Understanding Multicurrency Processing

Understanding Multicurrency Processing

This chapter provides overviews of multicurrency processing in PeopleSoft Receivables, multicurrency processing for items, multicurrency processing for payments, realized gain and loss processing, multicurrency processing for statements, dunning letters, and overdue charges, multicurrency processing in history and aging, and accounting entries for multicurrency transactions and discusses how to revalue transactions.

See Also

Processing Multiple Currencies

Understanding Multicurrency Processing

Understanding Multicurrency Processing

Multicurrency processing is fully integrated into PeopleSoft Receivables. It supports the common currency of the European Union (the euro), as well as currency conversions, remeasurement, revaluation, and translation. It also provides a complete audit trail of all multicurrency processing.

This section discusses:

Types of currency

Currency calculations

Types of Currency

Types of Currency

PeopleSoft applications use a currency code to identify and track individual currencies. Although the system does not require it, we suggest that you use the International Standards Organization (ISO) currency codes supplied with the application. You may use an unlimited number of currencies in PeopleSoft applications.

Base Currency

A business unit can have only one base currency. This is generally the local currency for the organization. Accounting rules or other circumstances may dictate that it be different.

In PeopleSoft Receivables, you assign a base currency to each business unit on the general ledger Definition page. PeopleSoft Receivables business units use the base currency of their associated general ledger business units. Once established, the base currency of a general ledger business unit cannot be changed.

The system stores all customer-level accounting data in the business unit base currency. This includes balance information stored on the Customer Information and Balances table (PS_CUST_DATA), aging information stored on the Customer Aging table (PS_CUST_AGING), and history information maintained on the Customer History table (PS_CUST_HISTORY).

Any currency in which a business unit conducts business—other than its base currency—is a foreign currency. In PeopleSoft Receivables, we refer to a foreign currency as the entry currency when describing the currency in which customers are billed and as the payment currency when describing the currency in which customers pay.

The system stores all item-level accounting data in both the business unit base currency and the entry currency. Maintaining accounting data in this parallel form enables you to view item-level information in either currency.

Currency Calculations

Currency CalculationsThe system performs several calculations when it works with multicurrency transactions.

Conversion is the exchange of one currency for another. In PeopleSoft Receivables, this refers to expressing the value of foreign currency transactions in terms of the base currency. Conversion occurs in many places in your PeopleSoft Receivables system.

When you receive items from a billing system, you can supply an entry amount in a foreign currency. The system uses an exchange rate to convert the entry amount to the business unit base currency amount. When you apply payments in one currency to items in a different currency, the system performs currency conversion as necessary to enable payment application. During the revaluation of your current receivables balance, the process revalues open items based on business unit base currency.

An exchange rate is the value of one currency expressed in terms of another. Actual exchange rates vary based on the currency rate type that you use. There are several recognized currency rate types, including spot (immediate), current, negotiated (discount and premium forward rates), average, and historical rates. The system supports any number of exchange rates.

An unrealized gain or loss represents the difference between the amount you would receive in your base currency if your outstanding foreign currency accounts receivable balance were paid now, and the amount you would have received if payment was made when the items were created. If the exchange rate is more favorable now than when the items were created, you have an unrealized gain. If the exchange rate is less favorable now, you have an unrealized loss.

A realized gain or loss represents the actual increase or decrease, due to exchange rate fluctuations, in the amount of money received in the base currency. The system determines realized gain or loss at payment time and when you offset items on the maintenance worksheet or by running the Automatic Maintenance Application Engine process (AR_AUTOMNT).

Understanding Multicurrency Processing for Items

Understanding Multicurrency Processing for Items

This section discusses:

Item entry.

Maintenance worksheets.

Automatic maintenance.

Transfer worksheets.

Every item is associated with two amounts:

An entry amount.

A converted base amount.

Many pages that contain item amounts display (or offer the option to display) both of these amounts.

At any time, you can revalue open items and generate adjusting entries for the general ledger.

If an item is entered with a currency that is different from that of the business unit, then the system handles currency conversion automatically. The currency conversion is based on the rate type, the exchange rate, and the base currency of the business unit.

