11g Release 1 (11.1.3)

Part Number E20384-03

Contents

Previous

Next

|

Oracle® Fusion

Applications Project Management Implementation Guide 11g Release 1 (11.1.3) Part Number E20384-03 |

Contents |

Previous |

Next |

This chapter contains the following:

Burdening Options for Project Types: Points to Consider

Capitalization Options for Project Types: Points to Consider

Associating Project Types and Class Categories: Examples

Asset Cost Allocation Methods: Explained

Burdening is a method of applying one or more burden cost components to the raw cost amount of each individual transaction to calculate burden cost amounts. Use project types to control how burden transactions are created and accounted. If you enable burdening for a project type, you can choose to account for the individual burden cost components or the total burdened cost amount.

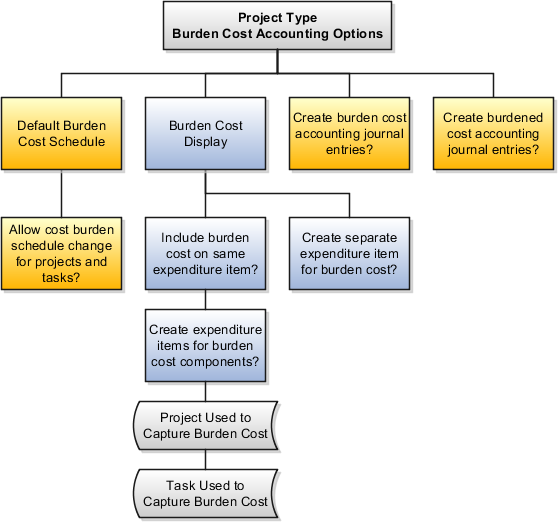

The following diagram illustrates the burden cost accounting options for project types.

You specify the following options when setting up burdening options for project types.

Default Cost Burden Schedule

Allow Cost Burden Schedule Change for Projects and Tasks

Include Burden Cost on Same Expenditure Item

Create Expenditure Items for Burden Cost Components

Create Separate Expenditure Item for Burden Cost

Create Burden Cost Accounting Journal Entries

Create Burdened Cost Accounting Journal Entries

If you enable burdening for the project type, you must select the burden schedule to use as the default cost burden schedule for projects that are defined with this project type.

Enable this option to allow a change of the default cost burden schedule when entering and maintaining projects and tasks. Do not enable this option if you want all projects of a project type to use the same schedule for internal costing.

Enable this option to include the burden cost amount in the same expenditure item. You can store the total burdened cost amount as a value with the raw cost on each expenditure item. Oracle Fusion Projects displays the raw and burdened costs of the expenditure items on windows and reports.

If you include burden cost amounts on the same expenditure item, but wish to see the burden cost details, enable the option to create expenditure items for each burden cost amount on an indirect project and task.

Enable this option to account for burden cost amounts as separate expenditure items on the same project and task as the raw expenditures. The expenditure items storing the burden cost components are identified with a different expenditure type that is classified by the expenditure type class Burden Transaction. Oracle Fusion Projects summarizes the cost distributions to create burden transactions for each applicable burden cost code. The most important summarization attributes are project, lowest task, expenditure organization, expenditure classification, supplier, project accounting period, and burden cost code. You can use the Burden Summarization Grouping Extension to further refine the grouping.

Indicate whether to create an entry for the burden cost amount.

If burdened costs are calculated for reporting purposes only, and you do not want to interface burdened costs to the general ledger, you can disable the creation of accounting journal entries. If you select this option, only the burden cost, which is the difference between the burdened cost and raw cost, is interfaced to general ledger.

Indicate whether to account for the total burdened cost amount of the items. You typically use this option to track the total burdened cost amount in a cost asset or cost work-in-progress account.

The burdened cost is the sum of raw and burden costs. Therefore, selecting this option may result in accounting for raw cost twice. For example, assume that the raw cost of an item is 100 USD, the burden cost is 50 USD, and the burdened cost is 150 USD. When the application creates a journal entry for 150 USD, it accounts for the 100 USD that was already accounted for as raw cost, plus the 50 USD burden cost.

You can assign assets to a project if capitalization is enabled for the project type. Use project types to configure capitalization options that are inherited by each project associated with that project type.

The following diagram illustrates the capitalization options for project types.

You specify the following information when setting up capitalization options for project types.

Construction in Progress (CIP) Options

Supplier Invoices Export Options

Capitalized Interest Options

You specify the following Construction in Progress options when setting up capitalization options for project types.

Indicate whether to capitalize costs at the burdened or raw cost amount for projects with this project type.

