11g Release 1 (11.1.3)

Part Number E20384-03

Contents

Previous

Next

|

Oracle® Fusion

Applications Project Management Implementation Guide 11g Release 1 (11.1.3) Part Number E20384-03 |

Contents |

Previous |

Next |

This chapter contains the following:

Invoice and Revenue Method Components: How They Work Together

Project and Contract Invoice Components: How They Work Together

Specifying the Unit of Measure for Invoice Lines Sent to Oracle Fusion Receivables: Critical Choices

Invoice and Revenue Method Classifications: Critical Choices

FAQs for Define Project Invoicing Options

Invoice methods and revenue methods control the way you create invoices and recognize revenue for contracts. During implementation you create the methods and assign them to bill plans and revenue plans. Any contract or contract line that uses the bill or revenue plan calculates the invoice or revenue amount according to the instructions in the invoice or revenue method.

Invoice method classifications and revenue method classifications are predefined by Oracle Fusion Projects. Select an invoice or revenue method classification to set the approach for calculating invoice or revenue amounts.

This table lists the invoice method classifications and their descriptions.

|

Invoice Method Classification |

Description |

|---|---|

|

Amount Based |

Generate invoices and revenue as billing events are completed. |

|

Percent Complete |

Generate invoices as progress is estimated.

|

|

Percent Spent |

Generate invoices as progress is calculated, based on actual cost to date over budget cost.

|

|

Rate Based |

Generate invoices as costs are incurred, using an invoice-specific set of bill rates, a burden schedule, or transfer price rates. |

This table lists the revenue method classifications and their descriptions.

|

Revenue Method Classification |

Description |

|---|---|

|

Amount Based |

Recognize revenue as billing events are completed. |

|

As Billed |

Recognize revenue as customers are invoiced, using a common set of bill rates, a burden schedule, or transfer pricing for both invoicing and revenue. |

|

As Incurred |

Recognize revenue as costs are incurred, using a revenue specific set of bill rates, a burden schedule, or transfer pricing for both invoicing and revenue. |

|

Percent Complete |

Recognize revenue as progress is estimated.

|

|

Percent Spent |

Recognize revenue as progress is calculated, based on actual cost to date over budget cost.

|

|

Rate Based |

Recognize revenue as costs are incurred, using a revenue-specific set of bill rates, a burden schedule, or transfer price rates. Tip Use this revenue classification method if you are using a fixed price for invoices, or if you require different burden schedules for invoices and revenue. |

If the invoice or revenue method will be used for intercompany contracts, enable the intercompany billing option to calculate the intercompany invoice or revenue amounts. Intercompany invoices and revenue use a rate-based classification method. Select a labor and nonlabor schedule for use when generating invoices or calculating revenue.

Important

An intercompany contract can use an invoice or revenue method that is not enabled for intercompany billing, or an invoice or revenue method that is enabled for intercompany billing. Enable the intercompany billing option if the invoice or revenue method will be used for intercompany contracts only.

Intercompany invoices can use any type of invoice method classification.

Select schedules for labor and nonlabor if your invoice or revenue method uses a rate-based classification method.

Tip

The schedule types for labor are Person and Job.

Optionally, assign custom billing extensions to automatically calculate the invoice or revenue amounts for contract lines that use the bill plans and revenue plans associated with the invoice or revenue method.

If the invoice or revenue method is percent complete or percent spent, the extension creates the billing event based on the calculation level for the billing extension specified in the bill plan or revenue plan. If the calculation level is contract line, the event is created for the contract and contract line. If the calculation level is associated project, the event is created for the contract line and its associated project and task.

Note

If the invoice or revenue method classification is percent complete or percent spent, the percent complete or percent spent billing extension is automatically added to the invoice or revenue method. You cannot change the status of the billing extension assignment to inactive, it must be active for a percent complete or percent spent billing extension.