See Also

Item Entry

Item Entry

When you enter pending items online, you provide an entry amount and currency for each pending item. If the entry currency is different from the business unit base currency, the system calculates the conversion and displays both amounts. Conversion uses the currency rate type from the customer or from the business unit. For groups of pending items, you can constrain all pending items to a selected currency; or you can leave multicurrency items in a single group with the totals represented by hash marks (#). Group balancing is based on the entry amount.

Billing systems may produce groups that contain invoices in multiple currencies, so you have the option to specify a currency for the group or to leave the currency code blank and then specify the currency code on the individual item. Currency conversion can occur before the interface or when you run the Receivable Update Application Engine process (ARUPDATE).

Maintenance Worksheets

Maintenance Worksheets

Worksheet totals are in the anchor currency. The system calculates realized gain or loss information for partially and completely offset items using the items' entry and base currencies.

You can select items on the maintenance worksheet in any currency. When the first item is selected, that item's currency becomes the anchor currency for the worksheet. Optionally, you can establish an anchor currency before the first item is selected on the worksheet.

On a maintenance worksheet with multiple currencies, if a rounding difference exists when the system converts amounts, the Receivable Update process posts any leftover amounts using the rounding account code that you assigned to the business unit on the Receivables Definition - Accounting Options 1 page.

Automatic Maintenance

Automatic Maintenance

The Automatic Maintenance process converts item amounts to a common currency and uses that currency for the anchor currency for maintenance worksheets that it creates. The system calculates realized gain or loss information for partially and completely offset items using the items' entry and base currencies.

If a rounding difference exists when the process converts amounts, the Receivable Update process posts any leftover amounts using the rounding account code that you assigned to the business unit on the Receivables Definition - Accounting Options 1 page.

Transfer Worksheets

Transfer Worksheets

Transfers can involve more than one currency, so the actual totals that display at the bottom of the worksheet are represented by hash marks (#). The system uses the original exchange rate and rate type for transfers when the base currency is the same. No realized gain or loss occurs as the result of a transfer.

Understanding Multicurrency Processing for Payments

Understanding Multicurrency Processing for Payments

This section discusses:

Deposit and payment entry

Payment worksheets

Payment Predictor

Draft worksheets

Payments carry both the payment amount and the converted base amount. The system handles conversion automatically based on rate types, exchange rates, and the base currency of the business unit. You can apply payments to items in different currencies. When an item is paid, the system calculates realized gain or loss and generates accounting entries to reflect the gain or loss.

The deposit and payment status pages reflect the currency of the payment. Other pages that contain payment amounts show both currencies—payment and base.

Deposit and Payment Entry

Deposit and Payment EntryYou can perform deposit entry using either of these methods:

Limiting the deposit to only one currency.

Entering a currency code for each payment.

If the deposit currency and the business unit base currency are different, the system stores both amounts in the system.

Payment Worksheets

Payment Worksheets

When you apply a payment to items, the items do not have to have the same currency, and the payment does not need to have the same currency as the items.

Worksheet totals appear in the payment currency. The system converts the sum of the selected items to the payment currency to match the deposit and payment totals at the bottom of the worksheet. When an item is partially or completely paid off on the payment worksheet, the system calculates realized gain or loss and generates the adjusting accounting entries.

If a rounding difference exists when the system converts the amount, the Receivable Update process posts the leftover amount using the rounding account code that you assigned to the business unit on the Receivables Definition - Accounting Options 1 page.

Example

Suppose that you have an invoice that is 12,565.39 USD, and you receive a EUR payment that converts to 12,565.40 USD. The Receivable Update process would post the .01 USD difference to the rounding account.

Note. If the transaction involves a realized gain or loss, the rounding account is not updated.

When the system calculates a realized gain or loss amount for an item, it includes in the calculation any gain or loss amount that results from a difference in exchange rates.

See Also

Understanding Realized Gain and Loss Processing

Defining the Accounting Options 1 Page

Payment Predictor

Payment Predictor

The Payment Predictor Application Engine process (ARPREDCT) applies payments to items, including items that do not share a single currency. Also, the payment may be in a different currency from the currencies of the items. For VAT-related transactions, we recommend that you route Payment Predictor results that contain remaining balance amounts to the payment worksheet.

Payment Predictor calculates the realized gain or loss on items for all applied payments, even when the entry currency for a payment differs from the item's base currency.

