36 Set Up Your System for the Multi-Purpose VAT Communication

This chapter contains these topics:

-

Section 36.1, "Set Up UDCs for the Multi-Purpose VAT Communication"

-

Section 36.3, "Enter Address Book Information for Tax Reporting Entities"

-

Section 36.4, "Enter Address Book Information for Customers and Suppliers in Italy"

36.1 Set Up UDCs for the Multi-Purpose VAT Communication

Before you generate the Multi-Purpose VAT Communication, set up these UDC tables:

-

74/CN (Country Codes for 770 Form)

-

74/EC (European Union Member Codes)

-

74/VT (ESL Transaction Type)

-

74Y/DT (Document Type)

-

74Y/IV (Yearly List- VAT Codes)

-

74Y/PY (Payment Instrument Excluded)

-

74Y/RL (Rental/Leasing)

-

74Y/TS (Type of Supplier)

-

74Y/TU (Type of Upload)

From Italian Localizations (G74Y), choose IYL Electronic Communications

From Yearly List Electronic Communications (G74Y003), choose User Defined Codes Yearly

From User Defined codes - Yearly List E. Com (G74Y031)), choose a UDC item.

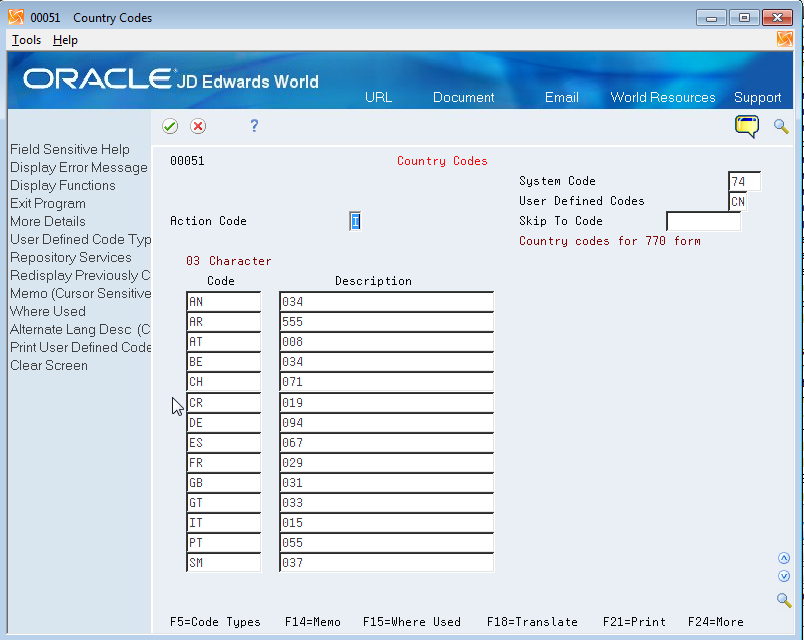

36.1.1 Country Codes for 770 Form (74/CN)

Set up the numeric country codes that have been defined by the fiscal authority for use in the Multi-Purpose VAT Communication. The Codes field must contain the same country codes as UDC 00/CN. The Description 01 field must contain the corresponding numeric code as defined by the fiscal authority. The system uses UDC 74/CN with UDC 00/CN to convert country codes to the proper numeric format for the Multi-Purpose VAT Communication.

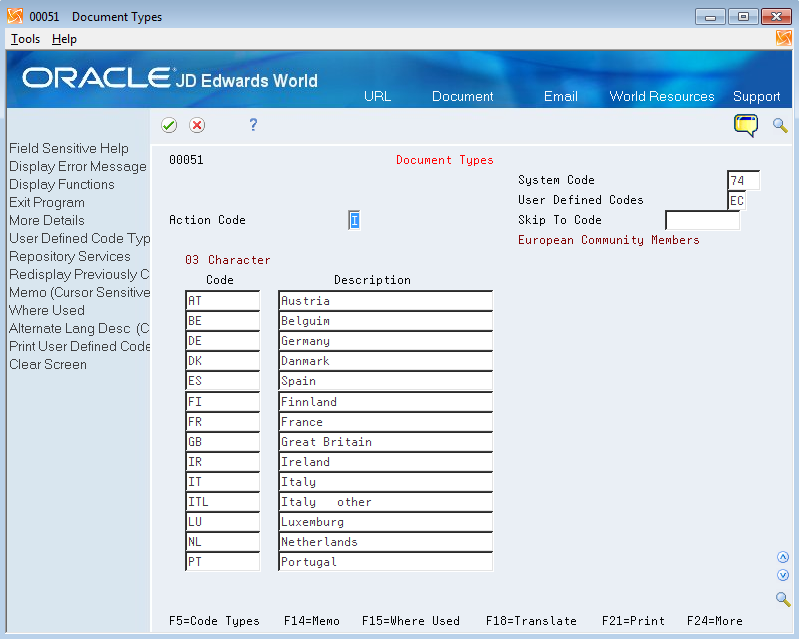

36.1.2 European Union Member Codes (74/EC)

Set up codes in this UDC table for countries in the European Union (EU). The system uses the values in this UDC to determine which countries are EU countries. When you generate the Multi-Purpose VAT Communication, the system does not include customers and suppliers in the countries listed in this UDC table because you do not report transactions for EU member countries in the Multi-Purpose VAT Communication.