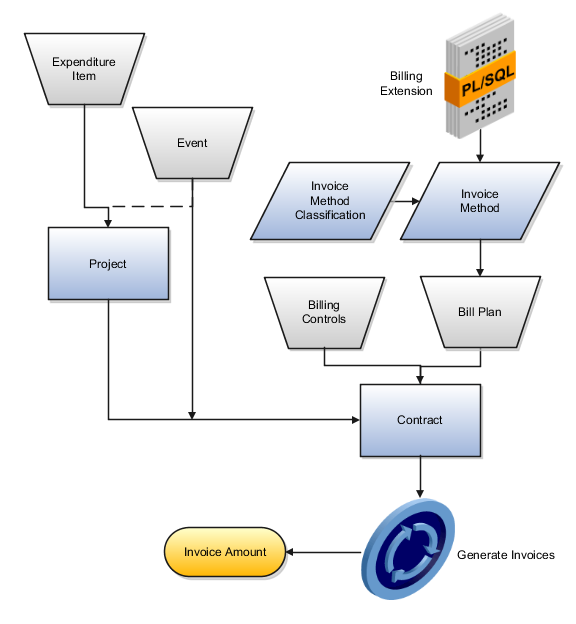

Project and contract components work together to create invoice distributions. The contract contains the instructions for calculating invoice amounts, and the project owns the cost transaction details. When you generate an invoice, invoice distributions are created for the contract.

Expenditure items and events are the transactions for projects and contracts. Invoice method classifications determine how transactions are invoiced.

The invoice method determines how invoice amounts are derived and which billing extensions, if applicable, calculate invoice amounts. Enter an invoice method on a bill plan, which you create for a contract and assign to contract lines to provide a set of instructions for creating an invoice.

Create billing controls for a contract or contract line to define the valid transaction dates, billing resources, and amount limits for transactions associated with the contract.

Generate invoices to calculate the invoice amounts for a contract.

The following diagram illustrates the components of a project and a contract that determine invoice amounts, and the relationships between the components.

Assign a predefined invoice method classification to an invoice method. The invoice method classification determines whether the invoice amount is calculated based on rates, amounts, or progress.

Create invoice methods for bill plans to use for determining the approach for generating invoice amounts. The invoice methods contain invoice generation instructions in the form of the invoice method classification and rate definition schedule types. Rate definition schedule types determines whether the rate source for invoicing comes from rate schedules, burden schedules, or transfer price schedules.

The invoice methods also contain any applicable billing extensions. If you assign a billing extension to the invoice method, the extension calculates the invoice amount and creates an automatic invoice event. The billing extension assignment must be active to calculate the invoice amount and create an event.

You must assign an invoice method to a bill plan, which contains the invoice generation instructions for a specific contract or contract line. An invoice method can be used by more than one bill plan.

Caution

Enable the invoice method for intercompany billing if it will be used for intercompany billing only.

Create a bill plan within a contract that uses the invoice method you require. Assign the bill plan to one or more contract lines.

If the invoice method classification for the bill plan uses a billing extension, that billing extension is automatically added to the bill plan.

Important

Oracle Fusion Project Billing does not create invoice amounts for contract lines that have a bill plan on hold.

A billing control defines the types of permitted transactions (using billing resources), transaction date range, and maximum invoice (and revenue) amounts for a contract or contract line. Create a billing control within a contract at either the contract or contract line level. The inception-to-date (ITD) invoice amount cannot exceed the hard limit amount of a billing control. If the ITD invoice amount exceeds the soft limit, invoice generation will still occur, but you will receive a warning the first time this occurs.

The project and task for an expenditure item are matched to the associated contract line during invoice generation. Invoicing can occur r if the transaction date, billing resource, and amount for the expenditure item pass the contract billing controls.

If the expenditure item is mapped to more than one eligible contract line, the processing order is determined as follows:

The contract billing sequence determines the processing order of multiple contracts.

The contract billing controls determine the processing order of multiple contract lines within a single contract.

The contract contribution percentage determines the eligible invoice amount for each contract line.

Oracle Fusion Project Billing creates a billing transaction for each unique combination of expenditure item and contract line. The billing transaction is the source for creating invoice distributions.

Invoice events are automatically created during invoice generation if the bill plan for a contract line plan contains a billing extension. The billing extension calculates the invoice event amount, and creates an invoice event.

Manual events are also processed during invoice generation. Oracle Fusion Project Billing creates a billing transaction for each automatic or manual event. The billing transaction is the source for creating invoice distributions.

The Specify Unit of Measure for Invoice Lines Sent to Oracle Fusion Receivables profile option indicates the unit of measure to use for all invoice lines transferred from Oracle Fusion Projects to Oracle Fusion Receivables. This profile option is required in order to use Oracle Fusion Project Billing. If you are using Oracle Fusion Projects without Oracle Fusion Receivables, you do not need to set this profile.