See Also

Payment Predictor and Multicurrency Processing

Draft Worksheets

Draft Worksheets

When you apply a draft to items, the items do not have to have the same currency, and the draft does not need to have the same currency as the items.

Worksheet totals display in the draft currency. The system converts the sum of the selected items to the draft currency to match the draft totals at the bottom of the worksheet.

Understanding Realized Gain and Loss Processing

Understanding Realized Gain and Loss Processing

Realized gains and losses are the actual increases and decreases, due to exchange rate fluctuations, in the amount of money received in the base currency.

The system determines and generates realized gain or loss at payment time when you apply a payment on the payment worksheet or when the Payment Predictor process applies payments. The system also determines and generates realized gain or loss when you offset items using the Automatic Maintenance process or on the maintenance worksheets. If an item is not paid in full or offset in full, the system calculates realized gain or loss for a portion of the item at the time of partial payment or partial offset. All realized gain or loss figures appear in the period in which the item is paid.

If PeopleSoft Payables is installed on your system, PeopleSoft Receivables does not create realized gain or loss entries in the primary or secondary ledgers for a refund. PeopleSoft Payables generates any realized gain or loss entries for the refund. If PeopleSoft Payables is not installed on your system, PeopleSoft Receivables creates a real gain or loss entry in both the primary and secondary ledgers for a refund if required.

The Receivable Update process creates the realized gain or loss accounting entries and the Journal Generator Application Engine process (FS_JGEN) summarizes them.

Note. If you pay for items using drafts, the system calculates the realized gain or loss for the item when the cash is recognized at either the due date or the discount date when the draft status is Complete.

PeopleSoft Receivables calculates the realized gain or loss for discounts taken. The system performs the calculation for discounts taken automatically in Payment Predictor or manually on a payment worksheet. The system updates the Realized Gain/Loss account.

Example

Suppose that you pay an item whose entry currency was 100.00 EUR and whose base currency was USD 90.00. The exchange rate at the time of entry was .9 USD equals 1 EUR. When the payment is made, the exchange rate is .8 USD equals 1 EUR. A 2 percent discount was taken when the payment was made.

When the payment is made, the accounting entries would look like this:

|

Transaction |

Entry Currency Debit |

Entry Currency Credit |

Base Currency Debit |

Base Currency Credit |

|

Cash (debit) |

98.00 EUR |

|

78.40 USD |

|

|

Discount expense (debit) |

2.00 EUR |

|

1.60 USD |

|

|

Discount realized gain/loss (debit) |

|

|

.20 USD |

|

|

Receivables realized gain/loss (debit) |

|

|

9.80 USD |

|

|

Receivables account * (credit) |

|

100.00 EUR |

|

90.00 USD |

* For drafts, the receivables account is the last updated debit account in the draft life cycle (for example, remitted draft receivables or draft cash control). For all other payments, the receivables account is the AR account.

Understanding Multicurrency Processing for Statements, Dunning Letters,

and Overdue Charges

Understanding Multicurrency Processing for Statements, Dunning Letters,

and Overdue Charges

Customer statements, dunning letters, and overdue charge invoices display the foreign currency information for an item and calculate customer totals by foreign currency. If a correspondence customer has open items in more than one foreign currency, the items are grouped and totaled by foreign currency. However, you may also choose to generate the correspondence in a single display currency by choosing a currency from the respective correspondence request on the Display Currency page.

Understanding Multicurrency Processing in History and Aging

Understanding Multicurrency Processing in History and Aging

The Aging Application Engine process (AR_AGING), which updates summary aging information, uses the base currency amount for items. The Receivable Update process also uses the base currency amounts to update user-defined history, payment performance history elements, and days sales outstanding.

Because the base currency balance of open items can vary due to currency fluctuations, you can generate aging reports using different values. The item balance can be the business unit base value, the value based on a specified rate, or the balance in the entry currency.