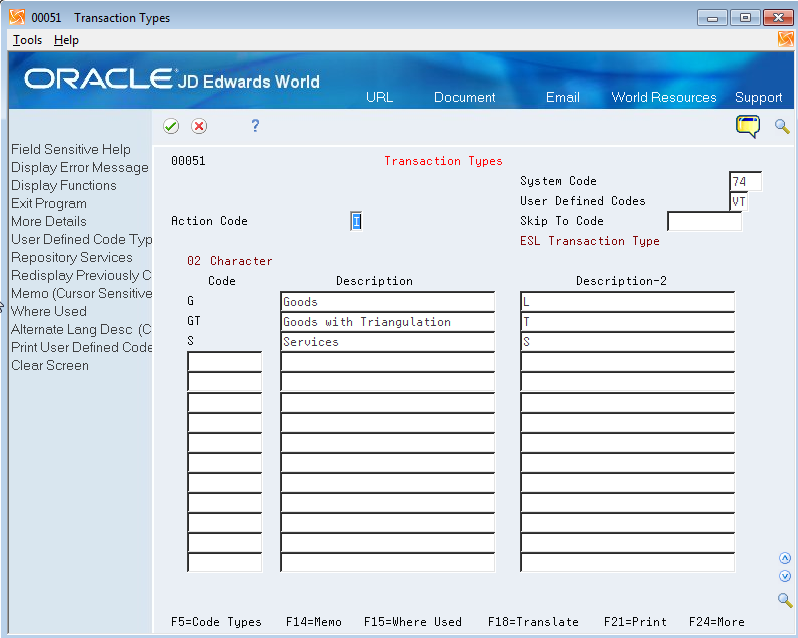

36.1.3 ESL Transaction Type (74/VT)

UDC 74/VT contains the Transaction Type for the Tax Area. The system does not use the value GT (Goods with Triangulation) for the Black List Declaration.

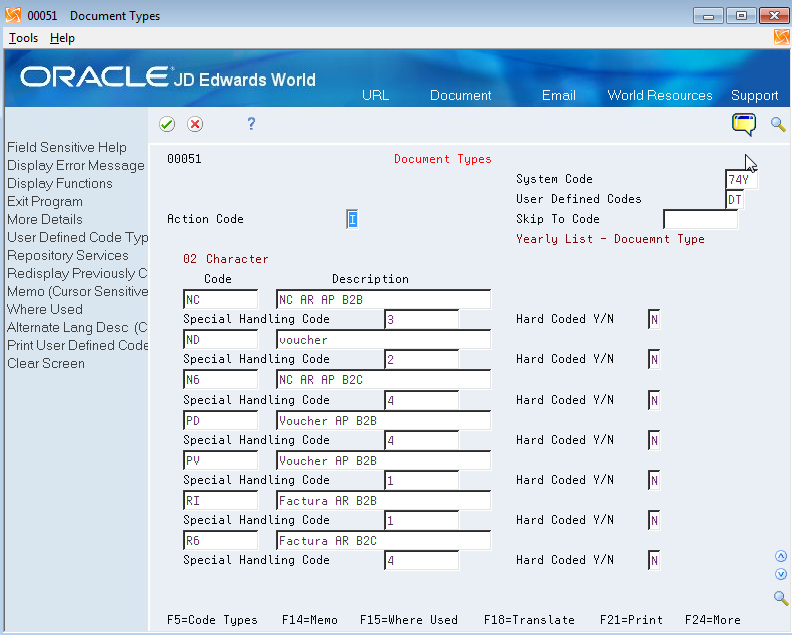

36.1.4 Document Type (74Y/DT)

You use the 74Y/DT UDC table to associate special handling codes to document types. The system uses the values in the Special Handling Code (SHC) field, along with tax IDs, to determine whether the transaction should be included in the Multi-Purpose VAT Communication. Document types that you enter in the 74Y/DT UDC table must also exist in the 00/DT UDC table.

Valid values for the SHC field are:

-

Blank: The transaction has an invoice and can be either a business-to-business (B2B) or a business-to-consumer (B2C) transaction.

-

1: Invoices (B2B and B2C).

-

2: Excluded documents.

-

3: Adjustments.

-

4: Tickets (B2C without Invoice)

The values in the SHC field indicate whether a transaction is:

-

Excluded from the declarations (SHC is 2).

-

An adjustment (SHC is 3).

-

A business-to-business (B2B) transaction that has an invoice. The system considers these transactions to be (B2B) transactions that have an invoice:

-

The document type is set up in 74Y/DT, the SHC field is blank or is 1, and the customer or supplier address book record has a Partita IVA.

-

The document type is not set up in 74Y/DT and the customer or supplier address book record has a Partita IVA.

-

-

A business-to-consumer (B2C) transaction that has an invoice.

The document type is set up in 74Y/DT, the SHC is blank or is 1, and the customer or supplier address book record includes a Codice Fiscal.

Note:

If a transaction is B2C with an invoice, the system compares the amount in processing option 12 of the IYL Elec. Communications - TXT Generator program (P74Y0047) to the amount of the transaction to determine whether the transaction meets the minimum amount to include in the report. -

A B2C transaction that does not have an invoice.

The document type for the transaction has an SHC value of 4.

Note:

If a transaction is B2C without an invoice, the system compares the amount in processing option 11 of the IYL Elec. Communications - TXT Generator program (P74Y0047) to the amount of the transaction to determine whether the transaction meets the minimum amount to include in the report.

