at that level.

To allow users to override a value on a deduction card, you must first add the item to the Overrides Allowed on Deduction Card table on the Create or Edit Deduction Ranges page and provide the name to appear on the deduction card for the item. You cannot enable new overrides for predefined deduction ranges.

The list of items available for override varies depending on the calculation type for the deduction range. For example, you can allow users to override the percentage value for a flat rate calculation or the monetary value for a flat amount calculation. The following three override items are available for all calculation types except text:

Deduction Range: Uses the deduction range entered on the deduction card to calculate the deduction amount.

Total Amount: Uses the amount entered on the deduction card as the total deduction amount.

Additional Amount: Adds the amount entered on the deduction card to the calculated deduction amount

If you allow multiple overrides for the same deduction range, the deduction calculation process applies them in the following priority:

Total amount

Deduction range

Range value component, such as rate or flat amount

Use the Manage Personal Deductions task in the Payroll Calculations or Payroll Administration work area to create deduction card overrides at the payroll relationship level. If overrides are allowed, the Overrides Allowed on Deduction Cards tab appears in the Details section of the Manage Deduction Cards page when you select a deduction component. Click Create to define an override. The override value you enter varies based on the type of override item defined in the deduction range, as described in the previous section. For example, you may enter a rate to be used in the deduction calculation or an amount to be added to the calculated amount.

If your localization supports deduction cards at multiple levels, use the Manage Legal Entity Deduction Records task in the Setup and Maintenance work area to create deduction card overrides at the payroll statutory unit level. Use the Manage Legal Reporting Unit Deduction Records task in the Setup and Maintenance work area to create deduction card overrides at the tax reporting unit level.

The Calculation Type field on the Create or Edit Deduction Ranges page specifies the default type of calculation to use for all deduction range value rows. You can override the default calculation type for individual rows in the Range Values section by selecting a different calculation type in the Calculation Type Override field. The calculation type determines which values you must provide in the Range Values section. For example, if you select Flat Amount as the calculation type, then you must provide a flat amount value.

You can choose from several predefined calculation types, as described in the following table:

|

Calculation Type |

Description |

|---|---|

|

Flat Amount |

Uses the specified flat amount as the total deduction amount. |

|

Flat Amount Times Multiplier |

Multiplies a flat amount by a multiplier value. If you select this option, you must specify a database item that provides the value of the multiplier. |

|

Conditional Flat Amount |

Uses the specified flat amount if the condition defined in the Calculation section is met. For example, a person might qualify for an exemption if their filing status is married or head of household. If you select this option, you must specify a database item that provides the value of the condition. |

|

Flat Rate |

Applies the specified rate to the balance. |

|

Incremental Rate |

Applies a different rate to portions of the balance. For example, assuming that the balance is 80,000, you could apply a 1% rate for the first 20,000 of the balance; a 3% rate for the next 30,000, and a 5% rate to the next 30,000. This is also referred to as a blended rate. |

|

Standard Formula 1 |

Calculates the total amount based on the following formula: y = Ax - Bz y is the deducted amount x is the reduced deductible amount A and B are specified values. z is a factor from a predefined formula. The value defaults to 1. |

|

Standard Formula 2 |

Calculates the value based on the following formula: y = (x - A) x B + Cz y is the deducted amount x is the reduced deductible amount A, B, and C are specified values. z is a factor from a predefined formula. The value defaults to 1. |

|

Text |

Uses the specified character string as the calculated value |

You can specify the view objects that define the valid values available to the selected calculation type. A view object is a query result set that is used to display a list of values. The view objects you can specify vary depending on the calculation type. For example, if the calculation type is Conditional Flat Amount, then you can specify view objects for the condition and flat amount values.

Include the fully qualified path name when you specify a view object, such as: oracle.apps.hcm.locUS.payrollSetup.details.publicView.UsStatePVO

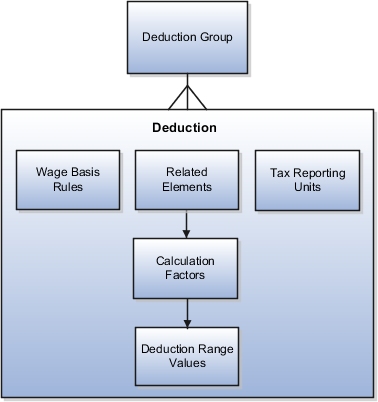

Deduction information defined at the legislative data group level comprises several different components, including wage basis rules, one or more payroll elements, and rules for calculating each element. The following figure shows the relationship between these components.