Understanding Accounting Entries for Multicurrency Transactions

Understanding Accounting Entries for Multicurrency Transactions

If you enter pending items or payments in a currency other than the business unit base currency, accounting entries carry currency information. PeopleSoft Receivables displays accounting entries as follows:

|

Entry Type |

Currency Type |

|

Receivables entries. |

Entry and business unit base currencies. |

|

Cash entries. |

Payment and business unit base currencies. |

|

User-defined entries. |

Entry and business unit base currencies. |

|

Realized or unrealized gain/loss entries. |

Base currency. |

You can display the totals on the Accounting Entries page in the entry, payment, or base currency.

You create accounting entries for unrealized gain or loss when you run the Receivables Revaluation Application Engine process (AR_REVAL). Accounting entries are also created when you run the Receivable Update process.

The accounting entries generated show both realized gain or loss, and unrealized gain or loss. The system creates accounting entries for realized gain or loss based on the items paid on the maintenance or payment worksheets.

For a partial payment, the system calculates realized gain or loss based on the payment amount.

The system stores realized gain and loss accounting entries in the Item Distribution (PS_ITEM_DST) table along with other accounting entries generated by the system. It stores unrealized gain or loss accounting entries in their own table (PS_RVL_ACCTG_LN_AR). The Journal Generator process creates and writes journal entries to the Journal Line table (PS_JRNL_LN) and the Journal Header (PS_JRNL_HEADER) table in the process of selecting and summarizing accounting entries in general ledger journal entries.

Note. The Journal Generator processes unrealized gain or loss accounting entries as a separate request.

Multibook Processing

Multibook Processing

If you select the multibook option on the Installation Options - Overall page, the Receivable Update process creates accounting entries for both the primary ledger and secondary ledgers, including translation ledgers. Each ledger may have a different currency. Secondary ledgers have the same foreign amount currency as the primary ledgers. Translation ledgers create accounting differently than primary and secondary ledgers. When a translation ledger is created, the base currency of the primary ledger becomes the transaction or foreign currency of the translation ledger. This amount is then converted to the base currency of the translation ledger.

Example

Suppose that you enter an item in EUR for a business unit whose base currency is CAD. The base currency for the secondary ledger is EUR. The base currency for the translation ledger is USD. In this case, the process would create entries in these currencies:

|

Ledger |

Foreign Currency (Transaction Currency) |

Base Currency |

|

Primary Ledger |

EUR |

CAD |

|

Secondary Ledger |

EUR |

EUR |

|

Translation Ledger |

CAD |

USD |

Note. Multibook functionality does not apply to direct journal payments. Therefore, secondary lines are not created for direct journals.

Rate Types for Secondary Ledgers

The method that the system uses to obtain the rate type for secondary ledgers varies based on the type of transaction. This table shows how it obtains the rate types for the different types of transactions.

|

Transaction Type |

Method |

|

Online pending item entry |

The system does the following:

|

|

Payment worksheets |

The system does the following:

|

|

Maintenance worksheets |

The system does the following:

|

|

Transfer worksheets |

The system does the following:

|

|

Customer-initiated drafts |

The system does the following:

|

|

Vendor-initiated drafts |

The system does the following:

|

|

Direct debits |

The system does the following:

|

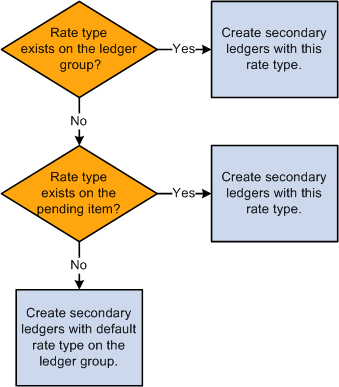

This flowchart shows how the system obtains the rate type for the secondary ledger entries. If the rate type exists in the ledger group, then secondary ledgers are created with that rate type. If the rate type exists in a pending item, then secondary ledgers are created with that rate type. If the rate type does not exist in the ledger group or in the pending item, then secondary ledgers are created with the default rate type of the ledger group.

Creation of secondary ledgers using rate types

See Also

Prerequisites

Prerequisites

The pages used to define the currency codes, rate types, and exchange rates for currency conversion are common to all PeopleSoft Financials Management Solutions and Supply Chain Management applications. You set up the currency tables once for all applications.

In addition to setting up currency tables, you must assign the currency codes to business units and setIDs. Currency controls include the base currency for each business unit, the default currency and rate types for customers and origins, and the accounting entry templates for realized and unrealized gain or loss.