Enable this option to require a complete asset definition in Oracle Fusion Projects before sending costs to Oracle Fusion Assets. If you select this option, you do not need to enter information for the imported asset line in Oracle Fusion Assets. The Transfer Assets to Oracle Fusion Assets process places asset lines with complete definitions directly into the Post queue in Oracle Fusion Assets.

Specify one of the following methods to summarize asset lines.

All, which is the highest level of summarization

CIP Grouped by Client Extension

Expenditure Category

Expenditure Category Nonlabor Resource

Expenditure Type

Expenditure Type Nonlabor Resource

This option interacts with the assignment status of the asset to either use or disregard the Asset Assignment extension, as shown in the following table:

|

Override Asset Assignment |

Asset Lines Assigned to Assets |

System Uses Asset Assignment Extension |

|---|---|---|

|

Do Not Override (option not selected) |

Not Assigned |

Yes |

|

Do Not Override |

Assigned |

No |

|

Override |

Not Assigned |

Yes |

|

Override |

Assigned |

Yes |

You can set up the Asset Assignment extension to assign any unassigned asset lines that result from the Generate Asset Lines process, or to override the current asset assignment for specified lines.

Select one of the following predefined allocation methods to automatically distribute indirect and common costs across multiple assets, or select no allocation method.

Actual Units

Current Cost

Client Extension

Estimated Cost

Standard Unit Cost

Spread Evenly

You can specify a capital event processing method to control how assets and costs are grouped over time. You can choose to use either periodic or manual events, or no events.

Enable this option to consolidate the expenditure items on a supplier invoice into one asset line according to the asset line grouping method. Deselect this option to send the lines to Oracle Fusion Assets based on the supplier invoice export option.

If you choose not to group supplier invoices, then select one of the following supplier invoice export options.

As New Additions: Sends each expenditure item on a supplier invoice line to Oracle Fusion Assets as a separate addition line with a status of New.

As Merged Additions: Sends each supplier invoice line to Oracle Fusion Assets as a separate addition line with the status of Merged.

Note

After the addition lines are sent to Oracle Fusion Assets, you can split, merge, or unmerge the lines manually in Oracle Fusion Assets.

Use this field to specify a default interest rate schedule for capitalized interest.

You can select the Allow Override option to allow an override of the default capitalized interest rate schedule for individual projects.

Project classifications group your projects according to categories and codes that you define. When you associate project classifications with project types, the classification is available for selection on projects with that project type.

Use any of the following methods to associate class categories with project types:

Add a classification to the project type definition

Add a project type to the class category definition

Enable the Assign to all Project Types option on the class category definition

The following diagram shows an example of three classifications that are associated with a project type definition. In this example, the Industry Sector, Reporting Group, and Media Sector classifications are available for selection on projects with the Sales Proposal project type.

For each classification that you associate with the project type, you can enable the Assign to All Projects option for the application to automatically add the classification to the project definition for all new projects with the project type. When this option is enabled, all projects with this project type must be assigned a class code for the class category.

The following diagram shows an example of three project types that are associated with a class category definition. In this example, the Industry Sector classification is available for selection when you create projects with the Sales Proposal, Consulting, or Internal project types.

For each project type that you associate with the class category, you can enable the Assign to All Projects option for the application to automatically add the class category to the project definition for all new projects with any of these project types. When this option is enabled, all projects with this project type must be assigned a class code for the class category.

The following diagram shows an example of a class category definition with the Assign to All Project Types option enabled. In this example, a code for the Industry Sector class category is required for all projects, regardless of the project type.

The asset cost allocation method determines how indirect or common costs incurred on a project are allocated to multiple assets.

You can specify an asset cost allocation method to enable Oracle Fusion Projects to automatically allocate unassigned asset lines and common costs across multiple assets. Unassigned asset lines typically occur when more than one asset is assigned to an asset grouping level.

Project templates and projects inherit a default asset cost allocation method from the associated project type. You can override the default at the project level. If you use capital events to allocate costs, then you can also override the asset cost allocation method at the event level.

The following table describes the available asset cost allocation methods.

|

Method |

Basis of Cost Allocation |

|---|---|

|

Actual Units |

Number of units defined for each asset |

|

Client Extension |

Rules defined specifically for your organization |

|

Current Cost |

Construction-in-process (CIP) cost of each asset |

|

Estimated Cost |

Estimated cost of each asset |

|

Standard Unit Cost |

Combination of the standard unit cost and the number of units defined for each asset |

|

Spread Evenly |

Equal allocation of cost to each asset |