Each deduction belongs to a deduction group used to categorize related deductions. Predefined deduction groups include social insurance, taxes, retirement plans, involuntary deductions, benefits, and more. The deduction groups available and their names vary by legislation.

A deduction refers to a complete set of rules and rates for calculating a payroll deduction. A set of statutory deductions is predefined for each legislative data group and cannot be changed. To create a deduction, you must use one of the predefined element templates provided for your legislation.

Wage basis rules determine the earnings that contribute to a deductible amount or, for exemptions, the elements that reduce the amount subject to deduction. For example, wage basis rules might define which classifications of standard and supplemental earnings are subject to a particular tax. If wage basis rules vary based on a factor such as a person's location of residence, then location of residence is defined as a wage basis rule reference.

A deduction is associated with one or more elements. The element definition provides rules for how and when the element should be processed and identifies the input values for the element.

A calculation factor is a data-driven rule for calculating an element. For example, a calculation factor for a tax calculation element might define a 4% rate on deductible amounts under 50,000. If the tax rate varies based on a factor such as a person's filing status, then filing status is defined as a calculation factor reference. Thus, an element may have multiple calculation factors, one for each unique set of rules and references values. If element calculation involves multiple steps, each step is defined in a separate calculation factor.

Each calculation factor references a deduction range that stores the numeric rate or amount used in the calculation, along with the range to which it applies. Predefined deduction ranges are provided for statutory deductions.

At the legislative level, a deduction can be associated with one or more tax reporting units for reporting purposes. These associations do not impact the deduction calculation or aggregation during a payroll run.

Wage basis rules determine the earnings that contribute to a deductible amount or, for exemptions, the elements that reduce the amount subject to deduction.

Each wage basis rule is associated with a primary element classification and one, some, or all secondary classifications within the primary classification. For deduction elements, the classifications identify which types of earnings are subject to the deduction. For exemption elements, the classifications identify which type of earnings reduce the amount subject to deduction.

A wage basis rule may be associated with up to six references that define the context for the rule. Each reference has a sequence number that determines the order in which it is evaluated for processing relative to other references. For example, if a wage basis rule for a regional tax deduction has references for both county and city, then the county reference should have a higher sequence number than the city so that it will be evaluated first.

The wage basis rules and related references for statutory deductions are predefined for each legislation. You cannot edit predefined rules or references. Depending on your configuration, you may be able to create wage basis rules for some deductions. Before you create a wage basis rule, first make sure that all the references you need for the rule are defined. If necessary, add new references.

The following example illustrates how to define a set of wage basis rules for a tax deduction when the earnings included in the wage basis vary depending upon where a person lives.

Brittany is a waitress who receives a salary of 5,000 USD each month plus tips. Brittany is subject to an income tax that is calculated at the rate of 10% of the deductible amount, which may vary based on where an employee lives. In Dover County, tips are included in the deductible amount, but in Smith County, tips are not included. This table shows the tax calculations that apply for each region.

|

Region |

Earnings in Salary |

Earnings in Tips |

Deductible Amount |

Deduction Amount |

|---|---|---|---|---|

|

Dover County |

5000 |

50 |

5050 |

505 |

|

Smith County |

5000 |

(50 - Exempt) |

5000 |

500 |

The wage basis rules for this tax deduction are as follows:

|

Region (Reference Value) |

Primary Classification |

Secondary Classification |

Use in Wage Basis? |

|---|---|---|---|

|

Dover County |

Earnings |

Salary |

Y |

|

Dover County |

Earnings |

Tips |

Y |

|

Smith County |

Earnings |

Salary |

Y |

|

Smith County |

Earnings |

Tips |

N |

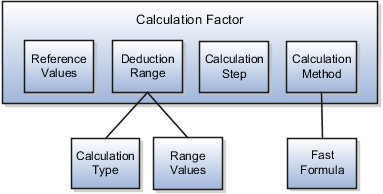

A calculation factor defines a data-driven rule for calculating a deduction or exemption element. For example, a calculation factor for a tax deduction element might define a context reference (such as a city or state), the deduction range value (such as a 4% tax rate on balances under 50,000), and optionally a calculation method and calculation step. Some elements may have a large number of calculation factors, one for each unique set of rules, ranges, and references values. The element calculation process determines which calculation factor to use based on the deduction range value, reference values, and calculation rules of the element being processed.