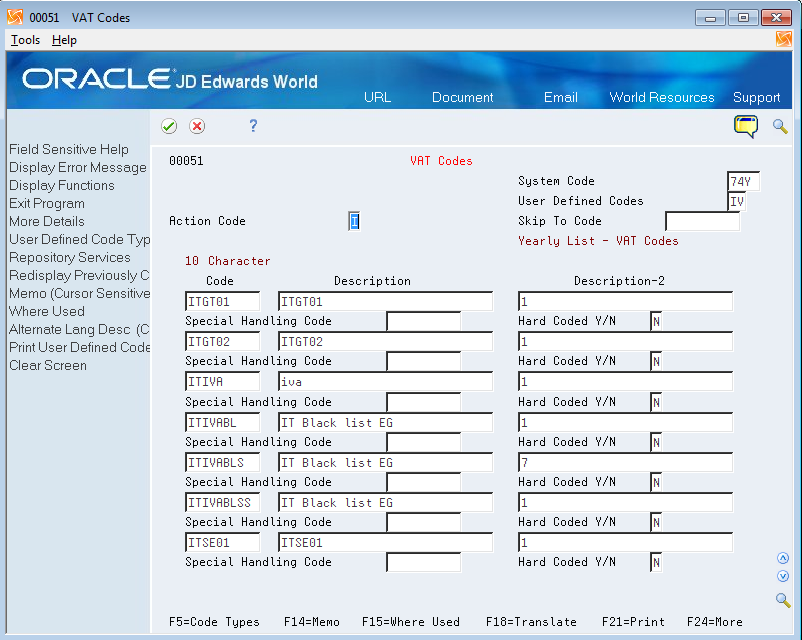

36.1.5 Vat Codes (74Y/IV)

Use this UDC table to set up values to associate VAT summary codes with tax rate areas for purchase and sales transactions. You enter the tax rate area code in the Codes field, and enter a value for the VAT summary code in the Description 02 field. The report includes only those transactions that have a tax rate area code set up in this UDC table.Values for the Description 02 field are:

-

1: Taxable

-

2: Nontaxable

-

3: Exempt

-

4: VAT not disclosed on invoice

-

5: Taxable amount in a VAT on profit scenario

-

7: Transaction is not subject to VAT

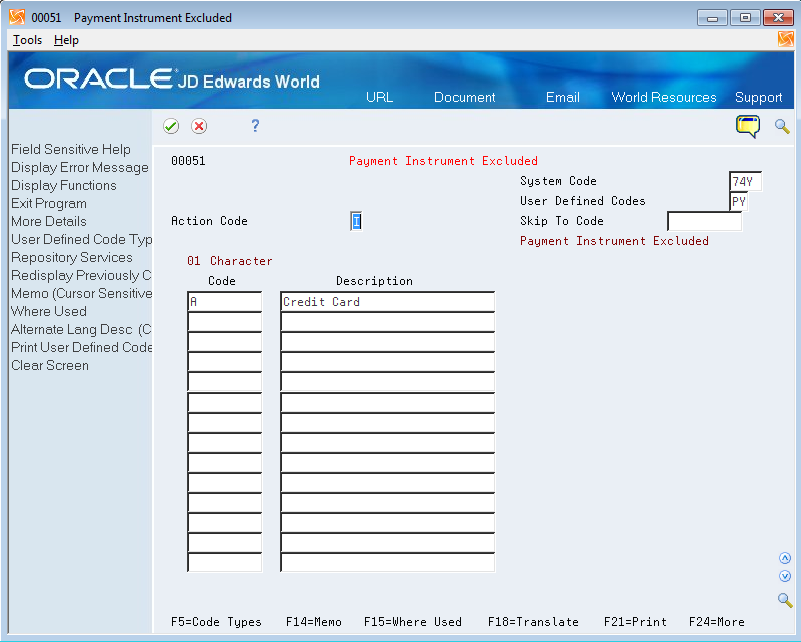

36.1.6 Payment Instrument Excluded (74Y/PY)

Set up values in this UDC table with the payment instruments that you use for credit card transactions. Transactions that are paid with a credit card, electronic debit card, or prepaid electronic cards should be excluded from the Yearly List when these cards are issued by a financial institution that is resident in Italy or that has a stable organization in Italy.

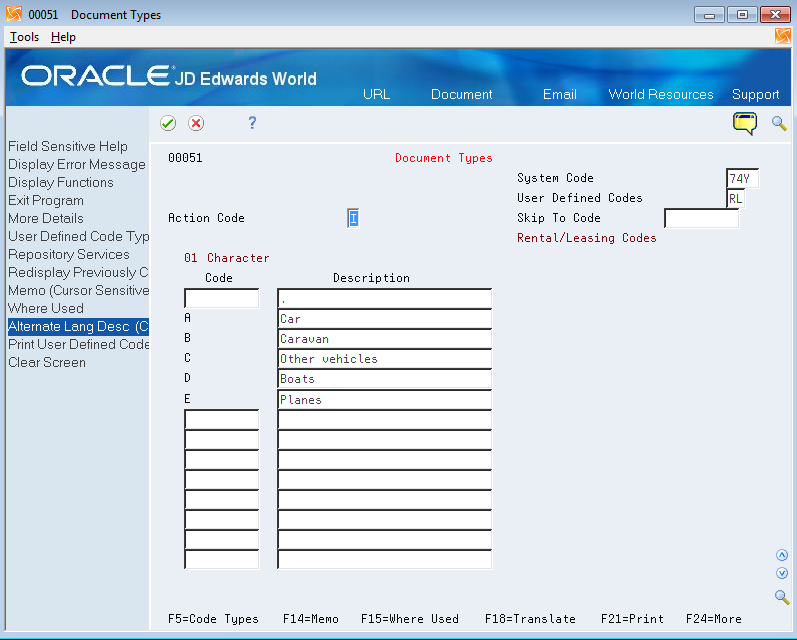

36.1.7 Rental/Leasing Codes (74Y/RL)

The values in the 74Y/RL UDC table indicate the type of lease or rental for a transaction. You assign one of these values to transactions for rentals or leases before you generate the Multi-Purpose VAT Communication. The system writes the code that you assign to transactions to the FA and SA sections of record type C, and to the FE, DF, and FN sections of record type D.