Before you can process items and payments in multiple currencies, you must perform these tasks:

Confirm that the currencies you use in your organization are already defined on the Currency Code page.

Assign a base currency to the general ledger business units with which your PeopleSoft Receivables business units are associated on the PeopleSoft General Ledger Definition page.

Note. You cannot change the base currency associated with a PeopleSoft Receivables business unit.

Set the default rate type for business units on the Receivables Options - Payment Options page.

Note. You can override the default rate type for individual customers when you set them up, and you can override the default for individual items during pending item entry.

Set up distribution codes for unrealized gains and losses.

Set up a distribution code for the AR account for translation ledgers if you enabled the multibook option.

Link the distribution codes that you created to business units on the Receivables Definition - Accounting Options 1 page.

Assign a rounding account for leftover amounts from currency conversion on worksheets to each business unit on the Receivables Definition - Accounting Options 1 page.

Specify the journal template to use when the system transfers revaluation information to the general ledger for each PeopleSoft Receivables business unit on Receivables Definition - Accounting Options 1 page.

See Also

Defining PeopleSoft Receivables Business Units

Revaluing Transactions

Revaluing Transactions

This section provides an overview of the Revaluation Application Engine process (AR_REVAL) and discusses how to:

Run the Revaluation process.

Review revaluation accounting entries.

Understanding the Revaluation Application Engine Process

Understanding the Revaluation Application Engine ProcessRevaluation restates the current receivables balance in the base currency, generating figures for unrealized gain or loss. As exchange rates fluctuate between the base currency and foreign currencies, the current value of open items changes. Companies generally revalue accounts at the end of each accounting period, resulting in adjusted entries that recognize unrealized gain or loss.

Note. If you use drafts to pay for items, the revaluation process also includes items paid by drafts until the draft status is Complete. The status for remitted drafts is complete when the cash is recognized on the due date, the discount date, or during bank reconciliation.

Some companies perform revaluation within their general ledger system. Others revalue in the source system and send resulting journals to the general ledger. The revaluation option is designed for companies that revalue in PeopleSoft Receivables and then send the results to their general ledger.

The Receivables Revaluation process performs revaluation and generates unrealized gain or loss information by currency based on a specified rate type. You can use the unrealized gain or loss information to create an accrual entry for the general ledger that is reversed when you revalue again and make the next accrual.

Accounting Entry Summarization

You can summarize accounting entries at three levels:

Business unit level.

Customer level.

Item level.

You make this choice on the Receivables Options - Payment Options page.

If you choose to summarize at the business unit level, the values for customer ID and item ID will be zero. If you choose to summarize at the customer level, the values for the item ID will be zero. If you summarize at the item level, each field contains a value.

The following examples show the accounting entries that the process would create using different summarization levels on the Receivables Options - Payment Options page for the following scenario:

The business unit FRA01 has a base currency of EUR.

The unrealized gain account is 68001.

The unrealized loss account is 68002.

The revaluation process includes the following invoices:

|

Customer |

Invoice Number |

AR Account |

Unrealized Gain or Loss |

|

A111 |

A1 |

12000 |

+10.00 |

|

A111 |

A2 |

22000 |

-40.00 |

|

A111 |

A3 |

12000 |

+50.00 |

|

B222 |

B1 |

22000 |

+20.00 |

|

B222 |

B2 |

12000 |

-80.00 |

If you summarize at the business unit level, the process creates the following accounting entries:

|

Business Unit |

Customer |

Invoice |

Currency |

Account |

Debit |

Credit |

|

FRA01 |

0 |

0 |

EUR |

68002 |

40.00 |

|

|

FRA01 |

0 |

0 |

EUR |

12000 |

|

20.00 |

|

FRA01 |

0 |

0 |

EUR |

22000 |

|

20.00 |

If you summarize at the customer unit level, the process creates the following accounting entries:

|

Business Unit |

Customer |

Invoice |

Currency |

Account |

Debit |

Credit |

|

FRA01 |

A111 |

0 |

EUR |

68001 |

|

20.00 |

|

FRA01 |

B222 |

0 |

EUR |

68002 |

60.00 |

|

|

FRA01 |

A111 |

0 |

EUR |

12000 |

60.00 |

|

|

FRA01 |

A111 |

0 |

EUR |

22000 |

|

40.00 |

|

FRA01 |

B222 |

0 |

EUR |

12000 |

|

80.00 |

|

FRA01 |

B222 |

0 |

EUR |

22000 |

20.00 |

|

If you summarize at the item level, the process creates the following accounting entries:

|

Business Unit |

Customer |

Invoice |

Currency |

Account |

Debit |

Credit |

|

FRA01 |

A111 |

A1 |

EUR |

68001 |

|

10.00 |

|

FRA01 |

A111 |

A1 |

EUR |

12000 |

10.00 |

|

|

FRA01 |

A111 |

A2 |

EUR |

68002 |

40.00 |

|

|

FRA01 |

A111 |

A2 |

EUR |

22000 |

|

40.00 |

|

FRA01 |

A111 |

A3 |

EUR |

68001 |

|

50.00 |

|

FRA01 |

A111 |

A3 |

EUR |

12000 |

50.00 |

|

|

FRA01 |

B222 |

B1 |

EUR |

68001 |

|

20.00 |

|

FRA01 |

B222 |

B1 |

EUR |

22000 |

20.00 |

|

|

FRA01 |

B222 |

B1 |

EUR |

68002 |

80.00 |

|

|

FRA01 |

B222 |

B1 |

EUR |

12000 |

|

80.00 |

Prerequisites

Prerequisites

Before you run the Receivables Revaluation process, perform these tasks:

Determine how you want to view unrealized gains and losses on financial statements.

If you want to view them separately, create one distribution code for unrealized gains and another for unrealized losses. Otherwise, create one distribution code for both unrealized gain and unrealized loss.

Determine at what level you want to summarize the accounting entries for each business unit on the Receivables Options - Payment Options page.

Run the Receivable Update process for all business units whose transactions you want to revalue.

See Also

Pages Used to Revalue Transactions

Pages Used to Revalue Transactions|

Page Name |

Definition Name |

Navigation |

Usage |

|

RVL_RUN_CNTL_AR |

Accounts Receivable, Receivables Update, Revaluation, Request Revaluation, Receivables Revaluation |

Run the Revaluation process. |

|

|

Receivables Revaluation (inquiry) |

RVL_AR_ACCTG_ENTS |

Accounts Receivable, Receivables Update, Revaluation, Review Receivables Revaluation, Receivables Revaluation |

View the accounting entries that the Revaluation process created for unrealized gain or loss. |

Running the Revaluation Application Engine Process

Running the Revaluation Application Engine ProcessAccess the Receivables Revaluation (process) page (Accounts Receivable, Receivables Update, Revaluation, Request Revaluation, Receivables Revaluation).

Note. The Receivables Revaluation process revalues only the items that you select to revalue. By default, the system revalues all items. You can override the default for a single item on the View/Update Item Details - Detail 1 page or on the detail information pages linked to a worksheet. You view a detail information page from any worksheet, but you can change the revalue flag only from the maintenance, payment, or draft worksheets.

See Also

Changing Discount, Payment, and Draft Options and Customer Relationship Information

Reviewing Revaluation Accounting Entries

Reviewing Revaluation Accounting Entries

Access the Receivables Revaluation (inquiry) page (Accounts Receivable, Receivables Update, Revaluation, Review Receivables Revaluation, Receivables Revaluation).

|

Currency |

The page displays one row for each currency that you revalued. |

|

Accounting Date |

Displays the date that the Journal Generator process uses when creating journals for the general ledger. |

|

Distribution Status |

Indicates if accounting entries with the specified currency have been incorporated in journals generated for the general ledger. Values are: H (hold): You selected the Check Only check box on the run control request. D (distributed): The Journal Generator process created journals that include revaluation entries in the currency. In this case, the general ledger Journal ID and Journal Date fields appear. When you run the Revaluation process, the system deletes all existing entries in the currency that have not yet been distributed to the general ledger. |

Note. If entries are unbalanced, look for a missing distribution code or journal template. Because the Journal Generator process selects accounting entries based on their journal template, each line must have a journal template associated with it when it is created. The system uses the journal template specified on the Receivables Definition - Accounting Options 1 page and creates unbalanced entries if the template is missing.