Aspects of a calculation factor are shown in the following figure:

A calculation factor may be associated with up to six references that define its context. For example, calculation of a social insurance deduction might vary based on a person's age and employment status. Each reference has a sequence number that determines the order in which it is evaluated for processing relative to other references.

To view and manage the references associated with a calculation factor, click the deduction in the Deduction Overview pane on the Manage Personal Deductions page.

Note

The calculation factors and related references for statutory deductions are predefined for each legislative data group. You cannot add or edit references for predefined deductions. Before you create a new calculation factor, be sure to define all the references you need for the calculation.

Each calculation factor is associated with one deduction range that defines the range of values to which the calculation factor applies, the calculation type, and the rate or amount to use when calculating the deduction for that range. You must define a deduction range before you can associate it with a calculation factor.

A calculation step is a label you assign to a calculation factor to identify its role in a complex calculation. For example, when calculating an income tax deduction, the process might first calculate the allowance, then any exemption amount, and then apply the tax rate to the reduced deductible amount. For such deductions, you can define multiple elements to be processed separately or define a single element with multiple calculation steps, each defined in a separate calculation factor. You can assign the same calculation step to more than one calculation factor. Calculation steps are optional.

A calculation method references a single fast formula. It is an optional component of a calculation factor. Calculation methods operate at a higher level than the calculation types defined in the deduction range. They provide a wrapper around the calculation of a deduction by retrieving values from a deduction range, applying a fast formula, and returning the final deduction amount for the current run. For example, if the calculation method is set to Cumulative, which references the Core Cumulative fast formula, then the calculation process returns the total deduction amount as a cumulative year-to-date amount.

The following examples illustrate how calculation factors are used to calculate different types of deductions.

Employers in many countries deduct social insurance payments from employees and also make contributions. Employee and employer rates are typically different. Such deductions often have wage limits.

To process this type of deduction, you might create a social insurance deduction processor element with the following calculation factors:

|

Employer or Employee Code (Reference Value) |

Calculation Method |

Calculation Step |

Deduction Range |

Range Values |

|---|---|---|---|---|

|

Employee |

(None) |

Calculate Social Insurance Employee Rate |

SI Employee Rate |

4% flat rate |

|

Employer |

(None) |

Calculate Social Insurance Employer Rate |

SI Employer Rate |

2% flat rate |

|

Employee |

(None) |

Calculate Social Insurance Employee Wage Limit |

SI Employee Wage Limit |

100,000 flat amount |

|

Employer |

(None) |

Calculate Social Insurance Employer Wage Limit |

SI Employer Wage Limit |

100,000 flat amount |

A national income tax deduction involves the multiple steps. First, it calculates the allowance, then any exemption amount, and then it applies the tax rate. The following table shows a subset of calculation factors that might be associated with a tax processor element.

|

Filing Status (Reference Value) |

Calculation Method |

Calculation Steps |

Deduction Range |

|

|---|---|---|---|---|

|

Single |

(None) |

Calculate Region A Allowance - Single |

Region A Allowance - Single |

10,000 flat amount |

|

Single |

(None) |

Calculate Region A Exemption Amount - Single |

Region A Exemption - Single |

0 flat amount |

|

Single |

(None) |

Calculate Region A Regular Rate - Single |

Region A Rate - Single |

7% flat rate |

|

Married |

(None) |

Calculate Region A Allowance - Married |

Region A Allowance - Married |

10,000 flat amount |

|

Married |

(None) |

Calculate Region A Exemption Amount - Married |

Region A Exemption - Married |

1,000 flat amount |

|

Married |

(None) |

Calculate Region A Regular Rate - Married |

Region A Rate - Married |

6% flat rate |

Use these examples of an individual income tax deduction and a social insurance deduction to understand how deduction components work together. Each example provides sample values for the following deduction components:

Deduction group

References for wage basis rules

References for calculation factors

Wage basis rules

Elements

Calculation factors for elements

Associations for tax reporting

A particular legislation has a statutory deduction for an individual income tax. The exemption amount for the tax varies based on a person's residential status. The earnings classifications included in the wage basis for the tax vary by geographical region. Thus, references are defined for both the wage basis rules and the calculation factors. The calculation is a two-step process: calculate the exemption and then calculate the tax amount based on the reduced deductible amount.