Codes are:

Blank: Transaction does not involve a lease or rental.

A: Car

B: Caravan

C: Other vehicles

D: Boats

E: Planes

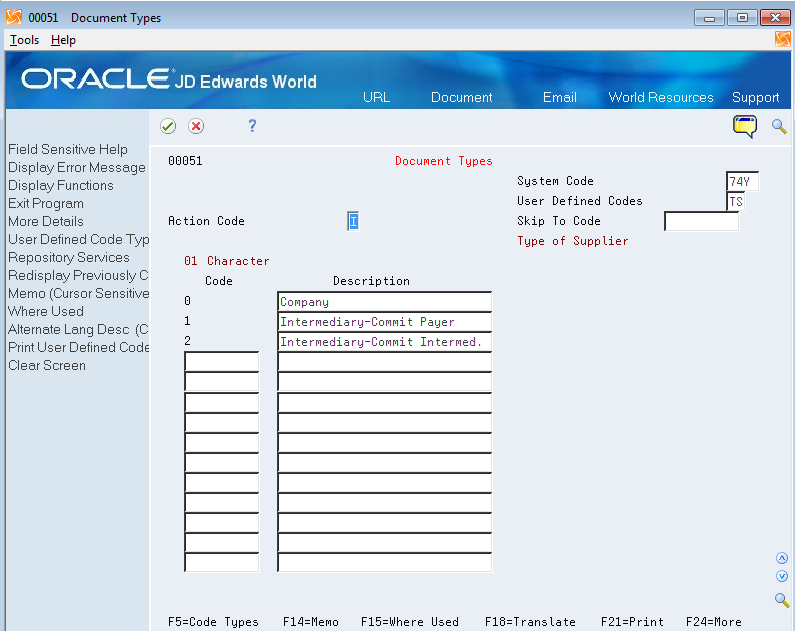

36.1.8 Type of Supplier (74Y/TS)

You assign a value from this UDC table in the processing options of the IYL Elec. Communications - TXT Generator report (P74Y0047). Values are:

| Codes | Description |

|---|---|

| 0 | Company |

| 1 | Intermediary-Commit Payer |

| 2 | Intermediary-Commit Intermed |

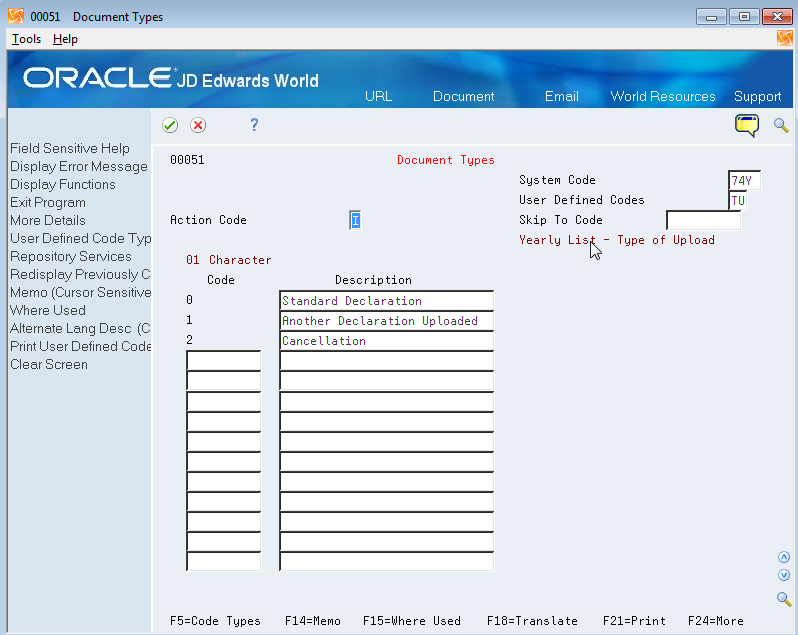

36.1.9 Type of Upload (74Y/TU)

The JD Edwards World system provides hard-coded values for this UDC table. You assign a value from this UDC table in the processing options for the IYL Elec. Communications - TXT Generator (P74Y0047) report. Values are:

| Codes | Description |

|---|---|

| 0 | Standard |

| 1 | Substitution |

| 2 | Cancellation |

36.2 Set Up Tax Rate Areas

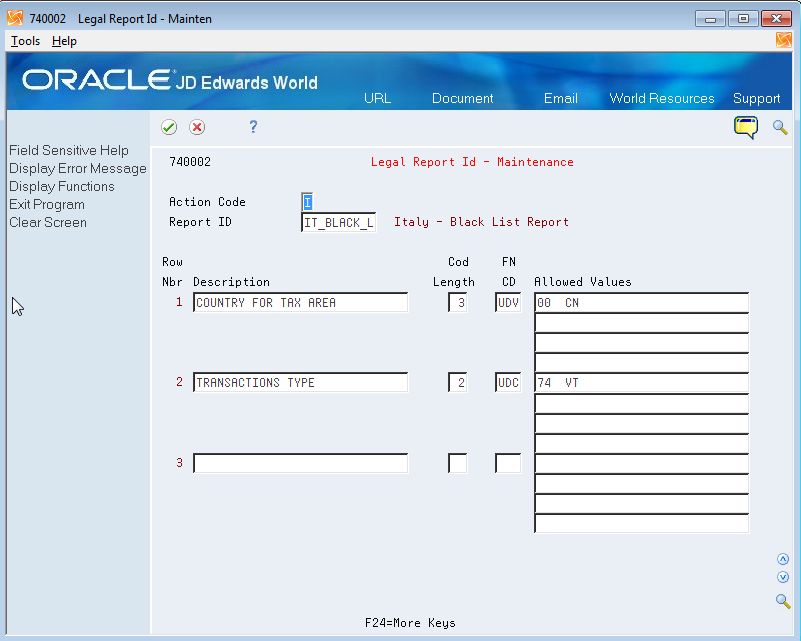

You use the Legal Report ID - Maintenance program (P740002) and the Tax Area Legal Report - Maintenance program (P740003) to set up the reports and associate tax rate areas that you use for purchase and sales transactions to the countries in which you use the tax rate areas and the transaction types codes. The transaction type code indicates whether a tax area is for goods or services.

You use the report ID IT_BLACK_L for all declarations generated for the Multi-Purpose VAT Communication. The report ID must exist in the 74/RI UDC table. To set up for the Black List Declaration, you specify in the Legal Report ID - Maintenance program the UDC tables that include the valid values for the setup. Then, you use the Tax Area Legal Report - Maintenance program (P740003) to associate a tax rate area with a transaction type, and, if applicable, with a country on Italy's black list.

The system uses the country code that you enter in the Tax Area Legal Report - Maintenance program to determine whether the tax rate area is for the Black List Declaration. For countries on the Italian black list, enter valid values for both the Country for Tax Area and Transactions Type rows. For tax rate areas in countries that are not included in the Italian black list, you complete the Transactions Type row and leave the Country for Tax Area row blank.

Setting up generic tax rate areas includes the following tasks:

-

To associate UDC tables with a report ID.

-

To associate countries and transaction types to tax rate areas.

To associate UDC tables with a report ID

You must verify the UDCs associated with the IT_BLACK_L report ID.

From Italian Localizations (G74Y), choose IYL Electronic Communications

From Yearly List Electronic Communications (G74Y003), choose Generic Report

From Generic Report (G740001), choose Legal Report Id - Maintenance

Figure 36-10 Legal Report Id-Maintenance screen

Description of "Figure 36-10 Legal Report Id-Maintenance screen"

-

Enter IT_BLACK_L in the Report ID field.

The value in the Function Code field for the Country for Tax Area row is UDV. The value UDV indicates that you can use more than one value from the UDC 00/CN on the Tax Area Legal Report - Maintenance form, where you specify the countries that Italy has included on its list of black list countries.

-

Enter a value in the Transactions Type row.

The value in the Function Code field for Transaction Type is UDC. This value indicates that the system uses only one value from UDC 74/VT when you specify the transaction type on the Tax Area Legal Report - Maintenance form.

To associate countries and transaction types to tax rate areas

You must associate tax areas to transaction types, and if applicable, to countries on Italy's black list.

From Italian Localizations (G74Y), choose IYL Electronic Communications

From Yearly List Electronic Communications (G74Y003), choose Generic Report

From Generic Report (G740001), choose Tax Area Legal Report - Maintenance

Figure 36-11 Tax Area Legal Report - Maint. form

Description of "Figure 36-11 Tax Area Legal Report - Maint. form"

From Tax Area Legal Report - Maintenance

-

Complete the following fields:

-

Report Id

-

Tax Rate/Area

-

-

Complete the Valid Code field for the Country For Tax Area line with the country code for black list countries that use the tax area. You enter values from the 00/CN UDC table. You can enter multiple countries.

You enter country codes for only black list countries.

-

Complete the Valid Code field for the Transactions Type line with a code from UDC 74/VT UDC table. You can associate one transaction type to each tax rate/area. Complete this field for each tax rate/area associated with transactions that you report in the Multi-Purpose VAT Communication.

Note:

The value GT (Goods with Triangulation) is not valid for tax rate/areas used in black list countries.

36.3 Enter Address Book Information for Tax Reporting Entities

This section provides an overview of address book information for tax reporting entities, lists prerequisites, and discusses how to enter additional address book information.

36.3.1 About Address Book Information for Tax Reporting Entities

When you report transactions for the Yearly List (Spesometro), San Marino Purchases Declaration and Black List Declaration, you must include information about the reporting company that does not exist in the Address Book Master table (F0101) or other address book tables. You must enter information about the intermediary, if applicable; and about the foreign taxpayer ID, jurisdiction type, and the taxpayer ID of the software company (Oracle).