Oracle Fusion Receivables requires a unit of measure for each invoice line. Oracle Fusion Projects creates each invoice line with a quantity of 1, a unit of the unit type you specify in your profile option, and an amount equal to the currency amount of the invoice line as it appears in Oracle Fusion Projects.

Note

The internal name for this profile option is PJB_AR_INVOICE_UOM.

Define a unit of measure class before you define a unit of measure. Oracle Fusion Receivables requires that you associate each unit of measure you define with a unit of measure class. You must define a unit of measure class before you can set the profile option.

The default unit of measure value is Each. Define a unit of measure of Each in Oracle Fusion Receivables to use with this profile option.

Only bill plans and revenue plans with certain combinations of invoice and revenue method classifications can be used on the same contract line. If you add a bill plan and revenue plan with an invalid invoice and revenue method classification to the same contract line, you will receive an error message when you submit the contract for approval.

The possible revenue method classifications are:

Amount based

As incurred

As invoiced

Percent complete

Percent spent

Rate based

The possible invoice method classifications are:

Amount based

Rate based

Percent complete

Percent spent

Valid bill plan and revenue plan combinations for a contract line are dependent on the invoice method classification and revenue method classification. Most invoice method and revenue method classifications are valid. The invalid combinations are described in the table below.

|

Revenue Method Classification |

Invoice Method Classification |

Valid Combination? |

|---|---|---|

|

As incurred |

Amount based |

No |

|

As incurred |

Percent complete |

No |

|

As incurred |

Percent spent |

No |

|

As invoiced |

Amount based |

No |

|

As invoiced |

Percent complete |

No |

|

As invoiced |

Percent spent |

No |

|

Rate based |

Rate based |

Yes, but a burden schedule is required for the bill plan and revenue plan. |

Note

After the contract is approved, any changes to the bill plan including the revenue or invoice method classification must go through the change management process.

An invoice format determines how Oracle Fusion Projects creates an invoice line. You can define different formats for labor, nonlabor and event invoice line items, and specify if you want to use the format for customer invoices, internal invoices, or both. Additionally, you can specify how you want to summarize expenditure items, and the fields you want an invoice line to display. You can also include free-form text on an invoice line.

You can use customer invoice formats only for regular contract invoices, and internal invoice formats only for invoices generated by intercompany and interproject contracts. You can also use an invoice format for both customer and internal invoices.

You configure the following components of an invoice format:

Format type

From and to dates

Grouping option

Customer or internal invoice option

Fixed format

Start and end position

Text column

The format type controls the invoice formats you see for labor, nonlabor and events when you enter invoice formats using the Projects window.

The from and to dates determine the period during which the invoice format is active.

A grouping option specifies the way invoice distribution lines are grouped together to form an invoice line.

If you are using intercompany or interproject billing, create an internal invoice format to summarize cross-charge transactions. Depending on the requirements of the receiver business units, you may need to define several internal invoice formats. All internal formats automatically have a fixed format.

If you create an internal invoice format, you must select contract line as an attribute. This is to ensure that no two contract lines can be combined into a single invoice line, as they could be tied to different receiver projects or tasks, and would need to be created as separate invoice lines in order to post to the correct receiver project or task.

Although one invoice format can support both customer and internal invoices, the list of values for the Field Name only includes those values that are shared by the two formats.

A fixed format prohibits distributions from being moved to other invoice lines. Intercompany and interproject invoices must have a fixed format.

The start and end positions are values between 1 and 240 that specify where the text in the Field Name appears on the invoice line.

Enter the text in this column that you want to display on the invoice.

A rule defined by the implementation team that determines the calculation method of invoice amounts for contracts during invoice generation.

A predefined classification for an invoice method that determines the basis for calculating invoice amounts. Assign an invoice method classification to an invoice method. The predefined invoice method classifications are: amount based, percent complete, percent spent and rate based. The percent spent or percent complete billing extension is automatically assigned to the invoice method when you select the percent spent or percent complete invoice method classification.

If you assign a billing extension to an invoice method or revenue method, the billing extension is automatically added to bill plans or revenue plans that use the method. The billing extension creates automatic invoice or revenue events for contract lines or projects associated with that bill or revenue plan.

The event amounts are calculated at the calculation level selected on the bill plan or revenue plan.

Important

You must enter the funding amount for either the contract line or the project and contract association, depending on the calculation level selected in the bill plan or revenue plan.

The bill plan for the invoice is not associated with an invoice template. Contact the contract administrator and request him or her to attach an invoice template to the bill plan.