Deduction group: Taxes

Deduction name: Individual Income Tax Deduction

References for wage basis rules:

|

Reference Name |

Reference Value |

|---|---|

|

Geographical Region |

Mainland |

|

Geographical Region |

Territory |

References for calculation factors:

|

Reference Name |

Reference Value |

|---|---|

|

Residential Status |

Resident |

|

Residential Status |

Non-Resident |

Wage basis rules:

|

Geographical Region Reference Value |

Primary Classification |

Secondary Classification |

Use in Wage Basis? |

|---|---|---|---|

|

Mainland |

Standard Earnings |

All secondary classifications selected |

Y |

|

Territory |

Standard Earnings |

All secondary classifications selected |

Y |

|

Mainland |

Supplemental Earnings |

Commission |

Y |

|

Territory |

Supplemental Earnings |

Commission |

N |

|

Mainland |

Supplemental Earnings |

Personal Use of Company Car |

Y |

|

Territory |

Supplemental Earnings |

Personal Use of Company Car |

N |

Related elements: Individual Income Tax Processor

Calculation factors for Individual Income Tax Processor element:

|

Resident Status Reference Value |

Calculation Method |

Calculation Step |

Deduction Range |

Range Values |

|---|---|---|---|---|

|

Non-Resident |

(None) |

Calculate exemption amount |

Tax Exemption Amount for Non-Resident |

4800 |

|

Resident |

(None) |

Calculate exemption amount |

Tax Exemption for Resident |

2000 |

|

(None) |

(None) |

Calculate individual income tax |

Individual Income Tax Rate |

0-50000:3% 50000-100000:4% Over 10000: 5% |

Tax reporting units: All tax reporting units defined for this legislation can report this deduction.

The same legislation has a statutory deduction for a social insurance tax. Both the employer and the employee contribute to the social insurance tax, but their contribution rates are different. Calculation of the deduction has several steps:

Calculate the base amount for the employee's contribution.

Calculate the base amount for the employer's contribution.

Calculate the employee's contribution amount.

Calculate the employer's contribution amount.

The following component values define this deduction at the legislative level:

Deduction group: Social Insurance

Deduction name: Medical Insurance Deduction

References for wage basis rules: None

References for calculation factors:

|

Reference Name |

Reference Value |

|---|---|

|

Contribution Level |

Employee |

|

Contribution Level |

Employer |

Wage basis rules:

|

Primary Classification |

Secondary Classification |

Use in Wage Basis? |

|---|---|---|

|

Standard Earnings |

All secondary classifications selected |

Y |

|

Supplemental Earnings |

All secondary classifications selected |

Y |

Related elements: Medical Insurance Calculation element

Calculation factors for Medical Insurance Calculation element:

|

Contribution Level Reference Value |

Calculation Method |

Calculation Step |

Deduction Range |

Range Values |

|---|---|---|---|---|

|

Employee |

(None) |

Calculate Employee Base Amount |

Employee Contribution Upper Limit |

8000 |

|

Employee |

(None) |

Calculate Employer Base Amount |

Employer Contribution Upper Limit |

5000 |

|

Employer |

(None) |

Calculate Employee Contribution Amount |

Employee Contribution Amount |

4% |

|

Employer |

(None) |

Calculate Employer Contribution Amount |

Employer Contribution Amount |

3% |

Tax reporting units: All tax reporting units defined for this legislation can report this deduction.

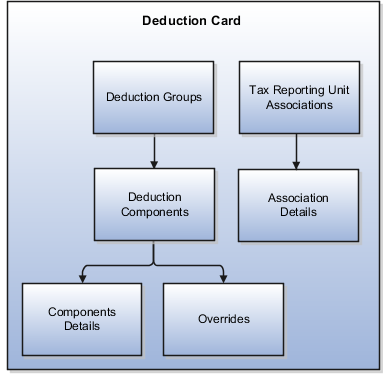

Personal payroll deductions represent deduction information specific to a particular payroll relationship. Personal payroll deductions comprise the components shown in this figure:

Personal deduction cards capture information, specific to a payroll relationship, that is used to calculate one or more related payroll deductions. For example, a deduction card might capture tax withholding information for calculating one or more tax deductions. A person may have multiple deduction cards, one for statutory deductions and another for involuntary deductions. An employee who has multiple assignments or employment terms might have different deduction cards for each one.