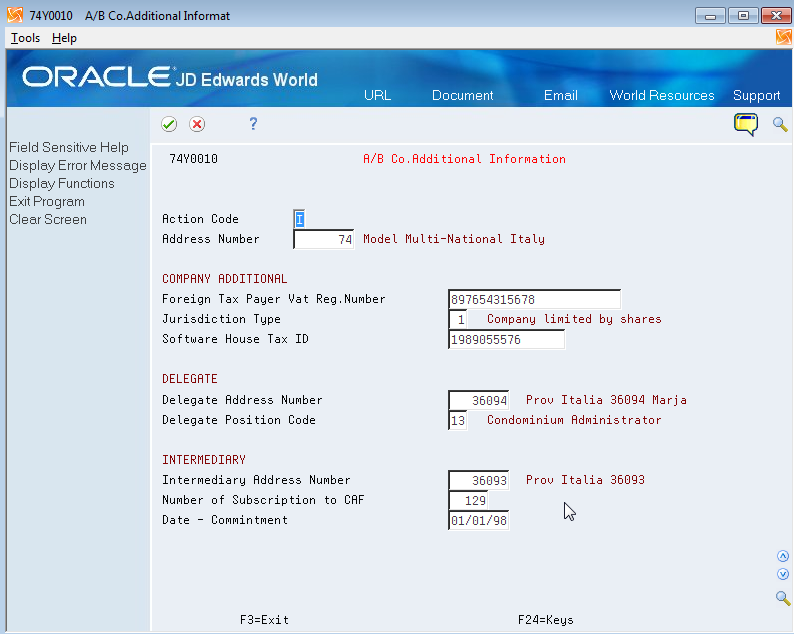

You use the A/B Co. Additional Information program (P74Y0010) to enter additional company information.

36.3.2 Before You Begin

Before you complete the task in this section, verify that the Localization Country Code field in your user profile is set to IT (Italy).

36.3.3 Entering Additional Address Book Information

From Yearly List Electronic Communications (G74Y003), choose A/B Co. Additional Information

Figure 36-12 A/B Co. Additional Information

Description of "Figure 36-12 A/B Co. Additional Information"

Foreign Taxpayer VAT Reg Number

Enter the company's foreign-taxpayer VAT registration number.

- Jurisdiction Type

-

Enter a value from the Jurisdiction Type (74Y/JT) UDC table to specify the type of legal entity. The values in this UDC table are hard-coded. Examples of values are:

01: Company limited by shares

02: Limited liability company

03: Corporation

09: Foundations

56: Banking institutions

- Software House Tax ID

-

Enter the code for the software company. For example, enter the code for Oracle.

- Delegate Address Number

-

Note:

This field is not used in the Multi-Purpose VAT Communication declarations.Enter the address book number of the person authorized to submit the report.

- Delegate Position Code

-

Note:

This field is not used in the Multi-Purpose VAT Communication declarations.Enter a value from the Position Code (74Y/PC) UDC table to specify the position within the company of the person submitting the report. Examples are:

01: Legal representative

06: Non-resident fiscal representative

- Intermediary Address Number

-

Enter the address book number of the company or person who submits the report on behalf of the reporting company.

- Number of Subscription to CAF

-

Enter the professional ID number of the intermediary.

- Date - Commitment

-

Enter the date on which the intermediary will submit the declaration.

36.4 Enter Address Book Information for Customers and Suppliers in Italy

This section provides an overview of supplier and customer address book information for Italian VAT reports; lists prerequisites; and discusses how to enter supplier and customer additional information.

36.4.1 About Supplier and Customer Address Book Information for Italian VAT Reports

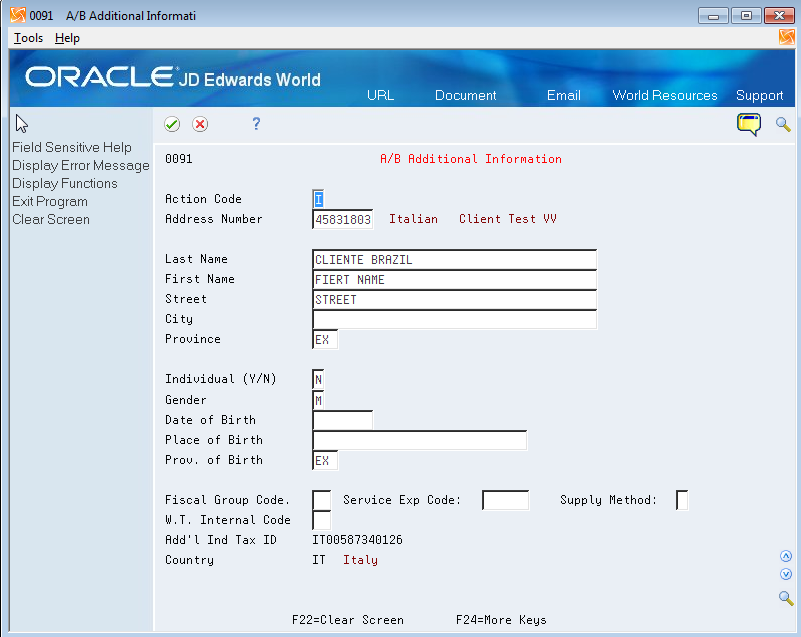

The Black List Declaration and the Yearly List (Spesometro) require information that does not exist in the standard address book, customer, or supplier records. You use the A/B Additional Information program (P0091) to enter the required additional information.

36.4.2 Before You Begin

Before you complete the task in this section:

-

Verify that appropriate values exist in the Form 770 Information (74/70) UDC table.

-

Verify that appropriate withholding codes exist for suppliers.

36.4.3 Entering Additional Supplier and Customer Address Book Information

From Yearly List Electronic Communication (G74Y003), choose A/B Additional Information

- Address Number

-

Inquire on the address book number of the customer or supplier.

- Last Name

-

Enter the surname of the individual as you want it to appear in the report.

- First Name

-

Enter the first name of the individual as you want it to appear in the report.

- Street

-

Enter the street name and number of the individual as you want it to appear in the report.

- City

-

Enter the city of the individual as you want it to appear in the report.

- Province

-

Specify the province where the individual resides.

- Individual (Y/N)

-

Enter Y to indicate that the supplier is an individual. Enter N to indicate that the supplier is not an individual.

- Gender

-

Enter M for male or F for female.

- Date of Birth

-

Enter the date of birth of the individual.

- Place of Birth

-

Enter the place of birth of the individual.

- Province of Birth

-

Specify the province of birth of the individual.

- Fiscal Group Code

-

Note:

You do not need to complete this field to report transactions in the Multi-Purpose VAT Communication.Enter a value from the Form 770 Information (74/70) UDC table to specify the fiscal group to which a supplier belongs. Values are:

0: Resident.

0A: Resident whose income is all subject to INPS.

0B: Resident whose income is partially subject to INPS.

0C: Resident whose income is not subject to INPS.

1: Nonresident whose income is all subject to INPS.

1A: Nonresident whose income is partially subject to INPS.

1B: Nonresident whose income is not subject to INPS.

1C: Nonresident.

- Service Expl. Code (service explanation code)

-

Note:

You do not need to complete this field to report transactions in the Multi-Purpose VAT Communication.Enter the value from the Service Explanation Code (74Y/SC) UDC table to specify the service class provided or received in the transaction.

- Method of Supply

-

Note:

You do not need to complete this field to report transactions in the Multi-Purpose VAT Communication.Enter the value that identifies how often the service is provided or received. The value that you enter must exist in the Method of Supply (74Y/SM) UDC table. Values are:

I: Immediate, when the service is provided in a single supply.

R: At different times, when the service is supplied at different times.

- W/T Code - Internal (withholding tax code - internal)

-

Note:

You do not need to complete this field to report transactions in the Multi-Purpose VAT Communication.You complete this field for suppliers only.

Enter a withholding code. The system uses the code to calculate withholding tax when you enter supplier vouchers for suppliers that are subject to withholding tax.

- Additional Ind Tax ID (additional individual tax ID)

-

The system populates this field with the value in the Additional Tax Id (ABTX2) field from the address book record. If no value exists in the field, then the system leaves the field blank on this screen.

36.5 Classify Transactions for Declarations

This section provides an overview of transaction classifications and discusses how to:

-

Classify individual transactions.

-

Apply global classifications to transactions.

36.5.1 About Transaction Classifications

After you post vouchers and process invoices and before you generate the Multi-Purpose VAT Communication, you must indicate for each transaction whether the transaction:

-

Is a rental or leasing transaction.

-

Is a reverse charge (adjustment) to include in section FR (Received Invoices and Recap Invoices (Payables)).

-

Needs to be included in one of these sections for non-residents:

-

Section C, subsection BL for transactions with subjects based in tax haven countries as defined in the black list maintained by the Italian tax authorities.

-

Section D, subsection FN for transactions for non-resident subjects (receivables).

-

Section D, subsection SE for transactions that are purchases of services from non-resident subjects.

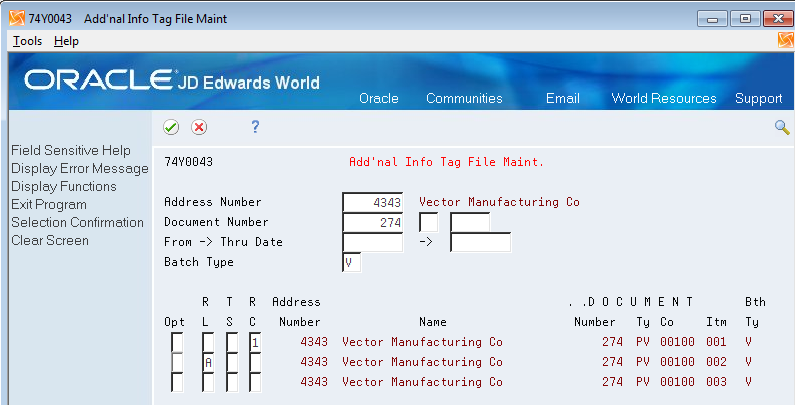

-

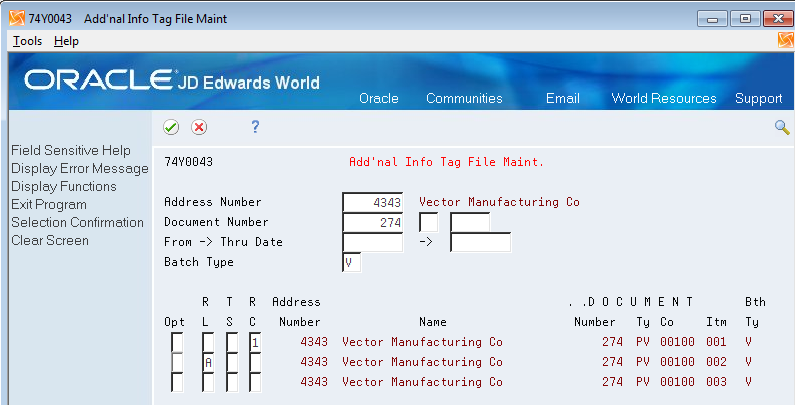

You use the Additional Info Tag File Maintenance program (P74Y0043) to search for and select the records to which to add additional information. You enter search criteria in the header fields to locate records from the Sales/Use/VAT Tax file (F0018). You then use the Additional Info Tag File Maintenance program or the Rental/Lease Doc Maintenance program (P74Y0045) to add information for selected records.