To view and manage deduction cards, select the Manage Personal Deductions task in the Payroll Administration or Payroll Calculation work area. The types of deduction cards you can create and the type of information captured on a card vary by legislation. Deduction card definitions are predefined for each legislation based on legislative requirements.

In legislations where all employees are subject to the same set of statutory deductions, one or more statutory deduction cards may be created automatically when a new employee is added; in other legislations, you must create deduction cards manually. Likewise, for most voluntary and involuntary deductions, you create deduction cards as needed for each employee.

Deduction groups are logical sets of deduction types, elements, and calculation rules. A set of deduction groups is predefined for each legislation. To view the deduction groups related to a deduction card, expand the Deduction Groups node in the Deduction Card Overview pane on the Manage Deduction Cards page (Manage Personal Deductions task).

A deduction component on a personal deduction card typically corresponds to a payroll deduction element, such as an income tax or social insurance contribution, defined at the legislative level. If the deduction calculation varies based on one or more factors, such as the employee's place of residence, the deduction component may have one or more references that define its context. Deduction component details capture additional information used to calculate the deduction.

To view deduction components for a deduction group, click the deduction group node in the Deduction Card Overview pane on the Manage Deduction Cards page. The center pane displays a list of existing components and allows you to create new ones. To view details for a deduction component, click a row in the Deduction Components table. Use the Component Details section to enter values used in the calculation of this deduction component.

Note

The deduction information displayed in the center pane varies by legislation, and may not include the Deduction Components and Component Details sections. Instead, this pane may display a custom form for capturing data items specific to your legislative data group.

You may be able to enter values on a deduction card that override values defined in a deduction range at the legislative level. The values you can override for each deduction component are predefined. If overrides are allowed for a component, the Overrides tab appears when you select the component in the Deduction Components table. Otherwise, the Overrides tab does not appear.

Some deductions, such as court orders and charitable donations, have no predefined values at the legislative level. Thus, you must enter values for such deductions on the deduction card to override the default value of zero at the legislative level.

Associating a tax reporting unit (TRU) with a deduction card enables the payroll process to apply rules and rates defined for that TRU when calculating deductions. Associations also control how deductions are aggregated for tax reporting. By default, all deductions defined on a deduction card are associated with the same tax reporting unit. Depending on the deduction card, you may be able to associate individual deduction components with different tax reporting units. If a person has multiple terms or assignments, you may also be able to associate specific terms or assignments with deduction components.

To view or manage associations for a deduction card, click the Associations node in the Deduction Card Overview pane on the Manage Deduction Cards page.

This example demonstrates how to create a deduction card at the payroll relationship level. The deduction card captures information for a social insurance deduction that varies depending on a person's country or territory of residence.

The following table summarizes the key decisions for this scenario.

|

Decisions to Consider |

In This Example |

|---|---|

|

What type of deduction card do you want to create? |

Social insurance deduction card |

|

What details must be captured? |

Person's country or territory of residence |

|

Field |

Value |

|---|---|

|

Name |

Enter the person's name |

|

Legislative Data Group |

Select your legislation |

|

Effective Date |

Enter the current date |

Note

Use the Deduction Card Overview pane to view the deduction groups associated with this deduction card. In this example, you should see a Social Insurance deduction group. A deduction card may contain multiple deduction groups.

Note

If your legislation uses a custom template to display and capture deduction information, the Deduction Component and Component Details sections may not appear.

A deduction component corresponds to a deduction element defined at the legislative level.

Note

Component details vary for each deduction component. For some components, you may also be able to enter amounts, rates, or other values that override default values set at the legislative level. If overrides are allowed, the Overrides tab appears. For this example, no overrides are allowed.

By default, all deductions defined on a deduction card are associated with the same tax reporting unit for reporting purposes. However, you can associate individual deduction components with different tax reporting units. Depending on your localization, you may also be able to associate specific terms or assignments with deduction components. This example uses the default tax reporting information.

You can define deduction cards at several different levels to capture information specific to a person or entity, such as an employee's tax filing status or an employer's tax identification number. You can also enter values on a deduction card that override default values defined at other levels. The priority of deduction information, from highest to lowest, is as follows:

Personal deduction card (payroll relationship level)

Tax reporting unit deduction card

Payroll statutory unit deduction card

Payroll deduction range values (legislative data group level)

Note

The ability to define deduction cards at different levels and the allowable overrides at each level vary by legislation.

The following are examples of how you can define deduction cards with overrides at each level.

A default tax rate is defined at the legislative level, but an employee qualifies for a special reduced rate. The payroll administrator enters the employee's reduced rate as an override on the personal deduction card, using the Manage Personal Deductions task in the Payroll Administration work area.

The tax exemption amount is set to $2000 at the legislative level, but a tax reporting unit in a particular state or province uses an exemption amount of $2500. The payroll manager defines the exemption amount as an override in the tax reporting unit deduction record, using the Manage Legal Reporting Unit Deduction Records task in the Setup and Maintenance work area.

Calculation of the contribution base for pension insurance varies by legal employer. During application setup, the implementation team defines entity-specific contribution information as overrides in the payroll statutory deduction record, using the Manage Legal Entity Deduction Records task in the Setup and Maintenance work area.

The application provides a set of localized income tax rates for the country in which an employer conducts business. The payroll manager periodically uses the Manage Deduction Ranges task in the Payroll Calculation work area to view tax information, but the application's configuration prohibits users from modifying any values. If, for example, an employee qualifies for a special tax rate or the employer qualifies for a special exemption, the payroll manager enters the appropriate values as overrides on a deduction card at the appropriate level.

Edit the primary classification row and deselect the Select all secondary classifications option. You can then edit individual secondary classification rows, and select the Use in Wage Basis option only for those classifications to be considered in the wage basis.

In the Deduction Overview pane on the Manage Payroll Deductions page, expand the Related Elements node to display a list of all elements associated with the deduction. Expand the node for an element to display the Calculation Factors node, and then click the Calculation Factors node to display a list of all calculation factors associated with the element. You can create calculation factors and edit existing ones that have an update status of Unlocked.

You cannot create deductions from the Manage Payroll Deductions page. To create a deduction, you must use one of the pre-defined element templates provided for your legislation.

The deduction card definition determines which components and component details you can create. Typically, you can only create one deduction component of any particular type. If you are trying to create a deduction component that varies based on one or more references (such as a tax that varies based on a person's place of residence), you must select the reference in the Deduction Card Overview pane before you can add the component. You cannot create component details until you create a deduction component.

First, make sure you have set the end date for all child records. (End date all deduction components before you end date a deduction card. End date all component details before you end date a deduction component. End date all association details before you end date an association.) Second, make sure that the end date of any parent component is not earlier than the end date of any child. A deduction card's end date must be the same or later than the latest end date of any of its deduction components or component details.

You cannot delete a deduction card or component until you have deleted all its child components and details, starting from the bottom of the hierarchy, in the following order: association details, associations, component details, components, and deduction card. Additional rules and restrictions, specific to your localization, may apply.

To suspend a single deduction, set the end date for the deduction component on the personal deduction card. To suspend all deductions on a deduction card, set the end date for the deduction card. Note that you must end date all component details before you can end date the deduction component, and you must end date all deduction components before you can end date the deduction card. If you want to resume payments at a later date, adjust the end dates accordingly. This is useful, for example, if you need to temporarily suspend a voluntary contribution to a charitable organization or retirement fund.

When you select the End Date option for a deduction component or component detail, the end date is set to the Effective As-Of Date you entered on the Manage Personal Deductions Search page. If you want to use a different end date, you must change the Effective As-Of Date at the top of the page. Make sure that the end date you enter for any parent component is not earlier than the end date of any child.

From the Manage Deduction Cards page (Manage Personal Deductions task) in the Payroll Administration or Payroll Calculation work area, click Associations in the Deduction Card Overview pane. Click Create in the Associations region, and then select a tax reporting unit. To associate all deductions on the card with this tax reporting unit, leave the Deduction Component field blank; otherwise, select the deduction component you want to associate.

For persons with multiple terms or assignments, you can identify the terms or assignments that pertain to each deduction component (if supported by your localization). To do so, select an association in the Associations table, and then click Create in the Association Details region. Select the term or assignment and the associated deduction component. Note that you must add deduction components and save the deduction card before you can create associations or association details for those components.

For payroll statutory unit (PSU) cards, select Manage Legal Entity Deduction Records in the Setup and Maintenance work area. For tax reporting unit (TRU) cards, select Manage Legal Reporting Unit Deduction Records in the Setup and Maintenance work area.