You use the Additional Info Tag File Maintenance program to add different values for the RL (Rental/Leasing), TS (Transactions Sections), and RC (Reverse Charge) fields to the selected records. For example, you could add a rental/leasing code to one record and add a different rental/leasing code to another selected record. You use the Rental/Lease Doc Maintenance program (P74Y0045) to add the same values for all selected records. For example, you could select a dozen records and add the same rental/leasing code and the same reverse charge flag to all dozen selected records.

The system saves the information that you enter to the Yearly List Additional Information Tag File Maintenance file (F74Y0043). When you generate the Multi-Purpose VAT Communication, the system reads the values in the F74Y0043 file to determine whether to include the transaction in the declaration sections.

36.5.2 Classifying Individual Transactions

From EMEA Localizations (G74), choose Italy

From Italian Localizations (G74Y), choose IYL Electronic Communications

From Yearly List Electronic Communications (G74Y003), choose Add'nal Info Tag File Maint.

Figure 36-14 Add'nal Info Tag File Maint. form

Description of "Figure 36-14 Add'nal Info Tag File Maint. form"

To classify individual transactions

On Add'nal Info Tag File Maint.

-

Enter values in the search fields in the header area. You can enter values in one field or in multiple fields.

- Address Number

-

Enter the address book number of the customer or supplier.

- Document Number

-

Enter the document number.

- Document Type

-

Enter a value from UDC 00/DT.

- Order Company

-

Enter the order company number.

- From Date

-

Enter the beginning date of a date range.

- Thru Date

-

Enter the ending date of a date range.

- Batch Type

-

Enter the batch type.

Valid batch types are V and W for accounts payable transactions; and I for accounts receivable transactions.

-

Press Enter to display the records that meet the search criteria.

-

Enter 4 in the Opt (Option) field of the records for which you add the additional information.

-

Complete one or more of these fields for each selected record:

- R L (Rental/Leasing)

-

Enter a code from the Rental/Leasing Code (74Y/RL) UDC table to specify the type of lease or rental for the transaction. The system writes the code that you enter to the FA and SA sections of record type C, and to the FE, DF, and FN sections of record type D.

If the transaction is not for a rental or lease, leave this field blank.

Values are:

Blank: Transaction does not involve a lease or rental.

A: Car

B: Caravan

C: Other vehicles

D: Boats

E: Planes

- T S (Transactions Sections)

-

Enter 1 for transactions with non-residents subject. The system includes the transaction in section BL if you generate a summarized report and includes the transaction in section FN if you generate a detailed report. Enter 2 for purchases of services with non-resident subjects. The system includes the transactions in section BL if you generate summarized report and includes the transactions in section SE if you generate Detailed report. Leave this field blank if the transaction should not be included in the BL, FN, or SE sections.

Note:

You can add a value in this field only when the country in the address book record for the customer or supplier is not Italy. - RC (Reverse Charge)

-

Enter 1 in this field to indicate that the invoices received are for purchases of gold or silver materials, for services in the construction industry performed by sub-contractors, and for purchases of non-ferrous scraps or materials.

-

Confirm your selection (F10).

The system shows your changes on the Rental/Lease Docs. Maintenance screen.

36.5.3 Applying Global Classifications to Transactions

From EMEA Localizations (G74), choose Italy

From Italian Localizations (G74Y), choose IYL Electronic Communications

From Yearly List Electronic Communications (G74Y003), choose Add'nal Info Tag File Maint.

To apply global classifications to transactions

On Add'nal Info Tag File Maint.

-

Enter values in the search fields in the header area. You can enter values in one field or in multiple fields.

-

Enter 4 in the Opt (Option) field for the records you want to update, and confirm your selection (F10).

-

On the Rental/Leasing Doc. Maintenance screen, enter a value for one or more fields to apply the value to all selected records:

- Rental/Leasing Code

-

Enter a code from the Rental/Leasing Code (74Y/RL) UDC table to specify the type of lease or rental for the transaction. The system writes the code that you enter to the FA and SA sections of record type C, and to the FE, DF, and FN sections of record type D.

If the transaction is not for a rental or lease, leave this field blank.

Values are:

Blank: Transaction does not involve a lease or rental.

A: Car

B: Caravan

C: Other vehicles

D: Boats

E: Planes

- Flag - Transaction Section FN/SE

-

Enter 1 for transactions with non-residents subject. The system includes the transaction in section BL if you generate a summarized report and includes the transaction in section FN if you generate a detailed report. Enter 2 for purchases of services with non-resident subjects. The system includes the transactions in section BL if you generate summarized report and includes the transactions in section SE if you generate Detailed report. Leave this field blank if the transaction should not be included in the BL, FN, or SE sections.

Note:

You can add a value in this field only when the country in the address book record for the customer or supplier is not Italy. - Flag - Reverse Charge

-

Enter 1 in this field to indicate that the invoices received are for purchases of gold or silver materials, for services in the construction industry performed by sub-contractors, and for purchases of non-ferrous scraps or materials.

-

Enter C in the Action Code field and confirm your selection (F10).

The system applies the entered values to all records.